Abstract

This paper establishes a dynamic stochastic partial equilibrium model for explaining residential investment dynamics in the United States, focusing on the distinctive cyclical features of residential investment in that it leads the whole economy. This paper is different from the existing literature by adding three new features to the model: news shocks, collateral constraints and agent heterogeneity. The partial equilibrium analysis where interest rates are exogenously fixed shows that these assumptions are essential to generating the dynamic pattern in which residential investment leads consumption and GDP.

Similar content being viewed by others

Notes

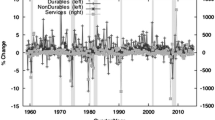

In Leamer (2007), household investment includes residential investment and consumer durables. The data from National Income and Product Accounts (NIPA) shows that residential investment not only leads gross domestic product more but also has higher volatility than consumer durables.

The data on the mortgage rate is taken from International Monetary Fund (2002). The data on the credit card rate is taken from Gross and Souleles (2002).

The education loans constitute about 50 % of the unsecured loans. These statistics are taken from Aizcorbe et al. (2003) computing these numbers with the data of Survey of Consumer Finance (SCF, 2001).

It is the service flow of the housing capital that contributes to personal utility. However, given the two assumptions of Cob-Douglas home production and CES utility function, we can transform the utility function into the form specified in utility function. For example, suppose that the utility function satisfies

$$ \mathcal{U}(c,c_h)=(1-\kappa_h^\prime)\ln c+\kappa_h^\prime\ln c_h, $$where c h is the service flow from the housing capital. Assume that the household production function satisfies Cob-Douglas form:\(c_h=h^{\alpha_h}\). Then by putting this home production function back into the above equation, we can obtain the CES utility function specified by Eq. 1.

The value of the capital tax rate is taken from Gomme and Rupert (2007).

0 is the unconditional mean of z in this paper.

References

Aiyagari, S.R. (1994). Uninsured idiosyncratic risk and aggregate saving. Quarterly Journal of Economics, 109, 659–684.

Aizcorbe, A.M., et al. (2003). Recent changes in U.S. family finances: Evidence from the 1998 and 2001 survey of consumer finances. Federal Reserve Bulletin.

Beaudry, P., & Lucke, B. (2009). Letting different views about business cycles compete. NBER Working Papers 14950.

Beaudry, P., & Portier, F. (2004). An exploration into pigou’s theory of cycles. Journal of Monetary Economics, 51, 1183–1216.

Beaudry, P., & Portier, F. (2006). Stock prices, news and economic uctuations. American Economic Review, 96, 1293–1307.

Beaudry, P., & Portier, F. (2007). When can changes in expectations cause business cycle uctuations in neo-classical settings? Journal of Economic Theory, 135, 458–477.

Benhabib, J., et al. (1991). Homework in macroeconomics: household production and aggregate fluctuations. Journal of Political Economy, 99, 1166–1187.

Bertaut, C., & Starr, M. (2000). Household portfolios in the United States. Finance and Economics Discussion Series 2000-26.

Black, J., et al. (1996). House price, the supply of collateral and the enterprise economy. Economic Journal, 106, 60–75.

Cagetti, M., & Nardi, M.D. (2006). Entrepreneurship, frictions, and wealth. Journal of Political Economy, 114, 835–870.

Campbell, J.Y., & Cocco, J.F. (2007). How do house prices affect consumption? Evidence from micro data. Journal of Monetary Economics, 54, 591—621.

Case, K.E., et al. (2005). Comparing wealth effects: the stock market versus the housing market. The B.E. Journal of Macroeconomics, 5, 1–34.

Cocco, J.F. (2005). Consumption and portfolio choice over the life cycle. Review of Financial Studies, 18, 491–533.

Cochrane, J.H. (1994). Shocks. Carnegie-Rochester Conference Series on Public Policy, 41, 295–364.

Davis, M.A., & Heathcote, J. (2005). Housing and the business cycle. International Economic Review, 46, 751–784.

Fisher, J.D. (2007). Why does household investment lead business investment over the business cycle? Journal of Political Economy, 115, 141–168.

Fisher, J.D., & Gervais, M. (2007). First-time home buyers and residential investment volatility. Working Paper Series WP-07-15.

Gomme, P., et al. (2001). Home production meets time-to-build. Journal of Political Economy, 109, 1115–1131.

Gomme, P., & Rupert, P. (2007). Theory, measurement and calibration of macroeconomic models. Journal of Monetary Economics, 54, 460–497.

Green, R.K. (1997). Follow the leader: how changes in residential and non-residential investment predict changes in GDP. Real Estate Economics, 25, 253–270.

Greenwood, J., & Hercowitz, Z. (1991). The allocation of capital and time over the business cycle. Journal of Political Economy, 99, 1188–1214.

Gross, D.B., & Souleles, N.S. (2002). Do liquidity constraints and interest rates matter for consumer behavior? Evidence from credit card data. Quarterly Journal of Economics, 117, 149–185.

Hercowitz, Z., & Campbell, J.C. (2005). The role of collateralized household debt in macroeconomic stabilization. Technical Report.

Iacoviello, M. (2005). House prices, borrowing constraints, and monetary policy in the business cycle. American Economic Review, 95, 739–764.

Jaimovich, N., & Rebelo, S. (2009). Can news about the future drive the business cycle? American Economic Review, 99, 1097–1118.

Khan, H., & Tsoukalas, J. (2009). The quantitative importance of news shocks in estimated DSGE models. Carleton Economic Papers. Carleton University, Department of Economics.

Kiyotaki, N., et al. (2007). Winners and losers in housing markets. CDMA Conference Paper Series. Centre for Dynamic Macroeconomic Analysis.

Leamer, E.E. (2007). Housing is the business cycle. NBER Working Papers 13428.

Li, W., & Yao, R. (2007). The life-cycle effects of house price changes. Journal of Money, Credit and Banking, 39, 1375–1409.

Pigou, A. (1927). Industrial fluctuations. London: Macmillan.

Schmitt-Grohe, S., & Uribe, M. (2008). What’s news in business cycles. NBER Working Papers 14215.

Silos, P. (2007). Housing, portfolio choice and the macroeconomy. Journal of Economic Dynamics and Control, 31, 2774–2801.

Tauchen, G. (1986). Finite state markov-chain approximations to univariate and vector autoregressions. Economics Letters, 20, 177–181.

Yao, R., & Zhang, H.H. (2005). Optimal consumption and portfolio choices with risky housing and borrowing constraints. Review of Financial Studies, 18, 197–239.

Acknowledgements

Ren’s research is partially supported by the Natural Science Foundation of Fujian Province of China (No. 2011J01384) and the Natural Science Foundation of China (# 71131008 and # 70971113). Yuan’s reserach is supported by the Natural Science Foundation of China (# 71203189). We are particularly indebted to Paul Klein, Karen Kopecky and John Whalley for their comments. We are also grateful to Jim MacGee, Elizabeth Caucutt, Hiroyuki Kasahara, James Davies, John Tsoukalas, Yi Wen , Xiaodong Zhu and Ying Shang.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

A. Data

This section describes all the data used in this paper.

-

1.

Gross domestic product, BEA, NIPA table 1.1.5, line 1

-

2.

Personal consumption expenditures, BEA, NIPA table 1.1.5, line 2

-

3.

Gross private domestic investment, BEA, NIPA table 1.1.5, line 7

-

4.

Government consumption expenditure and gross investment, BEA, NIPA table 1.1.5, line 21

-

5.

Residential investment, BEA, NIPA table 1.1.5, line 21, line 12

-

6.

Imputed rentals of self-owned houses, BEA, NIPA table 2.5.5, line 21

-

7.

Consumer price index, BEA, NIPA table 1.1.4, line 2

-

8.

Aggregate house values, BEA, NIPA table 2.1, line 60

-

9.

Mortgage rates, contract interest rates on commitments for fixed-rate first mortgages (30 years), Board of Governors of the Federal Reserve System

-

10.

Nominal output = 1 − 3 + 5 − 4 − 6. The output consists of the consumption and the residential investment but not business investment. Because the model we use is an endowment economy, we do not consider the business investment. Hence, we exclude the business investment from the subjects of research and similarly government expenditures.

-

11.

Nominal consumption = 2–6. The consumption is composed of non-durable goods, durable goods and services. To be consistent with the model, we subtract the imputed rentals of self-owned houses from the consumption.

-

12.

The ratio of residential investment to personal consumption expenditure = the mean of 5/11

-

13.

The ratio of residential investment to the aggregate house values = the mean of 5/8

-

14.

The ratio of aggregate house values to nominal output = the mean of 8/10

-

15.

Real output = 10/7

-

16.

Real consumption expenditure = 11/7

-

17.

Real residential investment = 5/7

All the real data are detrended with the Hodrick–Prescott filter.

B. Discretizing Two-Dimensional AR(1) Process

We extend the application of the method proposed by Tauchen (1986) from one-dimensional AR(1) process into the following two-dimensional AR(1) process defined by the following

where z is the current productivity, s is the current signal and z ′ denotes the next-period productivity. The disturbances (ν,η) are i.i.d processes and satisfy the following conditions:

where Π is defined by:

Following Tauchen (1986), we assume the members of \(\mathcal{Z}\) evenly-spaced and denoted as \(\mathcal{Z}=\{z_1,z_2,\dots,z_{n-1},z_n\}\) which satisfies

The upper and the lower bounds on the range, z 1 and z n , respectively, are set to m unconditional standard deviations on each side of 0.Footnote 6 Therefore, z 1 and z n satisfy the following

and

We also assume the signals \(s\in\mathcal{S}=\mathcal{Z}\). If we define the state composed of the current productivity and the signal, i.e. (z,s), the probability transition matrix is determined as follows.

Let ω = z i − z i − 1 (i > 1). Given (z,s), the probability of z ′ satisfies the following.

If 1 < i < n,

If i = 1,

If i = n,

where Φ(·) denotes the cumulated distribution function of standard normal distribution. Also, we know that given z ′, the probability of s ′ satisfies the following:

If 1 < j < n,

If j = 1,

If j = n,

Then the transition probability is defined by

C. Parameters of Income Process

This appendix displays the parameters of the processes of the individual income. The set of states for the individual income process (normalized to 1) is given by

And the transition matrix Ω is given by

Rights and permissions

About this article

Cite this article

Ren, Y., Yuan, Y. Why the Housing Sector Leads the Whole Economy: The Importance of Collateral Constraints and News Shocks. J Real Estate Finan Econ 48, 323–341 (2014). https://doi.org/10.1007/s11146-012-9389-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-012-9389-5