Abstract

We analyze how uncertainty affects bank lending. We measure uncertainty as the cross-sectional dispersion of shocks to bank-level variables. Comparing this measure of uncertainty in banking to more traditional measures of uncertainty, we find similar but no identical patterns. Higher uncertainty in banking has negative effects on bank lending. This effect is heterogeneous across banks: lending by banks that are better capitalized and have higher liquidity buffers tends to be affected less. Also, the degree of internationalization matters, as loan supply by banks in financially open countries is affected less by uncertainty. The impact of the ownership status of the individual bank is less important, in contrast.

Similar content being viewed by others

Notes

For research on the transmission of shocks across countries through internationally active banks, see the work by Cetorelli and Goldberg (2011, 2012).

For notational convenience, we will skip the bank index i in the following.

Measures of perceived uncertainty have also been used by Bachmann, Elstner, and Sims (2013) for firms, and by Leduc and Liu (2015) for consumers.

For robustness tests, we have changed the level of aggregation for the cross-sectional dispersion measure. Instead of taking the standard deviation across all banks in one country per year, we have aggregated by banks’ size, that is, small and large banks, as well as banks’ specialization type, that is, commercial banks vs. savings banks and credit unions. Regression results using these uncertainty measures can be found in the section “Robustness 3: Alternative aggregation of the measure of uncertainty.”

The key advantage of using annual bank-level data is that these data are available for a broad set of banks and not only for stock listed banks. Even if higher frequency balance sheet data were available, we would not expect the cross-sectional measures to vary much more given that balance sheet data move more slowly than stock market data and capture changes in the longer-term business model of banks.

A table with pairwise correlations can be found in the web appendix. We use regression analysis, as correlations do not allow accounting for common trends and country-specific shocks. Absolute values of the correlations are small, suggesting that our measures pick up different features of uncertainty in banking.

The bank-level variables entering the interaction terms are demeaned. Therefore, the estimated coefficient of uncertainty in banking (UncBank) can be interpreted as the marginal effect of uncertainty in banking on bank lending for the average bank. The average bank is defined as a bank for which all bank-level variables are set to their sample means.

Results of these robustness tests can be found in the web appendix.

For the other three measures for uncertainty in banking, the numbers are as follows: dispersion of asset shocks: 11.2 percent (UncBank at minimum) and −14.8 percent (UncBank at maximum); short-term funding shocks: 7.4 and 0.5 percent; productivity shocks: 6.5 and −6.9 percent.

Ivashina and Scharfstein (2010) and Campello and others (2011) document that private firms drew extensively on committed credit lines during the recent financial crisis.

There might be cases in which the bank is identified as foreign-owned, but the largest foreign shareholder does not hold the largest amount of shares. However, we cannot identify such cases from the information in the database.

References

Bachmann, R., S. Elstner, and E.R. Sims, 2013, “Uncertainty and Economic Activity: Evidence from Business Survey Data,” American Economic Journal: Macroeconomics, Vol. 5, No. 2, pp. 217–49.

Bloom, N., 2007, “Uncertainty and the Dynamics of R&D,” American Economic Review, Vol. 97, No. 2, pp. 250–55.

Bloom, N., 2014, “Fluctuations in Uncertainty,” Journal of Economic Perspectives, Vol. 28, No. 2, pp. 153–76.

Bloom, N., S. Bond, and J. Van Reenen, 2007, “Uncertainty and Investment Dynamics,” Review of Economic Studies, Vol. 74, No. 2, pp. 391–415.

Bloom, N., M. Floetotto, N. Jamovich, I. Saporta-Eksten, and S.J. Terry, 2012, “Really Uncertain Business Cycles.” NBER Working Paper 18245 (Cambridge, MA: National Bureau of Economic Research).

Buch, C.M., C.T. Koch, and M. Koetter, 2011, “Size, Productivity, and International Banking,” Journal of International Economics, Vol. 85, No. 2, pp. 329–34.

Campello, M., E. Giambona, J.R. Graham, and C.R. Harvey, 2011, “Liquidity Management and Corporate Investment During a Financial Crisis,” Review of Financial Studies, Vol. 24, No. 6, pp. 1944–79.

Cetorelli, N. and L. Goldberg, 2011, “Global Banks and International Shock Transmission: Evidence from the Crisis,” International Monetary Fund Economic Review, Vol. 59, No. 1, pp. 41–76.

Cetorelli, N. and L. Goldberg, 2012, “Liquidity Management of U.S. Global Banks: Internal Capital Markets in the Great Recession,” Journal of International Economics, Vol. 88, No. 2, pp. 299–311.

Cetorelli, N. and L. Goldberg, 2014, “Measures of Complexity of Global Banks,” Economic Policy Review, Vol. 20, No. 2, pp. 107–126. Special Issue: Large and Complex Banks. Federal Reserve Bank of New York.

Claessens, S. and N. van Horen, 2014, “Foreign Banks: Trends and Impact,” Journal of Money, Credit and Banking, Vol. 46, No. 1, pp. 295–326.

Cornett, M., J. McNutt, H. Tehranian, and P. Strahan, 2011, “Liquidity Risk Management and Credit Supply in the Financial Crisis,” Journal of Financial Economics, Vol. 101, No. 2, pp. 297–312.

Degryse, H., M. Kim, and S. Ongena, 2009, Microeconometrics of Banking: Methods, Applications, and Results(New York: Oxford University Press).

De Haas, R. and N. van Horen, 2012, “International Shock Transmission after the Lehman Brothers Collapse: Evidence from Syndicated Lending,” American Economic Review, Vol. 102, No. 3, pp. 231–37.

De Haas, R. and N. van Horen, 2013, “Running for the Exit? International Bank Lending During a Financial Crisis,” Review of Financial Studies, Vol. 26, No. 1, pp. 244–85.

De Haas, R. and I. van Lelyveld, 2014, “Multinational Banks and the Global Financial Crisis: Weathering the Perfect Storm?,” Journal of Money, Credit and Banking, Vol. 46, No. 1, pp. 333–64. 02.

De Veirman, E. and A. Levin, 2014, “Cyclical Changes in Firm Volatility.” DNB Working Papers No. 408 (Netherlands Central Bank, Research Department).

Giannetti, M. and L. Laeven, 2012, “The Flight Home Effect: Evidence from the Syndicated Loan Market during Financial Crises,” Journal of Financial Economics, Vol. 104, No. 1, pp. 23–43.

Ivashina, V. and D. Scharfstein, 2010, “Bank Lending during the Financial Crisis of 2008,” Journal of Financial Economics, Vol. 97, No. 3, pp. 319–38.

Jurado, K., S.C. Ludvigson, and S. Ng, 2015, “Measuring Uncertainty,” American Economic Review, Vol. 105, No. 3, pp. 1177–1216.

Leduc, S. and Z. Liu, 2015, “Uncertainty Shocks are Aggregate Demand Shocks.” Federal Reserve Bank of San Francisco Working Paper No. 2012-10.

Levinsohn, J. and A. Petrin, 2003, “Estimating Production Functions Using Inputs to Control for Unobservables,” Review of Economic Studies, Vol. 70, No. 2, pp. 317–41.

Nakane, M.I. and D.B. Weintraub, 2005, “Bank Privatization and Productivity: Evidence for Brazil,” Journal of Banking & Finance, Vol. 29, No. 8–9, pp. 2259–89.

Ongena, S., J.L. Peydro, and N. van Horen, 2015, Shocks Abroad, Pain at Home? Bank-Firm Level Evidence on the International Transmission of Financial Shocks. Available at SSRN: www.ssrn.com/abstract=2294462.

Shin, H.S., 2010, Risk and Liquidity, Clarendon Lectures in Finance,(New York: Oxford University Press).

Stein, L.C.D. and E.C. Stone, 2013, The Effect of Uncertainty on Investment, Hiring, and R&D: Causal Evidence from Equity Options. Available at SSRN: www.ssrn.com/abstract=1649108.

Valencia, F., 2013, “Aggregate Uncertainty and the Supply of Credit.” IMF Working Paper 13/241 (Washington DC: International Monetary Fund).

Additional information

Supplementary information accompanies this article on the IMF Economic Review website (www.palgrave-journals.com/imfer)

*Professor Claudia M. Buch is the Deputy President of the Deutsche Bundesbank. She is responsible for the Financial Stability Department, the Statistics Department, and the Audit Department. Her fields of specialization are international finance and macroeconomics, international financial markets, financial integration, business cycles and employment volatility, international banking and foreign direct investment. Manuel Buchholz has been a doctoral researcher at the Halle Institute for Economic Research (IWH) since September 2013. He obtained an MSc in International Economics and Finance from the University of Tuebingen in 2011 and completed the Advanced Studies Program at the Kiel Institute for the World Economy (IfW) in 2012. Lena Tonzer is a post-doctoral researcher in the Financial Markets department of the Halle Institute for Economic Research (IWH) since May 2014. She studied International Economics at the University of Tuebingen before joining the doctoral program in Economics at the European University Institute (EUI) in Florence in 2010. Her research focuses on banking and sovereign debt crises, integration of financial markets, and banking regulation. This paper has been written for the conference International Banking: Microfoundations and Macroeconomic Implications, organized by the International Monetary Fund (IMF) and the Dutch National Bank (DNB). The authors would like to thank the editors Pierre-Olivier Gourinchas, Luc Laeven, and Pau Rabanal, two anonymous referees, Franziska Bremus, Christian Dreger, Jacob de Haan, Marlene Karl, Michael Koetter, Felix Noth, Katheryn Russ, Gregor von Schweinitz, Daniel Streitz, and Emmanuel de Veirman for helpful comments. They also thank Annika Bacher and Florian Hüfner for efficient research assistance. Furthermore, they thank the Bank for International Settlements for kindly providing data. Manuel Buchholz and Lena Tonzer have benefitted from funding by the IMF and the DNB.

Electronic supplementary material

Appendix A.I.

Appendix A.I.

Bank Loan Supply and Capital Buffers

In the following, we show how the response of a bank’s loan supply (relative to assets in t−1) to higher uncertainty in banking depends on its capital buffer in t−1.

If we consider φ to be time-varying, we obtain from Equation (8):

The relevant cross derivative is given by:

which is >0 if r t >0 and <0 if r t <0.

Calculating Bank Productivity

We estimate bank productivity using an empirical methodology in the spirit of Levinsohn and Petrin (2003) and applied to banks by Nakane and Weintraub (2005):

Bank output is given by y it , x it denotes the free input variables, k it the fixed input and m it the intermediate input. The error consists of an unobserved productivity term ω it and a random term η it . The approach accounts for simultaneity between productivity and the factor input choices of banks. This is achieved by introducing the intermediate input which correlates with productivity. Productivity shocks thus primarily account for supply-side factors. The output of banks is defined as the total lending volume. We choose two free input variables. The first is total long-term funding. The second accounts for bank staff and is proxied by personnel expenses. Banks have to maintain branches or subsidiaries to provide loans. These cannot be adjusted rapidly and we capture the fixed input by fixed assets. For the intermediate input good, we choose total equity.

Data Definition and Sources

The results in this paper are based on various data sources. Data at the bank level are obtained from Bankscope. Information on foreign ownership of banks comes from the database provided by Claessens and van Horen (2014). Country-level data are obtained from Bloom (2014), Datastream, the International Monetary Fund (IMF), and the Bank for International Settlements (BIS).

List of Countries

illustration

Dependent Variable

Bank Lending

Our measure for bank lending is the difference in total loans relative to total assets in t−1 (in percent). The data come from Bankscope and the variable total loans is defined as gross loans minus impaired loans.

Bank-Level Explanatory Variables

Capital/Assets

To measure capitalization, we use the Tier 1 regulatory capital relative to total assets (in percent) as obtained from Bankscope.

Committed Loans/(Committed Loans+Assets)

To control for committed loan obligations, we use committed loans relative to the sum of committed loans and total assets (in percent). Data are provided by Bankscope.

Deposits/Assets

The variable deposits/assets denotes the share of customer deposits to balance sheet total (in percent) as obtained from Bankscope.

Liquid Assets/Assets

The liquidity ratio is defined as the ratio of banks’ liquid assets, that is, the sum of trading securities, loans and advances to banks, reverse repos and cash collateral, cash and due from banks minus mandatory reserves included in these positions, relative to total assets (in percent). Data are taken from Bankscope.

Log Total Assets

To obtain a measure for bank size we use the logarithm of banks’ total assets (in thousands of USD) as obtained from Bankscope.

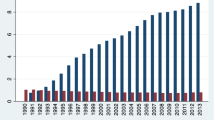

Uncertainty in Banking Measures

Total Assets

We use total assets in thousands of USD as provided by Bankscope.

Productivity

Productivity is estimated as proposed by Levinsohn and Petrin (2003). For the free input variables, we choose total long-term funding and personnel expenses. The intermediate input good is proxied by total equity and the fixed input is given by fixed assets. For the output variable, we use total loans defined as gross loans minus impaired loans. Data are in thousands of USD and obtained from Bankscope.

Profitability (RoA)

Return on assets (RoA) is the ratio of operating profits to total assets (in percent) and calculated from data available in Bankscope.

Short-Term Funding

The variable short-term funding (in thousands of USD) is obtained by taking the sum of deposits from banks, repos and cash collateral, and other deposits and short-term borrowings as provided by Bankscope.

Alternative Uncertainty Measures

Bank Stock Return Volatility

To construct a measure for bank stock return volatility, we use weekly bank price indices from Datastream. As they are not available for some countries, we resort to aggregates for the particular region. The measure for bank stock return volatility is computed as the volatility of weekly bank index returns for each year (in percent).

Firm Return Dispersion

From Bloom (2014), we take a measure to control for uncertainty in the real sector. Data come from the WRDS international equity database and are used to construct the standard deviation of quarterly returns across firms. For our analysis, we use the value for the last quarter of the respective year (in percent).

GDP Volatility

GDP volatility is computed as the three-year rolling volatility of quarterly (year-over-year) real GDP growth taken from the IMF International Financial Statistics (in percent).

Stock Market Volatility

To construct a measure for stock market volatility, we use monthly stock price indices from Datastream. We resort to monthly frequency as this is available for all countries. The stock market volatility measure is computed as the volatility of monthly stock market index returns for each year (in percent).

Internationalization

Foreign Ownership

Data on foreign ownership are taken from Claessens and van Horen (2014) and matched with bank-level information from Bankscope. The data are available for 5,324 banks in 137 countries for the period 1995–2009. We keep all banks which are located in one of our sample countries. For the years 2010-12, we project the ownership status of the year 2009 forward.

Openness

The variable openness is defined as total assets held by the banking system in reporting country j toward the rest of the world relative to nominal GDP in country j (in percent). Data on a country’s banking system’s cross-border activities come from the Locational Banking Statistics of the BIS.