Abstract

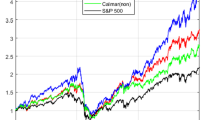

The Merton’s framework is used for finding the solution of a portfolio problem. Then the quantities in this solution are estimated via a cointegrated vector autoregressive model for the mean part and a multivariate Garch for the volatility part. Finally a thousand is simulated by using the estimation before in a Euler scheme for the prices.

Similar content being viewed by others

References

Allais M (1953) Le comportement de l'homme rationnel devant le risque: critique des postulats et axiomes de l'école Américaine. Econometrica 21:503–546

Bauwens L, Laurent S, Rombouts J (2004) Multivariate GARCH models: a survey. J Appl Econ 21:79–109

Bollerslev T, Engle RF, Nelson DB (1994) ARCH model, handbook of econometrics, vol IV. Elsevier Science, Amsterdam, pp 2959–3038

Brandt MW, Goyal A, Santa-Clara P, Stroud JR (2005) A simulation approach to dynamic portfolio choice with an application to learn about return predictability. Rev Financ Stud 18(3):831

Campbell JY, Chan YL, Viceira LM (2003) A multivariate model of strategic asset allocation. J Financ Econ 67(1):41–80

Campbella JY, Chacko G, Rodriguez J, Viceira LM (2004) Strategic asset allocation in a continuous-time VAR model. J Econ Dyn Control 28:2195–2214

Datastream Global Equity Indices (2008) User guide, issue 5. Thomson Reuters Ltd, Toronto

Duffie D (2001) Dynamic asset pricing theory. Princeton University Press, Princeton

Ellsberg D (1961) Risk, ambiguity, and the savage axioms. Quarterly J Econ 75(4):643–669

Engle R, Kroner K (1995) Multivariate simultaneous generalized ARCH. Econom Theory 11(1):122–150

Engle RF, Shephard N, Sheppard K (2008) Fitting vast dimensional time-varying covariance models, discussion paper series. University of Oxford, Oxford

Francq C, Zakoian JM (2010) GARCH models. Wiley, New York, pp 223–227

Hamilton JD (1994) Time series analysis. Princeton University Press, Princeton

Johansen S (1995) Likelihood-based inference in cointegrated vector autoregressive models. Oxford University Press, Oxford

Johansen S, Juselius K (1990) Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf Bull Econ Stat 52:169–210

Kloeden PE, Platen E (1992) Numerical solution of stochastic differential equation through computer experiments. Springer, New York

Lutkepohl H (2007) New introduction to multiple time series analysis. Springer, Berlin

Merton R (1973) An intertemporal capital asset pricing model. Econometrica 41(5):867–887

Milstein GN, Tretyakov MV (2004) Stochastic numerics for mathematical physics. Springer, Berlin

Oskendal B (2010) Stochastic differential equations. Springer, Berlin

Pojarliev M, Polasek W (2001) Applying multivariate time series forecasts for active porfolio management. Financ Mark Portf Manag 15(2):201

von Neumann J, Morgenstern O (1944) Theory of Games and Economic Behavior. Princeton University Press

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pierini, A. Merton’s Portfolio Estimation with CVAR-MGarch: An Application to the Italian Stock Market. J Indian Soc Probab Stat 19, 153–168 (2018). https://doi.org/10.1007/s41096-018-0038-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41096-018-0038-z