Abstract

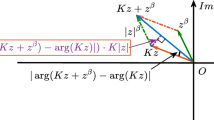

We discuss the issue of how to improve the efficiency of standard spectral methods for pricing options. As a prototype example, we consider American options which are frequently used in the market as they enjoyed the early exercise opportunities. Such options are often modeled by nonlinear partial differential equations, solutions of which are not obtainable in a closed form and thus necessitates robust numerical techniques. For the discretisation in space (asset) direction, we use a rational spectral methods. For time integration involved in the process, we looked at comparing the efficiency of the method by using contour integral method based on the inversion of the Laplace transform, and the Exponential Time Differencing Runge–Kutta method of order 4. It is known that when these spectral methods are applied to option pricing problems, they no longer retain their higher order convergence. This order reduction is attributed due to the non-smooth initial conditions. To overcome this, we propose a domain decomposition method based on our rational spectral method. For the problem under consideration, we divide the domain into two sub-domains, with the transition point as the strike price. To represent the solution in each sub-domains, we choose to approximate the solution by linear rational interpolants due to their improved stability properties as compared to the polynomial interpolant. Comparative results are also presented.

Similar content being viewed by others

References

Gesk, R., Johnson, H.: The american put options valued analytically. J. Financ. 39(5), 1511–1524 (1984)

Kuske, R., Keller, J.: Optimal exercise boundary for american put option. Appl. Math. Financ. 5(2), 107–116 (1998)

Mallier, R., Alobaidi, G.: Laplace transforms and american options. Appl. Math. Financ. 7(2), 241–256 (2000)

Wu, L., Kwok, Y.: A front-fixing finite difference method for the valuation of Americain options. J. Financ. Eng. 6(2), 83–97 (1997)

Zhu, S.: An exact and explicit solution for the valuation of American put options. Quant. Financ. 6, 229–242 (2006)

Brennan, M., Schwartz, E.: The valuation of american put options. J. Financ. 32(32), 449–462 (1977)

Brennan, M., Schwartz, E.: Finite difference methods and jumps processes arising in the pricing of contingent claims: A synthesis. J. Financ. Quant. Anal. 13(3), 461–474 (1978)

Cox, J., Ross, S., Rubinstein, M.: Option pricing: A simplified approach. J. Financ. Econom. 7(2), 229–264 (1979)

Han, H., Wu, X.: Fast numerical method for the black-scholes equations of american options. SIAM J. Numeric. Anal. 41, 2081–2095 (2003)

Nielsen, B., Skavhaug, O., Tveito, A.: Penalty and front-fixing methods for the numerical solution of american option problems. J. Comput. Financ. 5, 69–97 (2002)

Houstis, E., Pantazopoulos, K., Kortesis, S.: A front-tracking finite difference method for the valuation of american options. Comput. Econom. 12(3), 255–273 (1998)

Tangman, D., Gopaul, A., Bhuruth, M.: Numerical pricing of options using high-order compact finite difference schemes. J. Comput. Appl. Math. 218, 270–280 (2008)

Chen, X., Chadam, J., Stamicar, R.: The optimal exercise boundary for american put option: analytic and numerical approximation. Preprint (2000)

Forsyth, P., Vetzal, K.: Quadratic convergence for valuing american options using a penalty method. SIAM J. Sci. Comput. 23(6), 2095–2122 (2002)

Ngounda, E., Patidar, K., Pindza, E.: Contour integral for european options with jumps. Commun. Nonlinear Sci. Numeric. Simul. 18(3), 478–492 (2013)

Talbot, A.: The accurate numerical inversion of laplace transforms. IMA J. Appl. Math. 23(1), 97–120 (1979)

Trefethen, L.: Spectral Method in MATLAB. SIAM, Philadelphia (2000)

Zhu, Y., Wu, X., Chern, I.: Derivatives Securities and Difference Methods. Springer, New York (2004)

Baltensperger, R., Berrut, J., Noël, B.: Exponential convergence of a linear rational interpolant between transformed chebyshev points. Math. Comput. 68, 1109–1120 (1999)

Berrut, J., Mittelmann, H.: Rational interpolation through the optimal attachment of poles to the interpolating polynomial. Numer. Algorithms 23(4), 315–328 (2000)

Tee, W.: A rational collocation with adaptively transformed chebyshev grid points. SIAM J. Sci. Comput. 58(5), 1798–1811 (2006)

Schneider, C., Werner, W.: Some aspect of rational interpolation. Math. Comput. 47, 285–299 (1986)

Cox, S., Matthews, P.: Exponential time differencing for stiff system. J. Comput. Phys. 176, 430–455 (2002)

Hochbruck, M., Lubich, C., Selhofer, H.: Exponential integration for large systems of differential equations. SIAM J. Sci. Comput. 19, 1552–1574 (1998)

Hochbruck, M., Ostermann, A.: Explicite exponential Runge–Kutta methods for semilinear parabolic problems. SIAM J. Numeric. Anal. 43(3), 1069–1090 (2005)

Kassam, A., Trefethen, L.: Fourth-order time stepping for stiff pdes. J. Comput. Phys. 176, 430–455 (2002)

Spiegel, M.: Theory and Problems of Laplace Transforms. McGraw-Hill, New York (1965)

Weideman, J., Trefethen, L.: Parabolic and hyperbolic contours for computing the bromwich integral. Math. Comput. 76(259), 1341–1356 (2007)

Acknowledgments

We would like to acknowledge anonymous referees for their valuable suggestions. E. Ngounda would like to acknowledge the Office of Research and Development, University of the Western Cape, for the financial support. KCP’s research was also supported by the South African National Research Foundation.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ngounda, E., Patidar, K.C. Limitations and improvements of standard spectral methods for pricing standard options. Int J Adv Eng Sci Appl Math 7, 106–113 (2015). https://doi.org/10.1007/s12572-015-0140-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12572-015-0140-3