Abstract

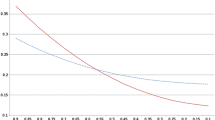

Strengthening of asset return dependence during the 2007–2008 credit crisis highlighted its dynamic and conditional nature. Option prices reflect the market assessment of how dependence between assets varies with price movements and time horizons, yielding the implied correlation surface. Return dependence increases in falling markets and makes correlation a priced risk factor, causing a spread between implied and actual correlation. Order flow pressure from hedging structured products also contributes to the spread. Prior to the crisis, the gap between implied and actual correlation motivated selling dependence between equities—dispersion trading. However, spiking dependence among stock returns during the crisis decimated correlation sellers. Selling at-the-money conditional correlation between NASDAQ-100 components regains an attractive risk-return profile during periods of strong bull market. This may be due to an increasing correlation risk premium caused by greater investor belief heterogeneity. The implied correlation surface enables the construction of strategies with exposures to dependence conditional on various market dynamics. In particular, a long correlation skew trade delivers attractive returns, while hedging the effects of volatility and mitigating exposure to the level of correlation. This suggests segmentation of the options market along the moneyness dimension. As a risk factor, a correlation skew trade is nearly orthogonal to the five Fama–French risk factors, as well as the momentum factor.

Similar content being viewed by others

Notes

According to Bennett (2014), a popular class of structured products that depend on correlation includes securities with payoffs determined by the best or worst performers among a basket of underlying assets (e.g. Altiplano, Everest, Himalayas). Short positions in such structured products confer negative correlation exposure to the vendors who then seek to hedge it in the options market.

Naïve implementation is defined by the use of index weights for option positions.

Wharton Research Data Services (2018c) “OptionMaterics”, wrds.wharton.upenn.edu.

Wharton Research Data Services (2018a) “Compustat”, wrds.wharton.upenn.edu.

Wharton Research Data Services (2018b) “CRSP”, wrds.wharton.upenn.edu.

Without loss of generality, current time is denoted by 0 and the notation is lightened by omitting it whenever no confusion can arise.

Averaging over a longer period introduces a greater probability of mixing in observations from different market environments.

While markets recognize the stochastic nature of correlation, few widely-recognized option pricing models incorporate this crucial feature.

Since it is crucial to preserve the effect of different variances of the ICS component changes, SD is applied to the covariance matrix, and not to the correlation matrix.

Since implied volatilities are inputs for calculating implied correlation [see Eq. (1)], IVS construction algorithms may exert significant influence on results.

Dependence structures between changes of various financial quantities varies with the movements’ magnitude. This explains the effectiveness of non-Gaussian copulas with positive tail dependence for modeling asset returns (see Diks et al. 2014).

Using straddles causes an immediate delta reduction of a position, while trading underlying assets removes the remaining exposures.

Correlation between assets is positive, and by its nature must be less than one.

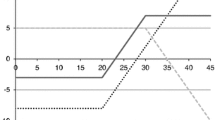

If the goal is to obtain exposure to the implied correlation skew, while hedging against parallel shifts of the implied correlation surface (ICS), the relative size, \(\psi\), of the ATM leg must satisfy:

$$\begin{aligned} vega_{bkt}\left( OTM\right) \,\frac{\partial \sigma _{bkt}\left( OTM\right) }{\partial \rho } - \psi \, vega_{bkt}\left( ATM\right) \,\frac{\partial \sigma _{bkt}\left( ATM\right) }{\partial \rho } = 0, \end{aligned}$$(8)where OTM and ATM refer to parameters of out-of-the-money and at-the-money options respectively. Correlation calendar and diagonal trades also hedge out parallel movements in the ICS, but have dispersion trades with different option maturities.

Generalization to using straddles and general scaling of a trade is straightforward.

The basis for spread-induced cost calculation is half the difference between ask and bid prices. Spread-induced cost estimate is based on spreads for held (long or short) quoted contracts, with extrapolation of costs for non-quoted positions. Since in a passive empirical study markets cannot be queried for quotes on held positions that did not trade, part of the modeled turnover is due to establishing equivalent positions in traded contracts. Such contracts are not treated as entirely new positions for the purpose of spread-induced cost calculation, as this would exaggerate the actual rebalancing costs.

Shorting stocks requires margin, while long positions may use leverage. To avoid arbitrary assumptions, capital required for a delta hedge is not included in (13).

The pitfalls of stochastic volatility model are explored in Diavatopoulos and Sokolinskiy (forthcoming) and Lee and Sokolinskiy (2015).

A numerical study of the issue supports this conjecture.

Since vanna is \(\frac{\partial }{\partial \sigma \partial S}\), the corresponding change in factors is \(\varDelta \sigma \varDelta S\), where \(\sigma\) and S capture the magnitudes of parallel changes in volatilities and stock prices of assets comprising the basket.

In terms of implied volatility.

Data source: Kenneth French’s website, data for North American factors. https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

The numbers in the table reflect daily returns.

Wharton Research Data Services (2018d), ”Pastor-Stambaugh Liquidity Factors”, wrds.wharton.upenn.edu.

Results not included to conserve space.

Constant maturity swap.

References

Andrews DW (1993) Tests for parameter instability and structural change with unknown change point. Econom J Econom Soc 61(4):821–856

Andrews DW, Ploberger W (1994) Optimal tests when a nuisance parameter is present only under the alternative. Econom J Econom Soc 62(6):1383–1414

Ang A, Chen J (2002) Asymmetric correlations of equity portfolios. J Financ Econ 63(3):443–494

Bennett C (2014) Trading volatility: trading volatility, correlation, term structure and skew. In: CreateSpace independent publishing platform. https://books.google.com/books?id=_zPuoAEACAAJ

Blenman LP, Wang GJ (2012) New insights on the implied and realized volatility relation. Rev Pac Basin Financ Mark Policies 15(01):1250001

Buraschi A, Kosowski R, Trojani F (2013) When there is no place to hide: correlation risk and the cross-section of hedge fund returns. Rev Financ Stud 27(2):581–616

Buraschi A, Trojani F, Vedolin A (2014) When uncertainty blows in the orchard: comovement and equilibrium volatility risk premia. J Finance 69(1):101–137

Byun SJ, Kim S, Rhee DW (2018) Ad hoc black and scholes procedures with the time-to-maturity. Rev Pac Basin Financ Mark Policies 21(01):1850006

CBOE (2000) Chicago board options exchange margin manual

Cespa G, Foucault T (2014) Illiquidity contagion and liquidity crashes. Rev Financ Stud 27(6):1615–1660

Chang MC, Wu CF (2012) Who offers liquidity on options markets when volatility is high? Rev Pac Basin Financ Mark Policies 15(04):1250021

Chen RR, Lee CF, Lee HH (2009) Empirical performance of the constant elasticity variance option pricing model. Rev Pac Basin Financ Mark Policies 12(02):177–217

Chiu J, Chung H, Ho KY (2014) Fear sentiment, liquidity, and trading behavior: evidence from the index etf market. Rev Pac Basin Financ Mark Policies 17(03):1450017

Corb H (2012) Interest rate swaps and other derivatives. Columbia Business School Publishing Series, Columbia Business School

Coval JD, Shumway T (2001) Expected option returns. J Finance 56(3):983–1009

Cox JC (1996) The constant elasticity of variance option pricing model. J Portf Manag 15:15–17

Deng Q (2008) Volatility dispersion trading. SSRN 1156620

Diavatopoulos D, Sokolinskiy O (forthcoming) Stochastic volatility models: faking a smile. In: Handbook of financial econometrics, mathematics, statistics, and machine learning, vol 2. World Scientific Publishing, Singapore

Diks C, Panchenko V, Sokolinskiy O, van Dijk D (2014) Comparing the accuracy of multivariate density forecasts in selected regions of the copula support. J Econ Dyn Control 48:79–94

Driessen J, Maenhout P (2007) An empirical portfolio perspective on option pricing anomalies. Rev Finance 11(4):561–603

Driessen J, Maenhout PJ, Vilkov G (2009) The price of correlation risk: evidence from equity options. J Finance 64(3):1377–1406

Driessen J, Maenhout P, Vilkov G (2013) Option-implied correlations and the price of correlation risk. Netspar discussion paper no 07/2013-061

Fama EF, French KR (2015) A five-factor asset pricing model. J Financ Econ 116(1):1–22

Garleanu N, Pedersen LH, Poteshman AM (2008) Demand-based option pricing. Rev Financ Stud 22(10):4259–4299

Gatheral J (2006) The volatility surface: a practitioner’s guide. Wiley Finance, Wiley, New York

Gennotte G, Leland H (1990) Market liquidity, hedging, and crashes. Am Econ Rev 80(5):999–1021

Gromb D, Vayanos D (2002) Equilibrium and welfare in markets with financially constrained arbitrageurs. J Financ Econ 66(2–3):361–407

Harikumar T, De Boyrie ME, Pak SJ (2004) Evaluation of black–scholes and garch models using currency call options data. Rev Quant Finance Account 23(4):299–312

Hitzemann S, Hofmann M, Uhrig-Homburg M, Wagner C (2017) Margin requirements and equity option returns

Hobbs J, Lee HW, Singh V (2017) New evidence on the effect of belief heterogeneity on stock returns. Rev Quant Finance Account 48(2):289–309

Ilmanen A, Asness C (2011) Expected returns: an investor’s guide to harvesting market rewards. The Wiley Finance Series, Wiley. https://books.google.com/books?id=WqFf6imwTsUC

Jacquier A, Slaoui S (2010) Variance dispersion and correlation swaps. arXiv preprint arXiv:10040125

Lee CF, Sokolinskiy O (2015) R-2gam stochastic volatility model: flexibility and calibration. Rev Quant Finance Account 45(3):463–483

Lee RW (2005) Implied volatility: statics, dynamics, and probabilistic interpretation. In: Baeza-Yates R, Glaz J, Gzyl H, Hüsler J, Palacios JL (eds) Recent advances in applied probability. Springer, Boston, MA, pp 241–268

Linders D, Schoutens W (2014) A framework for robust measurement of implied correlation. J Comput Appl Math 271:39–52

Longin F, Solnik B (2001) Extreme correlation of international equity markets. J Finance 56(2):649–676

Marshall CM (2009) Dispersion trading: empirical evidence from us options markets. Glob Finance J 20(3):289–301

Maze S (2012) Dispersion trading in south Africa: an analysis of profitability and a strategy comparison

McNeil AJ, Frey R, Embrechts P (2015) Quantitative risk management: concepts, techniques and tools-revised edition. Princeton University Press, Princeton

Muravyev D (2016) Order flow and expected option returns. J Finance 71(2):673–708

Pástor L, Stambaugh RF (2003) Liquidity risk and expected stock returns. J Polit Econ 111(3):642–685

Rebonato R (2004) Volatility correlation, 2nd edn. Wiley, New York

Santa-Clara P, Saretto A (2009) Option strategies: good deals and margin calls. J Financ Mark 12(3):391–417

Taleb N (1997) Dynamic heging: managing vanilla and exotic options. The Wiley Finance Series, Wiley, New York

Tanha H, Dempsey M (2016) The information content of ASX SPI 200 implied volatility. Rev Pac Basin Financ Mark Policies 19(01):1650002

Tavella D, Randall C (2000) Pricing financial instruments: the finite difference method. Wiley series in financial engineering, Wiley. https://books.google.com/books?id=E_GPuAEACAAJ

Walter C, Lopez JA (2000) Is implied correlation worth calculating? Evidence from foreign exchange options and historical data. Federal Reserve Bank of San Francisco

Wharton Research Data Service (2018a) Compustat. wrds.wharton.upenn.edu

Wharton Research Data Service (2018b) CRSP. wrds.wharton.upenn.edu

Wharton Research Data Service (2018c) OptionMetrics. wrds.wharton.upenn.edu

Wharton Research Data Service (2018d) Pastor–Stambaugh liquidity factors. wrds.wharton.upenn.edu

Yuan K (2005) Asymmetric price movements and borrowing constraints: a rational expectations equilibrium model of crises, contagion, and confusion. J Finance 60(1):379–411

Acknowledgements

The work on this paper was mostly conducted while the author was a faculty member at Rutgers Business School—Newark and New Brunswick, prior to his employment by the Board of Governors of the Federal Reserve System. Only minor revisions were made during the author’s employment by the Board of Governors of the Federal Reserve System. The analysis and conclusions set forth are those of the author and do not indicate concurrence by other members of the research staff or the Board of Governors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The work on this paper was conducted almost entirely over the period during which Oleg Sokolinskiy was a faculty member at Rutgers University, Rutgers Business School - Newark and New Brunswick. The analysis and conclusions set forth are those of the author and do not indicate concurrence by other members of the research staff or the Board of Governors of the Federal Reserve System.

Appendices

Appendix 1: Implied volatility interpretation

Price of the underlying asset, \(S\left( t\right)\) evolves as

where \(\left\{ \sigma \left( t\right) \right\}\) is a random volatility process, and \(W^{\mathbb {Q}}\left( t\right)\) is the Brownian motion under a risk-neutral probability measure \({\mathbb{Q}}\).

This section outlines the derivations and results presented in Gatheral (2006). From risk-neutral pricing and the Black–Scholes partial differential equation (see equation (3.5) in Gatheral (2006)):

where \(\Gamma_{BS}\) is the Black-Scholes gamma, as defined in Gatheral (2006), p27. Following Lee (2005) and Gatheral (2006), define the Radon–Nikodým derivative process:

Then, squared implied volatility is an integral over the expectations of random variance under measures \({\mathbb {V}}\left( t\right)\) (and not the risk-neutral measure \({\mathbb {Q}}\); see equation (3.6) in Gatheral (2006)):

Using the Radon–Nikodým derivative process of Eq. (20) and iterated conditioning, Eq. (21) yields Eq. (4).

Appendix 2: Common alternative dispersion trade implementations

Since a parallel shift may have some heuristic appeal, it forms the basis for alternative implementations of a dispersion trade. Let a strategy have positions \(\left\{ p_i\right\} _{i=1}^{N}\). A parallel equal magnitude shift of all individual implied volatilities has the effect of

on a long correlation dispersion trade. Similarly, a parallel equal relative shift of all individual and basket implied volatilities has the effect of

on a long correlation dispersion trade. Other common ways of implementing a dispersion trade seek to hedge either parallel absolute or relative changes in all volatilities (also see Bennett (2014) for descriptions and illustrations of common implementations of correlation trades):

-

Vega-weighted implementation treats basket and individual volatilities as separate variables. Then, the effect of a parallel equal magnitude shift of all (individual and basket) implied volatilities is

$$\begin{aligned} vega_{bkt} - \sum _{i=1}^{N} p_i \, vega_i, \end{aligned}$$instead of a theoretically more sound Eq. (22). Consequently, vega-weighted dispersion trade implementation sets

$$\begin{aligned} p^{vega}_i = \frac{vega_{bkt}}{N \, vega_i}. \end{aligned}$$(24) -

Theta-weighted implementation also treats basket and individual volatilities as separate variables, but focuses on equal relative shift of all individual and basket implied volatilities. It assumes that such shifts would have the effect of:

$$\begin{aligned} vega_{bkt} \, \sigma _{bkt} \, - \sum _{i=1}^{N} p_i \, vega_i \, \sigma _{i} \,. \end{aligned}$$instead of the more accurate Eq. (23). As a result, theta-weighted dispersion trade implementation sets

$$\begin{aligned} p^{\theta }_i = \frac{vega_{bkt} \, \sigma _{bkt}}{N \, vega_i \, \sigma _i}. \end{aligned}$$(25)

Finally, a naïve approach consists of taking positions in proportion to index weights. While it features in research, it is theoretically unjustified and not popular with practitioners. The naïve approach will not receive further consideration in this paper. Table 8 summarizes practical implementations of correlation trades.

Rights and permissions

About this article

Cite this article

Sokolinskiy, O. Conditional dependence in post-crisis markets: dispersion and correlation skew trades. Rev Quant Finan Acc 55, 389–426 (2020). https://doi.org/10.1007/s11156-019-00847-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-019-00847-y

Keywords

- Implied correlation

- Correlation risk premium

- Conditional dependence

- Basket options

- Dispersion trading

- Market segmentation

- QQQ