Abstract

In this paper, focusing on the policy initiatives between the central government and local governments, we analyze the privatization policies in a mixed oligopoly model composed of two regions. The main results are as follows. First, in the case of centralized regime, partial privatization is socially desirable if the substitutability between goods is relatively high; if not, full nationalization is socially desirable. In the case of decentralized regime, local governments take partial privatization in the equilibrium irrespective of substitutability. However, the local governments tend to lower the partial privatization rate of public firms as the substitutability between goods increases. Second, the central government is more (resp. less) aggressive for privatization than the local governments when the substitutability is higher (resp. lower) than the critical level. This shows that the argument in Han and Ogawa (FinanzArchiv Public Financ Anal 64(3):352–363, 2008) is justifiable under certain conditions. Finally, decentralization brings forth an increase (resp. a decrease) in market size and consumer surplus if the substitutability is higher (resp. lower) than the critical level. However, the social welfare necessarily decreases by the decentralization for any levels of substitutability.

Similar content being viewed by others

Notes

Many previous studies on mixed oligopoly have considered that public firms are owned by central governments which maximize the social welfare of their countries. But there are many sectors where firms are owned by local governments that are concerned only for the social welfare of their regions: the broadcasting market (Bel and Domènech 2009), hospital markets (Aiura 2013), the university system (De Fraja and Valbonesi 2012), the development of public facilities (Takahashi 2004), etc.

Because \(\frac{{\partial^{2} W_{H} }}{{\partial \theta^{2} }} = - \frac{{48a^{2} b\left\{ {15(\theta - 6) + 2b(84 + 55\theta ) + b^{2} (174 + 115\theta ) + 4b^{3} (6 + 5\theta )} \right\}}}{{\left\{ {5(\theta - 6) + b(5\theta - 12)} \right\}^{4} }} < 0\), the second order condition is also satisfied if \({{(\sqrt {601} - 19)} \mathord{\left/ {\vphantom {{(\sqrt {601} - 19)} 8}} \right. \kern-0pt} 8} < b \le 1\).

We set a = 50, θk = 0.5.

References

Aiura H (2013) Inter-regional competition and quality in hospital care. Eur J Health Econ 14:515–526

Bárcena-Ruiz JC, Garzón MB (2005) International trade and strategic privatization. Rev Dev Econ 9:502–513

Bárcena-Ruiz JC, Sedano M (2011) Endogenous timing in a mixed duopoly: weighted welfare and price competition. Jpn Econ Rev 62(4):485–503

Bel G, Domènech L (2009) What influences advertising price in television channels?: an empirical analysis on the Spanish market. J Media Econ 22:164–183

De Fraja G, Delbono F (1989) Alternative strategies of a public enterprise in oligopoly. Oxf Econ Pap 41:302–311

De Fraja G, Valbonesi P (2012) The design of university system. J Public Econ 96:317–330

Fjell K, Heywood JS (2002) Public Stackelberg leadership in a mixed oligopoly with foreign firms. Aust Econ Pap 41:267–281

Fjell K, Pal D (1996) A mixed oligopoly in the presence of foreign private firms. Can J Econ 29:737–747

Fujiwara K (2006) Trade patterns in an international mixed oligopoly. Econ Bull 6(9):1–7

Han L (2015) Excessive privatization in an international mixed oligopoly: normal view. Theor Econ Lett 5:647–650

Han L, Ogawa H (2008) Economic integration and strategic privatization in an International mixed oligopoly. FinanzArchiv Public Financ Anal 64(3):352–363

Matsumura T (1998) Partial privatization in mixed duopoly. J Public Econ 70:473–483

Matsumura T, Okamura M (2015) Competition and privatization policies revisited: the payoff interdependence approach. J Econ 116:137–150

Oates WE (1972) Fiscal federalism. Harcourt Brace Jovanovich Inc, New York

Ohnishi K (2010) Domestic and international mixed models with price competition. Int Rev Econ 57(1):1–7

Pal D, White MD (1998) Mixed oligopoly, privatization, and strategic trade policy. South Econ J 65:264–281

Sepahvand H, Cornes RC (2007) Ownership versus timing of the game. Aust Econ Pap 46:305–314

Takahashi T (2004) Spatial competition of governments in the investment on public facilities. Reg Sci Urban Econ 34:455–488

Waner M, Hefetz A (2003) Rural-urban differences in privatization: limits to the competitive state. Environ Plan C Gov Policy 21:703–718

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

With respect to the slope function in Eq. (21), we have

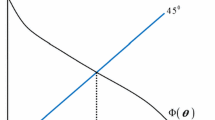

In addition, the partial derivative of the slope function with respect to b, i.e., \({{\partial r_{m}^{\prime } (\theta_{k} ,0)} \mathord{\left/ {\vphantom {{\partial r_{m}^{\prime } (\theta_{k} ,0)} {\partial b}}} \right. \kern-0pt} {\partial b}}\), is negative as in Fig. 3 in “Appendix”. This implies that the government strategies with respect to the privatization rate change from strategic complements to strategic substitute as b increases from a lower level.

About this article

Cite this article

Lee, W., Lee, KD. Strategic behaviors on privatization between regions. Asia-Pac J Reg Sci 2, 227–242 (2018). https://doi.org/10.1007/s41685-018-0069-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41685-018-0069-1