Abstract

Although probabilistic insurance loss models, particularly for ash fall, are currently being developed volcanic risk has been widely ignored by insurers and policy holders alike. Volcanic eruption cover is often grouped in insurance and reinsurance policies with earthquake and tsunami cover. Many volcanic eruptions include several perils occurring in different spaces around the volcano, with widely varying intensities and consequences, sometimes all at once, sometimes sequentially, and sometimes repeatedly. Given the possibly large differences in hazard characteristics, event durations and potential losses the policy alignment with earthquake and tsunami covers can be unfortunate. Does ‘volcanic activity’ have the same meaning as ‘volcanic eruption’? Do the terms ‘ash fall’ and ‘pyroclastic fall’ have identical meanings to an insurer—or to a volcanologist? Some policies cover all volcanic perils while others include only named volcanic perils such as pyroclastic flows, ash falls, and/or lava flows. Often the intent of the coverage is not clear—were some volcanic perils missing from a list excluded by accident or design? Does a policy that covers damage occasioned by a fall of volcanic ash also cover the cost of clean-up, removal, transport and appropriate storage of the ash—even if the fall of 5–10 mm of ash causes almost no property damage? Clear communication between the insurance sector and policy holders (and the media) is dependent upon informed understanding of the nature of volcanic perils and volcanic eruptions, insurance wordings, and the potential losses to property and business interruption covers. This chapter explores these issues using examples of policy wordings, evidence from past eruptions, insurance case law, and potential losses in future eruptions.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

Keywords

- Policy Wordings

- Policy Holders

- Reinsurance Policies

- Insurance Companies

- Pyroclastic Density Currents (PDCs)

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Our aim is to highlight the challenges presented by volcanic eruptions with respect to insurance and communication. In particular, we wish to provide stakeholders with a range of perspectives on (i) the important issues as the insurance industry might see them; and (ii) the (possible) views of some other stakeholders including the policy holder, re/insurer and regulator. We begin by focussing on a single realistic—yet hypothetical—disaster scenario for a large (VEI 6) eruption, the sort of eruption that might occur somewhere in the world on average once in 50 years or so (Deligne et al. 2010). Clearly, this is just one eruption scenario out of the thousands that are possible—even more likely—but it emphasises that there are numerous insurance-related issues to consider. Our main concern is with the possible approaches of two insurance companies at opposite ends of the corporate resilience spectrum—one that has an embedded strategy to quickly adapt to disruptions while maintaining continuous business operations and safeguarding people, assets and overall brand equity, and another that has considered risk resilience in less detail and may have difficulty continuing to function (or remaining solvent) in the aftermath of a large event where thousands of policyholders want to make a claim.

We then delve into three insurance-related issues:

-

modelling and communicating risk from volcanic activity

-

the Contract Wordings used in insurance policies and what they might mean in relation to an eruption and its aftermath; and

-

examples of insurance case law from around the world and what these court determinations might mean for insurers, policy holders and others experiencing the consequences of a large eruption.

While the eruption scenario and its insurance consequences are set in the (near) future, the details are firmly grounded in (recent) experience.

For the purposes of this chapter, we have not considered governments’ role in bridging the insurance protection gap or disaster risk financing, nor have we delved deeply into the ability of insurance as a signalling device to drive risk mitigation and risk management practices. In addition, we have not considered broader macroeconomic impacts—natural hazards have unexpected consequences beyond direct economic and insured loss including broad disruption from operational challenges, effects on counterparties, trading relationships and financial markets.

2 Modelling and Communicating Volcanic Risk

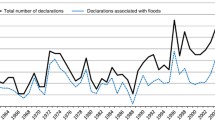

Assessment and communication of natural catastrophe risk within the insurance industry is often through the use of various catastrophe models. Traditionally the perils covered by these models are: earthquake (and now correlating tsunami); hurricane; windstorms; winterstorms; tornado; and flood. Increasingly there is a move towards modelling terrorism, pandemic and cyber risks.

Models vary in their levels of sophistication; from fully probabilistic models to simpler deterministic, scenario type models. The aim is to give a re/insurer a view on the probability of loss against their portfolio (of say residential houses in the UK) from one or more of these perils. For example, once every two hundred years an insurer might incur a loss of £100 m or more from flood. Companies use these results to understand the risk from natural catastrophes that they are exposed to, and to help them determine how much reinsurance (insurance for insurers) they need to buy.

There are currently few commercially available probabilistic catastrophe models for volcanic risk. Those that are available tend to focus on one hazard such as ash or pyroclastic density currents (PDCs). Development of new models is driven by industry demand; to date volcanoes have not caused sufficient insured losses to create a demand.

Developing deterministic scenario models is much more straightforward. Realistic Disaster Scenarios (RDSs) are commonly used within re/insurance to give companies a view of loss from a single event (Fig. 1). However, these do not always include a view on how frequently such an event might be expected.

Two of the challenges with respect to communication of volcanic risk within a re/insurance organisation are:

-

Volcanic risk often goes unmodelled. Therefore, do re/insurers have an appreciation of their exposure to volcanic eruptions and the potential for loss? Non-modelled (and poorly modelled) perils have gained more focus in recent years and there is a growing pressure on the industry to form a view (e.g. ABI 2014)

-

If an insurer has a view on volcanic risk, how does it compare that to the natural catastrophe risks that companies and boards are used to dealing with (e.g. earthquakes and hurricanes)? The return periods of volcanic eruptions can be very long (thousands of years) and may seem insignificant when compared to more frequently occurring perils such as earthquake or hurricane. However, volcanic eruptions have the potential to cause very large losses.

If a company does manage all of the above in terms of modelling and view of volcanic risk, there are many other challenges that still remain.

3 An Eruption Scenario

This scenario is based on a VEI 6 eruption. No location is specified, but it could be in almost any volcanic part of the world. We limit discussion to just one hypothetical country, but the reality may be that more than a single country is affected by ash fall, thus giving rise to even more insurance issues as policy conditions, interpretations and government responses vary significantly around the world.

A couple of middle-sized earthquakes stir the volcano to life producing a few throat-clearing but minor eruptions over a period of a few years. Minor ground shaking (volcanic tremor) continues intermittently throughout this time. Minor damage is limited to areas on the volcano’s slopes. Mandatory evacuation areas extend only five kilometres from the vent. Local ‘experts’, including volcanologists, speculate privately and argue publically about the future course of the eruption.

Then, one bright early spring morning the volcano stirs to life with a massive Plinian eruption, producing pyroclastic density currents (PDCs) on all sides of the cone out to 15 km radius from the vent. A tsunami produced by the PDCs down one side of the volcano damages ships in the harbour, harbour installations, other infrastructure, cargo on the wharf, and destroys an elite coastal residential area.

An ash column rises to an altitude exceeding 25 km with the upper atmosphere winds spreading the ash fall nearly 1000 km downwind—more than 1 m thick a few km from the vent, thinning to a few cm 500 km away and to just a millimetre near the margin of the more than 100,000 km2 experiencing ash fall. Evacuation is ordered from the city and surrounding areas but the reality is it is too little, too late. The ash fall lasts just 24 h or so, but is accompanied by complete darkness. Property and other damage are widespread across a sizeable city’s commercial centre and most but not all suburbs and surrounding areas. In areas near the volcano, PDCs destroy property. Where ash falls are more than 300–400 mm thick severe damage to buildings and other insured property is widespread; with falls of 100 mm or less only weaker buildings are damaged significantly but even these falls are enough to hinder transport and create substantial issues for communications, electricity, water distribution and sewage networks and other associated impacts from volcanic ash (Wilson et al. 2015). Across the very large areas where ash fall are only a few mm thick, some agricultural crops are severely damaged and livestock are distressed.

At the height of the eruption the volcanic cone collapses leaving a caldera 5 km across. Over the next few days rainfall compacts the ash to about half its freshly-fallen thickness and increases its density significantly; a hardened surface crust forms, strengthened by sulphur and other volatiles. Rainfall erodes and redistributes some of the ash, further clogging roads and drainage systems.

Late advice, clogged roads, a reluctance to evacuate, and a desire to remain to protect property meant hundreds of citizens didn’t evacuate. In more severely affected areas the remaining citizens are presumed dead but the threat of further PDCs and the heat retained in the deposits prevents access to the city or emergency assistance for some days, longer in some districts. Elsewhere emergency services are overloaded but the cleanup begins.

Airspace is closed across most of three countries for nearly a week. There is widespread disruption to commerce and the tourist industry.

The government enforces an exclusion zone across the remaining suburbs near the foot of the volcano for the best part of two months, fearing further eruptions.

A month or two after the eruption it is evident that some of the remaining metal roofs, even relatively new roofs, are corroding quickly. From 1500–2000 km downwind, beyond the region of ash fall, insurance claims are emerging for tarnished metal and silver, clothes and other exposed fabrics destroyed by acidic vapours.

Five months later, although the volcano is now doing nothing more than quietly steaming, the rainy season begins. Secondary lahars (volcanic mudflows), resulting from intense rainstorms on the volcano’s slopes, carve deep channels, threaten life, limb, property, and infrastructure (especially bridges) even at distances of 20–30 km from the caldera, with burial (or erosion) of some remaining insured property.

4 A Range of Insurance Responses

It is unrealistic to regard all insurers as similar. Table 1 shows a selection of eruption-related issues that are likely to arise, characterising an insurer at the ‘well-prepared’ end of the insurance company response spectrum.

At the other end of the insurance industry spectrum are the insurers who have not thought much about volcanic risk even though their policy wordings imply that they will compensate policy holders for volcanic eruption-related damage. As the volcano moves “inexorably” towards an eruption some companies will fail to think strategically or operationally about the impending damage, the myriad claims, communication with their clients and reinsurers or to recognise the potential consequences for the company itself.

Nearly all insurance companies will lie somewhere on the spectrum between the extremely well-prepared and proactive company described in the table and the rare ‘response’ just summarised.

5 Insurance Policy Wordings—Some Examples and Issues

Insurance policies contain a number of clauses or definitions that may not have been tested or thought about in detail until after an event occurs. While policies differ from country to country and insurer to insurer, all contain a standard clause defining a ‘loss occurrence’; this usually refers to all individual losses arising out of and directly occasioned by one catastrophe. Commonly, the duration and extent of any ‘loss occurrence’ is limited to ‘72 consecutive hours as regards earthquake, seaquake, tidal wave and/or volcanic eruption’ (LP098A; see further discussion regarding IUA01-033 at http://www.iuaclauses.com/site/cms/contentDocumentView.asp?chapter=9).

Around the world many wordings are similar: ‘volcanic eruption’ is often grouped together with earthquake and tsunami, even with ‘seaquake’ and ‘other convulsions of nature’. Some policies/contracts refer to ‘volcanic activity’, ‘volcanic eruption’ (seismic events) or even ‘losses caused by volcano’. In plain English, these different wordings do not have the same meaning—that may or may not have been the intent.

Some New Zealand examples help to highlight potential interpretation and communication issues with wordings:

-

i.

On Christmas Eve 1953, water in volcano Ruapehu’s crater lake breached the crater wall. The resulting mudflow/lahar destroyed a rail bridge pier and an overnight express train (Fig. 2) plunged into the Whangaehu River, taking 151 lives. The insured loss was minimal but could be considerably more today.

The Smithsonian Institution Global Volcanism Program in Washington D.C. is the world repository for volcanic information. The GVP database holds information on every known eruption in the world in the last 10,000 years. Volcanologists, historians and others contribute, check and update information while GVP staff scour the relevant literature to ensure the database is as accurate as possible.

The Smithsonian database shows that Ruapehu was not in eruption between 1952 and 1956 (or to be more precise between July 1952 and the 18th November 1956) (http://volcano.si.edu/volcano.cfm?vn=241100). Certainly the Ruapehu crater wall was breached on December 24th 1953 and a lahar rushed down the Whangaehu Valley ultimately taking 151 lives, but the breach was not the result of an eruption.

Would an insurance contract defining a loss occurrence using the expression ‘volcanic eruption’ provide cover? How would a policy relying on the seemingly broader expression ‘volcanic activity’ respond?

-

ii.

In 2005 several houses in Rotorua, New Zealand suffered damage caused by hydrothermal activity (Fig. 3)—steam, gas and hot water heated by igneous activity—at several locations within the city. There were no insurance issues as the New Zealand Earthquake Commission (EQC) policy, which provides additional cover to all privately insured residential property in the country, states: “If your house is damaged by earthquake, natural landslip, tsunami, volcanic eruption or hydrothermal activity (as defined in the Earthquake Commission Act 1993 and any amendments) we will pay.”

However, if the words ‘hydrothermal activity’ had been omitted from the EQC policy so that any claim relied on ‘volcanic eruption’ (or on ‘volcanic activity’) would the damage have been covered?

-

iii.

Another policy wording, probably used only once, stated: “volcanic activity and resulting earthquake, tsunami, lahar, lava flow, ash fall and/or fire following any of these perils” Notwithstanding it is agreed that no loss occurrence shall last more than 672 h [28 days].

This clause apparently aimed to be all-inclusive, but perhaps having the implication that if a hazard associated with ‘volcanic activity’ was not named, then it was not covered under this loss occurrence clause. If this implication is correct, it is unfortunate that the list does not include ‘pyroclastic density current’ or similar phenomena as the insurance claim for a building impacted by a PDC is likely to be around 110% of the sum insured: 100% damage + 10% for debris removal.

We might also note that the above definition may raise other issues. Does ‘resulting earthquakes’ mean that only damage produced by earthquakes that occur after volcanic activity has begun is covered? Would ‘ash fall’ (Fig. 4) include cover for damage produced by ‘volcanic bombs’? A volcanologist or sedimentologist could readily argue (with the support of scientific literature and practice) that ‘volcanic ash’ refers only to particles less than 2 mm in diameter (less than 4 mm in diameter in some definitions). The Greek word ‘tephra’ (used by Aristotle) which covers all airborne volcanic particles from fine dust and ash to blocks the size of houses would be more all-encompassing than ‘ash fall’. We needn’t worry about adding a Greek word to the definition; after all ‘lava’ is Greek, ‘tsunami’ is Japanese, and ‘lahar’ is Indonesian!

The Text Box below gives further examples from real-life insurance policies with a few questions highlighted in red. All of these examples emphasise that insurance Wordings need to keep the coverage simple and re/insurers need to think carefully about what their policies (intentionally or otherwise) include or exclude. Policy holders also need to think carefully about the Wordings in policies and, if necessary, to engage in dialogue with their insurers.

6 The Hours Clause

As implied in the foregoing examples ‘loss occurrence’ clauses in insurance policies (particularly reinsurance policies) usually contain an Hours Clause; commonly this refers to a loss occurrence being limited to a period such as 72 consecutive hours (3 days), 168 h (1 week), or occasionally 672 h (28 days). Usually, the insurer can specify to the reinsurer when the Loss Occurrence begins, but if the damaging event lasts longer than the specified Hours Clause then a new Loss Occurrence event begins. Generally, for each Loss Occurrence the insurer will pay the retention (which might be tens of millions of dollars) with the reinsurers footing the bill for the rest of the damage. Clearly, with the large sums potentially at stake the number of Loss Occurrences agreed is of major concern to both insurers and reinsurers. This will also be of interest to individual insurance policyholders when, say, a fall of tephra produces damage, followed two months later by another damaging tephra fall. In most cases the policyholder will have to pay the deductible twice.

The eruption of Soufriere Hills on Montserrat is a good example of how even defining a loss occurrence can be complicated when considering volcanic eruptions.

In 1995 Soufrière Hills, the volcano on Montserrat in the Caribbean began erupting. The eruption continues today. In 1997 parts of the capital, Plymouth, were destroyed by PDCs. Most of the surrounding areas in the southern part of the island were relatively undamaged. In 2014 most of the houses in areas near Plymouth remain only lightly damaged by ash fall (Fig. 5) and the occasional hurricane but stand empty as the southern end of the island is located in a government-ordained exclusion zone.

During June to August 1997 a number of explosive eruptions led to the expansion of the exclusion zone on the island. Properties within this zone, however, had not necessarily suffered any physical damage from the eruptions.

A large part of the discussion between one insurer on the island and its reinsurers was how to define ‘loss occurrence’. The loss in this example was ‘loss of use’. The question was whether the June 25th 1997 eruption was the ‘occurrence’ that led to those properties being in the exclusion zone, and effectively a total loss.

Explosive stages of volcanic eruptions can last from a few minutes to more than a year with a median value of less than 10 h (Jenkins et al. 2007). In many cases it is too dangerous for loss assessors to determine damage for days or weeks after an eruption where explosive phases are irregularly interspersed between less violent stages of activity. PDCs only a few tens of cm thick are probably too hot and dangerous to walk on for days or weeks. After an eruption has ceased heavy rains can redistribute ash as mudflows down streets and through buildings. Volcanic eruptions can produce long periods where loss assessment is not possible. This can become even more complicated when a policy is renewed with a different insurer between eruptions spaced a few days or weeks apart.

When large eruptions occur huge volumes of unconsolidated volcanic ash are deposited on surrounding slopes. As ash fall or PDCs have usually destroyed all vegetation there is little to hold the volcanic sediments in place so erosion is usually rapid—as a rough rule of thumb as much as half the sediment will be eroded within a year or two of the eruption. This means that huge volumes of sediment move into rivers and overflow burying lower-lying land. This process can continue for years as illustrated below. Only the upper half of the Bacolor (Philippines) church remains above ground (Fig. 6), buried over a period of several years by lahars from the cataclysmic eruption of Pinatubo in 1991 (one of the two largest eruptions in the world in the 20th century).

Both the Montserrat example and the burial of the Bacolor church, and numerous other buildings, villages and infrastructure, more than 30 km east of Pinatubo, illustrates that the direct consequences of a volcanic eruption can continue for years even after the volcano has ceased erupting. Such scenes also illustrate that insurers, policy writers and insureds need to understand the consequences and the timeframes of volcanic eruptions to ensure that policies reflect not only underwriting intent but also volcanic reality.

7 Clean-up Costs

Clean up costs resulting from ash fall over an urban area remains an important issue for policyholders, insurers and reinsurers to consider.

We can imagine an ash fall about 10 mm thick across a city of about 200,000 people that covers an area of roughly 100 km2. The ash has to be removed before it blows and washes into the storm water system which probably has (illegal) links to the sewage system and/or blows around aggravating respiratory problems, creating other health issues, and exacerbating wear and tear on machinery, vegetation including commercial crops, and nerves (Hayes et al. 2015).

A 10 mm fall of volcanic ash will likely cause little damage to well-constructed buildings, but the ash needs to be removed from building roofs and gutters, prevented from damaging sensitive equipment including most electronics, the electrical generation and distribution network, communication networks, airport runways, and roads (where a few mm obscures road markings and makes the surface slippery). The cleanup process may need to be repeated several times to remove most of the ash, or because ash continues to fall.

For our scenario city of 200,000 people the 10 mm ash fall has a volume of about 1 million cubic meters (say 10,000 truckloads); it is not simply a matter of trucking the ash to another location where it can continue to blow around. The clean-up will require planning. Suitable dump sites might be 20 km outside the city. Dump sites require maintenance so that ash doesn’t continue to blow around.

Cleanup can be expensive. A repeat of the 1707 eruption of Fuji in Japan, for example, would spread ash across the Tokyo and Yokohama urban areas (and elsewhere). The cost of cleanup and removal of ash from the urban areas has been estimated to cost more than USD10 billion (Christina Magill, Risk Frontiers, pers. comm., September 2015). The damage bill could be quite limited but the cleanup costs will be substantial.

Not all of this cost would fall to insurers but have re/insurers considered the potential costs? Would policies cover the cost of debris removal and cleanup when there is no or little material damage? After the 1980 Mount St. Helens (USA) eruption, around 90% of insurers in eastern Washington paid policyholders an hourly rate to remove ash from roofs and building surrounds. Would this practice continue?

8 Other Stakeholders

Here we briefly summarise some of the possible issues and considerations of other insurance industry stakeholders:

-

Loss adjusters are likely to have minimal (if any) experience of forensically examining the myriad claims’ issues arising in the aftermath of an eruption.

-

Like insurers, reinsurers may not have considered the implications of the contract wording, impacts of volcanic eruption in their pricing, or which aspects of eruption-related damage might be covered under the catastrophe bonds they issued.

-

Regulators will be working through the impacts of the event on the industry and specifically policyholders including the solvency positions of insurers.

-

The media are focused on a lot of local examples of tragedy, isolated insurance issues and massive generalisations, failing to appreciate the complexity of numerous issues from insurers’ points of view or the diversity in insurance response.

-

Government involvement is significant. Local governments have clean-up issues and desperately need support from state government officials to contribute funds to reinstate infrastructure, assist the clean-up process, provide handouts, and deal with those who are uninsured and/or underinsured. Nobody much has thought about where all the cleaned up ash is going to be dumped. Political motivation may also play a part, for example the assumption that re/insurance companies have deep pockets with politicians publically urging the industry to be generous, even outside policy conditions/limitations.

-

It is really difficult to contemplate the legal responses to the insurance issues generated by our eruption scenario, but the following examples from insurance case law provide insights for both insurers and insureds into the arcane worlds of policy wordings and the law.

9 Insurance Case Law

There is a rather limited amount of case law relating to insurance and volcanic eruptions available. Contract wordings (and their intent) are usually of paramount importance. The examples below allow few conclusions to be reached. Nonetheless, these brief summaries provide valuable examples of some of the issues that arise in interpreting insurance contracts.

9.1 Philippines, 1991

The eruption of Pinatubo in early June, 1991, covered a wide area in ash fall including two insured properties in Angeles City. Six days later Typhoon ‘Diding’ (known internationally as Typhoon Yunya) swept across central Luzon bringing significant rainfall to Angeles City. Subsequently the rooves of the insured properties collapsed. The insureds claimed that the proximate cause of the damage was the typhoon whereas the insurer claimed the damage resulted from the eruption of Pinatubo, that volcanic eruption was an excluded peril and that the losses were not covered under the policy.

Clause 6 of the policy read (in part): ‘This insurance does not cover any loss or damage occasioned by or through or in consequence, directly or indirectly, of any of the following occurrences, namely:

-

(a)

Earthquake, volcanic eruption or other convulsion of nature’.

The Appeal Court found: ‘An examination of the records reveals that no damage was sustained by the insured properties at the height of the volcanic upheaval. True, there may have been volcanic ashes deposited on the roofs but these did not result in any untoward incident until the typhoon came on June 15, 1991 which bought more significant amount of ash fall in the affected area, caused the same to be soaked with rainwater thereby making it heavy which lead to the damage of the insured properties. Consequently, it can be deduced that the proximate cause of the roofs caving in and the subsequent entry of the water inside the insured premises was the typhoon and not the volcanic debris’ (Court of Appeals, Manila 1993).

While this was bad news for the insurer, the Appeal Court also found that the lower court’s awarding of attorney’s fees to the defendant-appellant was uncalled for (Court of Appeals, Manila 1993).

9.2 New Zealand, 1995

Eruptions of Ruapehu in 1995 and 1996 during the ski seasons caused Ruapehu Alpine Lifts (RAL), a ski lift operator, to cease operating because of ash fall on the snow. The ash was corrosive, the ski field was closed and RAL lost business. RAL had a material damage policy and the material damage claim was met, but claims under Business Interruption (BI) were declined even though the cover provided for ‘Earthquake, geothermal activity or volcanic eruption’. The quantum of loss of NZD4.669 million plus GST + interest + any licence fees properly payable was not in dispute. The standard BI policy wording did not exclude snow from being ‘property’ whether natural or artificially created (possibly an important point as RAL had groomed and shaped the snow).

The issue revolved around the sense and meaning of the terms in the policy and the intention of the parties to the policy. Did ash fall onto snow constitute damage to ‘building and other property’ so as to fall within the cover of the consequential loss policy?; the argument was over whether snow is ‘property’, whether ‘building’ in ‘building and other property’ limits the nature of ‘other property’ and whether the cover was also limited by ‘for the purposes of the Business’. ‘Other property’ it appears is not confined to fixed assets but includes plant, machinery, and stock; in its wider sense ‘property’ can include debts, goodwill, rights, interests and claims.

RAL won the case with costs in June 1998 (High Court of New Zealand 1998). State Insurance appealed to the New Zealand High Court but lost in May 1999.

9.3 United States, 1980

The appeal arose from a dispute between two insurance companies and their insureds following the May 18 1980 eruption of Mount St. Helens in which pyroclastic density currents melted snow and ice on the volcano. These PDCs combined with sediment eroded from the large debris avalanche deposit and river channels and with torrential rain from the eruption cloud, groundwater and the waters of Spirit Lake to produce mudflows down the Toutle Valley. At a distance of 30–40 km from the volcano and about 10 h after the eruption began, the appellants homes were destroyed by mudflows/lahars or by mudflows/lahars preceded by water damage from flooding.

All three policies stated the following:

Section 1—Exclusions

We do not cover loss resulting directly or indirectly from:

…

2. Earth Movement. Direct loss by fire, explosion, theft, or breakage of glass or safety glazing materials resulting from earth movement is covered.

3. Water damage, meaning:

(a) flood ….

The term ‘Earth Movement’ was not specifically defined (evidently it had been defined in earlier years but had been omitted from this policy in order to simplify the language).

The insurers rejected the insured’s claims on the basis that the damage was excluded as ‘earth movement’. The trial court assumed the movement of Mount St. Helens was an ‘explosion’ within the terms of the insurance policies, and noted that the true meaning of ‘explosion’ was to be determined by jurors. It further determined that the mudflows which destroyed the appellants’ homes would not have occurred without the eruption of Mount St. Helens; that is, the eruption was a proximate cause of damage to the appellants’ homes. However, this was not a unanimous decision by the bench (Supreme Court of Washington 1983).

9.4 Iceland, 2010

The minor eruption of Eyjafjallojökull in 2010 produced an ash cloud which grounded more than 100,000 flights across Europe, disrupted the travel plans of around 10 million airline passengers and produced substantial economic losses to passengers, airlines and third parties (Alexander 2013).

-

Two insurance-related issues are of interest.

i. Costs of the disruption to insurers were relatively small as most BI policies require physical damage to an insured item to trigger the policy. As there was no damage to airplanes or to airports outside Iceland insurers were generally not liable for the losses sustained. However, policies do tend to cover ‘damage caused to third parties by negligent air traffic control guidance’ and it remains a question as to whether airspace was closed for longer than was strictly necessary—although the hazards to aviation (and jet engines and modern aircraft in particular) presented by volcanic ash have been well-known for at least 30 years, and a global network of VAAC (Volcanic Ash Advisory Centres) has been established for about two decades, surprisingly little effort was made to determine the ‘safe’ concentrations of volcanic ash through which aircraft could fly before the Eyjafjallajὅkull eruption.

More recently, non-damage Business Interruption (NDBI) policies have been offered whereby components of a BI policy without preceding property damage have been available as extensions to existing policies. NDBI policies indemnify an airline for any cancelled flight arising from airspace or airport closure by a third-party authority or airport operator caused by non-manmade events. However, there has been surprisingly limited uptake of such policies, perhaps emphasising (a) the extensions are too restrictive or too expensive; (b) a disconnect between the ways insurers see policy wording and the ways risk managers in industry view wordings; (c) short-term thinking on long-term issues; and/or (d) the need for all parties to view risk within a holistic corporate resilience framework.

ii. Under European Union regulations air passengers are not entitled to compensation when ‘force majeure’ is involved. However, not all travel policies are the same (Australian travel policies, for example, tended to provide cover for the disruption resulting from the Eyjafjallajὅkull ash cloud). Moreover, some European insurers made refunds on abandoned travel and some insurers paid goodwill gestures.

More significantly, both a UK lower court and the UK Financial Ombudsman Service regarded the ash cloud as falling under ‘poor weather conditions’ which were covered by at least some travel policies. The FOS Ombudsman concluded that ‘it would be fair and reasonable for the insurer to treat the wind-borne ash cloud as poor weather conditions under Ms B’s travel policy; it would not be fair and reasonable for the insurer to decline Ms B’s claim; and Ms B’s claim should succeed and the insurer should pay the benefit available under her policy plus interest (at 8% per year simple)’ (UK FOS Final Decision, March 2011; see also Brannigan 2010).

More recently there have been discussions among various parties regarding travel insurance cover for events such as the Eyjafjallajὅkull ash cloud but it will still be important to read the fine print.

Most interestingly for insurers and insureds alike the UK Financial Ombudsman Services (2011) made an important point in providing an opinion on Ms B’s claim: ‘It is a general principle of English courts that an ambiguous contractual term must be given the interpretation that is less favourable to the party who supplied the wording, which was the insurer in this case. So although I consider the “poor weather” encompasses ash on the wind, if there is any ambiguity about it, this principle will apply’.

10 Conclusions

Within the re/insurance industry, risk from volcanic hazards is often unmodelled and poorly understood. We need to understand more about the nature of volcanic hazards and to recognize that there are quite a few things happening before, during, and after volcanic eruptions that produce consequences including damage to a wide range of insured assets.

Not all insurance policies are the same. Insurers, reinsurers, loss adjusters, policy holders, and other players in the insurance space, need to ensure that policy wordings reflect both volcanic reality and underwriting intent.

Not all insurance companies are the same. Many are well-organised, experienced, pro-active and resilient, whilst others may have difficulty responding or even surviving an uncommon event that produces a large number of claims well beyond their experience. In that sense, insurers and the other insurance-related players in a volcanic crisis, are no different to other commercial organisations (or governments, or non-government organisations, or families, or individuals for that matter) experiencing an unusual event—some insurers have limited resilience; some have what we might call ‘planned resilience’; others will adapt quickly to changed circumstances. Some insurers (and some policyholders) will survive, some will thrive.

References

ABI, Association of British Insurers 2014 Non-modelled risks—a guide to more complete catastrophe risk assessment for (re)insurers. https://www.abi.org.uk/~/media/Files/Documents/Publications/Public/2014/prudential%20regulation/Nonmodelled%20risks%20a%20guide%20to%20more%20complete%20catastrophe%20risk%20assessment%20for%20reinsurers.pdf

Alexander D (2013) Volcanic ash in the atmosphere and risks for civil aviation: a study in european crisis management. Int J Disaster Risk Sci 4(1):9–19

Brannigan VM (2010) Alice’s adventures in volcano land: the use and abuse of expert knowledge in safety regulation. Eur J Risk Regul 107–113

Court of Appeals, Manila (1993) Republic of the Philippines Court of Appeals, Manila, Sixteenth Division, Leonor Infante and CA G.R> CV No 43449 Swagman Hotel and Travel, Inc., Decision, 7 p

Deligne NI, Coles SG, Sparks RSJ (2010) Recurrence rates of large explosive volcanic eruptions. J Geophys Res 115:B06203. doi:10.1029/2009JB006554

Hayes JL, Wilson TM, Magill C (2015) Tephra fall clean-up in urban environments. J Volcanol Geoth Res 304:359–377

High Court of New Zealand (1998) 61-404 Ruapehu Alpine Lifts Limited v State Insurance Limited, June 1998, CCH Australia Limited, 61-404, 74,432–74,443

Jenkins SF, Magill CR, McAneney KJ (2007) Multi-stage volcanic events: a statistical investigation. J Volcanol Geoth Res 161(4):275–288

Supreme Court of Washington (1983), 98 Wn.2d 533; 656 P.2d 1077; 1983 Wash. LEXIS 1340

UK Financial Ombudsman Service (2011) Final Decision, Complaint by Ms B, March 2011, 10 p

Wilson TM, Jenkins S, Stewart C (2015) Impacts from volcanic ash fall. In: Papale P (ed) Volcanic hazards, risks, and disasters. Elsevier, Amsterdam, pp 47–86

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2017 The Author(s)

About this chapter

Cite this chapter

Blong, R., Tillyard, C., Attard, G. (2017). Insurance and a Volcanic Crisis—A Tale of One (Big) Eruption, Two Insurers, and Innumerable Insureds. In: Fearnley, C.J., Bird, D.K., Haynes, K., McGuire, W.J., Jolly, G. (eds) Observing the Volcano World. Advances in Volcanology. Springer, Cham. https://doi.org/10.1007/11157_2016_42

Download citation

DOI: https://doi.org/10.1007/11157_2016_42

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-44095-8

Online ISBN: 978-3-319-44097-2

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)