Abstract

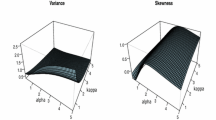

In this study, different value at risk models (VaR), which are used to measure downside investment risk, have been analyzed under different methods and stylized facts of financial time series. Downside investment risk of a single asset and of a hypothetical portfolio have first been measured by conventional VaR models (Parametrical VaR, Historical VaR, Historical Simulation VaR and Monte Carlo Simulation VaR) and then by alternative simulation models that consider fat tails (Alpha-Stable Simulation VaR) in return distributions and long memory in returns (Long Memory Simulation VaR). Empirical findings and the Duration Based Backtesting procedure indicate that the largest VaR value is obtained under Long Memory Simulation VaR that is based on the long memory in returns. This result is consistent with the findings of Mandelbrot’s various studies.

Similar content being viewed by others

References

Abry, P., & Veitch, D. (1998). Wavelet analysis of long-range-dependent traffic. IEEE Transactions on Information Theory, 44(1), 2–15.

Akdugan, U., & Akin, Y.K. (2013). Parametrik riske maruz deger hesaplamasinda volatilitenin modellenmesi: Turkiye’de emeklilik yatirim fonlari uzerine bir uygulama (Volatility modelling in parametric value at risk calculation: an application on pension funds in Turkey). International Conference on Eurasian Economies, St. Petersburg.

Aktas, O., & Sjostrand, M. (2011). Cornish–fisher expansion and value-at-risk method in application to risk management of large portfolios. Technical report, IDE1112, 1–94.

Altayligil, Y. B. (2008). Graw ve Ewma ile riske maruz deger: altin getirisi icin bir uygulama (Value at risk with Graw and Ewma: an application for gold returns). Sosyal Bilimler Dergisi, 1, 33–41.

Arik, A., Bulut, B., & Sucu, M. (2013). Finansal risklerin uc deger kurami ile olculmesi (Measuring financial risks with extreme value theory). Bilim Teknoloji Dergisi A-Uygulamali Bilimler ve Muhendislik, 14(2), 119–134.

Bachelier, L. (1900). Théorie de la speculation. Annales Scientifiques de L’École Normale Supérieure, 17, 21–86 (English translation by A. J. Boness (1964) In P. H. Cootner (Ed.), The random character of stock market prices (pp. 17–75). Cambridge: MIT Press).

Bostanci, A., & Korkmaz, T. (2014). Bankaların Sermaye Yeterliliği Oranı Açısından Riske Maruz Değer Hesaplama Yöntemlerinin Karşılaştırılması (Comparison of value at risk calculation models in terms of banks’ capital adequacy ratio). Business and Economics Research Journal, 5(3), 15–41.

Bulut, E., & Gul, Z. B. (2004). Parametrik riske maruz deger yontemi ile doviz kuru riski yonetimi: Turkiye ornegi (Currency risk management with parametric value at risk method: Turkey example). Ekonomik Yaklasim, 13(45), 72–92.

Candelon, B., Colletaz, G., Hurlin, C., & Tokpavi, S. (2011). Backtesting value-at-risk: A GMM duration-based test. Journal of Financial Econometrics, 9, 314–343.

Catal, D., & Albayrak, R. S. (2013). Riske maruz deger hesabinda karisim kopula kullanimi: dolar-euro portfoyu (Use of mixture capula in value at risk: dollar-euro portfolio). Journal of Yasar University, 8(31), 5187–5202.

Christoffersen, Peter F. (1998). Evaluating interval forecasts. International Economic Review, 39, 841–862.

Christoffersen, P., & Pelletier, D. (2004). Backtesting value-at-risk: A duration-based approach. Journal of Financial Econometrics, 2(1), 84–108.

Cifter, A., Ozun, A., & Yilmazer, S. (2007). Geriye donuk testlerin karsilastirmali analizi: doviz kuru uzerine bir uygulama (Comparative analysis of backtesting methods: an application on the currency rate). Bankacılar Dergisi, 62, 25–43.

Cont, R. (2001). Empirical properties of asset returns: Stylized facts and statistical issues. Quantitative Finance, 1, 223–236.

Evci, S., & Kandir, S. Y. (2015). Altin piyasasinda piyasa riskinin olculmesi: riske maruz deger (VaR) yontemi ile bir uygulama (Market risk measure in gold market: an application with value at risk (VaR) Model). Nigde Universitesi İktisadi ve İdari Bilimler Fakultesi Dergisi, 26(92), 53–70.

Fama, E. (1965). Random walks in stock market prices. Financial Analysts Journal, 21, 55–59.

Fama, E. (1970). Efficient capital markets: a review of theory and empirical work. Journal of Finance, 25(2), 383–417.

Gourieroux, C., Laurent, J. P., & Scaillet, O. (2000). Sensitivity analysis of values at risk. Journal of Empirical Finance, 7(3), 225–245.

Gunay, S. (2014). Are the scaling properties of bull and bear markets identical? evidence from oil and gold markets International Journal of Financial Studies, 2, 315–334.

Gursakal, S. (2007). Hisse senedi ve doviz piyasasi risklerinin riske maruz deger yontemi ile karsilastirilmasi (comparison of stock market and currency market risks through value at risk). Uludag Universitesi İktisadi ve İdari Bilimler Fakultesi Dergisi, 26(2), 61–76.

Hillebrand, E. (2003). Mean reversion models of financial markets. Unpublished Doctoral Dissertation, Bremen University.

Hurlin, C. (2013). Backtesting value-at-risk models, Séminaire validation des modèles financiers. Orleans: Orleans University.

Kilic, R. (2004). On the long memory properties of emerging capital markets: evidence from Istanbul stock exchange. Applied Financial Economics, 14, 915–922.

Korkmaz, T., & Bostanci, A. (2011). Rmd hesaplamalarinda volatilite tahminleme modellerinin karsilastirilmasi ve Basel II yaklasimina gore geriye donuk test edilmesi: Imkb 100 endeksi uygulamasi (The comparison of volatility forecasting models in var calculations and backtesting according to Basel II: an application on Ise 100 index). Business and Economics Research Journal, 2(3), 1–17.

Kupiec, P. (1995). Techniques for verifying the accuracy of risk management models. Journal of Derivatives, 3, 73–84.

Mandelbrot, B. B. (1963). The variation of certain speculative prices. Journal of Business, 36, 392–417.

Mandelbrot, B. B. (1972). Statistical methodology for nonperiodic cycles from covariance to R/S analysis. Annals of Economic and Social Measurement, 1(3), 259–290.

Mandelbrot, B. B., & Hudson, R. L. (2004). The misbehavior of markets: A fractal view of financial turbulence. New York: Basic Books.

Moody, J., & Wu, L. (1996). Improved estimates for the rescaled range and Hurst exponents. In P. Refenes, Y. Abu-Mostafa, J. Moody, & A. Weigend (Eds.), Neural network in the capital markets. London: Word Scientific.

Nolan, J. P. (2005). Modeling financial data with stable distributions. In S. T. Rachev (Ed.), Handbook of heavy tailed distributions in finance. Amsterdam: Elsevier-North Holland.

Onalan, O. (2010). α - Kararli dagilimlarla finansal risk olcumu (Financial risk measure with α – stable distributions. Marmara Universitesi IIBF Dergisi, 28(1), 549–571.

Ozturk, C., & Gurunlu, M. (2008). The effectiveness of the risk management, techniques in the Turkish banking system. Marmara Universitesi İİBF Dergisi, 14(1), 165–179.

Ramasamy, R., & Helmi, M. H. M. (2011). Chaotic behavior of financial time series-an empirical assessment. International Journal of Business and Social Science, 2(3), 77–85.

Rieger, J., Rüchardt, K., & Vogt, B. (2011). Comparing high frequency data of stocks that are traded simultaneously in the US and Germany: Simulated versus empirical data. Eurasian Economic Review, 1(2), 126–142.

Soytas, U., & Unal, O. S. (2010). Turkiye doviz piyasalarinda oynakligin ongorulmesi ve risk yonetimi kapsaminda degerlendirilmesi (Forecasting the volatility in turkish exchange markets and an evaluation from a risk management perspective). Yönetim ve Ekonomi, 17(1), 121–146.

Syriopoulos, T., & Tsatsaronis, M. (2012). Corporate governance mechanisms and financial performance: CEO duality in shipping firms. Eurasian Business Review, 2(1), 1–30.

Taleb, T. T. (2007). The black swan: The impact of the highly improbable. New York: Random.

Uckun, N., & Kandemir, S. (2008). Risk olcumunde riske maruz deger metodolojisi ve IMKB’de bir uygulama (Value at risk methodology in risk measurement and an implementation in Istanbul stock exchange). Muhasebe ve Finansman Ogretim Uyeleri Dernegi Dergisi, 38, 123–131.

Ural, M. (2009). Riske maruz deger hesaplamasinda alternatif yaklasimlar (Alternative approaches for estimating value at risk). BDDK Bankacılık ve Finansal Piyasalar, 3(2), 63–86.

Ural, M., & Adakale, T. (2009). Bireysel Emeklilik Fonlarinda Risk Yonetimi ve Riske Maruz Deger Analizi (risk management and value at risk analysis in the individual pension funds). Ege Akademik Bakıs, 9(4), 1463–1483.

Yildirim, H., & Colakyan, A. (2014). Finansal yatirim araclarinda riske maruz deger uygulamasi (A study on value at risk methods in financial investment tools). Dokuz Eylul Universitesi, İktisadi ve İdari Bilimler Fakultesi Dergisi, 29(1), 1–24.

Zhang, L. (2011). Multifractal properties of the industry indices for Chinese and Japanese stock markets. International Proceedings of Economics Development & Research, 12, 497–502.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Günay, S. Value at risk (VaR) analysis for fat tails and long memory in returns. Eurasian Econ Rev 7, 215–230 (2017). https://doi.org/10.1007/s40822-017-0067-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-017-0067-z