Abstract

Recently, rapid increases in house prices have caught policy makers’ attention, especially where regional discrepancies are stark. House price fluctuations in large cities can amplify macroeconomic fluctuations and impair financial stability. Price rises in cities tend to be persistent, and since urban areas tend to attract speculative buyers, house price reversals may be larger there. Externalities from such developments can be significant when the city is large and tightly connected to the rest of the country, through supply chain, labour market or financial sector links. Macroprudential policy may be applied to address regionally concentrated house price fluctuations, but the bar to using targeted macroprudential measures is currently high.

You have full access to this open access chapter, Download chapter PDF

Similar content being viewed by others

1 Why Might Regionally Concentrated House Price Booms Raise Concerns?

Housing markets have often had policy makers’ attention, most notably during the latest financial crises when prices plummeted in many economies. In recent years, rapid increases in house prices have again come into focus. In some countries, such as Sweden and Australia, these increases are widely spread, with real house prices surpassing levels seen before the 2007–2009 crisis. In others, such as the Netherlands, aggregate statistics may not signal similarly lofty valuations. But large discrepancies exist at the regional level, frequently involving booming markets in major cities and more subdued price developments in the rest of the country.

This chapter focuses on the effects of residential house price fluctuations for macroeconomic and financial stability, specifically in relation to house price increases concentrated within large cities. Large countrywide fluctuations in house prices and associated credit are known to amplify macroeconomic fluctuations and to impair financial stability. House price fluctuations that are concentrated within large cities can have qualitatively similar effects. These effects might become quantitatively important for macroeconomic or financial stability if the city is large and tightly integrated with the rest of the country’s economy, via real or financial links. In this case it might be appropriate to use macroprudential policy to address regionally concentrated house price fluctuations. Measuring the systemic importance of such fluctuations and assessing the effect of regionally targeted measures is, however, not straightforward, arguably setting a high bar for regulatory invention.

After reviewing house price developments, we discuss how risks emerging from regionally concentrated house price fluctuations might be assessed and present some implications for using macroprudential policy to address them.

2 House Price Developments

House prices have increased in many countries since the financial crisis, and rapidly so in some. One reason is that economic activity has picked up. Another are unusually low mortgage interest rates. The co-movement of house prices in particular among major cities with large and comparatively liquid housing markets could be driven by institutional investors searching for yield across housing markets in a low-interest-rate environment (IMF 2018; Gauder et al. 2014). House prices may also have increased as the memory of the 2007–2009 crisis is starting to fade and as households put doubts behind them regarding the safety and profitability of housing investments.

While the broad background is one of globally rising house prices, important differences remain between national markets (Fig. 4.1). These are likely driven by population and income growth; cost and availability of credit; and national public policy (land policy, tax policy, and prudential policy).

International differences in real residential property price growth. CPI deflated; rebased 2010 = 100. AU = Australia; BR = Brazil; CA = Canada; CN = China; DE = Germany; ES = Spain; FR = France; GB = United Kingdom; HK = Hong Kong SAR; IE = Ireland; IN = India; IT = Italy; KR = Korea; MX = Mexico; NL = Netherlands; SE = Sweden; US = United States. For US, seasonally adjusted

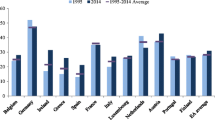

Differences exist not only between countries, but also within them. In particular, house prices in metropolitan areas have typically grown faster than in rural areas (Fig. 4.2).Footnote 1 Urbanisation is likely to be the key driver, in turn driven by factors such as growing labour productivity in agriculture and the emergence of technologies and industries that come with larger network externalities.Footnote 2 Regional deviations have therefore shown a large degree of persistence. Beliefs, to the extent that they are based on regional developments, can reinforce this persistence. But prices have also co-varied with more volatile changes in regional economic conditions. For example, in Canada, residential house prices fell in Calgary from their peak in 2014, following a downturn in the local energy sector, while house prices in Toronto, Montreal, and Vancouver, continued to increase. In addition, regions may influence land planning regulations, driving differences in the supply for housing. Such regulations often add to supply constraints linked to geographical factors.

Regional house price differences. Cumulative nominal price growth (2014–2017). UK: London vs all other regions. FR: Île-de-France vs. Province (INSEE). AU: Sydney vs a weighted average of Sydney, Melbourne, Brisbane, Adelaide, Perth, Hobart, Darwin, and Canberra. SE: simple average of Stockholm, Malmö and Göteborg vs a simple average of the other regions of the country (SCB). DE: 7 largest cities vs the whole country (Bundesbank). CN: simple average of Beijing, Shanghai, and Guangzhou (CEIC) vs an average of 70 cities. US: metropolitan areas vs non-metropolitan areas (FHFA). IE: Dublin vs the rest of Ireland. JP: Tokyo vs entire country. MX: Mexico City vs entire country. For DE, cumulative nominal price growth over the period 2012–2015

For the Netherlands, regional house price developments resemble those in most other countries. Average house prices have risen by 21% since their trough in June 2013 while regional discrepancies have widened (Fig. 4.3). In the major cities, the recovery has been speedier and firmer than elsewhere and house prices are above levels seen before the crisis. Amsterdam stands out, arguably showing signs of overheating. Higher prices in Amsterdam are, however, partly attributed to structural migration to cities and increasing interest shown by private investors (De Nederlandsche Bank 2017; Hekwolter of Hekhuis et al. 2017).

For the UK, Table 4.1 provides some detail on how leverage of first-time buyers co-varies with regional differences in house prices. House prices have grown rapidly since their post-crisis trough (2009 Q1) on average, and are now exceeding their pre-crisis peak (2007 Q3). But regional differences are large. Within London, economically the most important region, average income is almost double that in other regions. House prices are about 2.8 times higher than in other regions of the UK, as are average loan sizes, illustrating the strong positive correlation between house prices and mortgage credit. For first-time buyers, the ratio of average loan size to income is higher in London than in other regions. With income multiples high, the loan-to-value ratio is lower though in London, arguably offsetting the risks that banks incur from their borrowers’ larger exposure to increases in interest rates.

3 Macroeconomic and Financial Stability Risks Assessments

Rising house prices typically go hand in hand with an expansion of mortgage credit. The associated increase in leverage, both among new home owners and banks, can influence macroeconomic and financial stability. The importance of leverage among households and banks for amplifying house price moves, and indeed for causing macroeconomic and financial instability, has been discussed in depth following the financial crisis (Jordà et al. 2013; Duca et al. 2010). Effects arise in the boom phase, as increasing house prices, growing credit, and greater economic activity feed on each other. When the cycle turns, the impact on macroeconomic and financial stability is largest when falling house prices and high debt interact in a downward spiral (Borio and Lowe 2002; Crowe et al. 2013).

Even if outright financial stress is avoided, house price developments matter for the macroeconomy: while housing booms can have a significant positive effect on output in the short run, they tend to have a negative impact in the longer term.Footnote 3 When leverage is high, consumption and investment respond more to changes in wealth caused by housing price fluctuations.Footnote 4 Effects are larger the greater the amplitude of the fluctuations (because of larger wealth effects) and the longer their duration (because consumption and lending respond more strongly to persistent changes in wealth; see Claessens and Kose (2018) for a review). House price fluctuations that are concentrated within large cities can have qualitatively similar effects; these can be quantitatively significant for macroeconomic and financial stability if the city is tightly integrated with the rest of the country’s economy.

In order to assess risks emerging from regional housing price developments, it would therefore appear useful to have two sets of indicators. In the first set are those describing the likely persistence of house price changes and the size of reversals once the tide turns, as well as resilience indicators for households and banks, such as leverage. (Regional differences in the level of house prices are not necessarily relevant: limited supply and greater demand for housing are always likely to lead to higher house prices in cities.) In the second set are indicators capturing the external effects that a regional house price crash might have on the rest of the country. Aside from those measuring resilience, such indicators largely remain to be developed. In the following sections, we therefore qualitative describe factors that determine risks where indicators are, as yet, unavailable.

3.1 Persistence, Reversals and Resilience

Persistence

Persistence of house price fluctuations is determined by both supply and demand for housing. Indicators for supply-related determinants of persistence include the amount of newly built housing to be available within the next few years and restrictions to the number of floors of new buildings. Indicators for demand-related determinants of persistence appear to be more difficult to construct. The emergence of new or the decline of old industries, which alters the importance of agglomeration benefits and hence the attraction of cities to labour, may be a drawn-out process lasting decades but is harder to quantify. Where immigration is a source of persistent demand, the existence of areas in which there is already some immigrant population may be a sign of persistent demand as such areas tend to attract new immigrants (Bartel 1989).

Indicators capturing whether market forces tend to reduce or increase persistence would also appear useful. Market forces help reduce demand for housing in expensive areas by inducing people to move out to other regions. For example, an estimated net 1.2% of those aged 60 or older migrated out of London each year between 2000 and 2015 (Gordon et al. 2017, Table 5.2). And, in 2015, 869,000 people employed in their main job in London lived outside London, up from 665,000 10 years earlier (Office for National Statistics 2016). As a result, free transport capacity and an elastic supply of housing in the regions surrounding cities would tend to reduce the persistence of regional house price divergences. Persistence might also be lower if other regions have a high-quality infrastructure, and if labour is sufficiently mobile (e.g. a large proportion of renters), such that firms can relocate production away from more expensive metropolitan areas.Footnote 5

However, market forces might lose their power to attenuate regional housing imbalances if agglomeration benefits are large. Agglomeration benefits arise because densely populated areas can facilitate matching in labour markets, reduce transportation cost, and provide a fertile environment for spreading ideas and fostering innovation. This means that agglomerations might continue to attract labour and investment even when residential house prices are comparatively high. For example, while the number of inward commuters to London increased between 2005 and 2015, that of people living and working in London increased by even more, from 3.1 million in 2005 to 3.8 million in 2015. Indicators describing agglomeration benefits are difficult to construct: indeed, in estimations, agglomeration benefits have typically been identified as a residual component capturing movements in productivity unexplained by other factors, such as human capital, geography, and institutions (Gennaioli et al. 2013).

Reversals

The likely possibility and size of reversals in house price developments may depend on whether house price trends are driven by fundamental or speculative elements. House price booms driven by buyers hoping to benefit from future price increases, without paying much attention to fundamentals, are arguably destined for particularly strong reversals. The reason is that once speculative beliefs change direction, the typically high leverage in such markets tends to reinforce the decline in house prices, such that beliefs become self-confirming. But there are no tried-and-tested policy tools to affect beliefs systematically. Policy makers have used communication to affect housing markets by raising risk awareness, but the impact of such communications has proved difficult to predict (CGFS 2016).

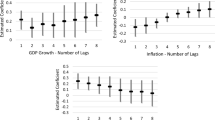

Surveys of house price expectations, that collect information about the reasons underlying them, can provide useful indicators that help determine to what extent such expectations appear to be based on fundamentals. In addition, the rental market provides information for constructing estimates of fundamentals-based house prices, which can be compared with observed values. Developments in other regions can provide useful benchmarks since intra-regional comparisons are robust against common factors driving rents and house prices across regions, such as changes in mortgage interest rates, interest deductibility, and tenant protection.

While house price trends driven by speculation may experience particularly strong reversals, it is useful to keep in mind that fundamentals do change, and sometimes quickly and by a substantial amount—for example, a decline in oil prices rapidly changed the economic fortunes of the region of Alberta in Canada and ended the regional house price boom. Accordingly, one might construct indicators capturing the dependence of the economic fortunes of a region on specific sectors or industries. More generally, indicators capturing resilience to income shocks and to changes in house prices can inform the strength of reversals.

Resilience

Finally, among indicators describing resilience, loan-to-value and debt service to income ratios have proven to be particularly useful to assess the risk that house price fluctuations cause macroeconomic and financial instability.Footnote 6 What level of debt is sustainable may depend on structural features of the housing market (e.g. fixed vs. floating rate mortgages, recourse vs. non-recourse, liquidity of the housing market) and on the design of the social safety net as it determines, for example, the degree of support households would receive if they become unemployed.Footnote 7 Aldasoro et al. (2018) show that the level of debt relative to income is most important for predicting banking crises, but the extent to which debt is denominated in foreign currency appears to matter as well.

3.2 Externalities

The second set of indicators, those attempting to capture the externality effects of regional house price crashes, remains to be developed. Such indicators are key, because concerns for countrywide financial and macroeconomic stability arise only if externality effects on other regions are sufficiently large. Put differently, only if the regional housing market is systemically important, should there be specific macroeconomic or financial stability concerns.

One indicator of a region’s macroeconomic importance is clearly its contribution to national GDP. For example, the metropolitan region including Dublin generates around half of Ireland’s GDP; that including London about a third of the UK’s GDP; but that including Berlin only 5% of Germany’s GDP.Footnote 8 Another is the extent to which a city’s economy is integrated with that of other regions, such as through supply chains or income transfers by workers commuting from one region to the other. For example, London-based companies and residents were estimated to source about a third of their supplies from other regions in the UK.Footnote 9 And around 15% of those working in London live in the surrounding regions, where they are likely to spend most of their salaries.

Regional shocks can also spill over to the rest of the country via financial links. These links can arise, for example, because of concentrated funding, interbank exposures, or an undiversified investor base. Indeed, as past crises have shown, the mere suspicion of the existence of exposures can create stress for lenders without any direct links to the region experiencing a downturn. For example, in 2009, regional housing market shocks had nation-wide effects; earlier U.S. crises (Texas, New England) had also some spillovers. Multiple channels were at play: the real estate bust in Texas in the late 1980s, related to a drop in oil prices, was a contributor to the savings and loan crisis, which in turn required federal government support to resolve. At times, changes in sovereign risks can give rise to links via the bank-sovereign nexus if the government’s support for struggling banks in one region exhausts its capacity to provide future support for banks in other regions. For example, the real estate related banking crises in Ireland and Spain affected the whole euro area: the final response involved a regional support mechanism with fiscal backing from other euro area countries. Moreover, it led to stresses among banks in other countries, which in turn affected local credit provisions.

4 Implications for Macroprudential Policy

Macroprudential policy has been shown to be generally effective in increasing resilience to housing price declines (Claessens et al. 2012). Against the background of large costs of housing market crashes, and a conjunctural environment that encouraged demand for property, policymakers have relied extensively on macroprudential tools to address financial risks associated with country-wide housing market imbalances.

Even if macroprudential measures apply uniformly to the entire country, they can affect different regions to different extents: an LTV ratio cap might well bind only in regions in which house prices are high. Nevertheless, some countries that experienced large regional imbalances have chosen to deploy region-specific measures, partly in order to reduce compliance costs in regions in which housing markets did not pose risks to stability.Footnote 10 For example, in New Zealand, restrictions on high-loan-to-value (LTV) mortgage lending were put in place in October 2013, with a cap of 80% applying for most mortgage borrowers. As the Auckland market started to accelerate while house prices in the rest of the country moderated, LTV requirements were tightened in Auckland in November 2015 and somewhat relaxed elsewhere: the share of mortgages banks were allowed to grant at LTVs exceeding the cap was raised from 10% to 15% for owner-occupied properties outside Auckland (Spencer 2015). This appeared to somewhat reduce house price inflation in Auckland (Spencer 2016). When housing market risks continued to grow nationwide, the regional differentiation was abandoned, with LTV restrictions being tightened somewhat in Auckland and more significantly elsewhere in 2016.

As the preceding discussion on indicators has shown, the bar to using macroprudential policy to target regional housing market imbalances is currently high. Calibrating such policy measures appears even more difficult than calibrating those measures targeting fluctuations at the national level. Externalities of regional housing market cycles have to be assessed and the impact of interventions on migration and agglomeration benefits should be taken into account. Economic models designed to calibrate regional macroprudential policies are more difficult to build and solve than those for national measures, because they require additional dimensions (capturing heterogeneity between regions) and additional non-linearities (arising from agglomeration externalities). A suitable avenue for future research would be to identify and quantify externalities that link cities with the rest of the country, and to consider how regulation can address specific risks emerging from regional house price fluctuations.

Notes

- 1.

Constrained by availability of comparable data, the figures refer to different types of residential housing for different countries.

- 2.

- 3.

- 4.

Bunn and Rostom (2015) show that between 2007 and 2009, spending cuts by UK households with debt ratios above 400% were 10 times higher than those of households with ratios below 100%.

- 5.

See Oxford Economic Forecasting (2004) for examples of lower-value-added jobs being outsourced to UK regions outside London.

- 6.

See, e.g. Aldasoro et al. (2018) and the literature cited therein.

- 7.

- 8.

Eurostat (2017), Fig. 6.2.

- 9.

London Development Agency (2003), Table 9.7.

- 10.

Fáykiss et al. (2017) discuss which macroprudential instruments might be effective when applied regionally.

References

Aldasoro, I., Borio, C., & Drehmann, M. (2018, March). Early warning indicators of banking crises: expanding the family. BIS Quarterly Review.

Auclert, A. (2017). Monetary policy and the redistribution channel (NBER Working Papers, no 23451).

Bank for International Settlements. (2018). Residential property prices. Accessed April 1, 2018, from https://www.bis.org/statistics/pp_selected.htm?m=6%7C288%7C596

Bartel, A. (1989). Where do the new U.S. immigrants live? Journal of Labor Economics, 7(4), 371–391.

Borio, C., & Lowe, P. (2002). Asset prices, financial and monetary stability: Exploring the nexus (BIS Working Papers, no 114).

Bunn, P., & Rostom, M. (2015). Household debt and spending in the United Kingdom (Bank of England Staff Working Paper, no 554).

CEIC. (2018). House prices growth. Accessed April 1, 2018, from https://www.ceicdata.com/en/indicator/house-prices-growth

Claessens, S., & Kose, M. A. (2018). Frontiers of macrofinancial linkages (BIS Papers, no 95).

Claessens, S., Kose, M., & Terrones, M. (2012). How do business and financial cycles interact? Journal of International Economics, 87(1), 178–190.

Committee on the Global Financial System. (2016). Objective-setting and communication of macroprudential policies. Basel.

Crowe, C., Dell’Ariccia, G., Igan, D., & Rabanal, P. (2013). How to deal with real estate booms: Lessons from country experiences. Journal of Financial Stability, 9(3), 300–319.

De Nederlandsche Bank. (2017). Financial stability report. Autumn.

Drehmann, M., & Juselius, M. (2012, September). Do debt service costs affect macroeconomic and financial stability? BIS Quarterly Review.

Drehmann, M., Juselius, M., & Korinek, A. (2017). Accounting for debt service: The painful legacy of credit booms (BIS Working Papers, no 645).

Duca, J., Muellbauer, J., & Murphy, A. (2010). Housing markets and the financial crisis of 2007–2009: Lessons for the future. Journal of Financial Stability, 6(4), 203–217.

Eurostat. (2017). Regional yearbook.

Fáykiss, P., Márton, N., & Szombati, A. (2017). Regionally-differentiated debt cap rules: A Hungarian perspective. In: BIS (2017): Macroprudential frameworks, implementation and relationship with other policies (BIS Papers, no 94).

Federal Housing Finance Agency. (2018). House price index. Accessed April 1, 2018, from https://www.fhfa.gov/DataTools/Downloads/pages/house-price-index.aspx

Gauder, M., Houssard, C., & Orsmond, D. (2014, June). Foreign investment in residential real estate. Reserve Bank of Australia Bulletin.

Gennaioli, N., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2013). Human capital and regional development. Quarterly Journal of Economics, 128(1), 105–164.

Glaeser, E., & Gottlieb, J. (2009). The wealth of cities: Agglomeration economies and spatial equilibrium in the United States. Journal of Economic Literature, 47(4), 983–1028.

Gordon, I., Champion, T., McDonald, N., & Whitehead, C. (2017, September 3). Migration influences and implications for population dynamics in the wider South East. Report to the East of England Local Government Association, London School of Economics and Political Science.

Hekwolter of Hekhuis, M., Nijskens, R., & Heeringa, W. (2017). The housing market in major Dutch cities. DNB Occasional Study, 15(1), 7–59.

International Monetary Fund. (2018, April). House price synchronization: What role for financial factors? Global Financial Stability Report (pp. 93–133).

Jordà, Ò., Schularick, M., & Taylor, A. (2013). When credit bites back. Journal of Monetary Credit and Banking, 45(2), 3–28.

Jordà, Ò., Schularick, M., & Taylor, A. (2016). The great mortgaging: Housing finance, crises and business cycles. Economic Policy, 31(85), 107–152.

Lombardi, M., Mohanty, M., & Shim, I. (2017). The real effects of household debt in the short and long run (BIS Working Papers, no 607).

London Development Agency. (2003, December). The London annual business survey.

Mian, A., Sufi, A., & Verner, E. (2017). Household debt and business cycles worldwide. Quarterly Journal of Economics, 132(4), 1755–1817.

Nationwide. (2018). House price index. Accessed April 1, 2018, from https://www.nationwide.co.uk/about/house-price-index/headlines

Office for National Statistics. (2016). London jobs by commuting pattern: 2004 to 2015. Ad-hoc request, Reference number 005564. Accessed from https://www.ons.gov.uk

Oxford Economic Forecasting. (2004). London’s linkages with the rest of the UK. Oxford, UK.

Spencer, G. (2015, August 24). Investors adding to Auckland housing market risk, speech delivered to The Northern Club, Auckland.

Spencer, G. (2016, July 7). Housing risks require a broad policy response, speech delivered to New Zealand Institute of Valuers, Wellington.

Statistics Netherlands. (2018). House price index per region. Accessed April 1, 2018, from https://opendata.cbs.nl/statline/#/CBS/en/dataset/83913ENG/table?dl=F8A5

Storper, M. (2011). Why do regions develop and change? The challenge for geography and economics. Journal of Economic Geography, 11(2), 333–346.

Zabai, A. (2017, December). Household debt: Recent developments and challenges. BIS Quarterly Review.

Author information

Authors and Affiliations

Corresponding authors

Editor information

Editors and Affiliations

Rights and permissions

Open Access This chapter is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license and indicate if changes were made.

The images or other third party material in this chapter are included in the chapter’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the chapter’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Copyright information

© 2019 The Author(s)

About this chapter

Cite this chapter

Claessens, S., Schanz, J. (2019). Regional House Price Differences: Drivers and Risks. In: Nijskens, R., Lohuis, M., Hilbers, P., Heeringa, W. (eds) Hot Property. Springer, Cham. https://doi.org/10.1007/978-3-030-11674-3_4

Download citation

DOI: https://doi.org/10.1007/978-3-030-11674-3_4

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-11673-6

Online ISBN: 978-3-030-11674-3

eBook Packages: Economics and FinanceEconomics and Finance (R0)