Abstract

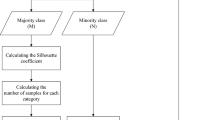

The core problem of the credit rating is how to build an efficient and accurate classifier on the imbalanced datasets. The ensemble learning and resampling technology have rich results in this field, but the efficiency of the classifier is limited when dealing with high imbalanced credit data. In this paper, we propose a credit rating model based on hybrid sampling and dynamic ensemble technique. Hybrid sampling can contribute to build a rich base classifier pool and improve the accuracy of the integrated learning model. The combination of hybrid sampling and dynamic ensemble can apply to various imbalanced data and obtain better classification results. In the resampling phase, synthetic minority over-sampling technique (SMOTE) and boundary-sensitive under-sampling techniques are used to process the training data set, and the clustering technique is used to improve the under-sampling and make it more adaptable to high imbalanced credit data, by generating more samples and more representative training subset to enhance the diversity of the basic classifier. A dynamic selection method is used to select one or more classifiers from the basic classifier pool for each test sample. Experiments on three credit data sets prove that the combination of hybrid sampling and dynamic ensemble can effectively improve the performance of the classification.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Thomas, L.C., Edelman, D., Crook, J.: Credit Scoring and Its Application. SIAM, Philadelphia (2002)

Xiao, J., Zhou, X., Zhong, Y., Xie, L.: Cost-sensitive semi-supervised selective ensemble model for customer credit scoring. Knowl.-Based Syst. 189 (2020). Article No. 113351

Maldonado, S., Peters, G., Weber, R.: Credit scoring using three-way decisions with probabilistic rough sets. Inf. Sci. 507, 700–714 (2020)

Classifier selection and clustering with fuzzy assignment in ensemble model for credit scoring. Neurocomputing 316, 210–221 (2018)

Eisenbeis, R.A.: Problems in applying discriminant analysis in credit scoring models. J. Bank. Finance 2(3), 205–219 (1978)

William, E., Hardy, J.R., John, L., Adrian, J.R.: A linear programming alternative to discriminant analysis in credit scoring. Agribusiness 1(4), 285–292 (1985)

Mircea, G., Pirtea, M., Neamtu, M., Bazavan, S.: Discriminant analysis in a credit scoring model. In: AIASABEBI 2011, pp. 257–262, August 2011

Patra, S., Shanker, K., Kundu, D.: Sparse maximum margin logistic regression for credit scoring. In: ICDM 2008, pp. 977–982, December 2008

Sohn, S.Y., Kim, D.H., Yoon, J.H.: Technology credit scoring model with fuzzy logistic regression. Appl. Soft Comput. 43, 150–158 (2016)

Vedala, R., Kumar, B.R.: An application of Naive Bayes classification for credit scoring in e-lending platform. In: ICDSE 2012, pp. 21–29, July 2012

Capotorti, A., Barbanera, E.: Credit scoring analysis using a fuzzy probabilistic rough set model. Comput. Stat. Data Anal. 56(4), 981–994 (2012)

Henley, W.E., Hand, D.J.: A k-NN classifier for assessing consumer credit risk. Statistician 65, 77–95 (1996)

Mukid, M.A., Widiharih, T., Rusgiyono, A.: Credit scoring analysis using weight k nearest neighbor. In: The 7th International Seminar on New Paradigm and Innovation on Natural Science and Its Application, October 2017

Nie, G., Rowe, W., Zhang, L., Tian, Y., Shi, Y.: Credit card churn forecasting by logistic regression and decision tree. Expert Syst. Appl. 38, 15273–15285 (2011)

Sohn, S.Y., Kim, J.W.: Decision tree-based technology credit scoring for start-up firms: Korean case. Expert Syst. Appl. 39(4), 4007–4012 (2012)

Li, Z., Tian, Y., Li, K., Zhou, F.: Reject inference in credit scoring using semi-supervised support vector machines. Expert Syst. Appl. 74, 105–114 (2017)

Luo, J., Yan, X., Tian, Y.: Unsupervised quadratic surface support vector machine with application to credit risk assessment. Eur. J. Oper. Res. 280(3), 1008–1017 (2020)

Zhou, Z., Xu, S., Kang, B.H.: Investigation and improvement of multi-layer perceptron neural networks for credit scoring. Expert Syst. Appl. 42(7), 3508–3516 (2015)

Mancisidor, R.A., Kampffmeyer, M., Aas, K., Jenssen, R.: Deep generative models for reject inference in credit scoring. Knowl.-Based Syst. 196 (2020). Article No. 105758

Sun, J., Lang, J., Fujita, H., Li, H.: Imbalanced enterprise credit evaluation with DTE-SBD: decision tree ensemble based on SMOTE and bagging with differentiated sampling rates. Inf. Sci. 425, 76–91 (2018)

Arora, N., Kaur, P.D.: A Bolasso based consistent feature selection enabled random forest classification algorithm: an application to credit risk assessment. Appl. Soft Comput. 86 (2020). Article No. 105936

Xia, Y., Liu, C., Li, Y., Liu, N.: a boosted decision tree approach using Bayesian hyper-parameter optimization for credit scoring. Expert Syst. Appl. 78, 225–241 (2017)

Chang, Y., Chang, K., Wu, G.: Application of eXtreme gradient boosting trees in the construction of credit risk assessment models for financial institutions. Appl. Soft Comput. 73, 914–920 (2018)

Feng, X., Xiao, Z., Zhong, B., Qiu, J., Dong, Y.: Dynamic ensemble classification for credit scoring using soft probability. Appl. Soft Comput. 65, 139–151 (2018)

Junior, L.M., Nardini, F.M., Renso, C., Trani, R.: A novel approach to define the local region of dynamic selection techniques in imbalance credit scoring problems. Expert Syst. Appl. 152 (2020). Article No. 113351

Salunkhe, U.R., Mali, S.N.: A hybrid approach for class imbalance problem in customer churn prediction: a novel extension to undersampling. Intell. Syst. Appl. 5, 71–81 (2018)

Ko, A.H.R., Sabourin, R., Britto, A.S., et al.: From dynamic classifier selection to dynamic ensemble selection. Pattern Recogn. 41(5), 1718–1731 (2008)

Sabourin, M., Mitiche, A., Thomas, D.: Classifier combination for hand-printed digit recognition. In: ICDAR, pp. 163–166 (1993)

Woods, K., Kegelmeyer, W.P., Bowyer, K.: Combination of multiple classifiers using local accuracy estimates. IEEE Trans. Pattern Anal. Mach. Intell. 19(4), 405–410 (1997)

Cruz, R.M.O., Sabourin, R., Cavalcanti, G.D.C.: META-DES: a dynamic ensemble selection framework using meta-learning. Pattern Recogn. 48(5), 1925–1935 (2015)

Acknowledgments

This study was supported by the National Natural Science Foundation of China (61602518, 71872180, 71974202) and the Fundamental Research Funds for the Central Universities, Zhongnan University of Economics and Law (2722 020JCT033).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this paper

Cite this paper

Liu, S., Wei, J., Chen, X., Wang, C., Wang, X.A. (2021). Credit Rating Based on Hybrid Sampling and Dynamic Ensemble. In: Barolli, L., Li, K., Miwa, H. (eds) Advances in Intelligent Networking and Collaborative Systems. INCoS 2020. Advances in Intelligent Systems and Computing, vol 1263. Springer, Cham. https://doi.org/10.1007/978-3-030-57796-4_33

Download citation

DOI: https://doi.org/10.1007/978-3-030-57796-4_33

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-57795-7

Online ISBN: 978-3-030-57796-4

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)