Abstract

In this study, we investigate how labor protection institutions and the presence of controlling shareholders interact to determine a firm’s cost of equity capital in an international setting. Our firm- and country-level analyses reveal that firms in countries with greater labor rights have a higher cost of equity, over and above the differences explained by investor protection environments and firm- and country-level risk factors. We find that operating leverage and information asymmetry serve as channels through which labor protection increases the cost of equity capital. More interestingly, the detrimental effect of labor protection on the cost of equity is mitigated in the presence of controlling shareholders, especially in the case of a family controlling owner, indicating the effectiveness of controlling owners at coping with difficult labor relations. The economic significance of this advantage is non-trivial: a one-unit increase in the labor market regulation index increases the annual cost of equity by 0.776% in widely held firms, whereas it increases by only 0.415% in firms with controlling shareholders. Our study identifies better labor relations as a potential channel through which concentered ownership affects the interaction of labor power and the cost of equity capital.

Similar content being viewed by others

Notes

The cost of equity capital is found to be negatively related to insider trading enforcement (Bhattacharya and Daouk 2002), high-quality accounting standards (Francis et al. 2004), extensive securities regulation and strong enforcement mechanisms (Hail and Leuz 2006), cross-listing on U.S. stock exchanges (Hail and Leuz 2009) and adoption of IFRS (Kim et al. 2014).

Researchers typically use the percentage of employed workers in a firm’s primary Census Industry Classification industry covered by unions to measure the collective bargaining power with employers.

Our sample period is aligned with our country-level labor market regulations data that were constructed from labor laws as of 1997 in Botero et al. (2004).

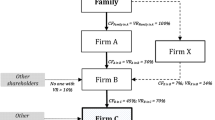

La Porta et al. (1999) find that controlling shareholders usually participate in management in 27 wealthy economics.

We also use the strength of the social security laws index obtained from Botero et al. (2004) as an alternative proxy for labor protection. Our empirical tests (untabulated) reveal consistent results.

As the Fraser Institute reports labor market regulations for 1990, 1995, 2000, 2001, 2002, and 2003, we use the average of 1990 and 1995 to proxy for 1991 to 1994, and the average of 1995 and 2000 to proxy for 1996 to 1999.

We perform sensitivity tests and discuss this problem in the last paragraph of Sect. 4.9.

We also apply the median and the principal component of the four individual measures of the cost of equity, respectively, and obtain similar results (untabulated).

Since the ratio of staff costs to total assets may capture the effective use of staff, we use the industry median to mitigate this effect.

We use the strength of securities regulations (La Porta et al. 2006) as an alternative investor protection institution and obtain similar results (untabulated).

As the Fraser Institute does not include Indonesian data from 1990, we are unable to estimate the labor market regulations for Indonesia for 1991–1994, which reduces our sample size by 37 observations.

We use the Social Security laws as another measure of labor protection, which measure the strength of social security laws (Botero et al. 2004) and obtain similar results.

When we exclude RETVAR in addition to ROAVAR and FBIAS, the results are similar.

When we compare ROAVAR (a proxy for operating leverage) and FBIAS (a proxy for information asymmetry) between High and Low labor protection countries, we find that the mean and median values of ROAVAR and FBIAS are significantly greater in countries with higher labor protection than in those with low labor protection, consistent with the prediction.

We also use labor relation data from the World Competitiveness Yearbook 1999 and data from the Global Competitiveness Report 1999 and 2003. The results are consistent with those in Table 6.

This short-hand valuation is widely used in current finance literature in the international context (e.g., Errunza and Miller, 2000). As Bekaert and Harvey (2000) show that dividend yields also reflect differences in growth expectations, the 1-year ahead percentage change in analyst earnings per share forecast is added to control for the variations in earnings growth.

The U.S. one-month Treasury Bill rates are the Fama risk-free rates taken from the Wharton Research Data Services (WRDS). The global market returns, the global value and growth portfolio returns are downloaded from Kenneth French’s homepage (http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data.library.html). Only 15 of the countries in the sample have available value and growth portfolios returns, hence observations from Indonesia, Korea, Portugal, the Philippines, Taiwan, and Thailand are excluded from this sensitivity analysis. The estimation is based on the rolling regressions of 60 monthly excess returns (with 36 monthly returns as a minimum) on the global market premium and the value-growth premium as the second explanatory return portfolios, as Fama and French (1998) suggest that a two-factor intertemporal capital asset pricing model (ICAPM) better explains the value premium in country and global returns than the international capital asset pricing model.

We exclude widely held firms from this analysis to make a clear comparison between family controlled firms and non-family controlled firms and thus the sample size is further reduced.

Although the country-level analysis has some appealing features, firm-specific variables provide finer and more detailed data than country-average variables. Garrett (2003) suggests that a firm-level regression is likely to provide a better specification as it measures variables for each firm (i.e., disaggregated data), whereas in a country-level regression the dependent and independent variables are based on the average within each country (i.e., aggregated data). Given the trade-offs between firm-level and country-level regressions, we conduct both analyses to provide robust evidence of our hypotheses.

Although + 10 months is somewhat arbitrary, Hail and Leuz (2006) show that all of the analyses remain qualitatively similar when + 7 months is used. To adjust for the time misalignment between financial data and forecasts data, Hail and Leuz (2006) discount the + 10 months price to the beginning of the fiscal year by the inputted cost of capital, that is, (1 + r)−10/12. The results are virtually identical with or without the adjustment.

On January 1, 1999, eleven of the countries in the European Economic and Monetary Union (EMU) gave up their own currencies and adopted the Euro currency. Among the Euro-in countries, Austria, Belgium, Finland, France, Germany, Italy, Portugal, and Spain are included in the sample. The I/B/E/S data for these eight countries are in legacy currency before the Euro adoption but are in Euro after the participation. An adjustment is made to correct this currency misalignment by converting the price and earnings forecasts data after January 1999 to the legacy currency based on the monthly exchange rate obtained from I/B/E/S. This currency conversion gives all of the stock price and earnings forecasts a consistent currency over the entire sample period.

As the Indonesian inflation rates of 1992 to 1996 are missing from Datastream, they are replaced by the data from the Statistical Yearbook 1997.

References

Alimov A (2015a) Labor market regulations and cross-border mergers and acquisitions. J Int Bus Stud 46:984–1009

Alimov A (2015b) Labor protection laws and bank loan contracting. J Law Econ 58:37–74

Atanassov J, Kim EH (2009) Labor and corporate finance: international evidence from restructuring decisions. J Finance 64:341–374

Bae KH, Kang JK, Wang J (2011) Employee treatment and firm leverage: a test of the stakeholder theory of capital structure. J Financ Econ 100:130–153

Bai J, Fairhurst DJ, Serfling M (2018) Employment protection, investment, and firm growth. Available at SSRN: https://doi.org/10.2139/ssrn.2705066

Banker RD, Byzalov D, Chen L (2013) Employment protection legislation, adjustment costs and cross-country differences in cost behavior. J Account Econ 55:111–127

Bassanini A, Breda T, Caroli E, Reberioux A (2013) Working in family firms: paid less but more secure? Evidence from French matched employer–employee data. Ind Labor Relat Rev 66:433–466

Bebchuk L, Kraakman R, Triantis G (2000) Stock pyramids, cross-ownership, and dual class equity. In: Morck RK (ed) Concentrated corporate ownership. National Bureau of Economic Research, Chicago, pp 295–318

Bekaert G, Harvey C (2000) Foreign speculators and emerging equity markets. J Finance 55:565–613

Bens DA, Berger PG, Monahan SJ (2011) Discretionary disclosure in financial reporting: an examination comparing internal firm data to externally reported segment data. Account Rev 86:417–449

Bhattacharya U, Daouk H (2002) The world price of insider trading. J Finance 57:75–108

Botero JC, Djankov S, La Porta R, Lopez-De-Silanes F, Shleifer A (2004) The regulation of labor. Q J Econ 119:1339–1382

Botosan C, Plumlee M (2005) A re-examination of disclosure level and expected cost of equity capital. J Account Res 40:21–40

Bova F (2013) Labor union and management’s incentive to signal a negative outlook. Contemp Account Res 30:14–41

Bova F, Dou YW, Hope OK (2015) Employee ownership and firm disclosure. Contemp Account Res 32:639–673

Bushman R, Piotroski J, Smith A (2004) What determines corporate transparency? J Account Res 42:207–252

Cameron A, Miller D (2015) A practitioner’s guide to cluster-robust inference. J Hum Resour 50:317–372

Chen HJ, Kacperczyk M, Ortiz-Molina H (2011) Labor unions, operating flexibility, and the cost of equity. J Financ Quant Anal 46:25–58

Cheng L (2017) Organized labor and debt contracting: firm-level evidence from collective bargaining. Account Rev 92:57–85

Chu T, Haw IM, Lee B, Wu W (2014) Cost of equity capital, control divergence, and institutions: the international evidence. Rev Quant Finance Account 43:483–527

Chung R, Lee BH, Lee WJ, Sohn BC (2015) Do managers withhold good news from labor unions? Manag Sci 62:46–68

Claessens S, Djankov S, Lang LHP (2000) The separation of ownership and control in East Asian corporations. J Financ Econ 58:81–112

Claessens S, Djankov S, Fan JPH, Lang LHP (2002) Disentangling the incentive and entrenchment effects of large shareholdings. J Finance 57:2741–2771

Claus J, Thomas J (2001) Equity premia as low as three percent? Evidence from analysts’ earnings forecasts for domestic and international stock markets. J Finance 56:1629–1666

Easton P (2004) PE ratio, PEG ratio, and estimating the implied expected rate return on equity capital. Account Rev 79:73–95

Easton P, Monahan S (2005) An evaluation of accounting-based measures of expected returns. Account Rev 80:501–538

Easton P, Taylor G, Shroff P, Sougiannis T (2002) Using forecasts of earnings to simultaneously estimate growth and the rate of return on equity investment. J Account Res 40:657–676

Edmans A (2011) Does the stock market fully value intangibles? Employee satisfaction and equity prices. J Financ Econ 101:621–640

Errunza V, Miller D (2000) Market segmentation and the cost of capital in international equity markets. J Financ Quant Anal 35:511–600

Faccio M, Lang LHP (2002) The ultimate ownership of Western European corporations. J Financ Econ 65:365–395

Faleye O, Mehrotra V, Morck R (2006) When labor has a voice in corporate governance. J Financ Quant Anal 41:489–510

Fama EF, French KR (1998) Value versus growth: the international evidence. J Finance 53:1975–1999

Francis J, LaFond R, Olsson P, Schipper K (2004) Cost of equity and earnings attributes. Account Rev 79:967–1010

Garrett T (2003) Aggregated versus disaggregated data in regression analysis: implications for inference. Econ Lett 81:61–65

Gebhardt W, Lee C, Swaminathan B (2001) Toward an implied cost of capital. J Account Res 39:135–176

Ghaly M, Dang VA, Stathopoulos K (2015) Cash holdings and employee welfare. J Corp Finance 33:53–70

Gode D, Mohanram P (2003) Inferring the cost of equity using the Ohlson–Juettner model. Rev Acc Stud 8:399–431

Guedhami O, Mishra D (2009) Excess control, corporate governance and implied cost of equity: international evidence. Financ Rev 44:489–524

Hail L, Leuz C (2006) International differences in the cost of equity capital: do legal institutions and securities regulation matter? J Account Res 44:485–531

Hail L, Leuz C (2009) Cost of capital effects and changes in growth expectations around U.S. cross-listings. J Financ Econ 93:428–454

Haw IM, Hu B, Hwang LS, Wu W (2004) Ultimate ownership, income management, and legal and extra-legal institutions. J Account Res 42:423–462

Haw IM, Ho SSM, Li A (2011) Corporate governance and earnings management by classification shifting. Contemp Account Res 28:517–553

Haw IM, Hu B, Wu D, Zhang X (2018) Having a finger in the pie: labor power and corporate payout policy. Financ Manag 47:993–1027

Hefeker C, Neugart M (2010) Labor market regulation and the legal system. Int Rev Law Econ 30:218–225

Hilary G (2006) Organized labor and information asymmetry in the financial markets. Rev of Account Stud 11:525–548

Hope O (2003) Disclosure practices, enforcement of accounting standards and analysts’ forecast accuracy. J Account Res 41:235–273

Jirasakuldech B, Dudney DM, Zorn TS, Geppert JM (2011) Financial disclosure, investor protection and stock market behavior: an international comparison. Rev Quant Financ Acc 37:181–205

John K, Knyazeva A, Knyazeva D (2015) Employee rights and acquisitions. J Financ Econ 118:49–69

Kim JB, Shi H, Zhou J (2014) International financial reporting standards, institutional infrastructures, and implied cost of equity capital around the world. Rev Quant Financ Acc 42:469–507

La Porta R, Lopez-De-Silanes F, Shleifer A (1999) Corporate ownership around the world. J Finance 54:471–517

La Porta R, Lopez-De-Silanes F, Shleifer A (2006) What works in securities law? J Finance 61:1–32

Lee S, Shin GH (2018) Employment protection, financial uncertainty, and corporate investment in innovation. Working paper

Lemmon ML, Lins KV (2003) Ownership structure, corporate governance, and firm value: evidence from the East Asian financial crisis. J Finance 58:1445–1468

Leuz C, Nanda D, Wysocki PD (2003) Earnings management and investor protection: an international comparison. J Financ Econ 69:505–527

Lins KV (2003) Equity ownership and firm value in emerging markets. J Financ Quant Anal 38:159–184

Masulis RW, Wang C, Xie F (2018) Employee-manager alliances and shareholder returns from acquisitions. J Financ Quant Anal (Accepted). https://depts.washington.edu/jfqa/2018/11/13/employee-manager-alliances-and-shareholder-returns-from-acquisitions/

Merz M, Yashiv E (2007) Labor and the market value of the firm. Am Econ Rev 97:1419–1431

Mueller HM, Philippon T (2006) Concentrated ownership and labor relations. Working paper

Mueller HM, Philippon T (2011) Family firms and labor relations. Am Econ J Macroecon 3:218–245

Ohlson J, Juettner-Nauroth B (2005) Expected EPS and EPS growth as determinants of value. Rev Acc Stud 10:349–365

Pagano M, Volpin P (2005) Managers, workers, and corporate control. J Finance 60:841–868

Pontuch P (2011) Labor intensity and expected stock return. Working paper

Scott TW (1994) Incentives and disincentives for financial disclosure: voluntary disclosure of defined benefit pension plan information by Canadian firms. Account Rev 69:26–43

Serfling M (2016) Firing costs and capital structure decisions. J Finance 71:2239–2286

Shleifer A, Summers LH (1988) Breach of trust in hostile takeovers. In: Auerbach AJ (ed) Corporate takeovers: causes and consequences. University of Chicago Press, Chicago, pp 33–56

Shleifer A, Vishny RW (1997) A survey of corporate governance. J Finance 52:737–783

Simintzi E, Vig V, Volpin P (2015) Labor protection and leverage. Rev Financ Stud 28:561–591

Stavrou E, Kassinis G, Filotheou A (2007) Downsizing and stakeholder orientation among the Fortune 500: does family ownership matter? J Bus Ethics 72:149–162

Stulz RM (2005) The limits of financial globalization. J Finance 60:1595–1638

Subramanian K, Megginson W (2018) Employment protection laws and privatization. J Law Econ 61:97–123

Tirole J (2001) Corporate governance. Econometrica 69:1–35

Waxin T (2010) The impact of founding-family ownership on labor relations: evidence from French workplace-level data. Working paper

Acknowledgements

We greatly acknowledge the helpful comments and suggestions of Cheng-Few Lee (editor), anonymous reviewer, the participants at the 27th PBFEAM Conference and 25th Australasian Finance and Banking Conference, and the seminar participants at Hong Kong Baptist University and University of Macau.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Cost of equity models and estimation procedure

Appendix: Cost of equity models and estimation procedure

1.1 Cost of equity models

Below are the four cost of equity models used in this study. They are stated in the form of a pricing equation and include the model-specific assumptions.

Notation:

\(P_{t}\) = Price per share at date t

\(bv_{t}\) = Book value of equity per share at date t

\(bv_{t + \tau }\) = Expected book value of equity per share at date t + τ

\(dps_{t + \tau }\) = Expected dividend per share at date t + τ

\(eps_{t + \tau }\) = Expected earnings per share at date t + τ

\(g,g_{st} ,g_{lt}\) = Expected perpetual, short-term, and long-term growth rate, respectively

\(r_{CT} ,r_{GLS} ,r_{OJ} ,r_{PEG}\) = Implied cost of equity capital of Claus and Thomas (2001), Gebhardt et al. (2001), Ohlson and Juettner-Nauroth (2005) and Easton (2004), respectively

Claus and Thomas (2001)

This model is an abnormal earnings model. The pricing equation shows that the current stock price equals the current book value of equity plus the present value of future expected abnormal earnings. Future abnormal earnings are proxies for economic profits and are computed by deducting a charge of equity capital from expected earnings. The model assumes an explicit forecast period of 5 years (T = 5), hence uses a stream of five expected earnings per share forecasts. Beyond year 5, all of the future earnings are assumed to grow perpetually at g, which is proxied by the country-specific 1-year ahead realized annual inflation rate.

Gebhardt et al. (2001)

This model is an abnormal earnings model. The pricing equation shows that the current stock price equals the current book value of equity plus the present value of future expected abnormal earnings. It specifies a forecast period of 12 years (T = 12). It first forecasts earnings explicitly for 3 years and then forecasts implicitly by mean reverting the period t + 3 firm return on equity to the industry-specific median return on equity. The mean reversion attempts to capture the long-term erosion of abnormal earnings over time. It further assumes that any growth in earnings past year 12 is value neutral, hence all future abnormal earnings thereafter are assumed to be constant.

Ohlson and Juettner-Nauroth (2005)

This model relates share price to expected earnings per share 1-year ahead, the expected dividends per share 1-year ahead, the short-term growth and long-term growth in expected earnings, and the cost of equity capital. It assumes that the present value of dividends per share affects share price though the dividend policy is irrelevant. Following the approach of Gode and Mohanram (2003), gst is proxied by the average of the growth in expected earnings between period t + 1 and t + 2 and the explicit 5-year growth forecast. The model also assumes positive growth in expected earnings so as to generate a solution. glt mirrors the growth rate of the overall economy and is proxied by the country-specific 1-year ahead realized annual inflation rate.

Easton (2004)

This model emphasizes the role of short-term earnings forecasts in valuation. It assumes that price is determined by the abnormal earnings, which is the expected earnings per share 2-year ahead plus earnings from re-invested dividends per share 1-year ahead minus the expected earning per share 1-year ahead. In addition, the model assumes that abnormal earnings are constant over time and constrain positive growth in expected earnings, so as to obtain a solution.

1.2 Estimation procedures

The four models collectively require earnings forecasts of 3 years ahead \((eps_{t + 1} , { }eps_{t + 2} \;{\text{and}}\;eps_{t + 3} )\) and the expected 5-year earnings growth rate \((g_{5} )\). All of the estimates are mean analyst consensus forecasts. Together with stock price \((P_{t} )\), they are gathered from I/B/E/S using the native currency. To be included in the sample, an observation must have \(P_{t}\), \(eps_{t + 1}\), and \(eps_{t + 2}\) data and either \(eps_{t + 3}\) or \(g_{5}\). If \(eps_{t + 3}\) is missing, it is assumed to be the 2-year ahead earnings forecast growing at the 5-year earnings growth rate, that is, \(eps_{t + 3} = eps_{t + 2} \times (1 + g_{5} )\). Any earnings forecasts beyond year 3 are generalized in the same way. However, \(g_{5}\) can be proxied by computing a growth rate between the 2-year ahead and 3-year ahead earnings forecasts, that is, \(g_{5} = (eps_{t + 3} - eps_{t + 2} )/eps_{t + 2}\). All of the negative earnings forecasts and growth rates are eliminated.

The financial data in the models are matched with the price and earnings forecasts taken +10 months after the fiscal year end, following Hail and Leuz (2006), to ensure that all of the financial information are available to investors and can be impounded into the model at the time of cost of equity estimation.Footnote 24 The book value of equity per share \((bv_{t} )\) is computed as the total common equity divided by the number of common shares outstanding as of the fiscal year end, both of which are taken from Worldscope. Unlike I/B/E/S, Worldscope data applies the Euro retroactively; hence, the total common equity of the eight Euro-in countries can be extracted using the legacy currency throughout the sample period. Currency consistency is required in the cost of equity estimation as all of the price and analyst forecasts are either in the native currency or the legacy currency after the currency conversion.Footnote 25 For the expected book value of equity per share \((bv_{t + \tau } )\), clean surplus accounting is assumed, that is, \(bv_{t + \tau } = bv_{t + \tau - 1} + eps_{t + \tau } - dps_{t + \tau }\). The expected dividend per share \((dps_{t + \tau } )\) is computed as a constant percentage of the expected earnings per share, that is, \(dps_{t + \tau } = eps_{t + \tau } \times k_{t}\). Dividend payout ratio is obtained directly from Worldscope and kt is defined as the historic 3-year mean dividend payout ratio. If kt is missing or less than zero, it is replaced by the country-year median payout ratio.

Both g and glt represent the perpetual or long-term growth rate in expected earnings. They are proxied by the country-specific 1-year ahead realized annual inflation rate, which are gathered from Datastream or the Statistical Yearbook.Footnote 26 Any negative inflation rates are substituted by the country-median inflation rates over the entire sample period. The rationale is that deflation is not expected to persist in the long-run, consequently a substitution is necessary.

Except for the Ohlson and Juettner-Nauroth (2005) model, there is no closed form solution provided for the equity valuation models. Each cost of equity proxy is therefore determined by an iterative numerical approximation that identifies an annual firm-specific discount rate that equates Pt to the right side of the pricing equation. The iteration starts at zero and increments by 0.0001 and will discontinue either when the cost of equity proxy is accurate at two decimal places or when the proxy reaches a value of one. A maximum of one is set in the iteration procedure because any cost of equity estimate that is greater than 100% seems irrational. To serve as a check over the iteration process, an inputted price is computed by placing the proxy back to the pricing equation and any proxy that results in greater than 1% difference between Pt and the inputted price is eliminated.

Rights and permissions

About this article

Cite this article

Chu, T., Haw, IM., Ho, S.S.M. et al. Labor protection, ownership concentration, and cost of equity capital: international evidence. Rev Quant Finan Acc 54, 1351–1387 (2020). https://doi.org/10.1007/s11156-019-00828-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-019-00828-1