In the context of improved disclosure and greater transparency, including cash flow in our earnings release has helped increase investor confidence in our guidance as well as in the analyst’s estimates by giving them the tools they need to do their jobs.

Jim Clippard, Vice President of Investor Relations, FedEx.

From Randerson (2004, p. 50).

Abstract

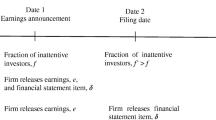

We test for the effect of limited attention on the valuation of accruals by comparing the immediate and long-term market reactions to earnings announcements between a subsample of firms that disclose only the balance sheet with a subsample of firms that disclose both the balance sheet and the statement of cash flows (SCF) in the earnings press release. Information about accruals generally can be inferred from comparative balance sheets, but the availability of the SCF makes accruals more salient and easier to process for investors with limited attention. Controlling for potential additional information and endogeneity of SCF disclosure, we find strong evidence that SCF disclosure enables more efficient pricing of accruals. Further analyses using a proxy for investor sophistication suggest that, when SCF is absent from the earnings press release, less sophisticated investors fail to discount accruals but sophisticated investors do.

Similar content being viewed by others

Notes

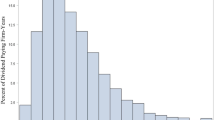

For comparison of the change in the frequency of disclosure of balance sheet and SCF items in the earnings announcement, D’Souza et al. (2010) report that, during their sample period of 2000–2003, 79.4 % of earnings announcements contain balance sheet items, while only 14.5 % contain SCF items. As of the second quarter of 2012 in our database, about 90 % of firms disclose balance sheet items, and about 50 % disclose SCF items.

For example, Hirshleifer and Teoh (2003) model equilibrium pricing of accounting information when investors have limited attention. Lim and Teoh (2010) offer a simple model of limited attention and investors’ reaction to accounting information and review the literature on limited attention and salience effects in the capital markets.

SCF disclosure may have the opposite effect of distracting investors if more information increases cognitive burden, causes sensory overload, or both (Hirshleifer et al. (2009)). If the additional SCF statement is distracting to investors, then the stock return response to earnings news would be more muted, and the post-earnings announcement drift would be larger for firms that disclose SCF at the earnings announcement. Our results are consistent with SCF disclosure increasing salience of accruals, rather than distracting investor attention.

Hribar and Collins (2002) find that accruals estimated from balance sheet are less accurate than those estimated from the SCF. While higher accrual estimation error may contribute to less discounting of accruals at the earnings announcement date, it would not explain the difference in cumulative discounting of accruals by the time of the filing date. Nevertheless, we perform robustness checks on all of our tests using (1) a restrictive sample where the accruals values are similar between the balance sheet and cash flow statement estimation methods and (2) the full sample replacing SCF accruals with balance sheet accruals. The results are robust. See Sect. 5.1 and Table 7.

Teachers of financial accounting can attest to how students struggle to understand and calculate accruals from the balance sheet.

The Compustat Quarterly Preliminary History database is distinct from the usual Compustat Database and must be purchased separately. Subscribers to the current Compustat database cannot view historical preliminary data because it is overwritten by finalized data from 10-Q reports when they are filed with the SEC.

We did a manual check of a random sample of 50 earnings announcements from 2011 for the accuracy of our identification procedure. We find that the Compustat Preliminary History database correctly identifies SCF disclosure for 49 of these 50 announcements. D’Souza et al. (2010) also checked the accuracy of this identification procedure. Their manual check of a random sample of 699 earnings announcements shows that more than 90 % were correctly identified using the Preliminary History database, so they conclude that data quality is not an issue (p. 183, footnote 7).

Some firms provide only annual SCF in their Q4 earnings releases. While it requires only simple calculations for investors to derive quarterly cash flow from annual figures, we have nonetheless verified that our results are robust to using only Q1–Q3 earnings announcements.

It is more common in accrual anomaly studies to scale total accruals by total assets; see Hirshleifer et al. (2012). We use the market value deflator for the accrual variable to maintain consistency with the deflator for the earnings news variable R_SUE so that R_TACC_MV can be viewed directly as a component of the R_SUE variable. This allows us to directly compare the signs and magnitudes of the coefficients between these two variables to infer whether investors are attending to and therefore incorporating the differential persistence of the accruals versus cash flow components of the earnings news. In addition to price-deflated accruals, we also replicated our analysis using the percent accruals definition proposed by Hafzalla et al. (2011) and obtained qualitatively similar results.

Our results are robust to more sophisticated risk-adjustment methods such as the four-factor portfolio adjusted returns of Daniel et al. (1997).

Earnings announcement data are from Compustat, which provides the date, but not time, of the announcements. Berkman and Truong (2009) report that the fraction of firms releasing earnings after hours increased by 40 %, and market reactions to after-hours earnings announcements are captured on day +1. Therefore we include day +1 to capture market reactions to announcements that are made after the market closed. We also replicate all analyses using a three-day window (−1, 1) to incorporate potential information leakage on day −1 and obtain similar results.

Our results are robust to using a more restrictive sample of firms where earnings surprise is estimated relative to analyst forecasts only.

Ali et al. (2008) argue that institutions holding small stakes (<1 %) will not have sufficient incentive to acquire costly private information, while institutions holding large stakes (>5 %) usually have long-term strategic considerations and do not trade on short-term earnings. Therefore these two types of institutions will not have the same incentives as institutions holding medium stakes (1–5 %) to react to disclosed information in the earnings release.

We start our sample period in 2000 to avoid the data quality issues associated with pre-2000 data in the Preliminary History database (D’Souza et al. 2010).

Our results are robust and stronger without the five-day restriction between earnings announcement and 10 K/Q dates because of the greater number of observations.

We randomly selected 50 earnings releases with balance sheets from our sample and find 47 of them contain two periods of balance sheet information. Also note that all previous period balance sheet information is publicly available by the time of current quarter’s earnings announcement. Therefore fully attentive investors can access past financials from public sources even if they are not contained in the current earnings release itself.

Our results are robust to two-way clustering of standard errors by firm and earnings announcement date.

All observations are jointly ranked every quarter so the accruals decile cut-offs are the same between the CF = 0 and CF = 1 subsamples. We have roughly similar distributions of the number of observations across deciles in the two subsamples so any difference in coefficients in the two groups are not due to a difference in the range of accruals.

To obtain the t-statistic for the difference in accrual coefficients between CF = 0 and CF = 1, we run a pooled regression with all observations from the two subsamples and interact all independent variables with the CF = 1 indicator variable.

Though our focus is on the differential persistence between accruals and cash flows, it is interesting that overall earnings persistence is lower for CF = 1 than CF = 0. This suggests that managers voluntarily disclose SCF when earnings persistence is low and especially when cash flow persistence is low. This is likely because of increased investor demand for cash flow information when earnings have low persistence.

In unreported robustness tests, we use the sum of the four quarterly 2-day earnings announcement returns over the following four quarters as the dependent variable in regression Eq. (3) and obtain qualitatively similar results. This specification assumes that price corrections occur mostly at earnings announcement dates in the subsequent four quarters (Cheng and Thomas 2006). We also use the Daniel et al. (1997) portfolio four-factor adjusted returns as the dependent variable, and the results are also robust. Finally, we include firm fixed effects in Tables 2 and 5 regressions, and again the results are robust.

We also perform the Mishkin (1983) test to compare the rationality of accrual pricing between CF = 0 and CF = 1 subsamples. The forecasting equation for the same quarter next year earnings is EARNt+4 = γ0 + γ1TACCt + γ2CFOt, and the pricing equation is EARETt+4 = β(EARNt+4 − α0 − α1TACCt − α 2CFOt), where EARETt+4 is the quarter t + 4 earnings announcement return. We find that the coefficient on TACC in the pricing equation (α1) is significantly larger than in the forecasting equation (γ1) only in the CF = 0 sample, whereas the two coefficients are not statistically different in the CF = 1 sample. In other words, investors perceive accruals to have much higher persistence for future earnings than they do, so investors significantly overprice accruals when the SCF is withheld but not when it is disclosed. Therefore the Mishkin test results are consistent with the salience effect of SCF disclosure at the earnings announcement.

The coefficients at earnings announcement dates are similar to those reported in Tables 2 and 5 Panel A, with minor differences resulting from a slightly different set of control variables between Eqs. (1) and (3). To facilitate comparing coefficients, we use the same set of control variables as in Eq. (3) for all regressions in Table 5 Panel B. The coefficients for the long window also differ between Table 5 Panels A and B because Panel B returns are inclusive of earnings announcement date returns.

Including year 2000 weakens the accrual anomaly for the earlier subperiod, likely from anomalous 2001 returns.

For all robustness tests only the accruals coefficients are reported for brevity.

Compustat mnemonics are in brackets.

In unreported analysis, we find the availability of depreciation information have no significant impact on market reaction to accruals for firms that provide only the balance sheet in the earnings release. This is consistent with prior research’s finding that investors tend to use depreciation information inefficiently (e.g., Miranda-Lopez and Nichols 2012).

Industry fixed effects are defined using the Fama–French 12 industry classification. Quarter fixed effects are intended to capture any special economic shocks in a particular quarter or time variations in the demand, supply and precision of financial statement information. For example, Bronson et al. (2011) report that lower reliability of preliminary earnings in recent years. Audits have become longer because of new requirements by the PCAOB, but firms have maintained the same preliminary earnings release dates and audits may be incomplete before the earnings release. Quarter fixed effects are stronger controls than a simple time-trend variable.

We have included an extensive set of plausible factors that affect the choice to disclose SCF. As with all empirical tests, it is often challenging to include instruments for all conceivable endogeneity factors. We caution that the second-stage results will rely on our ability to control sufficiently for the self-selection of SCF disclosure. We also emphasize that controls for endogenous voluntary disclosure of the SCF are less relevant for the post-earnings announcement returns tests. This is because the long-window tests cumulate returns after the mandated 10-K/Q information is reported.

Matching was done with replacement and with no restriction on the maximum difference in propensity scores between treatment and control firms. The matching appears successful as the mean absolute difference in propensity scores between treatment and control is 0.006 %, and the 99 percentile is 0.06 %. We include quarter fixed effects in the first-stage probit model, so matching within the same quarter is unnecessary. However, our PSM results are robust to imposing this additional requirement.

Results are also robust to further restricting consistency sample to those with 20 (minimum of eight) quarters of earnings releases, so neither changes in sample composition or disclosure policy drive our results.

References

Aboody, D. (1996). Recognition versus disclosure in the oil and gas industry. Journal of Accounting Research Supplement, 34(3), 21–32.

Aboody, D., Even-Tov, O., Lehavy, R., & Trueman, B. (2013). Firm-specific investor sentiment. Working paper, University of California, Los Angeles.

Ahmed, A., Kilic, E., & Lobo, G. J. (2006). Does recognition versus disclosure matter? Evidence from value-relevance of banks’ recognized and disclosed derivative financial instruments. The Accounting Review, 81(3), 567–588.

Ali, A., Klasa, S., & Li, O. (2008). Insititutional stakeholdings and better-informed traders at earnings announcements. Journal of Accounting and Economics, 46, 47–61.

Amihud, Y. (2002). Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets, 5, 31–56.

Baber, W., Chen, S., & Kang, S. (2006). Stock price reaction to evidence of earnings management: Implications for supplementary financial disclosure. Review of Accounting Studies, 11, 5–19.

Balsam, S., Bartov, E., & Marquardt, C. (2002). Accruals management, investor sophistication, and equity valuation: Evidence from 10-Q filings. Journal of Accounting Research, 40(4), 987–1012.

Battalio, R., Lerman, A., Livnat, J., & Mendenhall, R. (2012). Who, if anyone, reacts to accrual information? Journal of Accounting and Economics, 53(1–2), 205–224.

Berkman, H., & Truong, C. (2009). Event day 0? After-hours earnings announcement. Journal of Accounting Research, 47–1, 71–103.

Bradshaw, M. T., Richardson, S. A., & Sloan, R. G. (2001). Do analysts and auditors use information in accruals? Journal of Accounting Research, 39, 45–74.

Bronson, S., Hogan, C., Johnson, M., & Ramesh, K. (2011). The unintended consequences of PCAOB auditing Standard Nos. 2 and 3 on the reliability of preliminary earnings releases. Journal of Accounting and Economics, 51, 95–114.

CFA Institute Centre for Financial Market Integrity/Business Roundtable Institute for Corporate Ethics. (2007). Apples to apples: a template for reporting quarterly earnings.

Chakrabarty, B., & Moulton, P. (2012). Earnings announcements and attention constraints: The role of market design. Journal of Accounting and Economics, 53–3, 612–634.

Chen, S., DeFond, M., & Park, C. (2002). Voluntary disclosure of balance sheet information in quarterly earnings announcements. Journal of Accounting and Economics, 33, 229–251.

Cheng, A., & Thomas, W. (2006). Evidence of the abnormal accrual anomaly incremental to operating cash flows. The Accounting Review, 81(5), 1151–1167.

D’Souza, J., Ramesh, K., & Shen, M. (2010). Disclosure of GAAP line items in earnings announcements. Review of Accounting Studies, 15, 179–219.

Daniel, K., Grinblatt, M., Titman, S., & Wermers, R. (1997). Measuring mutual fund performance with charateristic-based benchmarks. The Journal of Finance, 52(3), 1035–1058.

Daniel, K., Hirshleifer, D., & Teoh, S. (2002). Investor psychology in capital markets: Evidence and policy implications. Journal of Monetary Economics, 49(1), 139–209.

Davis-Friday, P., Folami, B., Liu, C., & Mittelstaedt, F. (1999). The value relevance of financial statement recognition versus disclosure: Evidence from SFAS No. 106. Accounting Review, 74(4), 403–423.

Defond, M., & Hung, M. (2003). An empirical analysis of analysts’ cash flow forecasts. Journal of Accounting and Economics, 35(1), 73–100.

DellaVigna, S., & Pollet, J. (2009). Investor inattention and Friday earnings announcements. Journal of Finance, 64(2), 709–749.

Dietrich, R., Kachelmeier, S., Kleinmuntz, D., & Linsmeier, T. (2001). Market efficiency, bounded rationality, and supplemental business reporting disclosures. Journal of Accounting Research, 39(2), 243–268.

Fiske, S., & Taylor, S. (1991). Social cognition. New York: Mcgraw-Hill Book Company.

Green, J., Hand, J., & Soliman, M. (2011). Going, going, gone? The apparent demise of the accruals anomaly. Management Science, 57–5, 797–816.

Hafzalla, N., Lundholm, R., & Van Winkle, E. (2011). Percent accruals. The Accounting Review, 86–1, 209–236.

Hand, J. (1990). A test of the extended functional fixation hypothesis. The Accounting Review, 65–4, 740–763.

Heckman, J. (1979). Sample selection bias as a specification error. Enomometrica, 47(1), 153–161.

Hewitt, M. (2009). Improving investors’ forecast accuracy when operating cash flows and accruals are differentially persistent. The Accounting Review, 84(6), 1913–1931.

Hirshleifer, D., Hou, K., & Teoh, S. (2012). The accrual anomaly: risk or mispricing? Management Science, 58(2): 320–335. http://sites.uci.edu/dhirshle/abstracts/short-arbitrage-return-asymmetry-and-the-accrual-anomaly/

Hirshleifer, D., Lim, S., & Teoh, S. (2009). Driven to distraction: Extraneous events and underreaction to earnings news. Journal of Finance, 64(5), 2287–2323.

Hirshleifer, D., Lim, S., & Teoh, S. (2011). Limited investor attention and stock market misreactions to accounting information. Review of Asset Pricing Studies, 1(1), 35–73.

Hirshleifer, D., & Teoh, S. (2003). Limited attention, information disclosure, and financial reporting. Journal of Accounting and Economics, 36(1–3), 337–386.

Hirst, E., & Hopkins, P. (1998). Comprehensive income reporting and analysts’ valuation judgments. Journal of Accounting Research, 36, 47–75.

Hopkins, P. (1996). The effect of financial statement classification of hybrid financial instruments on financial analysts’ stock price judgments. Journal of Accounting Research (Supplement 1996): 33–50.

Hopkins, P., Houston, R., & Peters, M. (2000). Purchase, polling, and equity analysts’ valuation judgments. The Accounting Review, 75(3), 257–281.

Hribar, P., & Collins, D. (2002). Errors in estimating accruals: Implications for empirical research. Journal of Accounting Research, 40(1), 105–134.

Huang, X., Nekrasov, A., & Teoh, S. (2015). Headline Salience. University of California Irvine, Working Paper.

Huang, X., Teoh, S., & Zhang, Y. (2014). Tone management. The Accounting Review, 89(3), 1083–1113.

Jegadeesh, N., & Livnat, J. (2006). Revenue surprises and stock returns. Journal of Accounting and Economics, 41(1–2), 147–171.

Kahneman, D. (1973). Attention and effort. Englewood Cliffs, NJ: Prentice-Hall.

Klibanoff, P., Lamont, O., & Wizman, T. A. (1998). Investor reaction to salient news in closed-end country funds. Journal of Finance, 53–2, 673–699.

Larcker, D., & Rusticus, T. (2010). On the use of instrumental variables in accounting research. Journal of Accounting and Economics, 49, 189–205.

Lawrence, A. (2013). Individual investors and financial disclosure. Journal of Accounting and Economics, 56–1, 130–147.

Levi, S. (2008). Voluntary disclosure of accruals in earnings press releases and the pricing of accruals. Review of Accounting Studies, 13, 1–21.

Libby, R., & Emett, S. A. (2014). Earnings presentation effects on manager reporting choices and investor decisions. Accounting and Business Research, 44(4), 410–438.

Lim, S., & Teoh, S. (2010). Limited attention. In K. Baker & J. Nofsinger (Eds.), Behavioral finance: Investors, corporations, and markets (pp. 295–312). Hoboken, NJ: Wiley.

Louis, H., Robinson, D., & Sbaraglia, A. (2008). An integrated analysis of the association between accrual disclosure and the abnormal accrual anomaly. Review of Accounting Studies, 13, 23–54.

Mashruwala, C., Rajgopal, S., & Shevlin, T. (2006). Why is the accrual anomaly not arbitraged away? The role of idiosyncratic risk and transaction costs. Journal of Accounting and Economics, 42, 3–33.

Miller, B. P. (2010). The effects of reporting complexity on small and large investor trading. The Accounting Review, 85(6), 2107–2143.

Miranda-Lopez, J. E., & Nichols, L. M. (2012). The use of earnings and cash flows in investment decisions in the US and Mexico: Experimental evidence. Journal of International Accounting, Auditing, and Taxation, 21(2), 198–208.

Mishkin, F. (1983). A rational expectations approach to macroeconometrics: Testing policy effectiveness and efficient-markets models. Chicago: University of Chicago Press.

Mohanram, P. (2014). Analysts’ cash flow forecasts and the decline of the accruals anomaly. Contemporary Accounting Research, 31(4), 1143–1170.

National Investor Relations Institute. (2008). Standards of Practice for Investor Relations, December 3.

Posner, M. (2011). Cognitive neuroscience of attention (2nd ed.). New York: The Guilford Press.

Radhakrishnan, S., & Wu, S. (2014). Analysts’ cash flow forecasts and accrual mispricing. Contemporary Accounting Research, 31(4), 1191–1219.

Randerson, E. (2004). In an era of full disclosure, what about cash? Financial Executive, 20(6), 48–50.

Rennekamp, K. (2012). Processing fluency and investors’ reactions to disclosure readability. Journal of Accounting Research, 50(5), 1319–1354.

Richardson, S., Tuna, I., & Wysocki, P. (2010). Accounting anomalies and fundamental analysis: A review of recent research advances. Journal of Accounting and Economics, 50–2(3), 410–454.

Sacharin, K. (2000). Attention! How to interrupt, yell, whisper & touch customers. New York: Wiley.

Sloan, R. (1996). Do stock prices fully reflect information in accruals and cash flows about future earnings? The Accounting Review, 71(3), 289–315.

Song, H., & Schwarz, N. (2008). If it’s hard to read, it’s hard to do: Processing fluency affects effort prediction and motivation. Psychological Science, 19, 986–988.

Teoh, S., & Wong, T. J. (2002). why new issues and high-accrual firms underperform: The role of analysts’ credulity. Review of Financial Studies, 15(3), 869–900.

Teoh, S., & Zhang, Y. (2011). Data truncation bias, loss firms, and accounting anomalies. The Accounting Review, 86(4), 1445–1475.

U.S. Securities and Exchange Commission. (2008). Final Report of the Advisory Committee on Improvements to Financial Reporting (CIFiR), August 1.

You, H., & Zhang, X. (2009). Financial reporting complexity and investor underreaction to 10-K information. Review of Accounting Studies, 14(4), 559–586.

Yu, K. (2013). Does recognition versus disclosure affect value relevance? Evidence from pension accounting. The Accounting Review, 88(3), 1095–1127.

Acknowledgments

We thank Richard Sloan (the editor) and two anonymous reviewers for insightful suggestions. We also thank Spencer Anderson, Wen Chen, Patty Dechow, Ronald Espinosa, Yaniv Konchitchki, An-Ping Lin, Paul Ma, Jonathan Nam, Joe Schroeder, Samuel Tan, Barrett Wheeler, and workshop participants at Arizona State University, Indiana University, University of California – Berkeley, and University of Minnesota for very helpful conversations and comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: Definition of variables

Appendix: Definition of variables

- CF :

-

Indicator variable that equals to 1 if the firm provides cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities in quarterly earnings announcements and 0 otherwise.

- DR_BS :

-

Disclosure ratio of balance sheet items. It is defined as the number of balance sheet items disclosed at earnings announcements divided by the number of balance sheet items disclosed in 10-Q filings. The balance sheet items included for calculating this ratio are CHEQ, RECTQ, INVTQ, ACOQ, ACTQ, DPACTQ, PPENTQ, AOQ, ATQ, DLCQ, APQ, TXPQ, LCOQ, LCTQ, LOQ, DLTTQ, TXDITCQ, MIBQ, LTQ, PSTKQ, CSTKQ, CAPSQ, REQ, CEQQ, SEQQ, PSTKRQ, TSTKQ, PPEGTQ, TEQQ, and MIBNQ.

- DR_IS :

-

Disclosure ratio of income statement items. It is defined as the number of income statement items disclosed at earnings announcements divided by the number of income statement items disclosed in 10-Q filings. The income statement items included for calculating this ratio are ACCHGQ, COGSQ, CSTKEQ, DOQ, DPQ, DVPQ, IBADJQ, IBCOMQ, IBQ, MIIQ, NIQ, NOPIQ, OIBDPQ, PIQ, SALEQ, SPIQ, TXDIQ, TXTQ, XIDOQ, XINTQ, XIQ, XRDQ, XSGAQ, and IBMIIQ.

- PROFORMA :

-

Indicator variable that equals to 1 if Compustat EPS (EPSPXQ) differs from I/B/E/S actual EPS by more than 1 cent and 0 otherwise.

- FCPS :

-

Indicator variable that equals to 1 if there are analyst cash flow forecasts for the current fiscal year.

- OC :

-

Operating cycle, calculated as log(360*(average accounts receivable/sales + average inventory/cost of goods sold)).

- HT :

-

Indicator for high-tech industries, which equals to 1 if the firms’ SIC code is in the range of (2833–2836 or 8731–8734 or 7371–7379 or 3570–3577 or 3600–3674 or 3810<=sic<=3845) and 0 otherwise.

- LOSS :

-

Indicator variable that equals to 1 if income before extraordinary item is negative and 0 otherwise.

- ADJPIH :

-

Total shares owned by institutions with medium shareholding, divided by total shares owned by all remaining shareholders. Institutions with medium shareholding are defined as institutions holding 1–5 % of total shares for the company.

- IV :

-

Idiosyncratic volatility, measured by the standard deviation of residuals from a market model regression using daily returns over the 12-month period before earnings announcement.

- ILLIQ :

-

Amihud (2002)’s illiquidity measure, \(ILLIQ = \frac{1}{{D_{i,t} }}\sum\nolimits_{d = 1}^{{D_{i,t} }} {\frac{{|R_{itd} |}}{{DVOL_{itd} }} \times 10^{6} }\), calculated using daily return and volume data over 12 months before earnings announcement.

- logNUMEST :

-

Natural logarithm of the number of analysts that issues EPS forecasts for the current year.

- ACQ :

-

Indicator variable that equals to 1 if cash used for acquisitions is positive and 0 otherwise.

- logMV :

-

Natural logarithm market value of equity.

- MTB :

-

Market value of equity divided by book value of equity.

- LEV :

-

Total liabilities divided by total assets.

- EARN_VOL :

-

Standard deviation of income before extraordinary items divided by total assets over the past eight quarters.

- CFO_VOL :

-

Standard deviation of cash flow from operations divided by total assets over the past eight quarters.

- BIG4 :

-

Indicator variable that equals to 1 if the firm is audited by a Big 4 auditor (EY, DT, PWC, KPMG) and 0 otherwise.

- AGE :

-

Firm age, measured as the natural logarithm of 1 plus number of years since the firm first appears in CRSP.

- SARET2d :

-

Size-adjusted return over the 2-day window (0, 1), where day 0 is the earnings announcement date.

- TACC_MV :

-

Total accruals divided by market value of equity at fiscal quarter-end. Total accruals is calculated as income before extraordinary items minus cash flow from operations. R_TACC_MV is the decile rank of TACC_MV.

- SUE :

-

Earnings surprise divided by price at fiscal quarter-end. For firms with analyst forecasts, earnings surprise is defined as actual earnings per share (from IBES) minus median analyst forecasts. For firms with no analyst forecasts, earnings surprise is measured by current quarter EPS minus EPS from quarter t − 4, both adjusted for stock splits. R_SUE is the decile rank of SUE.

- SUS :

-

Revenue surprise divided by market value of equity at fiscal quarter-end. For firms with analyst forecasts, revenue surprise is defined as actual revenue (from IBES) minus median analyst forecasts. For firms with no analyst forecasts, revenue surprise is measured by current quarter revenue minus revenue from quarter t − 4. R_SUS is decile ranks of SUS.

- SARET5d :

-

Size-adjusted abnormal return over the 5-day window of (−6, −1), where day 0 is earnings announcement day.

- LSUE SUE :

-

For quarter t − 1. R_LSUE is decile ranks of LSUE.

- IMR :

-

Inverse mills ratio obtained from the Probit regression that models that determinants of SCF disclosure.

- FRET250d :

-

Buy-and-hold return over the 250-trading day period starting from two days after the earnings announcements.

- RET12m :

-

buy-and-hold return over the 12-month window ending on the current fiscal quarter-end

- RET_STD :

-

Standard deviation of monthly return over the 12-month before current fiscal quarter-end.

- FE :

-

Actual EPS of quarter t + 1 minus median analyst forecast of quarter t + 1 EPS surveyed at 1 month after announcement of quarter t earnings.

- ROA :

-

Income before extraordinary items divided by total assets at the end of quarter. R_ROA is decile ranks of ROA.

- EPSVOLD :

-

Standard deviation of annual EPS over the past five years, divided by price at the end of earnings announcement month. R_EPSVOLD is decile ranks of EPSVOLD.

Extreme values of the following variables are winsorized at 1 and 99 %: All ratio variables including TACC_MV, SUE, SUS, LSUE, OC, EARN_VOL, MTB, and LEV.

Rights and permissions

About this article

Cite this article

Miao, B., Teoh, S.H. & Zhu, Z. Limited attention, statement of cash flow disclosure, and the valuation of accruals. Rev Account Stud 21, 473–515 (2016). https://doi.org/10.1007/s11142-016-9357-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-016-9357-z

Keywords

- Limited attention

- Cash flow disclosure

- Voluntary disclosure

- Accrual valuation

- Salience

- Information processing cost