Abstract

The remanufacturing industry refers to industry that remanufactures used products through disassembling, cleaning, testing, repairing, adjusting and reassembling, so that their original function or condition would be maintained. This industry can bring excellent effects environmentally and economically. Especially, the labor intensive nature of remanufacturing provides an opportunity for job creation. The study was conducted to refine the understandings on the current status of the remanufacturing industry in Korea by investigating and analyzing the latest trend of Korea’s remanufacturing industry. The research works are based on literature reviews, on/off line contacts with remanufacturing companies, and field studies. The result showed that the remanufacturing business in Korea is well-established in the field of automobile parts, print cartridges, SCR (selective catalytic reduction)-coated products (modules), and electrical and electronic equipment sectors. The market size of the remanufacturing industry in Korea is approximately 700 million USD based on 2015 which is increased by 16% compared to 2010. However, the number of companies and the scale of employees were found out to decrease by 26 and 33%, respectively. In Korea, the market size of the remanufacturing industry is relatively small compared to other advanced countries; the U.S. remanufacturing market size per capita is 135 USD, the world’s highest while that of Korea is 14 USD, only one-tenth of the U.S.

Similar content being viewed by others

Introduction

Remanufacturing is a recycling method that can bring about excellent effect in terms of environment and economy, as it restores the original functionalities of a used product through a series of processes and supplies the product to the market with reasonable price [1, 2]. The definition of remanufacturing is based on the “Act on the promotion of the conversion into environmental friendly industrial structure” in Korea. Remanufacturing is to make renewable resources into a state where they can keep their original performance after undergoing a series of processes such as disassembly, cleansing, examination, repair, adjustment, recombination, etc. [3]. On the other hand, remanufacturing is defined as an industrial process that restores end-of-life goods to original working condition or better in U.S. International Trade Commission. A company that provides services for restoring a product to its original condition after use is called a producer of remanufactured products [4]. Remanufactured products are typically sold at 30–60% lower price, compared to new products, and the energy and resources are saved by 70–80%, compared to new manufacturing [5, 6]. At the same time, the remanufacturing is estimated to have the job creation effect three times more than general manufacturing [7, 8]. Furthermore, it can be considered as a responding measure to the global circumstances following the greenhouse effect, energy and resources issues, environmental regulations and economic recession. The remanufacturing is now spreading out to various industrial sectors in the U.S. and Europe, such as vehicle, electrical and electronics, aerospace, heavy duty and off-road (HDOR) and machinery, and it considerably contributes to greenhouse gas reduction, resource saving and profit-making [9,10,11,12]. The remanufacturing thus needs to be actively nurtured as one of the industries that bring about advantages of saving cost for manufacturing, reducing waste and greenhouse gas emission, and decreasing consumers’ expenses.

In order to foster the remanufacturing industry, the current status of the industry should be well understood. The U.S. is the country that has the biggest remanufacturing industry with the longest history in the world and has a variety of items for remanufacturing. It is said that 121 product items of the U.S. Standard Industrial Classification are remanufactured, for instance, aircraft, medical devices, and military equipment, other than automotive parts and printer cartridge [13]. The United States International Trade Commission (USITC) categorizes the remanufacturing industry into major 12 industries, i.e., aerospace, consumer goods, electronics, heavy equipment, IT products, train, machinery, medical devices, automotive parts, office furniture, restaurant instrument and tires. The commission collects the data on the U.S. remanufacturing industry and its export/import and provides the data to the concerned parties. According to the USITC, the remanufacturing market size of the U.S. in 2011 stood at 43 billion USD, increased approximately 15% from 37.3 billion USD of 2009 [4]. In Europe, the data on the remanufacturing market is presented by the European Remanufacturing Network (ERN) and there are nine industries, such as aerospace, vehicle, electronics, furniture, heavy equipment, machinery, ship, medical device, and railway, and the market size for 27 European countries in 2014 was estimated to be 33 billion USD [14]. In Japan, the items for remanufacturing include automotive parts, photocopier, toner cartridge and tire while the market size seems to be about 1444 million USD. The items from other industries, such as medical device, industrial machinery, ICT device, and liquid crystal panel for cellular phone, and office furniture and stationery, are also remanufactured in Japan [15,16,17,18,19,20]. However, it seems to be relatively small in terms of the market size. In Korea, the industries of automotive parts and toner cartridges are active in remanufacturing according to data from 2010 and the market is considered to be 600 million USD in size [9]. Unfortunately, however, Korea’s statistics on the remanufacturing industry is focused only on specific industry and the data is quite outdated. The latest status of the remanufacturing industry of Korea was thus studied and analyzed, and the comparative research with other countries’ cases was conducted to define the current situation of Korea’s remanufacturing industry.

Research methods

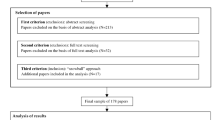

The remanufacturing business in Korea is active in automotive parts, cartridges, catalyst-coated products, and electrical and electronic equipment. In this study, the remanufacturing enterprises in these four industries were investigated on their revenue and employees in order to analyze the current status of remanufacturing industry of Korea. The data was gathered based on the year of 2015. In order to understand the current status of companies, the literature review, on-line research, telephone call research and on site field study were simultaneously implemented. The procedures and details of the remanufacturing industry survey are shown in Fig. 1.

A survey of the automotive sector was conducted for general remanufacturers and automobile maintenance companies engaged in remanufacturing business. This fact survey excluded indirect associates with the remanufacturing industry, such as distributors, because only those companies that produce remanufactured products were designed to be investigated. National remanufacturing quality certification system, one of Korea’s remanufacturing related systems, recently notified external parts such as bumpers, doors and fenders as items to be remanufactured. Some automotive maintenance companies are equipped with facilities for manufacturing automobile exterior products and are in the process of remanufacturing these items. Most OEMs producing automotive parts in Korea were found not to produce remanufactured automotive parts. We selected companies that only produce remanufactured automotive parts as survey population. There are very few OEMs doing remanufacturing business in Korea and the data is not reflected in this survey. In the case of toner cartridge, just cartridge remanufacturing enterprises were counted while the distributors and raw material suppliers were excluded (the distributors and raw material suppliers linked with the remanufacturing of toner cartridge were excluded in this sector).

Regarding the study on the remanufacturing enterprises for catalyst-coated products, the businesses that had records of delivering the remanufactured catalyst-coated products to power plants or petro-chemical facilities were included.

In Korea, rental business is increasing mainly in household electrical and electronic products, and it is producing remanufactured electric and electronic products by using after-use products that are generated here as cores. Major electrical and electronic products that can be remanufactured include air purifiers, water softeners, bidets, etc. We surveyed a company that produce these products in the electric and electronic products sector.

Results

The results from survey on Korea’s remanufacturing industry showed that 7332 employees are working at 1177 enterprises, forming the market size of 695 million USD (Table 1). The automotive parts enterprises turned out to take up the largest portion of Korea’s remanufacturing industry, with 85% in the number of enterprises, 81% of market size, and 71% of employees.

The surveyed 1177 enterprises were classified into five groups according to the number of their employees, i.e., enterprises less than 6 employees, 6 to 10 employees, 11 to 50 employees, 51 to 100 employees, and more than 100 employees, so that the size of the employment of these enterprises would be studied. The result of the grouping is illustrated in Fig. 2. The enterprises with 6 to 10 employees in the automotive parts remanufacturing took up the largest portion with 55%, followed by the enterprises with less than 6 employees (40%). In the cartridge remanufacturing, the enterprises with less than 6 employees took up the largest portion (43%), followed by the enterprises with 6 to 10 employees (33%). It turned out that most of automotive parts and cartridge remanufacturing companies, which take up 99% of the entire remanufacturing industry of Korea, are small businesses with less than 10 employees. On the other hand, most remanufacturers for catalyst-coated products and electrical and electronic equipment have 11 to 50, or 51 to 100 employees. However, there are not so many enterprises in these sectors.

The revenue of the automotive parts and cartridge remanufacturing enterprises, which take up the largest portion of Korea’s remanufacturing industry, was divided by the groups based on the number of employees. In case of the automotive parts remanufacturing, most businesses have less than 10 employees and less than 2 million USD in revenue, as shown in (a) of Fig. 3. In the case of cartridge remanufacturing, most businesses have less than 10 employees and less than 1 million USD in revenue, as shown in (b) of Fig. 3.

As shown in Table 2, the average revenue per company, the average number of employees, and the revenue per employee were calculated by each remanufacturing sector. It turned out that the average revenue per company was 590 thousand USD, the average number of employee was 6, and the revenue per employee was approximately 95 thousand USD in Korea’s remanufacturing industry. The electrical and electronic remanufacturing has the highest revenue, followed by catalyst-coated products, toner cartridges, and automotive parts remanufacturing sectors. The catalyst-coated products remanufacturing business tends to have the largest number of employees while the automotive parts remanufacturing business has the lowest number with 5. The electrical and electronic equipment remanufacturing business has the highest revenue per employee, 332 thousand USD, followed by automotive parts, toner cartridges, and catalyst-coated products remanufacturing businesses.

The reason for the relatively high average revenue in the electrical and electronic equipment remanufacturing business is that, as compared with remanufacturers in other fields, the company we surveyed is a large-sized manufacturer that is originally an OEM and operates a separate remanufacturing division. Average revenues in the electrical and electronic equipment sector include only revenues from the company’s remanufacturing business.

Discussion

Trends of Korea’s remanufacturing industry

Based on the results from the research, a comparative analysis work is conducted on Korea’s remanufacturing industry in 2010 and 2015. As shown in Table 3, the number of remanufacturing enterprises was 1596 in 2010; as of 2015, it is 1177 decreased by 26% from 2010. The number of employees also decreased by 33% from 11,000 to 7332. However, the market size increased by 16%, from 597 million USD (2010) to 695 million USD (2015). Over the past 5 years, the size of the remanufacturing market has grown by 16.4%, but the number of companies and the number of workers have declined somewhat.

The spread trend of the number of employees in the remanufacturing enterprises shows that the number of companies with less than 6 employees and with 11 to 50 employees decreased as seen in Fig. 4. It seems that the number decreased because the remanufacturing SMEs with less than 6 employees were relatively less competitive and the restructuring and streamlining of the SMEs due to the worsening of profitability. There were fewer than 10 companies with more than 51 employees and only a few companies in every remanufacturing sector. Although remanufacturers can show similar numbers of employees for each company, differences in the level of production facilities, technological competence, and market competitiveness of each company can result in differences in sales.

What needs to be highlighted in Korea’s remanufacturing market is that it had been only focused on the fields of automotive parts and toner cartridges until recently. This means that it has been operated in relatively quite narrow scope of industry fields compared to advanced remanufacturing countries. Fortunately the remanufacturing market in Korea is lately being stretched to other sectors such as catalyst-coated products, electrical and electronic equipment and construction machineries.

Comparative study on Korea and other countries’ remanufacturing industries

In order to define the current status of Korea’s remanufacturing industry, the comparative study on Korea and other countries’ remanufacturing industries was conducted. The result of this comparative study is summarized in Table 4. The US remanufacturing industry trends were compared by referring to the reports published by the USITC and other references [4, 12, 13]. The remanufacturing industry trends in Europe were explained with reference to the results of our joint research on remanufacturing in Europe with the CRR (Center for Remanufacturing & Reuse) and the “Remanufacturing Market Study” published by ERN [14, 21, 22]. We also compared the results of our joint research with AIST on the status of remanufacturing industry in Japan and various data such as JAPRA [15,16,17,18,19].The U.S., which has the longest history of remanufacturing industry, has the largest market of 43 billion USD in size and Europe including Germany and U.K. has the 34 billion USD market. In case of Japan, its remanufacturing market scale is estimated to be 1.4 billion USD, based on the public data. On the other hand, it was found that Korea has relatively small remanufacturing market with 695 million USD.

In the US, the aerospace sector accounts for 30% of the total remanufacturing market, followed by HDOR products (7.7 billion USD, 18.07%), auto parts (6.2 billion USD, 18.07%) and machinery (5.8 billion USD, 13.48%), respectively.

The size and field of European remanufacturing industry is close to that of the United States, the world’s largest remanufacturing level. As a result of reviewing the market size of the remanufacturing industry, the aviation sector accounted for the largest (12 billion USD, 30.52%), followed by automobile parts (8.8 billion USD, 22.57%), HDOR products (4.9 billion USD, 12.57% (11.28%), respectively.

The total market size of the Japanese remanufacturing industry was difficult to estimate clearly due to the lack of official statistical data or estimates. The major remanufacturing industries are automobile parts, copiers, cartridges, and tires, among which automobile parts account for the largest portion at 9.25 million USD.

Compared with the US and Europe, which are leading the global remanufacturing industry, many countries interested in remanufacturing, including Korea and Japan, are continuing efforts to expand their remanufacturing fields and markets.

Since Japan has never conducted nationwide remanufacturing market research, the entire HDOR market information is not available. Japan’s major HDOR companies include Komatsu Ltd. and Hitachi Construction Machinery Co., Ltd., but they do not announce the sales of remanufactured equipment.

Comparative study between countries with different population scales was conducted to understand the remanufacturing market size per person and employment rate of remanufacturing industry. This was conducted for economically active population aged over 15 [22,23,24,25]. The total population of 27 European countries, including the U.K., France, and Italy, was applied to study European case. As a result, as Table 5 shows, the U.S. which has the largest remanufacturing market, turned out to have the biggest market size per capita, 135 USD, followed by Germany (122 USD), France (74 USD), and U.K. (73 USD), and Italy (62 USD); the entire European market size per capita was 67 USD. The market size per capita of Korea was 14 USD. In addition, the rate of population engaged in the remanufacturing industry was 0.070% for the U.S. which is remarkably higher than other countries. When the population was taken into account, the market size of Korea seemed to be the smallest. This may be due to the lack of statistical data on the remanufacturing industry in Korea. Meanwhile, the remanufacturing engagement rates are the ratio of persons engaged in remanufacturing business among the economically active population aged 15 or older. The Japanese remanufacturing industry situation presented in Table 4 shows only motor vehicle parts and retreaded tires. As other remanufacturing sectors have not been identified due to the lack of publicly available data, Japan’s data are not reflected in the comparison of the national remanufacturing market sizes in Table 5.

Challenges and opportunities of remanufacturing industry

The South Korean government has been implementing the detail policies to promote the remanufacturing industry since it prepared the basis for fostering remanufacturing industry through the revision of Act on the promotion of the conversion into environment-friendly industrial structure in 2005. The main support systems are to certify the quality of remanufacturing parts (components) by national remanufacturing quality certification system and to support the research and development (R&D). Those led to expansion of market and increase of sales on remanufacturing industry than 2005. The initial remanufacturing industry was centered on automotive parts and toner cartridges however it recently expanded to include household appliances, chemical catalyst products, and machineries etc..

In order to revitalize the remanufacturing market, joint efforts between the public and the private sector are needed. In the public sector, it is necessary to promote the use of remanufactured products, support the national remanufacturing quality certification system, promote public relations (PR), and support R&D for the development of remanufacturing technologies. In the private sector, it is important to secure quality competitiveness and to establish a reasonable distribution network for products that customers can trust. As a result, each stakeholder will continue to play a role in each field and consumers will be able to create new markets by trusting the quality of remanufactured products and increasing their use.

Conclusion

Current status of the remanufacturing industries of Korea were intensively investigated. Furthermore, the comparative studies with leading countries in the field of remanufacturing were also implemented. Based on this study, it turned out that Korea has the market of 695 million USD in scale, only in the sectors of automotive parts, toner cartridges, electrical and electronic equipment, and catalyst-coated products. On the other hand, in the U.S. and Europe, not only automotive parts, but a variety of industries, such as aerospace, electrical and electronics, HDOR, machinery and medical devices, are active in remanufacturing. Compared to other advanced countries such as the U.S. (43 billion USD market size of the remanufacturing industry) and Europe (34 billion USD), Korea’s remanufacturing industry is relatively small in size. Likewise, it was analyzed that the U.S. has the largest remanufacturing market size per capita (135 USD) while Korea’s market size per capita stood at 14 USD, approximately one-tenth of the U.S. Once the remanufacturing market had been limited only to a few items such as automotive parts and toner cartridges, however, it has recently been expanded to catalyst-coated products and electrical and electronic equipment. The remanufacturing market size has also been increased by 16% for recent 5 years from 2010 to 2015. The data on the current status of Korea’s remanufacturing industry would be utilized for further business planning by all involved parties in the remanufacturing market.

References

Kang HY (2004) Sustainable value-added industry to foster 'Remanufacturing Industry'. Sustainable Industrial Development 7:36–43

MOTIE (Ministry of Trade, Industry and Energy), KEIT (Korea Evaluation Institute of Industrial Technology), KITECH (2010) From cleaner production technology to green technology. https://www.kncpc.or.kr/hq/promote_press01.asp?id=67&page=4. Accessed 19 October 2016

MOTIE (Ministry of Trade, Industry and Energy) (2017) Act on the promotion of the conversion into environmental friendly industrial structure

United States International Trade Commission (2012) Remanufactured goods: an overview of the U.S. and global industries, markets, and trade

Kang HY, et al (2007) Remanufacturing industry and its promotion. KNCPC RE-1. https://www.kncpc.or.kr/hq/promote_press01.asp?id=42&page=6. Accessed 19 October 2016

Kang HY (2005) Benefits of remanufacturing and its promoting policy. Geo. Engineering 8:71–74

Kang HY, Kim YC (2013) Current status and trend of Korea’s remanufacturing R&D in the field of automotive parts. Auto J. 35:20–24

Kang HY, Jun YS, Kim YC, Jo HJ (2016) Comparative analysis on cross-national system to enhance the reliability of remanufactured products. Pro. CIRP 40:280–284

Kang HY, Kim YC, Lee IS (2012) Current status and promotional measures of domestic and overseas remanufacturing industry. J. Korean Inst. Resour. Recycling 21:3–15

KITECH (Korea Institute of Industrial Technology) (2015) Study on Infrastructure and market expansion of the remanufacturing industry to maximize the reduction of greenhouse gas emissions

MOTIE (Ministry of Trade, Industry and Energy), KIETEP (Korea Institute of Energy Technology Evaluation and Planning), KITECH (Korea Institute of Industrial Technology) (2016) Resource Circulation Technology Roadmap 2015

Nabil N, Michael T (2006) Remanufacturing: a key enabler to sustainable product systems. 13th CIRP International Conference on Life Cycle Engineering Proceedings of LCE2006 15–18

Lund RT (2012) The database of remanufacturers. Boston University

Parker D et al (2015) Remanufacturing market study. European Commission

Association of Japan Cartridge Remanufacturers (2016) Statistical data. http://www.ajcr.jp/. Accessed 19 October 2016

Japan Automotive Parts Recyclers Association (2015) Recycled components. http://www.japra.gr.jp/. Accessed 19 October 2016

Japan Automobile Tire Manufacturers Association (2014) Tire Industry of Japan 2014

Matsumoto M, Umeda Y (2011) An analysis of remanufacturing practices in Japan. J. Remanufacturing 1:2

Matsumoto M (2015) Investigation on the remanufacturing industry in Japan. KITECH Research Report

YANO Research (2009) Automotive recycling market 2009. YANO Research

Parker D, Robinson S (2015) Remanufacturing in Europe. CRR (CenterforRemanufacturing&Reuse)

Eurostat (2016) Population data for the EU. http://ec.europa.eu/eurostat/data/database. Accessed 19 October 2016

Korean Statistical Information Service (2016) Population data for Korea. http://kosis.kr/eng/statisticsList/statisticsList_01List.jsp?vwcd=MT_ETITLE&parentId=A. Accessed 19 October 2016

Portal site of official statistics of Japan (2016) Population data for Japan. http://www.e-stat.go.jp/SG1/estat/eStatTopPortalE.do. Accessed 19 October 2016

U.S. Census Bureau (2016) Population data for the U.S. http://www.census.gov/popest/data/index.html. Accessed 19 October 2016

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kang, HY., Jun, YS., Jo, HJ. et al. Korea’s remanufacturing industry in comparison with its global status: a case study. Jnl Remanufactur 8, 81–91 (2018). https://doi.org/10.1007/s13243-018-0046-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13243-018-0046-x