Abstract

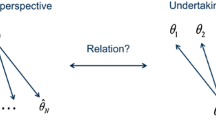

We assume that an insurance undertaking models its risk by a random variable \(\boldsymbol{X}=\boldsymbol{X}(\theta_{0})\) with a fixed parameter (vector) \(\theta_{0}\). If the undertaking does not know \(\theta_{0}\) and can only estimate it from historical data, it faces parameter uncertainty. Neglecting parameter uncertainty can lead to an underestimation of the true risk capital requirement (see e.g. Gerrard and Tsanakas 2011; Fröhlich and Weng 2015).

In this contribution we address some practical questions. To illustrate the relevance of the parameter risk we determine the probability of solvency for a risk capital model not taking parameter uncertainty into account for different distributions and samples sizes.

We then follow the “inversion method” introduced in Fröhlich and Weng (2015) known to model an appropriate risk capital requirement respecting parameter uncertainty for a wide class of distributions and common estimation methods. We extend the idea to distribution families and estimation methods that have not been considered so far in this context but are frequently used to model the losses of an insurance undertaking.

Zusammenfassung

Wir nehmen an, dass ein Versicherungsunternehmen sein Risiko durch eine Zufallsvariable \(\boldsymbol{X}=\boldsymbol{X}(\theta_{0})\) mit einem festen Parameter(vektor) \(\theta_{0}\) modelliert. Wenn das Unternehmen \(\theta_{0}\) nicht kennt und nur aus historischen Daten schätzen kann, liegt Parameterunsicherheit vor. Wenn diese bei der Risikokapitalberechnung unberücksichtigt bleibt, kann das zu einer Unterschätzung des Risikokapitalbedarfs führen (siehe z. B. Gerrard and Tsanakas 2011; Fröhlich and Weng 2015).

Diese Arbeit beschäftigt sich mit einigen praktischen Fragestellungen. Um die Relevanz des Parameterrisikos zu verdeutlichen, betrachten wir zunächst die Solvenzwahrscheinlichkeiten für ein Risikokapitalmodell, das die Parameterunsicherheit nicht berücksichtigt.

Wir greifen dann die Idee der Inversionsmethode (vgl. Fröhlich and Weng 2015), die für eine große Klasse von Verteilungen und Schätzmethoden zu einem angemessenen Risikokapitalbedarf unter Berücksichtigung der Parameterunsicherheit führt, auf und erweitern diese auf bisher in diesem Zusammenhang noch nicht betrachtete Familien von Zufallsvariablen bzw. Schätzmethoden, die bei der Schadensmodellierung ebenfalls häufig Anwendung finden.

Similar content being viewed by others

Notes

A transformed location-scale family is of the form \(\mathcal{F}=\{h(\mu+\sigma\boldsymbol{Z})|\mu,\sigma\in\mathbb{R},\sigma> 0\}\) where \(\boldsymbol{Z}\) is a fixed random variable and \(h\) is a strictly increasing function.

References

Bignozzi, V., Tsanakas, A.: Model uncertainty in risk capital measurement. J. Risk 18(3), 1–24 (2016a)

Bignozzi, V., Tsanakas, A.: Parameter uncertainty and residual estimation risk. J. Risk Insur. 83(4), 949–978 (2016b)

Bowman, K.O., Shenton, L.R.: Properties of estimators for the gamma distribution. Statistics: a series of textbooks and monographs, vol. 89. CRC Press, Boca Raton, Florida (1988)

Fröhlich, A., Weng, A.: Modelling parameter uncertainty for risk capital calculation. Eur. Actuar. J. 5(1), 79–112 (2015)

Gerrard, R., Tsanakas, A.: Failure probability under parameter uncertainty. Risk Analysis 8(5), 727–744 (2011)

Klugman, S., Panjer, S., Willmot, G.: Loss models from data to decisions, 4th edn. Series in probability and statistics. Wiley, Hoboken, New Jersey (2012)

Malik, H.: Estimation of the parameters of the pareto distribution. Metrika 15(1), 126–132 (1970)

MATLAB and Simulink release. The MathWorks, Inc, Natick, Massachusetts, United States (2016)

Johnson, N.L., Kotz, S., Balakrishnan, N.: Continuous univariate distributions. John Wiley & Sons, Toronto (1994)

Solvency II directive 2009/138/EC (2009). http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2009:335:0001:0155:en:PDF, Accessed 31 Aug 2016

Thom, H.: Estimation of the parameters of the Pareto distribution. Mon. Weather. Rev. 86(4), 117–122 (1958)

Acknowledgements

This work has been supported by the DVfVW (Deutscher Verein für Versicherungswissenschaft) by a Modul 1 Forschungsprojekt with the project title “Das Parameterrisiko in Risikokapitalberechnungen für Versicherungsbestände”.

The experimental results have been generated using Java and MATLAB (2016) programs. The calculations are quite time consuming. Therefore, we are very grateful for the opportunity to run our programs on the bwGRiD cluster of the Hochschule Esslingen.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

We give the probabilities of solvency for risk capital calculations without taking parameter uncertainty into account for sample sizes \(n=20\), \(n=50\) and \(n=100\).

Rights and permissions

About this article

Cite this article

Blanco, D., Weng, A. Practical aspects of modelling parameter uncertainty for risk capital calculation. ZVersWiss 108, 43–62 (2019). https://doi.org/10.1007/s12297-019-00428-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12297-019-00428-x