Abstract

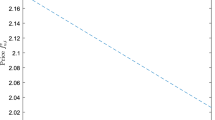

The pricing and hedging problem of foreign currency option with higher borrowing rate is discussed. The method to obtain the price and hedging portfolio of currency option is based on backward stochastic differential equations (BSDE for short) theory and Malliavin calculus technique. The sensitivity of the model parameters is also considered and some numerical simulations are given to illustrate our conclusion.

Similar content being viewed by others

References

Black F and Scholes M, The pricing of options and corporate liabilities, Journal of Political Economy, 1973, 81: 635–654.

Merton R C, Theory of rational option pricing, Bell Journal of Economics and Management Science, 1973, 4: 141–183.

El Karoui N, Peng S, and Quenez M C, Backward stochastic differential equation in finance, Mathematical Finance, 1997, 7(1): 1–71.

Biger N and Hull J, The valuation of currency options, Financial Management, 1983, 1: 24–28.

Hilliard J E, Madura J, and Tucker A L, Currency option pricing with stochastic domestic and foreign interest rates, Journal of Financial and Quantitative Analysis, 1991, 26(1): 139–151.

Yan J, A short course in mathematical finance, Presented at Yantai (China) Summer School of Mathematical Finance, 2007.

Pardoux E and Peng S, Adapted solution of a backward stochastic differential equation, Systems & Control Letter, 1990, 14: 55–61.

Nualart D, The Malliavin Calculus and Related Topics, Springer-Verlag, New York and Berlin, 1995.

Øksendal B, An introduction to Malliavin calculus with application to economics, Lecture notes from a course at the Norwegian School of Economics and Business Administration (NHH), NHH Preprint Series, 1996.

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper is supported by the National Nature Science Foundation of China (11221061, 61174092, 11126214, 11126208), the National Science Fund for Distinguished Young Scholars of China (11125102), and the Fundamental Research Funds for the Central Universities (2010QS05).

This paper was recommended for publication by Editor ZOU Guohua.

Rights and permissions

About this article

Cite this article

Chen, L., Huang, Z. & Wu, Z. Pricing and hedging problem of foreign currency option with higher borrowing rate. J Syst Sci Complex 26, 407–418 (2013). https://doi.org/10.1007/s11424-013-1018-8

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-013-1018-8