Abstract

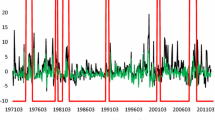

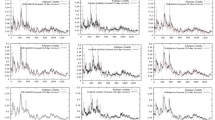

We report empirical evidence suggesting a strong and positive risk-return relation for the daily S&P 100 market index if the implied volatility index is included as an exogenous variable in the conditional variance equation. This result holds for alternative GARCH specifications and conditional distributions. Monte Carlo evidence suggests that if implied volatility is not included, whilst is should be, the risk-return relation is more likely to be negative or weak.

Similar content being viewed by others

Notes

Guo and Whitelaw (2006) found that omitting the ‘hedge component’ of stock returns from the estimation methodology of the risk-return relation causes a large downward bias in the estimate of relative risk aversion. These authors estimated the hedge component using a linear function of a vector of state variables including the dividend yield, the yield spread between Baa-rated and Aaa-rated bonds, and the yield spread between the 6-month commercial paper and the 3-month Treasury Bill rate. Using a GMM estimation approach and employing past realized volatility or implied volatility as instruments for conditional volatility, these authors found that incorporating the previously defined hedge component reveals a positive risk-return relation. The present study differs from Guo and Whitelaw (2006) in several ways. Firstly, we adopt a GARCH-in-Mean estimation framework, with the conditional variance being estimated on the basis of a GARCH-type specification and not being approximated using instruments. Secondly, in the present study, IVI is not used as an instrument variable for conditional variance but as an important variable for the specification of the conditional variance equation. Thirdly, we illustrate that it is the IVI, and not the hedge component, the important variable which is capable of revealing a positive risk-return relation.

The CBOE implied volatility index is also known as VIX. There exist an old VIX series (distributed under the new ticker VXO) which is highly correlated with the former VIX series (Banerjee et al. 2007).

Day and Lewis (1992, Tables 2 and 3, pages 277, 280).

References

Arora RK, Das H, Jain PK (2009) Stock returns and volatility: evidence from select emerging markets. Rev Pac Basin Financ Mark Pol 12:567–592

Baillie R, DeGennaro R (1990) Stock returns and volatility. J Financ Quant Anal 25:203–214

Banerjee P, Doran J, Peterson R (2007) Implied volatility and future portfolio returns. J Bank Financ 31:3183–3199

Bollerslev T, Wooldridge J (1992) Quasi maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econom Rev 11:143–172

Cai C, Faff R, Hillier D, McKenzie M (2006) Modelling returns and conditional volatility exposures in global stock markets. Rev Quant Financ Account 27:145–172

Cheng X, Smith D (2012) Disclosure versus recognition: the case of expensing stock options. Rev Quant Financ Account (forthcoming)

Day T, Lewis C (1992) Stock market volatility and the information content of stock index options. J Econom 52:267–287

Drew A, Marsden A, Veeraraghavan M (2007) Does idiosyncratic volatility matter? New Zealand evidence. Rev Pac Basin Financ Mark Pol 10:289–308

Elliott G, Rothenberg T, Stock J (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Glosten L, Jagannathan R, Runkle D (1993) On the relation between the expected value and volatility of the nominal excess return on stocks. J Financ 48:1779–1801

Goyal A, Santa-Clara P (2003) Idiosyncratic risk matters. J Financ 58:975–1007

Guo H, Neely C (2008) Investigating the intertemporal risk-return relation in international stock markets with the component GARCH model. Econ Lett 99:371–374

Guo H, Whitelaw R (2006) Uncovering the risk-return relation in the stock market. J Financ 62:1433–1463

Hamilton JD (1994) Time series analysis. Princeton University Press, Princeton

Hobbes G, Lam F, Loudon G (2007) Regime shifts in the stock-bond relation in Australia. Rev Pac Basin Financ Mark Pol 10:81–99

Kalev PS, Liu WM, Pham KP, Jarnecic E (2004) Public information arrival and volatility of intraday stock returns. J Bank Financ 28:1441–1467

Kanas A (2012) The risk-return relation and VIX: evidence from the S&P 500. Emp Ec (forthcoming)

Lamoureux CG, Lastrapes WD (1990) Heteroscedasticity in stock return data: volume versus GARCH effects. J Financ 45:221–229

Lettau M, Ludvigson S (2003) Measuring and modeling variation in the risk-return trade-off. Working Paper, New York University

Lundblad C (2007) The risk return tradeoff in the long run: 1836–2003. J Financ Econ 85:123–150

Nelson DB (1991) Conditional heteroscedasticity in asset returns: a new approach. Econometrica 59:349–370

Psychoyios D, Dotsis G, Markellos R (2010) A jump diffusion model for VIX volatility options and futures. Rev Quant Financ Account 35:245–269

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kanas, A. Uncovering a positive risk-return relation: the role of implied volatility index. Rev Quant Finan Acc 42, 159–170 (2014). https://doi.org/10.1007/s11156-012-0317-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-012-0317-9