Abstract

This section explores various aspects of the development of industry and the economy, and the changes in supply and demand of different energy sources, considered in combination with projected changes in economic growth, advances in technology and shifts in industrial structure. The aim is to determine the medium- to long-term demand and supply of natural gas and other energy sources in China.

* This chapter was overseen by Zhaoyuan Xu from the Development Research Center of the State Council and Martin Haigh from Shell International, with contributions from Baosheng Zhang and Shouhai Chen from the China University of Petroleum, Lianzeng Zhao from the China Petroleum Planning Research Institute, Linji Qiao from ENN and Juan Han from Shell China. Other members of the research group participated in discussions and revisions.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- High Energy Consumption Industries

- Standard Scenario

- Energy Source Price

- Carbon Price

- Clean Power Generation

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

This section explores various aspects of the development of industry and the economy, and the changes in supply and demand of different energy sources, considered in combination with projected changes in economic growth, advances in technology and shifts in industrial structure. The aim is to determine the medium- to long-term demand and supply of natural gas and other energy sources in China.

1 The Natural Gas Supply-Demand Model

In order to analyse and predict the future of natural gas demand, a Computable General Equilibrium (CGE) model was devised to reflect medium- to long-term economic growth and changes in industrial structure, in terms of total demand for energy sources and the interchangeability between natural gas and other energy sources. The CGE model relies on general equilibrium theory, using actual economic data as the initial equilibrium, and reflects optimised decision-making by the market components (manufacturers, consumers, government departments). Compared to general economic models, CGE models are more often used for simulating the effect that policies have on the economy, whether direct or indirect, making them an effective tool for analysing policies. The CGE model used in this study is based on the Computable General Equilibrium model developed and maintained over time by China’s State Council’s Development Research Center (DRC-CGE) for dynamically simulating the economy of China. The development of the model began in 1997; it has been perfected over the years and applied to studies of the effects of China joining the World Trade Organization, infrastructure construction, energy conservation, emission reduction, urbanisation and other policies.

1.1 Basic Characteristics of the Model

The model uses 2010 as the base year and, adopting the Social Accounting Matrix based on 2010 input-output tables of China for basic data, simulates the economy from 2010 to 2025. it includes economic activities from various sectors, reflecting five aspects in particular:

-

the manufacturing activities of various business sectors in the economy, and the demands stemming from such manufacturing activities;

-

the economy’s demand for products: the total demand coming from the everyday activities of the citizens, the government and businesses, as well as from other countries (regions), including the three major demands of consumption, investment and exports;

-

the income, consumption and reserves of each major economic body;

-

foreign trade; and

-

dynamic economic growth and development.

The relationships of these factors are shown in Fig. 5.1.

In this study, the model includes all of the 46 production industries (as seen in Table 5.1), specifically 1 from agriculture, 5 from mining, 22 from manufacturing, 3 from public works and construction, and 14 from the service sector. These industries illustrate the production activities of various business categories.

1.2 Main Intensifications and Adjustments Made Towards Studies of Natural Gas in This Model

Compared to typical CGE models, the one used in this study made the following major changes to reflect influences on the supply and demand equilibrium of natural gas.

-

1.

Detailed representation of primary energy production

To better reflect the input-output and interchangeability of various energy sources, this study takes into account coal mining and processing, oil drilling, natural gas extraction, oil refining, coking, coal power, natural gas power, hydroelectricity, wind power, solar power, nuclear power, natural gas heating, coal heating and natural gas processing, giving a total of 14 types of energy source, thus better reflecting the interchangeability of energy sources, especially the potential of natural gas to replace other energy sources.

Based on the national energy policy, this model separately configured production functions and development scales of different energy sources, such as installed capacity of nuclear energy, hydroelectricity, solar power and others, in order to ensure that they are in accordance with national planned goals.

-

2.

Detailed representation of characteristics of the demands of the various sectors towards natural gas

To examine natural gas demand in detail, this study subdivided industries, in particular industries with higher demand for natural gas. For example, the chemical industry was subdivided in order to reflect its demand for natural gas as a raw material and the transportation industry was subdivided in order to reflect its demand for natural gas.

2 Simulation Scenarios for Analysis Simulations of Natural Gas Demand

To carry out the simulated analysis of natural gas supply and demand, and to compare various policies, this study has devised two different scenarios: one is the standard scenario, where the current basic trends of economic growth are reflected, the other is the policy-driven scenario, which includes the effects of government policies favourable towards natural gas demand.

2.1 Key Assumptions of the Standard Scenario

In the standard scenario, backed by clearly designed policies, relatively assertive growth factors are observed in the Chinese economy. On the other hand, under the influence of ambitious government policies regarding environmentally friendly development and innovation, there are the following significant changes to the growth factors:

-

Changes in total population and age structure reflecting the influence of the newest population policy adjustments (one-child policy, two-child policy) in terms of medium- to long-term total population and workforce. The population of China peaks at around 2032, when it will be around 1.463 billion, with the workforce peaking between 2017 and 2027, at around 1 billion.

-

Growth in personal consumption expenditure, brought about by an increase in income levels. Particularly remarkable is the reduction in the percentage of expenditure taken up by food and other consumable goods, while travel, leisure, education and expenditure for other services continue to increase.

-

Policies promoting energy conservation and emission reduction, influenced by the attempt to bring about a “new normal” and a variety of activities targeted at alleviating atmospheric pollution, where the government continues to push for energy conservation and consumption reduction, raising energy efficiency by between 3 and 2% points each year (a higher rate of increase at first, followed by a lower one).

-

The new urbanisation policies progress smoothly, and more of the rural population are now living in cities. The urbanisation rate will hopefully reach 70% in 2030 and 75% in 2050.

-

Personal savings remain at high levels, but this is expected to gradually reduce as personal income and level of social security provision improve. By 2030, the personal savings rate of urban populations should fall by 13%, from the current rate of 38% to around 25%.

In addition to the above factors, optimised policies include policies that concentrate in particular on transformation of the mode of economic development:

-

A more significant ratio of renewable energy usage, mainly represented by rapid developments in non-fossil fuel energy sources such as nuclear power, wind power and solar power. For nuclear power, the installed capacity of 14.61 million MW in 2013 will quickly grow to 58 million MW by 2020, reaching 150 million MW by 2030 and 400 million MW by 2050. Installed capacity of hydroelectric power plants was 280 million MW in 2013, and will rise to 340 million MW in 2020, 400 million MW by 2030 and around 450 million MW by 2050. Other energy sources such as wind power and solar power will also grow at similar speeds.

-

The government places great importance on innovation-driven development, enabling remarkable breakthroughs in improving business innovation, the results of which will contribute to an increased significance of improvement in core areas driving economic growth, which will become evident by the 13th and 14th Five-Year Plans, at which stage secondary industry in China will have a high sustainable all-factor growth rate of 4%.

-

Mitigation of overcapacity is relatively smooth, allowing industry to grow continuously. This can be observed in the slowing growth in investment in heavy and chemicals industry while output growth stabilises, a trend that will benefit sustained development of the industry.

-

The nurturing of tertiary industries, in particular the hastening of the development of productive service industries and tertiary industries, which will be beneficial in bringing in new investment to monopolistic industries previously difficult to access, such as finance, logistics, education and health.

-

As a result of financial reforms, the proportion of the national economy accounted for by private income increases; this is advantageous because of raised income levels and the improved ratio of consumption and investment in the economy.

2.2 Key Assumptions of the Policy-Driven Scenario

In the policy-driven scenario, apart from making the same assumptions as the standard scenario, the government will also levy a carbon tax on coal, oil and natural gas—fossil fuels that result in greenhouse gas emissions. Pricing for this carbon tax collected through carbon trading will be implemented in 2015 for coal. The carbon price (or tax rate) for the first year will be 10% of price, rising to 20% in the second year, then remaining at 30% thereafter. The tax rate for petroleum (including both crude oils and refined oils) is the tax rate for coal multiplied by the difference in carbon emission rates, which works out at 0.64 times the tax rate for carbon price for coal, while the rate for natural gas is 0.2 times the rate for coal, converted based on a coal price of 500 CNY/ton once the rate reaches 30% (ad valorem). This is equivalent to a carbon emissions tax (or achieving a carbon price through carbon trading of an equivalent amount) of CNY 60 for every ton of carbon dioxide where coal is concerned.

3 Natural Gas Supply and Demand in the Standard Scenario

3.1 Speed of Economic Growth and International Comparison

Under the assumptions of the standard scenario, China will retain a relatively fast growth rate in the future. In the two years after the 12th Five-Year Plan, the average economic growth rate is expected to be around 7.3%, with GDP growth during the 13th Five-Year Plan at around 6.66 and 5.56% from 2021 to 2025. In the period between 2026 and 2030, economic growth is expected to be around 4.64%, around 3.47% from 2031 to 2040 and around 2.73% from 2041 to 2050 (Table 5.2).

Based on simulation results, the per capita GDP of China will continue rising at a relatively fast rate. For example, by around 2020, per capita GDP in China is hoped to reach $10,000 (in 2013 figures, and taking into account an average annual 0.5% appreciation of the CNY), while by 2030 per capita GDP in China could reach $20,000, and $40,000 by 2050, thus achieving a similar level to that current in Japan. If the comparison is made using purchasing power parity, China’s development level will be even higher (Fig. 5.2).

In the standard scenario, the speed of growth of China’s economy is still higher than the historical speed of other “catch-up economies”, while also exhibiting the usual sustained growth characteristics encountered with “catch-up” economies. For example, before 2020, there is a possibility that per capita GDP growth in China can be kept above 6%, exceeding the historical figures for Japan, Taiwan and the United States, only being lower than historical figures for specific years in South Korea. The same goes for the period from 2020 to 2030, when growth speed in China will far exceed historical figures for other countries.

Similar results were obtained from long-term purchasing power parity calculations using the World Bank’s International Comparison Program. Using this programme, per capita GDP in China will reach the level of South Korean per capita GDP by 2030 and by 2035 it will be on a par with Japanese per capita GDP, exceeding per capita GDP in the USA in 2050 (Figs. 5.3 and 5.4).

Growth speed in China and international comparisons in the standard scenario. Description Data for Japan, South Korea, Taiwan and USA drawn from historical growth figures; horizontal axis is the international dollar calculation based on 1990 purchasing power parity calculated using Maddison’s method. Data source Figures for China after 2013 based on model calculation results, other figures from Maddison

3.2 Mid- to Long-Term Changes in Industrial Structures

The simulation shows that the tertiary industry ratio will continue to rise. In 2013, the tertiary industry ratio was 46.1%, which is significantly lower than the level of most countries at a similar level of development. In 2015, it rises to around 48.1%, and from 2015 to 2020 it will rise by 4.9%, possibly exceeding 60% by 2030, reaching around 65% in 2050 (Table 5.3).

From experience gained with economic growth in other countries, as the level of development rises, the ratio of non-agricultural industries also goes up, especially the tertiary industry ratio, which seems to be a general norm. Major factors pushing the tertiary industry ratio higher are the changes in people’s consumer styles, increased services export ratio and rising demand for services in various sectors, as well as government spending. Deceleration of export growth also holds sway over tertiary industrial structure, since the main exports are manufactured goods and therefore, when other conditions remain unchanged, a faster growth in exports will most likely lead to a larger corresponding secondary industry ratio (Fig. 5.5).

In the period from 2020 to 2025, China will essentially complete the industrialisation process, entering the post-industrialisation era. Looking at the progress of industrialisation in China, the demand for heavy industries such as steel and concrete is approaching its peak, while the eastern coastal regions are on their way into the post-industrialisation stage. This development trend conforms to the strategic plans of the 18th National Congress of the Communist Party of China. This is based on two indicators: per capita GDP (which will exceed $10,000 in 2020 (at 2013 prices) and $14,000 in 2025, achieving the development standard for post-industrialisation) and secondary industry’s contribution to growth (which will be above 40% before 2020, but will go through a period of significant decrease after 2020). This is similar to the situation in South Korea in the 1990s (Table 5.4).

The proportion of high energy consumption industries will begin to fall. High energy consumption industries are a major factor affecting economic structures, and if the proportion of them is high, then economic growth requires more environmental resources, leading to more serious pollution. Under optimised policies, towards the end of the 12th Five-Year Plan, it is hoped that the ratio of high energy consumption industries will begin a continual descent, from accounting for 32.4% of all industries to accounting for 28.5% by 2030 and 24.5% by 2050 (Fig. 5.6).

3.3 Energy Consumption and Structural Change

Even though China’s national industries show significant optimisation in the standard scenario, industry still accounts for a considerable proportion of the economy, and along with the rise in personal income also comes higher personal energy use. China’s national energy consumption is therefore expected to increase greatly in the future. It is estimated that by 2020 total national energy source consumption will reach 5 billion tons, an annual increase of 3.4% from 2010 to 2020. The rise should slow between 2020 and 2030 to a 1.3% annual increase, reaching around 5.68 billion tons, and between 2030 and 2040 the rise will be further reined into 0.8% per year, but by 2040 the total national energy consumption will still reach 6.06 billion tons. Around 2045, total national energy source consumption in China will peak and in 2050 it will stabilise at around 6.1 billion tons (Fig. 5.7).

Even though total energy consumption will continue to rise, energy use per unit GDP will decline considerably, falling from 0.89 tons of coal per CNY 10,000 GDP in 2010 to 0.62 tons of coal per CNY 10,000 GDP in 2020, and then to 0.43 and 0.25 tons of coal per CNY 10,000 GDP in 2030 and 2050, respectively (Figs. 5.8 and 5.9).

There will also be great structural changes in medium- to long-term energy source production. Production of the most important primary energy source, coal, will peak in around 2020 at 3.07 billion tons of standard coal, or a total of 4.3 billion tons of coal. From then onwards, coal production will fall annually, dropping to below 3 billion tons of standard coal by 2030, below 2.5 billion tons by 2040 and around 2.26 billion tons by 2050. As for clean energy, there will be greater development of nuclear power and hydroelectricity; hydroelectricity will grow from 230 to 380 million TSCE in 2020, and hopefully will have reached 460 million TSCE in 2030. From that point onwards, however, growth will slow to a crawl due to limitations in hydroelectric resources, reaching around 500 million TSCE by 2050.

Nuclear power appears to have better development potential. Based on current plans, if progress is smooth, nuclear power output in China will grow from 20 to 130 million TSCE by 2020, and then rise to 320, 550 and 760 million TSCE by 2030, 2040 and 2050, respectively.

Looking at the final energy production structure, electricity will see the biggest expansion in medium- to long-term energy consumption. In 2010 electricity consumption was 1.22 billion TSCE, which is anticipated to rise to 2.65 billion TSCE into 2030 and 2.9 billion TSCE in 2050. Consumption of refined oil will also see further increases, from 520 million TSCE in 2010 to 850 million TSCE in 2030 and 940 million TSCE in 2050.

3.4 Demand for Natural Gas and Main Increases in Consumption

In the standard scenario, demand for natural gas is expected to grow rapidly. It is expected to approach 200 billion m3 in 2015, and exceed 300 billion m3 by 2020. By 2030 it may exceed 450 billion m3, and exceed 600 billion m3 by 2050. Limited by domestic production growth, imports of natural gas (including liquid natural gas) are expected to see a major increase, from 50 billion m3 in 2015 to 100 billion m3 by 2020 and 180 billion m3 by 2030, stabilising by 2040 at around 200 billion m3 (Fig. 5.10).

Although fast growth is expected, growth in other energy sources, and in particular power generation, is rising, therefore the ratio of total energy sources accounted for by natural gas still lags quite a long way behind target levels. It is expected that natural gas will make up 6.0% of total energy sources by 2015, which is somewhat less than the goal of 7.15% set out in the 12th Five-Year Plan. In 2020 it will be 8.0%, which is still lower than the planned goal of 10% (Fig. 5.11).

In terms of the main areas where natural gas consumption is growing, the most important is gas use in power generation. If use of natural gas in power generation becomes economically competitive, allied with strengthened attempts to improve air quality, it is likely that natural gas use in power generation may rise from 25 billion m3 in 2015 to 50 billion m3 by 2020, and the figure should then double and exceed 100 billion m3 by 2030, finally stabilising after 2040 at around the 160 billion m3 mark. Other than natural gas use in power generation, there are three other major natural gas uses: central heating, transport and the chemical industry.

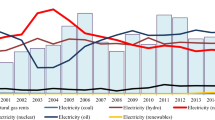

In the medium to long term, to achieve green, clean power generation it is essential that power source structures are optimised. One major aspect of the optimisation of generation would be a reduction in output of coal-based generation and a drop in the proportion of the total resources that it accounts for. Based on simulation analysis, the standard scenario is that coal power generation in China will peak at 5.1 trillion kWh in around 2020 and then decline from there on, to around 4.9 trillion kWh by 2030, going down further to 4.1 trillion kWh by 2040 and further still to 3.2 trillion kWh in 2050.

The reduction in coal power generation must be based on rapid developments in clean power generation. In the standard scenario, the biggest growth lies in nuclear power, while there is also much room for growth for natural gas power generation. Natural gas power generation will rise quickly from 77 billion kWh in 2010 to 280 billion kWh by 2020, 620 billion kWh by 2030 and around 920 billion kWh by 2050. Similarly, wind power, photovoltaic electricity, hydroelectricity and nuclear power will also undergo rapid development (Fig. 5.12).

4 Natural Gas Supply and Demand in the Policy-Driven Scenario

In the standard scenario, even though natural gas consumption in China will rise to 300 billion m3 by 2020, 450 billion m3 by 2030 and 600 billion m3 by 2050, it would still not reach the goals set out for natural gas development in the medium- to long-term energy development plan of the 12th Five-Year Plan. This indicates that, in order to achieve those goals, in addition to the current arrangements for energy sources, policies that are more effective must be put in place to boost natural gas demand.

4.1 Total Natural Gas Supply and Demand

Among the various possible economic measures, the most effective would be the much-vaunted pricing policy based on carbon trading and other ways of realising a carbon price. Under the pressure of a global push for reduction of greenhouse gas emissions, the introduction of a carbon tax could help to encourage society to reduce its reliance on fossil fuels and reduce greenhouse gas emissions. The use of natural gas produces much less carbon than coal or oil, and thus carbon pricing will help to further promote the replacement of coal and oil with natural gas.

In the policy-driven scenario, the demand for natural gas will increase, due to changes in relative energy source prices that are advantageous to natural gas. Due to the sensitivity of natural gas to pricing depending upon different uses, the increase in demand encountered will vary. Some uses, such as household use of natural gas, already contribute a substantial proportion, and thus the increase would be limited in these areas. Other uses, such as power generation and heating, which are more sensitive to pricing, will see a greater relative increase in demand (Fig. 5.13).

With the right policies in place, natural gas demand in China could be expected to reach 344.7 billion m3, achieving the planned goal of 350 billion m3 stipulated in the 12th Five-Year Plan. By 2030, natural gas consumption may approach the level of 580 billion m3, and be around 800 billion m3 by 2050.

4.2 Effects on Pollutant Discharge of Natural Gas Consumer Demand Growth

Under the influence of policy, demand for natural gas will grow and will replace major coal applications, so the use of natural gas will be effective to some degree in restricting emissions of various pollutants (Fig. 5.14).

Based on emissions of 2.46 tons of CO2, 8.5 kg of SO2 and 7.4 kg of nitrogen oxides for every one ton of standard coal burned (when approaching zero emissions, each one ton of standard coal burned results in 0.14 kg of SO2 and 1.12 kg of nitrogen oxides), under the policy-driven scenario, natural gas consumption will increase from 183 billion m3 in 2014 to 575.6 billion m3 by 2030, equivalent to at least 522 million tons of standard coal based on calorific value. Based on this, it would be possible to reduce emissions to 418 million tons of SO2 and 4.354 million tons of CO2 (replacing 20% of near-zero emission coal-fired power generation and 80% of dispersed coal use) by 2030. This is the equivalent of 21.3% of the national SO2 emissions total of 20.439 million tons in 2013. There will also be a reduction in nitrogen oxides emissions of 2.339 million tons, which is the equivalent of 10.5% of the national nitrogen oxides emissions total of 22.274 million tons in 2013. Moreover, by 2020 there will be further reductions of CO2 emissions by 172 million, of SO2 emissions by 1.794 million tons and of nitrogen oxide emissions by 964,000 tons.

In a policy-driven environment, it is possible to markedly reduce greenhouse gas emissions. In a baseline scenario, greenhouse fossil fuel energy consumption in China is expected to continue to grow in terms of emissions in China each year from the 13th Five-Year Plan to 2030. In 2015, greenhouse gas emissions caused by fossil fuels are expected to reach 9.51 billion tons (due to carbon exchange and other factors, greenhouse gas emissions caused by fossil fuel consumption is not equivalent to the total national emissions total), and by 2020 will approach 10.5 billion tons, an annual increase of 1.93%. By 2030 it will approach 11 billion, growing annually by 0.95% from 2020 to 2030, peaking in 2033 at approximately 11.08 billion tons. Subsequently it will gradually decline. In a policy-driven environment, because overall fossil fuel energy consumption will see a major reduction, the resulting greenhouse gas emissions also markedly drop. In 2015, there is expected to be a reduction in emissions of approximately 400 million tons compared to the baseline scenario. CO2 emissions reductions from 2020 to 2030 will be approximately 1.7 billion tons.

4.3 Main Areas of Natural Gas Demand

In the policy-driven scenario, areas where natural gas demand would grow quickly are still the ones more sensitive to costs and prices, namely natural gas power generation, transport and the chemicals industry, while changes in demand remain relatively small in other areas such as domestic use. For example, with the policies in place, compared to the standard scenario, domestic use would only rise by 5 billion m3 by 2050, while for natural gas power generation the consumption in 2030 would be 45 billion m3 higher compared to the standard scenario. Natural gas heating possesses tremendous potential and is very sensitive to costs. With policies in place it could be hoped that consumption might rise by 30 billion m3 by 2030.

Based on the simulation results, in the policy-driven scenario natural gas consumption in China reaches 600 billion m3 by 2030. Of that total, urban use (including vehicular and waterborne transport) accounts for 35%, while 32% goes to power generation, 27% to industrial fuels and 6% is used in the chemicals industry. Urban use mainly consists of cooking, hot water for everyday use, gas use in public utilities (airport, government departments, staff canteens, kindergartens, schools, hostels, hotels, restaurants, malls, offices etc.), centralised heating, centralised air conditioning and being used by vehicles and ships. As for industrial use, natural gas is used as fuel for equipment used in various industries, including pottery, glass, steel, petrochemicals, textiles, aluminium oxide, titanium dioxide, fire-resistant materials, carbon resources and so on. In the chemicals industry, natural gas is mainly used as an ingredient for the synthesis of ammonia and methanol and in hydrogen production. In power generation, natural gas is used in peak regulation power stations, thermal power stations and by distributed energy source users. There is, therefore, massive potential natural gas demand (Table 5.5).

4.4 Demand Curve for Natural Gas in China in 2030

-

1.

Predicted replacement energy source price series

With consideration given to the long-term trends in international oil prices, this analysis is based on an international oil price of $80 per barrel (Table 5.6).

-

2.

Demand curve for natural gas in 2030

The demand for natural gas in China in 2030 is expected to be 576.6 billion m3, subdivided between 31 provinces and 16 types of user. Assessment of terminal natural gas price tolerance for all users in all provinces was carried out based on the local price of replacement energy sources. Conversion was then carried out based on the Shanghai benchmark price conversion, with the natural gas price tolerance based on the Shanghai benchmark being ranked from high to low, yielding the demand curve for natural gas in China in 2030 (Fig. 5.15).

-

3.

Various integrated policies would be required in order to achieve a 575.6 billion m 3 natural gas consumption

If a pricing policy is not implemented, achieving a target of 575.6 billion m3 of natural gas consumption by 2030 would require a series of alternative policies to be introduced. Based on the national natural gas pricing reform plan of 2013, with an international oil price of $80 per barrel as the basis, it is calculated that the benchmark Shanghai natural gas price would be 2.6 CNY/m3. Looking at the effective demand curve for natural gas, the planned natural gas consumption in China by 2030 would be 575.6 billion m3, and with reference to the benchmark Shanghai natural gas price of 2.6 CNY/m3 and effective consumption of 206.7 billion m3, this would account for 32% of estimated demand. Urban natural gas centralised heating, power generation, synthesis of ammonia and methanol, and the majority of usage as fuel in other industries would not satisfy the conditions for generation of effective demand capacity based on the benchmark Shanghai natural gas price of 2.6 CNY/m3 (Table 5.7).

At the current energy source pricing levels, market forces alone would not push demand for natural gas up to the goal of 575.6 billion m3. Systematic design of policy which reflects the environmental and social value of natural gas is necessary.

Author information

Authors and Affiliations

Consortia

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter's Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter's Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2017 The Editor(s) and The Author(s)

About this chapter

Cite this chapter

Shell International and The Development Research Center., Ishwaran, M., King, W., Haigh, M., Lee, T., Nie, S. (2017). Analysis of Medium- to Long-Term Natural Gas Demand and Supply. In: China’s Gas Development Strategies. Advances in Oil and Gas Exploration & Production. Springer, Cham. https://doi.org/10.1007/978-3-319-59734-8_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-59734-8_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-59733-1

Online ISBN: 978-3-319-59734-8

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)