Abstract

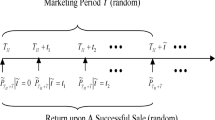

This paper studies three selling strategies of residential real estate: delegation to a broker, cheap talk with a broker and For Sale By Owner (FSBO). We find that if the state of the market is very uncertain and information of the market is scarce, the seller should hire a broker and delegate the decision right to the broker, even if the broker has no informational advantage. In this case, delegation may induce the broker to over-invest in information acquisition, i.e., more than what the seller would do in FSBO. If the market is certain and information is easily available, FSBO is optimal. Cheap talk, on the other hand, is never optimal, as much information is lost in the cheap-talk communication, weakening the broker’s incentive to acquire information.

Similar content being viewed by others

Notes

For any one-dimensional signal \(\tilde {s}\), we can always standardize it by taking an increasing transformation, \(F(\tilde {s})\), where F is the accumulative distribution function of \(\tilde {s}\). The standardized signal \(\tilde {z}\equiv F(\tilde {s})\) always follows a uniform distribution on [0, 1].

References

Alonso, R., & Matouschek, N. (2007). Relational delegation. The RAND Journal of Economics, 38, 1070–1089.

Alonso, R., & Matouschek, N. (2008). Optimal delegation. Review of Economic Studies, 75, 259–293.

Argenziano, R., Severinov, S., Squintani, F. (2016). Strategic information acquisition and transmission. American Economic Journal: Microeconomics, 8, 119–155.

Bernheim, B.D., & Meer, J. (2010). How much value do real estate brokers add? A case study. NBER working paper no 13796.

Colwell, P., & Yavas, A. (1995). A comparison of real estate marketing systems: theory and evidence. Journal of Real Estate Research, 10, 583–599.

Crawford, V.P., & Sobel, J. (1982). Strategic information transmission. Econometrica, 50, 1431–1451.

Dessein, W. (2002). Authority and communication in organizations. Review of Economic Studies, 69, 811–838.

Hendel, I., Nevo, A., Ortalo-Magne, F. (2009). The relative performance of real estate marketing platforms: MLS versus FSBOMadison.com. American Economic Review, 99, 1878–1898.

Holmstrom, B. (1984). On the theory of delegation. In Boyer, M., & Kihlstrom, R. (Eds.) Bayesian models in economic theory. New York.

Inderst, R., & Ottaviani, M. (2009). Misselling through brokers. American Economic Review, 99, 883–908.

Inderst, R., & Ottaviani, M. (2012). Competition through commissions and kickbacks. American Economic Review, 102(2), 780–809.

Krishna, V., & Morgan, J. (2004). The art of conversation: eliciting information from experts through multi-stage communication. Journal of Economic Theory, 117, 147–79.

Levitt, S., & Syverson, C. (2008). Market distortions when agents are better informed: the value of information in real estate transactions. Review of Economics and Statistics, 90(4), 599–611.

Li, Y., & Yavas, A. (2015). Residential Brokerage in hot and cold markets. Journal of Real Estate Finance and Economics, 51, 1–21.

Liu, P., & Xie, J. (2018). Optimal contract design in residential brokerage. Real Estate Economics.

Melamud, N., & Shibano, T. (1991). Communication in settings with no compensations. RAND journal of Economics, 22, 173–198.

Ottaviani, M. (2000). The economics of advice. Working Paper, London Business School.

Ottaviani, M., & Sorensen, P.N. (2006a). Professional advice. Journal of Economic Theory, 126, 120–142.

Ottaviani, M., & Sorensen, P.N. (2006b). Reputational cheap talk. The Rand Journal of Economics, 37, 155–175.

Radner, R., & Stiglitz, J. (1984). A nonconcavity in the value of information. In Boyer, M., & Kihlstrom, R. (Eds.) Bayesian models in economic theory. New York.

Rutherford, R.C., Springer, T.M., Yavas, A. (2005). Conflicts between principals and agents: evidence from residential brokerage. Journal of Financial Economics, 76, 627–665.

Szalay, D. (2005). The economics of extreme options and clear advice. Review of Economic Studies, 72, 1173–1198.

Xie, J. (2018). Who is “misleading” whom in real estate transactions? Real Estate Economics, 46(3), 527–558.

Yavas, A. (1992). A simple search and bargaining model of real estate market. Real Estate Economics, 20, 533–548.

Author information

Authors and Affiliations

Corresponding author

Appendix: Appendix: Proofs

Appendix: Appendix: Proofs

Proof of Lemma 1

where the last two equalities follows from Eq. 12. Then we have:

where the fourth equality follows from Eq. 34, and the fifth equality follows from Eq. 12. According to Eq. 15, we have:

From Eqs. 36 and 37, it is useful to compute the following:

Substituting (41) and (42) into (35), one gets:

From Eq. 43, we have:

In addition, we have:

Therefore, the broker’s welfare is:

where the third equality follows from Eqs. 43 and 44. This completes the proof. \(\ \Box \)

Proof of Lemma 2

From Eq. 17, it is obvious that \(U_{B}^{CT}(a)\) is continuous in a on each of the intervals (ai,ai+ 1) for all i, because n(a) is constant on (ai,ai+ 1). Then we are left to prove that \(U_{B}^{CT}(a)\) is continuous at a = ai for all i. That is, we need to prove that \(\lim _{a \rightarrow a_{i}^{-}}U_{B}^{CT}(a)=U_{B}^{CT}(a_{i})=\lim _{a\rightarrow a_{i}^{+}}U_{B}^{CT}(a)\), where \(a\rightarrow a_{i}^{-}\) means a approaches ai from below, and \(a\rightarrow a_{i}^{+}\) means a approaches ai from above. The first equality is obvious as \(\lim _{a\rightarrow a_{i}^{-}}n(a)=n(a_{i})\). The second equality is less apparent because \(\lim _{a\rightarrow a_{i}^{+}}n(a)=n(a_{i})+ 1=i + 1\). Nevertheless, according to Eq. 17 we have the following:

Note that

Substituting (47) into (46) gives \(\lim _{a \rightarrow a_{i}^{+}}U_{B}^{CT}(a)=U_{B}^{CT}(a_{i})\). This completes the proof. \(\ \Box \)

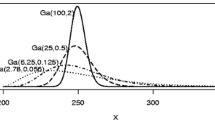

Proof of Proposition 1

If β ≥ 2b, then according to Eq. 14 (taking strict equality), n(a) ≥ 2 for all a > 0. From Eq. 17, we have \(\frac {\partial _{+} U_{B}^{CT}(a)}{\partial a}|_{a = 0}=M_{B}\frac {2\alpha \beta }{3}\left (1-\frac {1}{n(a)^{2}}\right )>0\). That is, a marginal increase of a at zero increases the broker’s expected utility, and therefore aCT must be positive. Since n(a) ≥ 2, there are multiple equilibria.

On the other hand, if β < 2b, then according to Eq. 14, n(a) = 1 and \(\frac {\partial U_{B}^{CT}(a)}{\partial a}=-2a<0\) for all \(a\leq \frac {2b-\beta }{\alpha }\). Then to prove that aCT = 0, it suffices to prove that \(\frac {\partial U_{B}^{CT}(a)}{\partial a}\leq 0\), \(\forall a\geq \frac {2b-\beta }{\alpha }\). We have:

where the inequality follows from the fact that n(a) ≥ 2 if \(a\geq \frac {2b-\beta }{\alpha }\). Therefore it suffices to prove that

One can readily check that (49) holds if and only if \(b\geq \frac {3\beta }{2(3-M_{B}\alpha ^{2})}\) and 3 − MBα2 > 0.

Since aCT = 0 and \(b >\frac {\beta }{2}\), then n(aCT) = 1 according to Eq. 14. Therefore, the only equilibrium is the “babbling” equilibrium where the seller completely ignores the broker’s advice. \(\ \Box \)

Proof of Proposition 2

If b ≤ β, then Case 2 is relevant for all values of a. Taking derivative of Eq. 21 in a at a = 0, we have:

That is, the broker benefits from a marginal increase of a from zero, and therefore aD > 0.

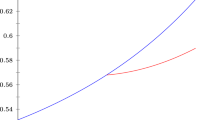

On the other hand, if \(b\geq \frac {\beta }{1-M_{B}\alpha ^{2}}>\beta \), then the model switches from Case 1 to Case 2 as a increases from 0 and exceeds \(\frac {b-\beta }{\alpha }\). In Case 1, the broker’s expected utility \({U_{B}^{D}}(a)\) is characterized by Eq. 19, while in Case 2, \({U_{B}^{D}}(a)\) is characterized by Eq. 21. Figure 8 shows \({U_{B}^{D}}(a)\) as a function of a. When a is small, i.e., \(a<\frac {b-\beta }{\alpha }\), \({U_{B}^{D}}(a)\) strictly decreases with a. Therefore to prove that \({U_{B}^{D}}(a)\) is maximized at a = 0, it suffices to prove that \({U_{B}^{D}}(a)\) in Case 2–as characterized in Eq. 21–is strictly concave in a and that \(\frac {\partial {U_{B}^{D}}(a)}{\partial a}\leq 0\) at \(a=\frac {b-\beta }{\alpha }\). Indeed, from Eq. 21 we have:

The second inequality in Eq. 51 follows from the condition that α2 < 3/MB. The inequality in Eq. 52 follows from the condition that \(b\geq \frac {\beta }{1-M_{B}\alpha ^{2}}\). Therefore, we have proven that aD = 0 in the equilibrium. And as shown in Fig. 8, the equilibrium is Case 1. \(\ \Box \)

Proof of Proposition 4

Proposition 4 can be proved by a sequence of lemmas as follows. \(\ \Box \)

Lemma 4

IfaCT > 0,aFSBO > aCT.

Lemma 5

IfaCT > 0,aD > aCT.

Lemma 6

IfaFSBO > 0 andaD > 0,thenaD < aFSBOifand only if\(\frac {3\beta }{3-2\alpha ^{2}}> b\left (\frac {2(1+r)}{1-r}\right )^{1/3}\).

Proof of Lemma 4

If aCT > 0, then

where the first equality follows from Eq. 27, the inequality follows from the fact that n(aCT) ≥ 1, and the second equality follows from Eq. 18. Since \(U_{S}^{FSBO}(a)\) is concave in a, Eq. 53 implies that aFSBO > aCT. \(\ \Box \)

Proof of Lemma 5

The proof takes two steps. In Step 1, we prove that if aCT > 0 then aD > 0. In Step 2, we prove that if aCT > 0 then aD > aCT.

-

Step 1.

We approve that if aD = 0 then aCT = 0 by contradiction. Assume aD = 0, then according to Proposition 2, b > β = αaD + β. Then according to Eq. 19, \({U_{B}^{D}}(0)=K_{B}-M_{B}(V(\tilde {\theta })+b^{2})\). Assume for contradiction that aCT > 0, then n(aCT) ≥ 2, or equivalently αaCT + β ≥ 2b according to Eq 14 (taking strict equality). Then we have:

$$\begin{array}{@{}rcl@{}} U_{B}^{CT}(a_{CT})&=&K_{B}-M_{B}\left[V(\tilde{\theta})-\frac{(\alpha a_{CT} + \beta)^{2}}{3}\left( 1-\frac{1}{n(a_{CT})^{2}}\right)\right.\\&&\quad\qquad\qquad\left.- \frac{b^{2}(1-n(a_{CT})^{2})}{3}+b^{2}\right] - a_{CT}^{2} \\ &&<K_{B}-M_{B}\left[V(\tilde{\theta})-\frac{(\alpha a_{CT} + \beta)^{2}}{3} + 2b^{2}\right]- a_{CT}^{2} \\ &&<K_{B}-M_{B}\left[V(\tilde{\theta})-\frac{(\alpha a_{CT} + \beta)^{2}}{3} + \frac{4b^{3}}{3(\alpha a_{CT} +\beta)}\right]- a_{CT}^{2} \\ &&={U_{B}^{D}}(a_{CT}) \leq {U_{B}^{D}}(a_{D}) = {U_{B}^{D}}(0) =U_{B}^{CT}(0), \end{array} $$where the first equality is Eq. 17, the first inequality follows from the fact n(aCT) ≥ 2 if aCT > 0, the second inequality follows from the fact that αaCT + β ≥ 2b if aCT > 0, the second equality is Eq. 21 since αaCT + β ≥ 2b > b, the third inequality follows from the fact that \({U_{B}^{D}}\) is maximized at a = aD, the third equality follows from the condition that aD = 0, and the last equality follows from the fact that \({U_{B}^{D}}(0)=U_{B}^{CT}(0)=K_{B}-M_{B}\left (V(\tilde {\theta }) + b^{2}\right )\). We thus arrive at a contradiction with the assumption that aCT > 0. Therefore, it must be true that aCT = 0.

-

Step 2.

If aCT > 0, then from Step 1 above we know that aD > 0. Therefore, \(U_{B}^{CT}\) and \({U_{B}^{D}}\) are characterized by Eqs. 17 and 21 respectively. Taking derivative of Eqs. 17 and 21 in a respectively, we have:

$$\begin{array}{@{}rcl@{}} \frac{\partial U_{B}^{CT}(a)}{\partial a} & =&M_{B}\left[\frac{2\alpha(\alpha a +\beta)}{3}\left( 1-\frac{1}{n^{2}}\right)\right]-2 a \\ &&< M_{B}\left[\frac{2\alpha(\alpha a +\beta)}{3} + \frac{4\alpha b^{3}}{3(\alpha a + \beta)^{2}}\right]\\&&-2 a = \frac{\partial {U_{B}^{D}}(a)}{\partial a}, \quad \forall a \text{ and } n. \end{array} $$(54)Since both \(U_{B}^{CT}(a)\) and \({U_{B}^{D}}(a)\) are concave in a, it must be true that aCT < aD.

\(\ \Box \)

Proof of Lemma 6

Since \({U_{B}^{D}}(a) \) is concave in a, aD < aFSBO if and only if:

where the equality follows from Lemma 3 and (21), and aFSBO is characterized by Eq. 28. Substituting (28) into (55) and rearranging, one gets that aD < aFSBO if and only if \(\frac {3\beta }{3-2\alpha ^{2}}> b\left (\frac {2(1+r)}{1-r}\right )^{1/3}\). This completes the proof. \(\ \Box \)

Proof of Proposition 5

We prove \({U_{S}^{D}}\geq U_{S}^{CT}\) for two cases: (i) aCT = 0 and (ii) aCT > 0.

-

(i)

If aCT = 0, then according to Proposition (1), \(b>\frac {\beta }{2}\). Then Eq. 14 implies that n(aCT) = 1 and Eq. 16 implies that \(U_{S}^{CT}(a_{CT})=K_{S}-M_{S} V(\tilde {\theta })\). On one hand, if b ≥ αaD + β, then Eq. 20 implies that \({U_{S}^{D}}(a_{D})=K_{S}-M_{S} V(\tilde {\theta })=U_{S}^{CT}(a_{CT})\). If, on the other hand, b < αaD + β, i.e., \(a_{D}>\frac {b-\beta }{\alpha }\), then \({U_{S}^{D}}(a_{D})\) follows (22). Equation 22 implies that:

$$ \frac{\partial {U_{S}^{D}}(a)}{\partial a}=M_{S}\left( \frac{2\alpha(\alpha a+\beta)}{3} - \frac{2\alpha b^{3}}{3(\alpha a+\beta)^{2}}\right)>0, \quad \forall \alpha a+\beta> b. $$That is, \({U_{S}^{D}}(a)\) increases in a for all \(a > \frac {b-\beta }{\alpha }\). Then we have:

$$ {U_{S}^{D}}(a_{D})> {U_{S}^{D}}\left( \frac{b-\beta}{\alpha}\right)=K_{S}-M_{S} V(\tilde{\theta})=U_{S}^{CT}(a_{CT}), $$(56)where the first inequality follows from the condition that \(a_{D}> \frac {b-\beta }{\alpha }\), the first equality follows from substituting \(a=\frac {b-\beta }{\alpha }\) into Eq. 22.

-

(ii)

If aCT > 0, we must have n(aCT) ≥ 2 because otherwise the “babbling” equilibrium is the only equilibrium, and aCT > 0 can not be a solution. In addition, according to Proposition 4, aD > aCT > 0. Then we have:

$$\begin{array}{@{}rcl@{}} U_{S}^{CT}(a_{CT})&=&K_{S}-M_{S}\left( V(\tilde{\theta})-\frac{(\alpha a_{CT} + \beta)^{2}}{3}\left( 1-\frac{1}{n(a_{CT})^{2}}\right)- \frac{b^{2}(1-n(a_{CT})^{2})}{3}\right) \\ &&< K_{S}-M_{S}\left( V(\tilde{\theta})-\frac{(\alpha a_{CT} +\beta)^{2}}{3} + b^{2}\right) \\ &&< K_{S}-M_{S}\left( V(\tilde{\theta})-\frac{(\alpha a_{CT} +\beta)^{2}}{3} + b^{2} - \frac{2b^{3}}{3(\alpha a_{D}+\beta)} \right) \\ &&< K_{S}-M_{S}\left( V(\tilde{\theta})- \frac{(\alpha a_{D} +\beta)^{2}}{3} + b^{2} - \frac{2b^{3}}{3(\alpha a_{D}+\beta)} \right) \\ &&={U_{S}^{D}}(a_{D}), \end{array} $$(57)where the first equality is Eq. 16, the first inequality follows from the fact that \(2\leq n_{CT}<\infty \), the second inequality follows from the fact that \(\frac {2b^{3}}{3(\alpha a_{D}+\beta )}>0\), the third inequality follows from the result that aD > aCT, and the last equality is Eq. 22.

\(\ \Box \)

Proof of Proposition 6

From Eq. 22, we have:

Formula (59) suggests that \({U_{S}^{D}}(a)\) is convex in a. And Eq. 58 implies that \(\frac {\partial {U_{S}^{D}}(a)}{\partial a}= 0\) at ab, where ab is defined as such that αab + β = b. That is, \({U_{S}^{D}}(a)\) reaches its minimum at ab. From Lemma 3, we know that aD > ab. Figure 9 demonstrates \({U_{S}^{D}}(a)\) as a function of a. The rest of the proof is composed of two parts.

If Eq. 32 holds true, then we have:

From Eq. 28, we also have:

where the first equality follows from Eq. 28, the first inequality follows from the fact that \(0<\left (\frac {1-r}{2(1+r)}\right )^{1/3}<1\) and the last inequality follows from Eq. 31.

Condition (61) implies that:

From Eqs. 60, 62 and 63, we have:

Adding \((2-r)\left (V(\tilde {\theta })-\frac {(\alpha a_{FSBO}+\beta )^{2}}{3}\right )\) to both sides of Eq. 64, one gets:

Then we have:

where the first equality follows from Eq. 22, the first inequality follows from the result that aFSBO > aD (due to Eq. 31) and \({U_{S}^{D}}(a)\) is convex in a (Fig. 9), the second equality follows from Eq. 22, the second inequality follows from the fact that \(K_{S}=(1-r)\left (\bar {P}-\frac {\hat {b}^{2}}{2-r}\right )<\bar {P}-\frac {\hat {b}^{2}}{2}\) and MS = 2 − r, the third inequality follows from Eq. 65.

-

Part 2.

Prove that \({U_{S}^{D}}>U_{S}^{FSBO}\)if Eq. 33holds.

where the first equality follows from Eq. 22, the first inequality follows from the fact that aD > ab and \({U_{S}^{D}}(a)\) is minimized at a = ab (Fig. 9), the second equality follows from Eq. 22, the third equality follows from the definition of ab, i.e., αab + β = b, the fourth equality follows from substituting in Eqs. 4 and 5, the last second equality follows from Eq. 33, and the last equality follows from Eq. 29. \(\ \Box \)

Rights and permissions

About this article

Cite this article

Xie, J. The Optimal Selling Strategy of Residential Real Estate. J Real Estate Finan Econ 59, 461–489 (2019). https://doi.org/10.1007/s11146-018-9689-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-018-9689-5