Abstract

When the 1968 Merger Guidelines were drafted, both the economics and antitrust literatures addressed how competition could be softened when oligopolists anticipated the natural and predictable responses of their rivals to their competitive moves, such as price cuts or output expansion. But when economists developed new models of oligopoly behavior, and of coordinated effects in particular, the older ideas were dropped—until the 2010 Guidelines, when the older ideas were reincorporated along with the newer ones . Our article points out limitations of the workhorse repeated game model of oligopoly conduct for analyzing coordinated effects of mergers, and suggests ways to make that model more realistic . We also identify important research questions that are raised when attempting to account for oligopolists’ natural and predictable responses in evaluating the consequences of mergers, and suggest studying Stackelberg reactions as a way to make progress in doing so .

Similar content being viewed by others

Change history

19 March 2021

Table 1 and its announcement were incorrectly placed under “Conclusion” section. Table 2 and its announcement were placed separately under “Appendix: Mean-Matching Model” section. Now both the Table 1 and Table 2 are moved near their respective announcements under “Appendix: Mean-Matching Model” section.

Notes

The familiar static Bertrand and Cournot models assume zero conjectural variations in price and quantity, respectively. The pre-game theory generation of Industrial Organization economists were not as focused on static models with zero conjectural variations as Industrial Organization economists are today (e.g., Bain 1968). Schmalensee (2012, p. 172) criticizes this nearly exclusive focus.

To anticipate a distinction we make later, Turner was clearly not talking about firms that pick out a coordinated price and use price cuts to force rivals back to it.

In addition, the 1982 Guidelines introduced the Herfindahl–Hirschman Index (HHI) measure of concentration. The drafter of the Guidelines (Baxter 1983) and economic commentary on them (Ordover and Willig 1983) defended its use primarily with reference to the relationship between the HHI and the likelihood of effective collusion identified by Stigler (1964). While both also noted that that HHI could also be related to the industry profit margins in a static oligopoly model, the 1982 Guidelines did not discuss either the possibility of non-zero conjectural variation or what were later termed unilateral effects.

One of us (Baker) worked on the drafting of the 1992 Guidelines.

Theoretical research on conjectural variations did not stop with the game theory revolution in microeconomics. In particular researchers have proposed ways to pin down the degree of conjectural variation that is most consistent with various theoretical approaches: e.g., Bresnahan (1981), Daughety (1985), Dixon and Somma (2002), Dockner (1992), Friedman and Mazzetti (2002), Lindh (1992), Liu et al. (2007), Maskin and Tirole (1987), Perry (1982), Possajennikov (2015). Researchers have also analyzed various effects of conjectural variation on competition (e.g., Ordover et al. 1982, pp. 1869–71, analyze the consequences for the aggregate industry markup of a merger-related shift from zero conjectural variations to non-zero conjectural variations). But that literature has not yet generated a simple, defensible workhorse model comparable to the models that underlay the competitive effects analyses that were described in the 1992 and 2010 Horizontal Merger Guidelines.

See note 13 below.

One of us (Farrell) worked on the drafting of the 2010 Guidelines.

Moreover, widely used economic concepts and closely related antitrust law concepts—such as “coordination,” “agreement,” “tacit collusion,” “oligopoly interdependence” and “conscious parallelism”—do not have clear, established definitions in the industrial organization economics and antitrust policy literatures. For two efforts to define terms, especially “agreement,” see Baker (1996) and Kaplow (2013).

Schelling distinguishes “threats” from “warnings.” Both are communications that are aimed at shaping the responses of others. A warning describes what the speaker would do anyway. A threat communicates a commitment to do something that would otherwise not be in the speaker’s interest. We identify warnings with natural and predictable (non-purposive) responses and threats with credible commitments to a (purposive) punishment response.

We do not mean to suggest that courts look solely or even primarily to intent evidence to distinguish between purposive and non-purposive conduct. Rather, we are describing hypothetical states of mind as an aid to understanding.

Nor do we grapple with the challenge of classifying experimental or empirical examples of algorithmic coordination as purposive or non-purposive. In one prominent experimental study, supracompetitive prices emerged when firms set price through algorithms that used trial-and-error with machine learning to work out strategies, but did not otherwise communicate (Calvano et al. 2020). While the authors interpret their results through a purposive (repeated game) lens, the gradual transition they observe as the firms return to supracompetitive prices after they match an initial price cut induced exogenously differs from the highly non-linear transitions between states of play often stressed in studies of supergame models. On the other hand, our “Appendix” provides an example in which non-purposive coordination leads to gradual transitions.

To model coordination in the framework of purposive deterrence and threats, it is technically unnecessary to have firm 1′s price at time t interact in the market with firm 2′s price at time (t + 1). For instance, the two prices need not both be available to any specific customer. Consequently, if researchers happened to approach the problem from the perspective of purposive deterrence, or if they were seeking simple models of coordination without aiming to include all kinds, it would be a natural modeling simplification to suppose that each period is structurally independent of history— as the standard repeated game literature does in fact suppose. But, as Maskin and Tirole (1988) discuss, that modeling simplification eliminates any price commitment that can be naturally reacted to. It rules out—presumably inadvertently—the kinds of natural or Markov responses that are studied by Cyert-March, Maskin-Tirole, and here. See also Fudenberg and Tirole (1991, ch. 13).

If “coordination” is limited (by definition) to purposively collusive outcomes, as was the focus of the 1992 Guidelines, then all other oligopoly conduct—including parallel accommodating conduct—would be classified as unilateral (absent some third category). If so, the 2010 Guidelines, which we follow, would be understood as changing the way that parallel accommodating conduct is classified. In any event, the important point is not the classification rubric, but rather that the 2010 Guidelines highlight the significance of that form of oligopoly behavior and seek to ensure that it does not continue to fall through the cracks.

Moresi et al. (2015) propose an alternative interpretation of “parallel accommodating conduct” that treats it as purposive. In their model, price-matching is a mechanism by which firms identify and reach a consensus coordinated price, and deviation from that outcome is deterred by rapid detection and response.

By contrast, the 2010 Guidelines (§ 6.1) explicitly allow for quantification when discussing unilateral effects, observing that “the Agencies may construct economic models designed to quantify the unilateral price effects resulting from the merger.” The precision of models of unilateral effects—and the concomitant way that they make transparent the mechanism by which the merger harms competition—help explain why unilateral effects models have become more important in horizontal merger analysis over time. Baker (2003).

An “indefinite number of times” may well be finite but uncertain, as long as it is never common knowledge that (for a finite T*) the game will conclude within the next T* periods. For example, there may be a constant hazard rate of unexpected termination, which would go into \(\delta \). With ongoing market growth as well as time discounting, one might have \(\delta \ge 1\), but presumably not forever, and we follow most of the literature in ignoring this possibility here.

Other continuations that follow defection from the cooperative equilibrium path—and in particular the “optimal punishment” schemes—require incentive-compatibility constraints during the punishment phase as well as on the equilibrium path. For simplicity, and because it is the norm in antitrust economics, we focus on Nash reversion.

The cooperative actions need not achieve full shared monopoly. Empirically, even in explicit cartels they often do not, and in general stopping short of full shared monopoly can facilitate coordination by relaxing the incentive constraint (although it does not do so in the simple undifferentiated Bertrand case).

As far as we know this approach of working with reduced-form transition probabilities is new; but the intuitive lessons are well understood, and a more specialized model with explicit (cartel design) micro-foundations for those probabilities was analyzed by Green and Porter (1984), see also Abreu et al. (1991). Perhaps confusingly, these models (or equilibria) are intuitively Markov-like, in that transition probabilities between the states are stochastically governed by current state and current conduct in a way that does not depend on time or on previous history except, importantly, that the “state” itself summarizes a key aspect of the history of play. Maskin and Tirole (2001) discuss what should be regarded as Markov in such contexts.

Levenstein and Suslow (2006, pp. 75–79) find that in their sample of express cartels (including some that are legal), the colluding firms commonly develop organizational methods to detect and deter cheating but cartels commonly break down when some members wish to renegotiate the terms of the coordinated outcome following unexpected shocks to demand or other forms of instability in the economic environment, or from the inability of the cartel to deter or accommodate entry. These observations suggest that cartels can break down for reasons other than the simple choice to cheat that is featured in the standard model; this can be recognized within our framework if we assume p > 0.

Shapiro described this analysis in his trial testimony as an expert on behalf of the plaintiff states in New York v. Deutsche Telekom AG, 439 F.Supp.3d 179 (S.D.N.Y. 2020).

Not all firms need to “participate” in coordination for it to have substantial effects. Participation has real meaning in an explicit cartel. On the other hand, with a mechanism-design focus we can analytically treat all firms as participants if we are willing to say that some participants are not constrained.

A firm’s S, and hence its incentive compatibility constraint, depends on both its stake in the coordinated outcome (which determines the numerator of S) and its ability to expand inexpensively (which determines the denominator of S). Among other things, this means that a firm with a small share might not be a maverick if it is very costly for the firm to expand. On methods of identifying mavericks empirically, see Baker (2002, pp. 173–77).

Abreu, Milgrom, and Pearce (1991) separate the effects of changes in interest rate, speed of observation, and speed of response—all of which are conflated in \(\delta \).

If q = 0, a hazard rate for breakdown of cooperation—here p—can be incorporated into \(\delta \) in this way (one can mathematically normalize the Nash payoffs n to zero). With a nonzero q, it is less simple.

For example, once one firm cheats, its rivals may no longer trust it to cooperate in the future, which complicates renegotiation by making it necessary for the coordinating firms to develop different means of detecting and punishing deviation. Or suppose that in the coordinated arrangement, output shares are allocated in the same way as capacity shares: This is a possible focal rule for determining market shares among coordinating firms. Then firms would have an incentive to expand capacity in order to be awarded a higher market share. A maverick could place itself in a particularly strong bargaining position by doing so, as a higher capacity could threaten to tip its incentives.

from cooperation to cheating, and thus allow it to impose substantial costs on the other firms if they do not award it a higher market share. Under such circumstances, renegotiating firms—having learned about this difficulty—may need to work out a different way to allocate market shares. In the absence of express communication, that renegotiation may be more difficult than the initial negotiation.

In particular, it may be difficult for courts to quantify the determinants of T, particularly the discount factor.

We call them “Stackelberg” reactions because Stackelberg’s theory of oligopoly involves actual reactions of the type and magnitude studied here. Mathematically these are also sometimes called Nash best-response functions, but that phrase is confusing and potentially misleading because in the Nash analysis there are no responses. (The best- “response” functions are a mathematical tool to help calculate simultaneous-choice equilibria).

One analogy is with the economics/game theory of bargaining: That theory recognizes that at some point either party would genuinely choose to walk away. Actual disagreement payoffs are not the end of the analysis, however, because there is often an incentive to “pretend” that the walk-away point is closer than it actually is. That kind of exaggeration or shading doesn’t make the true walk-away point irrelevant. In technical terms, the virtual type is closely related to the true type. See, e.g., Fudenberg and Tirole (1991, p. 287). Another analogy, perhaps closer to home, is with the direct unilateral effects of a horizontal merger on the merging parties’ conduct. Direct effects will be modified in complex ways by interactions with (e.g.) non-merging rivals’ conduct; but direct effects nevertheless provides a sensible and more tractable way to evaluate unilateral incentives when analyzing mergers.

Another plausible possibility is that the oligopolist anticipates a simple behavioral response in the spirit of price-matching. See Anderson (1984) for analysis of quick-response full matching. We study a less extreme multi-firm behavioral model along those lines in our “Appendix”.

See Lemma 1 in Maskin and Tirole (1987). Moreover, the dynamic denominator is larger in absolute value than is the Stackelberg version—\({\pi }_{11}\left(p,q\right)\)—if and only if \(U(p)\) is (locally) concave in p, which is, therefore, the condition for the dynamic reaction to be weaker than the Stackelberg reaction; Maskin and Tirole show that this is the case in their example. While U is complex and highly endogenous, it is the present-value payoff for a first mover, so an intuition that a first mover’s present value payoff is concave in its choice of p would imply that U is concave for a later mover also. Maskin and Tirole also show that in their model as the discount factor converges toward 1 (coinciding with the limit of the Cyert-deGroot model as the number of periods grows) the tradeoff is not overwhelmed by the U″ term in the denominator (which would lead to near-zero dynamic responsiveness). In fact Maskin and Tirole calculate that the dynamic responsiveness is somewhat over half of the Stackelberg responsiveness.

In somewhat the same spirit, Farrell and Shapiro (2010b) respond to the criticism that UPP is not a full-blown merger simulation by pointing out that “a ball that is kicked harder might not travel further… but as a general matter hard-kicked balls tend to [do so].”.

A caveat is that we might yet get a big response even if the shift in firm 2′s residual demand is small, when firm 2′s profit function (as a function of its price \({p}_{2}\)) is very flat on top (i.e., if firm 2 is almost indifferent when setting its own price near the profit maximum). (This is the case where the denominator of (3.2) is small.) That in turn corresponds in this class of models to firm 2′s having substantial market power: In simple parameterizations firm 2′s profit function is unlikely to be very flat on top if its maximizing price is close to its marginal cost.

Maskin and Tirole (1988, p. 553).

With merger analysis and the structural presumption in mind, it would be useful to study whether and how Stackelberg reactions are related to market concentration. We have not studied the relationship between Stackelberg reactions and diversion ratios with logit demand, where diversion ratios are related to market shares.

Also observe that if all other firms set (or are expected to set) their prices at cost (= 0); or if d = 0 (in which case other firms’ prices are of no concern to firm i), firm i’s profit-maximizing price is 1. Accordingly we can think of p = 1 as a kind of price benchmark or floor, and decompose prices into 1 plus an increment that is zero at d = 0 (which here means that the increment is d times an expression).

The Nash assumption that each firm optimizes while taking others’ actions as given (when contemplating varying its own action) does not mean that any of the players’ actions is unaffected by changes in the game, including merger. The actions of a non-merging firm—whose payoffs are not directly affected by the merger—are typically affected by its expectations of how other firms (in particular the merging firms) will change their actions. Also potentially confusing is the technical use of “best response” or “reaction” functions to calculate Nash equilibria despite the fundamental Nash principle that each player takes others’ actions as given and there are no “responses” or “reactions”.

Given the demand system (4.1), the change in consumer surplus from any change in the price vector p = (p1, p2, p3) is equal to the change in a quadratic function s(p1, p2, p3) of the three prices:

$$ {\text{~}}s\left( {p_{1} ,p_{2} ,p_{3} } \right) \equiv \int {\int {\int_{0}^{p} {\mathop \sum \nolimits_{{i = 1,2,3}} - [x_{i} dp_{i} ] = \frac{{1 + d}}{2}\mathop \sum \nolimits_{i} p_{i}^{2} - 2\mathop \sum \nolimits_{i} p_{i} - \frac{d}{2}\left[ {\mathop \sum \nolimits_{i} p_{i} } \right]^{2} ~.} } } $$We call \(s({p}_{1},{p}_{2},{p}_{3})\) the consumer surplus function. (There is nothing canonical about starting the integration at zero prices rather than some other fixed benchmark—only differences in the consumer surplus function, \(\Delta s({p}_{1},{p}_{2},{p}_{3})\), not levels, count for our purposes—but it makes the notation a little easier. It does, however, imply that when all prices are positive, measured consumer surplus is negative.) In principle, we could calculate the change in \(s({p}_{1},{p}_{2},{p}_{3})\) that is due to each merger that is modeled. That would be an appropriate summary statistic for the consumer impact of a merger that affects different prices differently. We leave this topic for future research.

The simple linear-demand model with Stackelberg reactions in the text turns out (Eq. 4.2) to have partial matching.

We thank Berkeley undergraduate Angela Jing for running the calculations. After we developed and presented this model at the 2020 Berkeley-Stanford IOFest, a Stanford graduate student, Lulu Wang, calculated a continuous-time formulation.

We do not understand the factor 2 here, and it suggests a substantial effect even for large n. It might be tempting to attribute its presence to the fact that the merged firm captures the price increase on both of its products; but it also suffers the cumulative interim pricing disadvantage on both of its products.

References

Abreu, D. (1986). Extremal equilibria of oligopolistic supergames. Journal of Economic Theory, 39, 191–225.

Abreu, D., Milgrom, P., & Pearce, D. (1991). Information and timing in repeated partnerships. Econometrica, 59(6), 1713–1733.

Bain, J. S. (1968). Industrial organization (2nd ed.). New York: Wiley.

Baker, J. B. (1996). Identifying horizontal price fixing in the electronic marketplace. Antitrust Law Journal, 67, 41–55.

Baker, J. B. (2002). Mavericks, mergers, and exclusion: Proving coordinated competitive effects under the antitrust laws. New York University Law Review, 77, 135–203.

Baker, J. B. (2003). Why did the antitrust agencies embrace unilateral effects? George Mason University Law Review, 12, 31–38.

Baker, J.B. (2010). Market concentration in the antitrust analysis of horizontal mergers. In Keith Hylton (Ed.), Antitrust Law & Economics (pp. 234–60), corrected working paper available at http://ssrn.com/abstract=1092248.

Baker, J. B. and Farrell, J. (2020). Oligopoly coordination, economic analysis, and the prophylactic role of horizontal merger enforcement. University of Pennsylvania Law Review (forthcoming)

Baxter, W. F. (1983). Responding to the reaction: The draftsman’s view. California Law Review, 71, 618–631.

Bernheim, B. D., & Ray, D. (1989). Collective dynamic consistency in repeated games. Games and Economic Behavior, 1, 295–326.

Bresnahan, T. F. (1981). Duopoly models with consistent conjectures. American Economic Review, 71, 934–945.

Brown, Z., and MacKay, A. (2020), Competition in Pricing Algorithms, working paper, Harvard Business School.

Calvano, E., Calzolari, G., Denicolò, V., & Pastorello, S. (2020). Artificial intelligence, algorithmic pricing, and collusion. American Economic Review, 110, 3267–3297.

Chamberlin, E. H. (1962). The theory of monopolistic competition (8th ed.). Cambridge, Mass.: Harvard University Press.

Corts, K. S. (1999). Conduct parameters and the measurement of market power. Journal of Econometrics, 88, 227–250.

Cyert, R., & DeGroot, M. (1970). Multiperiod decision models with alternating choice as a solution to the duopoly problem. Quarterly Journal of Economics, 84(3), 410–429.

Dixon, H. D., & Somma, E. (2002). The evolution of consistent conjectures. Journal of Economic Behavior and Organization, 51, 523–536.

Daughety, A. F. (1985). Reconsidering cournot: The cournot equilibrium is consistent. RAND Journal of Economics, 16, 368–379.

Dockner, E. J. (1992). A dynamic theory of conjectural variations. Journal of Industrial Economics, 40, 377–395.

Farrell, J. and Maskin, E. (1989). Renegotiation in Repeated Games. Games and Economic Behavior 1

Farrell, J. and Shapiro, C. (2010a). Antitrust evaluation of horizontal mergers: an economic alternative to market definition. Berkeley Electronic Press.

Farrell, J. and Shapiro, C. (2010b). Upward pricing pressure and critical loss analysis: response. Competition Policy International Antitrust Journal.

Friedman, J. W., & Mazzetti, C. (2002). Bounded rationality, dynamic oligopoly, and conjectural variations. Journal of Economic Behavior & Organization, 49, 287–306.

Fudenberg, D., & Tirole, J. (1991). Game theory. London: MIT Press.

Genesove, D., & Mullin, W. P. (2001). Rules, communication, and collusion: Narrative evidence from the sugar institute case. American Economic Review, 91, 379–398.

Green, E. J., & Porter, R. H. (1984). Noncooperative Collusion Under Imperfect Price Competition. Econometrica, 52, 87–100.

Harrington, J. (2014). Evaluating mergers for coordinated effects and the role of “parallel accommodating conduct.” Antitrust Law Journal, 78, 651–668.

Kaplow, L. (2013). Competition policy and price fixing. Princeton: Princeton University Press.

Kühn, K. (2004). The coordinated effects of mergers in differentiated products markets. Law & Economics Working Papers Archive: 2003–2009, 34. Retrieved from http://repository.law.umich.edu/law_econ_archive/art34.

Levenstein, M. C., & Suslow, V. Y. (2006). What determines cartel success? Journal of Economic Literature, 44, 43–95.

Lindh, T. (1992). The inconsistency of consistent conjectures. Journal of Economic Behavior and Organization, 18, 69–80.

Liu, Y., Ni, Y. X., Wu, F. F., & Cai, B. (2007). Existence and uniqueness of consistent conjectural variation equilibrium in electricity markets. Electrical Power and Energy Systems, 29, 455–461.

Martin, S. (1993). Advanced industrial economics. Cambridge, MA: Blackwell Publishers.

Maskin, E., & Tirole, J. (1987). A theory of dynamic oligopoly III: Cournot competition. European Economic Review, 31, 947–968.

Maskin, E., & Tirole, J. (1988). A theory of dynamic oligopoly, I: Overview and quantity competition with large fixed costs. Econometrica, 56, 549–569.

Maskin, E., & Tirole, J. (2001). Markov Perfect Equilibrium. Journal of Economic Theory, 100, 191–219.

Moresi, S., Reitman, D., Salop, S. C., and Sarafidis, Y. (2015). cGUPPI: Scoring incentives to engage in parallel accommodating conduct. Georgetown Law Faculty Publications and Other Works No. 1501. Retrieved from https://scholarship.law.georgetown.edu/facpub/1501.

Office of Fair Trading (UK) (2011). Conjectural variations and competition policy: Theory and empirical techniques. Retrieved Dec 31, 2020 from https://web.archive.org/web/20120511101929/; http://oft.gov.uk/shared_oft/research/CV_Competition_Policy.pdf.

Ordover, J. A., & Willig, R. D. (1983). The 1982 Department of Justice merger guidelines: An economic assessment. California Law Review, 71(2), 535–574.

Ordover, J. A., Sykes, A. O., & Willig, R. D. (1982). Herfindahl concentration, rivalry, and mergers. Harvard Law Review, 95, 1857–1874.

Perry, M. K. (1982). Oligopoly and consistent conjectural variations. Bell Journal of Economics, 13, 197–205.

Porter, R. H. (1985). On the incidence and duration of price wars. Journal of Industrial Economics, 33, 415–426.

Porter, R. (2020) Mergers and coordinated effects. International Journal of Industrial Organization, forthcoming.

Possajennikov, A. (2015). Conjectural variations in aggregative games: An evolutionary perspective. Mathematical Social Sciences, 77, 55–61.

Schelling, T. (1960). The strategy of conflict. Cambridge, MA: Harvard University Press.

Schmalensee, R. (2012). “On a level with dentists?” Reflections on the evolution of industrial organization. Review of Industrial Organization, 41, 157–179.

Shapiro, C. (1989). Theories of oligopoly behavior. In R. Schmalensee & R. Willig (Eds.), Handbook of industrial organization (Vol. 1, pp. 329–414). Amsterdam: North-Holland.

Shapiro, Carl (1996). Mergers with differentiated products. Antitrust, Spring, 23–30.

Stigler, G. J. (1964). A theory of oligopoly. Journal of Political Economy, 72, 44–61.

Turner, D. F. (1962). The definition of agreement under the Sherman act: Conscious parallelism and refusals to deal. Harvard Law Review, 75, 655–706.

Willig, R. D. (1991). Merger analysis, industrial organization theory, and merger guidelines. Brookings Papers: Microeconomics, 1991, 281–332.

Acknowledgements

The authors are indebted to Joe Harrington, Louis Kaplow, Al Klevorick, Alex MacKay, Adrian Majumdar, Leslie Marx, Nate Miller, Robert Porter, Michael Salinger, Steve Salop, Richard Schmalensee, Carl Shapiro and Bobby Willig, and to participants in Berkeley-Stanford IOFest and the University of Cambridge-University of Florida Antitrust Virtual Workshop Series.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Mean-Matching Model

Appendix: Mean-Matching Model

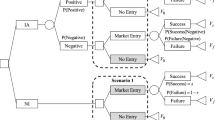

Here we describe a simple behavioral model of price dynamics in an oligopoly in which (exogenously) firms take turns having opportunities to adjust price, and at each such opportunity the firm whose turn it is sets its price to the mean of others’ prices. We first analyze the equilibrium of the model, then turn to the effects of mergers.

We do not claim that the behavioral rule that we study is optimal behavior; but it seems loosely and qualitatively to capture a part of how oligopolists may behaviorally respond to price changes by rivals (consistent with some reported evidence on available pricing algorithms—see Brown and MacKay 2020).Footnote 41

Given that behavioral dynamic, it is a steady state (or “equilibrium,” in a dynamic but not incentive-based sense) if all firms charge the same price: \({p}_{0}\). We consider moves away from such a steady state.

We first study the dynamics of convergence to a (new) steady state when an initiating firm moves its price away from an initial steady state, and reactions thereafter consist of each firm (including the initiator) in turn matching the mean price of all others.

While this is a non-optimizing “behavioral” model of dynamics, we are interested in the tradeoff that faces the initiating firm when it can lead the industry to a new and higher uniform steady-state price but during the readjustment or re-equilibration process is generally higher-priced than are its competitors. Equivalently (changing sign), we are concerned with the tradeoff when an initiating firm cuts its price and consequently is temporarily lower-priced than are its competitors during re-equilibration, but in the end the uniform market-wide price is lower than it had been. (Implicitly, therefore, we are considering prices below the monopoly price, so that it is more profitable for all to all have higher prices within this range.) We do not explicitly model the initiator’s preferences over that tradeoff, but instead consider how structure affects the available “terms of trade” that it faces.

Thus, consider an initial steady state in which all firms, \(1,\dots ,n\) price at \({p}_{0}\). Now on “day 1” firm 1 disrupts that initial steady state by changing its price to \({p}_{0}+\Delta \). On day 2, firm 2 gets the opportunity to re-set its price, and re-sets to the mean of its rivals’ prices (including firm 1′s): to the mean of \(({p}_{0}+\Delta ,{p}_{0},{p}_{0},\dots ,{p}_{0})\). Thus firm 2′s new price is \({p}_{0}+\frac{1}{n-1}\Delta \). On day 3, firm 3 adjusts its price to the mean of its rivals’ prices, which is \({p}_{0}+\left[\frac{1}{n-1}\left[1+\frac{1}{n-1}\right]\right]\Delta \). And so on.

Observing that everything takes the form \({p}_{0}+k\Delta \), we can simplify by taking \({p}_{0}=0\) and \(\Delta =1\), or to put it another way, by recording price departures from \({p}_{0}\) as fractions of the initiator’s initial departure from \({p}_{0}\). Then we can use numerical calculations to explore the price dynamics (Table 1).

Table 1 illustrates price dynamics for n = 3 for days 1 through 5, with those normalizations:

Following the one-time departure from price-matching, the maximum of the prices can only decrease, and the minimum can only increase. After 20 days (not shown here) the three prices are, to six decimal places, 0.666664, 0.666666, and 0.666668. We think it is reasonable to conclude that the prices are converging to 2/3.

We did corresponding numerical calculations for \(2\le n\le 10\) (and with more days for the larger values, so as to get credible near-convergence).Footnote 42 While we do not have algebraic results, the numerical results track closely the description that with \(n\) firms, prices numerically converge to a new steady state at price \(2/n\). Recalling our normalizations, we restate this as:

With \(n\) firms, if we start at a uniform steady-state price \({p}_{0}\) and one firm initiates a disequilibrium by increasing its price by \(\Delta \), prices re-converge to a new steady state at price \({p}_{0}+(2/n)\Delta. \)

If \(\Delta >0\), the higher uniform (steady state) price will normally be more profitable for each firm than the lower initial price if the higher price is not above the joint monopoly price. But what did the initiating firm 1 have to suffer in order to improve its own—and its rivals’—steady-state profits? It had to “lead” the price increase; and (while we do not model this explicitly) one might expect that it would lose customers to its rivals during that “leadership,” and wouldn’t necessarily get them back after prices converge. We consider this tradeoff here.

Assume that it is costly in terms of market share for a firm to have a higher price than the mean of its rivals’ prices, and that this cost aggregates linearly across days. Then a measure of that cost for the initiating firm 1 is the undiscounted sum of its “pricing disadvantage” relative to its rivals, day by day, until the sum converges. (We do not discount, for simplicity and also because one might expect these “days” to be short and, in the range we consider, not very many days are needed for effective convergence.) It is not immediate (even given that prices converge to each other and to a new steady state) that this open-ended sum also converges; but, again, our numerical calculations indicate that it does. Those calculations are (again, numerically rather precisely with a couple of dozen days when n is fairly small) consistent with the summary that with \(n\) firms, the initiator’s cumulative pricing disadvantage numerically converges to \([n-1]\). Recalling our normalizations, we restate this as:

With \(n\) firms, the initiator’s cumulative pricing disadvantage numerically converges to (\(n-1)\Delta \).

Since this cumulative pricing disadvantage is the sum over days of the intra-day pricing disadvantage, it is thus measured in [{dollars-per-widget} times days]. If we are comparing across different values of n, we are implicitly holding fixed the length (in terms of the hemorrhage of a higher-priced firm’s market share) of a “day” across that comparison. That might be appropriate; or, alternatively, it might make more sense to hold fixed the length of what we might call informally a “week”—the \(n\)- “day” period between any one firm’s (e.g., firm 1′s) successive opportunities to adjust its price. In that case, the cumulative pricing disadvantage would converge to (\(n-1)\Delta /n\) dollars-per-widget-weeks.

Because \(\Delta \) is a free choice variable, the absolute magnitude of the pricing disadvantage or of the change in steady-state price that is due to the initial departure of one firm’s price by \(\Delta \) is not meaningful in itself. What is economically meaningful is their ratio for a given \(\Delta \), which measures the “terms of trade” that face a firm that contemplates initiating a change. Given the results above, it follows that:

With \(n\) firms, the initiator of a price increase incurs a cumulative pricing disadvantage (using the measure with days) equal to \(n(n-1)/2\) times the steady-state price increase achieved.

Or, if we focus instead on price cuts (negative \(\Delta \)):

The initiator of a price cut reduces the steady-state price by \(2/[{\varvec{n}}\left({\varvec{n}}-1\right)]\) times the cumulative pricing advantage (in days) that it captures.

These ratios quantify how the terms of trade favor a price cut more (starting from any given uniform steady-state price) and favor a price increase less, the larger is n. If we measure the cumulative pricing disadvantage using weeks rather than days, the ratios tell the same qualitative story but less strongly: instead of \(n(n-1)/2,\) we have \((n-1)/2\), etc.

This suggests more competitive pricing in markets with a larger n, without having explicitly to model the specific impacts on profits. Because the tradeoff shifts uniformly with an increase in n, fewer potential initiators of price increases will find the tradeoff appealing, and more potential initiators of price cuts will do so. As the 2010 HMG put it:

[Reactions by rivals] “can blunt a firm’s incentive to offer customers better deals by undercutting the extent to which such a move would win business away from rivals. They can also enhance a firm’s incentive to raise prices, by assuaging the fear that such a move would lose customers to rivals.”

Next we consider the effect of a merger in this model. Suppose we begin with n symmetric single-product firms, and two of them (firms 1 and 2) merge, without changing the set of products offered. (This corresponds to the standard idea in merger analysis of considering a change in control of a given set of products.) We consider the merged firm as an initiator of a price increase. (We have not studied the consequences of merger when a non-merging firm is the potential initiator.)

We continue to assume that each non-merging firm in turn matches the average of others’ products, which is to say it matches a weighted average of rivals’ prices, so that the merged firm’s price (as it applies to two products) gets double weighting. We also assume that, in its turn, the merged firm adjusts both of its prices simultaneously to match the average price of the non-merging firms’ products (this is different from continuing the pre-merger product-by-product conduct of the merged products).

Then, illustrating with \(n=4\), we get (Table 2):

Again, based on carrying these numerical calculations to the point where convergence appears to have occurred, for n ranging up to 10, we find:

With n products, sold by \((n-1)\) firms, one of which is twice the size of each of the remaining firms, following a price increase of 1 that is initiated by the large firm, the steady-state price increases by \(4/(n+1)\) and the initiator’s cumulative pricing disadvantage is \({(n-1)}^{2}/(n+1)\) (measured using days). Thus, the ratio—the pricing disadvantage that is incurred per unit of steady-state price increase—is \({(n-1)}^{2}/4\).

Compare this ratio with the previously derived corresponding “pre-merger” ratio of pricing disadvantage to steady-state price increase with n independently controlled products, which was \(n(n-1)/2\). The pre-merger ratio is \(2n/(n-1)\) times the post-merger ratio.Footnote 43 Thus, the merger has created a firm that will be more tempted to increase price (from any particular level) and less tempted to cut price than were any of the pre-merger firms, especially for relatively concentrated industries (small n).

Rights and permissions

About this article

Cite this article

Farrell, J., Baker, J.B. Natural Oligopoly Responses, Repeated Games, and Coordinated Effects in Merger Analysis: A Perspective and Research Agenda. Rev Ind Organ 58, 103–141 (2021). https://doi.org/10.1007/s11151-020-09806-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-020-09806-7