Abstract

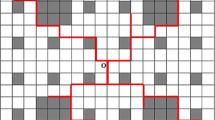

This paper investigates the statistical behaviors of fluctuations of price changes in a stock market. The Sierpinski carpet lattice fractal and the percolation system are applied to develop a new random stock price for the financial market. The Sierpinski carpet is an infinitely ramified fractal and the percolation theory is usually used to describe the behavior of connected clusters in a random graph. The authors investigate and analyze the statistical behaviors of returns of the price model by some analysis methods, including multifractal analysis, autocorrelation analysis, scaled return interval analysis. Moreover, the authors consider the daily returns of Shanghai Stock Exchange Composite Index, and the comparisons of return behaviors between the actual data and the simulation data are exhibited.

Similar content being viewed by others

References

Ilinski K, Physics Of Finance: Gauge Modeling in Non-equilibrium Pricing, John Wiley, New York, 2001.

Lux T and Marchesi M, Volatility clustering in financial markets: A micro-simulation of interacting agents, Int. J. Theoret. Appl. Finance, 2000, 3: 675–702.

Mills T C, The Econometric Modeling of Financial Time Series, 2nd edition, Cambridge University Press, Cambridge, 1999.

Mandelbrot B B, Fractals and Scaling in Finance: Discontinuity, Concentration, Risks, Springer, Berlin, Heidelberg, New York, 1997.

Falconer K J, The Geometry of Fractal Sets, Cambridge University Press, Cambridge, 1986.

Peters E E, Fractal Market Analysis: Applying Chaos Theory to Investment and Economics, John Wiley & Sons, New York, 1994.

Wang J and Deng S, Fluctuations of interface statistical physics models applied to a stock market model, Nonlinear Analysis: Real World Applications, 2008, 9: 718–723.

Wang J, Wang Q Y, and Shao J G, Fluctuations of stock price model by statistical physics systems, Mathematical and Computer Modelling, 2010, 51: 431–440.

Wang T S, Wang J, and Fan B L, Statistical analysis by statistical physics model for the stock markets, International Journal of Modern Physics C, 2009, 20: 1547–1562.

Wang F, Yamasaki K, Havlin S, and Stanley H E, Scaling and memory of intraday volatility return intervals in stock markets, Physical Review E, 2006, 73: 026117.

Zhang J H and Wang J, Modeling and simulation of the market fluctuations by the finite range contact systems, Simulation Modelling Practice and Theory, 2010, 18: 910–925.

Guo Y L and Wang J, Simulation and statistical analysis of market return fluctuation by Zipf method, Mathematical Problems in Engineering, 2011, 2011: Article ID 253523, 13 pages.

Stauffer D, Can percolation theory be applied to the stock market, Ann. Physics, 1998, 7: 529–538.

Wang F and Wang J, Statistical analysis and forecasting of return interval for SSE and model by lattice percolation system and neural network, Computers & Industrial Engineering, 2012, 62: 198–205.

Durrett R, Lecture Notes on Particle Systems and Percolation, Wadsworth & Brooks, California, 1988.

Grimmett G, Percolation, 2nd edition, Springer-Verlag, Berlin, 1999.

Liggett T, Interacting Particle Systems, Springer-Verlag, New York, 1985.

Stauffer D and Aharony A, Introduction to Percolation Theory, Taylor & Francis, London, 2001.

Takayasu H, Practical Fruits of Econophysics: Proceedings of the Third Nikkei Econophysics Symposium, Springer, New York, 2006.

Krivoruchenko M I, Best linear forecast of volatility in financial time series, Phys. Rev. E, 2004, 70: 036102.

Mantegna R N and Stanley H E, Scaling behavior in the dynamics of an economic index, Nature, 1995, 376: 46–49.

Kantelhardt J W, Zschiegner S A, Koscielny-Bunde E, Havlin S, Bunde A, and Stanley H E, Multifractal detrended fluctuation analysis of nonstationary time series, Physica A, 2002, 316: 87–114.

Bunde A, Kropp J, and Schellnhuber H J, The Science of Disasters — Climate Disruptions, Heart Attacks, and Market Crashes, Springer, Berlin, 2002.

Feder J, Fractals, Plenum Press, New York, 1988.

Mandelbrot B B, The Fractal Geometry of Nature, Freeman, San Francisco, 1982.

Chen M F, From Markov Chains to Non-Equilibrium Particle Systems, World Scientific, Singapore, 1992.

Shinoda M, Existence of phase transition of percolation on Sierpinski carpet lattices, J. Appl. Prob., 2002, 39: 1–10.

Shinoda M, Non-existence of phase transition of oriented percolation on Sierpinski carpet lattices, Probab. Theory Relat. Fields, 2003, 125: 447–456.

Wang J, Supercritical Ising model on the lattice fractal — The Sierpinski carpet, Modern Physics Letters B, 2006, 20: 409–414.

Peters E E, Fractal structure in the capital markets, Financial Analyst Journal, 1989, 7: 434–453.

Peitgen H O, Jürgens H, and Saupe D, Chaos and Fractals, Springer-Verlag, New York, 1992.

Muzy J F, Bacry E, and Arneodo A, Wavelets and multifractal formalism for singular signals: Application to turbulence data, Phys. Rev. Lett., 1991, 67: 3515–3518.

Bershadskii A, Multifractal critical phenomena in traffic and economic processes, Eur. Phys. J. B, 1999, 11: 361–364.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China Grant Nos. 71271026 and 10971010.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Dong, Y., Wang, J. Complex system analysis of market return percolation model on Sierpinski carpet lattice fractal. J Syst Sci Complex 27, 743–759 (2014). https://doi.org/10.1007/s11424-014-2073-5

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-014-2073-5