Abstract

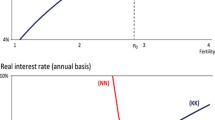

Some reports of the related literature describe examinations of whether a child allowance and the subsidy for education investment can raise fertility and education investment, or not. This paper presents consideration of the pension incentive policy as substitutive policies of a child allowance and a subsidy for education investment in a model of quality and quantity of children. Results of the study reported herein demonstrate that pension incentive policy cannot always increase fertility and the education investment, i.e., the growth rate of the human capital stock. If the pension incentive policy can raise fertility and the growth rate of the human capital stock, then the pension incentive policy plays the roles of a child allowance and a subsidy for the education investment. Otherwise, the pension incentive policy should not be provided in place of the child allowance and the subsidy for education investment. Pension incentive policy effects on fertility and the growth rate of the human capital stock depend on the preference parameters of quality and the quality of children.

Similar content being viewed by others

Notes

Some studies examine the quality and quantity of children model. de la Croix and Doepke (2003) set the log utility function with \(\alpha =\beta\). Zhang (1997) sets the utility function including offspring utility. Our paper examines nearly the same conditions as those used by de la Croix and Doepke (2003). In the "Appendix", the utility function as another form is examined.

See "Appendix" for a detailed proof.

Yasuoka and Miyake (2010) set the same profit function.

Assuming that \(N_{t+1}\) is the population size of younger people in \(t+1\) period, then \(N_t\) is the population size of younger people in t period, i.e., population size of older people in \(t+1\) period. Because \(N_{t+1}=n_tN_t\), one can obtain \(n_t =\frac{N_{t+1}}{N_t}\), which represents the intergenerational population size ratio.

See "Appendix" for a detailed explanation related to the income growth rate. This paper presents consideration of the growth rate of the human capital stock as the income growth rate.

With \(\epsilon =0\), \(1-\alpha -\beta -\epsilon +2\beta \epsilon =1-\alpha -\beta\) is obtainable if \(\alpha <\beta\). With \(\epsilon =1\), \(1-\alpha -\beta -\epsilon +2\beta \epsilon =-\alpha +\beta >0\) is obtainable because \(\alpha <\beta\). Then, considering \(0<\epsilon <1\), the sign of \(1-\alpha -\beta -\epsilon +2\beta \epsilon\) is always positive.

See the "Appendix" for parameter settings.

References

Apps, P., & Rees, R. (2004). Fertility, taxation and family policy. Scandinavian Journal of Economics, 106(4), 745–763.

Becker, G. S., Murphy, K. M., & Tamura, R. (1990). Human capital, fertility, and economic growth. Journal of Political Economy, 98(5), 12–37.

de la Croix, D., & Doepke, M. (2003). Inequality and growth: why differential fertility matters. American Economic Review, 93(4), 1091–1113.

Fanti, L., & Gori, L. (2013). Fertility-related pensions and cyclical instability. Journal of Population Economics, 26, 1209–1232.

Fenge, R., & Meier, V. (2005). Pensions and fertility incentives. Canadian Journal of Economics, 38(1), 28–48.

Fenge, R., & Meier, V. (2009). Are family allowances and fertility-related pensions perfect substitutes? International Tax and Public Finance, 16, 137–163.

Ferrero, D. M., & Iza, A. (2004). Skill premium effects on fertility and female labor force supply. Journal of Population Economics, 17, 1–16.

Glomm, G., & Ravikumar, B. (1992). Public versus private investment in human capital endogenous growth and income inequality. Journal of Political Economy, 100(4), 818–834.

van Groezen, B., Leers, T., & Meijdam, L. (2003). Social security and endogenous fertility: pensions and child allowances as siamese twins. Journal of Public Economics, 87, 233–251.

Kolmar, M. (1997). Intergenerational redistribution in a small open economy with endogenous fertility. Journal of Population Economics, 10, 335–356.

Meier, V., & Wrede, M. (2010). Pension, fertility and education. Journal of Pension Economics and Finance, 9(1), 75–93.

Oshio, T. (2001). Child-care reform in pension system and the fertility rate. Quarterly of Social Security Research, 36(4), 535–546 (in Japanese).

Wigger, B. U. (1999). Pay-as-you-go financed public pensions in a model of endogenous growth and fertility. Journal of Population Economics, 12, 625–640.

Yasuoka, M., & Goto, N. (2015). How is the child allowance to be financed? By income tax or consumption tax? International Review of Economics, 62(3), 249–269.

Yasuoka, M., & Miyake, A. (2010). Change in the transition of the fertility rate. Economics Letters, 106(2), 78–80.

Zhang, J. (1997). Fertility, growth, and public investments in children. Canadian Journal of Economics, 30(4), 835–843.

Zhang, J., & Casagrande, R. (1998). Fertility, growth, and flat-rate taxation for education subsidies. Economics Letters, 60(2), 209–216.

Zhang, J., & Nishimura, K. (1993). The old-age security hypothesis revisited. Journal of Development Economics, 41(1), 191–202.

Author information

Authors and Affiliations

Corresponding author

Additional information

The author is thankful to Yasuyuki Kusuda, anonymous reviewers and the seminar participants for helpful comments. Research for this paper was supported financially by JSPS KAKENHI (No. 26380253, 17K03791). Nevertheless, any remaining errors are the author’s responsibility.

Appendix

Appendix

1.1 Derivation of (4)–(6)

The Lagrange function can be set as

where \(\lambda\) denotes a Lagrange multiplier. Considering the first-order condition is reduced as follows,

Substituting (17) and (19) into (2) is reduced to \(\frac{1}{\lambda }=\frac{1}{1-\beta }\left( (1-\tau )wh_t+\frac{P_{t+1}}{1+r}\right)\). This equation and (19) can derive \(c_{t+1}\) as shown by (6). Considering (17) and (18), we obtain \(e_t\) as shown by (5).

1.2 Utility function form

This appendix assumes the following utility.

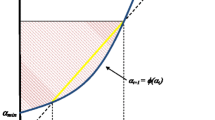

Households care for education investment for children, not the human capital stock of children. The households care not about the human capital of children, but the education investment for children. This is assumed by Glomm and Ravikumar (1992) and others. Then, the fertility (10) the income growth (12) can be changed as

Effects on fertility and education investment depend on the preference parameters as derived in utility function (1).

1.3 Growth rate \(1+g_t\)

\(1+g_t\) represents not only the growth rate of the human capital stock, \(h_t\), but also the growth rate of labor income, \(wh_t\), or the growth rate of discounted aggregate lifetime income shown by the right-hand-side of (2) \((1-\tau )wh_t+\frac{P_{t+1}+\theta \tau wn_th_{t+1}}{1+r}\). The growth rate of labor income is given as \(\frac{wh_{t+1}}{wh_t}\). It is equal to \(\frac{h_{t+1}}{h_t}=1+g_t\). Considering the growth rate of the discounted aggregate lifetime income and (9),

can be obtained.

Unless the parameter changes, \(1+g_t\) and \(n_t\) are constant over time because of (10) and (12). Therefore, \(1+g_t\) denotes the growth rate of human capital accumulation, labor income, and the discounted aggregate lifetime income. However, as shown by the following analysis, the parameter of pension policy changes. Then, \(1+g_t\) is not equal to the growth rate of the discounted aggregate lifetime income in the transition path. Then, this paper presents consideration of \(1+g_t\) as the growth rate of the human capital accumulation and labor income in the following section.

1.4 Parameter settings

This paper presents consideration of \(y_t=k^\eta _t\) the production function, where \(y_t\) and \(k_t\) denote the output per capita and the capital labor ratio. In economically developed countries, \(\epsilon =0.3\) is considered. With a perfectly competitive market, \(1+r=\eta k^{\eta -1}_t\) and \(w=(1-\eta )k^{\eta }_t\) are obtainable. The interest rate in economically developed countries is about \(1\%\) in recent years. Because one period in the overlapping generations model is regarded as 30 years, then \(1+r=1.35\) is obtainable. Therefore, the wage rate is \(w=0.3674\).

de la Croix and Doepke (2003) consider \(1-\alpha -\beta =0.2994\) and \(\epsilon =0.635\). Then, \(\alpha +\beta =0.7692\) is derived. \(\bar{z}=0.075\) is set as described by de la Croix and Doepke (2003). In economically developed countries, the income growth rate and fertility are regarded respectively as \(1+g_t=1.81\) and \(n_t=1\) because the income growth rate is about \(2\%\) and no population growth exists. \(\tau =0.183\) is set as the contribution rate. This is the rate for Japan. However, the rate is nearly equal to the contribution rate in Germany, Sweden, and other economically developed countries.

Therefore, \(\alpha =0.3358\), \(\beta =0.4342\) and \(H=6.7228\) to hold \(1+g_t=1.81\) and \(n_t=1\) in the economy with \(\theta =0\) (Data: OECD Statistics).

Rights and permissions

About this article

Cite this article

Yasuoka, M. Fertility and education investment incentive with a pay-as-you-go pension. Eurasian Econ Rev 8, 37–50 (2018). https://doi.org/10.1007/s40822-017-0078-9

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-017-0078-9