Abstract

This note examines recent evidence on the convergence of per capita incomes in Central and Eastern Europe. The motivation for revisiting this topic is a revival of interest among policymakers in speeding up the convergence process, after it apparently stalled during the financial crisis of 2008–2012 and the subsequent slow recovery. There are two main findings. First, the choice of benchmarks can make a significant difference for assessments of convergence. Most studies seem to ignore this “fine print” of data. Second, despite disappointments, the goal of convergence remains a useful anchor for economic policy in CEE. Going forward, it would be important to recognise that convergence is a slow process, but nevertheless requires sustained reforms to avoid prolonged periods of stagnation or pronounced booms and busts.

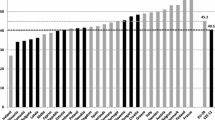

Sources: IMF, World Economic Outlook; author’s calculations

Sources: IMF, World Economic Outlook, October 2017; author’s calculations

Sources: IMF, World Economic Outlook, 2017; author’s calculations

Sources: IMF, World Economic Outlook, 2017; author’s calculations

Sources: IMF, World Economic Outlook; author’s calculations

Sources: ECB; Datastream

Similar content being viewed by others

Notes

Social psychologists have well documented the notion of “illusory superiority”, a tendency of individuals to overestimate their capabilities and performance (see e.g. Gilovich 1991). This tendency is also known as the Lake Wobegon effect, named after a fictional town from a long-running radio broadcast Prairie Home Companion “where all the women are strong, all the men are good-looking, and all the children are above average” (Keillor 1985).

Calculated as τ = − ln(0.5)/β.

References

Barro, R., and X. Sala-í-Martin. 1992. Convergence. Journal of Political Economy 100: 223–251.

Baumol, W. 1986. Productivity, convergence and welfare: What the long-run data show. American Economic Review 76: 1072–1085.

Borsi, M., and N. Metiu. 2013. The evolution of economic convergence in the European Union. Deutsche Bundesbank Discussion Paper, No. 28.

Dobrinsky, R., and P. Havlik. 2014. Economic convergence and structural change: The role of transition and EU accession. WIIW Research Report, No. 395, July.

European Central Bank. 2015. Real convergence in the euro area: Evidence, theory and policy implications. ECB Monthly Bulletin 5: 30–45.

Fukuyama, F. 1992. The end of history and the last man. New York, NY: Free Press.

Gilovich, Thomas. 1991. How we know what isn’t so: The fallibility of human reason in everyday life. New York, NY: Free Press.

Grieveson, R. 2016. History as a determinant of economic development: The Habsburg example, 20–26. Vienna Institute of International Economics, WIIW Monthly Report, No. 11.

Keillor, G. 1985. Lake Wobegon days. New York, NY: Viking.

Krugman, P. 1991. Increasing returns and economic geography. Journal of Political Economy 99: 483–499.

Mankiw, G., D. Romer, and D. Weil. 1992. A contribution to the empirics of economic growth. Quarterly Journal of Economics 107: 407–437.

Mihaljek, D. 2005. External balances, capital flows and monetary and exchange rate policies in central and eastern Europe. In Proceedings of the 65th Anniversary Conference of the Economics Institute Zagreb, ed. S. Švaljek, 281–314. Zagreb: Institute of Economics.

Mihaljek, D. 2006. Are the Maastricht criteria appropriate for central and eastern Europe? In Economic transition in central and eastern European countries, ed. Sima. Motamen-Samadian, 6–32. Cheltenham: Palgrave.

Podkaminer, L. 2013. Development patterns in central and eastern European countries (in the course of transition and following EU accession. WIIW Research Report, No. 388, July.

Podkaminer, L. 2017. Convergence: A long-term matter. WIIW Forecast Report, Autumn.

Rassekh, M. 1998. The convergence hypothesis: History, theory, and evidence. Open Economies Review 9: 85–105.

Romer, P. 1986. Increasing returns and long-run growth”. Journal of Political Economy 94: 1002–1037.

Schreyer, P., and F. Koechlin. 2002. Purchasing power parities—Measurement and issues. OECD Statistics Brief, No. 3, March.

Šikić, L. 2013. Long term economic convergence among ten new EU member states in the light of the economic crisis. Financial Theory and Practice 37 (4): 361–381.

Solow, R. 1956. A contribution to the theory of economic growth. Quarterly Journal of Economics 70: 65–94.

Thomsen, P. 2017. The role of governance and institutions. Speech at the IMF—Croatian National Bank conference Reaccelerating convergence in central, eastern and southeastern Europe, Dubrovnik, 11 July.

Vujčić, B. 2017. Convergence: is it here to stay? Speech at the National Bank of Poland conference on the Future of the European Economy, Warsaw, 20 October.

Wunsch, P. 2013. Is the European integration machine broken? Intereconomics 48: 72–92.

Author information

Authors and Affiliations

Corresponding author

Additional information

This note is based on my introductory remarks to the panel How much catching-up is still out there? at the 23rd Dubrovnik Economic Conference. The views expressed are those of the author and not necessarily those of the BIS. I would like to thank Paul Wachtel and participants of a seminar at Croatian National Bank for helpful comments.

Rights and permissions

About this article

Cite this article

Mihaljek, D. Convergence in Central and Eastern Europe: Can All Get to EU Average?. Comp Econ Stud 60, 217–229 (2018). https://doi.org/10.1057/s41294-018-0063-7

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41294-018-0063-7