Abstract

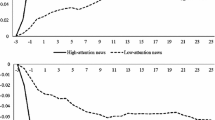

This paper examines the effects of dark and lit market fragmentation around both earnings announcements and earnings surprises. Results indicate that both dark and lit market fragmentation increase around earnings announcements. Further, I test whether dark and lit fragmentation hinder the level of price discovery around the earnings announcement, resulting in greater post-earnings announcement drift, PEAD. The analysis reveals that lit fragmentation has no significant impact on PEAD while dark fragmentation reduces the level of PEAD for stocks with positive earnings surprises. This result is consistent with the notion that dark venues capture more uninformed trading around positive news events, resulting in greater informed trading and higher informational efficiency in the lit venue. However, the results also indicate that dark fragmentation leads to stronger PEAD for stocks with negative earnings surprises. This last finding suggests that informed traders migrate to dark venues around negative earnings surprises, consistent with previous research that argues informed traders follow passive trading strategies around negative news events.

Similar content being viewed by others

Notes

Across 12 listed exchanges provided in Fidessa, the exchange with the highest market share is NASDAQ, which accounts for roughly 25% of all executed trades.

Comerton-Forde and Putniņš (2015) provide empirical results in support of Zhu’s claim that increases in dark fragmentation result in improved price discovery on the lit venue.

Chakrabarty and Shaw (2008) analyze hidden liquidity around earnings announcements. However, hidden liquidity, which refers to hidden limit orders within the lit venue limit order book, differs significantly from the use of off-exchange or dark trading venues. Degryse et al. (2015) provide an extensive review of how hidden liquidity and dark liquidity differentiate.

This study compares the weekly total of reported trades and trade volume reported by NYSE’s Daily Trades and Quotes (DTAQ) to the reported trades and trade volume in FINRA and find that the reported dark trading volume in FINRA accounts for only 30–40% of the reported dark trading volume in DTAQ. Thus, other studies are likely underestimating the amount of off-exchange around earnings announcements.

The time-series forecasts of SUE used in this study is consistent with prior studies. I do not have available analyst forecast data, however, Lorek and Pagach (2014) demonstrate that there are cases in which the time-series forecast is better than analyst-based forecasts of SUE.

In verifying my trading and trading volume numbers, I compare the overall numbers reported in TAQ with those reported by CRSP. The numbers are not exact but are very close. Similarly, I sum the number of trades and trading volume reported in MIDAS with those reported only for exchange code ‘D’ in TAQ to verify that the total resembles the aggregate trading volume on CRSP.

I also classify midpoint dark fragmentation if the thousandths place of the transaction price falls in the (0.4, 0.6) Zit interval. Likewise, I classify retail dark fragmentation if the thousandths place of transaction price falls in the (0,0.4) or (0.6,1.0) Zit interval. Boehmer et al. (2017) show that a considerable amount of dark or off-exchange trading that occurs away from the midpoint is likely retail executions.

My earnings announcement window covers the 21-day event window covering the 10 days before and after the announcement date.

I do not include the variable RetDark in Table 4 as the regression coefficients and t-statistics for RetDark will have opposite signs of MidDark.

I also measure excess abnormal dark and lit fragmentation using a standardized measure using the entire quarter to calculate average for both dark and lit fragmentation. I use this same time window to calculate the standard deviation of both dark and lit fragmentation. Using the standardized measure in determining quintiles does not alter my results.

References

Amihud Y, Mendelson H (1996) A new approach to the regulation of trading across securities markets. NYUL Rev. 71:1411

Balakrishnan K, Taori P (2017) Information asymmetry and trading in dark pools: evidence from earnings announcement and analyst recommendation revisions. Working Paper, London Business School

Ball R, Brown P (1968) An empirical evaluation of accounting income numbers. J Accounting Res. 6:159–178

Bartov E, Radhakrishnan S, Krinsky I (2000) Investor sophistication and patterns in stock returns after earnings announcements. Account Rev 75(1):43–63

Baruch S, Panayides M, Venkataraman K (2017) Informed trading and price discovery before corporate events. J Financ Econ 125(3):561–588

Battalio RH, Mendenhall RR (2011) Post-earnings announcement drift: bounds on profitability for the marginal investor. Financ Rev 46(4):513–539

Beaver, WH (1968) The information content of annual earnings announcements. J Acc Res 6:67–92

Bennett P, Wei L (2006) Market structure, fragmentation, and market quality. J Financ Mark 9(1):49–78

Bernard VL, Thomas JK (1989) Post-earnings-announcement drift: delayed price response or risk premium?. J Acc Res 27:1–36

Bernard VL, Thomas JK (1990) Evidence that stock prices do not fully reflect the implications of current earnings for future earnings. J Account Econ 13(4):305–340

Bhushan R (1994) An informational efficiency perspective on the post-earnings announcement drift. J Account Econ 18(1):45–65

Biais B (1993) Price formation and equilibrium liquidity in fragmented and centralized markets. J Financ 48(1):157–185

Bloomfield R, O'Hara M (1998) Does order preferencing matter? J Financ Econ 50(1):3–37

Bloomfield R, O'Hara M, Saar G (2015) Hidden liquidity: some new light on dark trading. J Financ 70(5):2227–2274

Boehmer E, Jones C, Zhang X (2017) Tracking retail investor activity. Working Paper, Singapore Management University

Boehmer E, Wu J (2012) Short selling and the price discovery process. Rev Financ Stud 26(2):287–322

Brandt MW, Kishore R, Santa-Clara P, Venkatachalam M (2008) Earnings announcements are full of surprises. Working Paper, Duke University, Durham

Buti S, Rindi B, Werner IM (2017) Dark pool trading strategies, market quality and welfare. J Financ Econ 124(2):244–265

Campbell JY, Ramadorai T, Schwartz A (2009) Caught on tape: institutional trading, stock returns, and earnings announcements. J Financ Econ 92(1):66–91

Chakrabarty B, Shaw KW (2008) Hidden liquidity: order exposure strategies around earnings announcements. J Bus Financ Acc 35(9–10):1220–1244

Chae J (2005) Trading volume, information asymmetry, and timing information. J Financ 60(1):413–442

Chordia T, Goyal A, Sadka G, Sadka R, Shivakumar L (2009) Liquidity and the post-earnings-announcement drift. Financ Anal J 65(4):18–32

Chordia T, Subrahmanyam A, Tong Q (2014) Have capital market anomalies attenuated in the recent era of high liquidity and trading activity? J Account Econ 58(1):41–58

Chung DY, Hrazdil K (2011) Market efficiency and the post-earnings announcement drift. Contemp Account Res 28(3):926–956

Comerton-Forde C, Putniņš TJ (2015) Dark trading and price discovery. J Financ Econ 118(1):70–92

Degryse H, De Jong F, Kervel VV (2014) The impact of dark trading and visible fragmentation on market quality. Rev Finance 19(4):1587–1622

Degryse H, Tombeur G, Wuyts G (2015) Two shades of opacity: hidden orders versus dark trading. Working Paper, University of Leuven

Fidessa (2018) Fidessa Fragmentation Index: Making Sense of Global Fragmentation. url: http://fragmentation.fidessa.com/ (visited on 09/10/2018)

Fleming MJ, Nguyen G (2013) Order flow segmentation and the role of dark trading in the price discovery of US treasury securities. Working Paper, Federal Reserve Bank of New York

Foley S, Putniņš TJ (2016) Should we be afraid of the dark? Dark trading and market quality. J Financ Econ 122(3):456–481

Foster G, Olsen C, Shevlin T (1984) Earnings releases, anomalies, and the behavior of security returns. Acc Rev 59:574–603

Garvey R, Huang T, Wu F (2016) Why do traders choose dark markets? J Bank Financ 68:12–28

Gkougkousi X, Landsman WR (2017) Dark trading volume at earnings announcements. Working Paper, Nova School of Business and Economics, Carcavelos

Gresse C (2017) Effects of lit and dark market fragmentation on liquidity. J Financ Mark 35:1–20

Hatheway F, Kwan A, Zheng H (2017) An empirical analysis of market segmentation on US equity markets. J Financ Quant Anal 52(6):2399–2427

Kaniel R, Liu S, Saar G, Titman S (2012) Individual investor trading and return patterns around earnings announcements. J Financ 67(2):639–680

Kim ST, Lin JC, Slovin MB (1997) Market structure, informed trading, and analysts' recommendations. J Financ Quant Anal 32(4):507–524

Kim O, Verrecchia RE (1991) Trading volume and price reactions to public announcements. J Acc Res 29:302–321

Kim O, Verrecchia RE (1994) Market liquidity and volume around earnings announcements. J Account Econ 17(1–2):41–67

Krinsky I, Lee J (1996) Earnings announcements and the components of the bid-ask spread. J Financ 51(4):1523–1535

Lee CM, Mucklow B, Ready MJ (1993) Spreads, depths, and the impact of earnings information: an intraday analysis. Rev Financ Stud 6(2):345–374

Livnat J, Mendenhall RR (2006) Comparing the post–earnings announcement drift for surprises calculated from analyst and time series forecasts. J Account Res 44(1):177–205

Lorek KS, Pagach D (2014) Analysts versus time-series forecasts of quarterly earnings: a maintained prediction revisited. Working Paper, Northern Arizona University, Flagstaff

Madhavan A (1995) Consolidation, fragmentation, and the disclosure of trading information. Rev Financ Stud 8(3):579–603

Mendelson H (1987) Consolidation, fragmentation, and market performance. J Financ Quant Anal 22(2):189–207

Menkveld AJ, Yueshen BZ, Zhu H (2017) Shades of darkness: a pecking order of trading venues. J Financ Econ 124(3):503–534

Ng J, Rusticus TO, Verdi RS (2008) Implications of transaction costs for the post–earnings announcement drift. J Account Res 46(3):661–696

Nimalendran M, Ray S (2014) Informational linkages between dark and lit trading venues. J Financ Mark 17:230–261

Pagano M (1989) Trading volume and asset liquidity. Q J Econ 104(2):255–274

Pan J (2017) Does dark trading affect the link between stock prices and fundamentals? Working Paper, University of Utah, Salt Lake City

Pantzalis C, Ucar E (2014) Religious holidays, investor distraction, and earnings announcement effects. J Bank Financ 47:102–117

Park TJ, Lee Y (2014) Informed trading before positive vs. negative earnings surprises. J Bank Financ 49:228–241

Petersen MA (2009) Estimating standard errors in finance panel data sets: comparing approaches. Rev Financ Stud 22(1):435–480

Sarkar A, Schwartz RA (2009) Market sidedness: insights into motives for trade initiation. J Financ 64(1):375–423

Thomas JK, Zhang F, Zhu W (2019) Off-exchange trading and post earnings announcement drift. Working Paper, Yale School of Management, New Haven

Thompson SB (2011) Simple formulas for standard errors that cluster by both firm and time. J Financ Econ 99(1):1–10

Ye M (2011) A glimpse into the dark: Price formation, transaction cost and market share of the crossing network. Working Paper, University of Illinois at Urbana-Champaign

Ye L (2016) Understanding the impacts of dark pools on Price discovery. Working Paper, University of California, Los Angeles (UCLA)

Zhao X, Chung KH (2006) Decimal pricing and information-based trading: tick size and informational efficiency of asset price. J Bus Financ Acc 33(5–6):753–766

Zhu H (2014) Do dark pools harm price discovery? Rev Financ Stud 27(3):747–789

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Cox, J. Market fragmentation and post-earnings announcement drift. J Econ Finan 44, 587–610 (2020). https://doi.org/10.1007/s12197-020-09506-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12197-020-09506-8