Abstract

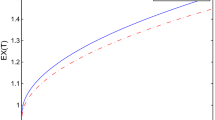

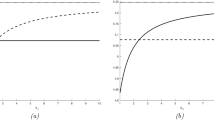

From the insurer’s point of view, this paper studies the optimal investment and proportional reinsurance in the Sparre Andersen model. Under the criterion of maximizing the adjustment coefficient, the authors obtain the closed form expressions of the optimal strategy and the maximal adjustment coefficient, and derive the explicit expression of the ruin probability or its lower bound when the claim sizes are exponentially distributed. Some numerical examples are presented, which show the impact of model parameters on the optimal values. It can also be seen that the optimal strategy to maximize the adjustment coefficient is sometimes equivalent to those which minimize the ruin probability.

Similar content being viewed by others

References

S. Browne, Optimal investment policies for a firm with random risk process:exponential utility and minimizing the probability of ruin, Mathematics of Operations Research, 1995, 20: 937–958.

B. Højgaard and H. Taksar, Optimal proportional reinsurance policies for diffusion models, Scandinavian Actuarial Journal, 1998, 1: 166–180.

C. Hipp and M. Plum, Optimal investment for insurers, Insurance: Mathematics and Economics, 2000, 27: 215–228.

C. Hipp and M. Plum, Optimal investment for investors with state dependent income, and for insurers, Finance and Stochastics, 2003, 7: 299–321.

H. Schmidli, Optimal proportional reinsurance policies in a dynamic setting, Scandinavian Actuarial Journal, 2001, 1: 55–68.

H. Schmidli, On minimizing the ruin probability by investment and reinsurance, Annals of Applied Probability, 2002, 12: 890–907.

C. Liu and H. Yang, Optimal investment for a insurer to minimize its probability of ruin, North American Acruarial Journal, 2004, 8(2): 11–31.

Z. Liang, Optimal proportional reinsurance for controlled risk process which is perturbed by diffusion, Acta Mathematicae Applicatae Sinica, English Series, 2007, 23(3): 477–488.

L. Bai and J. Guo, Optimal proportional reinsurance and investment with multiple risky assets and no-shorting constraint, Insurance: Mathematics and Economics, 2008, 42: 968–975.

Y. Cao and N. Wan, Optimal proportional reinsurance and investment based on Hamilton-Jacobi-Bellman equation, Insurance: Mathematics and Economics, 2009, 45: 157–162.

X. Zhang, K. Zhang, and X. Yu, Optimal proportional reinsurance and investment with transaction costs, I: Maximizing the terminal wealth, Insurance: Mathematics and Economics, 2009, 44: 473–478.

Z. Liang, L. Bai, and J. Guo, Optimal investment and proportional reinsurance with constrained control variables, Optimal Control, Applications and Methods, 2011, 32: 587–608.

H. Yang and L. Zhang, Optimal investment for insurer with jump-diffusion risk process, Insurance: Mathematics and Economics, 2005, 37: 615–634.

C. Hipp and H. Schmidli, Asymptotics of ruin probabilities for controlled risk processes in the small claims case, Scandinavian Actuarial Journal, 2004, 5: 321–335.

J. Gaier, P. Grandits, and W. Schachermeyer, Asymptotic ruin probabilities and optimal investment, Annals of Applied Probability, 2003, 13: 1054–1076.

H. Waters, Excess of loss reinsurance limits, Scandinavian Actuarial Journal, 1979, 1: 37–43.

M. L. Centeno, Excess of loss reinsurance and Gerber’s inequality in the Sparre Anderson model, Insurance: Mathematics and Economics, 2002a, 31: 415–427.

M. L. Centeno, Measuring the effects of reinsurance by the adjustment coefficient in the Sparre Anderson model, Insurance: Mathematics and Economics, 2002b, 30: 37–49.

M. Hald and H. Schmidli, On the maximisation of the adjustment coefficient under proportional reinsurance, ASTIN Bulletin, 2004, 34: 75–83.

Z. Liang and J. Guo, Optimal proportional reinsurance and ruin probability, Stochastic Models, 2007, 23(2): 333–350.

Z. Liang and J. Guo, Upper bound for ruin probabilities under optimal investment and proportional reinsurance, Applied Stochastic Models in Business and Industry, 2008, 24: 109–128.

K. C. Yuen, H. Yang, and R. Wang, On Erlang(2) risk process perturbed by diffusion, Communications in Statistics — Theory and Methods, 2005, 34: 2197–2208.

J. Cai and D. C. M. Dickson, Upper bounds for ultimate ruin probabilities in the Sparre Anderson model with interest, Insurance: Mathematics and Economics, 2003, 32: 61–71.

S. Li and J. Garrido, Ruin probabilities for two classes of risk processes, Astin Bulletin, 2005, 35: 61–77.

J. Grandell, Aspects of Risk Theory, Springer-Verlag, NY, 1991.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research is supported by the National Natural Science Foundation of China under Grant No. 11101215 and the Natural Science Foundation of the Jiangsu Higher Education Institutions of China under Grant No. 09KJB110004.

This paper was recommended for publication by Editor Shouyang WANG

Rights and permissions

About this article

Cite this article

Liang, Z., Guo, J. Optimal investment and proportional reinsurance in the Sparre Andersen model. J Syst Sci Complex 25, 926–941 (2012). https://doi.org/10.1007/s11424-012-0058-9

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-012-0058-9