Abstract

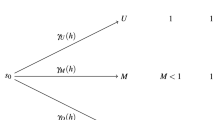

The classical analysis in terms of supply and demand appear irrelevant when the problem at hand is related to lending, and to the credit market. The limits that are imposed to the level of a firm’s debt by its creditors, or the effect of a firm’s capital structure on its value are phenomena that would still remain unexplained had the supply-demand analysis been uniquely employed.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Aghion, P. et P. Bolton (1986), “An “Incomplete contracts” approach to bankruptcy and the optimal financial structure of the firm” D.P., MIT.

Diamond, D. (1984), “Financial Intermediation and Delegated Monitoring” Review of Economic Studies, July, pp. 393–414

Diamond, D. (1986), “Reputation Acquisition in Debt Markets”, WP 134, Graduate School of Business, University of Chicago.

Freixas, X. (1987), “On Debt and Stock as Optimal financial instruments”, Cahier GREMAO, Université de Toulouse.

Gale, D. et M. Hellwig (1985), “Incentive Compatible Debt Contracts: The One Period Problem”, Review of Economic Studies, October, pp. 627–646.<<

Kreps, D. and R. Wilson (1982) “Reputation and Imperfect Information” Journal of Economic Theory, August.

Milgrom, P. and J. Roberts (1982) “Predation, Reputation and Entry Deterrence”, Journal of Economic Theory, August.

Rothschild, M. and J.E. Stiglitz (1970) “Increasing Risk: I, A definition”, Journal of Economic Theory, vol. 2., pp. 225–243.

Sapington, D. (1983), “Limited Liability Contracts between Principal and Agent”, Journal of Economic Theory, 29, pp. 1–21.

Townsend, R.M. (1979), “Optimal Contracts and Competitive Markets with Costly State Verification”, Journal of Economic Theory, 21, pp. 265–293.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 1988 Springer-Verlag Berlin Heidelberg

About this paper

Cite this paper

Freixas, X. (1988). Debt Contract under Imperfect Information: A Survey. In: Laussel, D., Marois, W., Soubeyran, A. (eds) Monetary Theory and Policy. Studies in Contemporary Economics. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-642-74104-3_6

Download citation

DOI: https://doi.org/10.1007/978-3-642-74104-3_6

Publisher Name: Springer, Berlin, Heidelberg

Print ISBN: 978-3-540-50322-4

Online ISBN: 978-3-642-74104-3

eBook Packages: Springer Book Archive