Abstract

This study sheds light on risk exposures of cooperative banks in Austria, Germany and Italy. We investigate how major risk elements of banks in these countries have evolved over time, across countries and institutions. Cooperative banks’ exposure to risk is analyzed looking at aggregate risk categories. In detail, we address the questions of (a) how single risk categories can be assessed in a consistent way, (b) how the different risk categories behaved over time, (c) what factors drive the diverse risks and (d) if there are similarities of risk characteristics for specific clusters of cooperative banks. We find that credit, interest rate and residual risk have a high degree of commonality. Liquidity risk is somehow dissociated from the other categories. Nevertheless, the risk behavior appears to vary over time and for different countries. This feature is relevant for the prudent management of cooperative banks and for the assessment of systemic financial risk.

Similar content being viewed by others

1 Introduction

Recent approaches in financial risk management emphasize a more comprehensive assessment of risk and return both from the perspective of a single institution’s aggregate riskFootnote 1 (Imbierowicz and Rauch 2014; Li et al. 2018) and from the perspective of aggregated banks’ risk (Black et al. 2016; Caballero 2015). From the perspective of individual banks, the combined exposure from multiple single risks is considered (enterprise risk). This is also motivated from pillar 2 in the Basel regulatory framework requiring a more complete and firm-wide risk management.Footnote 2 In addition to the aggregate risk of single institutions, several approaches have been developed to account for the connected risks between institutions or within the financial markets as a whole (systemic risk). Systemic risk is mostly driven from concentration and correlation issues across a group of financial institutions (Anginer et al. 2018 and studies cited therein).

This study investigates concepts of integrated risk assessment for cooperative banksFootnote 3 in Austria, Germany and Italy. Although these banks represent a large fraction of the national banking systems, their risk characteristics have been researched relatively sparsely up to now (for example, see Cihák and Hesse 2007; Fiordelisi and Mare 2014). Mainly, the risk performance of cooperative banks is debated. On the one hand, cooperative banks have proved to be rather stable during the repeated waves of the financial turmoil in Europe between 2008 and 2014. Their business model has even been acclaimed “winner” of the crisis (Ferri 2012, p. 8), due to their relative low exposure to mortgage-backed and sovereign debt assets. This can be seen by the strong acquisition of new customers and cash flows over the recent period. On the other hand, great losses have also characterized the period following the global financial havoc, questioning the diversification strategies particularly of cooperative banks’ central institutions. The protracted slowdown in economic activity in Italy has increased the risk of failure for Italian cooperative banks (Mare 2015). Austrian cooperative banks have been affected by the diversification strategy involving an expansion of operations in Central and Eastern Europe (Brazda et al. 2016). Raiffeisen Zentralbank Group (RZB) suffered the same fate with recent losses associated to the Ukrainian crisis from 2013. In addition, the decreasing interest margin from traditional lending business in conjunction with an unfavorable relation between size and overhead costs, makes cooperative banks more vulnerable to recent trends on the financial markets and the European Central Bank monetary policy (Groeneveld 2017).

In view of these considerations, the present study attempts to shed light on the integrated risk characteristics of cooperative banks in Austria, Germany and Italy. These countries have been chosen as they are geographically close, share a comparable history and legal framework of cooperative banking and may therefore be considered as significantly connected. We investigate how major risk elements of these banks have evolved over time, across countries and institutions. Risk exposure is analyzed while delving into specific risk categories both from an institution-specific and a systemic point of view. Particularly, we assess (a) how different risk categories can be derived in a consistent way, (b) how these categories behaved over time, and (c) what drives the diverse risk exposures.

To this extent, the categories of credit risk, interest rate risk, liquidity risk and residual risk are considered as major elements. In order to make single risk elements comparable, they are assessed following the same conceptual design and standardized for the sake of comparison. In this regard, we suggest the concept of “distance to insolvency” and “distance to illiquidity”, thereby relating the critical values from risk series to the banks’ risk mitigating capacity. This approach is based on information from financial statements. Thus, it is different from existing research where the assessment of risk mostly refers to data from capital markets. Accounting data is obtained from national banking authorities and from Bankscope covering primarily the period 2003–2015. Results are obtained from a panel regression analysis. Basically, the research design involves an extension of the risks typically considered in literature, an analysis of comprehensive bank risk patterns over time for three different cooperative bank systems as well as explanations for the risk observations.

The results obtained are relevant both for the management of individual banks and the assessment of systemic risk in the cooperative banking system. From an individual bank perspective, the findings may support the design and relevance of risk management strategies based on the behavior and impact of single risk categories. Knowledge about the drivers of risk enhances the quality of bank strategies. Further, we highlight the importance of assessing diversification benefits across risk elements as a basis for risk management strategies. From a systemic point of view, it is paramount to know up to what extent there is a common or different risk profile of institutions indicating a potential for diversification within the cooperative banking system.

After the description of the cooperative banking system in Austria, Germany and Italy (Sect. 2), we introduce the applied concept to consistently measure and aggregate risks and relate it to existing research (Sect. 3). We then present the data and main descriptive statistics for the sample (Sect. 4). We proceed with an empirical analysis of the banks´ risk exposure (Sect. 5) with specific emphasis on single risk categories, clusters of banks and explanations for the risk behavior. Finally, the findings and implications of this study are summarized (Sect. 6).

2 Cooperative banks in Austria, Germany and Italy

Cooperative banks are mostly characterized from two organizational principles (Fonteyne 2007; Ferri 2012). First, the specific commitment to their owners (ownership principle). Second, their continued relations with customers within a geographically specified region (relationship principle). Often there is an overlap between owners and customers in that favoring a long-term perspective in generating value and prudent risk management behavior. As a consequence of their commitment to owners, customers and local development, the majority of European cooperative banks are small- and medium-sized institutions offering services mainly to private customers and small businesses (Groeneveld 2014). It follows that from a regulatory perspective cooperative banks are considered as “Less Significant Institutions” (LSIs).Footnote 4 Within the euro area, 80% of the LSIs are concentrated in the three countries Austria, Germany and Italy, the majority being cooperative banks.Footnote 5 It is therefore paramount to describe the idiosyncrasies of the cooperative banking systems in these three countries and how these affect their risk-taking behavior and risk exposure.

Cooperative banks are mutual institutions. The mutual objective involves a broader set of goals including the provision of high quality products and services, along with adequate profitability (McKee and Kagan 2016). The business and form of organization are influenced by the national law though all European cooperative banks that are member of the European Association of Cooperative Banks (EACB) adhere to the “one-person-one-vote” principle, no matter the amount of equity held. This principle has important implications for the governance, ownership and efficiency of cooperative banks (Fonteyne 2007). For instance, shares are non-tradable since they do not reflect the value of the firm or the voting power of members. Members can exert checks and balances at each level of business. This, from the one hand favors prudent and conservative risk attitude, from the other hand it can weaken bank soundness if the governance becomes burdensome and ineffective.

The Austrian cooperative banking sector consists of two separate networks of institutions (Brazda et al. 2016): the Raiffeisenbanken and the Volksbanken.Footnote 6 The Raiffeisenbanken are by far the largest with shares in 2015 of more than 28 percent and 30 percent in domestic market loans and deposits, respectively (European Association of Co-operative Banks 2015). Conversely, Volksbanken have shares around 7 and 5 percent in loans and deposits. The network of Raiffeisen banks has a three-tier structure composed by independent local credit institutions that own regional banks, which in turn are shareholders of Raiffeisen Zentralbank Österreich AG (RZB), the central institution. The independent Raiffeisen Banks are rooted in the territory and compensate the lack of size with the possibility to adhere, on a voluntarily basis, to the regional banks. Regional Raiffeisen Banks provide those services that cannot be carried out by the local banks on their own. RZB is the central institution and operates as a commercial bank. The Raiffeisen banks offer a complete range of products through specialized entities, including insurance, asset management, leasing and building society savings. The Volksbanken have a two-tier structure with Volksbank Wien AG as their central institution.

The German cooperative banking sector has a two-tier structure, which consists of the local cooperative banks (Raiffeisenbanken and Volksbanken) and one central institution (DZ BANK).Footnote 7 The central institution operates as a commercial bank for the corporate clients and supports the local banks with advice and financial services when needed. DZ BANK does not supervise the local banks and the strategic course to follow is also not determined or initiated by the central bank. The local cooperative banks are completely independent. The local banks and the central institution are partners within the “The National Association of German Cooperative Banks” (BVR). End of 2015, the market share of German cooperative banks for both deposits and loans is around 21% (European Association of Co-operative Banks 2015). Similar to the Austrian cooperative sector, the local cooperative banks cooperate with further institutions within the cooperative banking sector providing specialized services in finance and investment (for example, R + V Versicherung provides insurance services for customers; Union Investment is the central organization that offers asset management services in the investment business).

The majority of Italian cooperative banks are small-rural credit institutions that specialize in relationship lending. Profits are mostly devoted to a reserve fund (at least 70%). The individual banks are associated to 15 Local Federations that in turn are members of the national association (Federcasse). Federcasse has an institutional role and it offers member banks legal, fiscal, and organizational support, along with training programs. The regional federations provide technical assistance and internal auditing to their members. In addition, there are three central institutions (Iccrea Group, Cassa Centrale Banca and Cassa Centrale Raiffeisen dell’Alto Adige), owned by cooperative banks, that provide specialist products and services to cooperative banks. Moreover, recent regulationFootnote 8 prescribes that cooperative banks should be part of a banking group or, subject to pre-specified conditions, convert into a joint stock company.

The literature on the risk exposure of cooperative banks is relatively thin (Groeneveld 2014) and it often involves the reference to retail banking, instead of focusing specifically on mutual institutions. Chaffei and Dietsch (2015) analyze the business risk of French retail banks and find that this is low. The authors focus on business risk as a separate category and claim that this can be more severe than financial risk for some banks. This risk is indeed related to the managerial ability of increasing profits and minimizing costs, which significantly explains the risk of bankruptcy of cooperative banks (Fiordelisi and Mare 2013). A related determinant is the business model and the impact on bank stability. Köhler (2015) advocates that retail-oriented banks, and particularly cooperative banks, should increase their share of non-interest income assets to increase profitability and diversify risk exposures. Other systematic factors can contribute to the explanation of cooperative banks’ default. Memmel et al. (2015) show that five common risk drivers (nationwide loss rate, difference in the portfolio composition, maturity, region and exposure to export-oriented industries) are able to explain almost 8% of the time variation in individual credit related write-down for German regionally active banks. Mare (2015) finds that the interstate deposit rate and the unemployment rate are significant variables to predict Italian cooperative banks’ default. Applying their model to forecast the distress of Italian cooperative banks based on CAMEL ratios, Forgione and Migliardo (2018) find that banks with high loan to deposit ratio and located in the south are most vulnerable.

Very few studies take a systemic perspective in analyzing the role and relevance of financial risk in cooperative banking. Cihák and Hesse (2007) advocate that cooperative banks are more stable than commercial banks due to the low volatility of returns. The authors argue that cooperative banks are systemically important as weak commercial banks are more unstable in a system with a higher presence of cooperative banks and that the overall impact on systemic stability is positive, although this last finding is somehow less robust. Fonteyne (2007) focuses on the European cooperative banks and suggests that cooperative banks face specific risks due to their governance and constraints in managing their capital. Although the author praises the business model of these credit institutions, there is a clear indication on vulnerability to specific shocks as, for instance, interest rate developments. This is not necessarily an element of concern but it has to be monitored because cooperative banks perform mainly the traditional credit intermediation function, i.e. collecting deposits from the general public and granting loans to customers.

Groeneveld (2014, 2017) compares the performance of cooperative banking groups in 11 (13) countries against the performance of the entire banking sector of these countries. Analyzing performance measures and capital ratios, the author finds that cooperative banking groups are less risky (higher z-score)Footnote 9 and more stable (higher level of capital). In a similar way, Broccardo et al. (2016) assess return on assets, return on equity and z-score of cooperative banks to test the relationship between financial performance and social performance of the institutions. Similarly, the authors look at aggregate measures of risk and return, but do not distinguish different types of risks and return. For US credit unions, McKee and Kagan (2016) analyze the relationship between efficiency and risk. They observe that risk variables affect the institutions´ efficiency at a varying degree.

As the research on the risks of cooperative banks is still sparse and mostly concentrates on credit risk, further investigation may contribute to a better understanding of the risk exposure of these banks. This, in turn, can enhance both risk management and business strategies to cope with the new dynamics on financial markets. Particularly, in the context of low interest margins and customer mobility, cooperative banks have to strive for new business opportunities. Here, a major question is up to what extent the diverse income sources enhance diversification. Regarding the cooperative banks as a whole, one of the strengths is the corporate identity of the system (Standard & Poor’s 2013). However, if cooperative banks allocate assets and manage liabilities similarly, this could lead to a kind of monolithic structure and increase concentration risk.

3 Assessment of the risk exposures of European cooperative banks

3.1 Concept of distance to insolvency (illiquidity)

The basic risk exposures considered in this study are credit, interest, residual and liquidity risk.Footnote 10 We consider these as risk categories and they are themselves composed from different items.Footnote 11 Each risk category is first studied separately and then simultaneously with the other categories to dissect potential interactions. In this regard, we need to consistently define what is considered as risk and avoid any overlapping or double-counting.

It is important to note that the main purpose here is to achieve a framework that allows to assess the different single risk categories in a consistent and complimentary setting. This is needed to further compare and aggregate risks in a conceptually sound way. Particularly, we develop our concept of risk as a downside measure from the distribution of underlying data. Further, risk exposure is defined as the combined outcome from both risk factors and the institutions´ ability to withstand these factors. The suggested approach allows a similar application for the different risk categories and complies with the available data from financial statements.

As mentioned above, research on the risk of cooperative banks adopts different approaches. Further relevant literature with a focus on aggregated risks also offers various methodologies. These mostly differ in the way risk is modeled in terms of causes and effects. A first direction assesses multiple risks based on the drivers of risk. For example, Birge and Júdice (2013) aggregate risks based on four risk drivers and their simultaneous behavior. Interest rate risk is determined both from mortgage and deposit interest rates; credit risk via the charge-off rate; liquidity risk through the cost to refinance liabilities. The interaction effect from these risks is obtained via a simulation approach and simultaneous runs of these factors. Bessler and Kurmann (2014) choose proxies for credit, foreign exchange (FX), interest, market, sovereign and real estate risk and find that changes in these risk factors are well reflected in banks´ stock prices. Imbierowicz and Rauch (2014) construct proxies for credit risk and liquidity risk using net loan losses in the current period to the allowances recorded in the previous period and the short-term obligations to short-term assets, respectively. They regress the combined effects from these indexes on banks´ stock prices and find that no reliable relationship can be found.

The works of Lepetit et al. (2008), Elsas et al. (2010) and Li et al. (2018) are conceptually close to this study as they look to sources of income as a basis of risk assessment and diversification. Lepetit et al. (2008) investigate the effects on bank risk caused by the banks´ expansion from interest income activities into non-interest sources of income. Diversification measures are constructed from the ratio of non-interest income to operating income and regressed against diverse measures of risk (mostly standard deviation of return) and insolvency (mostly z-score). They find that particularly the expansion into fee and commission related activities increases bank risk whereas the risk effects from trading activities are less expressed. Interestingly, the authors exclude from their analysis small German cooperative banks (Lepetit et al. 2008). Elsas et al. (2010) construct an overall Herfindahl index that is based on the concentration ratios of diverse income sources and the index is then regressed to a profitability ratio. They find benefits from diversification. Li et al. (2018) analyze the aggregated risk of Chinese commercial banks based on information from financial statements. They construct risk return ratios for credit, market, liquidity and operational risk while relating items from the income statement to corresponding on-balance and off-balance sheet activities. Risks are assessed as the difference between the annual value of the risk return ratio and its mean. Total risk is obtained from summing up single risks and dominated from market risk.

As far as sources of income are considered and compared for risk analysis (Betz et al. 2014; Männasoo and Mayes 2009), this study partly builds on existing literature. However, previous research is extended in different respects. The analysis considers four main categories of risk that are assessed in a complementary way. In addition, where previous research uses components of income basically to derive diversification ratios and then relates these to separately constructed measures of risks, here the income elements by themselves are considered as risk variables and assessed for their integrated behavior. Particularly, this is supposed to provide evidence about the diversification and/or concentration potential inside the distribution of income.

As will be shown, the setting of this study is further different from existing research in its conception to measure risk (Delis et al. 2014). The majority of cooperative banks are non-listed on a stock exchange and therefore risk assessment based on market data is not possible. Instead, this study makes use of information obtained from accounting statements (Li et al. 2018). As many studies choose rather flexibly among a broad set of possible risk factors to define risks, this study emphasizes a more consistent and complementary approach to differentiate among risk categories. As the basic perception of risk is concerned, we refer to risk as the “downside” realization of a variable impacting the income and/or the book value of a bank (Bessis 2015).Footnote 12 Risk measures such as Value-at-Risk or Expected Shortfall (for a description of both methods see Siu 2020) are in line with this perception whereas standard deviation is not compatible. However, the annual data from balance sheets and income statements is low frequency to construct meaningful distributions of risk observations/risk probabilities and derive stochastic risk measures upon that.

From a conceptual perspective, the critical values for the risk variables by themselves do not necessarily reflect how much the individual bank is impacted from these cut-off values. The information from risk variables must further be related to the ability of the bank to withstand those critical values, i.e. to the risk-absorption capacity of the bank. A basic concept integrating the idea of critical values and risk counter-balancing capacity is the contingent claims approach introduced from Merton (1974). This approach, also known as “distance to default” relates the distribution of a firm´s asset value to the firm´s equity (Milne 2014). The value of corporate debt as the (limited) difference between asset value and equity is then considered as the value of a short put on the firms´ assets and derived from the option pricing formula (Merton 1974).

In the present setting, the limited availability of data points does not allow for the application of option pricing. Particularly, it is not possible to derive the value of an institution’s assets from stock market prices. Also, as typical for cooperative banks, owners are supposed to behave much differently than owners of listed banks. As a consequence, the concept of “distance to default” is applied in a much more reduced way. We look at the difference between the value of a risk series and the corresponding counterbalancing absorbing capacity for this risk. If the distance between both is small, then this is considered as a high exposure of the bank to risk and vice versa. Depending on the nature of the risk, the offsetting potential is either equity or the capacity to provide additional liquidity. Therefore, we employ the terms “distance to insolvency” (DIN) or “distance to illiquidity” (DIL).

Figure 1 illustrates this idea for the concept of distance to insolvency. In the upper part of the diagram first the realizations of a risk series per year are shown. These can be negative (some kind of loss) or positive. In the case of negative values, the loss has to be covered from equity (represented in the lower part of the diagram). Due to retained earnings, distributed profits or fresh capital, equity may change from year to year. In the case of credit risk, as an example, the amount of write-downs is related to the equity of the bank.Footnote 13 The smaller the difference, the higher the probability that the credit loss may exceed the risk counterbalancing capacity, thereby driving the bank into insolvency. Technically, as the extent of risk should also be represented in its notation (higher risk means higher values), the distances DIN and DIL are inverted as (1/DIN) and (1/DIL). This means that a small distance is transformed into a high value in risk notation and vice versa.

3.2 Application to risk categories

We use financial statement information from a unique hand-collected data set to compute the risk exposures of cooperative banks in Austria, Germany and Italy over the period 2003–2015. This is the most comprehensive data set possible because there is little market information available on cooperative banks as most of them are unlisted. As explained in the previous section and illustrated in “Appendices 1 and 2”, the risk categories are composed from different accounting items to avoid overlapping or double-counting. Data to compute interest rate risk, credit risk, and residual risk is drawn from income statements and balance sheet information. Liquidity risk is quantified using balance-sheet information.

Credit risk is measured as the difference between impairments (the sum for loans and securities) and the bank´s equity. Basically, impairments involve a negative component in banks´ income statements. They have to be earned via premiums calculated in the banks´ interest rates and maximal losses may not exceed the banks´ equity as a final defense line. To compare credit risk for each bank (i) at each point in time (t), we divide by average assets (AA).

Interest rate risk is conceived as the distance between net interest income (difference of interest income and expenses)Footnote 14 and equity. For almost all cooperative banks, net interest income is the most important source of income and has to cover most of overhead expenses. However, in critical times banks may also face a negative margin from lending and borrowing which then is to be covered via equity.

Similarly, also for residual risk, the counterbalancing capacity is equity. Residual risk is hereby defined as the critical values from remaining income components of banks (residual income). Particularly, it includes the combined result from fees, provisions and dividends minus the expenses for operational and personnel infrastructure.Footnote 15 Changes in residual income display how well banks manage sources of income from non-interest related business and/or how well they comply with the management of overhead cost. In addition, as income statements do not account for cost of equity, a charge for own capital is also deducted. The risk categories are assessed based on data from banks´ income statements and balance sheets obtained from national banking authorities and from Bankscope and regrouped accordingly.Footnote 16 “Appendix 1” provides an overview of the calculation of credit, interest rate and residual risk.

In regard to liquidity risk, similarly to Yan et al. (2014) and Fall and Viviani (2015), a gap from cash inflows and cash outflows from ordinary business is constructed (liquidity gap). This gap is then opposed to the capacity of the bank to provide fresh money from selling liquid assets (asset liquidity). Deriving cash flows from banks’ accounting data implies several assumptions as for instance the behavior of depositors and borrowers or the stability of asset prices. The assumptions in this study are mainly chosen in line with run-off ratios, flow-in ratios and haircuts in the Liquidity Coverage Ratio and Net Stable Funding Ratio from the Basel III framework (Basel Committee on Banking Supervision 2013). The components and cash flow related ratios for liquidity risk are shown in “Appendix 2”. With respect to all risk categories, this approach results in a series of yearly observations that are obtained on the same conceptual design and that then are investigated for risk comparisons.

To be comparable across banks, risk categories and years, the absolute numbers of risk series derived from accounting statements have been transformed into relative numbers based on average assets (AA) for the corresponding years. Further, each time series is standardized via subtracting the mean for the overall period (2003–2015) and divided by the standard deviation computed over the same period.Footnote 17

3.3 Analytical approach

The assessment of single risks is carried on looking at the development over time of the single risk types. We first aggregate the data and take the sample median by country of the cooperative banks in a specific country in a specific year. Each item reported in “Appendices 1 and 2” is populated to compute the risk exposure by country by year. We also arrange the banks in two categories given the asset size, and country.Footnote 18 The dummy variable (Size) takes value of 1 for banks included in the highest decile of the distribution of total assets in a specific country, 0 otherwise.Footnote 19 We then graph these relationships.

Based on the results for single risk categories across banks and countries, regression analyses for the different variables are run. From these analyses, both the diversification potential within banks and also across banks and/or countries can be assessed. Particularly, we focus on:

-

(1)

Impact and behavior of different risk categories,

-

(2)

Drivers of risk categories.

It is specifically interesting to explore the relationships within the three profitability related risk categories credit risk (CR), interest rate risk (IR) and residual risk (RR) and further between these profitability risk categories and the liquidity risk. With regard to the drivers of risk, a basic question is up to what extent the cooperative banks’ risk is dependent on the economic environment (see also Athanasoglou et al. 2008; Leung et al. 2015) and thus on country-specific effects. We therefore include the annual real growth in gross domestic product (GDP), the unemployment rate and residential property prices as control variables (see also Agoraki and Kouretas 2019).Footnote 20 Furthermore, we differentiate also by the size.

We explore the degree of sensitivity among the different risk categories using panel data models, controlling for size, country characteristics, and time fixed effects. Our basic specification is the following:

where the subscripts i, c, and t denote the bank, country, and year, respectively; R is one of the four risk factors; V are the three macroeconomic control variables; Size is a dummy variable, as described above; α, β, γ, and θ are coefficients to be estimated; q and p are indices for risk category and v for the control variables; \(\varepsilon\) are standard errors clustered at the individual bank level.

4 Data and descriptive statistics

We obtain data from cooperative banks´ balance sheets and income statements from the database Bankscope, the Austrian central bank and the Italian association of cooperative banks (Federcasse). Bankscope provides a comprehensive range of items from banks´ financial statements. However, it does not fully cover the cooperative banking sector in Austria and Italy. Therefore, we requested further information from the Austrian central bank and Federcasse, the national association of Italian cooperative banks.Footnote 21 The data from all three sources is similarly structured and composed of identical items from the cooperative banks´ balance sheets and income statements. In addition, we performed quality checks between the data received from county authorities and available data on Bankscope, not finding any significant or systematic differences.

We use unconsolidated statements because they are more suitable to represent the situation of small- and medium-sized banks. All data is tested for plausibility and, where necessary, manually complemented by individual banks´ accounting statements. Moreover, we drop from the sample credit institutions that do not have data on total assets. We also select institutions based on a manual check of the sample as in the Bankscope database several Volksbanken are classified as savings banks. Also, we drop from the sample Italian “Banche Popolari” as they resemble more joint-stock companies (Groeneveld 2017, 9).

Most cooperative banks only publish yearly statements which limits the number of available data points and may also impact the quality of results obtained.Footnote 22 For this reason, we analyze the presence of outliers and correct the data where necessary.Footnote 23 The total of included yearly observations from cooperative banks´ accounting statements is shown in Table 1. German banks cover more than half of the sample, followed by Italian and Austrian commercial banks.

To be comparable across banks, risk categories and years, the absolute numbers of risk series derived from accounting statements have been transformed into relative numbers based on average assets (AA) for the corresponding years.

5 Results

This study investigates the risk exposures of cooperative banks both from an individual perspective and from clusters of banks. We analyze how risks have evolved across time, countries and size of credit institutions. From a conceptual point of view, risk is defined as the relative absorption capacity of bank equity after covering for the individual risk exposures.

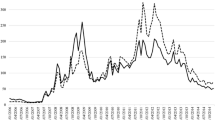

Figure 2 reports the absolute development over time of the median values of the risk categories by country. The dynamic development of the credit risk exposure shows an interesting diverging pattern across countries. On the one hand, Italian cooperative banks were largely less exposed to credit risk in the period before the financial crisis and some years into the beginning of the market havoc. However, since 2009 we notice an upward trend and at least half of the Italian banks in our sample are now more exposed to credit risk compared to German banks. As suggested in Mare (2015) for the overall bank solvency, a tentative explanation is that the slowdown in economic activity has taken a toll on Italian cooperative banks soundness. This is also true for the overall banking system where the percentage of outstanding non-performing loan rate was 18.1 percent in December 2015.Footnote 24 In contrast, whilst median credit risk was higher at the beginning of the observed period for German mutual credit institutions, since 2009 we notice a significant decrease. This may be explained from both the relative unaffectedness of German cooperatives from the global financial crisis and from the release of (hidden) reserves.Footnote 25 Since 2010, the impact from credit risk has further decreased, which may be related to generally favorable economic conditions in Germany and to the increase of banks’ equity driven from Basel III. The Austrian cooperative banks show a similar median exposure over the period with a median value above the other countries since 2011.

Risk categories by country—median values. In this figure we report the development over time for each country of the median values of the four risk categories. For each bank, credit risk exposure is computed using Eq. 1; interest rate risk from Eq. 2; residual risk from Eq. 3; and liquidity risk using Eq. 4

The development over time of the median value of the interest risk and residual risk show similar patterns. Austrian banks have the highest exposures by the end of the period. German cooperative banks have decreased their exposures whilst Italian cooperative banks show an upward trend starting from 2008 to 2009.

The median liquidity exposures display a different development over time. Italian cooperatives show the highest value at the beginning of the period with a marked increase since 2009.Footnote 26 The median liquidity risk has tapered off from 2011 to 2014 but it has spiked in 2015. German cooperatives show an almost flat performance over the period. Austrian mutual credit institutions have the lowest value throughout the period with a decrease in the exposure to liquidity risk over time.

Figure 3 displays the median values of the distribution of the standardized risk exposures by country and size. In this way, we are able to draw some inference on the relative performance of the banks included in the sample looking at the geographical location and size. There is an apparent difference between medians for big banks (solid lines) and for small banks (dash-dot lines). This is mostly visible for German cooperative banks where, except for liquidity risk, big banks have a higher risk exposure than small banks. These gaps have been narrowing over time but remain significant as per 2015 figures. Moreover, German cooperatives have performed relatively better compared to the average performance of the sample as the median values of the risk exposures for both small and big banks is the lowest in the sample for all risk categories. Conversely, Italian banks show an opposite development with a relative worse performance for all risk categories except for liquidity risk. The positive gap between small and big banks is also confirmed for Italian mutual banks but this time the breach is widening instead of closing. Austrian cooperatives display average development for credit and interest rate risk, a relatively better performance for residual risk and the worst figure for liquidity risk. The gap between big and small banks is very narrow. For liquidity risk, for some years, big banks have a lower liquidity risk exposure than small banks.

Risk categories (standardized) by country and size. In this figure we report the development over time by country of the median values of the standardized risk categories. For each bank, credit risk exposure is computed using Eq. 1; interest rate risk from Eq. 2; residual risk from Eq. 3; and liquidity risk using Eq.4. Each time series is then standardized via subtracting the mean for the overall period (2003–2015) and divided by the standard deviation computed over the same period (see footnote 17 for more detail)

While the focus of this analysis is on single risk categories, further research has to take into account how the diverse risk categories are interrelated (Claessens et al. 2014). We attempt to address briefly this question by showing the linear dependence among the risk categories.Footnote 27 Table 2 reports the pairwise Pearson’s correlation coefficients. Credit, interest rate and residual risks are positively correlated at the 10 percent significance level. Liquidity risk (LR) is almost not related to the three profitability risks. This is particularly interesting as it suggests that the cooperative banks do not simultaneously experience these two dimensions of risks. Particularly, the hypothesis that increased credit risk usually coincides with higher need for liquidity is not confirmed from this finding. Yet, it has to be reminded at this point how liquidity risk is determined in this study: even in economically stable periods with high cash inflows (and usually low default rates), a higher liquidity risk may occur if the potential for higher withdrawals associated with higher volumes of new deposits is not compensated from increasing asset liquidity.

A univariate framework may be inappropriate to capture the impact and behavior of the risk categories. To offer better support to our intuitions, we run a panel data model where we are able to control for unobserved heterogeneity at the country level and further explore some of the risk drivers. Table 3 reports our panel data model where we control for country and time fixed effects. We discuss the statistically significant results only.

The estimations confirm a positive and statistically significant association among the profitability risk categories. Credit risk exposure (Column 1, Table 3) is positively related with interest rate risk. The magnitude of the relationship is higher for residual risk, and lower for size and unemployment rate. Interestingly, credit risk increases with increasing size of the business as opposed to the assumption that larger banks have a higher diversification potential. High unemployment rates increase credit risk whereas the effect of residential property prices is almost zero.

Interest rate risk (Column 2, Table 3) is positively and distinctly related to credit risk, and negatively related to residual risk. Big banks are clearly more exposed to interest rate risk than small banks. Unemployment rate and the annual real GDP growth also appear to increase interest rate risk exposures though their impact is relatively small. Residual risk (Column 3, Table 3) is positively related to credit risk and negatively to interest rate risk. Size is positively related to residual risk suggesting that large cooperative banks cannot garner the expected benefits from diversification.

Turning to liquidity risk (Column 4, Table 3), there is no variable that is statistically significant in the regression and associated to liquidity risk exposure. Also, the low value for the R-squared denotes the low explanatory power in this specification. Overall, the results of the multivariate framework confirm that credit risk, interest rate risk and residual risk are positively and clearly associated and also significantly associated to the economic environment as expressed by the unemployment rate. Liquidity risk is instead just weakly and not significantly related to the profitability risk categories. Size and country characteristics are significant determinants of the profitability risk categories.

As a robustness test, we estimate Eq. (5) separately for each country. Results shown in “Appendix 3” display both similarities between the countries and some important nuances. The relationships between credit risk and residual risk as well as between credit risk and liquidity risk have for all countries the same sign and are in many cases significant. This is also the case for the coefficients related to interest rate risk and residual risk and further to interest rate risk and liquidity risk. However, the overall results for credit risk and interest rate risk as main risk dependencies are identical in sign and significance for Germany and Austria, while they are opposite for Italy. As already outlined, this may be traced back to the different overall economic situation in Italy and the cooperative banks´ specific affectedness from default risk. Altogether, we resume that our findings for the time-varying correlation coefficients by country are in line with the overall results from the panel model estimations.

6 Conclusions

The purpose of the paper is to provide empirical evidence about the risk characteristics of cooperative banks in Austria, Germany and Italy, the largest cooperative banking markets in Europe. It builds on an integrated risk assessment and contributes to the literature on cooperative banks as multiple types of risks are combined within a consistent framework. We assess four different categories of risk and focus on their joint behavior, both from the perspective of individual institutions and from the overall system. Our risk assessment framework allows comparing consistently across types of risk as well as across different sizes and locations of cooperative banks. The risk measure accounts for both the downside nature of outcomes from profitability and liquidity and the capacity of institutions to withstand negative outcomes.

Banking is a risky business and our work relates to the ongoing effort of improving the risk management practice in banks. We assess three profitability related exposures and one liquidity related exposure, defined in a complementary way. We analyze the connectivity between these risks and potential risk drivers based on correlation and regression analysis. There are different considerations related to our findings. First, as the behavior of single risk categories is considered, we observe moderate different patterns in the development over time that depend on the country and size of cooperative banks. German cooperative banks have been able to decrease their risk exposures over time whereas Austrian banks experienced an almost unvaried level of risk and Italian cooperatives have witnessed an increase in risk exposures. In absolute terms, in 2015 Italian cooperative banks are the most exposed to credit risk and to liquidity risk. We relate these findings to the different economic situation of countries and their specific vulnerability to the financial crises.

Second, with regard to the comparison and relations among the different risk categories, we find that it is important to assess the linear dependence of single pairs of risk exposures over time. As a first attempt, the Pearson’s correlation coefficients have been assessed. The coefficients are non-stationary and show a different magnitude and sign over time. We find that credit, interest rate and residual risks are associated in the multivariate framework. Risk managers and regulators have to take this into consideration when they assess the joint effects from single risk exposures in an integrated risk assessment framework. The comovement of the different profitability risk categories reduces opportunities for diversification. Further efforts will be needed to disentangle these parallel effects and show how to make the banks less vulnerable to their joint occurrence. However, the preliminary finding here is attenuated as the relationship between the profitability risks and liquidity risk is concerned. In the setting of this study, the two groups of risk do not behave in parallel. This may provide some kind of shelter as the occurrence of one group of risks is not related to the occurrence of the other.

The overall significant correlation among profitability risks is a common finding for the cooperative banks in the three countries. At first sight, this might point to a similar risk behavior and an aggregate concentration risk across the countries. However, it has also to be considered that even when the risks categories are associated within and across banks, this does not mean that they must appear simultaneously across the countries. Our findings suggest that bank size and country characteristics are significant determinants of most risk categories. As in particular economic growth and unemployment as the country-specific determinants of risks are not identical across the three considered regions, the risks are dispersed across the cooperative banks in different countries. Thus, from different economic conditions in the countries it follows also that the emergence of risk exposures is different for the countries´ banks. It may be argued in return that converging economic conditions in the countries will also contribute to a similar risk behavior and therefore may impact a multi-country concentration risk.

Emphasis has been laid upon the consistent and comprehensive assessment of single risk categories based on accounting data. This further allowed consequently comparing and aggregating the different individual risks. However, two main limitations have to be taken into account. First, the consistent assessment across multiple risks limits the degree of sophistication the individual risks can be looked at. Further, the risks have been observed based on their past realizations. Yet another challenge is to develop models that may explain future realizations of risks.

Notes

For simplicity, the expression “risk” is used instead of “risk and return”, thereby including a combined perspective.

For a detailed description of the Supervisory Review Process (Pillar 2), see the comprehensive version of the Basel II framework (Basel Committee on Banking Supervision 2006).

For simplicity, we refer interchangeably throughout the text to cooperative banks, cooperatives, and mutual credit institutions.

For the definition and implications of being a less significant bank, see European Central Bank (2016).

For example, in Italy 70% of LSIs are cooperative banks (source, Bank of Italy).

A comprehensive overview of European cooperative bank systems is given in Karafolas (2016).

In June 2016, the former two central institutions DZ Bank and WGZ Bank have merged.

Law n. 49, April 8 2016.

These are to be considered the main relevant risks and are dominant in the Basel framework. Another direction related to a key risk for cooperative banks is business risk (see for example Köhler 2015).

For example, the risk category “interest rate risk” is based on data for interest income and interest expense that can be further divided into interest related to loans or securities.

Basically, this is expressed as the critical values from a combined risk/return distribution.

Only equity is considered as the counterbalancing capacity, as “loan loss reserves” that are also given in the accounts are considered to already cover credit losses from the past.

In the original income statements, the position “net interest income” includes also dividend income. However, for the purpose of this analysis dividend income is extracted from this position.

In their analysis of the drivers of the net interest margin, Agoraki and Kouretas (2019, p. 1010) control for “implicit interest payments” which consist of non-interest related revenues and expenses. These correspond to the residual risk here.

Particularly, data is sourced from the Austrian central bank and Federcasse (Italian association of cooperative banks). Additional information from individual bank statements is used to complement data from Bankscope.

In detail, for each risk exposure (y) for each bank (i) at each point in time (t) we compute the following: \(Risk_{it} = [\left( {y_{it} - \mu \left( Y \right)} \right]/\sigma \left( Y \right)\).

For each country, we set as a threshold the 90th percentile.

For simplicity and without loss of generality, we refer to “small banks” instead of “small and medium sized banks” throughout the text.

Data from the annual real GDP growth and the unemployment rate is taken from Eurostat. Data for the residential property prices is taken from National sources, BIS Residential Property Price database. For each year, we consider the data on the last quarter on all types of dwellings for the whole country.

Official data received from Federcasse was first vetted by the Bank of Italy, the banking supervisory authority of all the Italian banks.

In their analysis of risk forecasts, Cleary and Hebb (2016, pp. 108–109) report better classification and prediction results for failed banks using quarterly data compared to the use of yearly data.

Two cases have been corrected.

Source: Bank of Italy’s 2015 Annual Report, p. 135.

The local accounting system in Germany permits German banks to build up undisclosed reserves (§ 340 f reserves). These reserves can be released in distressed periods without making it public.

Forgione and Migliardo (2018) find that liquidity risk is a major cause of failures for Italian cooperatives. They suggest looking for more stable funding sources as for example mid- and long-term securities.

Similarly, Agoraki and Kouretas (2019) regress the net interest margin on loan loss provisions and implicit interest payments (which correspond mostly to the residual risk here).

References

Agoraki MEK, Kouretas GP (2019) The determinants of net interest margin during transition. Rev Quant Financ Acc 53(4):1005–1029. https://doi.org/10.1007/s11156-018-0773-y

Anginer D, Demirgüç-Kunt A, Mare DS (2018) Bank capital, institutional environment and systemic stability. J Financ Stab 37:97–106. https://doi.org/10.1016/j.jfs.2018.06.001

Athanasoglou PP, Brissimis SN, Delis MD (2008) Bank-specific, industry-specific and macroeconomic determinants of bank profitability. J Int Financ Mark Inst Money 18(2):121–136. https://doi.org/10.1016/j.intfin.2006.07.001

Basel Committee on Banking Supervision (2006) International convergence of capital measurement and capital standards: a revised framework. Bank for International Settlements, Basel

Basel Committee on Banking Supervision (2013) Basel III: the liquidity coverage ratio and liquidity risk monitoring tools. Bank for International Settlements, Basel

Bessis J (2015) Risk management in banking. Wiley, Hoboken

Bessler W, Kurmann P (2014) Bank risk factors and changing risk exposure: capital market evidence before and during the financial crisis. J Financ Stab 13(August):151–166. https://doi.org/10.1016/j.jfs.2014.06.003

Betz F, Oprică S, Peltonen TA, Sarlin P (2014) Predicting distress in European banks. J Bank Finance 45(August):225–241. https://doi.org/10.1016/j.jbankfin.2013.11.041

Birge JR, Júdice P (2013) Long-term bank balance sheet management: estimation and simulation of risk-factors. J Bank Finance 37(12):4711–4720. https://doi.org/10.1016/j.jbankfin.2013.07.040

Black L, Correa R, Huang X, Zhou H (2016) The systemic risk of European banks during the financial and sovereign debt crises. J Bank Finance 63(February):107–125. https://doi.org/10.1016/j.jbankfin.2015.09.007

Brazda J, Blisse H, Schediwy R (2016) Cooperative banks in the Austrian banking system. In: Karafolas S (ed) Credit cooperative institutions in European countries. Springer, Cham, pp 3–18

Broccardo E, Costa E, Mazzuca M (2016) Corporate social responsibility and financial performance in Italian co-operative banks. In: Lehner OM (ed) Routledge handbook of social and sustainable finance. Routledge, Abingdon, pp 280–295

Caballero J (2015) Banking crises and financial integration: insights from networks science. J Int Financ Mark Inst Money 34(January):127–146. https://doi.org/10.1016/j.intfin.2014.11.005

Chaffei M, Dietsch M (2015) Modelling and measuring business risk and the resiliency of retail banks. J Financ Stab 16(February):173–182. https://doi.org/10.1016/j.jfs.2014.08.004

Čihák M, Hesse H (2007) Cooperative banks and financial stability. IMF working paper WP/07/02, International Monetary Fund, Washington

Claessens S, Kose AM, Laeven L, Valencia F (eds) (2014) Financial crises: causes, consequences, and policy responses. International Monetary Fund, Washington. https://doi.org/10.5089/9781475543407.071

Cleary S, Hebb G (2016) An efficient and functional model for predicting bank distress: in and out of sample evidence. J Bank Finance 64(March):101–111. https://doi.org/10.1016/j.jbankfin.2015.12.001

Delis MD, Hasan I, Tsionas EG (2014) The risk of financial intermediaries. J Bank Finance 44(July):1–12. https://doi.org/10.1016/j.jbankfin.2014.03.024

Elsas R, Hackethal A, Holzhäuser M (2010) The anatomy of bank diversification. J Bank Finance 34(June):1274–1287. https://doi.org/10.1016/j.jbankfin.2009.11.024

European Association of Co-operative Banks (2015) Key figures 2015. Retrieved from http://www.eacb.coop/en/cooperative_banks/key_figures.html

European Central Bank (2016) Banking supervision: supervisory practices. Retrieved from https://www.bankingsupervision.europa.eu/banking/list/criteria/html/index.en.html

Fall M, Viviani JL (2015) A new multi-factor risk model to evaluate funding liquidity risk of banks. The Eur J Finance 22(11):985–1003. https://doi.org/10.1080/1351847X.2014.996656

Ferri G (2012) Credit cooperatives: challenges and opportunities in the new global scenario. Euricse working paper 031/12

Fiordelisi F, Mare DS (2013) Probability of default and efficiency in cooperative banking. J Int Financ Mark Inst Money 26(October):30–45. https://doi.org/10.1016/j.intfin.2013.03.003

Fiordelisi F, Mare DS (2014) Competition and financial stability in European cooperative banks. J Int Money Finance 45(July):1–16. https://doi.org/10.1016/j.jimonfin.2014.02.008

Fonteyne W (2007) Cooperative banks in Europe: policy issues. IMF working paper WP/07/159, Washington

Forgione AF, Migliardo C (2018) Forecasting distress in cooperative banks: the role of asset quality. Int J Forecast 34(4):678–695. https://doi.org/10.1016/j.ijforecast.2018.04.008

Groeneveld H (2014) Features, facts and figures of European cooperative banking groups over recent business cycles. J Entrep Organ Divers 3(1):11–33

Groeneveld H (2017) Snapshot of European co-operative banking 2017. TIAS school for business and society, Tilburg

Imbierowicz B, Rauch C (2014) The relationship between liquidity risk and credit risk in banks. J Bank Finance 40(March):242–256. https://doi.org/10.1016/j.jbankfin.2013.11.030

Karafolas S (ed) (2016) Credit cooperative institutions in European countries. Springer, Cham

Köhler M (2015) Which banks are more risky? The impact of business models on bank stability. J Financ Stab 16(February):195–212. https://doi.org/10.1016/j.jfs.2014.02.005

Lepetit L, Nys E, Rous P, Tarazi A (2008) Bank income structure and risk: an empirical analysis of European banks. J Bank Finance 32(8):1452–1467. https://doi.org/10.1016/j.jbankfin.2007.12.002

Leung WS, Taylor N, Evans KP (2015) The determinants of bank risk: evidence from the recent financial crisis. J Int Financ Mark Inst Money 34(January):277–293. https://doi.org/10.1016/j.intfin.2014.11.012

Li J, Wei L, Lee CF, Zhu X, Wu D (2018) Financial statements based bank risk aggregation. Rev Quant Financ Acc 50(3):673–694. https://doi.org/10.1007/s11156-017-0642-0

Männasoo K, Mayes DG (2009) Explaining bank distress in Eastern European transition economies. J Bank Finance 33(2):244–253. https://doi.org/10.1016/j.jbankfin.2008.07.016

Mare DS (2015) Contribution of macroeconomic factors to the prediction of small bank failures. J Int Financ Mark Inst Money 39(November):25–39. https://doi.org/10.1016/j.intfin.2015.05.005

Mare DS, Moreira F, Rossi R (2017) Nonstationary z-score measures. Eur J Oper Res 260(1):348–358. https://doi.org/10.1016/j.ejor.2016.12.001

McKee G, Kagan A (2016) Determinants of recent structural change for small asset U.S. credit unions. Rev Quant Financ Account 47(3):775–795. https://doi.org/10.1007/s11156-015-0520-6

Memmel C, Gündüz Y, Raupach P (2015) The common drivers of default risk. J Financ Stab 16(February):232–247. https://doi.org/10.1016/j.jfs.2014.03.002

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Financ 29(2):449–470. https://doi.org/10.1111/j.1540-6261.1974.tb03058.x

Milne A (2014) Distance to default and the financial crisis. J Financ Stab 12(June):26–36. https://doi.org/10.1016/j.jfs.2013.05.005

Poghosyan T, Čihák M (2011) Determinants of bank distress in Europe: evidence from a new data set. J Financ Serv Res 40(3):163–184. https://doi.org/10.1007/s10693-011-0103-1

Siu YW (2020) Impact of expected shortfall approach on capital requirement under Basel. Rev Pac Basin Financ Mark Polic. https://doi.org/10.1142/S0219091519500255

Standard & Poor’s (2013) Cooperative banking sector Germany. Frankfurt, November

Yan M, Hall MJ, Turner P (2014) Estimating liquidity risk using the exposure-based cash-flow-at-risk approach: an application to the UK banking sector. Int J Finance Econ 19(3):225–238. https://doi.org/10.1002/ijfe.1495

Acknowledgements

Open Access funding provided by Projekt DEAL. The paper has benefited from suggestions received at the FEBS conference, University of Málaga 2016, the EURICSE conference, University of Trento 2016, and the Portsmouth-Fordham conference on Banking & Finance, University of Portsmouth 2016. The authors want to express their gratitude for all comments received. The findings, interpretations, and conclusions expressed in this paper are entirely those of the authors. They do not necessarily represent the views of the International Bank for Reconstruction and Development/World Bank and its affiliated organizations, or those of the Executive Directors of the World Bank or the governments they represent.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

This table presents the calculation of interest rate risk (IR), credit risk (CR) and residual risk (RR).

Appendix 2

This table presents the calculation of liquidity risk (LR).

Appendix 3

3.1 Germany

(1) | (2) | (3) | (4) | |

|---|---|---|---|---|

Variables | Credit risk | IR risk | Residual risk | Liquidity risk |

Credit risk | 0.910*** | 0.275*** | − 0.006 | |

(0.037) | (0.030) | (0.010) | ||

Interest rate risk | 0.750*** | − 0.011 | − 0.001 | |

(0.101) | (0.019) | (0.008) | ||

Residual risk | 0.058 | − 0.003 | 0.002 | |

(0.051) | (0.007) | (0.002) | ||

Liquidity risk | − 0.001 | − 0.000 | 0.001 | |

(0.002) | (0.002) | (0.002) | ||

Size | − 0.124** | 0.396*** | − 0.093*** | − 0.022 |

(0.060) | (0.064) | (0.025) | (0.039) | |

Constant | 0.557*** | − 0.358*** | 0.081*** | 0.134 |

(0.032) | (0.034) | (0.022) | (0.127) | |

Year FE | Yes | Yes | Yes | Yes |

Observations | 11,049 | 11,049 | 11,049 | 11,049 |

Number of banks | 953 | 953 | 953 | 953 |

R-squared | 0.803 | 0.761 | 0.076 | 0.001 |

3.2 Italy

(1) | (2) | (3) | (4) | |

|---|---|---|---|---|

Variables | Credit risk | IR risk | Residual risk | Liquidity risk |

Credit risk | − 0.204** | 0.229** | − 0.008 | |

(0.090) | (0.094) | (0.009) | ||

Interest rate risk | − 0.202** | − 0.140 | 0.034 | |

(0.085) | (0.123) | (0.037) | ||

Residual risk | 0.230*** | − 0.142 | 0.070 | |

(0.084) | (0.130) | (0.070) | ||

Liquidity risk | − 0.007 | 0.030 | 0.062* | |

(0.006) | (0.022) | (0.037) | ||

Size | 0.091** | 0.348*** | 0.095 | − 0.004 |

(0.035) | (0.088) | (0.085) | (0.031) | |

Constant | 0.026** | 0.033 | 0.025 | − 0.046 |

(0.011) | (0.036) | (0.059) | (0.031) | |

Year FE | Yes | Yes | Yes | Yes |

Observations | 5102 | 5102 | 5102 | 5102 |

Number of banks | 465 | 465 | 465 | 465 |

R-squared | 0.115 | 0.107 | 0.120 | 0.008 |

3.3 Austria

(1) | (2) | (3) | (4) | |

|---|---|---|---|---|

Variables | Credit risk | IR risk | Residual risk | Liquidity risk |

Credit risk | 0.090 | 0.028 | − 0.002 | |

(0.064) | (0.043) | (0.002) | ||

Interest rate risk | 0.101** | 0.267*** | − 0.000 | |

(0.041) | (0.043) | (0.011) | ||

Residual risk | 0.029 | 0.247 | − 0.000 | |

(0.048) | (0.180) | (0.001) | ||

Liquidity risk | − 0.002 | − 0.000 | − 0.000 | |

(0.002) | (0.009) | (0.001) | ||

Size | − 0.039 | 0.491*** | − 0.091* | − 0.042 |

(0.056) | (0.114) | (0.051) | (0.028) | |

Constant | 0.045* | 0.372*** | − 0.022 | − 0.026 |

(0.023) | (0.050) | (0.065) | (0.019) | |

Year FE | Yes | Yes | Yes | Yes |

Observations | 5165 | 5165 | 5165 | 5165 |

Number of banks | 614 | 614 | 614 | 614 |

R-squared | 0.016 | 0.139 | 0.072 | 0.004 |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Mare, D.S., Gramlich, D. Risk exposures of European cooperative banks: a comparative analysis. Rev Quant Finan Acc 56, 1–23 (2021). https://doi.org/10.1007/s11156-020-00884-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-020-00884-y