Abstract

In this paper, we investigate whether survey measures of inflation expectations in Sweden Granger cause Swedish CPI inflation. This is done by studying the precision of out-of-sample forecasts from Bayesian VAR models using a sample of quarterly data from 1996 to 2016. It is found that the inclusion of inflation expectations in the models tends to improve forecast precision. However, the improvement is typically small enough that it could be described as economically irrelevant. One exception can possibly be found in the expectations of businesses in the National Institute of Economic Research’s Economic Tendency Survey; when included in the models, these improve forecast precision in a meaningful way at short horizons. Taken together, it seems that the inflation expectations studied here do not provide a silver bullet for those who try to improve VAR-based forecasts of Swedish inflation. The largest benefits from using these survey expectations may instead perhaps be found among analysts and policy makers; they can after all provide relevant information concerning, for example, the credibility of the inflation target or challenges that the central bank might face when conducting monetary policy.

Similar content being viewed by others

Notes

There is a reasonably large literature looking at the importance of survey expectations of inflation, with varying results. See, for example, Nunes (2010) who generally found a small empirical role for survey expectations in the United States or Adam and Padula (2011) who found survey expectations to be an important factor of inflation in the United Kingdom. Fuhrer (2012) concluded that short-run inflation expectations have a significant role in explaining US inflation since the beginning of the 1980s, while long-run expectations generally did not have the same direct influence over the same period. Canova and Gambetti (2010) found that one-year ahead inflation expectations consistently had predictive content in the United States 1960–2005. Wimanda et al. (2011) showed that CPI inflation in Indonesia is significantly determined by, especially, backward-looking inflation expectations. Studying VAR estimates, Clark and Davig (2008), found that shocks to short- and long-term inflation expectations result in some pass-through to actual inflation in the United States.

The results from the survey are also available for five other sub-categories: money market players, employee organisations, employer organisations, manufacturing companies and trade companies. Money market players are (nowadays) interviewed every month and are generally given most attention in the media. We therefore also conduct analysis using data on the expectations of money market players; see Sect. 5.2.

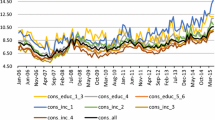

The households are asked every month and the businesses once every quarter. We use the mean of all respondents after excluding extreme values. Monthly values for the households have been converted to quarterly using the arithmetic mean.

The correlation between the different categories of inflation expectations varies between 0.63 and 0.98.

For a discussion about the problems associated with the anchoring of inflation expectations; see, for example, Beechey et al. (2011).

In the sensitivity analysis presented in Sect. 5, we also use VAR models estimated with classical methods.

It has been shown by, for example, Beechey and Österholm (2010) that this specification of the BVAR can improve forcast accuracy when it comes to inflation.

Specifically, the prior mean on the first own lag for each variable is here set equal to 0.9. All other coefficients in G have a prior mean of zero.

As an alternative to using the unemployment rate, the unemployment rate gap could be considered. We use the unemployment rate for two main reasons. First, the unemployment rate itself is commonly used in the literature as a way to catch inflationary pressure; see, for example, Cogley and Sargent (2005) and Knotek and Zaman (2017). Second, if the equilibrium unemployment rate moves slowly and not very much, which most studies suggest that it does, the difference between the two measures is minor.

To our knowledge, no valid test exists to test the null hypothesis of equal forecasting performance in our setting. The problem is that we compare forecasts from nested models estimated with Bayesian methods at forecast horizons exceeding one.

However, if one wants to do scenario analysis—where the effect of one variable on another is of interest – it is not unreasonable to choose the model with a higher RMSFE. As an extreme example, consider the case where a univariate model has the smallest out-of-sample RMSFE. Of course, such a model can not tell us anything about what happens when other related variables vary.

The impulse-response functions are based on a Cholesky decomposition of the covariance matrix where the variables in the model are ordered as in Eq. (5). Seeing that the ordering of the variables can matter when using this method, we also changed the ordering so that inflation expectations became the third variable and the treasury bill rate the last. This generated no qualitative differences and only minor quantitative differences when looking at the effect that shocks to inflation have on inflation expectations and the effect that shocks to inflation expectations have on inflation. Results are not presented in the paper but are available from the authors upon request.

See, for example, Hanson (2004) for a discussion.

The standard deviations of the shocks of the Prospera 1 and 5 years inflation expectations are 0.20 and 0.07 percentage points, respectively.

The standard deviations of the shocks of the NIER businesses’ and households’ inflation expectations are both 0.29 percentage points.

The inflation target policy was declared in 1993 but it was not until 1996 that interest rates began to come down to more normal levels.

Note that the inflation expectations and the 3 month treasury bill rate are not revised. Hence, the latest vintage is equal to real-time data. Inflation and the unemployment rate are subject to minor revisions. The fact that we do not use real-time data for these variables should hence have only minor effects on our results. For a discussion concerning real-time data, see Croushore and Stark (2001).

Table 4 in Appendix 3 gives the RMSFEs of two commonly used benchmarks, namely a naïve forecast and a recent mean forecast. The naïve forecast is a no-change forecast which simply states that the forecast—at all horizons—will be the same value as the last actual value; this is a commonly employed benchmark in macroeconomics since it is an optimal forecast for a univariate random walk.

We accordingly also use the traditional specification for the Minnesota prior and center the coefficient on the first own lag of all variables on unity (instead of 0.9). A diffuse normal prior is used for the vector of intercepts.

The Riksbank’s governor Stefan Ingves stated that he wanted to “see a reduction in inflation and inflation expectations before easing monetary policy” (Sveriges Riksbank 2008, p. 18).

See, for example, Sveriges Riksbank (2014).

References

Adam, K., & Padula, M. (2011). Inflation dynamics and subjective expectations in the United States. Economic Inquiry, 49, 13–25.

Adolfson, M., Andersson, M. K., Lindé, J., Villani, M., & Vredin, A. (2007). Modern forecasting models in action: Improving macro economic analyses at central banks. International Journal of Central Banking, 3, 111–144.

Ashley, R., Granger, C. W. J., & Schmalensee, R. (1980). Advertising and aggregate consumption: An analysis of causality. Econometrica, 48, 1149–1167.

Bachmeier, L. J., Leelahanon, S., & Li, Q. (2007). Money growth and inflation in the United States. Macroeconomic Dynamics, 11, 113–127.

Beechey, M., Johannsen, B., & Levin, A. (2011). Are long-run inflation expectations anchored more firmly in the euro area than in the United States? American Economic Journal: Macroeconomics, 3, 104–129.

Beechey, M., & Österholm, P. (2010). Forecasting inflation in an inflation targeting regime: A role for informative steady-state priors. International Journal of Forecasting, 26, 248–264.

Beechey, M., & Österholm, P. (2014). Policy interest-rate expectations in Sweden: A forecast evaluation. Applied Economics Letters, 21, 984–991.

Berger, H., & Österholm, P. (2011). Does money granger cause inflation in the Euro area? Evidence from out-of-sample forecasts using Bayesian VARs. Economic Record, 87, 45–60.

Blanchard, O., Cerutti, E., & Summers, L. (2015). Inflation and activity—two explorations and their monetary policy implications, NBER Working Paper No. 21726.

Canova, F., & Gambetti, L. (2010). Do expectations matter? The great moderation revisited. American Economic Journal: Macroeconomics, 2, 183–205.

Christoffel, K., Coenen, G., & Warne, A. (2011). Forecasting with DSGE models. In M. P. Clements & D. F. Hendry (Eds.), The Oxford handbook of economic forecasting. Oxford: Oxford University Press.

Clark, T. E., & Davig, T. (2008). An empirical assessment of the relationships among inflation and short- and long-term expectations, Research Working Paper 08-05, Federal Reserve Bank of Kansas City.

Cogley, T., & Sargent, T. J. (2001). Evolving Post-World War II U.S. Inflation dynamics. NBER Macroeconomics Annual, 16, 331–373.

Cogley, T., & Sargent, T. J. (2005). Drifts and volatilities: Monetary policies and outcomes in the post WWII US. Review of Economic Dynamics, 8, 262–302.

Coibion, O., & Gorodnichenko, Y. (2015). Is the Phillips curve alive and well after all? Inflation expectations and the missing disinflation. American Economic Journal: Macroeconomics, 7, 197–232.

Croushore, D., & Stark, T. (2001). A real-time data set for macroeconomists. Journal of Econometrics, 105, 111–130.

Friedman, B., & Kuttner, K. (1993). Another look at the evidence of money-income causality. Journal of Econometrics, 57, 189–203.

Friedrich, C. (2016). Global inflation dynamics in the post-crisis period: What explains the twin puzzle? Economics Letters, 142, 31–34.

Fuhrer, J. (2012). The role of expectations in inflation dynamics. International Journal of Central Banking, 8, 137–165.

Gavin, W. T., & Kliesen, K. L. (2008). Forecasting inflation and output: Comparing data-rich models with simple rules. Federal Reserve Bank of St Louis Review, 90, 175–192.

Gürkaynak, R., Levin, A. T., Marder, A. N., & Swanson, E. T. (2007). Inflation targeting and the anchoring of inflation expectations in the Western Hemisphere. Federal Reserve Bank of San Francisco Economic Review, 2007, 25–47.

Hanson, M. (2004). The ‘price puzzle’ reconsidered. Journal of Monetary Economics, 51, 1385–1413.

International Monetary Fund. (2013). World Economic Outlook, April 2013.

Jonsson, T., & Österholm, P. (2011). The forecasting properties of survey-based wage-growth expectations. Economics Letters, 113, 276–281.

Jonsson, T., & Österholm, P. (2012). The properties of survey-based inflation expectations in Sweden. Empirical Economics, 42, 79–94.

Jonung, L. (1981). Perceived and expected rates of inflation in Sweden. American Economic Review, 71, 961–968.

Knotek, E. S., & Zaman, S. (2017). Have inflation dynamics changed? Federal Reserve Bank of Cleveland Economic Commentary 2017-21.

National Institute of Economic Research. (2009). Konjunkturläget, December 2009 (in Swedish).

National Institute of Economic Research. (2014). The Swedish Economy, August 2014.

Nunes, R. (2010). Inflation dynamics: The role of expectations. Journal of Money, Credit and Banking, 42, 1161–1172.

Primiceri, G. (2005). Time varying structural vector autoregressions and monetary policy. Review of Economic Studies, 72, 821–852.

Ribba, A. (2006). The joint dynamics of inflation, unemployment and interest rate in the United States since 1980. Empirical Economics, 31, 497–511.

Scheufele, R. (2011). Are qualitative inflation expectations useful to predict inflation? Journal of Business Cycle Measurement and Analysis, 1, 29–53.

Stock, J., & Watson, M. (1989). Interpreting the evidence on money-income causality. Journal of Econometrics, 40, 161–181.

Sveriges Riksbank. (2008). Separate Minutes of the Executive Board Meeting on 3 September 2008.

Sveriges Riksbank. (2014). Minutes of the Monetary Policy Meeting on 2 July 2014.

Us, V. (2004). Inflation dynamics and monetary policy strategy: Some prospects for the Turkish economy. Journal of Policy Modeling, 26, 1003–1013.

Villani, M. (2009). Steady-state priors for vector autoregressions. Journal of Applied Econometrics, 24, 630–650.

Wimanda, E. R., Turner, P. M., & Hall, M. J. B. (2011). Expectations and the inertia of inflation: The case of Indonesia. Journal of Policy Modeling, 33, 426–438.

Acknowledgements

We are grateful to two anonymous referees and seminar participants at the National Institute of Economic Research for valuable comments on this paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Data

Appendix 2: Steady-state priors

See Table 3.

Appendix 3: RMSFEs and relative RMSFEs

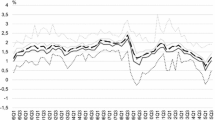

See Tables 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16 and Figs. 7, 8.

Reduction in RMSFE by adding inflation expectations to the univariate model of CPI inflation—money market players. Note: results from estimation of Eq. (1) with Bayesian methods. Reduction in RMSFE given in percentage points on the vertical axis. A positive number indicates that the model with inflation expectations has a lower RMSFE than the model without inflation expectations. Forecast horizon in quarters on the horizontal axis

Reduction in RMSFE by adding inflation expectations to the trivariate model of CPI inflation—money market players. Note: results from estimation of Eq. (1) with Bayesian methods. Reduction in RMSFE given in percentage points on the vertical axis. A positive number indicates that the model with inflation expectations has a lower RMSFE than the model without inflation expectations. Forecast horizon in quarters on the horizontal axis

Appendix 4: Impulse-response functions

Rights and permissions

About this article

Cite this article

Stockhammar, P., Österholm, P. Do inflation expectations granger cause inflation? . Econ Polit 35, 403–431 (2018). https://doi.org/10.1007/s40888-018-0111-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-018-0111-9