Abstract

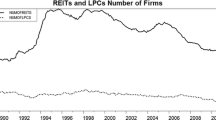

REITs are attractive to investors due to their unique characteristics such as high dividend yields, low correlation with common stocks, and a potential hedge against inflation. Thus the market demand curve of REIT equities may not be horizontal. This paper examines the shape of the market demand curve for REIT equities by employing REIT equity capital flows as a proxy for REIT aggregate demand. Our results do not support a downward demand curve for REIT equities. That is, we do not find evidence for the price-pressure effect in REIT returns. Instead, we find it is REIT returns that affect REIT equity capital flows rather than REIT equity flows that affect REIT returns. The results are consistent when we allow for the presence of market fundamental variables in our analysis. In addition, a variance decomposition analysis suggests that REIT equity capital flows do not cause revisions in expected cash flows (dividends) that are strong enough to impact REIT returns. Thus our findings are consistent with implications that the market demand curve for REIT equities is horizontal.

Similar content being viewed by others

References

Beneish, M. D., & Whaley, R. E. (1996). An anatomy of the S&P game: The effects of the changing the rules. Journal of Finance, 51, 1909–1930.

Campbell, J. Y. (1991). A variance decomposition for stock returns. Economic Journal, 101, 157–179.

Campbell, J. Y., & Shiller, R. J. (1988). The dividend–price ratio and expectations of future dividends and discount factors. Review of Financial Studies, 1, 195–228.

Cha, H. J., & Lee, B. S. (2001). The market demand curve for common stocks: Evidence from equity mutual fund flow. Journal of Financial and Quantitative Analysis, 36, 195–220.

Chan, K. C., Hendershott, P. H., & Sanders, A. B. (1990). Risk and return on real estate: Evidence from equity REITs. American Real Estate and Urban Economics Association Journal, 18, 431–452.

Chandrashekaran, V. (1999). Time-series properties and diversification benefits of REIT returns. Journal of Real Estate Research, 17, 91–112.

Forest, A. (1994). Now, dividend hunters are stalking REITS. Business Week, (June 6), 120–121.

Geltner, & Rodriquez (1997). Public and private real estate: Performance implications for asset allocation. In R. Garrigan & J. Parsons (Eds.), Real estate investment trusts (pp. 371–409). New York: McGraw Hill.

Glascock, J. L., Lu, C., & So, R. (2002). REIT returns and inflation: Perverse or reverse causality effects? Journal of Real Estate Finance and Economics, 24, 301–317.

Glascock, J. L., Michayluk, D., & Neuhauser, K. (2004). The riskiness of REITs surrounding the October 1997 Stock Market decline. Journal of Real Estate Finance and Economics, 28, 339–354.

Goetzmann, W. N., & Ibbotson, R. G. (1990). The performance of real estate as an asset class. Journal of Applied Corporate Finance, 3, 65–76.

Grupe, M. R., & DiRocco, C. J. (1999). The NARTEIT index of REIT industry performance. Real Estate Finance, 16, 21–50.

Harris, L., & Gurel, E. (1986). Price and volume effects associated with changes in the S& 500 list: New evidence for the existence of price pressures. Journal of Finance, 41, 815–829.

Howe, J., & Shilling, J. D. (1990). REIT advisor performance. American Real Estate and Urban Economics Association Journal, 18, 479–500.

Jain, P. C. (1987). The effect on stock price of inclusion in or exclusion from the S& 500. Financial Analysts Journal, 43, 58–65.

Ling, D., & Naranjo, A. (2003). The dynamics of REIT capital flows and returns. Real Estate Economics, 31, 405–434.

Ling, D., & Naranjo, A. (2004). Dedicated REIT mutual fund flows and REIT performance, Working paper.

Lynch, A. W., & Mendenhall, R. (1997). New evidence on stock price effects associated with changes in the S& 500 Index. Journal of Business, 70, 351–383.

Mikkelson, W. H., & Partch, M. M. (1985). Stock price effects and costs of secondary distributions. Journal of Financial Economics, 14, 165–194.

Sanders, A. (1998). The historical behavior of REIT returns. In R. Garrigan, & J. Parsons (Eds.), Real estate investment trusts (pp. 227–305). New York: McGraw Hill.

Sanger, G., & Peterson, J. (1990). An empirical analysis of common stock delistings. Journal of Financial and Quantitative Analysis, 25, 261–272.

Scholes, M. S. (1972). The market for securities: Substitution versus price pressure and the effects of information on share prices. Journal of Business, 45, 179–211.

Shleifer, A. (1986). Do demand curves for stocks slope down? Journal of Finance, 41, 579–590.

Vinocur, B. (2002). Taking stock. Realty Stock Review, 33, 9.

Warther, V. A. (1995). Aggregate mutual fund flows and market returns. Journal of Financial Economics, 39, 209–235.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lin, C.Y., Yung, K. Equity Capital Flows and Demand for REITs. J Real Estate Finan Econ 33, 275–291 (2006). https://doi.org/10.1007/s11146-006-9986-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-006-9986-2