Abstract

Rapidly rising house prices are a well-known source of financial instability. This chapter examines whether there are regional differences in house price growth within European countries and, whether this warrants more targeted measures to address vulnerabilities. The focus is on the division in terms of house prices between the capital cities and the rest of the territories of six EU countries. There is evidence of a decoupling between capitals and the rest of the country. House prices in capitals seem to have a stronger cyclical component which would indicate a clear rationale for regional-level tools. An instrument that could be used locally is tax. But adjusting taxes to dampen house prices would be very difficult. Structural measures to adjust the housing supply, such as relaxing planning restrictions typically have a long lead time. An alternative is to use macroprudential measures at a regional level, in particular loan-to-value and debt-to-income limits. In that way, the housing boom-bust cycle might be dampened.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Introduction

Rapidly rising house prices are a well-known source of financial instability. When fuelled by credit booms, asset price bubbles increase the risk of a financial crisis, and the collapse of such bubbles tends to be followed by deeper recessions and slower recoveries (Jordà et al. 2015). Debt-financed house price bubbles have emerged as a particularly dangerous phenomenon for two reasons. First, mortgages that are not repaid cause losses for the financial system. Second, households in negative equity (i.e. when the value of the house is lower than the outstanding mortgage) reduce their consumption significantly to rebuild their equity position. This deepens the economic downturn (Mian et al. 2013). By the same token, households increase their consumption when house prices are rising. Housing can thus be a strong pro-cyclical force in the economy, as housing boom-bust cycles in Spain and Ireland have made abundantly clear.

The cyclical pattern of house prices is very strong because households, as non-professional investors, mainly base their house price expectations on current price developments, even if these expectations look unrealistic from an ex-post perspective (Schoenmaker and Wierts 2017). Such expectations have a reinforcing effect both when house prices are rising and when they are falling. More remarkably, these price expectations are mainly local: in some cities, house prices might increase, but not in others, as Shiller (2008) shows.

This chapter examines whether there are regional differences in house price growth within European countries and, if so, whether this warrants more targeted measures to address vulnerabilities. The monitoring of vulnerabilities and potential imbalances in European housing markets is carried out jointly by the European Systemic Risk Board (2015 and 2016) and by national authorities. Their analyses are done mainly at the country level. Though essential, tracking only national indicators means that these analyses might miss imbalances developing within countries. In Denmark, for example, the International Monetary Fund noted the growing divergence of house prices within the country and found evidence of signs of overvaluation in Copenhagen (Chen et al. 2016).

We focus on the division in terms of house prices between the capital cities and the rest of the territories of six EU countries for which there are sufficiently long series of house price indices (HPI) at the regional level. Capital cities are important because they tend to be large and densely populated and because they possess structural (supply-side) characteristics that can amplify the response of prices to shocks. We do not examine the drivers of property prices at the regional level, nor do we set out to identify potential bubbles, which is very difficult in real time. Instead, we calculate indicators that can be used by policymakers to gauge the level of overvaluation of residential housing separately for national capitals and the rest of the country, in order to see if there are significant divergences between the two.

A stronger cyclical pattern of property prices—coupled with slower growth of household disposable income in capital cities—would represent an additional source of financial vulnerability. This combination could lead households in capital cities to carry heavier debt (compared to their income) and thus be more vulnerable to economic shocks, with implications for financial stability if those households are not able to repay their mortgage. Moreover, price developments in the capital region might spill-over to neighbouring regions within each country, causing price changes that might be even less justified by the fundamentals of these regions.

A stronger cyclical pattern in capital cities compared to other regions within each country would indicate a clear rationale for regional-level tools. The usual instrument to dampen cycles is the central bank’s interest rate, but its effects are felt economy-wide. Moreover, since the creation of the single currency, the euro area has one interest rate for the area as a whole, without differentiation between countries, let alone regions. That makes national and/or regional instruments to dampen financial cycles even more necessary. An instrument that could be used locally is tax. However, even though property taxes or stamp duties could be targeted regionally, adjusting taxes often to dampen house prices would be very difficult. The political decision-making and subsequent administrative implementation process is usually very slow, so that changes in the levels of the tax might even become procyclical. Structural measures to adjust the housing supply, such as relaxing planning restrictions, could also be useful to alleviate the pressure on house prices, but have typically a long lead time.

An alternative to address house-price imbalances is to use loan-to-value (LTV) and debt-to-income (DTI) limits. These borrower-based macroprudential instruments can be tightened to curb excessive house-price rises. Borrower-based instruments target homebuyers who need a mortgage, but not cash buyers. Mortgage buyers are particularly vulnerable to house-price shocks, because of their outstanding mortgage. Borrower-based instruments will still have (partial) impact on house prices, as the number of buyers on the market is reduced. So far, the use of borrower-based instruments in the European Union has only been based on the evolution of national house-price indices and applied at the national level. But regional use of these instruments might be desirable and is technically feasible, because houses are immovable and recorded in the land registry, which makes circumvention of regional policies difficult.

2 Are Capital Cities Different from Other Regions?

To assess the risks of regional differences in house price developments in the European Union (EU), house price index (HPI) data at the regional level for EU countries is needed. Most analyses focus on how house prices evolve in terms of national averages, and little attention is paid to differences in house price growth that might develop within a country. Whereas some factors influencing house prices are national (e.g. the availability of credit and the central bank’s policy rate), housing markets are by definition tied to location and thus involve a component of supply and demand that is local in nature.

In a working paper, we explain our methodology to decompose national house price indexes into an index for the capital and an index for the rest of the country (Claeys et al. 2017). In this chapter, we present house price data from six EU countries for which more than 20 years of data is available to identify patterns: Denmark, Finland, France, the Netherlands, Sweden and the United Kingdom (UK). The working paper provides additional information on Austria, Germany, Greece, Ireland and Lithuania, for which less than 20 years of data is available.

The capital cities of Denmark, Finland, France, the Netherlands, Sweden and the UK are those countries’ most populous urban centres, giving their associated local housing markets national importance. We focus on house price growth and price-to-income ratios at the regional level for these countries. These two metrics are widely-used and have a good record of performance in highlighting vulnerabilities. For macroprudential policy purposes, Goodhart (2011) refers to the monitoring of a set of early warning “presumptive indicators” including “a rate of growth of housing (and property) prices which is significantly faster than normal and above its normal trend relationship with incomes”.

Moreover, the European Systemic Risk Board has undertaken a comprehensive study assessing the predictive capacity of a set of early-warning indicators (Ferrari et al. 2015). In an EU-wide setting, nominal house price growth and price-to-income gaps were ranked among the most reliable early-warning indicators of unsustainable bubbles.

Figure 15.1 compares house price developments in the capitals and the rest of the territory in the six countries of our sample, relative to house prices at the start of the period in each case. Because the HPI data tracks house price growth (not absolute price levels) relative to a certain point in time, it follows that it is important to know the conditions prevailing at the start point in order to understand the influence of base effects. The shaded areas in Fig. 15.1 show periods of housing crises (using the dating convention from Ferrari et al. 2015). In the early 1990s, when most of the series began, all of the countries of our sample with the exception of the Netherlands went through housing crises, meaning the series start in the trough of the cycle.

House price indices, beginning of period = 100. Note: The shaded areas represent periods of real estate-related banking crisis, based on a table from Ferrari et al. (2015). For France, we included the series for Paris (apartments only) for illustration purposes

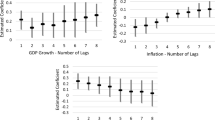

Figure 15.2 shows year-on-year HPI growth rates while Table 15.1 lists some of the descriptive statistics of the HPI growth rates. Higher average price growth in capitals over the longer run suggests that the price differential has structural features, such as persistently higher demand and less-responsive housing supply caused by restricted land supply and/or stricter planning rules in capitals. The price growth differential between the capitals and the other parts of each country ranges from 0.6% to 3.5% points. Interestingly, house prices in capitals also seem to have a stronger cyclical component, with higher upturns and deeper downturns. This stronger cyclical pattern is confirmed by more volatile year-on-year growth rates in capital cities, with the exception of London. As can be seen in Table 15.1, standard deviations and max/min of the price growth in 1 year are clearly higher in capital cities than in the rest of the countries.

HPI year-on-year growth rates (%). Note: See Fig. 15.1

As shown in Claeys et al. (2017), another striking feature of the data is the different responses of house prices after the most recent downturn. Within-country differences in growth rates have widened in the latest phase of rising house prices, mainly as a result of price growth outside the capitals remaining below its previous average.

Rapidly increasing property prices can be a sign of overheating in the housing market and raise the possibility of a housing bubble forming. At the heart of these risks is a misalignment between prevailing market prices and the value of residential housing assets justified by economic fundamentals.

As a first pass, we looked at price-to-income ratios (house prices relative to household disposable income) in Claeys et al. (2017). A rising price-to-income ratio indicates less affordable housing, with residential property prices growing faster than the disposable income of households. As with price growth, recent developments in price-to-income ratios point to growing divergences and strong growth in capital cities. Affordability has decreased in capital cities with the ratio for capital cities at or above its historical peak in all our sample countries. This contrasts with relatively stable price-to-income ratios in areas outside the capitals in recent years. There is, thus, evidence of a decoupling between capitals and the rest of the country.

Persistently decreasing affordability in capital cities is relevant for financial stability, to the extent that it could lead households in capitals to become excessively leveraged, thereby bringing into question their ability to service their debts in case of shocks (such as changes in interest rates or income levels). These diverging trends in affordability between parts of countries call for a differentiated approach in instruments, which we consider in the next section.

3 Policy Recommendations

It is clear that more rapidly rising house prices in capital cities are partly related to structural factors. These include faster population growth than areas outside the capitals, which is related to movement of labour from the provincial areas to the main cities and migration (migrants tend to concentrate in the most-populated urban areas). Combined with a shortage of new homes in capital cities, the extra demand leads to price rises if the supply is not elastic, which is often the case in capital cities which are already densely built-up and where planning restrictions are often stricter than in the countryside (Hsieh and Moretti 2018). Some of these restrictions could be relaxed to reduce the supply constraint, but, as our results show, house prices in capitals are also more volatile than in other areas. Structural measures by themselves might not be enough to moderate house price cycles in capital cities. Macroprudential measures, in particular borrower (DTI/loan-to-income/debt-service-to-income ratios, amortisation) and collateral-based (LTV) instruments, appear to be more adequate to tackle the cyclical nature of the problem. However, are policies based on national house price indices appropriate for dealing with the specific overly-cyclical pattern of capital cities?

Section 3.1 briefly describes the current frameworks in which such macroprudential measures are applied in the countries analysed in Sect. 2. Section 3.2 provides policy options going forward.

3.1 Country Experiences

In the Netherlands, the maximum LTV in 2010 was 112%. It has been undergoing a gradual reduction to 100% by 2018. The Dutch Financial Stability Committee has advised future governments to continue the gradual lowering of the LTV limit for mortgage loans after 2018 towards 90%, by reducing it by one percentage point per year. With house prices rising by 6% per year across the Netherlands, this advice appears sensible and there is no reason for macroprudential policies to intervene more forcefully. Moreover, high price rises of 15% per year in Amsterdam might justify further macroprudential action to take the heat out of that particular market. Nevertheless, the government has decided to keep the LTV limit at 100%.

Private home-owners in Denmark are required to make a down-payment of at least 5% when taking out a loan. Moreover, owing to the within-country divergence in house prices, the Danish Financial Supervisory Authority (Finanstilsynet) has seven best practice guidelines, to apply only in areas with high price levels and increases. In March 2017, the Danish Systemic Risk Council recommended a cap on the flow of new mortgages (15%) to borrowers with high debt-to-income (DTI) ratios (400% or greater) in high-price areas, which include the city of Copenhagen and its environs, and the city of Aarhus. The government has called on banks to follow the Council’s recommendations.

An 85% LTV limit was introduced in Sweden in 2010. In 2016, the Swedish financial services authority (Finansinspektionen) decided to impose amortisation requirements on new collateralised lending to highly leveraged borrowers (LTV exceeding 50%). Specifically, mortgages with an LTV ratio of more than 70% must be amortised at an annual rate of at least 2% of the original amount, with that rate falling to 1% when the LTV is between 50% and 70%. This measure was initially slated to be put in place in 2015 but its implementation was halted because of doubts about the compatibility of such measures with the Finansinspektionen’s mandate. Finally, in May 2017, the Finansinspektionen announced its proposal to tighten further amortisation requirements by an additional 1% annually if DTI ratios exceed 450%.

In Finland, a maximum LTV ratio was introduced in 2016 at 90%, with 95% for first-time buyers. The financial services authority (Finanssivalvonta) may reduce the limit by 10% if tightening is deemed appropriate.

In the UK, a cap on the quarterly flow of new lending (15% of the number of loans) to borrowers with high DTIs (above 450%), similar to that in Denmark, is in effect. The Bank of England Financial Policy Committee also requires lenders to apply an interest rate stress test before granting a mortgage. The test assesses whether borrowers can still afford the mortgage if the interest rate increases by 3% anytime in the first 5 years of the loan.

France has no borrower-based or collateral-based macroprudential measures in place. However, although there is no official limit, in practice French credit institutions have all adopted a standard whereby all repayments of housing loans (including interest rates payments) must not exceed one-third of the borrower’s gross income (Haut Conseil de Stabilité Financière 2017).

3.2 Policy Options

All the policies described in Sect. 3.1 (except in Denmark) are implemented at the national level and do not take into account divergences between capital cities and the rest of the countries in our sample. National policies, based on average house price growth, can be too blunt to dampen excessive house price growth in capital cities, and too tight for the rest of the country where house price growth is subdued. This could be tackled through taxes or structural measures, but these would require a long lead-time and would play out over the long term. Instead, a differentiated macroprudential policy could be implemented through different LTV or DTI ratios for mortgages in capital cities and in the rest of the countries. But where and when should these measures be applied?

Where to Differentiate

The first step would be to determine whether there are significant differences between capital cities and the rest of a country. If this were the case, a differentiated approach would be warranted. One country that already does this is Korea, which 15 years ago put in place a differentiated application of LTV and DTI ratios according to zip-codes, in order to tighten policy more quickly in areas more prone to overheating. In areas considered ‘bubble-prone’, the Korean Financial Services Commission implements tighter LTV ratios, regardless of types of housing, or the amount and maturity of new mortgages. LTV ratios are relaxed for first-time buyers and low-income households (Financial Services Commission 2017).

An area is designated as a ‘speculative zone’ where special measures might be required if both the following two criteria are satisfied (Igan and Kang 2011):

-

The monthly HPI rose more by than 1.3 times the nationwide CPI inflation rate during the previous month;

-

Either (i) the average house price growth rate in the previous 2 months was more than 1.3 times the average national rate in the previous 2 months, or (ii) the average of the month-on-month house price growth rates over the previous year was higher than the average of the month-on-month national rate over the previous 3 years.

Since 2002, the Korean authorities have imposed tighter limits on LTV and DTI ratios in specific areas on several occasions, and have succeeded in taming local house price booms, in terms of both prices and number of transactions (Igan and Kang 2011).

A similar framework could be applied in EU countries to prevent overheating of local housing markets and its consequences. In Claeys et al. (2017), we apply the criteria used in Korea to the six countries in our sample and show that the capital city in each case would qualify as a ‘speculative zone’ most of the time, especially in periods of rising prices.

When to Differentiate

With these criteria in place, the second step would be to monitor house prices at the regional level to decide when to tighten or to loosen the policies. When house price growth is considered to be excessive in a particular region, the responsible authority would impose measures or explain why measures are not taken. The ‘comply or explain’ strategy was also advocated by Ingves (2017) endorsing the presumptive indicators formulated by Charles Goodhart (2011).

However, it is difficult to set a specific house price growth trigger point beyond which action might be taken, in contrast to consumer price index inflation in monetary policy (Ingves 2017). For the responsible authority, it is hard to know what constitutes the correct price growth rate at a given time, because house prices are determined by a range of different factors that are both cyclical and structural in nature. Indicators are therefore necessary to know when to take action, as house prices are very important for financial stability.

Appropriate ranges for the indicator can be established precisely using historical data. As a starting point, we suggest that the five to 10% annual house price growth range would warrant close monitoring, with potential for action if deemed appropriate. The 10% or more range would set off a ‘comply or explain’ regime: ‘comply’ meaning macroprudential measures at the regional level would be tightened, and ‘explain’ meaning provision of a justification for the lack of measures. The macroprudential authority can publish the indicators and the measures (or the lack of them) in its semi-annual financial stability report. Tightening of macroprudential policies can be done through lowering LTV and/or DTI limits. In that way, the housing boom-bust cycle might be dampened.

References

Chen, J., Geng, N., Ho, G., & Turk, R. A. (2016). Denmark: Selected issues (IMF Country Report No. 16/185). International Monetary Fund.

Claeys, G., Efstathiou, K., & Schoenmaker, D. (2017). Spotting excessive regional house price growth and what to do about it (Bruegel Policy Contribution No. 26). Brussels.

European Systemic Risk Board. (2015). Report on residential real estate and financial stability in the EU.

European Systemic Risk Board. (2016). Vulnerabilities in the EU residential real estate sector.

Ferrari, S., Pirovano, M., & Cornacchia, W. (2015). Identifying early warning indicators for real estate-related banking crises (ESRB Occasional Paper Series No. 8). European Systemic Risk Board.

Financial Services Commission. (2017, August 2). FSC tightens mortgage rules to curb speculative demand in housing market (Press release).

Goodhart, C. A. (2011). The macro-prudential authority: Powers, scope and accountability. OECD Journal: Financial Market Trends, 2011(2).

Haut Conseil de Stabilité Financière. (2017). Rapport annuel.

Hsieh, C., & Moretti, E. (2018). Housing Constraints and Spatial Misallocation (CEPR Discussion Paper No. 12912).

Igan, D., & Kang, H. (2011). Do loan-to-value and debt-to-income limits work? Evidence from Korea (Working Paper 11/297). International Monetary Fund.

Ingves, S. (2017, May 11–12). Avoiding collective amnesia, speech to the conference. Should macroprudential policy target real estate prices. Vilnius, Lithuania.

Jordà, Ò., Schularick, M., & Taylor, A. M. (2015). Leveraged bubbles. Journal of Monetary Economics, 76(Suppl), S1–S20.

Mian, A., Rao, K., & Sufi, A. (2013). Household balance sheets, consumption, and the economic slump. Quarterly Journal of Economics, 128(4), 1687–1726.

Schoenmaker, D., & Wierts, P. (2017). The mortgage credit cycle, mimeo.

Shiller, R. J. (2008). Understanding the recent trends in house prices and home ownership. In Housing, housing finance and monetary policy. Jackson Hole Conference Series, Federal Reserve Bank of Kansas City.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2019 The Author(s)

About this chapter

Cite this chapter

Claeys, G., Efstathiou, K., Schoenmaker, D. (2019). Soaring House Prices in Major Cities: How to Spot and Moderate Them. In: Nijskens, R., Lohuis, M., Hilbers, P., Heeringa, W. (eds) Hot Property. Springer, Cham. https://doi.org/10.1007/978-3-030-11674-3_15

Download citation

DOI: https://doi.org/10.1007/978-3-030-11674-3_15

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-11673-6

Online ISBN: 978-3-030-11674-3

eBook Packages: Economics and FinanceEconomics and Finance (R0)