Abstract

This article builds the index of enterprise competitiveness based on the annual reports of the New Third Board of China, and then proposes the index of city competitiveness, which reflects the competitiveness of cities in high and new technology field. We select the critical values to get the city high and new technology development level, combined with the heat map analysis of the status quo of China urban high and new technology development and forecast the future development trend of Beijing-Tianjin-Hebei, Yangtze River Delta, Pearl River Delta and Chengdu-Chongqing science and technology ecosystem. Finally, the development potential of science and technology in china urban clusters is compared and analyzed.

You have full access to this open access chapter, Download conference paper PDF

Similar content being viewed by others

Keywords

- Enterprise competitiveness index

- Urban high technology development level

- Science and technology ecosphere

- China city clusters

1 Introduction

This article builds the enterprise competitiveness index [1,2,3] based on the talent reserve and financial status of new three board enterprise of China, reflecting the overall competitiveness of high and new technology enterprises in sustainable profitability. And according to the city where the enterprise is registered, the enterprise competitiveness index [4,5,6] is summed up to obtain the Chinese city competitiveness index, which reflects the city’s sustainable competitiveness in high and new technology field. Combined with the rank of high and new technology urban development in China, the status quo of high and new technology city development in China during 2013–2016 is analyzed. The development potential of high and new technology in major science and technology ecosphere [7,8,9] is predicted, which will provide reference for the city’s high and new technology industry layout.

2 Research Background

China’s new OTC (Over the Counter) Market [10] originated in the “National Equities Exchange and Quotations” in 2001, the earliest to undertake two companies and delisting companies, commonly known as the “old three boards”. In 2006, Zhongguancun Technology Park unlisted shares into the agency transfer system to transfer shares quoted, known as the “new three boards”. With the gradual improvement of the new three board market, China will gradually form a multi-level capital market system, including motherboard, gem, over-the-counter counter trade network and property market. In 2012, with the approval of the State Council, it decided to expand the pilot share transfer of unlisted joint-stock companies. The first batch of pilot projects was to expand Shanghai’s Zhangjiang High Technology Industrial Development Zone, Wuhan East Lake New Technology Industrial Development Zone and Tianjin Binhai High Technology Zone. Since December 31, 2013, the share transfer system has been receiving application for listing enterprises in the country. As of December 31, 2016, the number of new three board listed companies was 10,163, with a total share capital of 585.15 billion shares, and the total market capitalization of listed companies reached 4.055811 trillion yuan.

The competitiveness of enterprises [11] refers to the comprehensive ability of enterprises to realize their own value through creating their own resources and capabilities, acquiring externally-addressable resources and using them comprehensively under the competitive market conditions. The core competitiveness of China’s new OTC business is the line of endowment of talent; the number of employees in this paper reflects the number of employees in the enterprise reserve situation. The accounting identity reveals the operating results of a company in a specific period. This article chooses the total operating costs, total operating income and total operating profit as indicators to reflect the long-term sustainable profitability of the enterprise.

High and new technology [12] refers to the advanced technology group that has a far-reaching impact on the politics and economy of a country or a region, and can form an industry. National high and new technology zones and industrial bases have become important growth poles for promoting regional economic development and provide strong support for the cultivation and development of strategic emerging industries. The purpose of this paper is to study the status quo, trends and laws of high and new technology development in cities in China through China’s new OTC enterprise competitiveness index and to forecast the potential of high and new technology in major science and technology ecosphere.

3 China’s New OTC Enterprise Competitiveness Index

This paper through the crawler technology, accesses China’s new OTC corporate annual report from the online authoritative data source. After finishing the collection of a total of China’s new OTC annual report number as follows:

From the enterprise annual report, select the number of employees (a), total operating income (million), total operating costs (million) and total operating profit (million) four indicators of numerical values (Table 1). In this article, the 100-point system, the indicators of various years the value of data cleaning, extreme value processing and normalization, and then in accordance with the various dimensions of “equal rights” proposes enterprise competitiveness index [13].

3.1 Data Cleaning

Uniform data types and handle missing values. Data cleaning follows the principle of “total operating revenue − total operating costs = total operating profit”. After cleaning, the number of indicators is 17,100.

3.2 Extreme Value Processing

For a given indicator, if the indicator value is higher than the mean plus twice the standard deviations, we define it as positive outliers; if the indicator value is smaller than the mean minus twice the standard deviation, we define it as the negative outliers. These outliers are replaced by the respective maximum and minimum values observed over all the years and all enterprise.

3.3 Normalized

Given a target value of x, it is linearly transformed (x − min)/(max − min), where min is the minimum and max is the maximum. After normalization, the minimum is equal to 0 and the maximum is equal to 1.

3.4 Enterprise Competitiveness Index

Adopting the 100-point system and the “Index Equal Power Law”, the result of normalizing four indicators is multiplied by 100 and averaged to obtain the index of competitiveness of China’s new OTC enterprise.

In accordance with the stock code order, given some China’s new OTC enterprise competitiveness index as follows:

The index of enterprise competitiveness is between 0 and 100, and the greater the value, the stronger the overall competitiveness of enterprises for sustainable profitability (Table 2).

The research shows that the national average enterprise competitiveness index shows a steady upward trend, and the profitability, research and development ability and innovation ability of enterprises have been gradually increasing (see Fig. 1).

4 Urban High Technology Development Level

China’s new OTC Market Services Innovative, entrepreneurial, growth of small and medium-sized micro-enterprise coverage has been expanding. As of the end of 2017, among China’s new OTC listed companies, the proportion of small, medium and micro-enterprises reached 94%. China’s new OTC enterprise is an important constituent of the urban center of the city’s high and new technology development. China’s new OTC enterprise competitiveness indicator is used to construct the metropolis competitiveness index and measure the sustainable competitiveness of cities in high and new technology field.

In this paper, according to the city where China’s new OTC enterprises registered, the enterprise competitiveness index is summed up and the city competitiveness index score is obtained. Using the function \( f(x) = 10 \cdot 2^{x} \) to select the critical value, the city competitiveness index is divided into corresponding intervals, each corresponding to an urban high and new technology development level [14] (Table 3). The corresponding relationship is shown in the following table:

According to the levels from high to low in 2016, the table below shows the top 10 cities in high and new technology development indicators:

The stage of urban high and new technology development reflects the development potential of cities in high and new technology industries (Table 4). The higher the stage, the greater the potential for development. In 2016, the high and new technology development level of Beijing and Shanghai was the highest, reaching 12 level. Shenzhen, as the next, reached 11. Suzhou, Guangzhou, Hangzhou and Nanjing reached level 10.

5 China Urban High Technology Development Status Quo

Since 2013, the stock transfer system has been receiving application for listing in the country and the new OTC market of China has entered a golden stage of rapid development. This section mainly studies and analyzes the status quo of China city high and new technology development in 2013–2016.

In 2013, Beijing ranked the nation in terms of the level of high and new technology development in cities with a rank of 9. Shanghai, Wuhan and Tianjin followed. Shenzhen and Guangzhou have just started (Fig. 2).

In 2014, Beijing reached level 10. Shanghai second, to 9. Shenzhen and Guangzhou to achieve a qualitative leap, respectively, reached 8 and 7 (Fig. 3).

In 2015, the three companies covering 266 cities across the country. Beijing and Shanghai reached 11, followed by Shenzhen and Suzhou, level 10 (Fig. 4).

In 2016, China’s new OTC enterprises cover 299 cities nationwide. Beijing and Shanghai reached 12, Shenzhen level 11, Suzhou, Guangzhou, Hangzhou and Nanjing reached 10 (Fig. 5).

In the past four years, the new OTC market of China has undergone a start-up, development and maturity stage. China’s new OTC companies gradually expanded from Beijing and Shanghai to cover most of the country’s small and medium-sized metropolis. In 2013–2016, China high and new technology city achieved leapfrog development. From the coverage of the breadth, from the pilot Zhongguancun Technology Park quickly covered the entire country. From the depth of development, high and new technology development levels in first-tier cities such as Beijing, Shanghai and Shenzhen have been increasing year by year. Beijing has been gradually raised from the 9th level to 12 levels. Shenzhen has become even more remarkable. It has grown from level 1 to level 11. Other major cities, such as Suzhou and Guangzhou, also enjoyed explosive and rapid urban high and new technology growth.

6 Science and Technology Ecosystem Development Potential Forecast

This section examines the urban competitiveness index of 2017 in China and studies the potential and trends of high and new technology development in major cities in China from the perspective of science and technology ecosystem. Assuming that the average enterprise competitiveness index of cities in 2017 is consistent with that of the previous year, a regression model will be used to predict the number of China’s new OTC enterprises [15] in each city in 2017 and the product of the number of enterprises and the average enterprise competitiveness indicant to obtain the 2017 China urban competitiveness index number. Science and technology ecosystem is based on high and new technology, geographical space adjacent to urban agglomeration. The following is a combination of heat maps to predict the potential of high and new technology urban development in Beijing-Tianjin-Hebei, Yangtze River Delta, Pearl River Delta and Chengdu-Chongqing science and technology ecosystem in 2017.

6.1 Beijing-Tianjin-Hebei Science and Technology Ecosystem

With Beijing as the core, China will lead the development of science and technology in the entire country. The two core cities in the ecosphere co-exist and the neighboring cities have limited capacity to accept core science and technology radiation (Figs. 6 and 7).

Beijing ranks the highest in the development of high and new technology cities in the country and will reach 13 in 2018. Tianjin and Beijing echo each other, reaching 10 in 2018.

6.2 Yangtze River Delta Science and Technology Ecosystem

With Shanghai as the center, the high and new technology industries in cities such as Suzhou, Hangzhou, Nanjing and Wuxi have been developing rapidly. The ecosystem shows a trend of multi-polarization (Figs. 8 and 9).

The Yangtze River Delta technological ecosphere is the region with the highest potential for high and new technology development in China. Shanghai is expected in 2018 12 level, followed by Suzhou and Hangzhou, reaching 11 levels.

6.3 Pearl River Delta Science and Technology Ecosystem

With Shenzhen as the center, followed by Guangzhou and Dongguan, the Pearl River Delta is China science and technology innovation and technology research and development base and is the most dynamic eco-circle (Figs. 10 and 11).

Shenzhen is the region with the highest potential for high and new technology development in urban areas in China. It is forecast to reach 12 levels in 2018, followed by Guangzhou and Dongguan at 11 and 10 respectively.

6.4 Chengdu-Chongqing Science and Technology Ecosystem

Focusing on Chengdu and Chongqing, we will foster the leading role in leading the development of high and new technology in the western region and strengthening the strategy of developing the western region (Figs. 12 and 13).

Chengdu and Chongqing are the dual-core of the Chengdu-Chongqing science and technology ecosphere. In 2018, the city’s high and new technology is expected to reach 10 and 9 levels, respectively.

7 Comparison of Development Potentiality of Science and Technology in Urban Cluster

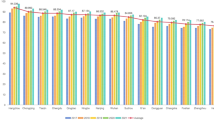

This section is a comparative analysis of the growing potential of the main cities in the above science and technology ecosphere. Figure 14 shows the urban competitiveness index of 2016 and forecast in 2017. Finally, it illustrates the advantages and characteristics of high and new technology development in each urban cluster.

Beijing-Tianjin-Hebei urban cluster: Zhongguancun radiation led role has continued to highlight the deepening of regional scientific and technological cooperation. Beijing is dominated by modern service industry. Tianjin is the dominant mode of processing industry and Hebei is the resource-based mode of development.

Yangtze River Delta urban cluster: Zhangjiang is the source and core of scientific and technological innovation in the Yangtze River Delta region, promoting the integration of technological innovation chain and industrial chain. Jiangsu efforts to build Sunan into an internationally influential industrial technology innovation center, Zhejiang around Hangzhou to build a national Internet platform, Anhui actively undertake the industrial transfer Jiangsu, Zhejiang and Shanghai developed regions.

Pearl River Delta urban cluster: Shenzhen is the first national independent innovation demonstration zone featuring cities as its basic unit. Guangzhou speeded up the construction of a national innovation center city and an international science and technology innovation hub. The other 7 cities in the PRD promoted innovation and development in light of their own advantages and industrial realities.

Chengdu-Chongqing urban cluster: Chengdu High Technology Zone is a state-level high and new technology industry development zone and an important engine for the rise of western China. High Technology Zone in Chongqing adhere to the principle of differentiation and sustainable development, is building a leading western “scientific development model window.”

References

Lin, L., Tang, J.: Medium and small-sized enterprises’ financing status and performance analysis of the new three board market. J. Hebei Univ. Econ. Bus. 71–76 (2015)

Fang, X., Wu, Y.: A research on financing efficiency of SMEs in NEEQ market. Econ. Manag. J. 42–51(2015)

Shen, C.: A research on financing efficiency of SMEs in NEEQ market. J. Audit Econ. 78–86 (2017)

Ni, P.: An empirical test about contribution of infrastructure to urban competitiveness. China Ind. Econ. 62–69 (2002)

He, T.: Progress of urban competitiveness study at home and abroad. Inquiry Into Econ. Prob. 21–24 (2005)

Yu, T.: Progress of urban competitiveness study abroad. Urban Plann. Overseas 28–34 (2004)

Ma, Y.: Build a corporate open innovation ecosystem. China Ind. Rev. 22–26 (2016)

Wang, F., Lv, J.: The evaluation and spatial-temporal evolvement of the city competitiveness of Zhongyuan Urban Agglomeration. Geogr. Res. 49–60 (2011)

Xu, X., Cheng, Y.: Spatial-temporal changes of urban competitiveness in urban cluster of Pearl River Delta. Scientia Geographica Sinica 257–265 (2006)

Song, X.: The characteristics, motives and implications of the development of the new third board market. Secur. Mark. Herald 4–12 (2015)

Zhang, X., Yu, W., Hu, Y.: Quantitative evaluation method of enterprise competitiveness. Manag. Rev. 32–37 (2003)

Fu, X.: Present situation and developing tendency of high and new technology. Mod. Chem. Ind. 2–6 (2001)

Jiang, R., Wu, Y.: Research on the competitiveness of China’s top 500 enterprises. Res. Fin. Econ. Issues 80–87 (2012)

Wang, X.: High-tech comprehensive assessment. Stud. Sci. Sci. 5 (1998)

Wang, M., Li, B.: Seamless linear regression and prediction model. Acta Geodaetica et Cartographica Sinica 1396–1405 (2016)

Acknowledgement

This work is partially supported by the technical projects No. 2017YFB1400604, No. 2016YFB1000803, No. 2017YFB0802703, No. 2012FU125Q09, No. 2015B010131008 and No. JSGG20160331101809920.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this paper

Cite this paper

Deng, L., Chen, H., Zhang, LJ., Li, X. (2018). Research on the High and New Technology Development Potential of China City Clusters Based on China’s New OTC Market. In: Chin, F., Chen, C., Khan, L., Lee, K., Zhang, LJ. (eds) Big Data – BigData 2018. BIGDATA 2018. Lecture Notes in Computer Science(), vol 10968. Springer, Cham. https://doi.org/10.1007/978-3-319-94301-5_22

Download citation

DOI: https://doi.org/10.1007/978-3-319-94301-5_22

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-94300-8

Online ISBN: 978-3-319-94301-5

eBook Packages: Computer ScienceComputer Science (R0)