Abstract

The COVID-19 pandemic is creating economic disruption worldwide affecting the global supply chains. India has to move ahead in these testing times with a focus on improving internal supply chains in particular. Indian service sector has been a major contributor to GDP share. But despite a huge talent pool of educated and skilled workforce, the country lags in manufacturing. The Indian government has its initiative of ‘Make in India’ with objectives of investments leading to job creation and GDP growth in twenty-five manufacturing sectors. The response to this initiative has been slow as the country has to cope up with political, economic, social, technological, legal, and environmental challenges. The pandemic outbreak is proving to be an additional hindrance. The authors feel that the ranking of the twenty-five sectors based on potentials will be an added advantage to the investors. In this paper, the authors have used the technique of the Fuzzy AHP to rank the identified sectors based on the potentials. The results are compared with the superstar sectors proposed by the Government. As seen in the past, most of the research is carried out by academicians, and decision making is based on inputs of academicians and/or industry professionals. The authors have analyzed the perspectives of academicians and industry professionals in this paper to address the gap in decision making.

Similar content being viewed by others

1 Introduction

The Indian Government introduced ‘Make in India’ in 2014 with objectives of job creation and GDP (Gross Domestic Product) growth in twenty-five manufacturing sectors (DPIIT 2014). The initiative targeted skill enhancement, foreign investments and development of well-organized infrastructure. But post-launch, the initiative did not gain the boost as expected. In the existing situation of the COVID-19 (Corona virus disease of 2019) pandemic, most of the countries have plans to shift their business from existing locations creating the right situation for India to grab the opportunity (Rooks 2020). However, the authors feel that there is a need to recognize potentials for targeted twenty-five sectors identified by the government in the context of supply chains.

1.1 Research motive

The current pandemic has disrupted global supply chains that have forced thousands of industries across the world in the temporary shutdown of their assembly lines including India (Agrawal et al. 2020). India needs to move ahead despite such issues and challenges. The following sections present the scenario.

1.1.1 ‘Make in India’ amidst global supply chain disruption due to pandemic

Epidemic outbreaks lead to risks like long-term supply chain disruption, propagations, and high uncertainty (Ivanov 2020). India has been on a world manufacturing scenario in recent years with the announcement of ‘Make in India’ in 2014. In the current pandemic situation, many business houses will be looking for the least resistance alternatives. India stands a chance to grab this big opportunity, undertaking broad-based structural reforms, despite its lockdowns and economic challenges (Inamdar 2020). Resilience, strategic agility, and entrepreneurship will be of prime importance in the current pandemic situation (Liu et al. 2020) and India needs to focus on these aspects.

1.1.2 Political, economic, social, technological, legal and environmental challenges

Though the pandemic can work as an advantage to India, the country has its challenges. The authors have identified fifty-seven factors affecting facility location using Political, Economic, Social, Technological, Legal, and Environmental (PESTLE) analysis which is the major strategic decision in supply chain network design (Sakhardande and Prabhu Gaonkar 2017). The major areas of focus identified are land, labour, liquidity, and laws as per the recent announcement by Prime Minister Shri. Narendra Modi for stabilizing the economy and inviting foreign investor partners for ‘Make in India’ progress as reported in Business Today (2020). The authors feel that the potential based ranking of sectors identified in ‘Make in India’ should be done on PESTLE identified factors.

1.1.3 Identification of potential in the announced sectors

The Indian government has identified twenty-five manufacturing sectors for the ‘Make in India’ initiative. Secondly, amongst these twenty-five, superstar sectors are also identified. However, amidst the challenges, analysis leading to the identification of the potential for manufacturing and future growth in each sector needs to be carried out.

1.1.4 Decision making by academicians and industry professionals

It is seen that most of the research in the decision-making field is carried out in academic institutions. Often, the decision making by academicians does not guarantee optimal results as their viewpoints are mostly based on theories, whereas the industry professionals make judgments’ based on practical aspects. In many research applications, the decisions are directly taken based on the experts’ opinions not accounting for the decision-makers’ field i.e. either academic or industry. Many times it is a mix of both. The authors feel that the viewpoints of academicians and professionals should be considered separately for gap identification and then analyzed as a mix for better understanding.

1.2 Research goal

The authors feel that there is a need to identify the potential for manufacturing and future growth in the twenty five sectors. In this paper, the authors have used fuzzy AHP to rank the sectors identified by ‘Make in India’ based on the views of academicians and industry professionals. The paper is divided into the following sections. Section 2 briefly reviews the existing literature. The proposed approach with a case study of the ranking of sectors based on separate and combined views of academicians and industry professionals is presented in Sect. 3. Section 4 shows the results and discussions on results. The results of the case study are compared further with the superstar sectors identified in ‘Make in India’. The conclusions are discussed in Sect. 5 at the end.

2 Literature review

The authors have reviewed literature in the context of the following:

2.1 Indian manufacturing scenario

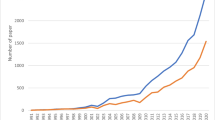

There have been mainly two breakthroughs in the Indian industrial policies, the first being in 1965–1966 which emphasized heavy industries and the second in 1984–1985 for major changes concerning liberalization (Singha and Gayatri 2010). After the 1984–1985 deregulations, there was no proper product-wise categorization in various parts of the country despite the expected growth of industries concerning the products (Athreye and Kapur 2006). Indian manufacturing sectors have to overcome major hurdles like poor policy decisions, lack of protection from foreign competition, absence of competitive domestic industries, and several other regional factors for growth and productivity improvements (Kanda 2015). In recent years, new land and labour laws along with infrastructure improvement have given a boost to the manufacturing sector in India (Mehta and Rajan 2017). Sharma and Kodali (2008) have proposed various frameworks that include elements like leadership, manufacturing strategy, supply chain management, world-class maintenance systems, etc. and initiatives like knowledge management, flexible processes, and innovative product planning to account for the changing manufacturing scenario. The manufacturing sector has the potential to enhance its share in the economic development of the country (Luthra et al. 2013).

2.2 ‘Make in India’

‘Make in India’ is an initiative to make the country world’s largest manufacturing center (Majumdar 2014). In the present pandemic conditions, India has a chance to lure low-end manufacturers that are planning to move their businesses overseas from other countries. India is at the cradle stage in the manufacturing sector and has plans for elementary manufacturing over the decade. However, Indian industry authorities have emphasized the need of implementing technology and digitalization to the manufacturing domain rather than depend entirely on cheap labour to make the initiative successful (Dhyani and Saxena 2015). India has cross-cultural issues (Lees and Khatri 2010) which need to be sorted. The potentially high impact of an acceleration of formal-sector manufacturing should serve as motivation for the Indian government at all levels to push hard toward the goal (Green 2014). Within all the advantages and limitations, the Government of India is thriving hard to rebuild the manufacturing sector through the ‘Make in India’ initiative. The twenty-five sectors recognized in ‘Make in India’ are Automobiles, Auto components, Aviation, Biotechnology, Chemicals, Construction, Defence manufacturing, Electrical machinery, Electronic system design and manufacturing, Food processing, IT and BPM, Leather, Media and Entertainment, Mining, Oil and Gas, Pharmaceuticals, Ports, Railways, Renewable energy, Roads and highways, Space, Textiles, Thermal power, Tourism & Hospitality, and Wellness. Amongst these, Pharmaceuticals, Renewable energy, Roads and highways, Electronic system design and manufacturing, Food processing, and Automobiles are mentioned as superstar sectors (DPIIT 2014).

2.3 Research perspectives of academicians and industry professionals

Academicians should work hand in hand with government and industry professionals for innovative solutions. The Collective research will lead to resilient societal outcomes that will benefit mankind (Wowk et al. 2017). Researchers have proved using forecasting methods case study that there is a similarity in the responses given by academicians and industry professionals. But, although the general outcome of this survey is that the same criteria are used by both groups, a certain lack of agreement still exists within each group (Carbone and Armstrong 1982). An Apparel industry case study carried out by Wright et al. (2002) represents the disparity of thought in the decision making of academicians and industry professionals. The gap in decision making between members of Industry and academia has been addressed on several occasions. While some think it is expanding, others consider it important for insightful research and speculations (Bartunek and Rynes 2014).

3 Proposed approach and case study

3.1 Fuzzy AHP

Fuzzy AHP (FAHP) has found a lot of importance in numerous applications. Fuzzy set theory (Zadeh 1965), introduced to represent vagueness, was extended for general decision-making applications by Bellman and Zadeh (1970). Van Laarhoven and Pedrycz (1983), the pioneers of FAHP, suggested Triangular Fuzzy Numbers (TFNs) for pairwise comparisons. In this paper, a fuzzy geometric mean method (Buckley 1985) has been used. The experts identified were asked to carry out pairwise comparisons of twenty-five sectors. The FAHP scale as shown in Table 1 is used for pairwise comparisons.

3.2 Case study

The twenty-five sectors identified in the ‘Make in India’ initiative, if ranked will provide a better picture to the investors in terms of potential. The authors have used FAHP for the ranking of these sectors. The decision makers are either academicians and/or industry professionals in research problems. The academicians are strong in theories whereas industry professionals are practical oriented. Literature states that there exists a gap in the decision making of the two fraternities. The authors feel that there is a strong need to identify this gap and minimize its effect in decision making. Hence the case study is divided into three sections i.e. one with academicians, second with industry professionals and the third case is a mix of decisions of both. Results are further analyzed for correlation.

3.3 Calculations

Table 2 shows the summary of responses along with the details of the experts. In theory for best consistency, the Consistency Ratio (CR) has to be less than 0.1(Saaty 1977). But it is seen in literature that CR up to 0.2 is also tolerable for higher-order matrices (Wedley 1993). As the matrix is of higher order, the expert responses with CR’s of less than 0.2 are considered for further analysis. The literature reviewed (Alinezad et al. 2013; Ertuǧrul and Karakaşoǧlu 2008; Hsu and Chen 2007; Kiani Mavi 2014; Lee and Seo 2016; Low and Hsueh Chen 2012; Mangla et al. 2015; Moghimi and Anvari 2014; Hanine et al. 2017; Haq and Kannan 2006; Singh et al. 2018; Yazdi 2017) shows that the number of experts chosen varies from 1 to 42. As FAHP is not a statistical method, the sample size is not standardized (Fu et al. 2010). Also, there is no mention of the number of experts and/or their respective fields in some FAHP applications (Kwong and Bai 2002; Taha and Rostam 2012; Wang and Wu 2016; Deshmukh and Sunnapwar 2019). In this case study, thirty responses from academicians and thirty five responses from industry professionals were received and checked for consistency. Alonso and Lamata (2006) have proposed Random Index (RI) for calculating CRs up to matrix size of thirty nine and further proposed an equation for calculating RI for matrices of order size higher than thirty nine. As twenty five sectors need to be ranked, the size of the matrix will be twenty five. The value of the Random Index (RI) used for calculating the CR for a matrix order size of twenty five is taken as 1.6624 from the Random Index Table of Alonso and Lamata (2006). In total forty responses, i.e. twenty academicians and twenty industry professionals with CR below 0.2 are taken for the analysis. Table 3 shows the CRs of the chosen responses. Tables 4 and 5 show a sample paired comparison matrix of academician and industry professionals respectively. Tables 6 and 7 show a sample calculation of weights of academicians and industry professionals respectively.

Table 8 shows the final ranking of sectors based on the sum of weights of respondents for all three cases.

4 Results and discussions

4.1 Data ranking

The authors have considered only the respondents who satisfy CR criteria for data analysis and ranking. The ranking of the data is as per the calculations in FAHP based on expert’s weights, as shown in Table 8. The ranking will provide an insight on investment opportunities in potential sectors. One of the goals of this paper is to identify the gap between the decision making of academicians and industry professionals. It is seen that there is not much difference of opinion in ranking between academicians and industry professionals for almost one-third of the sectors. There is the highest level of agreement for ranking of sectors like Biotechnology, Electronic system design and manufacturing, IT and BPM, Leather, Mining, Oil & Gas, Pharmaceuticals, Ports, Renewable energy and Wellness. On the contrary, rankings of sectors like Construction, Chemicals, and Tourism and hospitality show a high level of disagreement. The top five sectors according to industry professionals are Wellness, Pharmaceuticals, Renewable energy, Tourism & Hospitality, and Food processing whereas Renewable energy, Pharmaceutical, Construction, Wellness, and Roads and Highways are ranked as top five sectors by the academicians. Therefore we can observe there is an agreement in the importance of the three out of the top five factors. The top five sectors according to the combined opinions are Pharmaceuticals; Renewable energy, Wellness, Railways, and Road and highways. We observe that three of the five factors are similar to those given by academicians and industry professionals. This is because the construction and food processing sectors have been given less importance by the professionals as compared to the importance given to the Tourism & Hospitality sector by the academicians. Railways sector makes it to top five in combined decision as in both the individual ranking it is placed at sixth position.

4.2 Data correlation

To quantify the gap between decisions by the academicians and the industry professionals we evaluate the Spearman's correlation coefficient and Kendall’s tau (Van den Berg 2012) as shown in Table 9. The value of Spearman's correlation coefficient between academicians and professionals is 0.7492 whereas Kendall’s tau is 0.5533, suggesting a strong correlation (Van den Berg 2012; Akoglu 2018).To strengthen the fact that the combined decision of both the groups is a better choice than considering the decision from any one of the two fraternities, we evaluate the correlation coefficients between combined fraternities and single fraternities. The Spearman's coefficient and Kendall’s tau between Professionals and Combined are 0.9238 and 0.7733 respectively whereas those between Academicians and Combined are 0.9184 and 0.7799. All these values correspond to a strong correlation, thereby endorsing combined decision as the best option.

4.3 Comparison with superstar sectors

The Government of India has identified six superstar sectors viz. Automotive, Electronics system design and manufacturing, Renewable energy, Roads & Highways, Pharmaceuticals and, Food processing to boost the ‘Make in India’ campaign. Amongst the six superstar sectors, Pharmaceuticals and Renewable energy are ranked in the top five in all the three cases analyzed as seen in Table 8. Whereas, Roads & Highways and Electronics system design and manufacturing find a place in the top ten ranks in all the three cases. An important point to note is that the Wellness sector has been given a spot in the top three rankings in all the cases, but the Government has not identified it as one of the superstar sectors.

5 Conclusions

Post Independence of India, the service sector has been the major contributor to the growth of GDP and has overshadowed the manufacturing sector. The ‘Make in India’ campaign has been initiated by the government with a prime focus on boosting the manufacturing sector. In the current pandemic situation it is critical to focus on the potential sectors for increasing GDP share through manufacturing, therefore ranking the sectors is the primary objective of this paper. In this paper, the authors have ranked the sectors identified in the ‘Make in India’ initiative using FAHP. The ranking will help the investors to choose right sectors for investments. The sectors have been ranked in three different cases of expert classification, i.e. academicians, industry professionals, and using combinations to identify whether there is a gap in decision making. Observing the gap in decision making between the academicians and industry professionals we can conclude that the combined decision of both the fraternities is a better choice than relying on either academicians or industry professionals. According to the combined ranking, we can conclude that the six superstar sectors identified by the government can be ranked in the order as, Pharmaceuticals, Renewable energy, Roads & Highways, Food processing, Electronics system design and manufacturing and Automobiles. Finally, we can conclude that the Fuzzy AHP ranking approach can be utilized to identify potential sectors like the Wellness sector based on expert opinions, which might prove to be vital in the current situation.

References

Agrawal S, Jamwal A, Gupta S (2020) Effect of COVID-19 on the India economy and supply chain. Preprints 2020050148. https://doi.org/10.20944/preprints202005.0148.v1

Akoglu H (2018) User’s guide to correlation coefficients. Turk J Emerg Med 18:91–93. https://doi.org/10.1016/j.tjem.2018.08.001

Alinezad A, Seif A, Esfandiari N (2013) Supplier evaluation and selection with QFD and FAHP in a pharmaceutical company. Int J Adv Manuf Technol 68:355–364. https://doi.org/10.1007/s00170-013-4733-3

Alonso JA, Lamata MT (2006) Consistency in the analytic hierarchy process: a new approach. Int J Uncertain Fuzziness Knowl-Based Syst 14:445–459. https://doi.org/10.1142/S0218488506004114

Athreye S, Kapur S (2006) Industrial concentration in a liberalising economy: a study of Indian manufacturing. J Dev Stud 42:981–999. https://doi.org/10.1080/00220380600774764

Bartunek JM, Rynes SL (2014) Academics and practitioners are alike and unlike: the paradoxes of academic-practitioner relationships. J Manag 40:1181–1201

Bellman E, Zadeh LA (1970) A fuzzy environment. ManagSci 17:B141–B164

Buckley JJ (1985) Fuzzy hierarchical analysis. Fuzzy Sets Syst 17:233–247. https://doi.org/10.1016/0165-0114(85)90090-9

Business Today (2020) Coronavirus lockdown 4.0: PM Modi announces economic package worth Rs 20 lakh crore; 10% of GDP. Story. Business Today https://www.businesstoday.in/current/economy-politics/coronavirus-lockdown-4-pm-modi-speech-highlights-economic-package-rs-20-lakh-crore-10pc-gdp/story/403628.html. Accessed 24 June 2020.

Carbone R, Armstrong JS (1982) Note. Evaluation of extrapolative forecasting methods: results of a survey of academicians and practitioners. J Forecast 1:215–217. https://doi.org/10.1002/for.3980010207

Deshmukh S, Sunnapwar V (2019) Fuzzy analytic hierarchy process (FAHP) for green supplier selection in indian industries. In: Proceedings of international conference on intelligent manufacturing and automation. Springer, Singapore, pp 583–591

Dhyani K, Saxena A (2015) Make in india v. made in china. J Contemp Issues Law 3:1–11

DPIIT( 2014) Sectors. Webpage. Department for Promotion of Industry and Internal Trade, India. https://www.makeinindia.com/sectors. Accessed May 2020.

Ertuǧrul I, Karakaşoǧlu N (2008) Comparison of fuzzy AHP and fuzzy TOPSIS methods for facility location selection. Int J Adv Manuf Technol 39:783–795. https://doi.org/10.1007/s00170-007-1249-8

Fu HP, Chu KK, Lin SW, Chen CR (2010) A study on factors for retailers implementing CPFR—a fuzzy AHP analysis. J Syst Sci Syst Eng 19:192–209. https://doi.org/10.1007/s11518-010-5136-8

Green RA (2014) Can “ Make in India ” make Jobs? the challenges of manufacturing growth and high—quality job creation in India. Bak Inst Res Proj 1–61

Hanine M, Boutkhoum O, Tikniouine A, Agouti T (2017) An application of OLAP/GIS-Fuzzy AHP-TOPSIS methodology for decision making: location selection for landfill of industrial wastes as a case study. KSCE J Civ Eng 21:2074–2084. https://doi.org/10.1007/s12205-016-0114-4

Haq AN, Kannan G (2006) Fuzzy analytical hierarchy process for evaluating and selecting a vendor in a supply chain model. Int J Adv Manuf Technol 29:826–835. https://doi.org/10.1007/s00170-005-2562-8

Hsu P, Chen B (2007) Developing and implementing a selection model for bedding chain retail store franchisee using delphi and fuzzy AHP. Qual Quantity 41:275–290. https://doi.org/10.1007/s11135-006-9004-z

Ivanov D (2020) Predicting the impacts of epidemic outbreaks on global supply chains: a simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transp Res Part E LogistTransp Rev 136:101922. https://doi.org/10.1016/j.tre.2020.101922

Inamdar N (2020) Coronavirus: can India replace China as world's factory?. Story. BBC. https://www.bbc.com/news/world-asia-india-52672510. Accessed 25 June 2020

Kabir G, Ahsan Akhtar Hasin M (2012) Multiple criteria inventory classification using fuzzy analytic hierarchy process. Int J Ind Eng Comput 3:123–132. https://doi.org/10.5267/j.ijiec.2011.09.007

Kanda R (2015) Indian manufacturing sector: a review on the problems & declining scenario of Indian industries. Int J Sci Res 4:1039–1042

Kiani Mavi R (2014) Indicators of entrepreneurial university: fuzzy AHP and fuzzy TOPSIS approach. J Knowl Econ 5:370–387. https://doi.org/10.1007/s13132-014-0197-4

Kwong CK, Bai H (2002) A fuzzy AHP approach to the determination of importance weights of customer requirements in quality function deployment. J Intell Manuf 13:367–377. https://doi.org/10.1023/A:1019984626631

Lee S, Seo KK (2016) A hybrid multi-criteria decision-making model for a cloud service selection problem using BSC, fuzzy delphi method and fuzzy AHP. WirelPersCommun 86:57–75. https://doi.org/10.1007/s11277-015-2976-z

Lees A, Khatri S (2010) Made in India: are you ready for outsourced contract manufacturing. J Commer Biotechnol 16:258–265

Liu Y, Lee JM, Lee C (2020) The challenges and opportunities of a global health crisis: the management and business implications of COVID-19 from an Asian perspective. Asian Bus Manag 19:277–297. https://doi.org/10.1057/s41291-020-00119-x

Low C, Hsueh Chen Y (2012) Criteria for the evaluation of a cloud-based hospital information system outsourcing provider. J Med Syst 36:3543–3553. https://doi.org/10.1007/s10916-012-9829-z

Luthra S, Garg D, Haleem A (2013) Identifying and ranking of strategies to implement green supply chain management in Indian manufacturing industry using analytical hierarchy process. J Ind Eng Manag 6:930–962. https://doi.org/10.3926/jiem.693

Majumdar S (2014) Make in India versus made in China, Opinion. TheMillenium Post, Delhi. http://www.millenniumpost.in/make-in-india-versus-made-in-china-40689. Accessed 4 June 2020

Mangla SK, Kumar P, Barua MK (2015) Flexible decision modeling for evaluating the risks in green supply chain using fuzzy AHP and IRP methodologies. Glob J Flex Syst Manag 16:19–35. https://doi.org/10.1007/s40171-014-0081-x

Mehta Y, Rajan AJ (2017) Manufacturing sectors in India: outlook and challenges. In: Procedia engineering. The Author(s), pp 90–104

Moghimi R, Anvari A (2014) An integrated fuzzy MCDM approach and analysis to evaluate the financial performance of Iranian cement companies. Int J Adv Manuf Technol 71:685–698. https://doi.org/10.1007/s00170-013-5370-6

Rooks T(2020) 'Make in India' looking to take on China's tech industry. Story. Deutsche Welle. https://p.dw.com/p/3cVLY. Accessed 22 May 2020.

Saaty TL (1977) A scaling method for priorities in hierarchical structures. J Math Psychol 15:234–281. https://doi.org/10.1016/0022-2496(77)90033-5

Sakhardande M, Prabhu Gaonkar R (2017) Identification and Ranking of Factors Affecting Facility Location: a ‘Make in India’ Challenge. In: Int Conf Ind Eng ICIE 2017

Sharma M, Kodali R (2008) Development of a framework for manufacturing excellence. Meas Bus Excell 12:50–66

Singh RK, Gunasekaran A, Kumar P (2018) Third party logistics (3PL) selection for cold chain management: a fuzzy AHP and fuzzy TOPSIS approach. Ann Oper Res 267:531–553. https://doi.org/10.1007/s10479-017-2591-3

Singha R, Gayatri k. (2010) Government policy and performance: a study of Indian engineering industry. In: Work Pap Inst Soc Econ Chang India

Taha Z, Rostam S (2012) A hybrid fuzzy AHP-PROMETHEE decision support system for machine tool selection in flexible manufacturing cell. J Intell Manuf 23:2137–2149. https://doi.org/10.1007/s10845-011-0560-2

Van den Berg, R. (2012). Kendall’s Tau—simple introduction. Webpage. SPSS Tutorials. https://www.spss-tutorials.com/kendalls-tau/#kendalls-tau-interpretation]. Accessed 24 June 2020

Van Laarhoven PJM, Pedrycz W (1983) A fuzzy extension of Saaty’s priority theory. Fuzzy Sets Syst 11:229–241

Wang CH, Wu HS (2016) A novel framework to evaluate programmable logic controllers: a fuzzy MCDM perspective. J Intell Manuf 27:315–324. https://doi.org/10.1007/s10845-013-0863-6

Wedley WC (1993) Consistency prediction for incomplete AHP matrices. Math Comput Model 17:151–161. https://doi.org/10.1016/0895-7177(93)90183-Y

Wowk K, McKinney L, Muller-Karger F et al (2017) Evolving academic culture to meet societal needs. Palgrave Commun 3:1–7

Wright J, Cushman L, Nicholson A (2002) Reconciling industry and academia: perspectives on the apparel design curriculum. Educ + Train 44:122–128. https://doi.org/10.1108/00400910210424300

Yazdi M (2017) Hybrid probabilistic risk assessment using fuzzy FTA and fuzzy AHP in a process industry. J Fail Anal Prev 17:756–764. https://doi.org/10.1007/s11668-017-0305-4

Zadeh LA (1965) Fuzzy sets. Inf. Control 8:338–353

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Sakhardande, M.J., Prabhu Gaonkar, R.S. Potential based ranking of sectors identified in ‘Make in India’ initiative using fuzzy AHP: the academicians’ and industry professionals’ perspective. Int J Syst Assur Eng Manag 12, 337–344 (2021). https://doi.org/10.1007/s13198-020-01044-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13198-020-01044-0