Abstract

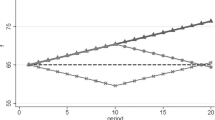

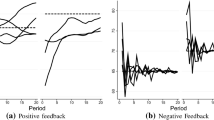

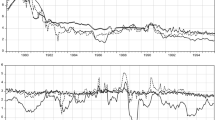

In this paper, we present the results of a Learning-to-Forecast Experiment (LtFE) where we eliciting short- as well as long-run expectations regarding the future price dynamics in markets with positive and negative expectations feedback. Comparing our results on short-run expectations with the LtFE literature, we prove that eliciting long-run expectations has no impact on the price dynamics nor on short-run expectations formation. In particular, we confirm that the Rational Expectation Equilibrium (REE) is a good benchmark only for the markets with negative feedback. Interestingly, our data show that while the term structure of the cross-sectional dispersion of expectations is convex in positive feedback markets, it is concave in negative feedback markets. Differences in the slope of the term structure stem from diverse degrees of uncertainty regarding the evolution of prices in the two feedback systems: (1) in the negative feedback system, the convergence of the price to the REE reflects a tendency for coordination of long-run expectations around the fundamental value; (2) conversely, oscillatory price dynamics observed in the positive feedback system is responsible for the diverging pattern of long-run expectations. Finally, we propose a new measure of heterogeneity of expectations based on the scaling of the dispersion of expectations over the forecasting horizon.

Similar content being viewed by others

Notes

Anufriev and Hommes (2012) and Hommes (2013) introduce an heterogeneous expectations model showing that a set of different anchor-and-adjustment rules can successfully reproduce experimental data in a LtFE eliciting short-run expectations. Colasante et al. (2018a, b) show that subjects do indeed anchor their short- and long-run expectations to the last realized price in a positive feedback system.

For a comprehensive survey of macroeconomic experiments on expectations see Assenza et al. (2014).

For the positive feedback treatment we use the dataset from Colasante et al. (2018a).

Although within our experimental setting we collect 20 1-step-ahead predictions from each subject instead of 50 as in most LtFEs, we can monitor the entire time-spectrum of expectations and its evolution over time.

The values of the interest rate and average dividend are constant through a given session. To avoid the effects of communication among subjects between sessions, we set two different values of the dividend, so that we have some markets with a fundamental price of 65 and others with 70.

We used a payoff mechanism similar to Haruvy et al. (2007).

We assigned the same weight to short and long-run predictions in the subjects’ final payoff by calibrating the parameters of the pay-off functions so that approximately \(\max \sum _{t=1}^{20} {}_i\pi ^{s}_{t} = \max \sum _{t=1}^{20} {}_i\pi ^{l}_{t}\).

We conducted additional sessions for negative as well as positive feedback treatments and implemented a rescaled hyperbolic continuous payoff function for both, long and short-run predictions. Results are qualitatively and quantitatively similar to those described in the present paper (material available upon request).

In the software, 1-step-ahead predictions (in green) have a different colour from long-term predictions(in black). A screenshot of the experiment is shown in “Appendix B.2”.

Each subject participated in only one session and had not previously taken part in LtFEs.

Colasante et al. (2018b) show that Hypothesis 1a cannot be rejected in the positive expectations feedback system.

The Heuristic Switching Model, introduced by Anufriev and Hommes (2012), is an example of a model with heterogeneous extrapolation strengths.

A cautionary note is in order here: Eq. (4) does not intend to be a precise description of the behavior of the subjects when forming their expectations; instead it should be considered as a simple mathematical formalization helping us to better illustrate our conjecture.

The variance of the coefficients \(m_i\) does not vanish, since we have assumed heterogeneous priors among subjects.

Although many contributions in the LtFEs literature have shown that the last realized price constitutes an anchor in the formation of expectations, they limit the forecasting horizon to 1 or 2-steps ahead predictions.

The notation \(<\cdots >_g\) denotes the average across groups.

We compare treatments by conducting a Wilcoxon signed-rank test whose result confirm that the median value of \(MAD_{t,t}^{p_f}\) is significantly higher in the positive feedback system (z \(=\) 19.71, p value \( <0.001\)).

The comparison of \(MAD_{t,t}^{C}\) between treatments, by means of Wilcoxon signed-rank test, confirms that they are statistically different. In particular, \(MAD_{t,t}^{C}\) in the negative feedback treatment turns out to be significantly higher than that in the positive feedback treatment up to period 10. From the peirod 10 on, the difference between positive and negative feedback treatments is not statistically significant.

We use the same specification of Heemeijer et al. (2009) and have adapted it to our mathematical notation.

We apply the Breusch–Godfrey test for small samples to check the autocorrelation of the residuals.

Since we have used two different fundamental values, in order to compare the long-run equilibrium price convergence to the fundamental price across markets, we use the difference between the long-run equilibrium price computed using Eq. (10) and the corresponding fundamental value.

We use the same pooled panel regression of the normalized variances as in Eq. (13).

References

Anufriev M, Hommes C (2012) Evolutionary selection of individual expectations and aggregate outcomes in asset pricing experiments. Am Econ J Microecon 4(4):35–64

Assenza T, Heemeijer P, Hommes C, Massaro D (2011) Individual expectations and aggregate macro behavior. Dnb working papers, Netherlands Central Bank, Research Department, May 2011

Assenza T, Bao T, Hommes C, Massaro D (2014) Experiments on expectations in macroeconomics and finance. In: Experiments in macroeconomics. Emerald Group Publishing Limited, pp 11–70

Bao T, Ding L (2016) Nonrecourse mortgage and housing price boom, bust, and rebound. Real Estate Econ 44(3):584–605

Bao T, Duffy J, Hommes C (2013) Learning, forecasting and optimizing: an experimental study. Eur Econ Rev 61:186–204

Barberis N, Shleifer A, Vishny R (1998) A model of investor sentiment. J Financ Econ 49(3):307–343

Colasante A, Alfarano S, Camacho E, Gallegati M (2018a) Long-run expectations in a Learning-to-Forecast Experiment. Appl Econ Lett 25(10):681–687

Colasante A, Alfarano S, Camacho-Cuena E, Gallegati M (2018b) Long-run expectations in a Learning-to-Forecast Experiment: a simulation approach. J Evol Econ. https://doi.org/10.1007/s00191-018-0585-1

Cornand C, M’baye CK, (2016) Does inflation targeting matter? An experimental investigation. Macroecon Dyn 22(2):1–40

Haltiwanger J, Waldman M (1989) Limited rationality and strategic complements: the implications for macroeconomics. Q J Econ 104(3):463–483

Haruvy E, Lahav Y, Noussair CN (2007) Traders’ expectations in asset markets: experimental evidence. Am Econ Rev 97(5):1901–1920

Heemeijer P, Hommes C, Sonnemans J, Tuinstra J (2009) Price stability and volatility in markets with positive and negative expectations feedback: an experimental investigation. J Econ Dyn Control 33(5):1052–1072

Hirshleifer D (2001) Investor psychology and asset pricing. J Finance 56(4):1533–1597

Hommes C (2013) Behavioral rationality and heterogeneous expectations in complex economic systems. Cambridge University Press, Cambridge

Hommes C, Sonnemans J, Tuinstra J, van de Velden H (2005) A strategy experiment in dynamic asset pricing. J Econ Dyn Control 29(4):823–843

Mankiw NG, Reis R, Wolfers J (2003) Disagreement about inflation expectations. NBER Macroecon Ann 18:209–248

Manski CF (2004) Measuring expectations. Econometrica 72(5):1329–1376

Marimon R, Spear SE, Sunder S (1993) Expectationally driven market volatility: an experimental study. J Econ Theory 61(1):74–103

Patton AJ, Timmermann A (2010) Why do forecasters disagree? Lessons from the term structure of cross-sectional dispersion. J Monet Econ 57(7):803–820

Acknowledgements

The authors are grateful for the funding by the Universitat Jaume I under the Project P11B2015-63, and also the funding by the Spanish Ministry of Science and Technology under the Project ECO2015-68469-R and the Valencian Regional Government for the financial support under the Project AICO/2018/036. We also thank the participants of the 22nd Annual Workshop on Economic Science with Heterogeneous Interacting Agents for their helpful comments to an earlier version of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Term structure of cross-sectional dispersion of expectations

In this appendix we provide some simple examples of how a given forecasting rule affects the term structure of cross-sectional dispersion of expectations.

Let us assume that the subjects, when forming their long run expectations, linearly extrapolate the past price change with a coefficient \(m_i\) depending on each individual subject. Considering Eq. (4), it is possible to compute the average expectation across subjects:

The variance of the expectations is therefore:

Consequently, given that:

and plugging it into Eq. (17), the term structure is:

An alternative to the linear forecasting rule is a “random walk rule”, whose starting value is the realized price in the previous period:

where \({}_i\eta _{t+k}\) are iid random variables with \(\mathrm {E}[{}_i\eta _{t+k}]=0\) for each k and i. Under the rule of Eq. (20), it is easy to show that the term structure of the variance is linear in the forecasting horizon:

An additional possible forecasting rule for long-run predictions is the following:

where \(\xi _{t}\) are iid random variables with \(\mathrm {E}[{}_i\xi _{t}]=0\) for each t and i. The variance of the subjects’ predictions will not depend on the forecasting horizon H:

A more general term structure for the dispersion of the predictions exhibits a curvature which depends on the shape parameter \(\alpha \):

which nests all the previous specific cases.

These simple calculations show that the term structure of the variance of subjects’ predictions can be extremely informative about the possible underlying rules for the formation of long-run expectations.

Instructions and screenshot

1.1 Translated instructions (from the original in Spanish)

[General instructions]

Welcome to the Laboratory of Experimental Economics! You are participating in an experiment in which you will take decisions in a financial market. The instructions are very simple but, please, read them carefully.

During the whole experiment you will play with experimental currency unit (ECU) and, at the end of the experiment, your final profit, which will be added to a show-up fee of 3 euros, will be converted into euro according to the following exchange rate: 1 Euro = 500 ECU. The total amount will be paid at the end of the experiment in cash.

[Only in the positive feedback treatment]

You are a financial advisor to a pension fund that wants to invest an amount of money to buy an asset. The pension fund has to choose between investing its money in a bank account which pays fixed interest rate and a risky asset that pays dividends. The allocation depends on your forecast for the evolution of the asset price. When making your predictions remember that the asset price in each period is affected as follows: positively by the dividend, negatively by the interest rate and positively by the investors’ expectations of the asset price in that period.

Your task is to predict the price for 20 periods. In each period (t) you will predict the price for all the remaining \(20-t\) periods, i.e. in period 1 you will submit 20 predictions starting from the prediction about the price at the end of period 1, in period 2 you will submit 19 predictions and so on. Your predictions must be between 0 and 100.

In period 1 you will submit predictions with information only about the interest rate and the average dividend. From period 2 onwards, you will have more information: a graph with the time series of your past predictions and the time series of the market prices. The green dots represent the time series of your 1-step-ahead predictions, while the blue dots represent the asset price in each period. Additionally, you will see the values of these time series and the time series of all your past predictions. Remember that in any period you will see the information about the asset price in the previous periods.

The interest rate will be equal to \(5\%\) and the mean dividend will be equal to 3.25 (or 3.5 depending on the session).

[Only in the negative feedback treatment]

You are an advisor to a firm that wants to buy a certain amount of a particular good. In each period, the manager of the firm decides how many units of this particular good she wants to buy with the aim of selling it in the next period. To take an optimal decision, the manager needs a good prediction of the market price in the next period. The evolution of the market price will be as follows: if the demand for the good is higher than the supply, the price will rise. Conversely, if the supply is higher than the demand, the price will decrease. The manager will take his/her decision based on your predictions about the market price in given period: the higher (lower) the prediction is, the higher (lower) the demand will be and, as a consequence, the market price will fall (rise).

Your task is to predict the price for 20 periods. In each period (t) you will predict the price for all the remaining 20-t periods, i.e. in period 1 you will submit 20 predictions starting from the prediction about the price at the end of period 1, in period 2 you will submit 19 predictions and so on. Your predictions must be between 0 and 100.

In period 1 you will submit predictions without any information about past prices. From period 2 onwards, you will see a graph with the time series of your past predictions and the time series of the prices. The green dots represent the time series of your 1-step-ahead predictions, while the blue dots represent the market price in each period. Additionally, you will see the values of those time series and the time series of all your past predictions. Remember that in any period you will see the information about the market price of the previous periods.

[General instructions]

Once each subject has submitted his/her prediction for each period, the price will be computed and it will be shown at the beginning of period 2. The same mechanism will be used for subsequent periods. Once you and the other subjects submit the predictions, the price as well as the profits will be computed according to the forecasting accuracy.

Remember that your profit depends on your forecasting accuracy. The lower your forecasting error (the distance between your predictions and the price in a given period), the higher your profit will be. Your profit will be computed at the end of each period. In addition to the profit for your 1-step-ahead prediction each period, you will receive an extra profit for your past predictions about the price for each period. This extra profit will be computed according to the following table:

Difference between price of period t and your prediction for period t | ECU |

|---|---|

\(\pm 5\) | 25 |

\(\pm 10\) | 12 |

\(\pm 1\)5 | 5 |

At the beginning of each period you will see the profit for all the predictions and the cumulative gains.

1.2 Screenshot

See Fig. 11.

Individual prediction strategies

Following Heemeijer et al. (2009), we estimate the linerar forecasting rule for each subject:

The heuristic described in Eq. (25) can be successfully estimated for 72 out of 90 subjects. Using the estimates obtained we can classify subjects as:

-

(i)

Fundamentalist in the negative feedback treatment: \(\alpha _1 + \alpha _2 \approx 0\) and \(\beta =0\)

-

(ii)

Adaptive: \(\alpha _1 + \alpha _2 \ne 0\) and \(\beta =0\)

-

(iii)

Naïve: \(\alpha _1 \approx 1\) and \(\alpha _2 =\beta =0\);

-

(iv)

Naïve and fundamentalist: \(\alpha _1 < 1\) and \(\alpha _2 =\beta =0\)

-

(v)

Adaptive trend follower in the positive feedback treatment: \(\alpha _1 \ne 0, \alpha _2 \ne 0\) and \(\beta \ne 0\)

-

(vi)

Naïve trend follower in the positive feedback treatment: \(\alpha _1 \ne 0, \alpha _2 = 0\) and \(\beta \ne 0\)

-

(vii)

Trend follower in the positive feedback treatment: \(\alpha _1 = 0, \alpha _2 = 0\)

Tables 4 and 5 summarize our results and compare them with those reported in Heemeijer et al. (2009).

Rights and permissions

About this article

Cite this article

Colasante, A., Alfarano, S. & Camacho-Cuena, E. The term structure of cross-sectional dispersion of expectations in a Learning-to-Forecast Experiment. J Econ Interact Coord 14, 491–520 (2019). https://doi.org/10.1007/s11403-019-00245-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-019-00245-6

Keywords

- Long-run expectations

- Heterogeneous expectations

- Experiment

- Coordination

- Convergence

- Learning-to-Forecast Experiment