Abstract

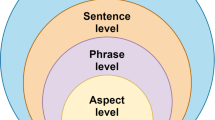

From the cross perspective of media emotion and multilayer network correlation, this paper uses big data technology to mine the data of news reports about bank liquidity, constructs a bank liquidity multilayer network including different media emotional layers, and then analyzes the correlation characteristics of interbank liquidity risk. The main conclusions are as follows: there are banks with higher strength and activity in the bank liquidity multilayer network. These systemically important banks are large state-owned banks and joint-stock commercial banks with large assets. However, among systemically important banks based on strength, large state-owned banks are dominant, and when based on activity, joint-stock commercial banks have more significant influence. The interlayer correlation of the bank liquidity multilayer network is high, and the importance of banks is relatively consistent in different layers. A bank liquidity multilayer network has the characteristics of a small world network with smaller average path length and larger clustering coefficient. The interlayer similarity of the bank liquidity multilayer network is low, and the substitution is poor between positive media emotional network layer and negative media emotional network layer.

Graphic abstract

Similar content being viewed by others

Notes

In this paper, mixed media emotional network refers to the bank liquidity network that is composed of positive and negative media emotion without considering stratification. The media emotion subnetworks include positive media emotional network and negative media emotional network, which together constitute a bank liquidity multilayer network.

It should be noted that according to Kolmogorov Smirnov (KS) statistics, the tail distribution of bank co-occurrence strength does not meet the exponential distribution. Therefore, this paper only presents the fitting results of Weibull distribution in Appendix C.

This article only shows the plots of the statistic KS with respect to the truncated value (bank co-occurrence number)\({_{_{trun}}}\) for Weibull distribution in mixed media emotional network. The situation in positive media emotional network and negative media emotional network is similar to that in mixed media emotional network.

References

S. Langfield, K. Soramäki, Comput. Econ. 47, 3 (2016)

S. Li, J. Li, Eur. Phys. J. B 89, 116 (2016)

F. Blasques, F. Bräuning, I. Van Lelyveld, J. Econ. Dyn. Control 90, 310 (2018)

T.C. Silva, M. da Silva Alexandre, B.M. Tabak, J. Financ. Stabil. 38, 98 (2018)

F. Castiglionesi, M. Eboli, Rev. Financ. 22, 1291 (2018)

K.J. Mitchener, G. Richardson, J. Polit. Econ. 127, 465 (2019)

C. Brunetti, J.H. Harris, S. Mankad et al., J. Financ. Econ. 133, 520 (2019)

G. Ferrara, S. Langfield, Z. Liu et al., Quant. Financ. 19, 1779 (2019)

A. Liu, M. Paddrik, S.Y. Yang et al., J. Bank. Financ. 112, 105191 (2020)

M. Boss, H. Elsinger, M. Summer et al., Quant. Financ. 4, 677 (2004)

T. Silva, M. Silva, B. Tabak, Research Department Technical Report, No. 401, (2015)

K. Soramäki, M.L. Bech, J. Arnold et al., Phys. A Stat. Mech. Appl. 379, 317 (2007)

M. Zanin, D. Papo, P.A. Sousa et al., Phys. Rep. 635, 1 (2016)

D. Chong, L. Li, H. Wu et al., J. Ind. Integrat. Manag. 3, 1850007 (2018)

P. Cerchiello, P. Giudici, Universita di Pavia Department of Economics and Management Report, No. 086 (2014)

C. Paola, G. Paolo, N. Giancarlo, Neurocomputing 264, 50 (2017)

X. Fan, Y. Wang, D. Wang, Pac. Basin Financ. J. (2020). https://doi.org/10.1016/j.pacfin.2020.101322

S. Langfield, Z. Liu, T. Ota, J. Bank. Financ. 45, 288 (2014)

L. Bargigli, D.G. Iasio, L. Infante et al., Quant. Financ. 15, 673 (2015)

S. Martinez-Jaramillo, B. Alexandrova-Kabadjova, B. Bravo-Benitez et al., J. Econ. Dyn. Control 40, 242 (2014)

S. Poledna, J.L. Molina-Borboa, S. Martínez-Jaramillo et al., J. Financ. Stabil. 20, 70 (2015)

I. Aldasoro, I. Alves, J. Financ. Stabil. 35, 17 (2016)

R. Burkholz, M.V. Leduc, A. Garas et al., Phys. D 323, 64 (2016)

C. Kok, M. Montagna, European Central Bank Working Papers, No. 1944, (2016)

A.C. Hüser, G. Hałaj, C. Kok et al., J. Financ. Stabil. 38, 81 (2018)

S. Rönnqvist, P. Sarlin, Quant. Financ. 15, 1619 (2015)

Y. Shen, S. Li, X. Ye et al., J. Converg. Inf. Technol. 5, 135 (2010)

T. Forss, P. Sarlin, J. Netw. Theory Financ. 4, 65 (2018)

S. Boccaletti, G. Bianconi, R. Criado et al., Phys. Rep. 544, 1 (2014)

M.E.J. Newman, Phys. Rev. E 64, 016132 (2001)

A. Barrat, M. Barthelemy, R. Pastor-Satorras et al., Proc. Natl. Acad. 101, 3747 (2003)

A.D. Broido, A. Clauset, Nat. Commun. 10, 1 (2019)

Z.Q. Jiang, W.J. Xie, M.X. Li et al., Proc. Natl. Acad. Sci. 110, 1600 (2013)

Z.Q. Jiang, W.J. Xie, W.X. Zhou et al., Rep. Prog. Phys. 82, 125901 (2019)

S. Battiston, M. Puliga, R. Kaushik et al., Sci. Rep. 2, 541 (2012)

V. Nicosia, V. Latora, Phys. Rev. E Stat. Nonlinear Soft Matter Phys. 92, 032805 (2015)

E.W. Dijkstra, Numer. Math. 1, 269 (1958)

M.P. Mcassey, F. Bijma, Netw. Sci. 3, 183 (2015)

R. Albert, A.L. Barabási, Rev. Mod. Phys. 74, 1 (2002)

D. Ding, L. Han, L. Yin, Quant. Financ. 17, 9 (2017)

R. Criado, J. Flores, A.G.D. Amo, Int. J. Comput. Math. 89, 3 (2012)

Acknowledgements

This work was supported by the National Natural Science Foundation of China (Grant numbers 71671037, 71971111, 71501094 and 71871115), Humanities and Social Science Planning Foundation of the Ministry of Education of China (Grant numbers 17YJC630128 and 19YJAZH086), the Key Project of Philosophy and Social Science Research in Colleges and Universities of Jiangsu Province (Grant numbers 2018SJZDI046 and 2018SJZDI063), the Outstanding Innovation Team of Philosophy and Social Science Research in Colleges and Universities of Jiangsu Province (Grant number 2017ZSTD005), Postgraduate Research& Practice Innovation Program of Jiangsu Province (Grant number KYCX19_0130), and Scientific Research Foundation of Graduate School of Southeast University (Grant number YBPY1942).

Author information

Authors and Affiliations

Contributions

LW: conceptualization, methodology, calculation and analysis. WW and WY: writing-original draft preparation. HW: writing-revised draft preparation. SL: supervision. LW, WW, WY and HW contributed equally to this work. They are co-first authors.

Corresponding author

Ethics declarations

Competing interests

The authors declare that they have no competing interests.

Rights and permissions

About this article

Cite this article

Wang, L., Li, S., Wang, W. et al. A bank liquidity multilayer network based on media emotion. Eur. Phys. J. B 94, 45 (2021). https://doi.org/10.1140/epjb/s10051-020-00017-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1140/epjb/s10051-020-00017-3