Abstract

Markets of Biobased Resources and Products: This chapter takes a closer look at the global market for biobased products and resources and its interactions with agricultural and food markets. In particular, it describes the effect of increasing demand for biobased products on market prices and thus the quantity of agricultural resources demanded and supplied. Furthermore, we discuss factors that may drive or limit demand and supply of biobased products. We analyse the market for biobased resources and products, considering products that are already established in the market, such as biofuels, as well as products that could acquire a substantial market acceptance in the future, such as bio-plastics. In addition, we briefly introduce selected policy instruments applied to support biobased products.

The chapter provides a simple example of a perfectly competitive market for biobased products to introduce the market model. It starts by presenting the supply and demand curves and discussing the differences between price changes and those of other determinants of supply and demand with respect to their effects on the respective curve. It then explains how the supply and demand curves jointly determine the equilibrium price and quantity on the market and how the market price regulates surpluses and shortages under the assumption of an autarkic country. We apply this market model to demonstrate the effect of one particular policy for promoting the production of biobased products on the equilibrium market price and quantity.

Sustainable Development and Sustainability Management: In the last decade(s), the idea of sustainable development has become a widely acknowledged topic which is supported by many actors in modern society.

Companies, as central economic players, are increasingly pressured by a wide set of stakeholders to engage in sustainability management and to contribute their share towards sustainability. Against this background, this chapter first introduces the general idea of sustainable development with its elements of intragenerational and intergenerational justice and illustrates the roots of sustainable development as a normative-anthropocentric concept. Since sustainability is a contested idea with many different notions, the different understandings of weak, strong and quasi-sustainability are introduced and the status quo of sustainability in society is highlighted.

Following this general introduction, actors of sustainability in society are named and the relevance of sustainability management for companies is discussed. In the remainder of this chapter, three base strategies to achieve sustainability (i.e. eco-efficiency, eco-effectiveness and sufficiency) are explained along with their opportunities and limitations in achieving sustainability. Finally, some exemplary elements and tools of sustainability management from the areas of sustainability accounting and management control as well as of sustainable supply chain management are introduced to provide a first glimpse of possibilities for companies to engage with sustainability.

Life Cycle Sustainability Assessment: The bioeconomy is based on the three pillars of sustainability and aims to balance the environmental, economic and social aspects. For this task, tools are required that provide qualitative and quantitative information on the environmental, economic and social performance of biobased products and on the trade-offs between the goals of the three dimensions of sustainability. In this chapter, a methodological approach for a Sustainability Assessment based on ‘Life-Cycle Thinking’ is presented. This approach combines the use of three forms of assessment: Life-Cycle Assessment (LCA) for the environmental aspects, Life-Cycle Costing (LCC) for the economic aspects and Social Life-Cycle Assessment (sLCA) for the social aspects. Together these form the most comprehensive methodology for sustainability assessment: Life-Cycle Sustainability Assessment (LCSA). A hypothetical example of an LCSA is elaborated for a biobased product to illustrate the different assessment steps.

Entrepreneurial Ventures and the Bioeconomy: Entrepreneurship is based on entrepreneurial opportunities and the bioeconomy offers a plethora of such opportunities. As the bioeconomy—at least partially—addresses humanity’s greatest challenges, it consequently offers the greatest entrepreneurial opportunities as well. One useful tool to break down the idea generation process and manage the entrepreneurial process is the business model canvas, which makes it possible to clearly describe the value proposition of a new venture in the bioeconomy. The lean start-up approach can help entrepreneurs in the bioeconomy to move efficiently through the entrepreneurial process and to quickly develop a value proposition and a validated business model.

The original online version of this chapter was revised. An erratum to this chapter can be found at https://doi.org/10.1007/978-3-319-68152-8_13.

Individual section’s authors are indicated on the corresponding sections.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- Market mechanisms

- Biobased resource and product markets

- Food and feed markets

- Demand and supply curves

- Policy instruments

- Carbon tax

- Sustainability

- SDGs

- Stakeholder

- Eco-efficiency

- Eco-effectiveness

- Sufficiency

- Value chain assessment

- System analysis

- Life-cycle thinking

- Life-cycle assessment

- Life-cycle costing

- Social life-cycle assessment

- Life-cycle sustainability assessment

- Entrepreneurial opportunity

- Business model

- Start-up process

In the year 2013, the turnover of the total European (EU 28) bioeconomy, including the primary sectors agriculture and forestry as well as the sectors of food, pulp and paper, forestry-based industries, bioenergy and others, was 2.1 trillion euros (based on Eurostat data of 2013). Roughly half of this is accounted for by the food and beverages sector, almost a quarter by the primary sectors (agriculture and forestry), while the other quarter comes from biobased industries, such as bio-chemicals, bio-plastics, pharmaceuticals, pulp and paper products, forest-based industries, textiles, biofuels and bioenergy (see Fig. 8.1).

Turnover in the European (EU 28) bioeconomy in the year 2013 (Piotrowski et al. 2016)

The relevance of the different bioeconomic sectors may differ between regions and countries. However, it becomes clear that, presently, food production is the economically most important sector in the bioeconomy, followed by agriculture, forest-based industry and pulp and paper production (Fig. 8.1). The resources for the forest-based industry and pulp and paper production mainly come from forestry. Most other biobased resources used in the bioeconomy, especially for food production but increasingly also for chemicals, plastics, pharmaceuticals, textiles and other products, stem from agricultural production and therefore may indirectly, via land use, or directly, via use of edible raw material, interfere or compete with food supply. Markets for biobased resources therefore overlap with food markets to a large extent. To avoid negative effects on food security, it is necessary to understand how markets for biobased products function. Thus, in Sect. 8.1 explains market mechanisms and market influencing factors of biobased resource and product markets, e.g. an increasing demand for biobased resources for biofuel production and policy instruments, such as subsidies.

The precondition for a sustainably growing bioeconomy is that sustainably produced biobased products are brought onto the market. Section 8.2 therefore provides guidance on how companies, as central economic players, can engage in sustainability management and contribute their share towards sustainability. Actors of sustainability in society are named and the relevance of sustainability management for companies is discussed. Important elements and tools of sustainability management from the areas of sustainability accounting and management control as well as of sustainable supply chain management are introduced to provide a first glimpse of possibilities for companies to engage with sustainability. Life-Cycle Sustainability Assessment (LCSA) is so far the most comprehensive methodology for sustainability assessment and Life-Cycle Assessment (LCA) is a tool broadly used by companies to assess the ecological and energetic performance of biobased value chains. These tools and their use are described in Sect. 8.3.

Finally, the bioeconomy will only grow if entrepreneurs take the initiative to develop novel and innovative biobased products and bring them onto the market. The bioeconomy offers great entrepreneurial opportunities. Section 8.4 introduces the business model canvas, a useful tool to break down the idea generation process and manage the entrepreneurial process. This tool makes it possible to clearly describe the value proposition of a new venture in the bioeconomy. This lean start-up approach can help entrepreneurs in the bioeconomy to move efficiently through the entrepreneurial process and to quickly develop a value proposition and a validated business model.

1 Markets of Biobased Resources and Products

Abstract

This chapter takes a closer look at the global market for biobased products and resources and its interactions with agricultural and food markets. In particular, it describes the effect of increasing demand for biobased products on market prices and thus the quantity of agricultural resources demanded and supplied. Furthermore, we discuss factors that may drive or limit demand and supply of biobased products. We analyse the market for biobased resources and products, considering products that are already established in the market, such as biofuels, as well as products that could acquire a substantial market acceptance in the future, such as bio-plastics. In addition, we briefly introduce selected policy instruments applied to support biobased products.

The chapter provides a simple example of a perfectly competitive market for biobased products to introduce the market model. It starts by presenting the supply and demand curves and discussing the differences between price changes and those of other determinants of supply and demand with respect to their effects on the respective curve. It then explains how the supply and demand curves jointly determine the equilibrium price and quantity on the market and how the market price regulates surpluses and shortages under the assumption of an autarkic country. We apply this market model to demonstrate the effect of one particular policy for promoting the production of biobased products on the equilibrium market price and quantity.

© Uli Maier

Learning Objectives

After reading this chapter, you should be able to

-

Understand the challenges on the market for biobased products, and explain driving and limiting forces of supply and demand for biobased products

-

Understand the functioning of resource and product markets and the price mechanism

-

Analyse the effects of supply and demand shocks on the market for biobased products, and understand interlinkages with food and feed markets

-

Explain policy effects and how they can be used to influence the markets for biobased products

1.1 Introduction

Concerns about the exhaustion of natural resources and climate change have raised interest in the production of biobased products. This has been driven in particular by the depletion of limited global natural resources such as oil reserves (Sect. 2.1), the dependency on oil-producing countries and the increasing number of agreements on environmental protection and climate change mitigation. As a consequence, governments are increasingly endeavouring to support the production of biobased products through policies. The associated political objectives include sustainable production and achievement of sustainable development goals, reduction of environmental pollution, mitigation of climate change effects, and increased self-sufficiency in energy production thus lowering dependence on oil-producing countries, such as Organization of the Petroleum Exporting Countries (OPEC) members and other politically unstable regions.

However, the market for biobased resources and products also faces several limiting factors. The production costs of biobased products are much higher than those of “unsustainable” products already established on the market. As a result, biobased products are often not competitive at current market prices. Their future competitiveness requires continued research and development, which—due to market failures—may not occur without some temporary government intervention, such as subsidies, public procurement, blending mandates and the establishment of labelling or certification programs that distinguish these products from traditional ones, attesting their higher value and thus justifying the charging of viable prices. Figure 8.2 lists the major driving and limiting factors in the demand and supply of biobased products and resources.

The continuous growth in global population, together with changes in diets through improved living standards, has led to sharp increases in the demand for food and feed products. On the other hand, climate change and finite resources are driving additional demand for biobased products. Since biobased products are often at least partly based on primary agricultural commodities, this creates a conflict with food security objectives through the competition for limited resources, such as land, water and other inputs to agricultural production. For example, additional demand for agricultural products as feedstock for biofuels production has been identified as one factor that triggered the food price spikes in 2007/2008 and 2011. These interdependencies with food demand and supply and thus food security hamper the implementation of policy instruments to support sustainable production, because this requires comprehensive consideration of the entire nexus between development, food security and environmental objectives.

1.2 Developments on the Markets for Biobased Products (and Resources?)

The OECD (2012) defines biobased products as goods excluding food and feed that are “composed in whole or in significant parts of biological products, forestry materials, or renewable domestic agricultural materials, including plant, animal or marine materials”. In this section, we briefly introduce market developments for biobased products that can be divided into three main categories: biofuels, biochemicals and biomaterials (see Fig. 8.3 for further explanations).

First, we take a closer look at the market for biofuels, the largest of the three biobased product groups and one which has existed for more than three decades. Markets for the other two, biochemicals and biomaterials, are still in development and information on these is scarce.

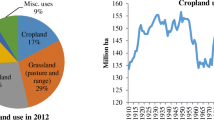

Global liquid biofuel production has continuously increased over the last three decades. Figure 8.4a shows the development of the world ethanol and biodiesel production from 2007 to 2015. In 2015, global biofuel production amounted to 146 billion litres, almost double that of 2007. Ethanol production accounts for nearly 80% of total biofuel production (OECD/FAO 2016). In 2015, North America was the major producer of biofuels, followed by Latin America (including the Caribbean) and the European Union (Fig. 8.4b). According to Gallagher (2008), around 1% of total global cropland was used for biofuel production in 2006. OECD/FAO (2016) predicts an increase in production of 11.1% for biodiesel and 31.1% for ethanol by 2025.

Development of global liquid biofuel production (OECD.Stat 2016)

As a result of the 1973 oil embargo initiated by OPEC, which led to a dramatic increase in oil prices, Brazil started the production of ethanol from sugar cane with a view to becoming less dependent on oil-producing countries. This move was facilitated by the low international sugar prices at that time and by Brazil’s implementation of several policies promoting the further expansion of ethanol production. In 2009, Brazil produced around one third of global ethanol, only exceeded by the USA with a share of more than 50%, mainly produced from maize (Janda et al. 2012). The EU is the major producer of biodiesel (80%). In Germany, 760,000 ha of agricultural land were cultivated with rapeseed in 2016 for the production of biodiesel and vegetable oil (FNR 2017). However, the production of biodiesel from soybean is increasing in the USA. Figure 8.5 depicts the development in demand for three crops used for biofuel production from 2000 until 2015. It becomes obvious from these graphs how much biofuel production has increased the demand for the agricultural products maize, sugar cane and vegetable oils. While the biofuel demand for sugar cane (vegetable oils) accounted for around 11% (less than 1%) in 2000 it increased to 21% (more than 12%) in 2015. The graph for sugar cane demand in particular highlights the food price spikes in 2007/2008 and 2011 and shows increased demand for biofuels due to very high oil prices with one year lag.

Crop product demand for biofuel production (OECD.Stat 2016). Note: Red line: % of total crop production, blue bars: biofuel use in tons

A high crude oil price may be an important factor for the competitiveness of biofuels. However, energy also contributes to the total production cost of biofuels. The extent differs between countries and crops used for production. Van Lampe (2007) assess biofuel production costs by considering energy, processing and feedstock costs and subtracting the value of by-products. A simple indicator of the biofuel competitiveness can be derived from the ratio of crude oil to biofuel feedstock prices. The demand for alternative fuels, such as biofuels, increases with rising crude oil prices. This, in turn, increases the demand for agricultural commodities, such as maize, rapeseed and sugar cane, and raises their prices. Consequently, higher oil prices increase biofuel production and feedstock costs. In addition, the contribution of by-products may diminish, because outlets become satiated, increasing biofuel production costs even further. Figure 8.6 reveals that the price index for commodity fuels tracks the price index for crude oil, whereas the index for agricultural raw materials follows to a lesser extent. During the crude oil price spikes in 2007/2008 and 2011–2014, biofuel feedstock prices, represented by the index for agricultural raw materials, increased less than the crude oil price, thus increasing the competitiveness and economic viability of biofuels.

Price indices for different commodity aggregates (IMF 2016 and World Bank 2016). Note: Commodity Agricultural Raw Materials Index includes timber, cotton, wool, rubber and hides price indices. Commodity Index includes both fuel and non-fuel price indices. Commodity Fuel (energy) Index includes crude oil (petroleum), natural gas, and coal indices. Crude Oil (petroleum) Price index is simply the average of three spot prices: Dated Brent, West Texas and the Dubai Fateh

The markets for biochemicals and biomaterials are less developed than that for biofuels. Biochemicals and biomaterials can still be regarded as infant industries but they could acquire a substantial market acceptance in the future.

Both the number of biochemicals produced from biomass and the range of products made from these biochemicals are very high. Due to this diversity, the OECD (2011) classifies the biochemical market according to the different chemical industry segments. In 2007, the sale of chemicals made from biobased raw materials in the chemical industry amounted to EUR 48 billion, which represents only a minor fraction (3.47%) of the total output produced (Festel 2010).

In 2007, the EU 27, North America including Canada, the USA and Mexico (NAFTA), and Asia dominated the market for biochemicals, accounting for more than 90% of total sales. All other countries (ROW = rest of the world) made up the remaining 10%. Active pharma ingredients, organic chemicals and cosmetics are of particular importance (Fig. 8.7).

The market for biochemicals (adapted from OECD 2011, p 52). Note: Biotechnology sales per segment 2007 in EUR billions; ROW = rest of the world

The EU is the major player in the biochemicals market. In 2013, around 6% of total chemical products can be considered as biobased. However, at EU member state level we see large differences. Denmark and Latvia reach shares of biochemicals of over 35%, while France, Germany and the Netherlands only of around 5%, and many of the newer member states of even less (Piotrowski et al. 2016). According to Hatti-Kaul et al. (2007), the EU average is estimated to increase to 20% in 2020. In the USA, the share of biochemicals in total chemicals sales is less than 4%. Asia is gradually increasing its market share.

The market for bioplastics dominates the category biomaterials and increased substantially in recent years. Bioplastics are plastics derived from renewable biomass sources, such as vegetable fats and oils, starches, cellulose, biopolymers and a variety of other materials. In 2013, 300 million tons of plastic are produced annually of which only 1% can be categorised as bioplastic (European Bioplastic 2016). However, due to the high rise in the demand for bioplastics, this market has the potential to boost its market share. Estimates indicate that the production of bioplastics could increase from 4.2 million tons in 2016 to approximately 6.1 million tons in 2021 (European Bioplastic 2016).

Figure 8.8 presents the market for bioplastics in 2016 which is clearly dominated by Asia (1.81 million tons) followed by Europe (1.13 million tons) and North America (0.97 million tons). The land used to grow the renewable feedstock for the production of bioplastics was about 0.68 million hectares in 2014, around 1% of the global agricultural land (European Bioplastic 2016). Within the bioplastics industry, bio-based Polyethylene Terephthalate (PET) and Polylactic Acid (PLA) are the leading biobased plastics products and grow faster than others. Baltus et al. 2013 state a production capacity of bio-based PET equal to around 5 million t per year in 2020. PLA is used mainly in packaging but it also has a large number of other durable applications. The world’s PLA production has doubled within the time period 2011–2015 to around 400,000 t per year and has been projected to increase even faster in the near future, by around 800,000 t per year in 2020 (Baltus et al. 2013). The company “Nature Works” from Thailand and the USA holds a PLA market share of almost 80% in 2011 (140,000 t from a total of 180,000 t per year), whereas the other producers have a current capacity varying between 1500 and 10,000 t per year (bioplastic Magazine 2012).

The market for bioplastics (European Bioplastic 2016). Note: Bioplastic Production in 2016 in million tons by region

Of the global agricultural land in 2008, 18% were allocated to food, 71% to animal feed, 4% to bioenergy and 7% to material use (Raschka and Carus 2012).

In this section, we have briefly introduced the recent developments on the markets for biobased products and how these developments are reflected in the demand for agricultural commodities, land use and prices. How does this additional demand for maize, sugar cane and vegetable oils (on top of food and feed demand) affect the market for agricultural commodities? To answer this question, we analyse supply and demand on the market for maize, exemplary for an input to the production of biobased products.

1.3 The Market for Biobased Resources and Products: Deriving Demand and Supply Curves

How supply and demand on a market interact and how they depend on and affect other markets is explained using a market diagram. Here, we are going to use the maize market as an example for introducing the market diagram due to its omnipresence in all areas of the bioeconomy, i.e. food, feed, biofuels, bioplastics as well as biochemicals. For a comprehensive introduction to theory of markets, the reader is referred to standard textbooks of microeconomics, e.g., Varian (2014). In the market diagram presented in Fig. 8.9a, the horizontal axis represents the quantity demanded, whereas the vertical axis represents the price. The demand curve (D) shown in black depicts the relationship between the price for maize and the quantity of maize consumers are willing and able to buy at each particular price where—according to the law of demand—the quantity demanded depends negatively on the price. This normal, negative demand reaction to price increases is the result of two separate effects: (1) If the maize price increases, the consumer can afford less quantity of maize at the given income and thus demands less. This is the income effect. (2) When the price of maize increases, the consumer will look for alternative products similarly satisfying the need and thus substitute some of the consumption of maize, for instance, with wheat. This is the substitution effect. Both effects will cause the consumer to buy less maize if its price increases, so that the total quantity of maize demanded will decrease. Usually, a demand curve in a market reflects the aggregate demand of all consumers in the market. In Fig. 8.9 we assume that consumer 1 (blue curve) represents the maize demand by food and feed producers, whereas consumer 2 (green curve) represents the maize demand by producers of for example biofuels and bioplastics. Both curves together add up to the total maize demand.

If the price for maize increases, both consumers want to buy less of it. The strength of the consumers’ reaction to the price increase is measured by the price elasticity of demand.Footnote 1 A price elasticity of demand equal to one means that for example a 20% increase in the price for maize leads to a 20% decrease of the quantity demanded. A price elasticity of demand of less than one means the fall in demand is less than 20% and the demand curve is steeper and the demand is said to be less elastic. If the elasticity is greater than one, then the quantity demanded increases by more than 20% and the demand curve is flatter and the demand more elastic.

Figure 8.9b displays the supply side of the maize market in the same type of diagram. The supply curve (S) shown in black depicts the relationship between the price for maize and the quantity of maize producers in the country are willing and able to supply. Usually, supply is positively related to the price due to factors causing production costs to increase with increasing level of production output, depending on the particular product market. This is illustrated by two examples. Increasing the production of maize could be achieved, for example, by allocating additional land or using more fertilizer. Both would increase the production costs of a ton of maize: Commonly, all good quality, suitable land is already under productive use and thus the farmer would need to offer a higher land rental price than others to obtain additional land. Likewise, applying additional fertilizer increases the maize yield but the particular gain in yield per hectare for the next unit of fertilizer applied is the lower, the more fertilizer is already applied to the field (diminishing marginal productivity). Thus, the quantity of maize that can be profitably produced increases with the market price of maize and the quantity supplied to the market increases. The supply curve represents the aggregated supplies of all sellers, here supplier 1 and 2, just as the demand curve is the sum of the demand of all consumers.

This simple example of a market is general and equivalently applies to the demand and supply of any other market, such as those for sugar, fuels or bioplastics.

1.4 The Market for Biobased Resources and Products: Determining the Equilibrium Price and Quantity

In the previous section, we have graphically analysed the demand and supply curves using the example of maize. Now, we combine demand and supply curves in a market diagram to determine the equilibrium quantity and price at which a good is traded in the market.

Figure 8.10 represents the market by combining the supply and demand curves in a single diagram. The market equilibrium (E) is the point at which the demand and supply curves intersect. This point defines the market price (equilibrium price) at which the quantity supplied on the market equals the quantity demanded, thus the price at which the market is cleared. Usually, the market price automatically settles in the equilibrium due to the interactions between consumers and producers. Let’s consider again our maize example. Suppose that in the initial situation the market price for maize is higher than the equilibrium price. At this price, the quantity supplied is larger than the quantity demanded (excess supply or surplus). As a result, not all suppliers are able to sell their maize at the current price and they reduce their prices. At a lower price, consumers demand more maize and producers supply less. This process of lowering the price of maize and the corresponding reactions of buyers and sellers will continue until the quantity of maize supplied equals the quantity demanded, equivalent to movements along the demand and supply curves, respectively, towards the equilibrium point.

Besides the market price, there are other factors which determine the quantities supplied and demanded, respectively. We can observe movements along the demand curve and shifts of the demand curve. Continuing the example, if the price for maize decreases, the result is an increase in the quantity demanded which is equivalent to a movement along the demand curve. Similarly, the price decrease declines the quantity of maize supplied and is equivalent to a movement along the supply curve. By contrast, an increase (decrease) of the quantity demanded at a given price reflects a shift of the curve to the right (left) and analogously for the quantity supplied. What are causes for such shifts of the demand and supply curves?

Let us start with the demand side. Usual factors that lead to a shift of the demand curve are: changes in the price of goods related to the observed good, income changes, changes of tastes and preferences and changes in expectations. In our maize example, concerns about the climate impacts of fossil oil-based industries increase the demand for biofuels. This results in a shift of the demand curve for biofuels to the right and consequently also in a shift to the right of the demand curve for the biofuel feedstock maize (change in preferences). Conversely, a decrease in the fossil oil price would lead to a decrease in biofuel demand and thus also decreases the demand for maize shifting the demand curve to the left (change in the price of a good related to biofuels).

From an economic perspective, biofuels are a substitute for fossil oil. Products are called substitutes, if an increase in the price of one commodity (fossil oil) leads to an increase in the demand for the other commodity (biofuels). However, in other cases an increase in the price of one commodity would lead to a decrease in the demand of another commodity, e.g. fossil oil and cars. Such products are called complements.

How are the equilibrium price and quantity on a market affected by a price increase of a related product?

Figure 8.11 presents the effects of a rise in the oil price on the market for biofuels (Fig. 8.11a) and on the market for the biofuel input maize (Fig. 8.11b). Due to the increase in the fossil oil price, the market price for fuels also increases so that biofuels become relatively cheaper and demand for biofuels increases at every price, indicated by the demand curve shift to the right (D1 → D2). At the old price (P1) demand exceeds now supply. This excess demand induces suppliers of biofuels to raise the price. Consequently, the increased oil price raises the equilibrium price for biofuels (P1 → P2) and the equilibrium quantity of biofuels sold (Q1 → Q2).

An increase of the equilibrium biofuel quantity in diagram (a) raises the demand for its inputs such as maize. This is shown in diagram (b). At every price, the demand for maize is increased as represented by a shift of the demand curve to the right (D1 → D2). This results in an increase of the equilibrium price and quantity for maize, which in turn affects biofuel producers.

Shifts of the supply curve are usually caused by changes in input prices, technological changes or changes in expectations. For the production of biofuels several inputs are required, among them maize. If the price of maize increases as described in Fig. 8.11b, this increases the input costs of biofuel production and therefore leads to a reduction of biofuel quantity supplied at every price, as represented by a shift of the supply curve to the left (Fig. 8.12a), Whereas technological progress decreases the production costs of biofuels and shifts the supply curve to the right. If biofuel producers expect a further increase in oil prices and therefore decide to expand the biofuel production, the supply curve shifts to the right.

Effects on the supply of inputs that cause increased input prices are for example a drought that leads to a reduced maize harvest, an increase in the rental price for land, and an increase in fertilizer prices (effects shown in Fig. 8.12b). The effects of increased input costs are shown in Fig. 8.12a. The reduced supply of biofuels leads to an increase in the equilibrium price and a reduction of the equilibrium quantity.

When analysing the effects on the market for biobased products and resources, we also need to consider the effects on factor markets, e.g. land. In the real world, we have to cope with limited land supply. The options for gaining additional land area for farming via for example deforestation or polder landscape are limited. In addition, desertification and soil erosion cause loss of land. Therefore, an increase in the demand and supply of biobased products and consequently an increase in the amount of crops produced for the biobased market are only possible by a reallocating land from the production of food to the production of biobased resources. This increase in the demand for land leads to an increase in the price of land, which increases input costs and thus makes production of biobased products less cost efficient.

So far, we treated the markets for fossil oil, agricultural raw materials and biobased products in the same way. However, as stated in the introduction, most of the biobased products are relatively new so that the corresponding production processes often need substantial further research and development before the products eventually might become competitive with their established non-biobased substitutes. Figure 8.13 shows the average cost curves for fossil fuel and biofuel production. Currently, Q1 litres of fossil fuel are sold on the market at price P1. At this price, the average cost curve for biofuels lies below the average cost curve for fossil fuel implying that biofuels potentially could be sold cheaper. However, the fossil fuel industry got established first and is able to sell fuels at price P1, which is below the start-up cost of C0 of the biofuel industry. Due to the current lack of experience and market share to gain from economies of scale, the biofuel industry cannot compete on the market, due to its higher production costs. This provides a reason for temporary support of the biofuel industry through the government—often referred to as the infant industry argument. Through the support (or protection) of the biofuel industry at its initial development stages, the industry can develop and reduce its production costs through the development of new technologies and economies of scale so that it might be able to compete with the fossil fuel industry in the future. Another argument for government support of the biofuels sector could be made due to the additional environmental costs fossil fuels cause and which are not included in their price. This will be discussed in a later chapter under the concept of externalities (see Chap. 10).

1.5 Policy Instruments to Support Biobased Products

In the previous sections, we have introduced the drivers of and barriers to the demand and supply of biobased products. Objectives such as sustainable development, energy security, independence from fossil fuels, food security, waste reduction and climate change mitigation require an increase in the production and the use of biobased products. However, the only recently developed biobased products have a disadvantage in the market due to their particularly high production costs compared to products already established in the market (see Fig. 8.13). Conventional products based on fossil energy sources (e.g. crude oil, natural gas or coal) have an advantage over renewable fuels/energy, because they have gained from economies of scale due to mass production and learning effects which have decreased their production costs over time. However, the use of these products is associated with high carbon dioxide and GHG emissions that lead to additional cost for society, e.g. through increasing occurrences of severe weather events, melting ice caps and increasing air pollution. These external costs, equal to the value of agricultural production losses, health costs, costs of destruction through storms and flooding, and the like, are not covered by the market price of these products, leading to an inefficient allocation of resources, i.e. a market failure.

In light of the reasons pushing the development of biobased products listed in the introduction to this chapter, governments aim to correct the market failures associated with the use of fossil energy sources and to provide an enabling environment for renewable alternatives which should allow these industries to mature and become competitive. To this end, governments introduce various policy instruments that aim to promote the development of biobased products by enabling the development of better technologies, to increase the production quantity and thus the market share, and to discourage the use of fossil fuels (see Chap. 10). Technological progress and economies of scale would then lead to a decrease in production costs and consequently increase the competitiveness of biobased products.

The comparison of the policy landscape of different biobased products clearly reveals that the policies implemented to support bioenergy and liquid biofuels are the most advanced. Biochemicals and biomaterials are found to be at a relative disadvantage, because many of the policies applied to support biofuel and bioenergy production reward the use of biomass in these industries. According to the Renewable Energy Policy Network for the twenty-first century (REN21), nearly all countries worldwide (146 countries) apply policies to support the provision of renewable energies (REN21 2016). Most of them established bioenergy targets. In general, countries use manifold ways and policies to support biofuel production, e.g. establishing targets for the share of bioenergy in total energy use (more than 70 countries), applying policy instruments to support the production of biofuels (more than 100 countries), and imposing policy instruments which improve market access (more than 50 countries) (OECD 2014).

A large number of policy instruments have been applied to stimulate bioenergy and biofuel production. In this section, we provide a general but brief overview of applied instruments to support biobased products, particularly used for bioenergy and biofuels, and explain their economic rationale using the example of energy and carbon taxes.

Different instrument types are applied to support biobased products. One distinction can be made between direct policy instruments, e.g. tariffs and subsidies on different (biobased) products either domestically produced or traded, and indirect policy instruments, e.g. environmental taxes (carbon tax) or voluntary agreements. Direct policy instruments can either be provided to support renewable products, e.g. a subsidy on the production of biobased products or a subsidy on agricultural products, such as maize, sugar or grains, to enhance the production of biomass or a tariff on the imports of biobased products to support domestic producers. Governments provide subsidies across the entire biomass value chain to facilitate suitable conditions for biobased product deployment. By contrast, indirect policies are mainly applied to fossil-based products by taxing these products to account for their negative external effects on the environment. This will be further explained instantly. All of these policies are price-driven, e.g. in the case of a subsidy on biobased products, the policy drives a wedge between the market price and producer price, so that the producers achieve a price higher than the market price. Feed-in tariffs serve as another example for creating price-driven incentives that are often applied in the renewable energy market. Producers of renewable energy can feed-in the full production of green electricity at fixed prices. This policy provides specific support to producers of renewable energies for a defined period. Specifically, the producer price for renewable energies equals the market price for energy plus the feed-in tariff rate, so that producers of renewable energies are paid a cost-based price for their energy supply that exceeds the fossil energy source-based price. Governments also promote the use of biobased products, particularly biofuels, through excise tax reductions or exemptions that decrease the price paid by consumers.

Box 8.1 Energy and Carbon Taxes

Energy and carbon taxes are imposed to restrain the production of for example energy from fossil fuels and enhance the production of biofuels. This simple instrument provides product group specific taxes and aims to correct a market failure by charging a price for GHG emissions, e.g. fossil fuel production is taxed due to the high GHG emissions of its use.

What is the underlying economic rationale behind a policy instrument such as energy and carbon taxes impose additional costs on the use of fossil energy sources such as oil, natural gas and coal in proportion to the amount of carbon these resources contain. These additional costs to the use of fossil energy sources is passed through to the price of the final good such as fuels, electricity or any goods that use these sources intensively. The policy instrument corrects the market failure by incorporating these additional environmental costs into the market price, thereby modifying the incentives for producers and consumers such that the quantity produced and consumed is decreased.

Figure 8.14 presents the effects of energy and carbon taxes and shows how these policy instruments stimulate the production of biofuels. Let us assume that all energy products based on fossil fuels are taxed by an ad valorem tax t that drives a wedge between the market price P M and the producer price P S equivalent to the size of the tax.

For each quantity of energy from fossil fuels sold on the market producers have to pay the tax. Consequently, they receive less per unit of output and reduce their supply on the market, which in turn leads to a market price increase.

In Fig. 8.14 we analyse the effects of energy carbon taxes on the fuel market considering both the supply of fossil fuel and biofuel. \( {S}_{\mathrm{TF}}^1 \) represents the total supply of fossil fuels and biofuels together (\( {S}_{\mathrm{FF}}^1+{S}_{\mathrm{BF}}={S}_{\mathrm{TF}}^1 \)), whereas D TF shows the total demand on the fuel market. The supply curve is upward-sloping indicating that the supply of fuel increases as the market price increases. The demand curve is downward-sloping showing that a price increase leads to a decrease in fuel demand. In the equilibrium (intersection of \( {S}_{\mathrm{TF}}^1 \) and D TF) at the market price P M the quantity \( {Q}_{\mathrm{TF}}^1 \) is sold on the market of which \( {Q}_{\mathrm{FF}}^1 \) are fossil fuels and \( {Q}_{\mathrm{BF}}^1 \) are biofuels. What happens when the government decides to impose an energy and carbon tax? This tax affects the fossil fuel producers, because they pay now a tax per unit of output based on fossil fuels, therefore, the supply curve of fossil fuels shifts to the left in the panel (a) of Fig. 8.14 reflecting that at every price producers sell less fossil fuel due to the tax. However, the tax does not directly affect biofuel producers. Consequently, the biofuel supply curve in panel (b) of Fig. 8.14 does not change. In accordance with the change in panel (a), the total fuel supply curve in panel (c) also shifts to the left (\( {S}_{\mathrm{TF}}^2 \)). At any market price for fuel less quantity is supplied. The new market equilibrium reveals a decrease in the quantity of fuels supplied and demanded at a higher price. However, at this higher price biofuel producer sell a higher quantity of biofuels at the market so that the share of biofuel relative to fossil fuel quantity has increased due to the implementation of carbon taxes.

After this excursus on the economic rationale of a price-driven policy, we now briefly introduce other types of policies also often imposed in the markets for bioenergy and biofuels. Examples for quantity-driven policies are, e.g. blending mandates that define a specific share of biofuels in transport fuel sold on the market. This policy is relatively cost neutral for the government, however, it increases the demand for biofuels at the expenses of the final consumer due to higher production costs of biofuels. Also (tradable) green certificates provide quantity-driven incentives to increase the production of biobased products. They are based on a quota-like-mechanism that obliges producers to produce a specified fraction of their supply from renewable resources. These instruments are successfully applied to support bioenergy, e.g. low carbon energy.

In addition to price- or quantity-driven policy instruments, governments provide other budgetary support measures such as investment subsidies and new technology support. These subsidies are available in a large variety of different designs. Examples are funding for capital investments associated with a new project, or subsidised loans/interest rates or grants for production facilities. The objective is to increase the efficiency of biomass use for the production of biobased products to increase supply and reduce production costs. Other measures are support provided to research or rural development.

Why is the amount of support provided to biofuels much higher than the amount provided to biochemicals and biomaterials? According to OECD (2014) the share of crude oil used for energy production exceeds 90% in most of the countries. In addition, simpler and a smaller number of standards is applied to biofuels compared to biochemicals. Consequently, controls on the chemicals market are much higher which increases the number of obstacles that need to be overcome by new products to enter the market. Plastic is a material used for a large variety of purposes, which in return increases the number of expectations on the properties of plastics compared to fuel (OECD 2014). This large variety with regard to standards, applications and expectations aggravates the design and implementation of policy instruments to support biochemicals and biomaterials. By contrast, the development of all three product groups depends on the same resource (biomass) and related technologies. Crude oil prices determine their competitiveness in the market and there are beneficial effects from sharing production facilities.

1.6 Conclusions

This chapter provides a brief introduction to the market of biobased products that might become increasingly important in the future. The future global challenges lead to an increasing demand and supply of biobased products. In addition, this market is highly interlinked with the demand and supply of primary agricultural commodities and thus food security. We introduce market diagrams representing the demand and supply functions for biobased products to show how the equilibrium price on the market is determined. We apply these diagrams to show the effects of supply and demand side shocks on the market for biobased products, but also on the market for agricultural commodities and fossil fuels. The particularly high production costs of the relatively new developed biobased products compared to conventional products already established in the market, which are often based on fossil fuels, create a disadvantage for biobased products. In addition, the prices for conventional products do not include the additional environmental costs they create due to for example high carbon emissions, and thus lead to a market failure corresponding to an inefficient allocation of resources. Politicians use these two arguments as major justifications for implementing policies to support biobased products. We provide a brief overview of selected policy instruments and explained the effects of carbon taxes on prices, and demand and supply on the market for biofuels using a graphical market model.

Review Questions

-

1.

Name and discuss reasons why the production of biobased products has gained importance in recent years?

-

2.

Explain how high crude oil prices influence the demand for biofuels?

-

3.

What are the challenges on the market for biobased products?

-

a.

Explain driving and limiting forces for the supply of biobased products using 1 example for each.

-

b.

Explain driving and limiting forces for the demand of biobased products using 1 example for each.

-

a.

-

4.

The demand for bioplastics is expected to considerably increase in the future.

-

a.

How would this increase in the demand for bioplastics affect the market price and quantity sold of bioplastic material? Please use a market diagram to illustrate and explain the results.

-

b.

In addition, the government aims to support the production of bioplastics. Please explain and discuss appropriate policy instruments the politicians might introduce.

-

a.

-

5.

Assume that the bioplastics industry is able to considerably decrease their costs for producing bioplastics due to technological change.

-

a.

How would this affect the supply of bioplastics? Please use a market diagram to show and explain the effects.

-

b.

Bioplastics are produced from starch. How would therefore an increase in the production of bioplastics affect the market for wheat, maize and potatoes? Is there empirical evidence for the effect?

-

c.

What would be potential effects on prices and supply of food products and thus food security?

-

a.

-

6.

Governments often use the infant industry argument to justify the introduction of policy instruments to support relatively new industries such as biofuel producers. Please explain and discuss this argument using biofuels as an example.

-

7.

Please use a graph similar to the initial situation in Fig. 8.14 as starting point. Assume that the government starts to pay a specified amount of euros to the producer for each ton of biofuel produced (a subsidy).

-

a.

How does this output subsidy for biofuels affect the market equilibrium of biofuels (producer price, market price, quantity)?

-

b.

What are the effects on the total fuel market (equilibrium price and quantity)?

-

a.

2 Sustainable Development and Sustainability Management

Abstract

In the last decade(s), the idea of sustainable development has become a widely acknowledged topic which is supported by many actors in modern society.

Companies, as central economic players, are increasingly pressured by a wide set of stakeholders to engage in sustainability management and to contribute their share towards sustainability. Against this background, this chapter first introduces the general idea of sustainable development with its elements of intragenerational and intergenerational justice and illustrates the roots of sustainable development as a normative-anthropocentric concept. Since sustainability is a contested idea with many different notions, the different understandings of weak, strong and quasi-sustainability are introduced and the status quo of sustainability in society is highlighted.

Following this general introduction, actors of sustainability in society are named and the relevance of sustainability management for companies is discussed. In the remainder of this chapter, three base strategies to achieve sustainability (i.e. eco-efficiency, eco-effectiveness and sufficiency) are explained along with their opportunities and limitations in achieving sustainability. Finally, some exemplary elements and tools of sustainability management from the areas of sustainability accounting and management control as well as of sustainable supply chain management are introduced to provide a first glimpse of possibilities for companies to engage with sustainability.

Keywords

Sustainability; SDGs; Stakeholder; Eco-efficiency; Eco-effectiveness; Sufficiency

Agrophotovoltaic plant in combination with potato production © Andrea Ehmann

Learning Objectives

After studying this chapter, you will be able to:

-

Characterise sustainable development with its various conceptual elements and understandings.

-

Discuss the main actors of sustainability management and their influence on corporate sustainability.

-

Distinguish eco-efficiency, eco-effectiveness and sufficiency as base strategies in sustainability management and highlight their potential and limitations.

-

Exemplarily illustrate elements of sustainability management.

2.1 Sustainable Development: Characterisation and Historical Roots

“Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs” (WCED 1987, p. 41). This probably most widely cited characterisation of sustainable development stems from the 1987 report of the United Nations World Commission on Environment and Development (WCED; also called Brundtland report after the chairperson of the commission, then Norwegian Prime Minister Gro Harlem Brundtland).

This broad characterization covers the two main pillars upon which sustainable development rests: Intragenerational and intergenerational justice. Meeting the needs of the present (i.e. within today’s generation) verbalizes the idea of intragenerational justice and was already at the centre of thinking in the WCED report despite often being less prevalent in many discussions around sustainable development. In fact, the report highlights the overriding priority for needs of the poor and gives a voice to the large group of unprivileged poor in the world. Fulfilling these needs, for example, in terms of providing enough food, safe drinking water, sanitation, or minimum social security is thus a cornerstone without which sustainable development cannot be achieved. At the same time, the concept of sustainable development gives future generations a voice through the idea of intergenerational justice, which calls for preserving societal and ecological systems in a way that future generations are not inhibited in their own development.

This latter perspective, which mainly focuses on natural sources and sinks, is also included in the historical roots of sustainable development, which trace back to the times of medieval forestry. Already here, central aspects of a sustainable resource utilisation (i.e. permitting only as much logging as could be grown again) were known and practiced. Both elements of justice illustrate that sustainable development is a normative (i.e. relating to an ideal standard or model) and anthropocentric (i.e. relating to the influence of human beings on nature) concept. As such, it is widely acknowledged but still contested and there is no rule of nature that determines whether or not mankind has to adhere to the principles of sustainable development, but it is instead an ethical decision (see for example Hahn 2009, 2011).

Box 8.2 Intragenerational and Intergenerational Justice and the Role of the Bioeconomy

Some products and activities from the bioeconomy sector provide a good perspective on why intragenerational and intergenerational justice are sometimes difficult to align and why achieving sustainability is such a complex task. Take the example of biofuels or bioplastics made from renewable energy sources such as plant material. From an intergenerational perspective, such products are favourable because they potentially allow for carbon-neutral products, which have no or at least less impact on climate change compared to conventional fuel sources or plastics. However, the production of the renewable agricultural raw material for the biobased products might lead to a crowding out of staple crops on limited cultivable surfaces. This could have detrimental effects on intragenerational justice if food prices increase or if, in extreme cases, food supply is limited (also known as food vs. fuel debate; see, for example, Kuchler and Linnér 2012).

But when would sustainable development be achieved? Despite providing some general yardsticks for orientation, the above-cited characterisation still allows for different interpretations and some even note that sustainable development is a journey that will never be finished. For others, however, sustainable development is easier to achieve. This is especially the case when following an interpretation of sustainable development known as “weak sustainability” (for overviews of the different concepts see Sect. 10.2; Ayres 2007; Hediger 1999; Neumayer 2013). In this perception, sustainability is achieved if the total sum of anthropogenic (i.e. man-made) capital and natural capital are held constant. This bears the main assumption that natural capital can generally be substituted by anthropogenic capital and still ensure the continuation of human well-being on earth. Main strategies to achieve sustainability under this assumption are a focus on efficiency (i.e. achieving the same output with less input or more output with the same input) and consistency (i.e. entirely closed systems with no input of raw materials and no emissions and waste production) through technology, growth, and markets. The drawback of this notion of sustainability is, however, that a full substitutability of natural with man-made capital is likely to be impossible due to technical limitations and laws of nature. Once all non-renewable resources as well as the Earth’s biodiversity and biocapacity are depleted, it is unlikely by all known standards that mankind can still survive at the same level of prosperity as before, if at all.

The counterpart to weak sustainability is “strong sustainability” (see Sect. 10.2). The general idea of this perception of sustainability is to live only from the “interest” of the natural capital, that is, to use only those natural goods and services that are continuously added. It would thus not be permitted to use non-renewable resources (because they are not reproduced and hence generate no “interest”) and renewable resources can only be utilised below their regeneration capacity. If followed through, this would mean renouncing any further growth of consumption and production due to the status quo of intergenerational justice as further depicted below. To walk this path, society would need to aim at sufficiency (i.e. asking how much is enough) and efficiency at the individual and political level. The drawback of this notion of sustainability is that is has a rather metaphorical character. A complete abdication of any growth is unlikely and would also mean that intragenerational justice could only be achieved through a very drastic (and thus unrealistic) redistribution of worldwide wealth.

Weak, Strong, and Quasi/Critical/Ecological Sustainability

These are different understandings of sustainability, which lead to fundamentally different implications for actions and strategies.

The middle ground between the two extremes is occupied by the idea of “quasi”, “critical”, or “ecological” sustainability. It builds upon the principle of prudence and puts critical levels or critical boundaries, for example, of the Earth systems into the middle of thinking (for an explanation of such critical boundaries see, for example, Steffen et al. 2015). Such thresholds should not be exceeded and, for example, a substitution of natural capital by man-made capital has to be well justified. To achieve this, a mixture of the three strategies might be needed but the technological feasibility and the socio-political enforceability of these strategies is uncertain.

2.2 Status Quo of Sustainable Development

When looking at the current state of the world, it seems to be safe to say that neither intragenerational nor intergenerational justice have been achieved despite some scientific debates and uncertainties on specific issues. Although the last 25 years have seen some progress, today still more than 830 million people live in extreme poverty (earning less than US$1.25 per day), 6 million children under the age of five die annually, 2.4 billion people have no access to improved sanitation and almost 800 million people are illiterate (United Nations Human Development Programme 2015), while at the same time less than 10% of the world’s population accumulate almost 85% of total wealth (Stierli et al. 2015). Looking at rich versus poor countries, people living in high-income countries use roughly six times more natural resources than those living in low-income countries (WWF International 2016). This directly links to the perspective of coming generations. Today’s human population uses almost double the amount of the world’s available biocapacity, thus already at present living at the expense of future generations. In their seminal study, Steffen et al. (2015) identified seven planetary boundaries which, if crossed, bear a high risk of destabilising the Earth system. Of these seven boundaries, two (biosphere integrity and biochemical flows) have certainly already been exceeded according to scientific standards and two others (climate change and land-system change) are marked with an increasing risk so that the need to act is urgent if sustainable development is a favoured goal.

Eventually, however, the concepts of intragenerational and intergenerational justice need to be broken down into actionable pathways and concrete fields of action, no matter what perception of sustainability one follows. Therefore, in 2015 the United Nations proposed a set of seventeen aspirational “Sustainable Development Goals (SDGs)” with 169 sub-targets as depicted in Fig. 8.15. The SDGs are supposed to influence and provide guidance not only to worldwide politics but also to businesses and individuals in their actions to serve the idea of sustainable development.

The sustainable development goals (Maria Gershuni; CC BY-SA 4.0 via https://commons.wikimedia.org)

Another often-mentioned reference to reduce complexity is the so-called “IPAT-Equation” (e.g. Meadows et al. 2004, pp. 124–126), which illustrates the human impact on ecological ecosystems. The “Impact” refers to the ecological footprint of any population or nation upon the planet’s sources and sinks. “Population” counts the number of people influencing the ecological footprint. “Affluence” is determined by the impact or throughput generated by the material, energy, and emissions associated with consumption. “Technology” illustrates the damage caused by the particular technologies chosen to support that affluence (i.e. the energy needed to make and deliver material flows, multiplied by the environmental impact per unit of energy). Changes in any factor of the equation lead to changes in the ecological footprint we leave on the Earth system.

IPAT-Equation

It illustrates the human impact on Earth systems through the term: Impact = Population × Affluence × Technology.

2.3 Actors and Understandings of Sustainability Management

To steer the world society in the direction of sustainable development and to promote the SDGs, multiple actors need to play along (see Fig. 8.16). Politicians need to recognise the need to embed sustainability goals and principles into rules and regulations at different levels, consumers need to recognise how their behaviour adds up and contributes to or hinders sustainability, civil society organizations need to recognise their influence on other players and advocate different elements of sustainability, and of course companies, as central and powerful players in modern society, need to contribute their share by means of various elements of sustainability management either through reducing their environmental and social footprint or through actively and positively contributing to sustainable development with sustainability-oriented business models, goods, and services.

To make a company more sustainable (or less unsustainable), the management needs to balance a multitude of interests and bring in line various actors (see Fig. 8.16). Certain types of investors or stockholders, for example, might pressure a company to actively pursue the idea of sustainability while others fear that measures of sustainability management are costly and could thus reduce their earnings. Many potential employees nowadays are increasingly demanding when it comes to the social responsibility of their future employer and at the same time many people still do not see the need to change their own behaviour and, for example, do not switch off the computer monitor when leaving the office. Customers often claim to value sustainability and the market for organic and fair-trade products is constantly growing around the world but the willingness to pay a higher price for fair and sustainable products is still often limited. Supply chains and networks of most goods and services are extremely complex and easily cover thousands of suppliers, which makes it difficult for companies to monitor the sustainability performance, while at the same time many pressure groups actively advocate better working conditions and environmental standards. In sum, the management of sustainability is a complex endeavour.

Stakeholder

“Any group or individual who can affect or are affected by the achievement of the firm’s objectives” (Freeman 1984, p. 25). This encompasses internal (e.g. employees, management and owners/stockholders) and external stakeholders (e.g. suppliers, government, customers, creditors and society).

But why then should a company embrace the idea of sustainable development at all? First, it is the pressure of many different stakeholder groups, for example regulators, governments, or sustainability-oriented activists who demand a responsible business conduct and who lobby for sustainability management. Second, a growing sustainability-consciousness among consumers and businesses as well as changing regulations produce new market opportunities in this area and companies with a distinct sustainability profile might also reap reputation benefits. Third, sustainability management can lead to reduced costs when, for example, more resource- or energy-efficient products and processes lead to material or energy savings. Fourth, some consider sustainability management to also be part of an active risk management, because many of the most pressing risks companies face are connected to sustainability issues (e.g. reputation risks in (un)sustainable supply chains, raw material shortages or price volatilities, natural catastrophes and extreme weather events, social instability).

However, beyond such examples of a business case for sustainability management (i.e. beyond win-win paradigms in which sustainable management is good for the financial bottom line of a company), there are also numerous tensions and trade-offs companies have to cope with (Hahn et al. 2015b). For example, various measures in sustainability management require substantial upfront investments, which may put pressure on short-term financial objectives and benefits of sustainability management are sometimes hard to measure so that a (financial) quantification is not always straightforward. Another example from the area of the bioeconomy illustrates such dilemmas on a larger scale. Individual organizations usually strive for efficiency and they are likely to adopt similar solutions when acting under similar external conditions (e.g. monocultures as efficient means of cultivating agricultural produce). Such a homogenization, however, could lead to a lower resilience of the entire agricultural system due to a loss of (bio)diversity. Society is called to recognise such trade-offs and tensions and develop solutions to cope with such difficulties (see again Hahn et al. 2015b, for initial suggestions).

As can be seen from these remarks, sustainability management is a task with a myriad of potential fields of action, not all of which are relevant for each and every company in the same way. To make the elusive concepts of intragenerational and intergenerational justice within sustainable development more comprehensible and manageable at the company level, the concept is often broken down into three distinct pillars of action in which companies present their actions: economic, ecological, and social responsibility (e.g. Elkington 1997), sometimes also termed the 3P of people, planet and profit. In the corporate domain, the economic pillar (“profit”) is usually understood as the responsibility of a company to generate profits to be sustainable in an economic sense. Furthermore, aspects such as economic prosperity and development are also often mentioned. In the ecological pillar (“planet”), topics such as environmental protection and resource preservation and respective corporate actions to achieve these goals are discussed. The social dimension (“people”) covers topics such as social justice and equal opportunity and is often connected to employees and suppliers with issues such as fair compensation, diversity, labour conditions, work–life balance and so on. This also shows that the distinction of previously often separately covered topics such as sustainability and corporate social responsibility (CSR) is in fact very blurred. Nowadays, some companies have a CSR department or CSR manager while others have a sustainability officer, both of which often cover similar tasks and also in academia the concepts and terms are increasingly used interchangeably (see, e.g. Hahn 2011).

2.4 Base Strategies in Sustainability Management

As illustrated in the beginning, the road to sustainability can only be successfully taken if intragenerational and intergenerational justice are pursued simultaneously. This implies that we need to decouple the human development on the one hand from the ecological impact caused and the consumption of resources on the other hand. To achieve such a decoupling, three basic sustainability strategies are often discussed: eco-efficiency, eco-effectiveness/consistency and sufficiency (for an overview see, e.g. Hahn 2008).

Eco-efficiency

The general approach of eco-efficiency is to aim at a more efficient use of natural resources or of emissions caused in producing goods or services. It thus follows the idea of relative improvements through the quantitative reduction of resource usage and emissions of products “from cradle to grave” (i.e. from raw material extraction at the beginning of a product life cycle to the final disposal at the end of the cycle). With successful examples of eco-efficiency, less resources or emissions are needed to produce the same amount of goods and services compared to a previous status quo (i.e. easing the environmental burden for a constant level of consumption) or more goods and services can be produced with the same amount of resources and emissions (i.e. enabling development without further deteriorating the environment). This strategy mainly aims at technological solutions and innovations either at the product level (i.e. more energy-efficient electrical household consumer devices, fuel-efficient cars etc.) or already in the production stage (i.e. more resource or energy efficient processes) and there are numerous examples of successful eco-efficiency innovations. Different academics point to the enormous potential of eco-efficient products and processes which could lead to an improved efficiency of resource and energy consumption of up to factor 4 or 10 (Schmidt-Bleek 1998; Weizsäcker et al. 1996). The strategy is comparably easy to translate into the corporate domain because companies already regularly aim at an efficient use of various (especially financial) resources and technological innovations are an established means of progress in many firms. However, the success of the eco-efficiency strategy (as well as the success of the other strategies discussed below) is limited by the so-called rebound effect (for an overview see for example Figge et al. 2014; Hahn 2008). This effect illustrates that an improved eco-efficiency is often counteracted by increased consumption. The improved efficiency often, for example, leads to cost savings, which in turn lead to a disproportionate growth in overall demand for goods and services, if the reduced costs are associated with lower prices. The same pattern might occur in a psychological dimension when, for example, improved eco-efficiency can induce people to buy more products or buy products that they do not need just because they are supposedly eco-friendlier than before. Furthermore, the introduction of a partly sustainable product or process might have negative impacts on other aspects of sustainability, which have not been considered before. The automotive industry, for example, increasingly substitutes metal with lightweight synthetic and composite materials to help improve fuel efficiency. However, such materials can cause problems during the production and disposal processes (e.g. if their production requires hazardous substances and/or if they are difficult to disassemble for recycling).

Eco-effectiveness

Other than eco-efficiency, eco-effectiveness (or consistency) tries to decouple economic development from environmental burden by organising economic processes entirely without waste, emissions, or other environmental impacts through closed-loop systems. It thus aims for a qualitative change of material flows by way of fundamental structural change (e.g. Braungart et al. 2007; Huber 2000; McDonough and Braungart 2002). The idea of the “cradle-to-cradle” thinking of eco-effectiveness is the abdication of using (finite) natural resources and/or of generating waste by creating non-polluting production and consumption processes in which each end-product of a consumption or production process serves as a basis for other processes. Closed-loop systems can come either in form of biological loops or of technological loops (Ellen MacArthur Foundation 2013). Biological loops are closely related to processes in the bioeconomy. Biological materials are farmed, processed to goods, which are then used or consumed and finally end up in the biosphere again as biological waste products. Examples are compostable clothing, houses made from organic building materials etc. In technological loops, recyclability of materials is ideally already included in the design phase of products, which then, for example, allow for easy disassembling or maintenance and refurbishment. Following the use phase, products are disassembled and either used as parts again in new products or materials are recycled to be used in new production processes. If it is feasible to develop and implement such kinds of sustainable innovations, they provide the opportunity to fully decouple growth and development from environmental impact by aligning nature and technology. However, such closed biological or technological loops usually require some fundamental changes in terms of extensive technological innovations and organizational transformations usually beyond the boundaries of a single company, which are not easy to find or implement. Furthermore, critiques describe rebound effects also for the eco-effectiveness strategy especially in the form of growth effects and psychological effects (see again above). Furthermore, uncertainties about the future side effects of innovations are another obstacle. Since innovations are, by definition, the introduction of something new, their ecological, economic, and social impacts cannot be entirely assessed ex ante.

Sufficiency