Abstract

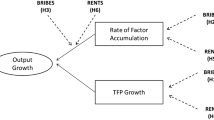

Prior literature on the role that firm heterogeneity plays in corruption finds that larger firms pay smaller bribes and are less likely to pay bribes than smaller firms. These studies, however, often overlook the plausible reverse causality between firm growth or firm size and corruption. Utilizing an innovative identification strategy that accounts for this source of endogeneity, this study finds that increased firm size actually causes greater corruption and bureaucratic burdens on a typical firm and provides evidence against the argument for a uniform corruption burden regardless of size. It was determined that a one standard deviation increase in sales leads to 0.33 standard deviation increase in bribes, and to 0.36 standard deviation increase in management time spent dealing with public officials. Moreover, although corruption burden increases with increasing firm size, we find that this relationship is non-linear and diminishes in magnitude as firm size approaches to medium and large. We conclude with implications and policy considerations.

Similar content being viewed by others

References

Angrist, J. D., & Pischke, J.-S. (2008). Mostly harmless econometrics: an empiricist’s companion. Princeton, NJ: Princeton University Press.

Aquilina, M., Klump, R., & Pietrobelli, C. (2006). Factor substitution, average firm size and economic growth. Small Business Economics. Springer, 26(3), 203–214. https://doi.org/10.1007/s11187-005-4715-4.

Banfield, E. C. (1985) Corruption as a feature of governmental organization. In Here the People Rule. Boston: Springer, pp. 147–170. https://doi.org/10.1007/978-1-4613-2481-2_8.

Baruch, Y., & Holtom, B. C. (2008). Survey response rate levels and trends in organizational research. Human Relations. Sage Publications, 61(8), 1139–1160. https://doi.org/10.1177/0018726708094863.

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2005). Financial and legal constraints to growth: Does firm size matter? The Journal of Finance. Wiley Online Library, 60(1), 137–177. https://doi.org/10.1111/j.1540-6261.2005.00727.x.

Becker, G. S., & Stigler, G. J. (1974). Law enforcement, malfeasance, and compensation of enforcers. The Journal of Legal Studies. JSTOR, 3(1), 1–18.

Bertrand, M., et al. (2007). Obtaining a driver’s license in India: an experimental approach to studying corruption. The Quarterly Journal of Economics. JSTOR, 122(4), 1639–1676. https://doi.org/10.1162/qjec.2007.122.4.1639.

Bliss, C., & Di Tella, R. (1997). Does competition kill corruption? Journal of Political Economy. JSTOR, 105(5), 1001–1023. https://doi.org/10.1086/262102.

Bradford, C. S. (2004). Does size matter-an economic analysis of small business exemptions from regulation. J. Small & Emerging Bus. L. HeinOnline, 8, 1. Available at: https://heinonline.org/HOL/P?h=hein.journals/jsebl8&i=9. Accessed 20 Oct 2016.

Clarke, G. R. G., & Xu, L. C. (2004). Privatization, competition, and corruption: how characteristics of bribe takers and payers affect bribes to utilities. Journal of Public Economics. Elsevier, 88(9), 2067–2097. https://doi.org/10.1016/j.jpubeco.2003.07.002.

Cook, C., Heath, F., & Thompson, R. L. (2000). A meta-analysis of response rates in web-or internet-based surveys. Educational and psychological measurement Sage Publications, 60(6), 821–836. https://doi.org/10.1177/00131640021970934.

Donadelli, M., Fasan, M., & Magnanelli, B. S. (2014). The agency problem, financial performance and corruption: country, industry and firm level perspectives. European Management Review, 11(3–4), 259–272. https://doi.org/10.1111/emre.12038.

Dutta, N., & Sobel, R. (2016). Does corruption ever help entrepreneurship? Small Business Economics. Springer Science & Business Media, 47(1), 179. https://doi.org/10.1007/s11187-016-9728-7.

Fisman, R., & Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics. Elsevier, 83(1), 63–75. https://doi.org/10.1016/j.jdeveco.2005.09.009.

Garicano, L., Lelarge, C., & Van Reenen, J. (2016). Firm size distortions and the productivity distribution: evidence from France. The American Economic Review. American Economic Association, 106(11), 3439–3479. https://doi.org/10.1257/aer.20130232.

Hellman, J. S., Jones, G. & Kaufmann, D. (2002). Far from home: do foreign investors import higher standards of governance in transition economies? Available at SSRN 386900. https://doi.org/10.2139/ssrn.386900.

Hoekman, B. M., Mattoo, A. & English, P. (2002). Development, trade, and the WTO: a handbook. World Bank Publications. https://doi.org/10.1596/978-0-8213-4997-7.

Kaufmann, D. et al. (2000). Measuring governance, corruption, and state capture: how firms and bureaucrats shape the business environment in transition economies. World Bank Policy Research Working Paper, (2312). https://doi.org/10.1596/1813-9450-2312.

Klitgaard, R. (1988). Controlling corruption. Berkeley and Los Angeles, CA: University of California Press.

Knack, S. (2007). Measuring corruption: a critique of indicators in Eastern Europe and Central Asia. Journal of Public Policy. Cambridge Univ Press, 27(03), 255–291. https://doi.org/10.1017/S0143814X07000748.

Kugler, M., Verdier, T., & Zenou, Y. (2005). Organized crime, corruption and punishment. Journal of Public Economics. Elsevier, 89(9–10), 1639–1663. https://doi.org/10.1016/j.jpubeco.2004.05.005.

Martin, K. D., et al. (2007). Deciding to bribe: a cross-level analysis of firm and home country influences on bribery activity. Academy of Management Journal, 50(6), 1401–1422. https://doi.org/10.5465/amj.2007.28179462.

Mauro, P. (1995). Corruption and growth. The Quarterly Journal of Economics, 110(3), 681–712. https://doi.org/10.2307/2946696.

La Porta, R., et al. (1999). The quality of government. Journal of Law, Economics, and Organization. Oxford University Press, 15(1), 222–279. https://doi.org/10.1093/jleo/15.1.222.

Rand, J., et al. (2012). Firm-level corruption in Vietnam. Economic Development and Cultural Change. JSTOR, 60(3), 571–595. https://doi.org/10.1086/664022.

Rodriguez, P., Uhlenbruck, K., & Eden, L. (2005). Government corruption and the entry strategies of multinationals. Academy of Management Review, 30(2), 383–396. https://doi.org/10.1086/664022.

Schaffer, M. (2015). ‘xtivreg2: Stata module to perform extended IV/2SLS, GMM and AC/HAC, LIML and k-class regression for panel data models’, Statistical Software Components. Boston College Department of economics. Available at: https://econpapers.repec.org/RePEc:boc:bocode:s456501. Accessed 10 Oct 2016.

Schiffer, M. and Weder, B. (2001) Firm size and the business environment: worldwide survey results. World Bank Publications. https://doi.org/10.1596/978-0-8213-5003-4.

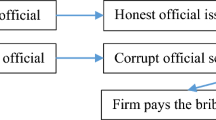

Shleifer, A., & Vishny, R. W. (1993). Corruption. The Quarterly Journal of Economics, 108(3), 599–617.

Svensson, J. (2002). Who must pay bribes and how much? Available at: www.jstor.org/stable/25053902. Accessed 15 Jan 2015.

Svensson, J. (2003). Who must pay bribes and how much? Evidence from a cross section of firms. The Quarterly Journal of Economics, 118(1), 207–230.

Svensson, J. (2005). Eight questions about corruption. The Journal of Economic Perspectives. American Economic Association, 19(3), 19–42. https://doi.org/10.1257/089533005774357860.

Tonoyan, V., et al. (2010). Corruption and entrepreneurship: how formal and informal institutions shape small firm behavior in transition and mature market economies. Entrepreneurship theory and practice. Wiley Online Library, 34(5), 803–831. https://doi.org/10.1111/j.1540-6520.2010.00394.x.

Treisman, D. (2000). The causes of corruption: a cross-national study. Journal of public Economics, 76(3), 399–457. https://doi.org/10.1016/S0047-2727(99)00092-4.

Vanhanen, T. (2014). ‘Measures of democracy 1810-2014’, Finnish Social Science Data Archive. Available at: http://urn.fi/urn:nbn:fi:fsd:T-FSD1289. Accessed 10 Sept 2016.

Wei, S.-J. (1997). Why is corruption so much more taxing than tax? Arbitrariness kills. https://doi.org/10.3386/w6255.

Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data. Cambridge: MIT Press.

Wu, X. (2009). Determinants of bribery in Asian firms: evidence from the world business environment survey. Journal of Business Ethics. Springer, 87(1), 75–88. https://doi.org/10.1007/s10551-008-9871-4.

Funding

Dr. Nguyen has been received a United Nations University UNU-MERIT Ph.D Fellowship and Indiana University’s postdoctoral fellowship funded by the Searle Freedom Trust when conducting this work.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

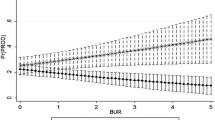

Effects of firm size on kickback rate. This figure presents the adjusted difference (bar) and its 95% confidence interval (in error bars) in kickback rate attributable to firm size. The dataset represents one observation per firm per year, over the period of 2002–2005. All models are restricted to all firms which have completed data on dependent variables, independent variable, instrument variables, and control variables (5465 firms)

Rights and permissions

About this article

Cite this article

Nguyen, T.D. Does firm growth increase corruption? Evidence from an instrumental variable approach. Small Bus Econ 55, 237–256 (2020). https://doi.org/10.1007/s11187-019-00160-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-019-00160-x