Abstract

Many economists have argued that all farm subsidies are ultimately capitalized in land values. This chapter shows, both theoretically and empirically, that this is not so, although there is much room for disagreement as to the precise shares that accrue to landowners, farmers, and consumers. A review of econometric models in the literature, multimarket simulations, and the application of a sector model of US agriculture yields a range of results about the share of subsidy payments going to land. The truth probably lies in between the results from the static theoretical models with full adjustment and the general run of the econometric evidence. A significant share of even the so-called decoupled transfers goes to farmers rather than landowners, and both landowners and farm operators receive a significant share of the net benefits from subsidies. In an in-between case, based on 2005 market and policy conditions, for every dollar of government spending on farm subsidies, farmers receive about 50 cents, landlords receive about 25 cents, domestic and foreign consumers receive about 20 cents, and 5 cents is wasted. Additional amounts are wasted collecting the taxes to finance the spending and in administering the policies – perhaps another 20 cents.

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

This chapter presents analysis and evidence on the commodity and factor market consequences of US farm commodity programs and the gains and losses to different groups, with special attention to landowners as recipients of rents generated by programs. This introduction defines the scope of the analysis and summarizes the main findings.

A host of conceptual and measurement issues are involved in estimating and interpreting measures of the consequences of agricultural policies. These issues are sometimes subtle, with implications that are not always appreciated. In addition to differences in measures intended for a given concept and purpose, differences are found because different measures are appropriate for different purposes. For these types of reasons, there is no single set of widely accepted estimates of consequences of farm subsidy policies or even of the parameters of the underlying economic relationships that determine the consequences. For similar reasons, it is useful to define the terms and scope of any particular analysis.

This chapter examines the overall impact of US farm program policies, in a forward-looking way, to consider the implications of continuation of the current farm programs compared with an alternative in which those programs are eliminated – either instantaneously or in some phased-out fashion. I assume explicitly throughout that the policies of other countries are exogenously fixed, even though it would be more reasonable to think that any substantial reform of US farm program policies would be accompanied by changes in other countries, either as a response to the effects of US policies or as part of an agreement among nations to change policies together. Since the analysis involves joint elimination of multiple policies affecting multiple commodities, we must allow for the multimarket interaction effects of own- and cross-commodity policy changes.

A simple and popular theoretical model of the consequences of farm program policies yields clear qualitative results on some aspects of the question, as shown in Section 5.2 of this chapter. Specifically, using a simple two-factor model it can be shown that output subsidies benefit both consumers of agricultural products and suppliers of other inputs used by farmers, not just landowners, unless extreme assumptions are made about (a) the nature of demand for agricultural products (it is perfectly elastic); (b) the supply of land to agriculture (it is fixed), and (c) the technology of production (land and other inputs are used in fixed proportions). Under more realistic assumptions, the issue is not whether all subsidy benefits go to land, but rather, what is the share of the benefits that go to land. To say more than this about the distribution of benefits from output subsidies requires empirical work, and empirical results on this issue are mixed.

Theoretical analysis also suggests that a pure decoupled transfer should have little (if any) effect on input use or output and, if that transfer is tied to land, it should be reflected in land rents and should accrue entirely to landowners.1 Significant elements of US farm program payments implemented in 1996, and still employed, are widely regarded as essentially decoupled payments tied to land. According to the mainstream theory, the benefits from those “direct payments” should be mostly, if not entirely, reflected in land rents and land values. A range of recent empirical work, however, shows that when direct payments change, only a fraction of those changes in benefits – possibly as little as one-quarter – is reflected in changes in land rents in the current period (see, for example, Kirwan, 2007). Hence, at least in the short run, the payments do not entirely accrue to land. One rationale for this finding is that land rents are specified in multiyear contracts, and it may take some years for the market for land to fully adjust to a change in farm program payments (or any other factor affecting farm profitability). However, direct evidence is not yet available, showing that the payments are fully capitalized into land, even in the long run. The finding that changes in direct payments are not fully reflected in changes in land rents might also mean that they are not fully decoupled (that is, that they have some effects on input use and output). Some econometric and other evidence support that view.

These econometric findings, summarized and reviewed in Section 5.3, are at odds with the predictions from our simple static model and must weaken our confidence in predictions from such models more generally until we understand more about why the particular prediction was rejected. At the same time, it is appropriate to question both forms of evidence – from statistical and econometric models versus calibrated theoretical or simulation models – as we attempt to resolve the difference. Certainly the simple static model does not allow for the multiyear nature of cash-rent contracts, and that fact alone may be sufficient to resolve the issue. At the same time, econometric estimates are always open to some questioning; indeed, the range of published estimates reminds us that the estimates are imprecise.

Section 5.4 presents a more disaggregated set of estimates to show the effects, commodity by commodity, of a comprehensive reform of US farm programs. These results, from ABARE (McDonald et al., 2006), indicate that for most of US agriculture, the complete elimination of US farm commodity programs would result in fairly modest changes in production, prices, and value of production. More aggregative estimates are derived from a sector model of farm program crop production, based on 2005 data and policies, and using an approach proposed by Sumner (2005a) for partitioning the different elements of farm program policies into two components: a fully coupled subsidy equivalent and a fully decoupled residual. This model yields comparable results to those from the ABARE model, though larger effects. It indicates that eliminating policies for program crops would result in a 7.3% decrease in output of program crops. In addition, the same model indicates that the output-reducing consequences from the Conservation Reserve Program (CRP) having removed land from production have partially offset the output-enhancing effects of the subsidy programs. Eliminating both the CRP and program crops policies would result in a net 5.0% decrease in output of program crops.

The results from these models are used to develop some “back-of-the-envelope” estimates of deadweight losses associated with US commodity program policies. Since the subsidies have mostly only modest implications for production and consumption, for the most part only modest net national benefits would be achieved by eliminating the net social costs (or deadweight losses) associated with distortions in resource use and production and consumption of agricultural commodities. Program crop subsidies generate a deadweight loss in the range of 2–5% of the total transfer, or about $400–800 million per year, given subsidy expenditure of $16.5 billion in 2005. The social costs of distortions from taxation to finance the transfers are likely to be five to ten times greater than this amount, such that the overall social cost is around $4 billion. The opportunity cost of that money might be higher again. (For instance, it could be used to finance an increase in agricultural research, which has a very high benefit–cost ratio.)

2 Models of Agricultural Policy and Land Rents

It is commonly suggested by agricultural economists that the benefits from agricultural subsidies will ultimately be capitalized mostly, if not entirely, into land, as the fixed factor.2 However, as shown by Alston and James (2002), this view depends on the use of assumptions that are extreme and likely to be inappropriate for most applications.

2.1 A Simple Model of Subsidies and Land Rents

Alston and James (2002, pp. 1715–1721) used a simple but general two-factor model of agricultural production to consider the implications of subsidies for land rents.3 The model includes a final demand, two factor supply equations, a production function to represent the technology for the production of a homogeneous product, Q, using two factors of production, X 1 and X 2, and equations imposing competitive market clearing. The solutions to the model are equations for proportional (or percentage) changes in the endogenous quantities and prices of the product and the two factors (Q, X 1, X 2, P, W 1, and W 2), each as a function of a set of fixed parameters, and exogenous shift parameters representing the effects of policies. The parameters of the model are the cost shares of the two factors (k 1 and k 2, where k 1 + k 2 = 1), the elasticities of demand for the product and supply of the two factors (η, ε 1, and ε 2), and the elasticity of substitution between the two factors (σ).

The supply and shift parameters can be used to represent a subsidy on an input or output. In either case, for moderate rates of subsidy, the benefits to consumers are approximately proportional to the percentage change in quantity consumed – ΔCS ≈ (d ln Q)(PQ/η) – and the benefits to suppliers of each factor are approximately proportional to the percentage change in the use of the factor – ΔPS i ≈ (d ln X i)(k i PQ/ε i). The benefits from the subsidies are shared between landowners, other factor suppliers, and consumers even when the quantity of land (input 1) is fixed, unless key parameters take on extreme values: either the price of non-land inputs (input 2) is fixed and there is no producer surplus for its suppliers (that is, ε 2 = ∞) or the factor proportions are fixed (that is, σ = 0). Under any other circumstances, the total benefit to factors will be shared between land and other inputs; and, if output changes and the output price is not fixed (that is, η < ∞), consumers will benefit, too. In general, then, we expect the benefits from subsidies to be distributed among consumers and factor owners, with the proportions depending on parameters and the details of the policy. Some more-specific results regarding the benefits to landowners can be obtained by transforming results from Alston and James (2002). In the case of an output subsidy at a rate τ Q , or an input subsidy on land at a rate τ 1, the equations for proportionate changes in quantities of land are as follows:

where \(D = \varepsilon _1 \varepsilon _2 + \sigma (k_1 \varepsilon _1 + k_2 \varepsilon _2 + \eta ) + \eta (k_2 \varepsilon _1 + k_1 \varepsilon _2 ) > 0.\)

Substituting these results into ΔPS 1 ≈ (d ln X 1)(k 1 PQ/ε 1) and then dividing by the cost of the subsidy expenditure (which is equal to τ Q PQ for the output subsidy and τ 1 W 1 X 1 for the input subsidy) yields expressions for the benefit to landowners per dollar of subsidy expenditure:

If all of the subsidy benefits go to landowners, these ratios will be equal to 1, but in each case the ratio is less than 1 in general. To see this more clearly, we can consider some limiting cases. First, suppose the demand for output is perfectly elastic such that consumers cannot obtain any of the benefits. Taking the limits of equations (5.3) and (5.4) as ηη ∞ yields:

By inspection, these ratios are less than 1, in general. In the extreme case where the supply of land is fixed (that is, ε 1 = 0), all of the benefits from an input subsidy on land would accrue to landowners, regardless of the elasticity of factor substitution and regardless of the elasticity of demand. However, in the case of an output subsidy, we require both a fixed output price (that is, η = ∞) and fixed factor proportions (that is, σ = 0) as well as a fixed supply of land before the subsidy expenditure will accrue entirely as a benefit to landowners.

This simple model illustrates some key determinants of the extent to which farm program payments accrue to landowners versus others, treating the output from agriculture as a single homogeneous product, produced using homogeneous land, and with a given subsidy applying to all of land or all of the output. US agriculture is more complicated than that, with heterogeneous land used to produce many different outputs that are subject to a variety of complex policies involving multiple instruments. As an approximation, however, we can apply the simple model to US agriculture in aggregate and look at the incidence of output or input subsidies on landowners. What might be reasonable values for the parameters in this case? Useful direct econometric evidence is not available for any of the parameters, but subjective estimates can be made. First, demand for US agricultural output is probably elastic but not very elastic, reflecting highly elastic demand for some traded goods and inelastic demand for some nontraded goods. Second, the supply of land in total may be essentially fixed, but the supply to agriculture is variable, as it can be allocated between agriculture and forestry and other nonagricultural uses. Third, the supply of “other” inputs to agriculture is more elastic than that of land but less than perfectly elastic, reflecting the specialized nature of some agricultural inputs, including managerial inputs and some capital.

In view of these arguments, and further arguments and econometric evidence presented by Alston (2007, appendix B), the following values seem reasonable for the key parameters of the model: elasticity of demand for US aggregate farm output, η = 1.0; elasticity of supply of land, ε 1 = 0.1; elasticity of supply of the aggregate “other” input used in agriculture, ε 2 = 1.0; cost share of land in total costs of agricultural production, k 1 = 0.20; cost share of “other” inputs in total costs of agricultural production, k 2 = 0.80; and elasticity of substitution between land and the aggregate “other” input, σ = 0.10.4 Substituting these values into equations (5.3) and (5.4), landowners would receive 39 cents per dollar of output subsidy expenditure and 68 cents per dollar of input subsidy expenditure applied to land. Holding the other parameters constant but assuming a fixed supply of land (ε 1 = 0), the landowner would receive 58 cents per dollar of output subsidy expenditure but 100% of the land subsidy expenditure.

Table 5.1 shows how benefits to landowners as a percentage of subsidy expenditure change as we change the elasticities of demand, factor substitution, and supply of land (η, σ, and ε 1) holding the other parameters (the elasticities of supply of non-land inputs and the factor shares, ε 2 and k 1) constant. In addition, this table includes corresponding estimates of benefits to consumers as a percentage of subsidy expenditure. The residual amount approximates the share of benefits to suppliers of non-land inputs (after allowance for deadweight loss). The results are intuitive. The share of benefits going to land from either an output subsidy or an input subsidy on land increases with reductions in the elasticity of supply of land or with increases in either the elasticity of substitution between land and non-land inputs or the elasticity of demand for agricultural output, either of which implies an increase in the elasticity of the derived demand for land. In the extreme case of a fixed supply of land, landowners receive 100% of the benefits from an input subsidy but only 33–62% of the benefits from an output subsidy. Allowing for some elasticity of supply of land (with ε 1 = 0.1), landowners would receive 60–80% of the benefits from an input subsidy on land or 24–44% of the benefits from an output subsidy, depending on the values for the other parameters.

A more realistic view of the incidence of US agricultural subsidy programs might be obtained by modeling program crops that receive the bulk of subsidy expenditure, as opposed to all of agriculture. Even if the total supply of land were fixed, the supply of land to the cropping industries would not be so. If we reinterpret the model above as representing the program crop sector of US agriculture, rather than agriculture as a whole, the main implied difference would be to increase the elasticity of supply of land to the sector (say 0.2 rather than 0.1 or zero). The other parameters may be about the same. Using these alternative parameters (η = 1.0, σ = 0.1, ε 1 = 0.2, ε 2 = 1.0, k 1 = 0.20), landowners would receive 30 cents per dollar of output subsidy expenditure and 51 cents per dollar of input subsidy expenditure applied to crop land.5

2.2 Implications of Rental Market Institutions

As well as simplifying the nature of supply of land to agriculture or to the cropping sector, the analysis presented above has been based on some simplifying implicit assumptions about the function of the land rental markets and farm program policies. Almost half of all US farmland is leased, and US policy specifies how farm program payments – such as direct payments or countercyclical payments – may be distributed in the first instance between farm operators versus farm owners. Sherrick and Barry (2003) reported that in 1999, 45.3% of farmland was leased and, of that amount, 59.4% was for cash rent. If a lease arrangement meets the technical definition of a “cash” lease under federal regulations, then the farm program payments must go entirely to the farm operator; the landlord is not eligible to receive any payments. Otherwise, under a share lease arrangement, the same subsidy payments must be divided between the landlord and the tenant. Thus, if subsidy payments increase unexpectedly in the presence of preexisting leases, tenants holding cash leases will capture all of the benefits (and their landlords will receive none), whereas tenants holding share leases will share the same benefits with their landlords. Of course these regulations govern only the initial distribution of the subsidy payments between landlord and tenant, which is different from the final incidence after markets have adjusted in response to the subsidies. Ultimately, other things being equal, one would expect the rates of cash rent eventually to adjust to equivalence with the corresponding share lease rate.

The competitive market model implicitly has rental markets for farmland clearing continuously. However, rental arrangements are typically multiyear in nature (for example, typical contracts may fix a rental rate that will apply every year for a 3-year term) and may reflect long-term personal relationships, often among members of the same family. Competitive pressures might not take full and immediate effect in such a setting.6 Further, the fact that information on crop yields and sales prices is incomplete and held asymmetrically may mean that landlords do not always have good knowledge of how much their tenants are receiving in government payments or what would be their fair share. In these circumstances, rental payments to landowners (as landlords) may adjust incompletely and sluggishly to changes in farm program payments. Thus, the short-run may differ from the long-run incidence, with less of the incidence on land than predicted by our simple model, and the difference between the short run and the long run may take several years to work through.

3 Econometric Evidence on the Incidence of US Farm Program Policies

The recent published literature includes a number of econometric studies of impacts of farm commodity policies on land markets, mainly in the United States. This section reviews the evidence from these studies.7 An overview of key points that are relevant in interpreting the published work is provided first. Some of these points relate to what our theoretical models suggest about the relationships between policies and land markets; others relate to the econometric problems likely to be encountered in looking for evidence about those relationships.

3.1 Key Points for Interpreting the Econometric Findings

First, the details of policies matter. Real-world farm program policies tend to be complicated, involving multiple instruments working in concert, none of which are exactly the same as the stylized textbook counterparts presented here. Hence, even when payments are fully decoupled, whether the payments are fully reflected in land rents or capitalized into land values may depend on other details of the policy. But real-world policies for the most part are not fully decoupled, and their final incidence will also depend on the extent to which the incidence is shifted through changes in input use and output, which will depend in turn on details of the policies and parameters of supply and demand and so on. As a consequence, we have to be careful in generalizing about the likely transmission of subsidies into land rents and land values. Econometric studies often require some aggregation across different types of subsidies in ways that may cause problems if the nature of the subsidies varies across the observations (for example, the mixture of forms of subsidies varies in a cross section or the details of the instruments change over time). To what extent are results influenced by how policies are represented in the models?

Second, formal and informal land rental contracts mean that the transmission of changes in policy into rental prices and asset prices for land is not instantaneous. Sluggish adjustment of rental rates means that the short- and intermediate-run incidence of policies (and the extent to which subsidies are decoupled) will be different from the long-run outcome with complete adjustment. Even without contracting, the market involves lags and dynamics and uncertainty and expectations, from which our simple models typically abstract. Because contracts are established well in advance of market realizations, some of our measures do not precisely correspond to the theoretical constructs they are meant to represent. For instance, our theoretical model might correspond to the relationship between land rents and expected values of subsidies under risk-neutral preferences or certainty, but the land rents are set ex ante and the subsidies we observe are ex post. Further, data on land rents and land values are often based on expert assessments rather than the direct evidence from market transactions. These assessments are likely to understate the true movements in rental prices associated with year-to-year variations in income received from the market or the government. Both these factors will mean that short-term movements in observed rental prices will tend to understate the long-term impact of a permanent change in subsidies. How well have studies dealt with unobservable expectations and what are the implications for their findings?

Third, models that attempt to measure the extent to which subsidies are capitalized into asset prices of land combine the problems associated with modeling impacts of subsidies on land rents with the (probably more serious) econometric problems that arise in modeling the asset price of land. On the other hand, the sluggish short-term adjustment of land rents that confounds the rental market models may be less of an issue in land market models since land prices should reflect longer-term expectations.

Fourth, econometric studies of land-market implications of agricultural subsidies have involved either aggregative time-series data (where the unit of analysis is a state or a nation) or disaggregated cross-sectional data (where the unit of analysis is a farm firm). Both approaches involve some general problems. In aggregate time-series studies, the fundamental problem may be simply lack of data, which compounds a lack of confidence over whether the model structure is right or whether the empirical proxies for theoretical constructs are reasonable, and thus how to interpret the estimated model. In cross-sectional studies, the primary econometric issues appear to be related to dealing with the roles of unobserved factors (such as farm-specific weather and soil fertility that determine the farm’s history and thus its eligibility for subsidies as well as its current production mix and productivity) in jointly influencing land rents, land prices, and agricultural subsidies – manifested as identification problems.

Many of these aspects are discussed by various authors who have studied impacts of farm programs on land markets, such as Goodwin et al. (2003b), Lence and Mishra (2003), and Roberts et al. (2003). Much of the work in the literature has been concerned with finding solutions to these conceptual and measurement problems or with drawing inferences for the interpretation of findings. The main findings are discussed next.

3.2 Evidence on Farmer Responses to Decoupled Payments

A variety of approaches have been applied to the problem of estimating the impact of decoupled payments on farmer decision making, including simulation models and direct econometric estimation using various types of data. The general conclusion from the relevant empirical literature appears to be that decoupled program payments – such as direct payments – have statistically significant effects on farmer behavior. The magnitude of these effects varies from study to study, however, and econometric issues remain. The crux of the problem is that nonprogram farms will not likely serve as a valid comparison group in any investigation of program impacts, and it is unclear to what extent analysts are able to control for unobserved heterogeneity. Fixed-effects models are certainly an improvement on ordinary cross-sectional regressions, but their conclusions are valid only to the extent that differences between program and nonprogram farms are time invariant; it is not clear that this will be the case. Although the evidence generally indicates that decoupled payments do have some effects on farmer behavior, the evidence is mixed on the size of the effects. In Section 5.4, specific parameterizations are used to represent these effects, allowing for comparatively large effects of so-called decoupled payments, more consistent with the findings of Key et al. (2005).

3.3 Effects of Program Payments on Land Rents and Land Prices

The attempts made by analysts to estimate the impact of program payments on land rents and land prices can be broken down into two broad categories. In the first approach, the present value (or asset price) of land is modeled as a function of government payments and other explanatory variables.8 While estimated elasticities of land prices with respect to program payments from these studies are often small, the total share of land value determined by support payments can be quite large. The second approach uses farm-level variation in government payments and farm revenues to explain variation in land rents, controlling for observable covariates and fixed effects when panel data are available. The studies using this approach face the same hurdles as the nonexperimental, cross-sectional studies of decoupled payments outlined above: econometric problems associated with unobserved heterogeneity, errors in variables, and other potential sources of bias.9

The econometric literature on the incidence of farm subsidies on land values indicates that while landowners certainly benefit from support programs, they do not appear to capture the full value of subsidies, at least in the short to medium run. That this is so is not surprising in relation to subsidies generally. However, much of the econometric work relates to forms of subsidies that we would expect to have most if not all of their final incidence on land, and those studies generally have found a surprisingly small share of subsidy benefits going to landowners. The works by Kirwan (2005, 2007) and Roberts et al. (2003) are good examples. The authors have made exhaustive attempts to identify and address potential sources of econometric bias, but their estimates of the multiplier for decoupled subsidies are still well less than half the size that standard theory would predict. One possible interpretation is that the authors are estimating an intermediate-run effect, which is smaller than the long-run effect, because of fixity associated with contracts or because of roles played by expectations or other dynamics. An implication may be that the so-called decoupled subsidies are much less decoupled than is commonly thought: that is, the subsidies are being transmitted to other non-land inputs or consumers with consequences for production and consumption. Alternatively, the estimates may be biased because, notwithstanding their comprehensive efforts, the authors have not fully resolved the econometric issues that they identified.

4 Consequences of the Elimination of US Farm Program Policies

This section presents some quantitative results on the potential implications of comprehensive reform of US farm program policies. ABARE staff (McDonald et al., 2006) simulated the consequences of elimination of US farm program policies. An overview of their results is presented first, and then supplemented with a sector model analysis of farm program crop production based on 2005 data.

4.1 ABARE Analysis of Omnibus Reforms

McDonald et al. (2006) published an ex ante analysis of the implications of a phased elimination of US farm program policies over 10 years, 2007–2016. They considered various scenarios. For simplicity, consideration here is limited to the scenario in which the policies remained at status quo in all other countries and in which the reform did not engender enhanced productivity growth. The published report does not include full details of the results for the scenarios simulated. However, ABARE staff generously provided unpublished details on the implications for prices and quantities produced and consumed. Table 5.2 reports selected results, showing the impacts in the last year of the simulation, 2016, from elimination of policies beginning in 2007. The results in Table 5.2 reflect assumptions about the baseline of world prices and US policies and thus the extent of the US market adjustments that would be required to accommodate the elimination of the programs. They also reflect modeling details such as elasticities of supply and demand response to price changes, elasticities of price transmission, and the specific mathematical representation of policies, with corresponding assumptions about the extent to which elements of subsidies are decoupled. These details are not known to me. However, the estimated changes in quantities and prices in Table 5.2 seem plausible enough, given a baseline that was established in 2006, before the more-recent commodity price increases.10

Looking across commodities, the pattern of results for 2016 is consistent with expectations based on general knowledge of the US farm program policies. For most of the commodities, the effects of elimination of farm programs on price, quantity, and value of production would be modest: less than 5% of the baseline for corn, soybeans, fruit and vegetables, and all of the livestock products. The effects would be larger for wheat (but still modest, a reduction of less than 10% in quantity and value of production). Only the heavily supported rice, cotton, and sugar industries would experience changes in quantity and value of production greater than 10% of the baseline – and only sugar, more than 15%. The directions of changes in quantity are plausible: reductions in output for all crops except fruit and vegetables; increases in output for livestock products except dairy. The withdrawal of support would result in lower prices as well as lower quantities produced for rice, cotton, sugar, and milk. Some of the other price changes are less obvious, reflecting complex cross-commodity effects as well as own-commodity policy effects in the multimarket setting. For instance, the movement of resources into the fruit and vegetable industry, in response to lower relative profitability of program crops, would result in an increase in production and consequently a lower price of fruit and vegetables; similar patterns apply for beef, pigs, and poultry but for less-clear reasons; the converse is the case for wheat and maize.

4.2 A Sector Model Analysis of Farm Program Consequences

An alternative approach to evaluating the impact of subsidies is to use a sector model approach. In this section, a sector model approach is applied to the main program crops, using data on program payments for 2005 combined with an approach proposed by Sumner (2003, 2005a, b) for representing different elements of program payments as equivalent amounts of revenue from the market (or fully coupled output subsidy equivalents) in terms of their production incentive effects. For both corn and upland cotton, Sumner has reviewed, case by case, the types of incentive effects different elements of farm program payments would have, and derived multipliers to be applied to the different forms of subsidy to represent their differential incentive effects relative to revenue from the market.

The case of corn provides a useful introduction to the approach. In this case, Sumner (2005a) argued that loan program payments (including loan deficiency payments, marketing loan gains, and certificate exchange gains) are closely tied to production and could be treated as equivalent to a pure output subsidy. In contrast, direct payments are significantly decoupled from production, but Sumner offers four reasons for why direct payments have effects on production: through lowering a recipient’s cost of capital; through increasing a recipient’s tolerance of market risk; because of limitations on what may be grown on program acreage; and because of the expectation that payment bases will be updated. He derived a multiplier of 0.40 for direct payments to corn growers, which means that a dollar of direct payments has the same effect on production as 40 cents from the market. In other words, in our models we can represent a dollar of direct payments, equivalently, as a decoupled payment of 60 cents and an output subsidy of 40 cents. Countercyclical payments fall in between these two, and Sumner suggested a multiplier of 0.50 to be applied to countercyclical payments for corn. In each instance, he argued that the multiplier was conservatively small. In what follows, the same multipliers are applied to the other program crops as well.

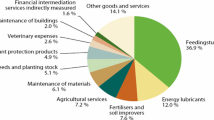

Table 5.3 shows crop-by-crop details and in total of government subsidy payments to program crops in 2005. Total government payments in 2005 of $24.3 billion included a range of payments (such as ad hoc and emergency program payments or tobacco transition payments) that we would not include in our measure of subsidies in the current context. Subsidies to producers of program crops included $5.25 billion in the form of direct payments (DP), $4.82 billion in the form of countercyclical payments (CCP), and $6.44 billion in the form of loan program payments (LPP, including loan deficiency payments, marketing loan gains, and certificate exchange gains), together totalling $16.5 billion. Production of program crops had a value in 2005 of about $58 billion and used 318 million acres such that the payments were equal to 28.6% of the value of production, or $52 per acre of program crops nationally. In addition to the simple sum of program payments, the total subsidy (TS1), the table includes a weighted sum of payments (TS2), given by applying the weights (0.4, 0.5, and 1.0) to the respective elements of payments (DP, CCP, and LPP): TS2 = 0.4 × DP + 0.5 × CCP + LPP. These subsidy amounts are expressed relative to the value of production in the last two columns of the table. The entries in the final column, 100 × TS2/V, represent the percentage output subsidy equivalent of the payments. The last entry in that column represents the average rate of subsidy equivalent, in terms of the incentive effects, for the commodities in the table: 19.0%.

Applying that subsidy rate in the two-factor model, with parameters representing program crops as a whole (η = 1.0, σ = 0.1, ε 1 = 0.2, ε 2 = 1.0, k 1 = 0.20), the implied effect of eliminating the programs would be a reduction in production of these crops by 7.3%.11 This estimate is comparable to (albeit implying larger effects than) the corresponding estimates from the ABARE (McDonald et al., 2006) model, which ranged from 2.9 to 13.9% for the crops considered here but were only 2.9 and 3.8%, respectively, for soybeans and maize (which together represent two-thirds of the value of production). The implications are similar: the total output effects of elimination of subsidies would be modest, even for the most-subsidized crops.

The direct net benefit (deadweight loss avoided) is correspondingly small. As shown by Alston (2007, appendix E), the deadweight loss from distortions in production and consumption resulting from an output subsidy, expressed as a percentage of the subsidy expenditure, is proportional to the percentage subsidy-induced change in production. Using the same parameters for program crops in the two-factor model (that is, η = 1.0, σ = 0.1, ε 1 = 0.2, ε 2 = 1.0, k 1 = 0.20) and allowing for the role of international trade, the proportion to be applied to the percentage increase in production is in the range of 0.5–1.0. Thus if elimination of subsidies at an average rate of 19% (in incentive effect) would yield a 7.3% increase in production, it would yield net gains to society in the range of 3.6–7.3% of the amount of effective subsidy expenditure of $10.96 billion in 2005 (that is, in the range of $400 million to $800 million; 2–5% of the actual subsidy expenditure of $16.52 billion; 0.7–1.4% of the value of program crop production of $58 billion). Of course, the total deadweight loss is much bigger if we allow for any significant deadweight losses associated with general taxation to raise the government revenues to finance subsidies (that is, a social opportunity cost of government revenues significantly greater than $1.00 per dollar spent – say $1.20 per dollar). When these additional deadweight losses are added to the full subsidy expenditure of $16.52 billion in 2005, the total deadweight loss is about $4 billion.

4.3 CRP Acreage

Suppose, in 2005, the Conservation Reserve Program was eliminated and an additional 35 million acres of CRP land were added to the 442 million acres of cropland used, which is a 7.8% increase in crop acreage. Applying that percentage increase in supply of land in the model from Section 5.2, with parameters representing program crops as a whole (that is, once more, η = 1.0, σ = 0.1, ε 1 = 0.2, ε 2 = 1.0, k 1 = 0.20), the implied effect would be an increase in production of these crops by about 2.3%. Thus, if the CRP were eliminated along with crop subsidies, the net effects on output would be smaller, compared with eliminating the subsidies alone, but still negative – an output reduction of around 5%.

4.4 Incidence on Land Rents

In 2005, cropland rented for about $80 per acre as a national average (but closer to $120 per acre in the Midwest, and cropland rents represented about 20–25% of the value of production, which is less than the value of subsidies as a percentage of production. Thus, if all of the payments had been fully reflected in land rents, income from the market would have accounted for only a small (possibly negative!) share of the income to land; government payments would have accounted for the lion’s share. However, we would not expect all of the subsidy payments to go to land.

Table 5.4 replicates some information from Table 5.3. It includes, crop by crop, the total subsidy amount (TS1) and the fully coupled equivalent (TS2) as well as the difference between these two (TS3 = TS1 – TS2 = 0.6 × DP + 0.5 × CCP), which represents the amount of the total subsidy that can be treated as a pure decoupled payment that goes to land. Having partitioned the total subsidies into an element that can be treated as a fully coupled output subsidy (TS2) and a residual that can be treated as a fully decoupled payment (TS3), we can analyze the impacts on landowners. The total benefits to landowners are equal to the benefits from the fully decoupled element (TS3) plus the amount going to land from the fully coupled element (μ TS2, where μ is the share going to land): TS4 = TS3 + μ TS2. In the two-factor model, with parameters representing program crops as a whole (η = 1.0, σ = 0.1, ε 1 = 0.2, ε 2 = 1.0, k 1 = 0.20), the implied value for μ is 30.0%. This value is used to compute the values for TS4 in Table 5.4. These amounts are expressed relative to the value of production and per acre. Again, the last row expresses these subsidies summed across the program crops included in the table. Taking this approach, the total of $16.52 billion is equivalent to a decoupled transfer of $5.56 billion, 100% of which accrues to land, combined with a pure output subsidy of $10.96 billion, 30% of which accrues to land. The overall incidence is therefore about $8.85 billion on land and $7.65 billion on suppliers of non-land inputs and consumers.

We can replicate this kind of analysis at the level of US states, given information on the total government payments, on the value of agricultural production, and on cash rents to land. Appendix Table 5.5 shows the details, state by state and in total. Considering the last three columns, we can compare the cash rent (R) with the total subsidy per acre of cropland (TS1/A) in the third-last column, or the weighted subsidy per acre of cropland as an estimate of the subsidy accruing to land (TS4/A) in the second-last column. To facilitate this comparison, Fig. 5.1 plots the unweighted (TS1/A) and weighted (TS4/A) payments per acre versus cash rents.

Cash rent versus farm program payments per acre, by State, 2005. Source: Based on data in the last three columns of Appendix Table 5.5 Note: Excludes California and Washington

In most (but not all) of the states, the total subsidy per acre of cropland (TS1/A) is less than cash rents per acre, but often it is large relative to the total cash rents, and sometimes implausibly large as a measure of the incidence of the subsidy on land rents. On that basis, these simple comparisons alone are sufficient to question the view sometimes expressed that all subsidy payments end up in land rents. On the other hand, the estimate of the subsidy accruing to land (TS4/A) is typically about one-half to one-third of the total cash rent, which is plausible.

These results provide a useful background for the interpretation of the results from econometric studies that have attempted to draw direct statistical inferences about the effects of farm program payments on land rents or land prices and the related econometric work that has attempted to measure the extent to which farm program payments are decoupled from production. The econometric studies in this area have found that subsidies that we might expect to be mostly, if not fully, decoupled do have some effects on production and resource use, although the quantitative effects of these responses were fairly small in some cases. Much of this work is consistent with the view that the so-called decoupled transfers really do not have much effect on production and would be expected to be distributed for the most part as returns to landowners and in land rents. On the other hand, some studies found larger effects of these subsidies on production, and most econometric studies of the land market found surprisingly small effects of subsidies on land rents and land values.

5 Conclusion

This chapter has discussed theory and evidence on the incidence of US farm commodity programs. Specifically, it has attempted to answer the question: What are the impacts of agricultural subsidies on consumers, taxpayers, and landowners (as opposed to farm operators, who may be seen by some as the intended recipients of subsidy payments)? The focus of the question is contemporary or forward looking and holistic, referring to the full impact of all of the programs together, allowing for the interactions among all the affected markets for agricultural products and factors.

Simple theoretical models, following Floyd (1965), can be used to illustrate how different types of subsidy policies have different incidence. Analysis with such models indicates that we should expect a fully decoupled payment attached to land to be reflected entirely in land rents and capitalized fully into land. Under extreme assumptions (such as a fixed supply of land), the same would be true of an input subsidy on the use of land. More generally, however, even a subsidy on land will have some effects on input combinations and output and thus the incidence will be shifted partly to suppliers of non-land inputs and consumers. A subsidy on output is expected to have even less of its incidence on land and more of it on consumers and suppliers of non-land inputs, but still it will have a disproportionate incidence on landowners as the suppliers of the least elastic factor of production. Consequently, with some plausible values for the relevant parameters, based on theoretical analysis alone we might rank instruments in terms of their approximate incidence on landowners versus others as follows: decoupled direct payment tied to land, 100% to landowners; land input subsidy, 45–77% to landowners, depending on the details of the case; output subsidies, 1–45% to landowners, depending on the details of the case. The specific details of actual policies matter for incidence. Real-world policies are typically not pure output subsidies or pure input subsidies; they often combine multiple instruments together, and even the direct payments policies may not be fully decoupled. Nonetheless, the abstract theoretical analysis of stylized policies provides some guidance as to the range of incidence outcomes we might expect from real-world policies, and it gives a basis for interpretation of the results from empirical work with models of land markets.

Econometric studies generally have found a surprisingly small share of subsidy benefits going to landowners. The work by Roberts et al. (2003) is a good example. The authors have made exhaustive attempts to identify and address potential sources of econometric bias, but their estimates of the multiplier for decoupled subsidies are still well less than half what the static theory would predict. One possible interpretation is that the authors are estimating an intermediate-run effect, which is smaller than the long-run effect, because of fixity associated with contracts or because of roles played by expectations or other dynamics.

A direct analogy can be drawn between this finding and the more general findings about the elasticity of supply response to output prices. Synthetic models based on theory and assumptions about parameters generally yield much larger elasticities of supply response than econometric models do. A reasonable interpretation is that the synthetically estimated elasticities are too high and that the econometrically estimated ones are too low to represent long-run responses; though they might well represent intermediate-run or short-run responses (for instance, see Cassels, 1933). In the context of supply response, there is no such thing as “the” elasticity; it depends on the length of run. Similarly, perhaps we should not think of “the” multiplier effect of farm programs on land rents and should identify the relevant length of run for particular estimates.

The share of subsidy payments going to land remains uncertain. The truth probably lies in between the results from the theoretical models and the general run of the econometric evidence: A significant share of even the so-called decoupled transfers goes to farmers rather than landowners, and both landowners and farm operators receive a significant share of the net benefits from subsidies. To make matters concrete, the evidence is generally consistent with a view that 40–60% of subsidy payments accrue as benefits to landowners, 20% to consumers, and 15–35% to farmers per se, with a modest amount – say 5% – wasted as a deadweight loss (more if we count benefits to foreign consumers as a loss to the United States, and more again if we count the deadweight loss of taxation).

In round figures, then, perhaps 75% of the subsidy expenditure accrues as a benefit to farm operators and landlords. Given that farmers collectively own about half the land that they farm, farmers receive about half of the total that goes to landowners, leaving 20–30% to nonfarmer landlords. Thus, 45–55% of the total subsidy expenditure accrues as a benefit to farm operators. In short, for every dollar of government spending on farm subsidies, farmers receive about 50 cents, landlords receive about 25 cents, domestic and foreign consumers receive about 20 cents, and 5 cents is wasted. Additional amounts are wasted collecting the taxes to finance the spending and in administering the policies – perhaps another 20 cents. If the purpose is to transfer income to farmers, the mechanism is very inefficient, with less than half of the amount taken from taxpayers ending up with the intended recipients.

6 Notes

-

1.

By definition, “decoupled” transfers are meant not to have any effects on input use and production and therefore should not have any effects on markets for factors or products.

-

2.

For example, see Rosine and Helmberger (1974); Gisser (1993).

-

3.

The model is described by Alston and James (2002, pp. 1715–1721), and Alston (2007, appendix B). An equivalent model was used by Floyd (1965) for a similar purpose; see, also, Gardner (1987, 2003).

-

4.

Floyd (1965, p. 155) suggested values for these parameters of η = 0.25–0.50, σ = 0.5−1.5, ε 1 = 0, ε 2 = 1.0−3.0, k 1 = 0.20 (and k 2 = 0.80).

-

5.

These parameters imply an elasticity of supply of program crops in aggregate of 0.45. If, alternatively, we assume an elasticity of supply of land of 0.3, and a cost share of land of 0.3, the implied elasticity of supply of program crops is 0.5.

-

6.

Uchtman (2006) and Johnson et al. (2007) illustrate the reality of complications with farmland leases and how they may be renegotiated when circumstances change and, reading between the lines, how rental contracts may be expected to adjust sluggishly to changes in the market.

-

7.

Alston (2007, appendix D) provides a more complete discussion of the published work.

-

8.

Examples of this approach include Goodwin and Ortalo-Magné (1992); Weersink et al. (1999); and Shaik et al. (2005).

-

9.

Examples include Gardner (2003); Goodwin et al. (2003a, b); Lence and Mishra (2003); Roberts et al. (2003); and Kirwan (2005, 2007).

-

10.

The baseline is crucial. If the baseline had been set based on an extrapolation out to 2020 of market prices for commodities in 2007 or 2008, which are above support prices because of high oil prices and the enhanced demand for use of program crops for biofuels, then the measured consequences of the US farm program policies would be negligible. The ABARE baseline apparently reflects market conditions that had applied reasonably recently, but not currently, and which may well be an appropriate view of “normal” conditions in the longer-term future to which their estimates apply.

-

11.

These parameters together imply an elasticity of supply of program crops in aggregate of 0.62.

References

Alston, J.M. (2007), Benefits and Beneficiaries from U.S. Farm Subsidies. AEI Agricultural Policy Series: The 2007 Farm Bill and Beyond. American Enterprise Institute. Accessed May 2010. Available at http://aic.ucdavis.edu/research/farmbill07/aeibriefs/20070515_alstonSubsidiesfinal.pdf.

Alston, J.M., James, J.S. (2002), The incidence of agricultural policy, Chapter 33, In B.L. Gardner, G.C. Rausser (eds.), The Handbook on Agricultural Economics, Vol. II(a), Elsevier, Amsterdam, 1869–1929.

Cassels, J.M. (1933), The nature of statistical supply curves, Journal of Farm Economics 15: 378–387.

Floyd, J.E. (1965), The effects of farm price supports on the returns to land and labor in agriculture, Journal of Political Economy 73: 148–158.

Gardner, B.L. (2003), U.S. commodity policies and land values, Chapter 5, p. 81, In C.B. Moss, A. Schmitz (eds.), Government Policy and Farmland Markets: The Maintenance of Farmer Wealth, Iowa State University Press, Ames, IA.

Gardner, B.L. (1987), The Economics of Agricultural Policies, Macmillan, New York, NY.

Gisser, M. (1993), Price support, acreage controls, and efficient redistribution, Journal of Political Economy 101: 584–611.

Goodwin, B.K., Ortalo-Magné, F.N. (1992), The capitalization of wheat subsidies into agricultural land values, Canadian Journal of Agricultural Economics 40: 37–54.

Goodwin, B.K., Mishra, A.K., Ortalo-Magné, F.N. (2003a), Explaining regional differences in the capitalization of policy benefits into agricultural land values, Chapter 6, p. 97, In C.B. Moss, A. Schmitz (eds.), Government Policy and Farmland Markets: The Maintenance of Farmer Wealth, Iowa State University Press, Ames, IA.

Goodwin, B.K., Mishra, A.K., Ortalo-Magné, F.N. (2003b), What’s wrong with our models of agricultural land values, American Journal of Agricultural Economics 85: 745–752.

Johnson, B., Prosch, A., Raymond, A. (2007), The Art of Leasing Negotiation in a Frenzied Environment, Cornhusker Economics, University of Nebraska, Lincoln Extension. Accessed January http://www.agecon.unl.edu/Cornhuskereconomics/12-20-06.pdf.

Key, N., Lubowski, R.N., Roberts, M.J. (2005), Farm-level production effects from participation in government commodity programs: Did the 1996 federal agricultural improvement and reform act make a difference? American Journal of Agricultural Economics 87: 1211–1219.

Kirwan, B.E. (2005), The Incidence of U.S. Agricultural Subsidies on Farmland Rental Rates, Working Paper 05-04, University of Maryland, College Park, MD.

Kirwan, B.E. (2007), The Distribution of U.S. Agricultural Subsidies. AEI Agricultural Policy Series: The 2007 Farm Bill and Beyond. American Enterprise Institute, Washington, DC. Accessed May 2010. Available at http://www.arec.umd.edu/people/faculty/Kirwan_Barrett/KirwanSubsidyDistribution5-07.pdf.

Lence, S.H., Mishra, A.K. (2003), The impacts of different farm programs on cash rents, American Journal of Agricultural Economics 85: 753–761.

Mcdonald, D., Nair, R., Podbury, T., Sheldrick, B., Gunasakera, D., Fisher, B.S. (2006), U.S. Agriculture Without Farm Support. Research Report 06.10. ABARE (Australian Bureau of Agricultural and Resource Economics), Canberra (September).

Roberts, M.J., Kirwan, B., Hopkins, J. (2003), The incidence of government program payments on agricultural land rents: The challenges of identification, American Journal of Agricultural Economics 85: 762–769.

Rosine, J., Helmberger, P.G. (1974), A neoclassical analysis of the U.S. farm sector, 1948–1970, American Journal of Agricultural Economics 56: 717–729.

Shaik, S., Helmers, G.A., Atwood, J.A. (2005), The evolution of farm programs and their contribution to agricultural land values, American Journal of Agricultural Economics 87: 1190–1197.

Sherrick, B.J., Barry, P.J. (2003), Farmland markets: Historical perspectives and contemporary issues, Chapter 3, p. 27, In C.B. Moss, A. Schmitz (eds.), Government Policy and Farmland Markets: The Maintenance of Farmer Wealth, Iowa State University Press, Ames, IA.

Sumner, D.A. (2003), Implications of the USA farm bill of 2002 for agricultural trade and trade negotiations, Australian Journal of Agricultural and Resource Economics 47: 117–140.

Sumner, D.A. (2005a), Boxed in: Conflicts between U.S. farm policies and WTO obligations, Cato Institute Trade Policy Analysis 32(December). Accessed May 2010. Available at http://www.cato.org/pubs/tpa/tpa-032.pdf.

Sumner, D.A. (2005b), Production and trade effects of farm subsidies: Discussion, American Journal of Agricultural Economics 87: 1229–1230.

Uchtman, D.L. (2006), Is Your Lease Compatible with Your Division of USDA Farm Program Payments Between Landlord and Tenant? Agricultural Law and Taxation Briefs, Vol. 6(1, May 30). Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, IL. Accessed January 2007 http://www.farmdoc.uiuc.edu/legal/articles/ALTBs/ALTB_06-01/ALTB_06-01.pdf.

USDA, ERS (U. S. Department of Agriculture, Economic Research Service). Various Years. U.S. and State Farm Income Data Farm Cash Receipts, 1924–2004. Accessed January 2007. http://www.ers.usda.gov/Data/FarmIncome/finfidmu.htm.

Weersink, A., Clark, S., Turvey, C., Sarkar, R. (1999), The effect of agricultural policy on farmland values, Land Economics 75(3): 425–439.

Acknowledgments

This chapter is drawn from work undertaken in the context of the American Enterprise Institute project, led by Bruce Gardner and Daniel Sumner, The 2007 Farm Bill and Beyond (http://aic.ucdavis.edu/research/farmbill07/aeibriefs/20070515_alstonSubsidiesfinal.pdf), as reported in my AEI paper (Alston, 2007), on which I was assisted by Matt Andersen, Henrich Brunke, Antoine Champetier de Ribes, Conner Mullally, and Sebastien Pouliot.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

Rights and permissions

Copyright information

© 2010 Springer Science+Business Media, LLC

About this chapter

Cite this chapter

Alston, J.M. (2010). The Incidence of US Farm Programs. In: Ball, V., Fanfani, R., Gutierrez, L. (eds) The Economic Impact of Public Support to Agriculture. Studies in Productivity and Efficiency, vol 7. Springer, New York, NY. https://doi.org/10.1007/978-1-4419-6385-7_5

Download citation

DOI: https://doi.org/10.1007/978-1-4419-6385-7_5

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4419-6384-0

Online ISBN: 978-1-4419-6385-7

eBook Packages: Business and EconomicsEconomics and Finance (R0)