Abstract

The EU VAT Law will be examined with specific reference to the interaction and co-ordination of VAT systems between Member States, specifically with regard to eCommerce supplies. The USA does not have a nationally imposed VAT system, but each state applies a retail sales tax system. As the USA is a major commercial hub it is obligatory to examine its retail sales tax system specifically regarding electronic commerce.

The OECD upholds the place of consumption to be where the consumer ‘usually resides’ (op cit Rendahl, Pernilla Cross-Border Consumption Taxation of Digital Supplies (2009), IBFD, Netherlands, p256). Certain eRetailers are already using a customer’s IP address to determine the customer’s downloading location. Amazon.com may be able to detect whether the location of the ‘downloading’ computer and the billing address are inconsistent.

‘Electronic services’ are defined and electronically supplied services are detailed in Annex L of the Sixth Directive of the EU VAT Directive. However, electronically supplied services detailed in Annex II to the VAT Directive is not an exhaustive list and software which may not be included may still meet the definition of ‘electronically supplied services’. However, amendments to the VAT Directive see a shift away from such an exhaustive list which may allow for a more flexible application.

The ‘one-stop-scheme’ allows the non-EU established supplier to register in one EU jurisdiction of his choice in regard to taxable supplies throughout the EU, but he will be required to levy VAT on electronically supplied services at the VAT rate applicable in the ‘destination jurisdiction’ (idem, p257).

The EU ‘one-stop-scheme’ would not only reduce administrative burden but would probably increase VAT compliance internationally. Such a scheme could, potentially, be administered by an international organisation such as the OECD.

Appendix 1

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Notes

- 1.

It should be noted that the information of particular countries in respect of jurisdictional analysis was obtained primarily from the respective countries official revenue authority website. Furthermore, the information obtained is restricted to the applicable revenue websites information as from April 2010 through December 2010.

- 2.

Where current VAT/GST legislation has been obtained, an analysis of the various definitions, etc will be provided. However, where research was limited, an overview of the basic VAT/GST facts have been provided for purposes of illustrating either differences or similarities between jurisdictions applying a VAT model. Furthermore, the electronic commerce publications and/or guidelines issued by different revenue authorities may be the only source of information referring to relevant enacted legislation or the manner in which the relevant jurisdiction deals with electronic commerce transactions. Certain VAT/GST legislated sections regarding various definitions, ‘place of supply rules’, etc may also be provided in full in the footnotes only.

- 3.

The European Community and, therefore, the abbreviation EC, has been replaced by the name European Union and, therefore, the abbreviation EU in terms of the Treaty of Lisbon. However, the name European Community, and abbreviation EC, is still, nevertheless, found in several Member States’ revenue documents and literature and, therefore, will be used interchangeably with European Union and the abbreviation EU throughout this paper.

The abbreviation EC has also been defined by the Swedish Tax Agency in The VAT Brochure SKV 552B Edition 10 (“Swedish VAT Brochure”), p4. Available at http://www.skatteverket.se/download/18.6efe6285127ab4f1d2580008470/552B10svartvit.pdf [Accessed 9/12/2010].

- 4.

Pricewaterhouse Coopers offers the following description of VAT in the EU and the VAT Directives enacted:

The Sixth VAT Directive (77/388/EC) has represented for over twenty years the pillar of the common European framework for VAT. However, numerous amendments made it complicated to read and hard to access for practitioners.

As from 1 January 2007, the new EC VAT Directive entered into force (2006/112/EEC), enhancing clarity, rationality and simplification without, however, entailing content changes.

In clear, practical terms, A Guide to VAT in the EU of 27 Countries explains what the rules set out in the new EC VAT Directive entail in practice and how they are implemented in each of the 27 EU Member States.

Available at http://www.pwc.com/be/en/publications/guide-to-vat-in-the-eu-of-27-countries.jhtml [Accessed 13/12/2010].

- 5.

European Commission Taxation & Customs Union. VAT Directive 2 (01.01.2010) eLearning Course (Course on the VAT Directive). Available at http://ec.europa.eu/taxation_customs/common/elearning/vat/index_en.htm [Accessed 13/12/2010].

- 6.

op cit Schenk, Alan & Oldman, Olivier, Value Added Tax, A Comparative Approach (2007), USA, p58.

- 7.

loc cit European Commission Taxation & Customs Union VAT Directive 2 (01.01.2010) eLearning Course (Course on the VAT Directive). Available at http://ec.europa.eu/taxation_customs/common/elearning/vat/index_en.htm [Accessed 13/12/2010].

- 8.

supra.

- 9.

supra.

- 10.

supra.

- 11.

The type of transactions subject to VAT is otherwise referred to as the ‘VAT base’.

- 12.

European Commission Taxation & Customs Union. General Overview – The History of VAT in the European Union until 1993 [“EU VAT General Overview”].

Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.htm [Accessed 05/06/2010].

- 13.

The Sixth VAT Directive was adopted in terms of Directive 77/388/EEC of 17 May 1977.

- 14.

op cit European Commission Taxation & Customs Union General Overview – The History of VAT in the European Union until 1993. Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.htm [Accessed 05/06/2010].

and

Makipaa, A Value Added Tax (VAT) EN 4.18.2 (2008) p1. European Commission Taxation & Customs Union. Available at http://europarl.europa.eu/ftu/pdf/en/FTU_4.18.2.pdf [Accessed 14/12/2010].

- 15.

supra.

- 16.

To achieve the “realisation of the single market” the European Union “…Commission proposed moving from the pre-1993 “destination based” system, where VAT is effectively charged at the rate of VAT applicable where the buyer is established, to an “origin based” system, with VAT being charged at the rate in force where the supplier is established. This would have effectively abolished fiscal frontiers within the EU.

This was, however, not acceptable to Member States as rates of VAT were too different and there was no adequate mechanism to redistribute VAT receipts to mirror actual consumption.

Therefore, until the conditions were right the Community adopted the Transitional VAT System which maintains different fiscal systems but without frontier controls. The intention is still eventually to have a common system of VAT where VAT is charged by the seller of goods – an origin based VAT system. The transitional system is an origin based system for sales to private persons who can go and buy tax paid anywhere they like in the Union and take the goods home without having to pay VAT again. There are some exceptions to this general rule however (e.g. the purchase of new means of transport and distance selling). For transactions between taxable persons it is still a destination based VAT system”.

Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.htm [Accessed 31/05/2011].

- 17.

European Commission Taxation and Customs Union VAT: VAT and the Single Market – 1993 to now. Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.htm [Accessed 31/05/2011].

- 18.

The ‘destination principle’ was examined in, 16.2.1. Basic Principles & Definitions, Part V of this paper [p152]. Basically, in terms of the ‘destination principle’ VAT is imposed on the consumer in the country where the goods or services are consumed. Thus, with regard to the EU and intra-community transactions the VAT rate applicable in the consumer’s country is effectively the VAT rate applied to the transaction.

- 19.

European Commission Taxation and Customs Union EU VAT General Overview – History pre-1993. EU Taxation and Customs, General Overview – VAT and the Single Market – 1993 to now [“EU VAT General Overview – VAT & the Single Market post-1993”].

Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.html [Accessed 21/01/2012].

- 20.

The ‘origin principle’ was examined in Part V, Chap. 16, 16.2.1 – Basic Principles & Definitions, page 152 of this paper. Basically, the ‘origin principle’ is effectively the opposite of the ‘destination principle’ whereby VAT is imposed in the jurisdiction “where the goods are produced and services rendered”. Thus, with regard to the EU and intra-community transactions the VAT rate applicable in the supplier’s country is effectively the VAT rate applied to the transaction.

- 21.

op cit European Commission Taxation & Customs Union VAT: VAT and the Single Market – 1993 to now. Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.htm [Accessed 31/05/2011].

- 22.

loc cit Makipaa, http://europarl.europa.eu/ftu/pdf/en/FTU_4.18.2.pdf. p2–3.

- 23.

supra.

- 24.

loc cit, Schenk and Oldman, p60.

- 25.

supra.

- 26.

The ‘reverse charge mechanism’ is discussed in 18.1.2. The United Kingdom’, Part V of this paper [p188].

In terms of the ‘reverse charge mechanism, the supply is “treated as supplied in the country where the business customer is established, and the business customer will account for VAT under the reverse charge mechanism.” – [op cit HM Revenue & Customs: VAT: Cross-Border VAT Changes 2010 . http://www.hmrc.gov.uk/vat/cross-border-changes-2010.htm ].

- 27.

op cit Tumpel, Michael, Professor, A Hybrid VAT System in the European Union, http://docs.google.com/viewer?a=v&q=cache:g5ZTN7J6sf8J:www.law.nyu.edu/...Y4eFA&pli=1. p15.

- 28.

The following is a brief biography of Professor Michael Tumpel:

Michael Tumpel is full professor and head of the Department of Tax Management at the Johannes Kepler University Linz. He studied in Vienna and was visiting researcher at New York University (NYU). His special research interests are VAT, European Tax Law, corporate reorganisations and International Tax Law. He publishes in international journals and is the author of several books on European and International Tax Law. Available at http://www2.wu-wien.ac.at/sfb-itc/tumpel.html [Accessed 14/12/2010].

- 29.

- 30.

Otherwise referred to as The Recast VAT Directive.

- 31.

Directive 2006/112/EC.

- 32.

- 33.

loc cit European Commission Taxation & Customs Union. VAT Directive 2 (01.01.2010) eLearning Course (Course on the VAT Directive). http://ec.europa.eu/taxation_customs/common/elearning/vat/index_en.htm.

- 34.

supra.

- 35.

European Commission Taxation & Customs Union. VAT Directive 2 (01.01.2010) eLearning Course (Course on the VAT Directive). http://ec.europa.eu/taxation_customs/common/elearning/vat/index_en.htm.

- 36.

supra.

- 37.

supra.

- 38.

Article 2(1)(a) of the VAT Directive 2006/112/EC.

- 39.

Article 2(1)(c) of the VAT Directive 2006/112/EC.

- 40.

Article 2(1)(b) of the VAT Directive 2006/112/EC.

- 41.

Article 2(1)(d) of the VAT Directive 2006/112/EC.

- 42.

loc cit European Commission Taxation & Customs Union. VAT Directive 2 (01.01.2010) eLearning Course (Course on the VAT Directive). http://ec.europa.eu/taxation_customs/common/elearning/vat/index_en.htm.

- 43.

op cit Rendahl, p154.

- 44.

supra.

- 45.

The criterion “that there has to be a direct link between the service supplied and the consideration received” was first established in the Case 154/80 Staatssecretaris van Financien v. Association Cooperatieve “Cooperative Aardappelenbewaarplaats GA” (1981) ECR I-044d, as discussed and analysed in Rendahl, p155. Furthermore, a synopsis of the case is given in Rendahl, p155:

The case concerned an agricultural cooperative association running a potato warehouse in the Netherlands. The members, equal shareholders in the cooperative, paid a storage charge at the end of the season, fixed by the cooperative. During two years there were no storage charges. Hence, the cooperative argued that there was no consideration for the service of storing potatoes, while the national fiscal authority claimed that the consideration consisted of a reduction of the value of the shares the members possessed… Where the consideration, as in this case, consists of an unfixed reduction in the value of shares, such a loss of value cannot be regarded as payment received by the cooperative that provides the service. Furthermore, the consideration is a subjective value that must be capable of being expressed in money, since it is the consideration actually received that is the basis of assessment and not a consideration based on objective criteria. Hence, no direct link between the service provided and the consideration received could be found.

- 46.

Review of the ‘legal relationship’ was examined in the Case C-16/93 R. J. Tolsma v. Inspecteur der Omzetbelasting Leeuwarden (1994) ECR I-0743 (Tolsma). [op cit Rendahl, p157]. A synopsis of the case is given in Rendahl, p157:

Mr Tolsma played a barrel organ on the public highway in the Netherlands and offered passers-by the option of giving donations in a collecting-tin. The national Inspector of Turnover Taxes argued before the national court that there was a direct link between the donations and the service provided by Tolsma. The national court asked the ECJ for a preliminary ruling. With reference to its earlier case law, the ECJ emphasized the criteria of establishing a direct link between the services provided and the consideration received. In this case the passers-by do not request the music to be played for them and their donations, if any, depend on their subjective motives and not on the musical service. Hence, there is no necessary link between the donations and the service.

- 47.

op cit Rendahl, p157.

- 48.

‘Any person’, per A Guide to the European VAT DirectivesAA, encompasses a variety of entities such as a legal person, co-operations joint ventures and partnerships, and individuals.

AA Terra, Ben and Kajus, Julie A Guide to the European VAT Directives, Introduction to European VAT 2010, Volume 1 (2010), Netherlands, p331.

- 49.

Article 9(1) of the VAT Directive 2006/112/EC.

- 50.

loc cit European Commission Taxation & Customs Union. VAT Directive 2 (01.01.2010) eLearning Course (Course on the VAT Directive). http://ec.europa.eu/taxation_customs/common/elearning/vat/index_en.htm.

- 51.

op cit, Terra and Kajus, Volume 1, p336.

- 52.

Article 9(1) of the VAT Directive 2006/112/EC.

- 53.

op cit, Terra and Kajus, Volume 1, p485.

- 54.

The place of supply of goods without transport is governed by Article 31 under Section 1, Chapter 1, Title V of the VAT Directive 2006/112/EC.

- 55.

The place of supply of goods with transport is governed by Articles 32 through to 36 under Section 2, Chapter 1, Title V of the VAT Directive 2006/112/EC.

- 56.

The place of supply of goods on board ships, aircraft or trains is governed by Article 37 under Section 3, Chapter 1, Title V of the VAT Directive 2006/112/EC.

With regard to the place of supply of goods on board ships, aircraft or trains, Article 37 deems the supply to be “[w]here goods are supplied on board ships, aircraft or trains during the section of a passenger transport operation effected within the Community… the point of departure of the passenger transport operation”.

- 57.

The place of supply of goods through distribution systems is governed by Articles 38 through to 39 under Section 4, Chapter 1, Title V of the VAT Directive 2006/112/EC.

With regard to the place of supply of goods through distribution systems, Article 38 deems the supply to be “[i]n the case of the supply of gas through the natural gas distribution system, or of electricity, to a taxable dealer,… where that taxable dealer has established his business or has a fixed establishment for which the goods are supplied, or, in the absence of such a place of business or fixed establishment, the place where he has his permanent address or usually resides”.

Alternatively, in terms of Article 39, “where such a supply is not covered by Article 38, the place of supply shall be deemed to be the place where the customer effectively uses and consumes the goods”.

- 58.

Article 31 of Section 1, Chapter 1, Title V of the VAT Directive 2006/112/EC

- 59.

Article 32 of Section 2, Chapter 1, Title V of the VAT Directive 2006/112/EC.

- 60.

European Commission Distance Selling of Goods. Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/distance_selling/index_en.htm [Accessed 05/06/2010].

- 61.

op cit, Terra and Kajus, Volume 1, p488.

- 62.

European Commission Mail Order and Distance Purchasing. Available at http://ec.europa.eu/taxation_customs/taxation/vat/consumers/mail_order_distance/index_en.htm [Accessed 05/06/2010].

- 63.

op cit, Terra and Kajus, Volume 1, p503.

- 64.

European Commission Taxation & Customs Union General Overview – VAT on Goods Moving between Member States. Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.htm [Accessed 05/06/2010].

- 65.

Article 40 of Chapter 2, Title V of the VAT Directive 2006/112/EC.

- 66.

op cit, Terra and Kajus, Volume 1, p504.

- 67.

Article 60 of Chapter 4, Title V of the VAT Directive 2006/112/EC.

- 68.

op cit Terra and Kajus, Volume 1, p510.

- 69.

Kay & Davis The VAT Services, ch. 6 of Gillis, Shoup & Sicat, Value Added Taxation in Developing Countries 70–82, at 77 (World Bank 1990) as quoted and referenced in Schenk and Oldman, p189.

- 70.

op cit, Terra and Kajus, Volume 1, p510.

- 71.

Article 44 of Section 2, Chapter 3, Title V of the VAT Directive 2006/112/EC.

- 72.

Article 45 of Section 2, Chapter 3, Title V of the VAT Directive 2006/112/EC.

- 73.

op cit Terra and Kajus, Volume 1, p510.

- 74.

Article 59a of Section 10, Chapter 3, Title V of the VAT Directive 2006/112/EC.

- 75.

Article 59a(a), (b) and Proviso thereto of Section 10, Chapter 3, Title V of the VAT Directive 2006/112/EC.

- 76.

op cit Terra and Kajus, Volume 1, p577.

- 77.

Article 59(k) of Section 10, Chapter 3, Title V of the VAT Directive 2006/112/EC.

- 78.

Terra, Ben and Kajus, Julie, A Guide to the European VAT Directives, Integrated Texts of The Recast VAT Directive (Including the Implementing Regulation) and the former Sixth VAT Directive 2010 – Volume 2 (2010). Based on Directive 2008/8/EC, p37.

As of 2010, the current Article 58 of the VAT Directive reads as follows:

Supply of electronic services to non-taxable persons

Article 58

The place of supply of electronically supplied services, in particular those referred to in Annex II, when supplied to non-taxable persons who are established in a Member State, or who have their permanent address or usually reside in a Member State, by a taxable person who has established his business outside the Community or has a fixed establishment there from which the service is supplied, or who, in the absence of such a place of business or fixed establishment, has his permanent address or usually resides outside the Community, shall be the place where the non-taxable person is established, or where he has his permanent address or usually resides.

Where the supplier of a service and the customer communicate via electronic mail, that shall not of itself mean that the service supplied is an electronically supplied service.

- 79.

op cit, Terra and Kajus, Volume 1, p532.

- 80.

Annex L is examined in 18.1.2. The United Kingdom, Part V of this paper [p188].

- 81.

Ben Terra is one of the co-authors of the ‘Guide to EU VAT Directives – Volume 1’. The Guide to EU VAT Directives – Volume 1 provides the following brief biography of Ben Terra:

Ben Terra Prof. ddr. h.c., is professor of law at the universities of Amsterdam, the Netherlands and of Lund, Sweden.

- 82.

Julie Kajus is one of the co-authors of the ‘Guide to EU VAT Directives – Volume 1’. The Guide to EU VAT Directives – Volume 1 provides the following brief biography of Julie Kajus:

Julie Kajus Advokat LLM, is indirect tax adviser specialized in European VAT.

- 83.

op cit Terra and Kajus, Volume 1, p576.

- 84.

supra.

- 85.

idem Terra and Kajus, Volume 1, p535.

- 86.

idem, p534.

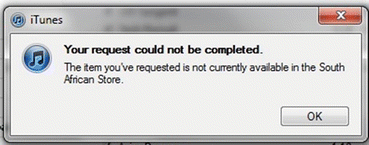

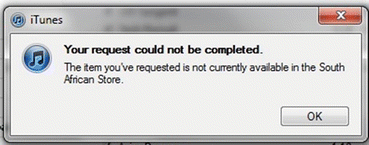

- 87.

Article 58 of the VAT Directive which will come into effect 1 January 2015.

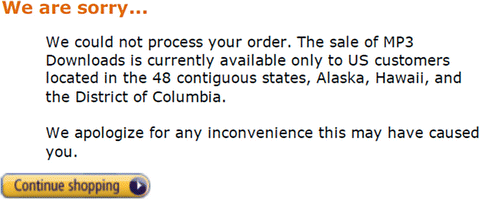

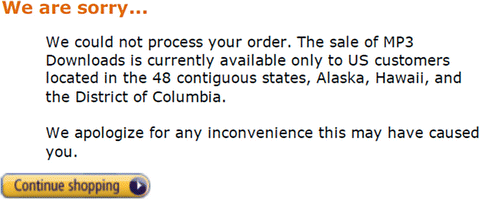

- 88.

op cit Rendahl, p256.

- 89.

supra.

- 90.

supra.

- 91.

Refer to 8.1. The Virtual World versus the Physical World, Part II of this paper [p72].

- 92.

Discussed in 18.2.2. South Africa’, Part V of this paper [p205].

- 93.

In terms of Amazon.com’s Terms and Conditions, Clause 6, territorial restrictions are imposed on the downloading of certain digitised content:

“As required by our Digital Content providers, Digital Content will, unless otherwise designated, be available only to customers located in the United States.”

Amazon.com Amazon MP3 Music Service: Terms of Use. Available at http://www.amazon.com/gp/help/customer/display.html?nodeId=200154280 [Accessed 8/01/2011].

- 94.

Per the Amazon Pop-up Screen which displays when the download is blocked due to territorial restrictions.

- 95.

The common pop-up screen which displays when the download is blocked due to territorial restrictions pertaining to the downloading of digital content:

“

”

” - 96.

Refer to 18.1.1.3. Place of Supply Rules’, Part V of this paper [p178].

- 97.

op cit Rendahl, p199.

- 98.

Article 11(1) of the EU Council Regulation (EC) No. 1777/2005.

- 99.

Refer to 18.1.2., Part V of this paper [p188].

- 100.

Refer to 18.1.3., Part V of this paper [p194].

- 101.

- 102.

op cit Rendahl, p211.

- 103.

supra.

- 104.

op cit Rendahl, p211.

- 105.

idem, p189 & 255.

- 106.

idem, p257.

- 107.

EU Member State VAT Rates obtained from the European Commission VAT Rates Applied in the Member States of the European Union.

European Commission Taxation and Customs Union VAT Rates Applied in the Member States of the European Union. (Situation at 1st May 2010). Available at http://ec.europa.eu/taxation_customs/resources/documents/taxation/vat/how_vat_works/rates/vat_rates_en.pdf [Accessed 06/05/2010].

- 108.

As the UK is the first European country to be examined within this analysis, significant reference to, and quoting of, the EU VAT Directives will be made hereunder. Where the EU VAT Directives are referenced or quoted, same will not be reiterated under the sub-chapter relating to the European VAT.

- 109.

Pricewaterhouse Coopers Worldwide Tax Summaries: United Kingdom – Corporate – Other Taxes. Available at http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HU8E [Accessed 9/12/2010].

- 110.

HMRC Website. HM Revenue & Customs: Introduction to VAT, VAT Glossary. Available at http://www.hmrc.gov.uk/vat/start/introduction.htm [Accessed 9/12/2010].

- 111.

Comments provided herewith demonstrate the different registration threshold requirements which are, however, subject to change (i.e. the threshold value may increase or decrease or may even be removed altogether). The current applicable registration threshold requirements can be obtained from the HMRC website.

- 112.

HM Revenue & Customs When to Register for UK VAT. Available at http://www.hmrc.gov.uk/vat/start/register/when-to-register.htm [Accessed 05/10/2011].

- 113.

As discussed in 16.2.7. VAT Rates, Part V of this paper [p156], the VAT threshold is one of the desirable OECD factors which is required for a greater efficiency in the management and collection of consumption tax.

- 114.

Op cit HM Revenue & Customs Website. HM Revenue & Customs: Introduction to VAT, When you must register for VAT. Available at http://www.hmrc.gov.uk/vat/start/introduction.htm [Accessed 9/12/2010].

- 115.

loc cit Pricewaterhouse Coopers Worldwide Tax Summaries: United Kingdom – Corporate – Other Taxes. http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HU8E.

- 116.

Reference may also be made to Schedule 1 of the UK Value Added Tax Act 1994 c.23 (as amended) which addresses “registration in respect of taxable supplies”.

- 117.

loc cit Pricewaterhouse Coopers Worldwide Tax Summaries: United Kingdom – Corporate – Other Taxes. http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HU8E.

- 118.

Loc cit HMRC Website. HM Revenue & Customs: Introduction to VAT, VAT Glossary. http://www.hmrc.gov.uk/vat/start/introduction.htm.

- 119.

HRMC Website, Notice 741A Place of Supply of Services (January 2010), p6.

Available at http://customs.hmrc.gov.uk/channelsPortalWebApp/channelsPortalWebApp.portal?_nfpb=true&_pageLabel=pageVAT_ShowContent&propertyType=document&id=HMCE_PROD1_029955#downloadopt [Accessed 12/12/2010].

- 120.

To the extent that each member state of the EU implements the EU VAT Directive, with specific emphasis on the place of supply rules, the EU Member States are, in effect, implementing a standardised ‘place of supply’ rule.

- 121.

HRMC Website, HM Revenue & Customs. Main Rules: Structure and Application. VATPOSG3100 – Main Rules: Structure and Application, Introduction. Available at http://www.hmrc.gov.uk/manuals/vatposgmanual/VATPOSG3100.htm [Accessed 9/12/2010].

- 122.

Loc cit HMRC Notice 741A Place of Supply of Services (January 2010). http://customs.hmrc.gov.uk/...pt. p4.

- 123.

supra.

- 124.

HM Revenue & Customs: VAT: Cross-Border VAT Changes 2010. Available at http://www.hmrc.gov.uk/vat/cross-border-changes-2010.htm [Accessed 9/12/2010].

- 125.

op cit McKenzie, Alastair, GST – A Practical Guide, New Zealand, p111.

- 126.

op cit HMRC Notice 741A Place of Supply of Services (January 2010). http://customs.hmrc.gov.uk/...pt. p4.

- 127.

Similar to Registration requirements and threshold, place of supply rules may change and reference should be made to the HMRC website for updated place of supply rules, as well as section 7 of the UK Value Added Tax Act 1994 c.23 for updated comments. Individual EU jurisdictions are discussed to illustrate harmonization in respect of EU VAT Directive commentary and application. This principle applies to all EU Jurisdictions examined.

- 128.

op cit HMRC Notice 741A Place of Supply of Services (January 2010). http://customs.hmrc.gov.uk/...pt. p9.

- 129.

supra.

- 130.

supra.

- 131.

supra.

- 132.

supra.

- 133.

Refer to 9.2. Traditional Definition & Approach to ‘Residence’, Part III of this paper [p89] regarding a discussion on the ‘residence’ of a company or individual.

- 134.

op cit HMRC Notice 741A Place of Supply of Services (January 2010). http://customs.hmrc.gov.uk/...pt. p13–14.

- 135.

HM Revenue & Customs: How to Work Out Your Place of Supply of Services for VAT.

Available at http://www.hmrc.gov.uk/vat/managing/international/exports/services.htm [Accessed 9/12/2010].

- 136.

HM Revenue & Customs: Electronically Supplied Services: A Guide to Interpretation (April 2003). p1–2.

Available at http://customs.hmrc.gov.uk/channelsPortalWebApp/channelsPortalWebApp.portal?_nfpb=true&_pageLabel=oageVAT_ShowContent&id=HMCE_CL_000907?&propertyType=document#downloadopt [Accessed 12/12/2010].

- 137.

Idem, p3.

- 138.

supra.

- 139.

Annex L of the EU VAT on E-Commerce Directive (2002/38/EC) provides an “Illustrative List of Electronically Supplied Services…”. Annex L lists five (5) categories of services which qualify as ‘electronically supplied services’. The HMRC ‘Electronically Supplied Services: A Guide to Interpretation’ (April 2003) lists the five (5) categories/items referred to in Annex L and also provides examples for each category/item, as well as examples of transactions which are not considered to be an ‘electronically supplied service’ with corresponding rationale for the non-inclusion. For the purpose of this paper, the tables provided in the HMRC ‘Electronically Supplied Services: A Guide to Interpretation’ (April 2003) will be listed. The later subsection relating to the EU VAT analysis may refer back to these tables which are, in essence, based on Annex L of the EU VAT on E-Commerce Directive (2002/38/EC).

- 140.

Loc cit HM Revenue & Customs: VAT: Cross-Border VAT Changes 2010. http://www.hmrc.gov.uk/vat/cross-border-changes-2010.htm.

- 141.

Table 1 and Table 2 as set out in HMRC Electronically Supplied Services: A Guide to Interpretation, (April 2003). Available at http://customs.hmrc.gov.uk/channelsPortalWebApp/channelsPortalWebApp.portal?_nfpb=true&_pageLabel=oageVAT_ShowContent&id=HMCE_CL_000907?&propertyType=document#downloadopt [Accessed 12/12/2010]. Also, Op cit Europa, Annex L of the EU VAT on E-Commerce Directive (2002/38/EC), Available at http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2002:128:0041:0044:en:PDF [Accessed 17/12/2014]. p4–8.

- 142.

op cit HMRC Notice 741A Place of Supply of Services (January 2010). http://customs.hmrc.gov.uk/...pt. p61–62:

The additional rules for electronically supplied services apply only where there is a B2B supply in either of the following situations:

• The place of supply would be in the UK (because the supplier or the customer belongs in the UK, but the services are effectively used and enjoyed outside the EC); or

• The place of supply would be outside the EC (because the supplier or the customer belongs outside the EC), but the services are effectively used or enjoyed in the UK.

In these circumstances, the place of supply of the electronically supplied services is where their effective use and enjoyment takes place. Where this is [in] the UK, the services are subject to UK VAT.

Consequently, they do not apply in any situation where:

• B2C supplies of electronically supplied services are made. This is because most consumers are considered to use and enjoy the service in the same country in which they belong.

• The place of supply is the UK (because either the supplier or the customer belongs in the UK) and the service was effectively used and enjoyed in another Member State; or

• The place of supply is in another Member State (because either the supplier or the customer belongs there, but the supply is effectively used and enjoyed in the UK).

- 143.

op cit HMRC Notice 741A Place of Supply of Services (January 2010). http://customs.hmrc.gov.uk/...pt. p61.

- 144.

op cit HMRC Notice 741A Place of Supply of Services (January 2010). http://customs.hmrc.gov.uk/...pt. p62.

- 145.

supra.

- 146.

Swedish Tax Agency, The VAT Brochure SKV 552B Edition 10. Available at http://www.skatteverket.se/download/18.6efe6285127ab4f1d2580008470/552B10svartvit.pdf [Accessed 9/12/2010]. p5.

- 147.

- 148.

Pricewaterhouse Coopers Worldwide Tax Summaries. Austria – Corporate – Other Taxes. Available at http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HRKN [Accessed 3/12/2010].

- 149.

The significance of exported transactions being exempt rather than zero rated will be discussed further in the brief summary of Ireland’s VAT system in 18.4.2. Ireland, Part V of this paper [p196].

- 150.

loc cit Pricewaterhouse Coopers Worldwide Tax Summaries Austria – Corporate – Other Taxes, http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HRKN.

- 151.

loc cit Pricewaterhouse Coopers Worldwide Tax Summaries Austria – Corporate – Other Taxes. http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HRKN.

- 152.

International VAT Services, TMF Group. Austria VAT. Available at http://www.tmf-vat.com/vat/austria-vat.html [Accessed 3/12/2010].

- 153.

supra.

- 154.

International VAT Services, TMF Group. Irish VAT. Available at http://www.tmf-vat.com/vat/ireland-vat.html [Accessed 3/12/2010].

- 155.

supra.

- 156.

The EU VAT Directives were discussed further in 18.1.1 . European Union VAT Law, Part V of this paper [p171].

- 157.

Irish Tax and Customs Revenue website. VAT Registration FAQs. Available at http://www.revenue.ie/en/tax/vat/registration/index.html [Accessed 12/12/2010].

- 158.

Irish Tax and Customs Revenue website. VAT Registration for Foreign Traders. Available at http://www.revenue.ie/en/tax/vat/leaflets/vat-registration-foreign-traders.html [Accessed 12/12/2010].

- 159.

Only five (5) of the 11 listed activities carried on by a non-established supplier qualifying for VAT registration in Ireland are pertinent to and, therefore, noted for the purpose of this paper.

- 160.

loc cit Irish Tax and Customs Revenue website. VAT Registration for Foreign Traders. http://www.revenue.ie/en/tax/vat/leaflets/vat-registration-foreign-traders.html.

- 161.

TMF Group International VAT Services – Irish VAT. Available at http://www.tmf-vat.com/vat/ireland-vat.html [Accessed 31/05/2011].

- 162.

Irish Revenue Legislation Services, Indirect Taxes Division (11th Edition) VAT Guide 2008, Chapter Eight, p68. Link to the VAT Guide 2008 available at http://www.revenue.ie/revsearch/search.jsp [Accessed 31/05/2011].

- 163.

Pricewaterhouse Coopers Worldwide Tax Summaries. Ireland – Corporate – Other Taxes. Available at http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HSNF [Accessed 3/12/2010].

- 164.

Pricewaterhouse Coopers Worldwide Tax Summaries. Russian Federation – Corporate – Other Taxes. Available at http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HTPC [Accessed 3/12/2010].

- 165.

supra.

- 166.

supra.

- 167.

International VAT Services, TMF Group. Russia VAT. Available at http://www.tmf-vat.com/vat/russia-vat.html [Accessed 3/12/2010].

- 168.

supra.

- 169.

International VAT Services, TMF Group. Switzerland VAT. Available at http://www.tmf-vat.com/vat/switzerland-vat.html [Accessed 3/12/2010].

- 170.

supra.

- 171.

supra.

- 172.

op cit, Schenk and Oldman, p195.

- 173.

As discussed in 18.2.3 . Australia, Part V of this paper [p208].

- 174.

op cit, Schenk and Oldman, p196.

- 175.

Zero rating is subject to exceptions.

- 176.

op cit, Schenk and Oldman, p197.

- 177.

op cit, Schenk and Oldman, p197.

- 178.

Section 8(1) of the New Zealand Goods and Services Tax Act, No. 141 of 1985 (as amended).

- 179.

Section 8(2) of the NZ GST Act, No. 141 of 1985 (as amended).

- 180.

Section 6(1)(a) of the NZ GST Act, No. 141 of 1985 (as amended).

- 181.

Section 2 of the NZ GST Act, No. 141 of 1985 (as amended).

- 182.

New Zealand Goods and Services Tax Legislation 2010 (Edition 24), p18.

- 183.

supra.

- 184.

supra.

- 185.

supra.

- 186.

New Zealand Goods and Services Tax Legislation 2010 (Edition 24), p18.

- 187.

Refer to Footnotes 9 and 10 of this paper [p163]. An opposing school of thought to the OECD recommendations holds that on-line software may constitute a ‘good’ rather than a ‘service’. However, despite opposition New Zealand applies the OECD recommended guidelines and treats digitised software as the supply of services.

- 188.

New Zealand Inland Revenue E-Commerce and GST (E-Commerce and tax). Available at http://www.ird.govt.nz/ecommerce-tax/ecommerce-gst/business-australian-ecommerce-gst.html [Accessed 4/12/2010].

- 189.

New Zealand Inland Revenue GST and Imported Services – a challenge in an electronic commerce environment; A Government Discussion Document (June 2001). Policy Advice Division of the Inland Revenue Department, New Zealand. Available at http://taxpolicy.ird.govt.nz/sites/default/files/2001-dd-gst-imported-services.pdf [Accessed 05/10/2011].

- 190.

op cit NZ GST and Imported Services Discussion Document, http://taxpolicy.ird.govt.nz/sites/...pdf. p29–31.

- 191.

New Zealand Inland Revenue Guide to Tax Consequences of Trading Over the Internet (May 2002), p12 Available at http://www.ird.govt.nz/resources/d/9/d902a3804bbe5893bc4bfcbc87554a30/internettaxguide.pdf [Accessed 4/12/2010].

- 192.

New Zealand Inland Revenue Guide to Tax Consequences of Trading Over the Internet (May 2002). http://www.ird.govt.nz/resources/d/9/d902a3804bbe5893bc4bfcbc87554a30/internettaxguide.pdf. p15.

- 193.

op cit McKenzie, p119.

- 194.

ibid, p120.

- 195.

ibid, p119–120.

- 196.

ibid, p118.

- 197.

supra.

- 198.

Section 11A of the NZ GST Act pertains to the zero-rating of services. Section 11A(1)(j) of the NZ GST Act, No. 141 of 1985 (as amended) reads as follows:

11A(1) [Zero-rated services] A supply of services that is chargeable with tax under section 8 must be charged at the rate of 0 % in the following situations:…

-

(j) The services are physically performed outside New Zealand or are the arranging of services that are physically performed outside New Zealand;…

(This is similar to section 11(2)(k) of the South African VAT Act, No. 89 of 1991 (as amended), which reads as follows:

11. Zero Rating. – (2) Where, but for this section, a supply of services would be charged with tax at the rate referred to in section 7(1), such supply of services shall,… be charged with tax at the rate of zero per cent where –

-

(k) the services are physically rendered elsewhere than in the Republic…)

-

- 199.

Also zero rated in terms of section 11A(1)(j) of the NZ GST Act, No. 141 of 1985 (as amended).

- 200.

Such services may be zero-rated in terms of section 11A(1)(f) of the NZ GST Act, No. 141 of 1985 (as amended), which reads as follows:

11A(1) [Zero-rated services] A supply of services that is chargeable with tax under section 8 must be charged at the rate of 0 % in the following situations:…

-

(f) The services are supplied directly in connection with moveable personal property, other than [choices] in action, situated outside New Zealand when the services are performed;…

(This is similar to section 11(2)(g) of the South African VAT Act, No. 89 of 1991 (as amended), which reads as follows:

11. Zero Rating. – (2) Where, but for this section, a supply of services would be charged with tax at the rate referred to in section 7(1), such supply of services shall,… be charged with tax at the rate of zero per cent where –

-

(g) the services are supplied directly in respect of –

-

(i) moveable property situated in any export country at the time the services are rendered…)

-

- 201.

Such services may be zero-rated in terms of section 11A(1)(k) of the NZ GST Act, No. 141 of 1985 (as amended), which reads as follows:

11A(1) [Zero-rated services] A supply of services that is chargeable with tax under section 8 must be charged at the rate of 0 % in the following situations:…

-

(k) Subject to subsection (2), the services are supplied to a person who is a non-resident and who is outside New Zealand at the time the services are performed, ….

(This is similar to section 11(2)(l) of the South African VAT Act, No. 89 of 1991 (as amended), which reads as follows:

11. Zero Rating. – (2) Where, but for this section, a supply of services would be charged with tax at the rate referred to in section 7(1), such supply of services shall,… be charged with tax at the rate of zero per cent where –

-

(l) the services are supplied to a person who is not a resident of the Republic, not being services which are supplied directly –

-

(i) in connection with land or any improvement thereto situated inside the Republic; or

-

(ii) in connection with moveable property…situated inside the Republic at the time the services are rendered, except moveable property which –

-

(aa) is exported to the said person subsequent to the supply of such services…

-

(iii) to the said person or any other person, … if the said person or such other person is in the Republic at the time the services are rendered…”)

-

- 202.

ibid, p118.

- 203.

It should be noted that in the earlier analysis of various European VAT systems, while some European countries may have a compulsory VAT registration threshold, no reference is found regarding a voluntary registration threshold.

South African VAT registration thresholds are legislated and may be found under section 23(1) and 23(3) of the VAT Act, No. 89 of 1991 (as amended) respectively.

- 204.

Within South African legislation, South Africa is often referred to as “the Republic”.

- 205.

Section 1 of the Republic of South Africa Value-Added Tax (‘VAT’) Act, No. 89 of 1991 (as amended) (“the SA VAT Act”).

- 206.

The MP3 downloading purchase price for the album ‘One Love’ by David Guetta from Amazon.com as at 22 December 2010.

- 207.

‘Imported services’ as defined under Section 1 of the Republic of the SA VAT Act, No. 89 of 1991 (as amened).

- 208.

Per Chapter 10 of the South African Revenue Service VAT 404 – Guide for Vendors, Example 31 on page 70 reads as follows:

Example 31 – Imported Services (digital goods/electronic products)

Mrs Bookworm orders an electronic version of the latest “Harry Potter” novel from Virtual Books (an internet based business located in Belgium) and downloads the document on her personal computer. She pays € 20 for this service on her credit card. Digital products such as electronic books are regarded internationally as ‘services’ and not ‘goods’. Therefore, as these ‘services’ are supplied by a non-resident (Virtual Books, Belgium) to a recipient who is resident in the RSA [Republic of South Africa] (Mrs Bookworm) for non-taxable (private) purposes, VAT will be payable by Mrs Bookworm in this situation. If € 20 was equivalent to R200 on the date of the importation, the VAT payable would be calculated as follows:

VAT payable = R200 × 14 % = R28.00

The SARS VAT 404 – Guide for Vendors continues to provide the time period within which the VAT must be accounted:

The VAT on imported services must be declared on form VAT215 and paid to the local SARS branch office within 30 days from the time of supply.

[SARS VAT 404 – Value-Added Tax Guide for Vendors . p70. Available at http://www.sars.gov.za/home.asp?pid=4150&tid=65&s=pubs&show=1312 [Accessed 22/12/2010]].

- 209.

The iTunes pop-up notice reads as follows:

- 210.

The Amazon.com notice reads as follows:

You have selected to purchase: One Love (New Version) [Explicit] by David Guetta (Amazon MP3 purchases are limited to U.S. customers.)

Available at http://www.amazon.com/gp/dmusic/order/amd-get-interstitial.html?ie=UTF8&ASIN=B003FAE0OE&isTrack=0&tryInPlace=0 [Accessed 22/12/2010].

After trying to proceed with the purchase despite the above notice, the download was blocked and the following notice was posted:

We are sorry…

We could not process your order. The sale of MP3 Downloads is currently available only to US customers located in the 48 contiguous states, Alaska, Hawaii, and the District of Columbia.

We apologize for any inconvenience this may have caused you.”

Available at http://www.amazon.com/gp/digital/order/geo-filter-note.html?ie=UTF8&glCode=340 [Accessed 22/12/2010].

- 211.

Amazon.com identifying a customer’s location was discussed briefly in 18.1.1.3. Place of Supply Rules, Part V of this paper [p178].

- 212.

op cit Rendahl, p164.

- 213.

The Pirate Bay is a website which operates using BitTorrent software. BitTorrent software is faster than Peer-to-Peer file sharing methods. BitTorrent software is described by How Stuff Works as follows: “[u]nlike some other peer-to-peer downloading methods, BitTorrent is a protocol that offloads some of the file tracking work to a central server (called a tracker). Another difference is that it uses a principal called tit-for-tat. This means that in order to receive files, you have to give [files for downloading]… BitTorrent downloads different pieces of the file you want simultaneously from multiple computers…”

How Stuff Works. How BitTorrent Works, What BitTorrent Does. Available at http://computer.howstuffworks.com/bittorrent2.htm [Accessed 08/10/2009].

- 214.

Refer to Chap. 21 – The Impact of Technology on Tax & VAT in the Virtual World, Part V of this paper [p257].

- 215.

Op cit, Schenk and Oldman, p196.

- 216.

Australian Taxation Office GST Registration Information for a non-resident. Available at http://www.ato.gov.au/print.asp?doc=/content/57758.htm [Accessed 3/12/2010].

- 217.

op cit, Schenk and Oldman, p196.

- 218.

supra.

Alan Schenk describes this “unique set of place of supply rules” as follows:

A supply of goods is connected with Australia if the goods are delivered or made available in Australia to the recipient of the supply, the goods are being removed from Australia, the goods are being imported or installed or assembled in Australia… Any other supply is connected with Australia if the thing (like a service) is done in Australia or the supplier makes the supply through an enterprise conducted in Australia… Although a business or other activity apparently does not have to be conducted in Australia to be an enterprise and therefore some supplies by a non-resident enterprise can be subject to the GST… definition of an enterprise, which does not require that the business be conducted in Australia. Supplies of anything other than goods or real property that are not done in Australia are taxable only if the enterprise is carried on in Australia… For this purpose, an enterprise is carried on in Australia if it is carried on through a permanent establishment… Thus, supplies of services through a permanent establishment in Australia or services rendered in Australia appear to come within the scope of the GST, but most or all would be zero rated.

- 219.

op cit, Rendahl, p94.

- 220.

Defined in terms of section 85–10 of the Australian GST Act of 1999, reads as follows:

A telecommunication supply is a supply relating to the transmission, emission or reception of signals, writing, images, sounds or information of any kind by wire, radio, optical or other electromagnetic systems. It includes:

-

(a)

The related transfer or assignment of the right to use capacity for such transmission, emission or reception; and

-

(b)

Provision of access to global information networks.

[op cit , Rendahl, p239].

-

(a)

- 221.

ibid, p134.

- 222.

Refer to Footnote 187 of this paper [p202].

- 223.

Also supported by Dr. Rendahl’s overview of Australian GST. While it may be recognised that digital supplies may comprise “part of intangible personal property as well as services”, within Australian GST legislation “[d]igital supplies do not cover supplies of goods or real property…”. However, it is further noted that “[a]t first glance the possible classification alternatives for digital supplies in Australian GST appear as a middle way between EC VAT and Canadian GST”.

[op cit , Rendahl, p237].

- 224.

Refer to Footnotes 10 and 187 of this paper [p163 & 202 respectively].

- 225.

Australian Taxation Office Electronic Commerce Industry Partnership – Issues Register, p6. Available at http://www.ato.gov.au/print.asp?doc=/content/18428.htm [Accessed 3/12/2010].

- 226.

supra.

- 227.

supra.

- 228.

“GST-free” has been defined by the Australian Tax Office as follows:

“The Australian GST law makes certain supplies of things GST-free. Broadly, the following are examples of GST-free supplies:…most educational services;… international travel and transport;… and exports of goods or services or other things from Australia if certain requirements are met.”

[op cit ATO, GST Registration Information for a non-resident, http://www.ato.gov.au/...htm ].

- 229.

op cit ATO, Electronic Commerce Industry Partnership – Issues Register, http://www.ato.gov.au/p...htm. p2.

- 230.

The Australian GST legislation provides five types of supplies which may qualify “for consumption outside of Australia” and be “GST-free”:

1. “Supply connected with property outside Australia – a supply that is directly connected with goods or real property situated outside Australia;

2. Supply to non-resident outside Australia – a supply that is made to a non-resident who is not in Australia when the thing supplied is done, and:

(a) The supply is neither a supply of work physically performed on goods situated in Australia when the work is done nor a supply directly connected with real property situated in Australia; or

(b) The non-resident acquires the thing in carrying on the non-resident’s enterprise, but is not registered or required to be registered.

3. Supplies used or enjoyed outside Australia – a supply:

(a) That is made to a recipient who is not in Australia when the thing supplied is done; and

(b) The effective use or enjoyment of which takes place outside Australia;

Other than a supply of work physically performed on goods situated in Australia when the thing supplied is done, or a supply directly connected with real property situated in Australia.

4. Rights – a supply that is made in relation to rights if:

(a) The rights are for use outside Australia; or

(b) The supply is to an entity that is not an Australian resident and is outside Australia when the thing supplied is done.

5. Export of services used to repair, etc imported goods – a supply is constituted by the repair, renovation, modification or treatment of goods from outside Australia whose destination is outside Australia.”

[op cit ATO, Electronic Commerce Industry Partnership – Issues Register , http://www.ato.gov.au/p...htm . p2–3].

- 231.

op cit, Rendahl, p99.

- 232.

supra.

- 233.

ibid, p107.

- 234.

ibid, p241.

- 235.

Idem, Rendahl, p244.

Dr. Rendahl provided an organogram of the supplies which constitute digital supplies. One such subcategory, also referred to as ‘things’, is “supplies for anything else”, which may include “advice or information, services related to rights like copyright”. [op cit , Rendahl, p238 & 241].

- 236.

ibid, p245.

- 237.

supra.

- 238.

Op cit, Rendahl, p238.

- 239.

ibid, p245.

- 240.

supra.

- 241.

International VAT Services, The TMF Group. Brazil VAT, ICMS, IPI, GST. Available at http://www.tmf-vat.com/global-vat/brazil-vat-icms-ipi-gst.html [Accessed 3/12/2010].

- 242.

Loc cit International VAT Services, The TMF Group. Brazil VAT, ICMS, IPI, GST. http://www.tmf-vat.com/global-vat/brazil-vat-icms-ipi-gst.html.

- 243.

MecroPress, South Atlantic News Agency. Japan Retains Position as World’ Second Largest Economy. Available at http://en.mecropress.com/2010/02/15/japan-retains-position-as-world-second-largest-economy [Accessed 27/12/2010].

- 244.

International VAT Services, TMF Group. China VAT/GST. Available at http://www.tmf-vat.com/global-vat/china-vat-gst.html [Accessed 3/12/2010].

- 245.

Pricewaterhouse Coopers Worldwide Tax Summaries. China, People’s Republic of – Corporate – Other Taxes. Available at http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HRZF [Accessed 3/12/2010].

- 246.

supra.

- 247.

supra.

- 248.

Loc cit Pricewaterhouse Coopers Worldwide Tax Summaries. China, People’s Republic of – Corporate – Other Taxes. http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HRZF.

- 249.

loc cit International VAT Services, TMF Group. China VAT/GST. http://www.tmf-vat.com/global-vat/china-vat-gst.html.

- 250.

International VAT Services, TMF Group. Japan Consumption Tax. Available at http://www.tmf-vat.com/global-vat/japan-consumption-tax.html [Accessed 3/12/2010].

- 251.

Pricewaterhouse Coopers Worldwide Tax Summaries. Japan – Corporate – Other Taxes. Available at http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HSSD [Accessed 3/12/2010].

- 252.

op cit, Schenk and Oldman, p41.

- 253.

ibid, p68.

- 254.

ibid, p69.

- 255.

ibid, 41 & 67.

- 256.

op cit, Schenk and Oldman, p68.

- 257.

supra.

- 258.

‘Calendar quarter’ is defined as follows: “[a] calendar quarter means a period of three consecutive months ending on the last day of any of the following months: March, June, September, or December.”

Canadian Revenue Agency (‘CRA’) Definitions for GST/HST. Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/glssry-eng.html#quarter [Accessed 13/01/2011].

- 259.

CRA GST/HST Mandatory Registration. Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/rgstrng/mndtry-eng.html [Accessed 13/01/2011].

- 260.

‘Small supplier’ is defined as including “charities, and other public service bodies, that are engaged in commercial activity with revenues from worldwide taxable supplies (not including sales of capital property and financial services) equal to or less than $ 50,000 in the current calendar quarter and over the preceding four consecutive calendar quarters. The threshold for businesses that are not public service bodies is $ 30,000. Charities are also small suppliers if they meet the gross revenue test of $ 250,000 or less.”

CRA Definitions for GST/HST. Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/glssry-eng.html [Accessed 13/01/2011].

- 261.

CRA GST / HST Mandatory Registration for Non-Resident Businesses. Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/rgstrng/rgstr/rgstrng/mndtry_nr-eng.html [Accessed 30/05/2011].

- 262.

ibid, p376.

- 263.

Pricewaterhouse Coopers, Worldwide Tax Summaries Canada – Corporate – Other Taxes. Available at http://taxsummaries.pwc.com/uk/taxsummaries/wwts.nsf/ID/JDCN-89HRUU [Accessed 28/12/2010].

- 264.

CRA Goods and Services tax/harmonized sales tax (GST/HST). Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/menu-eng.html?=slnk [Accessed 28/12/2010].

- 265.

CRA What is HST? Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/gnrl/hst-tvh/wrks-eng.html [Accessed 30/04/2010].

- 266.

loc cit CRA Goods and Services tax/harmonized sales tax (GST/HST). http://www.cra-arc.gc.ca/tx/...=slnk.

- 267.

op cit, Schenk and Oldman, p376.

- 268.

supra.

- 269.

supra.

- 270.

ibid, p377.

- 271.

op cit, Schenk and Oldman, p377.

- 272.

The USA Retail Sales Tax system will be examined in further detail in 20.2 . The Indirect Tax System Employed in the United States of America, Part V of this paper [p240].

- 273.

op cit, Schenk and Oldman, p376.

- 274.

As per the brief history of Richard M Bird and Pierre-Pascal Gendron provided in Bird and Gendron’s paper, ‘Sales Taxes in Canada: The GST-HST-QSR-RST “System”’, Richard M Bird is Professor Emeritus of the Rotman School of Management at the University of Toronto, and Pierre-Pascal Gendron is Professor of The Business School at the Humber College of Technology and Advanced Learning, Toronto. Available at http://www.americantaxpolicyinstitute.org/pdf/VAT/Bird-Gendron.pdf [Accessed 28/12/2010].

- 275.

op cit, Schenk and Oldman, p376.

- 276.

supra.

- 277.

supra.

- 278.

supra.

- 279.

op cit, Schenk and Oldman, p379.

- 280.

ibid, p380.

- 281.

ibid, p379.

- 282.

ibid, p380.

- 283.

Subsection 132(2) of the Canadian Excise Tax Act, per the CRA published guidelines, provides that:

a non-resident person who has a permanent establishment in Canada is considered to be resident in Canada in respect of, but only in respect of, the person’s activities carried on through that permanent establishment. As a result, a non-resident person who makes taxable supplies through a permanent establishment in Canada is required to register for GST/HST purposes under subsection 240(1) of the [Canadian Excise Tax] Act as a resident person, and to collect tax on its taxable (other than zero rated) supplies made in Canada, unless the person is a small supplier.

Registration is not limited to non-residents with a permanent establishment in Canada. Non-residents without a permanent establishment in Canada may also be required to register for GST / HST in accordance with subsection 240(1) of the Canadian Excise Tax Act:

…every non-resident person who makes taxable supplies in Canada in the course of a business carried on in Canada (other than as a small supplier), is required to register for GST/HST purposes. As a registrant, the non-resident is required to collect tax on its taxable (other than zero-rated) supplies made in Canada.

CRA, GST/HST Technical Information Bulletin GST/HST and Electronic Commerce (July 2002) p27.

Available at http://www.cra-arc.gc.ca/BBF6E666-8A29-47F6-7781B1517476/FinalDownload/DownloadId_F964750C245682CA22DA0BC295CE6E20/BBF6E666-8A29-47F6-BF42-7781B1517476/E/pub/gm/b-090/b-090_e.pdf [Accessed 30/04/2010].

- 284.

CRA Non-Residents and Carrying on Business in Canada Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/cmm/gst-tps/nnrs-eng.html [Accessed 30/04/2010].

- 285.

CRA Doing Business in Canada – GST/HST Information for Non-Residents. p4. Available at http://www.cra-arc.gc.ca/E/pub/gp/rc4027/rc4027-09e.pdf [Accessed 30/04/2010].

- 286.

ibid, p6.

- 287.

Refer to the discussion regarding The Pirate Bay Case discussed in 18.2.1 . New Zealand, Part V of this paper [p200].

- 288.

op cit, Rendahl, p166.

- 289.

loc cit CRA Doing Business in Canada – GST/HST Information for Non-Residents. http://www.cra-arc.gc.ca/E/pub/gp/rc4027/rc4027-09e.pdf. p4.

- 290.

CRA GST/HST Memoranda Series, 3.1. Liability for Tax (August 1999, Revised September 2000) p11. Available at http://www.cra-arc.gc.ca/E/pub/gm/3-1/3-1-e.pdf [Accessed 28/12/2010].

- 291.

loc cit CRA GST/HST Memoranda Series, 3.1. Liability for Tax. http://www.cra-arc.gc.ca/E/pub/gm/3-1/3-1-e.pdf. p11.

- 292.

loc cit CRA GST/HST Memoranda Series, 3.1. Liability for Tax. http://www.cra-arc.gc.ca/E/pub/gm/3-1/3-1-e.pdf. p12.

- 293.

op cit, Rendahl, p130.

- 294.

supra.

(As examined in 18.2.1. New Zealand, Part V of this paper [p200]. Certain jurisdictions are of the opinion that digital supplies may constitute the supply of both ‘services’ and ‘goods’ and jurisdictions such as New Zealand deem the supply to constitute services only.)

- 295.

loc cit GST/HST Technical Information Bulletin GST/HST and Electronic Commerce. http://www.cra-arc.gc.ca/B...90_e.pdf. p16.

- 296.

supra.

- 297.

ibid, p17.

- 298.

ibid, p20.

- 299.

loc cit GST/HST Technical Information Bulletin GST/HST and Electronic Commerce. http://www.cra-arc.gc.ca/B...90_e.pdf. p20.

- 300.

ibid, p17.

- 301.

supra.

- 302.

supra.

- 303.

ibid, p18.

- 304.

supra.

- 305.

loc cit GST/HST Technical Information Bulletin GST/HST and Electronic Commerce. http://www.cra-arc.gc.ca/B...90_e.pdf. p21.

- 306.

ibid, p2.

- 307.

ibid, p4 – The table is an exact extract from the GST/HST Technical Information Bulletin GST/HST and Electronic Commerce. http://www.cra-arc.gc.ca/B...90_e.pdf.

- 308.

The CRA bulletin examined various examples pertaining to electronic commerce and examined whether such supplies constitute intangible personal property or services. The examples, along with brief comments, read as follows:

I. “Electronic Ordering and Downloading of Digitized Products

… A limitation with respect to the frequency, even to a single occurrence, or period of use of a downloaded copy of a digitized product, even to a single occurrence, does not alter the nature of the supply… The customer is provided with a copy of the product, as well as the right to use the product… Similarly, the supply of the updates and add-ons is characterized as a supply of intangible personal property…

II. Software Maintenance Contracts

These supplies typically involve the provision of software updates with technical support. Technical support may be provided on-line, through the use of a trouble-shooting database, or by communications (e.g., telephone or e-mail) with technicians. These supplies are characterized either as supplies of intangible personal property or of services, depending upon the principal object of the supply… As the principal object of the supply [of software maintenance] is the provision of a software update delivered electronically, the supply is characterized as one of intangible personal property… if the technical support [in regard to customer support over a computer network] is essentially the supply of a right to use existing technical information in the form of on-line documentation and access to a trouble-shooting database, and the interaction with the technician is incidental, the supply would be characterized as one of intangible personal property. If technical support is provided through interaction with technicians, and the provision of any rights to documentation or databases is incidental, the supply would be characterized as a supply of a service, since it is of specific work performed for a specific customer.

III. Application Hosting, Web site hosting, and data warehousing

These supplies include remote access and use of software, space on and access to servers to store data or run software, and technical support. They are characterized as either intangible personal property or services… [Where] [t]he host entity is essentially providing the space to store and run the software application on its equipment, as well as technical support… [such hosting is consequently] characterized as a supply of a service… [Under circumstances where] the host entity (rather than the customer) is the copyright holder for the software, the customer is being provided with the right to use the software… [and] is characterized as a supply of intangible personal property…

[With regard to web site hosting, where the] agreement between the supplier and the customer is to host the customer’s Web site on a server maintained by the supplier, and the customer maintains all rights in the site[, there] is no supply of rights or of property between the supplier and the customer, and therefore the supply is characterized as a supply of a service… [Similarly, where the agreement relates to the storage of the] customer’s computer data on a server maintained by the supplier[,]… there is no provision of rights or property, the supply is characterized as a supply of a service.

IV. Supplies Related to On-Line Sales

These supplies include advertising, referral, and representation on behalf of on-line suppliers of goods or services. The suppliers provide a means of bringing consumers and merchants together on-line, but do not supply the goods or services being advertised or marketed. These supplies are generally characterized as supplies of services…

V. Subscriptions to Databases and Web sites

These supplies typically involve a provider making digitized content available to customers for search, retrieval and use. They are generally characterized as supplies of intangible personal property…

VI. Information Provided by Electronic Means

These supplies range from professional advisory services to the periodic electronic delivery of data to subscribers in accordance with their personal preferences. If the supply is of an existing product or a product created for a group of customers who receive rights to the product (e.g., subscriptions for data delivered on a periodic basis), it is characterized as a supply of intangible personal property. If there is human involvement in the making of the supply, or specific work is performed by a person for a specific customer, and the supply does not involve the transfer of rights, it is characterized as a supply of a service…The supply of…advice to clients, delivered by electronic means, is a supply of a service, as it involves specific work that is performed for a specific client, and does not involve a supply of rights to an existing product… [If the] supply is one of a right to customized information[, t]here is no human involvement on the part of the supplier in the making of the supply. Consequently, the supply is characterized as one of intangible personal property…”

[loc cit GST/HST Technical Information Bulletin GST/HST and Electronic Commerce . http://www.cra-arc.gc.ca/B...90_e.pdf . p5–p11].

- 309.

ibid, p5.

- 310.

op cit, Rendahl, p230.

- 311.

supra.

Also, refer to the discussion and examination of the EU VAT model in 18.1.1 European Union VAT Law, Part V of this paper [p171].

- 312.

‘Telecommunication facilities’ is defined in subsection 123(1) of the Canadian Excise Tax Act as follows:

any facility, apparatus or other things (including any wire, cable, radio, optical or other electromagnetic system, or any similar technical system, or any part thereof) that is used or is capable of being used for telecommunications

[loc cit GST/HST Technical Information Bulletin GST/HST and Electronic Commerce . http://www.cra-arc.gc.ca/B...90_e.pdf . p12].

- 313.

Subsection 123(1) of the Canadian Excise Tax Act.

[ibid , p12].

- 314.

ibid, p13.

- 315.

loc cit GST/HST Technical Information Bulletin GST/HST and Electronic Commerce. http://www.cra-arc.gc.ca/B...90_e.pdf. p13–p16.

- 316.

op cit, Rendahl, p280.

- 317.

op cit Jean Monnet Center for International & Regional Economic Law & Justice, Chapter III: Shortcomings of the Present European VAT System with Respect to Electronic Supplies, Classification of E-Commerce Transactions. Available at http://centers.law.nyu.edu/jeanmonnet/papers/01/013301-03.html [Accessed 05/10/2011].

- 318.

supra.

- 319.

Refer to 21.3.3. Is VAT Perfect in its Current Form? Part V of this paper [p270].

- 320.

loc cit GST/HST Technical Information Bulletin GST/HST and Electronic Commerce. http://www.cra-arc.gc.ca/B...90_e.pdf. p25.

- 321.

Canada v Dawn’s Place Ltd. [2006] G.S.T.C. 137 [Canada].

- 322.

op cit, Rendahl, p283.

- 323.

Her Majesty the Queen v Dawn’s Place Ltd [2006] FCA 349 at para 3 [Canada]. Available at http://decisions.fca-caf.gc.ca/en/2006/2006fca349/2006fca349.html [Accessed 05/10/2011].

- 324.

ibid at para 9.

- 325.

ibid at para 10.

- 326.

ibid at para 13.

- 327.

ibid at para 14.

- 328.

ibid Her Majesty the Queen v Dawn’s Place Ltd [2006] FCA 349 at para 3 [Canada], http://decisions.fca-caf.gc.ca/en/2001/2001fca260/2001fca260.html. at para 17.

- 329.

ibid at para 20.

- 330.

op cit, Rendahl, p281–p282.

- 331.

op cit Her Majesty the Queen v Dawn’s Place Ltd. [2006] FCA 349 at para 3 [Canada]. http://decisions.fca-caf.gc.ca/en/2001/2001fca260/2001fca260.html. at para 29.

- 332.

op cit, Rendahl, p282.

- 333.

An argument was submitted that “the correct interpretation of [the relevant zero rating provision] must respect the doctrine of neutrality, which is the notion that tax should not provide an incentive or disincentive it determining the manner in which business is conducted”. Interpreting and applying the legislation in a manner which may give rise to double taxation may be viewed as a contradiction of the doctrine of neutrality. The double taxation may discourage foreign recipients from utilising services supplied by Dawn’s Place causing Dawn’s Place to suffer a competitive disadvantage.

Both the Crown and Dawn’s Place attempted to argue the doctrine of neutrality to support their cases respectively: “the Crown argued that if the supply of copyrighted material in electronic form is zero-rated, then the supply of electronic versions of copyrighted material would have an advantage over the supply of the same content in the form of a magazine. Dawn’s Place agreed that neutrality was important, but argued that the supply of electronic material to non-residents is the functional equivalent of the export of magazines, so that if the supply in this case is not zero-rated, the export of magazines would have an advantage over the supply of electronic material to non-resident”.

The Appellate Court held, however, that “the submissions on neutrality [were] of no assistance, given the record of this case. The doctrine of neutrality generally is a guideline for the development of tax policy, which in turn may inform the drafting and enactment of tax legislation. However, except for what may be inferred from the language of [the relevant zero rating provision/s] and the relevant elements of the statutory scheme, [the Judge had] no basis for determining the policy underlying [the zero rating provisions]. In particular, [the Judge had] no basis for determining whether, or to what extent, [the zero rating provisions were] intended to give effect to the doctrine of neutrality”.

op cit Her Majesty the Queen v Dawn’s Place Ltd. [2006] FCA 349 at para 3 [Canada]. http://decisions.fca-caf.gc.ca/en/2001/2001fca260/2001fca260.html. at para 30–31.

- 334.

ibid, p285.

- 335.

supra.

- 336.

supra.

- 337.

ibid, p285–p286.

Bibliography

Primary Sources

Cases

Canadian Cases

Canada v Dawn’s Place Ltd. 2006. G.S.T.C. 137. Available at http://reports.fja.gc.ca/eng/2007/2006fca349.html. Accessed 22 Jan 2012.

Her Majesty the Queen v Dawn’s Place Ltd. 2006. FCA 349. Available at http://decisions.fca-caf.gc.ca/en/2006/2006fca349/2006fca349.html. Accessed 05 Oct 2011.

Statutes

Australian Goods and Services Tax Act, No. 55 of 1999 (as amended)

Europa. Official Journal of the European Communities. VAT on E-Commerce Directive (2002/38/EC). Available at http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2002:128:0041:0044:en:PDF. Accessed 17 Dec 2014.

European Union VAT Directive 2006/112/EC

New Zealand Goods and Services Tax Act, No. 141 of 1985 (as amended)

South Africa Value-Added Tax Act, No. 89 of 1991 (as amended)

UK Value Added Tax Act 1994 c.23 (as amended)

Secondary Sources

Amazon.com. Amazon MP3 music service: Terms of use. Available at http://www.amazon.com/gp/help/customer/display.html?nodeId=200154280. Accessed 8 Jan 2011.

Amazon.com. Further notice. Available at http://www.amazon.com/gp/digital/order/geo-filter-note.html?ie=uUTF8&glCode=340. Accessed 22 Dec 2010.

Amazon.com. The notice. Available at http://www.amazon.com/gp/dmusic/order/amd-get-interstitial.html?ie=UTF8&ASIN=B003FAE0OE&isTrack=0&tryInPlace=0. Accessed 22 Dec 2010.

Australian Taxation Office. Electronic commerce industry partnership – Issues register. Available at http://www.ato.gov.au/print.asp?doc=/content/18428.htm. Accessed 3 Dec 2010.

Australian Taxation Office. GST registration information for a non-resident. Available at http://www.ato.gov.au/print.asp?doc=/content/57758.htm. Accessed 3 Dec 2010.

Bird, Richard M., and Pierre-Pascal Gendron. Sales taxes in Canada: The GST-HST-QSR-RST ‘system’. Available at http://www.americantaxpolicyinstitute.org/pdf/VAT/Bird-Gendron.pdf. Accessed 28 Dec 2010.

Canadian Revenue Agency. Definitions for GST/HST. Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/glssry-eng.html#quarter. Accessed 13 Jan 2011.

Canadian Revenue Agency. Definitions for GST/HST. Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/glssry-eng.html#smallsupplier. Accessed 13 Jan 2011.

Canadian Revenue Agency. Doing business in Canada – GST/HST information for non-residents. Available at http://www.cra-arc.gc.ca/E/pub/gp/rc4027/rc4027-09e.pdf. Accessed 30 Apr 2010.

Canadian Revenue Agency. Goods and services tax/harmonized sales tax (GST/HST). Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/menu-eng.html?=slnk. Accessed 28 Dec 2010.

Canadian Revenue Agency. GST/HST mandatory registration for non-resident businesses. Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/rgstrng/rgstr/rgstrng/mndtry_nr-eng.html. Accessed 30 May 2011.

Canadian Revenue Agency. GST/HST mandatory registration. Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/rgstrng/mndtry-eng.html. Accessed 13 Jan 2011.

Canadian Revenue Agency. GST/HST memoranda series, 3.1. Liability for tax (August 1999, Revised September 2000). Available at http://www.cra-arc.gc.ca/E/pub/gm/3-1/3-1-e.pdf. Accessed 28 Dec 2010.

Canadian Revenue Agency. 2002, July. GST/HST Technical Information Bulletin. GST/HST and electronic commerce. Available at http://www.cra-arc.gc.ca/BBF6E666-8A29-47F6-7781B1517476/FinalDownload/DownloadId_F964750C245682CA22DA0BC295CE6E20/BBF6E666-8A29-47F6-BF42-7781B1517476/E/pub/gm/b-090/b-090_e.pdf. Accessed 30 Apr 2010.

Canadian Revenue Agency. Non-residents and carrying on business in Canada. Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/cmm/gst-tps/nnrs-eng.html. Accessed 30 Apr 2010.

Canadian Revenue Agency. What is HST? Available at http://www.cra-arc.gc.ca/tx/bsnss/tpcs/gst-tps/gnrl/hst-tvh/wrks-eng.html. Accessed 30 Apr 2010.

Europa. The EU at a glance – The history of the European Union. Available at http://europa.eu/abc/history/index_en.htm. Accessed 2 July 2010.

European Commission. Distance selling of goods. Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/distance_selling/index_en.htm. Accessed 05 June 2010.

European Commission. Mail order and distance purchasing. Available at http://ec.europa.eu/taxation_customs/taxation/vat/consumers/mail_order_distance/index_en.htm. Accessed 05 June 2010.

European Commission Taxation & Customs Union. General overview – VAT on goods moving between member states. Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.htm. Accessed 05 June 2010.

European Commission Taxation & Customs Union. General overview – The history of VAT in the European Union until 1993. Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.htm. Accessed 05 June 2010.

European Commission Taxation & Customs Union. VAT directive 2 (01.01.2010) eLearning course (Course on the VAT directive). Available at http://ec.europa.eu/taxation_customs/common/elearning/vat/index_en.htm. Accessed 13 Dec 2010.

European Commission Taxation & Customs Union. VAT rates applied in the member states of the European Union. (Situation at 1st May 2010). Available at http://ec.europa.eu/taxation_customs/resources/documents/taxation/vat/how_vat_works/rates/vat_rates_en.pdf. Accessed 06 May 2010.

European Commission Taxation & Customs Union. VAT: VAT and the single market – 1993 to now. Available at http://ec.europa.eu/taxation_customs/taxation/vat/how_vat_works/index_en.htm. Accessed 31 May 2011 and 21 Jan 2012.

HM Revenue & Customs. When to register for UK VAT. Available at http://www.hmrc.gov.uk/vat/start/register/when-to-register.htm. Accessed 05 Oct 2011.

HM Revenue & Customs Website. HM revenue & customs. Main rules: Structure and application. VATPOSG3100 – Main rules: Structure and application, introduction. Available at http://www.hmrc.gov.uk/manuals/vatposgmanual/VATPOSG3100.htm. Accessed 9 Dec 2010.

HM Revenue & Customs Website. HM revenue & customs: Introduction to VAT, VAT glossary. Available at http://www.hmrc.gov.uk/vat/start/introduction.htm. Accessed 9 Dec 2010.

HM Revenue & Customs Website. 2010, January. Notice 741A place of supply of services. Available at http://customs.hmrc.gov.uk/channelsPortalWebApp/channelsPortalWebApp.portal?_nfpb=true&_pageLabel=pageVAT_ShowContent&propertyType=document&id=HMCE_PROD1_029955#downloadopt. Accessed 12 Dec 2010.

HM Revenue & Customs Website. HM revenue & customs: Introduction to VAT. Available at http://www.hmrc.gov.uk/vat/start/introduction.htm. Accessed 9 Dec 2010.

HM Revenue & Customs. 2003, April. Electronically supplied services: A guide to interpretation. Available at http://customs.hmrc.gov.uk/channelsPortalWebApp/channelsPortalWebApp.portal?_nfpb=true&_pageLabel=oageVAT_ShowContent&id=HMCE_CL_000907?&propertyType=document#downloadopt. Accessed 12 Dec 2010.

HM Revenue & Customs. How to work out your place of supply of services for VAT. Available at http://www.hmrc.gov.uk/vat/managing/international/exports/services.htm. Accessed 9 Dec 2010.

HM Revenue & Customs. VAT: Cross-border VAT changes 2010. Available at http://www.hmrc.gov.uk/vat/cross-border-changes-2010.htm. Accessed 9 Dec 2010.

How Stuff Works. How BitTorrent works, what BitTorrent does. Available at http://computer.howstuffworks.com/bittorrent2.htm. Accessed 08 Oct 2009.