Abstract

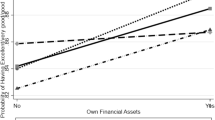

Low- and moderate-income (LMI) households need financial assets to help cope with income and expenditure shocks. Prior research identifies racial differences in wealth and wealth effects. We examined whether these gaps and effects exist for liquid financial assets. Using group invariance tests in structural equation modeling, we assessed the relationship between financial shocks and material hardship, as mediated by liquid financial assets and moderated by race/ethnicity among a sample of LMI tax filers (N = 7544). Though most study participants were employed (71%), average income was only $18,055 and average liquid financial assets was $4701. Black households had $2774 less in liquid financial assets compared to white households (p < .001) after controlling for income and other factors. Model fit for the final moderated mediation model was excellent (RMSEA = 0.026, 90% C. I. [0.020, 0.033], CFI = 0.977). The mediating effect of liquid financial assets was 10.4% for white, but only 3.6 and 4.4% for black and Latino households, respectively. That is, the proportion of the relationship between shocks and hardship mediated by liquid financial assets varied by race/ethnicity. Policies aimed at helping LMI households build emergency savings such as tax refund savings matches may be less likely to benefit black and Latino households than white households, suggesting the need for other policies to address this form of the racial wealth gap.

Similar content being viewed by others

Notes

Participants not randomly assigned (n = 192,481) had filed their taxes before the start of the experiment on January 31, 2013 or began their tax return in another software program from the sample company.

References

Abbi S. A need for product innovation to help LMI consumers manage financial emergencies. 2012. Retrieved from http://www.d2dfund.org/files/publications/A%20Need%20for%20Production%20Innovation_Jan12.pdf.

Acs G, Loprest P, Nichols A. Risk and recovery: documenting the changing risks to family incomes (brief). Washington, DC: Urban Institute; 2009. http://www.urban.org/publications/411890.html

Artiga S, Foutz J, Damico A. Health coverage by race and ethnicity: changes under ACA (Issue Brief). Menlo Park: The Henry J. Kaiser Family Foundation; 2018. http://files.kff.org/attachment/Issue-Brief-Health-Coverage-by-Race-and-Ethnicity-Changes-Under-the-ACA

Baron RM, Kenny DA. The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol. 1986;51:1173–82. https://doi.org/10.1037/0022-3514.51.6.1173.

Barth JR, Hilliard J, Jahera JS, Sun Y. Do state regulations affect payday lender concentration? J Econ Bus. 2016;84:14–29. https://doi.org/10.1016/j.jeconbus.2015.08.001.

Bayer P, Ferreira F, Ross SL. The vulnerability of minority homeowners in the housing boom and bust. Am Econ J Econ Pol. 2016;8(1):1–27. https://doi.org/10.1257/pol.20140074.

Beverly SG. Material hardship in the United States: evidence from the survey of income and program participation. Soc Work Res. 2001;25(3):143–51. https://doi.org/10.1093/swr/25.3.143.

Bollen KA. Structural equations with latent variables. New York: Wiley; 1989.

Bowen N, Guo S. Structural equation modeling. New York: The Oxford University Press; 2011.

Bower KM, Thorpe RJ, Rohde C, Gaskin DJ. The intersection of neighborhood racial segregation, poverty, and urbanicity and its impact on food store availability in the United States. Prev Med. 2014;58:33–9. https://doi.org/10.1016/j.ypmed.2013.10.010.

Carroll CD, Samwick AA. How important is precautionary saving? Rev Econ Stat. 1998;80(3):410–9. https://doi.org/10.1162/003465398557645.

Chetty R, Hendren N, Jones MR, Porter SR. Race and economic opportunity in the United States: An intergenerational perspective (No. w24441). Natl Bur Econ Res. 2018. https://doi.org/10.3386/w24441.

Collins JM, Gjertson L. Emergency savings for low-income consumers. Focus. 2013;30(1):12–7. http://irp.wisc.edu/publications/focus/pdfs/foc301c.pdf

Conley D. Being black, living in the red: race, wealth, and social policy in America. Berkeley: University of California Press; 1999.

Consumer Financial Protection Bureau. Payday loans and deposit advance products: a white paper of initial data findings (White Paper). Washington DC: Consumer Financial Protection Bureau. 2013. http://files.consumerfinance.gov/f/201304_cfpb_payday-dap-whitepaper.pdf.

Couch KA, Fairlie R. Last hired, first fired? Black-white unemployment and the business cycle. Demography. 2010;47(1):227–47. https://doi.org/10.1353/dem.0.0086.

Couch KA, Reznik GL, Iams HM, Tamborini CR. The incidence and consequences of private sector job loss in the Great Recession. Soc Secur Bull. 2018;78:31–46. https://www.ssa.gov/policy/docs/ssb/v78n1/ssb-v78n1.pdf

Deaton A. Saving and liquidity constraints. Econometrica. 1991;59:1221–48. http://www.jstor.org/stable/2938366

Despard M, Friedline T, Refior K. Can post offices increase access to financial services? A geographic investigation of financial services availability. Lawrence: University of Kansas, Center on Assets, Education, & Inclusion (AEDI); 2017a.

Despard MR, Grinstein-Weiss M, Ren C, Guo S, Raghavan R. Effects of a Tax-Time Savings Intervention on Use of Alternative Financial Services among Lower-Income Households. J Consum Aff. 2017b;51(2):355–79. https://doi.org/10.1111/joca.12138

Despard M, Guo S, Grinstein-Weiss M, Russell B, Oliphant J, de Ruyter A. The mediating role of assets in explaining hardship risk among households experiencing financial shocks. Soc Work Res. 2018. Advance online publication. https://doi.org/10.1093/swr/svy012.

Dimitrov DM. Testing for factorial invariance in the context of construct validation. Meas Eval Couns Dev. 2010;43:121–49. https://doi.org/10.1177/0748175610373459.

Edin K, Greene SS, Halpern-Meekin S, Levin E. The Rainy Day EITC: a reform to boost financial security by helping low-wage workers build emergency savings (Federal Policy Proposal). Washington, DC: Corporation for Enterprise Development; 2015. http://cfed.org/assets/pdfs/The_Rainy_Day_EITC.pdf.

Elliott W, Friedline T, Nam I. Probability of living through a period of economic instability. Child Youth Serv Rev. 2013;35(3):453–60. https://doi.org/10.1016/j.childyouth.2012.12.014.

FINRA Investor Education Foundation. Financial capability in the United States 2016. 2016. http://www.usfinancialcapability.org/downloads/NFCS_2015_Report_Natl_Findings.pdf.

Fowler CS, Cover JK, Kleit RG. The geography of fringe banking. J Reg Sci. 2014;54(4):688–710. https://doi.org/10.1111/jors.12144.

Friedline T, Masa RD, Chowa GA. Transforming wealth: using the inverse hyperbolic sine (IHS) and splines to predict youth’s math achievement. Soc Sci Res. 2015;49:264–87. https://doi.org/10.1016/j.ssresearch.2014.08.018.

Gjertson L. Emergency saving and household hardship. J Fam Econ Iss. 2016;37:1–17. https://doi.org/10.1007/s10834-014-9434-z.

Goldscheider FK, Goldscheider C. The intergenerational flow of income: Family structure and the status of black Americans. J Marriage Fam. 1991;53:499–508. http://www.jstor.org/stable/352915

Grinstein-Weiss M, Perantie DC, Russell BD, Comer K, Taylor SH, Luo L, Key C, Ariely D. Refund to Savings 2013: Comprehensive report on a large-scale tax-time saving program (CSD Research Report 15-06). St. Louis, MO: Center for Social Development, Washington University in St. Louis. 2015. http://csd.wustl.edu/Publications/Documents/RR15-06.pdf. Accessed 13 July 2016.

Grinstein-Weiss M, Russell B, Tucker B, Comer K. Lack of emergency savings puts American households at risk: Evidence from the Refund to Savings Initiative (CSD Research Brief 14- 13). St. Louis, MO: Washington University, Center for Social Development. 2014. http://csd.wustl.edu/Publications/Documents/RB14-13.pdf. Accessed 21 July 2016.

Guo S, Fraser WM. Propensity score analysis: statistical methods and applications. 2nd ed. Thousand Oaks: Sage Publications; 2015.

Hanson A, Santas M. Field experiment tests for discrimination against Hispanics in the US rental housing market. South Econ J. 2014;81(1):135–67. https://doi.org/10.4284/0038-4038-2012.231.

Haveman R, Wolff EN. The concept and measurement of asset poverty: levels, trends and composition for the U.S., 1983–2001. J Econ Inequal. 2005;2(2):145–69. https://doi.org/10.1007/s10888-005-4387-y.

Hayes AF. Introduction to mediation, moderation, and conditional process analysis: a regression-based approach. New York: The Guilford Press; 2013.

Heflin C. Family instability and material hardship: results from the 2008 Survey of Income and Program Participation. J Fam Econ Iss. 2016;37(3):359–72. https://doi.org/10.1007/s10834-016-9503-6.

Heflin CM, Pattillo M. Kin effects on black-white account and homeownership. Sociol Inq. 2002;72(2):220–39. https://doi.org/10.1111/1475-682X.00014.

Hegerty SW. Commercial bank locations and “banking deserts”: a statistical analysis of Milwaukee and Buffalo. Ann Reg Sci. 2016;56(1):253–71. https://doi.org/10.1007/s00168-015-0736-3.

Hoe SL. Issues and procedures in adopting structural equation modeling technique. J Appl Quant Methods. 2008;3:76–83. http://jaqm.ro/issues/volume-3,issue-1/pdfs/hoe.pdf. Accessed 2 Mar 2016.

Hoyle RH. The structural equation modeling approach: Basic concepts and fundamental issues. In: Hoyle RH, editor. Structural equation modeling: concepts, issues, and applications. Thousand Oaks: Sage Publications; 1995. p. 1–15.

Hu LT, Bentler PM. Fit indices in covariance structure modeling: sensitivity to underparameterized model misspecification. Psychol Methods. 1998;3:424–53. https://doi.org/10.1037/1082-989X.3.4.424.

Jung Y, Lee Y, MacEachern SN. Efficient quantile regression for heteroscedastic models. J Stat Comput Simul. 2015;85(13):2548–68. https://doi.org/10.1080/00949655.2014.967244.

Keating ER. The relationship between asset holdings and material hardship following economic shocks in a household. Unpublished thesis Georgetown University, Washington, DC. 2012. Retrieved from https://repository.library.georgetown.edu/bitstream/handle/10822/557795/Keating_georgetown_0076M_11652.pdf?sequence=1&isAllowed=y.

Keister LA. Race and wealth inequality: the impact of racial differences in asset ownership on the distribution of household wealth. Soc Sci Res. 2000;29(4):477–502. https://doi.org/10.1006/ssre.2000.0677.

Kenny DA. Measuring model fit. 2014. Retrieved from http://davidakenny.net/cm/fit.htm.

Kerbo HR. Social stratification and inequality: class conflict in historical and comparative perspective. 3rd ed. New York: McGraw-Hill; 1996.

Larrimore J, Durante A, Kreiss K, Park C, Sahm C. Report on the economic well-being of U.S. Households in 2017 (Report for the Board of Governors of the Federal Reserve System). Washington, DC: Board of Governors of the Federal Reserve System. 2018. https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf.

Lim Y, Livermore M, Davis BC. Material hardship among banked and unbanked earned income tax credit-eligible families. Journal of Poverty. 2010;14(3):266–84. https://doi.org/10.1080/10875549.

Lui M. The color of wealth: the story behind the U.S. racial wealth divide. The New Press; 2006.

Manturuk K, Quercia R. North Carolina consumers after payday lending: attitudes and experiences with credit options. Chapel Hill: Center for Community Capital, University of North Carolina at Chapel Hill; 2007. Retrieved July 7, 2016 from http://ccc.unc.edu/contentitems/orth-carolina-consumers-after-payday-lending-attitudes-and-experiences-with-credit-options/

Manturuk K, Riley S, Ratcliffe J. Perception vs. reality: The relationship between low-income homeownership, perceived financial stress, and financial hardship. Soc Sci Res. 2012;41:276–86. https://doi.org/10.1016/j.ssresearch.2011.11.006.

Martin LL. Black asset ownership: does ethnicity matter? Soc Sci Res. 2009;38:312–23. https://doi.org/10.1016/j.ssresearch.2008.11.003.

Mayer S, Jencks C. Poverty and the distribution of material hardship. J Hum Resour. 1989;24(1):88–114. http://www.jstor.org/stable/145934

McKernan SM, Ratcliffe C, Vinopal K. Do assets help families cope with adverse events? (Perspectives on Low-Income Working Families Brief No. 10, Urban Institute). 2009. Retrieved July 7, 2016 from the Urban Institute website http://www.urban.org/research/publication/do-assets-help-families-cope-adverse-events

Melzer BT. The real costs of credit access: evidence from the payday lending market. Q J Econ. 2011;126(1):517–55. https://doi.org/10.1093/qje/qjq009.

Moller S, Huber E, Stephens JD, Bradley D, Nielsen F. Determinants of relative poverty in advanced capitalist democracies. Am Sociol Rev. 2003;68:22–51. http://www.jstor.org/stable/3088901

Morduch J, Schneider R. The financial diaries: how Americans cope in a world of uncertainty. Princeton: Princeton University Press; 2017.

Mplus. Chi-square difference testing using the Satorra-Bentler scaled chi-square. 2015. Available from https://www.statmodel.com/chidiff.shtml.

Muller D, Judd CM, Yzerbyt VY. When moderation is mediated and mediation is moderated. J Pers Soc Psychol. 2005;89:852–63. https://doi.org/10.1037/0022-3514.89.6.852.

Muthén LK, Muthén BO. Mplus user’s guide. 7th ed. Los Angeles: Muthén & Muthén; 1998–2012.

O’Brien RL. Depleting capital? Race, wealth and informal financial assistance. Social Forces. 2012;91(2):375–96. https://doi.org/10.1093/sf/sos132.

Oliver ML, Shapiro TM. Black wealth, white wealth: a new perspective on racial inequality: Taylor & Francis; 2006.

Ouellette T, Burstein N, Long D, Beecroft E. Measures of material hardship: final report. Washington, DC: U.S. Department of Health and Human Services, Office of the Secretary, Office of the Assistant Secretary for Planning and Evaluation; 2004. https://aspe.hhs.gov/system/files/pdf/73366/report.pdf

Pence KM. The role of wealth transformations: an application to estimating the effect of tax incentives on saving. B E J Econom Anal Policy. 2006;5(1):1–24. https://doi.org/10.1515/1538-0645.1430.

Pew Charitable Trusts. Payday lending in america: who borrows, where they borrow, and why (Payday Lending in America). Washington, DC. 2012. Retrieved July 23, 2016 from http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2012/pewpaydaylendingreportpdf.pdf.

Pew Charitable Trusts. How do families cope with financial shocks? (Issue Brief). Washington, DC. 2015a. Retrieved July 23, 2016 from http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2015/10/the-role-of-emergency-savings-in-family-financial-security-how-do-families.

Pew Charitable Trusts. What resources do families have for financial emergencies? (Issue Brief). Washington, D.C. 2015b. Retrieved July 7, 2016 from http://www.pewtrusts.org/~/media/assets/2015/11/emergencysavingsreportnov2015.pdf.

Pew Charitable Trusts. Financial shocks put retirement security at risk (Research Brief). Washington, DC. 2017. Retrieved on June 1, 2018 from http://www.pewtrusts.org/~/media/assets/2017/10/rs_financial_shocks_put_retirement_security_at_risk.pdf.

Pilkauskas NV, Currie J, Garfinkel I. The great recession, public transfers, and material hardship. Soc Serv Rev. 2012;86(3):401–27. https://doi.org/10.1086/667993.

Prager RA. Determinants of the locations of alternative financial service providers. Rev Ind Organ. 2014;45(1):21–38. https://doi.org/10.1007/s11151-014-9421-4.

Reid CK, Bocian D, Li W, Quercia RG. Revisiting the subprime crisis: the dual mortgage market and mortgage defaults by race and ethnicity. J Urban Aff. 2016:1–19. https://doi.org/10.1080/07352166.2016.1255529.

Roll S, Despard M, Taylor S, Bufe S, Grinstein-Weiss M. The front lines of financial defense: How low- and moderate-income households manage financial emergencies. Manuscript submitted for publication. 2018.

Rothwell DW, Han CK. Exploring the relationship between assets and family stress among low-income families. Fam Relat. 2010;59(4):396–407. https://doi.org/10.1111/j.1741-3729.2010.00611.x.

Russo CA, Andrews RM, Coffey RM. Racial and ethnic disparities in potentially preventable hospitalizations, 2003 (Statistical Brief #10). Washington, DC: U.S. Agency for Healthcare Research and Quality. 2006. https://www.hcup-us.ahrq.gov/reports/statbriefs/sb10.pdf.

Schreiber JB, Nora A, Stage FK, Barlow EA, King J. Reporting structural equation modeling and confirmatory factor analysis results: a review. J Educ Res. 2006;99:323–38. https://doi.org/10.3200/JOER.99.6.323-338.

Semega JL, Fontenot KR, Kollar MA. Income and poverty in the United States: 2016 (Current Population Reports). Washington, DC: U.S. Department of Commerce, Economic and Statistics Administration, Census Bureau. 2017. https://www.census.gov/content/dam/Census/library/publications/2017/demo/P60-259.pdf.

Shapiro TM. Race, homeownership and wealth. Wash U J L & Pol'y. 2006;20:53.

Shapiro T, Meschede T, Osoro S. The roots of the widening racial wealth gap: explaining the black-white economic divide. Institute on Assets and Social Policy, 1–8. 2013. https://iasp.brandeis.edu/pdfs/Author/shapiro-thomas-m/racialwealthgapbrief.pdf.

Short KS. Material and financial hardship and income-based poverty measures in the USA. Journal of Social Policy. 2005;34(01):21–38. https://doi.org/10.1017/S0047279404008244.

Sobel ME. Some new results on indirect effects and their standard errors in covariance structure model. In: Tuma NB, editor. Sociological Methodology. San Francisco: Jossey-Bass; 1986. p. 159–86.

Sullivan JX, Turner L, Danziger S. The relationship between income and material hardship. Journal of Policy Analysis and Management. 2008;27(1):63–81. https://doi.org/10.1002/pam.20307.

Temkin K, Sawyer N. Analysis of alternative financial service providers. Washington, DC: The Urban Institute. 2004. Retrieved from. http://www.urban.org/sites/default/files/alfresco/publication-pdfs/410935-Analysis-of-Alternative-Financial-Service-Providers.PDF.

Turner MA, Santos R, Levy DK, Wissoker D, Aranda C, Pitingolo R, The Urban Institute. Housing discrimination against racial and ethnic minorities 2012: executive summary. 2013. Retrieved from http://www.huduser.gov/portal/Publications/pdf/HUD-514_HDS2012_execsumm.pdf.

United States Commission on Civil Rights. Targeted fines and fees against communities of color: civil rights and constitutional implications (Briefing Report). 2017. http://www.usccr.gov/pubs/Statutory_Enforcement_Report2017.pdf.

United States Department of Labor. Labor force statistics from the current population study—unemployed persons by age, sex, race, Hispanic or Latino ethnicity, marital status, and duration of unemployment. 2018. https://www.bls.gov/cps/cpsaat31.htm.

West SG, Taylor AB, Wu W. Model fit and model selection in structural equation modeling. In: Hoyle RH, editor. Handbook of structural equation modeling. New York: Guilford Press; 2012. p. 209–31.

Wikoff N, Huang J, Kim Y, Sherraden M. Material hardship and 529 college savings plan participation: the mitigating effects of Child Development Accounts. Soc Sci Res. 2015;50:189–202. https://doi.org/10.1016/j.ssresearch.2014.11.017.

Acknowledgements

Washington University in St. Louis gratefully acknowledges the funders who made the Refund to Savings Initiative possible: the Ford Foundation; the Annie E. Casey Foundation; Intuit, Inc.; the Intuit Financial Freedom Foundation; the Smith Richardson Foundation; and JPMorgan Chase & Co.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Rights and permissions

About this article

Cite this article

Despard, M., Grinstein-Weiss, M., Guo, S. et al. Financial Shocks, Liquid Assets, and Material Hardship in Low- and Moderate-Income Households: Differences by Race. J Econ Race Policy 1, 205–216 (2018). https://doi.org/10.1007/s41996-018-0011-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41996-018-0011-y