Abstract

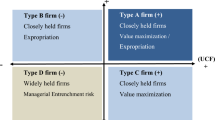

We examine shareholder wealth effects in a heterogeneous sample of 115 European leveraged going private transactions from 1997 to 2005. Average abnormal returns as reaction to the LBO announcement amount to 24.20%. In cross-sectional regressions, we find that these value gains can largely be attributed to differences in corporate governance: on a macro level, abnormal returns for pre-LBO shareholders are larger in countries with a poor protection of minority shareholders. On a firm level, companies with a high pre-LBO free float and comparatively weak monitoring by shareholders tend to show high abnormal returns. Furthermore, companies that are undervalued with respect to an industry peer-group exhibit higher announcement returns, indicating that agency conflicts and/or market inefficiencies can serve as an explanation.

Similar content being viewed by others

References

Admati, A., Pfleider, P., Zechner, J.: Large shareholder activism, risk sharing and financial market equilibrium. J. Political Econ. 102, 1097–1130 (1994)

Agrawal, A., Knoeber, C.: Firm performance and mechanisms to control agency problems between managers and shareholders. J. Financ. Quant. Analysis 31, 377–397 (1996)

Amihud, Y.: Leveraged management buyouts and shareholders’ wealth. In: Amihud, Y. (ed.) Leveraged Management Buyouts, pp. 3–34. Homewood (1989)

Beiner, S., Drobetz, W., Schmid, M., Zimmermann, H.: An integrated framework of corporate governance and firm value. Eur. Financ. Manag. 12, 249–283 (2006)

Brown, S.J., Warner, J.B.: Using daily stock returns: The case of event studies. J. Financ. Econ. 14(1), 3–31 (1985)

Burrough, B., Helyar, J.: Barbarians at the Gate—The Fall of RJR Nabisco, p. 5. HarperCollins, New York (1990)

CMBOR: Centre for Management Buy-Out Research Quarterly Review. Nottingham University Business School (2005)

Corrado, C.J.: A nonparametric test for abnormal security-price performance in event studies. J. Financ. Econ. 23(2), 385–395 (1989)

De Angelo, H., De Angelo, L., Rice, E.M.: Going private: Minority freeze-outs and stockholder wealth. J. Law Econ. 27(2), 367–401 (1984)

De Long, B.J., Shleifer, A., Summers, L.H., Waldmann, R.J.: Noise trader risk in financial markets. J. Political Econ. 98(4), 703–738 (1990)

Faccio, M., Lang, L.H.P.: The ultimate ownership of Western European corporations. J. Financ. Econ. 65(3), 365–395 (2002)

Fama, E.F.: Efficient capital markets: A review of theory and empirical work. J. Finance 25(2), 383–417 (1970)

Fama, E.F.: Efficient capital markets II. J. Finance 46(5), 1575–1617 (1991)

Franks, J., Mayer, C.: Capital markets and corporate control: a study of France, Germany and the UK. Econ. Policy 4(10), 189–231 (1990)

Grammatikos, T., Swary, I.: Incentives for public firms to go private: Superior information or organizational efficiency. Working Paper (1986)

Grossman, S.J., Hart, O.: Takeover bids, the free-rider problem, and the theory of the corporation. Bell J. Econ. 11(1), 42–64 (1980)

Halpern, P., Kieschnick, R., Rotenberg, W.: On the heterogenity of leveraged going private transactions. Rev. Financ. Stud. 12(2), 281–309 (1999)

Handelsblatt: Schon 20 Firmen in diesem Jahr von britischen Kurszetteln verschwunden, No 149, p. 29 (4th of August 2000)

Hite, G.L., Vetsuypens, M.R.: Management buyouts of divisions and shareholder wealth. J. Finance 44(4), 953–971 (1989)

Jensen, M., Meckling, W.: Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3(4), 305–360 (1976)

Jensen, M., Murphy, K.: Performance pay and top-management incentives. J. Political Econ. 98(2), 225–264 (1990)

Jensen, M.: Agency costs of free cash flow, corporate finance and takeovers. Am. Econ. Rev. 76(2), 323–329 (1986)

Jensen, M.: Eclipse of the public corporation. Harv. Bus. Rev. 67(5), 61–74 (1989)

Kaplan, S.N.: The effects of management buyouts on operating performance and value. J. Financ. Econ. 24(2), 217–254 (1989)

Lang, L.H.P., Stulz, R.M.: Contagion and competitive intra-industry effects of bankruptcy announcements: An Empirical Analysis. J. Financ. Econ. 32(1), 45–60 (1992)

La Porta, R., Lopez-De-Silanes, R., Shleifer, A., Vishny, R.: Law and Finance. J. Political Econ. 106(6), 1113–1155 (1998)

Lee, C.I., Rosenstein, S., Rangan, N., Davidson, W.N.: Board composition and shareholder wealth: the case of management buyouts. Financ. Manag. 21(1), 58–72 (1992)

Lehn, K., Poulsen, A.: Free cash flow and stockholder gains in going private transactions. J. Finance 44(3), 771–787 (1989)

Loderer, C., Martin, K.: Executive stock ownership and performance: Tracking faint traces. J. Financ. Econ. 45, 223–255 (1997)

Lowenstein, L.: Management buyouts. Columbia Law Rev. 85(4), 730–784 (1985)

Marais, L., Schipper, K., Smith, A.: Wealth effects of going private for senior securities. J. Financ. Econ. 23(1), 155–191 (1989)

Mehran, H.: Executive compensation structure, ownership, and firm performance. J. Financ. Econ. 38, 163–184 (1995)

Morck, R., Shleifer, A., Vishny, R.W.: Management ownership and market valuation: An empirical analysis. J. Financ. Econ. 20, 293–315 (1988)

Mcconnell, J., Servaes, H.: Additional evidence on equity ownership and corporate value. J. Financ. Econ. 27, 595–613 (1990)

Opler, T., Titman, S.: The determination of leveraged buy-out activity: free cash flow vs financial distress costs. J. Finance 48, 1985–1999 (1993)

Peasnell, K., Pope, P., Young, S.: Managerial equity ownership and the demand for outside directors. Eur. Financ. Manag. 9, 231–250 (2003)

Renneboog, L., Simons, T., Wright, M.: Leveraged public to private transactions in the UK. Working Paper 78/2005. European Corporate Governance Institute (2005)

Shleifer, A., Vishny, R.W.: Large shareholders and corporate control. J. Political Econ. 94, 461–488 (1986)

Tirole, J.: The Theory of Corporate Finance. University Presses of CA, Berkeley (2006)

Travlos, N.G., Cornett, M.M.: Going private buyouts and determinants of shareholders’ returns. J. Accounting, Auditing Finance 8(1), 1–30 (1993)

Van Der Gucht, L.M., Moore, W.T.: Predicting the duration and reversal probability of leveraged buyouts. J. Empir. Finance 5(4), 299–315 (1998)

Weir, C., Laing, D., Mcknight, P.: Internal and external governance mechanisms: Their impact on the performance of large UK public companies. J. Bus. Finance Account. 29, 579–611 (2002)

Weir, C., Laing, D., Wright, M.: Incentive effects, monitoring mechanisms and the market for corporate control: An analysis of the factors affecting public to private transactions in the UK. J. Bus. Finance Account. 32(5–6), 909–943 (2005a)

Weir, C., Laing, D., Wright, M.: Undervaluation, private information, agency costs and the decision to go private. Appl. Financ. Econ. 15(13), 947–961 (2005b)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Andres, C., Betzer, A. & Weir, C. Shareholder wealth gains through better corporate governance—The case of European LBO-transactions. Financ Mark Portfolio Manag 21, 403–424 (2007). https://doi.org/10.1007/s11408-007-0061-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-007-0061-7