Abstract

Background

With the rapid population aging, the payment crisis of China’s pension insurance fund is increasing yearly. The government adjusts fertility policy to alleviate population aging and improve the solvency of pension insurance fund. On January 1, 2016, China’s fertility policy was adjusted from “selective two-child policy” to universal two-child policy.

Methods

This paper establishes actuarial models to analyze how fertility policy adjustment influences the pension insurance fund.

Results

(1) if the “one-child policy” were still employed, the accumulated deficit of pension insurance fund would appear in the year of 2076; (2) if all couples that satisfy the rules of “selective two-child policy” bear the second child, the time of accumulated deficit of pension insurance fund would be postponed by about 9 years; (3) after implementing the universal two-child policy, the time of accumulated deficit of pension insurance fund would delay under different situations of fertility intentions, if more than 54% of the qualified couples bear a second child, the accumulated deficit of pension insurance fund would not appear before 2090. The above conclusions have passed the sensitivity tests.

Conclusion

Therefore, “two-child policy” can alleviate the payment pressure of pension insurance fund. If the government wants to solve the payment crisis of pension insurance fund, fertility intentions should be improved.

Similar content being viewed by others

Introduction and literature review

At this stage, most countries in the world have become the aging society, and China is no exception. China became the aging society in 2000,Footnote 1 and population aging is increasing in the following years. The proportion of population at the age of 60 and age of 65 and above reached 15.53 and 10.06%Footnote 2 in 2014, which increased by 5.2 and 3.06 respectively. One of the main reasons for China’s entering into the aging society is the one-child policy implemented since 1978 (Wang, 2010). The implementation of “one-child policy” has reduced the total fertility rate,Footnote 3 as well as the newly born population (namely low fertility), which contributes to the increasing population aging. The population aging has brought a series of problems and negative effects, such as the decline of economic growth, disappearance of demographic dividend, rising payment pressure of China’s pension insurance fund,Footnote 4 even the payment crisisFootnote 5 and so on (Peng and Hu 2011).

In order to reduce these risks and negative effects, China started to adjust the “one-child policy” to improve the total fertility rate and to alleviate the degree of population aging. The “CPC Central Committee on deepening reform of overall number of major issues” issued on November 15, 2013 put forward the implementation of policy that either the husband or the wife is from a single-child family can have the second child, which marks the landing of “selective two-child” policy. However, as of the end of May 2015, only 1.45 million couples in the 11 million couples that satisfy the above requirement apply for having the second child.Footnote 6 The Recommendations of the CPC Central Committee for the 13th Five-Year plan for National Economic and Social Development (hereinafter referred to as recommendations for the 13th Five-Year plan) put forward the policy that a couple can have the second child (universal two-child policy). The National People’s Congress passed the population and family planning law amendment on December 27, 2015, and the universal two-child policy was formally implemented on January 1, 2016. Therefore, will the universal two-child policy alleviate the pressure of pension insurance fund payment, and even crackthe payment crisis of pension insurance fund?Footnote 7 This paper uses the actuarial model to analyze the impact of adjustment of fertility policy on financial operation of pension fund.

Most of the developed countries became aging society in the middle of or the latter part of the twentieth century. The negative effect of aging population on economic and social security system arouse the attention of scholars abroad (Bakshi and Chen 1994; Anderson, 2000). In order to reduce the adverse effects of aging population, abroad scholars put forward suggestions to encourage fertility. Chesnais (1996) suggested the low total fertility rate in the developed industrial society could not maintain reasonable population structure. With increasingly high status of women nowadays, it is necessary to adopt policies to encourage fertility rate with the replacement level of 2.1. Futagami and Nakajima (2002) demonstrated the rationality of policies that raise the total fertility rate from the perspective of morality, economy, and society. Then, what is the impact of encouraging fertility on financial operation of pension insurance fund? With UK as example, Blake and Mayhew (2006) used the macro data to demonstrate that the rising of total fertility rate can alleviate financial burden of pension insurance fund. Zeng (2007) taking China as example used the population model and found the two-child policy had significant advantage in narrowing the gap of pension than the one-child policy. Overall, literature about the impact of raising fertility rate on financial operation of pension insurance fund is less than that about reasons why fertility rate is low (Lee and Miller, 1990; Castles, 2003).

Similar to the foreign scholars, many domestic scholars proposed to adjust one-child policy and analyzed its impact on population system since China became an aging society (Tian et al., 2005; Cai, 2013). Guo (2014) suggested one-child policy should be adjusted and corresponding simulation method of population was also put forward. Zeng (2006) compared the one-child policy with the two-child policy and found the two-child policy had significant advantage in improving elderly dependency ratio and in reducing high sex ratio. Since the “selective two-child” policy came out at the end of 2013 and followed by the “universal two-child policy” at the beginning of 2016, many scholars have studied relative issues about these two policies (Zhang and Wang, 2014; Qiao, 2015). Shi and Yang (2014) studied fertility intention and fertility behavior of families that satisfy the requirement of “selective two-child”. Zhang (2016) put forward complementary measures that promote the implementation of “universal two-child policy”. Overall, current literatures have optimistic attitude to the “selective two-child” and “universal two-child policy”, and consider the rising fertility intention would ease the pressure caused by aging and be conductive to continuation of demographic dividend.

With more and more scholars suggesting adjusting the “one-child policy” and restrictions in fertility gradually being liberalized, some scholars (Chen and Song 2013, Luo et al., 2015) began to study the impact of adjusting policies on financial operation status of pension fund. Zhang (2010) is one of earliest scholars that study this subject and he finds the gap of basic pension fund in high fertility situation is lower than that in low fertility situation. Sun et al. (2011) simulated the impact of different policies on basic pension fund and found that the fund gap peak in the two-child policy is 1.19 billion yuan less than that in the one-child policy. Zeng et al. (2015) set five different contexts of “selective two-child” and used an actuarial model to analyze theses polices’ impact on gap of basic pension fund. Zeng found that with the fertility intention gradually improved, payment gap of basic pension fund would shrink. Yu and Zeng (2015) consider delaying retirement age and implementing “selective two- child policy” are effective measures to realize sustainable development of pension fund. It is obvious that scholars both home and abroad think adjusting birth policy (or raising total fertility rate) is one of effective measures to alleviate payment pressure of pension fund.

However, there is little literature studying the universal two-child policy’s impact on financial operation of pension fund, nor further studying the fertility intention. This paper sets the actuarial model to analyze the impact of universal two-child policy on population aging and financial operation of pension fund. This paper not only simulates the impact of different fertility intention on financial operation of pension fund but also compares the effects of universal two-child policy with selective two-child policy. Comprehensively evaluating the universal two-child provides empirical evidence for the policy implementation, as well as reference for policy guidance. Hereinafter, the pension insurance fund refers to the basic pension fund of urban workers if not specified otherwise.

Model and method

The “decision of State Council on establishment of a unified basic pension system for enterprise employees” ([1997] No. 26 Document) promulgated in 1997 is a symbol of the establishment of pension system for urban workers. The “decision of State Council on the improvement of basic old-age insurance system for enterprise employees” ([2005] No. 38 Document) promulgated in 2005 partly amended the former document. These two documents are applicable for different people. This paper divides the subjects into four samples: the old, the second old, the second new, and the new. The old refers to those who retired before the implementation of [1997] No. 26 Document, and they receive the basic pension; the second old refers to those who work before the implementation of [1997] No. 26 Document, as well as those who retire in time between the implementation of [1997] No. 26 Document and [2005] No. 38 Document, and they receive the basic pension, individual account pension, and transitional pension. The second new refers to those who work before the implementation of [1997] No. 26 Document and retire after the implementation of [2005] No. 38 Document, and they also receive basic pension, individual account pension, and transitional pension. The new refers to those who work after the implementation of [1997] No. 26 Document, they receive basic pension fund and individual account pension.

As of the end of 2014, there are 13 provinces that have fully funded personal accounts, and the process is slow.Footnote 8 For convenience in research, this paper assumes that China has not fully funded personal accounts. Then, the personal account only has the payment records of employees, which provides numerical basis for granting individual account pension, as well as the balance of individual account pension. At the same time, the unified financial accounts include personal account payment income and fund payment income, which are used to pay for the basic pension, transitional pension, personal account pension, and individual account return expenses. The return of personal accounts also refers to the balance of individual account that granted to employees’ heirs in the situation that employees died. Moreover, if individual account is exhausted and the employees still survive,Footnote 9 the government would continue to grant individual account fund. To guarantee the reliability of the conclusion, this paper also show results of the situation with personal account funding in the part of sensitivity analysis.

The pension fund income model

The pension fund income in the year of t is equal to the value of insured workers in the year of t multiplied by the base of pension payment in the year of t, and multiplied by the pension payment rate in the year of t, the function is as follows:

(AI) t refers to the pension fund income in the year of t, and i is equal to 1, 2, 3,4, which refers to the old, the second old, the second new, and the new. j = 1, 2, 3, which refers to male, female cadres, and female workers respectively. \( {N}_{t, x}^{i, j} \) refers to the number of insured workers that are included in i or j, as well as at the age of x in the year of t. \( {a}_t^i\;\mathrm{and}\;{b}_t^i \) refers to the age that employees participate in old-age insurance, and that employees retire respectively. \( {\displaystyle {\sum}_{i=1}^4{\displaystyle {\sum}_{j=1}^3{\displaystyle {\sum}_{x={a}_t^j}^{b_t^j}{N}_{t, x}^{i, j}}}} \) refers to the number of insured employees, w t refers to the base of pension payment in the year of t, t 0 refers to the starting time of actuarial analysis, k t refers to the growth rate of payment base in the year of t, and R t refers to payment rate of pension fund.

The expenditure model of pension fund

The expenditure of pension fund in the year of t (AC) t includes the basic pension fund expenditure in the year of t (AC) t,b , the transitional pension expenditure in the year of t (AC) t,g , the individual account pension expenditure in the year of t (AC) t,j ,Footnote 10 and the return expenditure of individual account (AC) t,i .Footnote 11 The basic pension expenditure in the year of t is equal to the number of insured employees who retire in the year of t multiplied by the annual per basic pension in the year of t, and the per basic pension in the year of t is equal to planned base multiplied by the planed proportion of basic pension fund, and multiplied by the growth coefficient,1 the function is as follows:

\( {C}_t^j \) refers to the maximum survival age of insured workers who are j in the year of t, \( {\overline{B}}_{t, x}^{i, j} \) is the planned base of basic pension fund of the insured workers who are i and j at the age of x in the year of t. The annual planned base of old and the second old is the average wage before his retirement while that of the new and the second new is the average of the above value and the indexation of expenditure base. \( {s}_{t, x}^{i, j} \) is the planned proportion of basic pension fund of insured employee who are i and j in the year of t. g t is the growth rate of basic pension in the year of t. 1 + g t is the growth coefficient of basic pension fund.

The transitional pension expenditure in the year of t is equal to number of second old and second new who retire in the year of t multiplied by the per transitional pension fund in the year of t. The per transitional pension fund in the year of t is equal to the planned base multiplied by payment period, and multiplied by planned granting proportion of transitional pension fund, and multiplied by the growth coefficient. The function is as follows:

\( {\overline{G}}_{t. x}^{i, j} \) is the planned granting base of transitional pension of insured employees who are i and j at the age of x in the year of t. The planned granting base of the second old and second new are the average wage before retiring and the indexation of average expenditure base respectively. [1998 ‐ (t ‐ x + at j)] refers to payment term of insured employees who are j.2 \( {v}_{t, x}^{i, j} \) is the planned granting proportion of transitional pension fund of insured employees who are i and j at the age of x in the year of t.1 The growth rate of transitional pension fund in the year of t is equal to the growth rate of basic pension in the year of t.

The expenditure of individual account pension fund in the year of t is equal to the number of second old, second new, and new who retired in the year of t multiplied by per individual account pension fund in the year of t. The per individual account pension fund in the year of t. is equal to the individual account storage divided by the total number of planned granting months, and multiplied by value of 12, and multiplied by growth coefficient. The function is as follows:

r is the deposit band interest rate of 1 year, \( {R}_t^2 \) is the expenditure rate of individual account in the year of t, \( {m}_t^{i, j} \) the number of planed months that grant individual account pension to insured employees who are i and j in the year of t. The return expenditure of individual account is equal to the number of dead employees multiplied by individual account balance. The function is as follows:

\( {D}_{t, x}^{i, j} \) is the number of dead insured employees who are i and j at the age of x in the year of t. Other symbols have the same meaning as the above symbols. The first item at the right of the function is the returned expenditure of individual account of retired insured employees while the second item is that of working insured employees.

The cumulative balance model of pension fund

The cumulative balance of pension fund in the year of t is equal to the total of balance in the last year t − 1 (including the interest) and the balance in the year of t (including the interest). The balance in the year of t is equal to revenue of pension fund minus expenditure of pension fund. The function is as follows:

F t is the cumulative balance of pension fund in the year of t. Other symbols are same as the above symbols.

Relative parameter calculation and description

Parameter of age

According to the “labor law of People’s Republic of China”, the legal minimum employment age is 16. The employment rate of urban population at the age from 16 to 20 is not high (about 10%). Most urban workers are university graduates, and their employment age is about 22 years old. Therefore, we assume the age that employees initially attend insurance is 22. According to the data of the sixth census in 2010, population over 100 is combined into that at the age of 100, which means that the default maximum survival age in the census is at 100. Since population forecasting is based on census, this paper also considers 100 as maximum. “The Recommendations for the 13th Five-Year Plan” points out the policy of progressive delaying retirement age, which shows the trend of retirement age delaying. Since the specific plan has not been announced, this paper assumes to set the scheme according to developed countries: China begins to delay the retirement age since the year of 2022. First, delaying the retirement age of female workers with 6 months every year, and the retirement age of female workers will reach 55 in 2031. Secondly, the retirement age of female cadres and female workers begins to be delayed in 2032 with 6 months every year, and the retirement age of female reaches 60 in 2041. Finally, the retirement age of both female and male begins to be delayed at 2042 with 6 months every year, and the retirement age of both female and male reaches 65 in 2051. Taking the uncertainty of retirement age program and the occurrence of early retirement behavior into consideration, sensitivity of the retirement age would be analyzed.

Forecasting the number of insured employees

This paper bases on the sixth census data in 2010 and uses the method of queue elements to predict the future population. First, the natural growing population (classified by age, gender, urban, and rural) is equal to the resident population (classified by age, gender, urban, and rural) in the year of t − 1 multiplied by the corresponding survival probability (1 - death probability). Second, the number of newborns in the year of t is equal to total of the population of women who are at the age from 15 to 49 multiplied by corresponding birth rate in the year of t. Third, taking the migration from rural to urban into consideration, the resident population (classified by age, gender, urban, and rural) could be acquired.

The following describes how to get the population data of old, second old, second new, and new. First, it is assumed that the female cadres and female workers account for 50% in the women of cities and towns. Second, it is assumed that age distribution of insured employees in 2014 (255 million) is consistent with that of cities and towns population that at the working age. For example, male population at the age from 22 to 59, female cadres at the age from 22 to 54,Footnote 12 and female population at the age from 22 to 49 accounts for 54.82, 24.04, and 21.14% in the cities and towns population that at the working age respectively. Therefore, the number of male at the age from 22 to 59, female cadres at the age from 22 to 54, and female at the age from 22 to 49 is 139.95, 61.37, and 53.97 million respectively. The male population at the age of 22 in cities and towns in 2014 accounts for 2.68% in the total male population at the age from 22 to 59 in cities and towns, then the male population at the age of 22 in cities and towns is 3.74 million. Other insured employees population at different ages can be calculated with the same methods. Moreover, with the same method, we assume the age distribution of insured retired workers in 2014 (85.93 million) is consistent with that of retired workers in cities and townsFootnote 13, then the insured retired employees classified by different ages can be calculated. According to the four types of age range showed in the Table 1, the population of old, second old, second new, and new in 2014 can be obtained. Finally, according to queue elements method, the population of old, second old, second new, and new (classified by age and gender) in the year of t is equal to the population in the year of t − 1 multiplied by corresponding survival probability. There are employees at the age of 22 in cities and towns being brought into the population system.

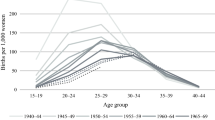

The total fertility rate

The total fertility rate is one of the most important parameters of population prediction. This paper first calculates the total fertility rate in the situation of continually implementing “one-child policy.” According to the “Chinese Statistic Yearbook of Population and Employment”, the average fertility rate from 2000 to 2012 was lower than 1.5. The fertility rate in 2010 was as low as 1.18. Is low level of fertility the actual situation in China? Based on the age distribution of this six census data in 2010, this paper studies the population progress in the past 20 years and the main population index. Then, comparing with the population index published by the “Statistic Yearbook of Chinese Population and Employment”, this paper finds that the phenomenon of concealment is not serious. After the fine-tuning, the total fertility in 2010 is 1.44. With this value as the total fertility rate in the situation of continually implementing “one-child policy”, the total fertility rate in towns and rural is magnified by 1.22 times. Adjusting fertility policy would improve the total fertility rate. According to the fifth and sixth census data and relative data in the sampling survey in 2005, the number of couples that satisfied different fertility policies (selective two-child policy and universal two-child policy) is calculated. And in combined with the model of “421 family micro simulation”, this paper simulates the situation of Chinese total fertility rate in the future. In the process of calculation, this paper takes the different fertility willingness’s impact on total fertility rate into consideration.

Payment base, payment rate, and interest rate

The payment rate of pension fund is 28%, of which the payment rate of employer and employee is 20 and 8% respectively. The pension fund policy set the payment base at the average wage of employer in the previous year. However, the actual base has a gap with this base. For example, the actual payment base in 2014 is 35,405 yuan, and the average wage of employer in 2013 is 51,483 yuan.Footnote 14 In order to make closer to the actual situation, this paper makes the actual payment base as the standard, and the base in 2015 and in the following years increases by a certain growth rate. It is assumed that the growth rate of payment base from 2015 to 2020 is 7%, and drops by 0.5% every 5 years until to 2%. According to the data published by people’s Bank of China, the fixed deposit rate of 1 year is from 1.5 to 3.5%. This paper takes 2.5% as the fixed deposit rate of 1 year. We will make the sensitive analysis to the growth rate of payment base and interest rate.

Proportion of granting pension fund and the planned granting months

According to [2005] No. 38 Document promulgated by State Council, the assumption is as follows: (1) the planned granting proportion of basic pension fund to old is 70%. (2) The planned granting proportion of basic pension fund to second old is 20%, and the number of planned granting months of individual account is 120. (3) For the second new and new, the planned granting proportion of basic pension fund is relative with retiring age. The granting proportion of payment in the first year is 1%, and the proportion would be 40% when the employee is 62 years old. (4) The number of planned granting month of the individual account pension fund of the second new and new is relative with retiring age, which is clearly shown in the file of [2005] 38. (5) The planned proportion of transitional pension fund in second old and second new is 1.2%. (6) The growth rate of per pension fund is about 90% of the growth rate of payment base.Footnote 15

Empirical results and discussion

The actuarial analysis period is from 2015 to 2090, which has the length of 75 years and belongs to the medium and long-term forecast (Fig. 1). There are two factors influencing the choice of sample. On the one hand is to describe the financial situation of pension fund in the long term and to investigate whether the pension fund has the financial sustainability. On the other hand is that the impact of adjusting policy on pension fund has time-lag effect. Therefore, the length of 75 years, approximately life cycle of one generation, is facilitating to analyze the long-term effect.

The first situation: continually implementing “one-child policy”

With the above 6 functions and the key parameters in Table 2, this paper simulates the financial operation of pension fund in the situation of continually implementing “one-child policy”. Table 3 shows that deficit of pension fund appears in 2023 and would expand year by year. Then deficit shrinks from 2032 until to 2038, and then the surplus appears. However, with deepening of population aging, deficit again appears in 2059. Due to the accumulated balances, deficit of pension fund appears in 2076 and would expand in the following years. The cumulative deficit would be 422.36 trillion in 2090. In all, if the “one-child policy” were continually implemented, pension fund would have no capacity to pay for the insured residents in 2076, which needs the introduction of other policies to improve financial situation of pension fund.

The second situation: the introduction of “selective two-child policy”

The “selective two-child policy” has been introduced since the end of 2013. However, there are only 13% of qualified couples applying for the second child, which indicates the policy is not effective. After the calculation, in comparison with continually implementing one-child policy, when the 13% of qualified couples would have the second child, the proportion of retired employee in the on-the-job employee would decline,Footnote 16 which indicates supporting pressure could be relieved. For example, the proportion of retirement of the pension fund system in 2090 would be 0.7538 when the “one-child policy” would be continually implemented. This means that 1.32 employees would support 1 retired employee. If the 13% of qualified couples would have the second child, the proportion of retirement of the pension fund system in 2090 would be 0.7163. This means that 1.39 employees would raise 1 retired employee. The declining proportion improves the financial operation of pension fund. Compared with continually implementing “one-child policy”, 13% couples having the second child would make the revenue and expenditure of pension fund increase by 0.06–6.25% and 0.01–1.04% respectively from 2037 to 2090. The point that deficit of pension fund appears would not been delayed, but the cumulative deficit pointFootnote 17 would be delayed by 1 year with cumulative deficit decreasing by 9.26% in 2090.

If the 13% of qualified couples would have the second child, the financial operation of pension fund would be improved. However, the capacity of payment before 2090 would not be enough. Table 4 shows that in compared with continually implementing “one-child policy”, if 50%Footnote 18 of qualified couples would have the second child, the retirement proportion of pension fund system would be 0.6273 in 2090. The points that deficit and cumulative deficit appear would be delayed 2 and 5 years respectively, and with cumulative deficit decreasing by 36.02% in 2090. If all the couples that satisfied the requirement of “selective one-child policy” have the second child, the retirement proportion of pension fund system would be 0.543 in 2090, and the point that deficit and cumulative deficit appear would be delayed by 7 and 9 years respectively, and with cumulative deficit decreasing by 71.85% in 2090. It can be seen that with the fertility intention improves, the point that cumulative deficit of pension fund appear would be delayed, and the cumulative deficit would decrease.

Third situation: implementing the “universal two-child policy”

From the above analysis, the effect of “selective two-child policy” is limited, which cannot relieve the payment crisis of pension fund. Then what is the effect of “universal two-child policy”? From Table 1, if the “one-child policy” is continually implemented, the total population would reach a peak in 2023 with the value of 1.4 billion. The total population would also show a downward trend with 0.6458 billion in 2090. If 13%Footnote 19 of couples would have the second child, the total population would reach a peak in 2024 with the population of 1.407 billion. Then it would also show a downward trend. If all the couples that satisfied the requirement of “universal two-child policy” would have the second child, the total population would reach a peak in 2031 with the population of 1.466 billion. Then it would still show a downward trend. It can be seen that the implementation of “universal two-child policy” cannot contribute to the rapid growth of population. The problem of population expansion needs no government attention.

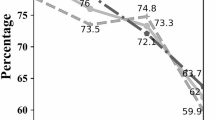

Fig. 2 shows the impact of “universal two-child policy” on the population aging. It can be seen that if the “one-child policy” were continually implemented, the proportion of population of 65 years and older would increase from 20.82% in 2015 to 36.35% in 2090. If 13% of couples that satisfy the “universal two-child policy” would have the second child, the proportion of population of 65 years and older would decrease to 34.39%. If all the couples that satisfy the “universal two-child policy” would have the second child, the proportion would decrease to 23.9% in 2090. It can be seen that the “universal two-child policy” could relieve pressure of population aging. The higher the fertility intention of “universal two-child policy”, the stronger the relieving effect is.

The implementing of “universal two-child policy” can relieve the pressure of population aging, and further contributes to the decline of retirement proportion of pension fund. Actuarially, if 13% of couples that satisfy the requirement of “universal two-child policy” would have the second child, the retirement proportion of pension fund system in 2090 would be 0.6926, which decreases by 0.0612 compared with continually implementing “one-child policy” while decreases by 0.0237 in comparison with the situation that 13% of couples that satisfy the requirement of “selective one-child policy”. If all the couples that satisfy the requirement of “universal two-child policy” would have the second child, the retirement proportion of pension fund system in 2090 would be 0.4408, which decreases by 0.3413 compared with continually implementing “one-child policy” while decreases by 0.1022 compared with the situation that all couples that satisfy the “selective two-child policy”. It can be seen that “universal two-child policy” relieves the pressure of arising of employee with different degrees.

After calculation, if 13% of couples that satisfy the universal two-child would have the second child, the revenue and expenditure would increase by 0.06 to 12.47% and 0.000002–3.6% since 2037 respectively compared with continually implementing “one-child ” policy. Since the growth rate of revenue is higher than that of expenditure, the point that deficit of pension fund appears would delay to 2060. The balance would increase by 7.38–190% from 2038 to 2058 while the deficit would decrease by 3.8–227.32% from 2059 to 2090. Further, the point that cumulative deficit appears would delay to 2079. The cumulative balance would increase by 0.85–15.98% from 2037 to 2058 while the cumulative deficit would decrease by 0.85–15.98% from 2059 to 2090. The cumulative deficit decreases by 23.56% in 2090, which has more effect than the “selective two-child” policy in the same condition.

According to Table 5, if the fertility willingness would be raised further, the point that deficit and cumulative deficit appear would be delayed and even the cumulative deficit would not appear before 2090. If all couples that satisfy the “universal two-child” policy would have the second child, the cumulative deficit of pension fund would not appear before 2090, with cumulative balance of 0.407 trillion yuan. If 50% of couples that satisfy the “universal two-child” policy would have the second child, the point that cumulative deficit that pension fund appear would be postponed to 2089. If 60% of couples that satisfy the “universal two-child” policy would have the second child, cumulative deficit of pension fund would not appear before 2090. Therefore, the critical point of fertility intention could be calculated to ensure the cumulative deficit not appear before 2090. Through the interpolation calculation, if 54% of couples that satisfy the “universal two-child” policy would have the second child, the cumulative deficit of pension fund would not appear before 2090. In all, the “universal two-child” policy could relieve pressure of pension fund. Alleviating pressure of pension fund, to a certain extent, depends on the fertility willingness.

Sensitivity analysis

In order to test whether the conclusion has fluctuation when subjecting to the changes of some parameters, this paper makes a sensitivity analysis. From Table 6, if the growth rate of payment base was 0.5% higher than the benchmark assumption, the conclusion would not change: the “universal two-child” policy can play the role of postponing the cumulative deficit of pension fund. If the fertility intention of “universal two-child” policy would reach 50% and higher, the cumulative deficit of pension fund would not appear before 2090. If the bank deposit interest rate were 0.5% higher than benchmark assumption, the conclusion would still not change. If there were 53% and more of couples that satisfy the “universal two-child” policy would have the second child, the cumulative deficit of pension fund would not appear before 2090. If the retirement age were delayed 4 months every year, the conclusion would also not change. If the individual account would be funded in 2016, the increasing fertility intention would improve the ability of payment. If the retirement is taken into consideration, the “universal two-child policy” can improve the financial operation of pension fund. It can be seen that the conclusion is quite robust.

Conclusion and policy recommendations

Since January 1, 2016, China’s fertility policy has been transformed from “selective two-child policy” to “universal two-child policy”. This paper sets the actuarial model to simulate the impact of adjusting policies on financial operation of pension fund. This paper finds that (1) if China would continually implement “one-child policy”, cumulative deficit would appear in 2076. (2) After the introduction of “selective two-child policy”, if all the couples that satisfy the requirement of “selective two-child policy” have the second child, the point that cumulative deficit of pension fund appears would be delayed by 9 years. Although the “selective two-child policy” can relieve the pressure of pension fund, the payment crisis of pension fund would not be broken. (3) After the introduction of “universal two-child policy”, there is no rapid growth in population with different fertility willingness. The pressure of population aging is relieved and the point cumulative deficit appears is delayed. (4) 54% and more of couples that satisfy the “universal two-child policy” would have the second child, cumulative deficit would not appear before 2090. All the above conclusions have passed the sensitivity test, which indicates that the “universal two-child policy” can relieve the pressure of pension fund, and alleviating pressure of pension fund, to a certain extent, depends on the increase in fertility willingness.

Through the above empirical analysis and sensitivity analysis, following commendations are made in order to promote the sustainable development of pension fund.

First, introducing series of relevant polices about raising the fertility intention of “universal two-child”. The empirical analysis shows that the higher the fertility willingness of the “universal two-child policy”, the better the financial operation of pension fund. The following policies could be introduced: (1) maternity allowance for the families that have the second child, (2) income tax relief for the families that have the second child, (3) in implementing policies such as “low rent housing”, “affordable housing” give priority to the families that have the second child, (4) providing additional medical insurance benefits for the families that have the second child, (5) education fee, especially the cost at the university, is waivered for these families, (6) some preferential tax policies in domestic service industry are introduced, which reduces some pressure of rearing child.

Second, the retirement aging program would be introduced as soon as possible and delay the retirement age as soon as possible. From the results of sensitivity analysis, if the retirement age would delay by 6 months each year, the financial operation of pension fund would be better compared with the situation that retirement age is delayed by 4 months each year. Moreover, in order to ensure the deficit of pension fund not appear before 2090, if the retirement age would be delayed by 6 months each year, the fertility intention could be 54%. However, if the retirement age would be delayed by 4 months each year, the fertility intention has to reach 58%. Therefore, the government should delay the retirement age at a faster speed to promote the sustainable development, announce the scheme and the implementing time as soon as possible so that current employees can have time for relevant preparations.

Third is raising the appreciation rate of pension fund. The results of sensitivity analysis show that if the bank deposit interest rate were 0.5% higher than the benchmark assumption, the results would not significantly change in addition to the absolute value of accumulated balance of pension fund. Currently, the added rate of pension fund is equal to the deposit interest of 1 year. But the interest rate is lower and the replacement rate of majority of insured employees’ pension fund is lower than the assumption (58.5%), and even lower than the international warning line (40%). As a result, government can raise the appreciation rate of pension fund to increase the pension benefits of insured workers without much burden on government.

Notes

According to the United Nations, if the proportion of population at the age of 60 and age of 65 and above reached 10 and 7%, it means the country is an aging society. In the year of 2000, the proportion of Chinese population at the age of 60 and age of 65 and above reached 10.33 and 7% respectively.

China’s total fertility rate fell from 5.81 in 1970 to 1.8 in the middle of late 1990s. The sixth census data showed the total fertility rate was 1.18 in 2010. Although some scholars are skeptical about the data, the academy community universally accepted China had entered the era of low fertility.

The pressure of payment refers to that the growth rate of payment fund expenditure is higher than that of fund income. Three situations would appear: First is that current deficit has not yet appeared, namely the pension fund income is more than expenditure. Second is that the current deficit has appeared, but the accumulative deficit has not yet appeared, namely accumulated balance can deal with the current deficit. Third is that accumulative deficit appears, namely the accumulative balance is depleted and other methods should be found to deal with the expenditure. The third situation refers to the payment crisis.

The pressure of payment refers to that the growth rate of payment fund expenditure is higher than that of fund income. Three situations would appear: First is that current deficit has not yet appear, namely the pension fund income is more than expenditure. Second is that the current deficit has appear, but the accumulative deficit has not yet appear, namely accumulated balance can deal with the current deficit. Third is that accumulative deficit appears, namely the accumulative balance is depleted and other methods should be found to deal with the expenditure. The third situation refers to the payment crisis.

Easing the pressure of payment crisis refers to that the accumulative deficit is gradually reduced, but it may still appear. Solving the payment crisis refers to that accumulative deficit is gradually reduced and accumulative balance appear. Government prefers to achieve the purpose of solving the payment crisis.

Source: the statistical bulletin of human resources and social security development in 2014.

The number of planning granting month of personal account pension of the male workers that retired at the age of 60 is 139. If when they were at the age of 71, and still alive, the government would continue to grant the pension and till the insured workers died.

The [2005] 38 file points out that timely adjusting the level of basic pension fund with the adjusting range of the certain percentage of average wage growth rate.

The payment term refers to the work period of insured workers before the formally establishment of insurance system. \( t- x+{a}_t \) refers to the first year that insured workers participating work.

The population of urban labors concludes the male at the age from 22 to 59, female cadres at the age from 22 to 54, and female workers at the age from 22 to 49.

The population of urban retired workers concludes the male above the age of 60, female cadres above the age of 55, and female workers above the age of 50.

In 2014, the pension fund income and the population of insured workers are 2.53 trillion and 255 million. Therefore, the per payment is 9913 yuan, and the base of actual payment is 35,405 yuan.

According to China Statistical Yearbook, the average growth rate of per pension fund from 2000 to 2013 is 12.88%, which is equal to 90% of the average growth rate of payment base.

The proportion of retirement is mainly used to judge whether the pressure of employee raising retirement is alleviated. The decreasing retirement proportion refers to that employee population is relatively increased and the retirement population is relatively decreased. Then the pension fund is relatively increased while the fund expenditure is relatively decreased, then financial operation is being improved. Through reporting the changing trend of pension fund balance, the financial operation of pension fund is judged to whether improved or not.

It refers that the point that current deficit secondly appears. In various situations, the time point that pension fund deficit appears is in the year of 2023, but the second time point that deficit appears is different.

Reporting 50% is to analyze when the fertility willingness is at a moderate level, how the financial operation of pension fund changes.

Reporting 13% is to compare with the prediction results of “one-child” policy, which facilitates to compare the effects of these two policies.

References

Anderson G, Hussey P (2000) Population aging: a comparison among industrialized countries. Health Aff 19(3):191–203

Bakshi G, Chen Z (1994) Baby boom, population aging, and capital markets. J Bus 67(2):165–202

Blake D, Mayhew L (2006) On the sustainability of the UK state pension system in the light of population ageing and declining fertility. Econ J 116(512):286–305

Cai F (2013). The path choice of fertility policy adjustment. Modern Talent (6):34–36.

Castles F (2003) The world turned upside down: below replacement fertility, changing preferences and family-friendly public policy in 21 OECD countries. J European Social Policy 13(3):209–227

Chen Q & Song Z (2013). How the urbanization deal with population aging— From the perspective of fluctuation of urban and rural population and pension fund balance. Financ Res (6):1–15.

Chesnais J (1996) Fertility, family, and social policy in contemporary Western Europe. Popul Dev Rev 22(4):729–739

Futagami K, Nakajima T (2002) Population aging and economic growth. J Macroecon 23(1):31–44

Guo Z (2014). Research on population simulation method of fertility policies adjustment. Chinese Population Science (2):2–12.

Lee R, Miller T (1990) Population growth, externalities to childbearing, and fertility policy in developing countries. The World Bank Economic Review 4(1):275–304

Luo Z (2015). The impact of fertility policies adjustment on intergeneration balance of pension fund for Chinese enterprise employee. J Guangxi University of Finance and Economics, (3):94–99.

Peng X & Hu Z (2011). The population aging from the perspective of public policy. Chinese Social Science (3):121–138.

Qiao X (2015). The choice of fertility policy from the perspective of operation effort of selective two-child. Chinese Population Science (2):26–33.

Shi Z & Yang Y (2014). The fertility willingness and behavior of families that satisfy the selective two-child policy. Popul Res (5):27–40.

Sun B, Dong K & Tang Y (2011). Research on the impact of fertility policy adjustment on pension fund gap. Popul Econ (2):101–107.

Tian X Wang J & Li W (2005). Soft landing: The rational choice of Chinese population development strategy. Social Science Front (2):237–241.

Wang W (2010). Saving and growth effect of family planning: Theory and empirical analysis of China. Economic Research (10):64–77.

Yu H & Zeng Y (2015). Retirement age, fertility policy and the sustainability of Chinese pension fund. Financial Research (6):46–57.

Zeng Y (2007) Options for fertility policy transition in China. Popul Dev Rev 33(2):215–246

Zeng Y (2006). The necessity and feasibility of soft landing of two-child policy. Chinese social science (2):93–109.

Zeng, Y, Ren, C & Liu Q. (2015). Crack the payment crisis of pension fund: Is the selective two-child policy effective—take the urban employees’ basic pension fund as the example. Financial Research (1):21–34.

Zhang L, & Wang G. (2014). The population target of selective two-child policy and related issues. Sociological Research (1):25–39.

Zhang S Wang L & Zhang W (2010). Research on the impact of population structure change on basic pension fund gap—take Shanxi Province as example, Forecast, (2):37–41.

Zhang X Huang C & Zhang Q Chen S & Fan Q. (2016). The comparison between selective two-child policy and universal two-child policy and recommendation. Population Research (1):87–97.

Acknowledgements

My deepest gratitude goes first and foremost to peer reviewers; thank you for the constructive comments which help the author made the paper more perfect. Second, I would like to express my heartfelt gratitude to Prof. Yu Hong, from whom the author has received valuable comments. Last, my thanks would go to my father and my mother for their loving considerations and great confidence in me all through these years. All the errors remaining are the author’s.

Funding

This paper is sponsored by the National Social Sciences Foundation Program, An Evaluation of the Impact of China’s Family Planning Policy Adjustment on the Sustainability of the Social Security Fund and A Study of the Relevant Countermeasures (Grant No. 15XRK005, chaired by: Zeng Yi).

Author information

Authors and Affiliations

Contributions

All of the authors contribute equally. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Zeng, Y., Zhang, X. & Liu, L. From “selective two-child policy” to universal two-child policy: will the payment crisis of China’s pension system be solved?. China Financ. and Econ. Rev. 5, 14 (2017). https://doi.org/10.1186/s40589-017-0053-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1186/s40589-017-0053-3