Abstract

Community currencies (CCs) are alternative forms of money usually issued and managed by citizens, NGOs and companies as well as local public administrations. Used to trade goods and services in limited territories or among a certain community, CCs are composed of symbolic, cultural, and social dimensions and fully immersed in particular economic and institutional contexts. Despite the increasing adoption of CCs, the discussion on guiding principles and values to address their purposes, particularly in relation to environmental sustainability issues is still scarce in the literature. Given this gap, this paper relies on the following research question: what are the design principles to be considered for community currency projects oriented to sustainable development goals? We follow the design science research paradigms to describe the design principles of a CC project. We analyze the institutional and economic context in which they are implemented, the goals for what they were created, the processes and mechanisms to rely upon their operation, and how they are evaluated according to their specific goals and to their implications to the sustainable development goals. It is important to emphasize that in this article we focus on improving the understanding of CC projects and what should be considered in their evaluation, however not to the extent on how they should be implemented. The design principles framework presented in this paper specifies guidelines to discuss principles to be considered within a range of different possibilities of diversified CC implementation strategies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

History shows that the monetary system has taken different forms across time. Currently, the most accepted trade and payment system worldwide is characterized by the central role played by states in issuing fiduciary currencies that circulate in national or transnational regions (Gómez and Demmler 2018). Despite being widely accepted and institutionalized, these currencies have been questioned due to the potential contribution to increasing economic and social disparities, speculation, and unsustainable consumption patterns (Gómez and Demmler 2018; Meyer and Hudon 2019). For example, the quantitative easing policy, adopted in the USA in the wake of the subprime crisis, is often cited as an additional source of more inequality (Montecino and Epstein 2015) and unemployment (Watkins 2014).

The phenomenon of community currencies (CCs) usually emerges in contexts of national currencies shortage due to economic constraints, such as the cases of WIR, in Switzerland (Stodder 2009), Wörgl, in Austria (Barinaga 2020a, b), and the Trueques, in Argentina (Gomez 2010), but also to achieve political autonomy, such is the case of MazaCoin for the Indigenous people from Canada (Alcantara and Dick 2017). CCs are alternative forms of money that differently from official national currencies can be issued and managed by citizens, NGOs, and companies as well as public administrations (Ingham 2004; Meyer and Hudon 2019). This type of currency is, in essence, used to trade goods and services that sometimes are not valued by the market-driven pricing system (Meyer and Hudon 2019). Available data points to the existence of thousands of initiatives worldwide involving CC (Diniz et al. 2019). CCs are composed of symbolic, cultural, and social dimensions (Blanc 2018), fully immersed in particular economic and institutional contexts (Fantacci 2005; Meyer 2020). As a part of the monetary system, CCs also need guiding principles and values to address their purposes (Blanc 2011).

Despite the increasing adoption of CCs (Diniz et al. 2019; Fullerton 2018; Larue 2020; Blanc and Fare 2022), literature still lacks a systematic approach for understanding the design characteristics of existing CC projects and prescriptive knowledge to guide the development of future initiatives (Chasin et al. 2020). Design principles in the CC literature are too generic, not being helpful as guiding principles (Alves et al. 2022), or lack a more theoretical basis to justify the choices made (CCIA 2015).

In this paper, we try to fill this gap in the academic literature of design principles for CCs by grounding the discussion of CCs design into the (DSR) approach. Design science research (DSR), among other design-based theories, aims to provide scientific legitimacy to knowledge creation focused on discussion of artifacts that solve practical problems and achieve concrete goals. Mostly used in the information systems (IS) field, DSR has been adopted in previous studies of CC projects related to sustainability (França et al. 2020; Diniz et al. 2021) and can represent a theoretical and methodological innovation to study design principles for CC projects.

Additionally, most CCs focus on social and economic goals, but a few explicitly target pro-environmental goals (Seyfang and Longhurst 2013; Michel and Hudon 2015). Thus, this paper proposes a framework for developing design principles for CCs aligned with the sustainable development goals (SDGs) (United Nations 2015). We explore the academic literature to consolidate the design principles of CCs, investigating how they can be related to the SDGs. Community currencies have the potential to serve as a valuable mechanism for addressing local challenges and can be integrated into a comprehensive approach aimed at attaining the SDGs. By promoting sustainability, inclusion, and economic prosperity at the community level, these currencies can contribute to a broader strategy for achieving the SDGs (Michel and Hudon 2015).

A better understanding of those principles can be a basis for future guidelines to support the discussion on community currencies and SDGs, either in academic or managerial terms, with potential impacts on public policies. Thus, the research question guiding this study is: what are the design principles to be considered for community currency projects oriented to sustainable development goals? To approach this question, we follow the DSR paradigms to describe the design principles of a CC project by analyzing the institutional and economic context in which they are implemented, the goals for what they were created, the processes and mechanisms to rely upon their operation, and how they are evaluated according to their specific goals and to their implications to the sustainable development goals (SDGs).

It is important to emphasize that, in this paper, we understand design principles as separate from the implementation process. DSR is fundamentally a problem-solving paradigm that seeks to build the knowledge base for further development and evaluation of a project (Hevner and Chatterjee 2010). Although it involves discussion on implementation decisions, it does not necessarily need to go to the level of implementation methodologies as long as it provides researchers and practitioners sufficient detail to enable the described artifact either to be evaluated or further implemented and used within an appropriate context. In other words, in this paper we focus on building the knowledge base for better understanding of CC projects and what should be considered in their evaluation or further development, however not to the extent on how they should be implemented. CCs real life implementation requires extensive design knowledge and expertise beyond the design principles framework presented in this paper, which only specifies guidelines to discuss principles to be considered within a range of different possibilities of diversified CC implementation strategies.

This paper is organized as follows. We start by discussing why the DSR provides the needed elements for creating a design principles framework to guide CC projects implementation. Then we expand a discussion on the economic and institutional elements that characterize the context surrounding the implementation of a CC. Next, we develop an explanation of the CC purpose and its relations with scale and scope objectives followed by the mechanisms composed by governance and architecture processes that determine features to be implemented in CC projects. After that, we discuss the most common criteria to evaluate the performance of CC projects, including their adoption level and alignment with their intended goals and the SDGs. Finishing, we summarize the contributions of the paper, pointing out its limitations and possible future studies on design principles for CCs.

Design principles for CC projects based on design science research

The academic literature on CCs, in general, considers the need for design principles as important, however, they are presented in a very generic or limited way. Martignoni (2015), for example, believes that design principles for CCs can help to find better ways to redesign the economy through cooperation and forms of working together locally as well as globally. For this author, these design principles must be adapted to the reality of people who like to exchange and share a better living together on the planet and cannot be considered as a set of principles for implementation. Carrillo et al. (2018) focus on digital aspects of implementing a CC project and highlight the importance of improving usability for users and other technical aspects such as connectivity, privacy and security. However, these principles do not include governance and contextual issues that also impact the design of CCs.

Based on a literature review, Chasin et al. (2020) found six design principles related to CCs. For the authors, these design principles are: competitiveness, transparency and self-government, circulation velocity, non-transferability, legitimacy, and self-organizing locality. Although interesting, from our perspective, those items cannot be clearly framed in the perspective of analyzing a CC project. While transparency and self-government, as well as self-organizing locality, are elements of governance and thus could be considered as principles related to the design of CCs, competitiveness, and legitimacy are not implementable characteristics in a project, but something that is desirable as a result of a successful implementation. While non-transferability, or non-convertibility, into other currencies can be considered as design features, circulation velocity will result from specific implementable design for CCs, such as demurrage for example, but hardly could be considered a design principle by itself. Thus, although original and relevant, we consider that these authors did not clearly present a set of principles to guide the analysis of a CC project.

Other authors discussing the design of CCs (Hudon and Meyer 2016; Barinaga 2017; Siqueira et al. 2020) bring the topic of design principles based on the core design principles for governing commons (Ostrom 1990). These principles—boundaries, appropriation, provision, monitoring, enforcement, conflict resolution, rights to organize and governance activities—are all significant; however, they do not include technical aspects or definitions of features, for example. Although we find all these perspectives and advice valuable as guiding principles, we also consider they do not cover all the issues to which developers must pay attention to make CC projects successful, in particular concerning the SDGs.

Based on these comments, we consider that the topic of design principles still has gaps in the literature about CCs and provides an interesting perspective for academic investigation. We believe that by choosing DSR as a way for developing design principles framework to CCs, we contribute for filling these gaps for at least two reasons. First, it is a general approach to deal with general types of artifacts, what includes diversified types of projects, including CCs (see Blanc 2011, for the characterization of CCs development as a project). Second, besides going beyond the universe of commons (Ostrom 1990), DSR could provide the method for the expansion of any proposed framework, such as the one we present in this paper, opening avenues for future studies that can complement ours.

Design science research as source for proposing design principles

Despite the increasing adoption of CCs, literature still lacks a systematic approach that could generate prescriptive knowledge for understanding the design characteristics of CC projects (Chasin et al. 2020). To fulfill this gap in the CC literature, we rely on the design science research (DSR) literature to propose the design principles for CC projects.

According to Hevner et al. (2004), design theories, such as DSR, produce theories in the form of constructs, models, methods, and artifacts. Thus, DSR focuses on giving prescriptions for evaluating and designing an artifact, whether it is a technological product or a managerial intervention (Jones and Gregor 2007). Design of artifacts is at the core of the multidisciplinary, multi-methodological approach toward creating impact through solutions and tools generated from design principles (Ram and Goes 2021).

In the DSR literature, design principles are prescriptive statements that can be used as a means of accumulating knowledge and acting in real-world situations to do something to achieve a goal (Gregor et al. 2020). This way, design principles represent knowledge created to formulate generalized and intelligible prescriptive components of a project that allows them to be reused in different contexts. Based on DSR, Cronholm and Göbel (2018) state that design principles must be based on intelligible content, i.e., formulated based on the context, purpose, processes, properties, and evaluation of the artifact. Such design principles must also have homogeneous structure, i.e., be directed to a specific artifact, connecting different aspects that together form a consistent wholeness, and consider a level of abstraction that supports reusability.

Structuring the elements for creating design principles in CC projects

Although not specifically focused on CCs, the DSR approach seeks to produce theory on design of projects based on the concept of artifact. Thus, considering CCs as artifacts designed for establishing alternative payment systems that could improve community economies and promote the SDGs, it is possible to present guidelines which can be used to formulate design principles for CC projects. Combining the anatomy for creating design principles proposed by Gregor et al. (2020) and using the elements suggested by Cronholm and Göbel (2018) for creating intelligible content for design principles, we propose a framework for design principles in CC projects aligned with the SDGs based on four dimensions:

-

Analysis of the context in which a CC project is being developed.

-

Description of goals to be achieved by a CC project.

-

Detailing the mechanisms (characteristics of governance and architecture, as well as resulting features from this interaction) necessary to implement a CC project.

-

Defining the evaluation criteria for assessment of the implications of a CC project.

Figure 1 presents the dimensions of the proposed framework for understanding the design principles of CC projects compromised with the SDGs. Next, we will develop in further detail the four dimensions of the design principles for CC projects—context, goals, mechanisms and evaluation—, drilling down the aspects and elements that should be considered in each dimension.

Context

Preliminarily, context is understood as the interrelation of historical, social, economic, and ecological circumstances in which a phenomenon is inscribed (Stalnaker 2014). A phenomenon inscribed in a context does not imply that the actors involved are necessarily ultimately constrained, nor do they have complete agency (Seo and Creed 2002). Thus, a relational perspective of context understands that actors have some form of awareness of the limits imposed by the context, but they seek to transcend them to, eventually, modify the context itself (Harmon et al. 2019; Crossley 2021).

Context is a dynamic and complex concept. It can be difficult for designers of context-aware applications to identify relevant information and actions in highly variable contexts shaped by people’s experiences, social dynamics, goals, and local peculiarities (Greenberg 2001). However, it is not the purpose of this article to go into a deeper discussion of the multiple dimensions of context, but to seek to understand how design principles for CCs relate to context. As part of an analytic framework for a CC project, we will focus only on two aspects: the economic and institutional environments related to the design of CC. This is possible because we are adopting a holistic approach to the institutional environment (Rowan 1982; DiMaggio and Powell 1983; Wolk et al. 2016). Although coexisting and coevolving, for explanatory reasons, we explain these two environments separately.

Economic environment

The economic environment is a determinant for analyzing CC projects, since its impacts tend to be more significant in periods of economic instability (Michel and Hudon 2015). Economic environment means all external factors—at the macro level—that affect people and organizations in their economic transactions (Wolk et al. 2016). Thus, the economic environment comprises the characteristics of the formation of the gross domestic product, the level of occupation and the unemployment rate of a given region, the inflation rate, public industrial policies, the organization of various economic activities, the roles of the public and private sectors, and the degree of openness of the economy, among other factors (Wolk et al. 2016).

The literature on CC often points out that the emergence of these currencies is a response to crises in the economic environment, such as recessions and unemployment, as was the creation of the Wörgl shilling in Austria and the WIR in Switzerland in the 1930s (Amato and Fantacci 2020) and the Ecoseny in Catalonia in 2009 (Conill et al. 2012). However, CC are not always responses to macroeconomic crises and may be created to oppose the dominant economic environment from an ethical platform of systemic transformation to maintain social cohesion and mitigate social and environmental damage (Larue et al. 2022). This is the case with Basque currencies, such as the Eusko, which not only appear as an alternative to local development, but also as a form of expression of identity (Radeljak 2018). Sarafu, in Kenya, which, in addition to the objective of mitigating the effects of the 2008 crisis, is also part of a larger context of the struggle for more horizontal processes of local decision-making amidst a context of automating operations in a neoliberal economic environment (Barinaga 2020a, b).

In this way, CC experiences that align with the SDGs can alternate characteristics of response to the environmental crises we are experiencing and the attempt to transform the capitalist system radically. In the first case, the "Lixo" coin from the Campolide community in Lisbon (Portugal) has precisely the characteristic of promoting the separation and collection of recyclable waste (Coelho 2019). In the second case, the experience of Faircoin in Catalonia, a cryptocurrency that presents itself as an alternative means of payment for transactions between cooperatives, has a clear linkage to a degrowth objective (Balaguer Rasillo 2021).

Institutional environment

By institutional environment, we mean the net of different coercive, normative, and cultural rules in which people and organizations are embedded, affecting behavior and organization structures and arrangements (Rowan 1982; DiMaggio and Powell 1983). As we mentioned earlier, the embeddedness of the economic transactions in the institutional environment creates some challenges to separate them. For example, the political components of the institutional environment are also part of the economic environment (Wolk et al. 2016), such as the degree of democracy in a country, centralization and concentration of powers, the continuity of policies, and the observance of contracts. Thus, concerning the institutional environment, the regulatory framework constraining or promoting CC projects (Blanc 2018) and the cultural–cognitive forces, such as local values and customs (Rauschmayer et al. 2018), are aspects that must be included in a framework created to analyze design principles of a CC project.

The regulatory environment refers to configuring a legal system comprising organizational routines and institutionalized procedures either by public policies or legislative acts (Hancher and Moran 1989; Edelman and Suchman 1997; Bieri 2017). In the specific case, the institutionalized procedures comprise the laws that govern the possibility of creating and transacting with CC (Blanc and Fare 2013), which restrict or prohibit their creation or circulation (Freire 2009). Commonly, national states have the primary and sovereign roles in creating the regulatory environment (Freire 2009); however, studies have pointed to the ability of communities themselves to create their own regulation, for example by observing local practices of self-organization (North 2014; Radeljak 2018). Thus, for example, even with the absence of specific legislation for complementary currencies, despite a certain laxity of the Brazilian Central Bank, it was possible through the innovation capacity of municipalities to create social currencies such as Mumbuca in Maricá, Brazil, already taking advantage of the experience accumulated by the community Palmeiras in Ceará with Banco Palmas (Gonzalez et al. 2020) or the community of the Basque Country to develop coins such as Eusko, Ekhi, and Txantxi from the design of new local institutional arrangements (Radeljak 2018).

Money derives much of its social significance and usefulness from the cultural environment in which it is utilized (Arno 2005). It is from the cultural–cognitive forces that constitute a community that CCs derive their symbolic status (Arno 2005; Thiel 2012). The German regional currency Chiemgauer serves the members of the community "as an individual moral affirmation, as a sign of a symbolic community of 'better' people or as a hook for moral discussions" (Thiel 2012: 95). Still, the reciprocal relationship between the CC and cultural ties is strengthened as we understand it as a form of constitution of the commons. This is the case, for example, of some CC in Brazil, in which interactions between municipal agents and local civil society organizations help to reinforce the ties of belonging to communities, primarily through currencies that reflect their identity in the distinctive characteristics of the communities themselves (Siqueira et al. 2020).

In sum, to develop a framework for designing principles of special-purpose money to achieve the SDGs, we must understand the institutional context, both in its coercive-regulatory dimensions, like statutory laws, jurisdictional capacities (constraints and possibilities) and in the social values and practices involved (Joachain and Klopfert 2012). Not by chance, many of the new experiences of CCs have been guided by values of solidarity economy and the achievement of the SDGs (Alves et al. 2022).

Goals of a CC project

The goals of a CC project are usually related to problems of a given economic, social and environmental context. Based on the proposed design principles framework (Fig. 1), CC initiatives/projects must start by defining their goals (Gregor et al. 2020). The definition of these goals may be better captured by two interrelated components: the purpose of a CC project and its aimed scale and scope.

Purpose of a CC project

Purpose is defined considering the development orientation of CC, which is typically designed to face problems such as fighting poverty or promoting local sustainable development. Since CC initiatives are associated with redesigning local social, economic and environmental relations (Brenes 2011), in the same way the goals of CC projects are focused on solving problems in these three fronts: economic, social and environmental.

The economic and social purposes of CCs have been extensively analyzed. For instance, the pattern of adoption of CC presents a counter-cyclical behavior (Stodder 2009). In other words, when the economy is in recession and/or in crisis, the mainstream financial system becomes more restrictive, there are more incentives for adopting CCs. That is the case, for instance, of credit cuts during crisis, which is often an obstacle for local microentrepreneurs to survive crisis (Place et al. 2018). CCs are, thus, intensively used as part of survival strategies adopted during a crisis, filling the void of the mainstream financial system.

Blanc (2011) considers the design of any CC according to three focuses in their projects: a territory, a community and an economic system. From this perspective, he proposes three ideal types of CCs: local currencies (based on territory), community currencies (based on solidarity principles) and complementary currencies (based on economic principles). The author argues that the proposition of this framework of ideal types helps to look to future CC projects more than classify the existent (or deceased) ones.

Although ideal types are an interesting way to define a CC purpose, Blanc’s framework focuses on one single dimension for each type. The territorial project focuses on geopolitical space; the community project focuses on a pre-existing or ad hoc community; and the economic project focuses on production and exchange markets.

Looking at real projects, we see how problematic this unidimensional approach is to propose ideal types. Some relevant CC cases show those ideal types are challenging to be used as criteria to define the purpose of CC projects. The cases of Mumbuca, in Brazil, and the Eusko, in the French Basque Country, are examples of how those ideal types are all mixed in one single CC project. Both, Mumbuca and Eusko, were created with a focus on a particular territory, based on solidarity and community principles and search for the economic sustainability of the communities they intend to serve (Cernev 2019; Radeljak 2018).

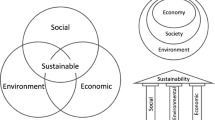

Considering the sustainability goals, defining ideal types of CCs becomes even more difficult. The launching of the SDGs by the United Nations in 2015 expanded and consolidated the concept of “sustainable development” into 17 goals, grouped by the Stockholm Resilience Center (Rockström and Sukhdev 2016) in three dimensions (biosphere, society and economy). Thus, thinking about sustainability projects means intrinsically considering more than one dimension when defining the purpose of a CC project.

Brenes (2011) pointed out that the purpose of almost every CC project is to “re-design local social, economic and environmental relations, where possible in a more sustainable way”. Place and Bindewald (2015) expanded the goals for CCs beyond the three economic, social and environmental traditional dimensions to include cultural and governance dimensions, to represent objectives such as community resilience and citizenship engagement.

Although considering the multidimensional aspect of sustainability, previous literature points out the limited focus on environmental issues in CC projects. Seyfang and Longhurst (2013), for example, claim that most CCs focus on social and economic goals, while projects explicitly pro-environmental are rare, which is confirmed by Michel and Hudon (2015), noticing few studies identifying environmental outcomes in CC projects.

In some cases, the environmental purposes of CC are linked to economic and social ones by fostering local economic activity and increasing the circulation of money in the community. Local economic activities thus may mitigate the environmental effects of global flows with import substitution and the reduction of transportation costs (Michel and Hudon 2015). In this case, CCs favor the consumption of local goods and services, thus reducing the impact on the environment and contributing to achieving the SDGs (Lenis Escobar et al. 2020). Environmental purposes of CC may also be represented by the possibility of raising awareness regarding environmental issues (Longhurst and Seyfang 2011).

CC initiatives are promoting recycling and natural environment protection together with income generation activities (Kobayashi et al. 2017). This is often implemented through creating value for activities that are not priced by traditional markets. The case of Moeda Verde’, in Brazil, is an example of CC that provides earnings to low-income families while educating young people on the benefits of the correct use of solid waste (França et al. 2020). In sum, CC projects need to include more explicitly in their goals the focus on environmental issues.

Connecting CC projects with the SDGs

The connection with the UN sustainable goals must start with the explicit purpose of the CC project. As mentioned before (Seyfang and Longhurst 2013; Michel and Hudon 2015), although most CCs do not express explicitly environmental issues in their purpose, the 17 UN SDGs are concerned with economic and social issues usually found in CC projects, starting with the SDG1, fighting against poverty, the number one concern of most CC projects. Nevertheless, some CCs are designed to foster local markets and thus avoid gases emission related to transport of goods. That is the case of CC Palmas, in Brazil, whose design is based on the mapping of the local production and consumption (Miszczuk 2018).

However, in the last few years, the climate emergency might be influencing the design of CCs toward a more explicit concern with environmental issues. Starting in the higher-income countries, where extreme poverty is less common, some CCs express environmental priorities in their purpose. That is the case of solidarity cryptocurrencies such as solar dollars (Greco Jr 2021) and plastic bank (Howson 2021), as well as more traditional CCs, such as the Domo, in Japan (Nakazato and Lim 2017).

CCs in countries with harsher economic conditions follow the trend. Community currencies in Kenya, for example, have already assumed the compromise with economic, social and environmental integrated approaches of sustainable development (Sillen et al. 2019). This is also the case of Moeda Verde, in Brazil (França et al. 2020). This trend is promising toward bringing CC designs more in line with the environmental emergency and more fully sustainable.

Scale and scope of a CC project

CC projects cannot be dissociated to the scale and scope, since they are most times designed for regional use and circulation, thus expecting a limited number of users and transactions (Lietaer and Hallsmith 2006). However, digitalization of CCs and the emergence of community cryptocurrencies have raised questions on new types of CCs designed to different scope and scale of transactions (Diniz et al. 2019).

This expansion on scale introduces the issue of the territorial scope of CCs, considering that they can also expand their geographic boundaries. Thus, a CC can be designed to be used only under certain geographical limits or being targeted to social groups that are not defined by territorial boundaries. The limitations in scope and scale that characterize CCs can also be associated with the niche-building processes of setting up networks, managing expectations and creating local significance provided by organizations that promote them (Seyfang and Longhurst 2013).

Based on the design principles framework (Fig. 1), the scale and scope must be defined as part of CC goals. The idea of scale is related to producing more units of a good or service with (on average) fewer input costs. Given that CCs are a type of special-purpose money usually designed for circulation within predefined geographic boundaries (Blanc and Lakócai 2020), the goal of scaling up is related to maximizing users and transactions inside the limits of these boundaries. Scale is a way of leveraging the impact of the CCs on economic, social and environment purposes. Thus, in terms of scale, CCs can be related to volume of transactions or number of users, as they can be regional, national, supra-national, global or even hyper-local, which means that a particular project can emerge or disappear quietly (CCIA 2015).

The concept of scope is related to the idea of diversifying products and services. In other words, the economy of scope occurs when producing a wider variety of goods or services is less costly than producing each good or service independently. In this sense, the goal of scope could be related to using CC to offer various services that may be connected to local needs. For instance, CC may be used for payments and also for microcredit (Gonzalez et al. 2020). Another form of scope occurs when a specific CC may be exchanged for another one to be used in a different region or neighborhood or when the CC is used by specific groups of workers who are spread along different geographic areas (Barinaga 2020a, b).

The pattern of adoption of CC and, as a consequence, purpose (economic, social and environmental), scale and scope may be affected by digitalization and the emergency of community cryptocurrencies (França et al. 2020). Paper versions of CC may create additional transaction costs that are obstacles to the CC circulation. In this sense, the potential for transaction cost reduction via digitalization may be a turning point for CC purposes in terms of generating social, economic and environmental impacts (Diniz et al. 2019; Uzureau et al. 2019). In this fashion, one example comes from Kenya, where people who have run out of the country’s official money due to the epidemiological crises still have access to basic goods by using Sarafu, a blockchain-based complementary currency (Chibwara 2020).

The finance strategy of CC projects has direct impact on their scale and scope since, as they grow or become well established, CC projects need cash flow in fiat currency to cover at least a portion of their operational costs. Although a small-scale project can rely on volunteer work of its supporters, usually, to grow or to achieve long-term survival and continuity some sort of funding will be necessary during CC projects life. The most common sources of funding are: private donations, public grants, fees charged from users, either individuals or businesses, and secondary revenues, such as advertising or merchandising selling (CCIA 2015).

To sustain an operation with thousands of users during more than a decade, DCC Mumbuca in Brazil expanded its scale and scope by combining different funding strategies (Gonzalez et al. 2020). Scale was created through disbursing municipal basic income programs for the city government in local currency. As the city expands its range of benefits with different social programs (to unemployed or as scholarships, for example), the scope of the CC expanded accordingly. Mumbuca also charges transaction fees from associated businesses that are used to fund microcredit operations, thus diversifying products and services which is a typical example of gaining scope.

Design mechanisms

We formulate the design principles by describing the “means” (or mechanisms) to achieve the goals of a project (Gregor et al. 2020). Thus, mechanisms refer to these means to achieve the goals of a CC project. Three aspects compound the mechanisms of CC projects. First, we consider the human and social aspects involved in the decision processes related to the CC project and label these aspects as “governance”. Second, we consider the non-human aspects of the artifact to be created as a result of the CC project and label these aspects as “architecture”. These two dimensions represent the aspects of behavior and structure in a CC project and are strongly intertwined (Tiwana 2014). The “features” implemented in CC projects specify functional elements resulting of the alignment between governance decisions and architecture affordances, as illustrated in Fig. 1. We adopt the term mechanism to refer to all these three aspects, both resulting from direct agency through human and or non-human elements that include both impersonal material factors as well as the interpretations and understandings of the actors involved (Gregor et al. 2020).

Governance

Governance refers to the power of decisions on how a CC project effectively operates and who will approve its future directions. The governance of a CC project must reflect its values to guarantee the achievement of its purpose (CCIA 2015). Since there are always a number of different stakeholders involved in a CC project, a governance structure orchestrates their participation in the decision-making process and shapes project’s direction (Jones 2011). Users collectively determine currency rules in CC systems (Meyer and Hudon 2019) While CCs share common elements, they are adapted to the local context through collective-choice arenas involving local actors (Meyer and Hudon 2019). This allows for the customization of rules, such as partnerships with businesses or public authorities, as different local stakeholders define their unique guidelines for issuance, use and circulation (Meyer and Hudon 2019; Siqueira et al 2020). On the technological aspect of a CC project, governance includes rules and mechanisms to coordinate efforts and responsibilities among platform participants (provider and developers) (Tiwana 2014). Governance also impacts the other design principles of the CC project: the features, scale and scope for operation, and the technical architecture, as well as the assessment of the performance of the CC project.

Although there are different levels of decision (e.g., strategic, operational, etc.), one way to understand the governance of a CC project is to evaluate how centralized or shared the decision-making process is (Diniz et al. 2019). Thus, the CC project governance can range from a bottom-up to a top-down decision process. From one hand, since a CC is usually a multistakeholder project, the governance must consider the decision-making process that guarantees transparency and accountability to all partners involved. On the other hand, since CC projects usually lack well-structured legal frameworks, governance should also guarantee space for the project to be innovative and flexible.

Thus, in this paper, we develop a governance framework for CC projects considering its dimensions of (1) decision-making process (centralized vs decentralized) (Telalbasic 2017; Diniz et al. 2021; Chasin et al. 2020; Meyer 2020; Meyer and Hudon 2017); (2) the transparency and accountability process (Sartori and Dini 2016; Jones 2011), and the (3) platform-level governance (Tiwana 2014). These dimensions emerged from the literature that discuss monetary governance and are detailed next.

Decision-making process

The governance of a CC project can be characterized by the degree of centralization of the decision-making process. In this sense, governance models can be localized in a continuum between the extremes centralized and decentralized. Centralized structures are characterized by top-down decisions taken by a central authority. There are various options for central authority decision-making, such as local government, NGOs or even private companies (sometimes called proprietary governance) (Chasin et al. 2020). Saito and Morino (2010) highlight that a centralized governance structure depends on the quality and motivation of their administrations, which may challenge the long-term survival of this type of initiative. The authors suggest that digitalization of CCs would reduce dependence on administrators’ quality. Some examples of centralized CC projects are: TradeQoin, Sardex, Liberex, Ecopesa, Credito, Torekes, WIR Bank, Brixton Pound, Bristol Pound (Chasin et al. 2020; Telalbasic 2017).

On the other hand, decentralized or shared governance occurs when decisions about currency operations are taken bottom-up and guided by democratic participation of its members, usually from a community bank, cooperative association or non-profit organization (Chasin et al. 2020; Meyer and Hudon 2017). These CCs are then closer to the commons concept, where resources are collectively managed by community users and the organization governed by democratic and participatory decision-making principles (Barinaga 2020a, b; Meyer 2020; Meyer and Hudon 2017). Community currencies based on solidarity finance principles are usually categorized as shared governance, since there is a combination of cooperativism, self-management, informal economy and grassroots (Diniz et al. 2018; Meyer and Hudon 2017). For example, Banco Palmas in Brazil uses different community participation arenas to enable participation in the definition of organizational strategies (Hudon and Meyer 2016). Other examples of decentralized governance are Fureai Kippu and Kapil Chit Funds (Telalbasic 2017).

Transparency and accountability

Considering the different governance structures, community currencies must control, delegate and manage a variety of stakeholders’ interests (Chasin et al. 2020). Therefore, it is essential to amplify transparency to promote accountability. To this end, CCs should provide access to current and accurate information to enable stakeholders and community members to fully exercise their regulative power and claim their interests. In a shared governance model, where CCs are considered as commons, this is an important mechanism to prevent misuse and enable transparency and self-government (Chasin et al. 2020; CCIA 2015; Jones 2011). Sardex, for example, has a centralized electronic system that allows tax transparency for the local government (Sartori and Dini 2016). To achieve this goal, blockchain technology is an opportunity to offer increased transparency of the transactions performed using cryptocurrencies and provide a robust accountability system (Diniz et al. 2021).

Platform-level governance

In CC projects where digital platforms are used to process CC transactions, governance arrangements are also necessary to provide rules of interaction and influence among ecosystem participants—platform providers and developers. In essence, the governance of the CC platform is represented by the mechanisms through which the platform provider influences developers. Adapting Tiwana (2014) proposal, two dimensions are important for this governance: (1) division of responsibilities and authority; (2) mechanisms of control.

The first dimension essentially depicts the level of centralization or decentralization of decisions, who has the authority and responsibility for decisions, similar to the project-wide dimension described before. These decisions can be divided into two categories: (a) strategic—what a party (provider or developer) should accomplish—setting the directions for each one; (b) implementation—how should this task be accomplished—features, design, interface etc. The second dimension, control, expresses how the provider ensures the alignment of developers’ work with the platform’s interest. To this end, control mechanisms are put in place to punish inadequate behaviors and reward the desirable ones (Tiwana 2014; Eisenmann et al. 2009).

Architecture

Architecture refers to the operational infrastructure in which a particular CC is implemented and used, including the main characteristics of the technological base of the CC project. The project’s architectural choices reflect the governance arrangement and is composed by the system, i.e., how the CC operates, its subsystems (smaller components) and how they interact with each other (Tiwana 2014). In essence, through this architectural system the CC project can deliver the functionality for which it was designed. This system can be described in terms of the technological choice and its openness.

Typically, CCs use one or a combination of different transaction media technologies, from more traditional media, such as paper notes, coins, tokens, vouchers and checks, to digital media, such as magnetic or with chip cards, barcodes and QR-codes, SMS (short message service) and other smart device apps (CCIA 2015).

Electronic and magnetic card-based systems dominated digital payment platforms for decades, but most recently, mobile and Internet technologies started raising interest. Mobile payment, for example, has risen with the natural evolution of protocols for providing access to money transfers and online payments. Although originated from significantly different environments, cryptocurrencies and community currencies are employed together in a growing number of CC projects giving birth to the architecture of solidarity cryptocurrencies (Diniz et al. 2019). Many studies on the possibility of uniting the two substantially different concepts of CCs and cryptocurrencies have been published in the last decade (among many examples, Vandervort et al. 2015; Fama et al. 2020; Avanzo et al. 2023).

For Internet and/or mobile-based technologies, an important architectural choice concerns the level of openness of these platforms. This choice should reflect the platform-level governance options stated above. The level of openness of the architecture in a given CC project can be considered at three levels—provider, technology and user level (Ondrus et al. 2015). The question to be asked concerning the architecture model is to what extent each level is open or closed since this decision can increase or decrease the control of the platform, as well as its market potential.

The provider level refers to whether the provider firm(s) will open the possibility for additional firms to collaborate with specific roles and responsibilities. Ondrus et al. (2015) mapped three possibilities: (1) competition—single firm; (2) co-opetition—collaboration between firms from the same industry; (3) collaboration—collaboration between firms from different industries. The technology level is concerned with the interoperability of the platform with other rival or complementary platforms (Ondrus et al. 2015). To this purpose, blockchain technologies can offer interoperability and leverage synergies with other decentralized applications (Friis and Glaser 2018). The user level relates to what extent a platform discriminates against different segments of the customer base. There are three options of user level architecture: (1) one sided, when the payment platform allows transactions between the peers within the same groups, such as B2B (e.g., Sardex, Brixton Pound, WIR) and P2P (e.g., Palmas, Fureai Kippu); two sided, meaning that transactions can occur between users of different profiles, such as B2C (Bristol Pound, RES); (2) multi-sided, when more than two profiles can transact among themselves G2P2B (governments that deliver social benefits to be used in local merchants), such as Mumbuca (Gonzalez et al. 2020; Diniz et al. 2019; Telalbasic 2017; Carrillo et al. 2018).

Features

The features needed to be implemented resul from the negotiation of all actors involved, including partners, providers, implementers and users of the CC, and the technological architecture adopted. The implemented features must align CC projects with their purpose, be defined according to the governance model and be delimited by the affordances of the architecture. Those features influence the operational activity of the CCs, such as the quantity of CC available and the total money supply, and require consideration during the design phase. Features also relate to fundraising strategies, rules of issuance, backing model, convertibility and other means to control the quantity of CC available and the total money supply (CCIA 2015).

The first features associated with a CC project are related to financial mechanisms, implying fundraising strategies. The financial model of the CC project is related to cost recovery and value propositions related to the economic sustainability of the currency project. To make the currency less vulnerable, its project can adopt, isolate or combine many different income sources, such as public and private grants and donations, fees (membership, transaction, and exchange) or advertising (CCIA 2015). Another finance mechanism is the constitution of loans or grant funds especially designed to help small businesses and assist those in need, being a possible driver of economic development. A community loan fund is a way of delivering these grants or loans. Adding a small fee on currency transactions is an alternative to supply this fund (Vandervort et al. 2015).

Issuance is the act of putting the CC into circulation and is related to the quantity of CC available for use and the way CC is taken off the circulation. Some features related to the issuance can also be potential sources of income, such as demurrage (devaluation of the currency when not used), merchandise (selling collector notes), leakage (taking notes out of circulation) and zero balance (for mutual credit systems based on CCs). Demurrage and zero balance are characteristics that guarantee the velocity of money circulation. Demurrage reduces the value of money depending on how long it is retained in the account, encouraging people to use the currency to avoid losing its value. One example is the LETS currency in Chiba (Japan) which charges a monthly fee of 1% for a currency not being used (Vandervort et al. 2015). In mutual credit systems using CCs, such as Sardex, the clearance or zero balance principle should always be pursued by merchants due to two reasons: (1) to constantly match supply and demand; (2) the absence of interest rates (Sartori 2020). Since positive and negative balances do not accumulate interest, this stimulates merchants holding positive balances to spend the currency, thus stimulating the local economy. As a result, Sardex is exchanged approximately ten times faster than the Euro (Sartori and Dini 2016).

Backing is another design feature of a currency that guarantees the long-term purchasing power of a currency, meaning that the issuer of a currency guarantees the exchange of a currency for either another currency or a commodity (CCIA 2015). The backing principle can be used to limit the issuance of a currency and infuse trust in projects that do not have government endorsement. The backing can be an official currency, material (gold, silver or collateral) or nonmaterial (government bond or backed by the community) (Diniz et al. 2021). In mutual credit systems (where companies lend money to one another), the backing consists of products and services that the company will sell in the next 12 months. Hence, money is created in a social relation of credit and debt. Although an asset backs these currencies, they are not necessarily convertible to a fiat currency (Dini and Kioupkiolis 2019).

Security and convertibility are also important features identified in CC projects. Security relates to physical and digital instruments to protect the CC value, especially as it becomes widely adopted and involves the prevention against the likelihood of fraud, counterfeiting, and hacking. Convertibility is also essential during the design phase and relates to whether or not a given CC is convertible into another currency, being a fiat currency or another CC. According to Sartori and Dini (2016), sometimes non-convertibility might be a desired design feature for a CC. In Sardex, for example, even though the 1 Sardex equals 1 Euro, it is not convertible. In this way, the initiative emphasizes the importance of retaining the resources circulating within the Sardex network—only spending and earning in this CC (Sartori and Dini 2016). Additionally, convertibility can also be an opportunity to attract new users to the community currency, offering them a way to convert the CC to fiat money.

Privileged transactions are also used by CCs to encourage specific behavior valued by the community by providing extra incentives. Some examples include discounts for purchasing eco-friendly products and bonuses for providing services for the elderly (Vandervort et al. 2015). Fureai Kippu is an example of the latter where in Japan people receive credits for helping the elderly in the community, promoting a solidary relationship (Diprose 2020). The NU-card in the Netherlands is a currency designed to promote environmental-friendly behavior in consumers by rewarding the consumption of sustainable products. In Brazil there is also the example of Moeda Verde (Santa Cruz da Esperança/SP), an initiative that provided extra income for vulnerable families through the recycling of solid waste (França et al. 2020).

Usability One of the main challenges in designing digital currencies is guaranteeing usability since users may not have the necessary basic digital skills to use the technology properly, limiting the access and the attainment of benefits of the digital technologies. To reduce this barrier, community currencies could focus on designing user interfaces in a more intuitive and simple manner (Gestalt law and KISS principle) reducing the gaps for those with lower levels of digital literacy (Carrillo et al. 2018).

Evaluation

Venable et al. (2016) discuss the evaluation of design principles in the DSR literature by pointing out: (1) the two reasons for performing an evaluation, either through "formative" evaluations that focus on improving the project, or "summative" evaluations, that focus on the selection of the project for a given application; (2) the two moments for an evaluation that could be "ex-ante," i.e., evaluation performed to estimate the impact of future implementations, and "ex-post" evaluation as an assessment of implemented project (Koppenhagen et al. 2012, also considers continuous evaluation of activities to build the artifact); (3) the forms of evaluation, by determining which aspects are essential, more important or less important; and (4) the general set of features, goals and requirements of the artifact (design and/or instantiation) that are to be subject to evaluation.

Given that this paper proposes a general framework for CC projects considering their alignment with the SDGs, the evaluation of the artifact must be considered based on the pre-established sustainability objectives of the CC. Thus, no matter if it is formative or summative, ex-ante or ex-post, in the proposed framework, the evaluation process is a tool to produce an assessment that considers the purpose of the CC, thus evaluating its social, economic and environmental impacts.

Lenis Escobar et al. (2020) make a clear connection between CCs and the SDGs, listing how these alternative monetary systems can help achieve 12 of the 17 SDGs the UN prescripts. For these authors, CCs consider the fight against poverty (SDG1) among their goals by focusing on access to economic and social rights for the poor. CCs can also aim to achieve gender equality (SDG5) by creating payment instruments for usually non-paid work carried out by women, which can promote their social and economic empowerment. If by design, the CCs' goals include paying for basic public services, such as water and electricity, they can contribute with SDG6 (water and sanitation for all) and SDG7 (access to affordable energy). As CCs are usually recognized for their power to foster the local economy (Belmonte et al. 2021), one of the expected goals of a CC is to promote inclusive growth (SDG8), which can also relate to a more resilient local infrastructure (SDG9) and has the power to reduce inequalities (SDG10). Considering the growing level of urbanization, CCs operating in urban areas should be able to contribute with the goals of making cities more sustainable and inclusive (SDG11), promoting the consumption of local products and services (SDG12), which can also foster bio-agriculture and natural environment protection (SDG15). Lastly, CC projects should be based on democratic and representative citizen participation (SDG16) by implementing solidarity principles to promote partnership for sustainable development (SDG17).

Another dimension of the evaluation of CC projects needs to consider their ability to be absorptive, adaptive, or rather transformative concerning the context in which it is developed. Blanc and Fare (2022), studying the role of CCs in helping the recovery from the pandemic crisis, found out that some of them had just absorptive capacity, relying on their ability to contribute to absorbing the repercussions of the crisis without changing the local monetary system. In other cases, CCs had a more adaptive capacity and relied on the flexibility of the monetary system to foster incremental adaptations. The authors also found cases of CCs with transformative capacity, provoking a more far-reaching way to change the monetary system. The authors point out, however, that each of these capacities has a different time horizon, being absorptive with more immediate implications, while adaptive and transformative projects demand increasingly more time to consolidate changes.

A third dimension of evaluating a CC project is related to its level of adoption, which is also an important aspect to consider while assessing the design of a CC project. By definition, adoption can be only measured "ex-post" and, as any other payment system that relies on multiple side markets, must consider the different types of users involved, either individuals, businesses, civil organizations or public agents (Diniz et al. 2019). The adoption evaluation can be measured vertically, counting the number of each type of user, or horizontally, which considers the different types of communities impacted by the CC project. Another proxy for measuring the adoption could be, for instance, the amount of transactions in CCs (Lietaer and Hallsmith 2006).

To conclude, for design science research, the evaluation is the item of the framework that defines: (1) the goals of the evaluation, which can be either for defining the characteristics of a project to be implemented to assess or improve of an implemented project; (2) the choice of the evaluation strategy, that can include one of the three dimensions presented previously; (3) the properties to evaluate by selecting specific elements of the presented dimensions; and (4) the design of each evaluation episode that helps to improve the outcomes of the process under evaluation (Venable et al. 2016).

Final considerations

This paper discussed design principles for analyzing CC projects oriented to sustainable development goals based on four dimensions: context, goals, mechanisms and evaluation. It presents three main contributions to the CC literature. First, it introduces the concept of design principles based on DSR literature, which opens new perspectives to investigate CC projects. Second, it pushes the discussion on CC projects toward the need of alignment with objectives that go beyond the usual economic aspects related to the design of monetary systems. If this approach is not exactly new in the discussion of CC projects, it is far from being dominant and it has rarely been structured as elements related to design of CC projects. Third, it provides a framework to academics and practitioners interested in analyzing CC projects related to the SDGs before or after implementation.

Designing community currency (CC) projects to achieve Sustainable Development Goals (SDGs) requires a thoughtful and nuanced approach that considers both the goals and their evaluation in the wider context of community development. Firstly, it is crucial to define the purpose of the currency and whether it's meant to address environmental sustainability, economic equity, or social inclusion. Different goals may require distinct design features, such as specific transaction mechanisms, complementary currencies, and governance structures.

Being a fully theoretical instrument, although based on updated literature of both CC and DSR, the design principles presented in this paper still need a more robust evaluation test of actual cases. In the literature of design principles and DSR, evaluation has two different meanings: one related to evaluating the proposed artifact and another related to evaluating the design principles themselves (Iivari et al. 2021). In this paper, we did not evolve to the evaluation of the tool of the design principles themselves, which was out of the scope of this paper. Additionally, the framework proposed did not provide specific guidance on the implementation of the CC projects. This goes beyond this paper’s scope and is an opportunity for future studies.

Many possibilities of future studies can follow the discussions presented in this paper. First, the design principles must be properly evaluated both theoretically and as an instrumental tool for practitioners interested in developing and analyzing monetary systems that could contribute with the sustainable development goals. Second, the design principles presented here can be used as a framework to categorize existing CC projects and classify them according to their contributions to a more sustainable planet. Third, given the dynamic evolution of the purposes and characteristics of complementary monetary systems, the design principles presented in this paper should be regularly revisited in order to be updated and expanded, taking advantage of the DSR approach that understands the performance of the design cycle in a project as a "balance between the efforts spent in constructing and evaluating the evolving design artifact" (Hevner and Chatterjee 2010, p. 19).

Data availability

We did not collect any data for the study presented in this paper, which is entirely based on literature review.

References

Alcantara C, Dick C (2017) Decolonization in a digital age: cryptocurrencies and indigenous self- determination in Canada. Can J Law Soc 31(1):19–35

Alves FM, Santos R, Penha-Lopes G (2022) Revisiting the missing link: an ecological theory of money for a regenerative economy. Sustainability 14(7):4309

Amato M, Fantacci L (2020) Complementary currencies. In: Battilossi S, Cassis Y, Yago K (eds) Handbook of the history of money and currency. Springer, Berlin, pp 501–522

Arno A (2005) Cobo and tabua in Fiji: two forms of cultural currency in an economy of sentiment. Am Ethnol 32(1):46–62

Avanzo S, Criscione T, Linares J, Schifanella C (2023) Universal basic income in a blockchain-based community currency. In: Proceedings of the 2023 ACM conference on information technology for social good. September 06–08, 2023, Lisbon, Portugal, pp 223–232. https://doi.org/10.1145/3582515.3609538 ACM, New York

Balaguer Rasillo X (2021) Alternative economies, digital innovation and commoning in grassroots organisations: analysing degrowth currencies in the Spanish region of Catalonia. Environ Policy Gov 31(3):175–185

Barinaga E (2017) Land, labour, capital: solidarity and inequality in a community currency. In: IV international conference on social and complementary currencies. Barcelona

Barinaga E (2020a) A route to commons-based democratic monies? Embedding the governance of money in traditional communal institutions. Front Blockchain 3:50

Barinaga E (2020b) The Miracle of Wörgl. Harvard Business Publishing, Brighton

Belmonte SM, Puig J, Roca M, Segura M (2021) Crisis mitigation through cash assistance to increase local consumption levels—a case study of a bimonetary system in Barcelona, Spain. J Risk Financ Manag 14(9):1–17

Bieri DS (2017) Regulatory space and the flow of funds across the hierarchy of money. In: Martin R, Pollard J (eds) Handbook on the geographies of money and finance. Edward Elgar Publishing, New York, pp 377–414

Blanc J (2011) Classifying “CCs”: community, complementary and local currencies types and generations. Int J Community Curr Res 15(D):4–10

Blanc J (2018) Making sense of the plurality of money: a Polanyian attempt. In: Gómez GM (ed) Monetary plurality in local, regional and global economies. Routledge, London, pp 48–66

Blanc J, Fare M (2013) Understanding the role of governments and administrations in the implementation of community and complementary currencies. Ann Public Cooper Econ 84(1):63–81

Blanc J, Fare M (2022) Community-based alternative currencies as drivers of new monetary arrangements. In: Vallet G, Kappes S, Rochon LP (eds) Central banking, monetary policy and the future of money. Edward Elgar Publishing, pp 245–271

Blanc J, Lakócai C (2020) Toward spatial analyses of local currencies: the case of France. Int J Community Curr Res 24(1):11–29

Brenes E (2011) Complementary currencies for sustainable local economies in Central America. Int J Community Curr Res 15:32–38

Carrillo CIP, Rosa JLDL, Peña PNC, Pharow P (2018) Identification of barriers and solutions for adoption of social, complementary and/or virtual currencies. Int J Community Curr Res 22:125–140

CCIA (2015) People powered money: designing, developing and delivering community currencies. Community Currencies in Action (CCIA). New Economics Foundation. https://monneta.org/en/people-powered-money-ccia/. Accessed 20 Aug 2022

Cernev A (2019) Mumbuca É Dinheiro. Rev Bras De Casos Gvcasos 9(2):10

Chasin F, Schmolke F, Becker J (2020) Design principles for digital community currencies. Paper presented at the 53rd Hawaii International Conference on System Sciences, Maui

Chibwara W (2020) Rural villages coping with COVID-19. Grassroots Economics Blog. https://www.grassrootseconomics.org/post/rural-villages-coping-with-covid-19. Accessed 9 Apr 2022

Coelho SL (2019) Moedas locais: reflexões sobre três casos em Portugal. J Stud Citizensh Sustain 4:110–122

Conill J, Castells M, Cardenas A, Servon L (2012) Beyond the crisis: the emergence of alternative economic practices. In: Castells M, Caraça J, Cardoso G (eds) Aftermath: the cultures of the economic crisis. Oxford University Press, Oxford, pp 210–250

Cronholm S, Göbel H (2018) Guidelines supporting the formulation of design principles. In: 29th Australasian conference on information systems (ACIS). Sydney, December 3–5, 2018

Crossley N (2021) A dependent structure of interdependence: structure and agency in relational perspective. Sociology 56:166–182

DiMaggio PJ, Powell WW (1983) The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. Am Sociol Rev 48:147–160

Dini P, Kioupkiolis A (2019) The alter-politics of complementary currencies: the case of Sardex. Cogent Soc Sci 5(1):1646625

Diniz E, Cernev A, Daneluzzi F, Rodrigues D (2018) Social cryptocurrencies: social finance organizations at the new era of digital community currencies. EGOS 2018 Colloquium, 34, Tallinn, Estonia

Diniz EH, Siqueira ES, van Heck E (2019) Taxonomy of digital community currency platforms. Inf Technol Dev 25(1):69–91

Diniz EH, Araujo MHD, Gonzalez L, Faria LAS, Cernev AK (2021) Basic income with digital community currency: digital platforms for public policies implementation during pandemic crisis. In: Proceedings GlobDev 2021, Austin. https://aisel.aisnet.org/globdev2021/8

Diprose G (2020) Transacting services through time banking: renegotiating equality and reshaping work. In: Gibson-Graham JK, Dombroski K (eds) The handbook of diverse economies, chapter 26. Edward Elgar Publishing, Cheltenham, pp 238–245

Edelman LB, Suchman MC (1997) The legal environments of organizations. Ann Rev Sociol 23(1):479–515

Eisenmann TR, Parker G, Van Alstyne M (2009) Opening platforms: how, when and why. Platf Mark Innov 6:131–162

Fama M, Lucarelli S, Orzi R (2020) Rethinking money, rebuilding communities: a multidimensional analysis of crypto and complementary currencies. Partecip Confl 13(1):337–359

Fantacci L (2005) Complementary currencies: a prospect on money from a retrospect on premodern practices. Financ Hist Rev 12(1):43–61

França ASL, Neto JA, Gonçalves RF, Almeida CMVB (2020) Proposing the use of blockchain to improve the solid waste management in small municipalities. J Clean Prod 244:118529

Freire MV (2009) Social Economy and Central banks: legal and regulatory issues on social currencies (social money) as a public policy instrument consistent with monetary policy. IJCCR (int J Community Curr Res) 13:76–94

Friis G, Glaser F (2018) Extending blockchain technology to host customizable and interoperable community currencies. Int J Community Curr Res 22:71–84

Fullerton JOHN (2018) Finance for a regenerative world. Capital Institute, New York

Gomez GM (2010) What was the deal for the participants of the Argentine local currency systems, the Redes de Trueque? Environ Plan A 42(7):1669–1685

Gómez GL, Demmler M (2018) Social currencies and cryptocurrencies: characteristics, risks and comparative analysis. CIRIEC Esp Rev De Econ Públ Soc Cooper 93:265–291

Gonzalez L, Cernev AK, Araujo MHD, Diniz EH (2020) Moedas complementares digitais e políticas públicas durante a crise da COVID-19. Rev De Adm Públ 54:1146–1160

Greco TH Jr (2021) Solar dollars: a complementary currency that incentivizes renewable energy. Front Built Environ 7:785145

Greenberg S (2001) Context as a dynamic construct. Hum Comput Interact 16(2–4):257–268

Gregor S, Chandra Kruse L, Seidel S (2020) Research perspectives: the anatomy of a design principle. J Assoc Inf Syst 21(6):1622–1652

Hancher L, Moran M (eds) (1989) Capitalism, culture, and economic regulation (No 3). Oxford University Press, Oxford

Harmon DJ, Haack P, Roulet TJ (2019) Microfoundations of institutions: a matter of structure versus agency or level of analysis? Acad Manag Rev 44(2):464–467

Hevner A, Chatterjee S (2010) Design science research in information systems. In: Design research in information systems, Integrated Series in Information Systems, vol 22. Springer, Boston. https://doi.org/10.1007/978-1-4419-5653-8_2

Hevner AR, March ST, Park J, Ram S (2004) Design science in information systems research. MIS Q 28:75–105

Howson P (2021) Distributed degrowth technology: challenges for blockchain beyond the green economy. Ecol Econ 184:107020

Hudon M, Meyer C (2016) A case study of microfinance and community development banks in Brazil: private or common goods? Nonprofit Volunt Sect Q 45(4_suppl):116S-133S

Iivari J, Rotvit Perlt Hansen M, Haj-Bolouri A (2021) A proposal for minimum reusability evaluation of design principles. Eur J Inf Syst 30(3):286–303

Ingham G (2004) The nature of money. Polity Press, Cambridge

Joachain H, Klopfert F (2012) Emerging trend of complementary currencies systems for environmental purposes: changes ahead. Int J Community Curr Res 16(D):156–168

Jones SD (2011) Money and Participatory Governance: a review of the literature. Int J Community Curr Res 15(A):56–68

Jones D, Gregor S (2007) The anatomy of a design theory. J Assoc Inf Syst 8(5):1

Kobayashi S, Yoshihisa M, Yoshida M (2017) Historical transition of community currencies in Japan (Paper). In: 4th international conference on social and complementary currencies. Barcelona, Spain

Koppenhagen N, Gaß O, Müller B (2012) Design science research in action—anatomy of success critical activities for rigor and relevance. In: Proceedings of the 20th European Conference on Information Systems (ECIS 2012), Barcelona

Larue L (2020) A conceptual framework for classifying currencies. Int J Commun Currency Res 24:45–60 https://doi.org/10.15133/j.ijccr.2020.004

Larue L, Meyer C, Hudon M, Sandberg J (2022) The ethics of alternative currencies. Bus Ethics Q 32(2):299–321

Lenis Escobar A, Rueda López R, Solano-Sánchez MÁ, García-Moreno García MDLB (2020) The role of complementary monetary system as an instrument to innovate the local financial system. J Open Innov Technol Mark Complex 6(4):141

Lietaer B, Hallsmith G (2006) Community currency guide. http://www.community-exchange.org/docs/community_currency_guide.pdf. Global Community Initiatives, Montpelier

Longhurst N, Seyfang G (2011) Complementary currencies: the state of the art. Int J Community Curr Res 15(D)

Martignoni J (2015) Cooperation and intertrade between community currencies. Int J Community Curr Res 19(D):137–151

Meyer C (2020) The commons: a model for understanding collective action and entrepreneurship in communities. J Bus Ventur 35(5):106034

Meyer C, Hudon M (2017) Alternative organizations in finance: commoning in complementary currencies. Organization 24(5):629–647

Meyer C, Hudon M (2019) Money and the commons: an investigation of complementary currencies and their ethical implications. J Bus Ethics 160:277–292

Michel A, Hudon M (2015) Community currencies and sustainable development: a systematic review. Ecol Econ 116:160–171

Miszczuk M (2018) Local currencies as an instrument for implementing the concept of sustainable development. Probl Ekorozw Probl Sustain Dev 13(2):83–90

Montecino J, Epstein G (2015) Did quantitative easing increase income inequality? Institute for New Economic Thinking Working Paper Series No. 28, SSRN: https://ssrn.com/abstract=2692637 or https://doi.org/10.2139/ssrn.2692637

Nakazato H, Lim S (2017) Community rebuilding processes in a disaster-damaged area through community currency: the pilot project of Domo in Kamaishi, Japan. Disaster Prev Manag Int J 26(1):79–93

North P (2014) Complementary currencies. In: Parker M, Cheney G, Fournier V, Land C (eds) The Routledge companion to alternative organization. Routledge, London, pp 206–218

Ondrus J, Gannamaneni A, Lyytinen K (2015) The impact of openness on the market potential of multi-sided platforms: a case study of mobile payment platforms. J Inf Technol 30(3):260–275

Ostrom E (1990) Governing the commons: the evolution of institutions for collective action. Cambridge University Press, Cambridge

Place C, Bindewald L (2015) Validating and improving the impact of complementary currency systems through impact assessment frameworks. Int J Community Curr Res 19(D):152–164

Place C, Calderon A, Stodder J, Wallimann I (2018) Swiss currency systems: atlas, compendium and chronicle of legal aspects. Int J Community Curr Res 22:85–104

Radeljak F (2018) Autonomy of community and complementary currencies in relation to state law. The Eusko, the Ekhi and the Txantxi in the Basque Country. Oñati Socio Legal Ser [online] 8(7):1041–1070

Ram S, Goes P (2021) Focusing on programmatic high impact information systems research, not theory, to address grand challenges. MIS Q 45(1):479–483

Rauschmayer F, Polzin C, Mock M, Omann I (2018) Examining collective action through the capability approach: the example of community currencies. J Hum Dev Capab 19(3):345–364

Rockström J, Sukhdev P (2016) The SDGs wedding cake. Stockholm Resilience Centre. https://www.stockholmresilience.org/research/research-news/2016-06-14-the-sdgs-wedding-cake.html. Accessed 10 Oct 2022

Rowan B (1982) Organizational structure and the institutional environment: the case of public schools. Adm Sci Q 27(2):259–279

Saito K, Morino E (2010) The brighter side of risks in peer-to-peer barter relationships. Future Gener Comput Syst 26(8):1300–1316

Sartori L (2020) The social life of sardex and liberex: Kin or acquaintances? A comparison between two mutual credit circuits in Italy. Partecip Confl 13(1):487–513

Sartori L, Dini P (2016) From complementary currency to institution: a micro-macro study of the Sardex mutual credit system. Stato e Mercato 36(2):273–304

Seo MG, Creed WD (2002) Institutional contradictions, praxis, and institutional change: a dialectical perspective. Acad Manag Rev 27(2):222–247

Seyfang G, Longhurst N (2013) Growing green money? Mapping community currencies for sustainable development. Ecol Econ 86:65–77. https://doi.org/10.1016/j.ecolecon.2012.11.003

Sillen D, Wong PH, Türkeli S (2019) Community currency programmes as a tool for sustainable development: the cases of Mombasa and Nairobi Counties. Kenya. Tech. Rep. 2019-2. UNRISD, Geneva

Siqueira ACO, Honig B, Mariano S, Moraes J (2020) A commons strategy for promoting entrepreneurship and social capital: implications for community currencies, cryptocurrencies, and value exchange. J Bus Ethics 166(4):711–726

Stalnaker R (2014) Context. Oxford University Press, Oxford

Stodder J (2009) Complementary credit networks and macroeconomic stability: Switzerland’s Wirtschaftsring. J Econ Behav Organ 72(1):79–95

Telalbasic I (2017) Redesigning the concept of money: a service design perspective on complementary currency systems. J Des Bus Soc 3(1):21–44

Thiel C (2012) Moral money-the action guiding impact of complementary currencies. Int J Community Curr Res 16:91–96

Tiwana A (2014) Platform ecosystems: aligning architecture, governance, and strategy. Elsevier, New York

United Nations (2015) Transforming our world: the 2030 Agenda for Sustainable Development. General Assembly. Seventieth session. Resolution adopted by the General Assembly on 25 September 2015. https://www.un.org/ga/search/view_doc.asp?symbol=A/RES/70/1&Lang=E. Accessed 30 Nov 2021

Uzureau C, Furlonger D, Merji A (2019) Expand your token universe to create new business models. Gartner Research, Stamford

Vandervort D, Gaucas D, Jacques RS (2015) Issues in designing a bitcoin-like community currency. In: International conference on financial cryptography and data security. FC 2015 International Workshops, BITCOIN, WAHC, and Wearable, San Juan, Puerto Rico. Springer, Berlin, pp 78–91

Venable J, Pries-Heje J, Baskerville R (2016) FEDS: a framework for evaluation in design science research. Eur J Inf Syst 25(1):77–89

Watkins JP (2014) Quantitative easing as a means of reducing unemployment: a new version of trickle-down economics. J Econ Issues 48(2):431–440. https://doi.org/10.2753/JEI0021-3624480217

Wolk HI, Dodd JL, Rozycki JJ (2016) Accounting theory: conceptual issues in a political and economic environment. Sage Publications. https://doi.org/10.4135/9781506300108

Funding

This study was funded by Formas, the Swedish Research Council for Sustainable Development, and the authors declare that they have no conflict or competing interests in this research.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict related to this study. The study did not involve any data collections or interviews with human participants.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Handled by Paul Weaver, Maastricht University, UK.

Rights and permissions