Abstract

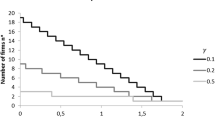

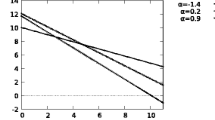

This paper studies a general dynamic duopoly in which two firms compete in the adoption of current technology with a further new technology anticipated. Three kinds of equilibria may occur in technology adoption, namely the preemptive, sequential, and simultaneous equilibrium, depending on the level of operating costs and the first-move advantage. It shows that the faster technological innovation encourages the leader to invest earlier, while induces the follower to invest later. Furthermore, like the investment costs, with the increase of the operating costs, the follower tends to invest later, while the leader tends to invest earlier. However, the investment thresholds are more sensitive to the change of the operating costs than that of the investment costs.

Similar content being viewed by others

References

M. Kijima, Stochastic Process with Applications to Finance, Chapman and Hall, London, 2002.

R. McDonald and D. Siegel, The value of waiting to investment, Quarterly Journal of Economics, 1986, 101(4): 707–727.

S. R. Grenadier and A. M. Weiss, Investment in technological innovations: An option pricing approach, Journal of Financial Economics, 1997, 44: 397–416.

G. Götz, Strategic timing of adoption of new technologies under uncertainty: A note, International Journal of Industrial Organization, 2000, 18: 369–379.

B. James, Real Options and the Adoption of New Technologies, Working paper, MIT press, Cambridge, 1999. URL: http://www.researchoninnovation.org/lealopt.pdf.

A. Dixit and R. Pindick, Investment Under Uncertainty, Princeton University Press, Princeton, NJ, 1994.

L. Trigeorgis, Real Options: Managerial Flexibility and Strategy in Resource Allocation, MIT press, Cambridge, 1996.

S. R. Grenadier, Game Choices: The Intersection of Real Options and Game Theory, London, Risk Books, 2000.

F. Smets, Exporting Versus FDI: The Effect of Uncertainty, Irreversibility and Strategic Interactions, Working Paper, Yale University, New Haven, CT, 1991.

D. Fudenberg and J. Tirole, Preemption and rent equalization in the adoption of new technology, Review of Economic Studies, 1991, 52: 383–401.

M. J. Nielsen, Competition and irreversible investments, International Journal of Industrial Organization, 2002, 20: 731–743.

K. J. M. Huisman and P. M. Kort, Effects of strategic interactions on the option value of waiting, CentER Discussion Paper No. 9992, University of Tiburg, Tiburg, the Netherlands, 1999. URL: http://www.kub.nl:2080/greyfiles/center/1999/doc/92.pdf.

L. H. R. Alvares and R. Stenbacka, Adoption of uncertainty mutistage technology projects: A real options approach, Journal of Mathematical Economics, 2001, 35: 71–97.

G. Pawlina and P. M. Kort, Real options in an asymmetric duopoly: Who benefits from your competitive disadvantage, Working paper No. 2001-95, University of Tiburg, Tiburg, the Netherlands, 2002. URL: http://www.center.uvt.nl/phd_stud/pawlina/2c0102.pdf.

K. J. M. Huisman, P. M. Kort, G Pawlina, and J. J. Thijssen, Strategic investment under uncertainty: Merging real options with game theory, CentER Discussion Paper No. 0924, University of Tiburg, Tiburg, the Netherlands, 2003. URL: http://www.kub.nl:2080/greyfiles/center/2003/doc/24.pdf.

B. J. Yin, S. G. Hu, and D. X. Lei, The impact of operating costs on investment strategies in new technology adoption with a further new technology anticipated, Applied Mathematics A Journal of Chinese Universities, 2006, 21(1): 8–20.

Author information

Authors and Affiliations

Corresponding author

Additional information

The work is supported by National Natural Science Foundation of China under Grant No. 70301003.

Rights and permissions

About this article

Cite this article

Yin, B., Hu, S. Competitive Investment Strategies in New Technology Adoption with a Further New Technology Anticipated. Jrl Syst Sci & Complex 20, 444–453 (2007). https://doi.org/10.1007/s11424-007-9040-3

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/s11424-007-9040-3