Abstract

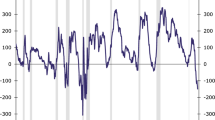

We propose an ordered probit framework to simultaneously predict the probabilities of recession, weaker recovery, and stronger recovery. Our approach helps identify (a) whether the next phase is a recession, (b) when the recovery period starts, and (c) whether the recovery would be a weak or strong one compared to historical standards. We believe our approach would help policy makers decide when would be appropriate to (1) start expansionary policies (higher probabilities of recession), (2) continue expansionary policies (higher probabilities of weaker recovery), or (3) turn to neutral/contractionary policies (higher probabilities of stronger recovery). The ordered probit model shows the probabilities of recession staying above 50 percent during all five recessions in our simulated out-of-sample analysis of 1980:Q1–2016:Q1. The probabilities of weaker recovery are consistent with actual periods of below trend growth. Based on 2016:Q1 data, the model suggests a meaningfully higher chance of continuing below trend growth. One key result is that the probability of weaker growth has been persistently higher than the other two scenarios for the past several years. These higher probabilities of weak growth are consistent with the accommodative monetary policy stance of the past eight years.

Similar content being viewed by others

Notes

With the exception of the recovery from the 1980 recession. However, since that recovery only lasted for 3 quarters, we did not consider that period as a full recovery/expansion.

It is worth noting that if we change the benchmark to the average of the last two recoveries instead of the last recovery then the conclusion does not change.

As noted, we use the NBER dates to determine periods of recession. For more detail see http://www.nber.org/cycles/cyclesmain.html.

See the next section for more detail about the threshold parameters, r 1, r 2, and r 3.

Typically, we face non-stationary issue when we deal with a time series dataset. Augmented Dickey–Fuller test results suggest that all predictors are stationary.

References

Estrella, Arturo and Mishkin Frederic S. 1998. “Predicting U.S. Recessions: Financial Variables as Leading Indicators.” The Review of Economics and Statistics, 80(1): 45–61.

Greene, William H. 2008. Econometric Analysis. Prentice Hall.

Hausman, Jerry A, Lo Andrew and Craig MacKinley A. 1992. “An Ordered Probit Analysis of Transaction Stock Prices.” Journal of Financial Economics, 31(3): 319–379.

Maddala, G. S. 1983. Limited-Dependent and Qualitative Variables in Econometrics. Cambridge University Press.

Silvia, John and Iqbal Azhar. 2015. “An Ordered Probit Approach to Predicting the Probability of Inflation/Deflation.” Business Economics, 50(1): 12–19.

Silvia, John, Iqbal Azhar, Bullard Sam, Watt Sarah and Swankoski Kaylyn. 2014. Economic and Business Forecasting: Analyzing and Interpreting Econometric Results. New York: Wiley.

Sims, Christopher. 1980. “Macroeconomics and Reality.” Econometrica, 48(1): 1–48.

Wright, Jonathan H. 2006. “The Yield Curve and Predicting Recessions.” FEDS Working Paper No. 2006-7, Federal Reserve Board.

Yang, Joey W. 2005. Predicting Stock Price Movements: An Ordered Probit Analysis on the Australian Stock Market. http://www.efmaefm.org/0EFMAMEETINGS/EFMA%20ANNUAL%20MEETINGS/2005-Milan/papers/281-yang_paper.pdf.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Iqbal, A., Silvia, J. Is Predicting Recessions Enough?. Bus Econ 51, 248–259 (2016). https://doi.org/10.1057/s11369-016-0017-x

Published:

Issue Date:

DOI: https://doi.org/10.1057/s11369-016-0017-x