Abstract

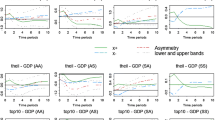

The study examines the effect of monetary and fiscal policy on inequality conditioned on low and high uncertainty. We use U.S. quarterly time series data on different measures of income, labour earnings, consumption and total expenditure inequality as well as economic uncertainty. Our analysis is based on the impulse responses from the local projection methods that enable us to recover a smoothed average of the underlying impulse response functions. The results show that both contractionary monetary and fiscal policies increase inequality, and in the presence of relatively higher levels of uncertainty, the effectiveness of both policies is weakened. Thus, pointing to the need for policy-makers to be aware of the level of uncertainty while conducting economic policies in the U.S.

Similar content being viewed by others

Notes

More details about the inequality data can be found in Coibion et al. (2017).

Our results were qualitatively similar when we used categorical uncertainty dealing with monetary and fiscal policies, over 1985:1 to 2008:4, developed also by Baker et al. (2016) (available at: http://www.policyuncertainty.com/categorical_epu.html) specifically rather than overall economic uncertainty, and the monetary policy uncertainty measures developed by Husted et al. (2017) (available at: https://www.federalreserve.gov/econresdata/notes/ifdp-notes/2016/measuring-monetary-policy-uncertainty-the-federal-reserve-january-1985-january-2016-20160411.html) covering 1985:1 to 2008:4, and Istrefi and Mouabbi (2017) (available at: https://sites.google.com/site/istrefiklodiana/interest-rate-uncertainty or https://sites.google.com/site/sarahmouabbi/interest-rate-uncertainty) over the period of 1993:2 to 2008:4. Since, these indices are available monthly, we used temporal aggregation to convert to quarterly frequency. Complete details of these results are available upon request from the authors.

The newspapers searched are: the Wall Street Journal, the New York Times, the Washington Post, the Chicago Tribune, the LA Times, and the Boston Globe, along with USA Today, the Miami Herald, the Dallas Morning Tribune, and the San Francisco Chronicle.

The fiscal and monetary policy shocks were obtained from: http://econweb.ucsd.edu/~vramey/research.html#govt and http://lorenzkueng.droppages.com/, respectively.

We tried to compare conventional and unconventional monetary policy impacts on inequality. To do this, we regress unconventional monetary policy proxied by the U.S. shadow short rates on inequality (Gini coefficient) using recursive estimation. The shadow short rates data were obtained from https://sites.google.com/site/jingcynthiawu/home/wu-xia-shadow-rates (Wu and Xia 2016) while the Gini coefficient data were sourced from https://www.shsu.edu/eco_mwi/inequality.html (Frank 2009, 2014). We converted the monthly shadow short rates data to annual data since the Gini coefficient data are available on annual basis from 1917 to 2015. The plot of the slope coefficient (C2) from 2008 to 2015 shows that monetary policy still has a positive relationship with inequality. Hence the results are robust to both conventional or unconventional monetary policy. Results are available from authors upon request.

We also interacted the fiscal policy shock with the news-based measure of partisan conflict developed by Azzimonti (2018) (available at: https://www.philadelphiafed.org/research-and-data/real-time-center/partisan-conflict-index). The Partisan Conflict Index tracks the degree of political disagreement among U.S. politicians at the federal level by measuring the frequency of newspaper articles reporting disagreement in a given month. Higher index values indicate greater conflict among political parties, Congress, and the President. We used temporal aggregation to convert the monthly data to quarterly frequency. Interestingly, we observed, over 1918:01 to 2008:4, that the strength of the tax shock is stronger under higher degrees of partisan conflict than lower levels of the same. This could possibly be due to the fact that partisan conflict and uncertainty are negatively correlated, since with higher partisan conflict agents might believe that policies are less likely to change, and hence, there is lower level of policy uncertainty, as discussed comprehensively in Azzimonti (2018). Complete details of these results are available upon request from the authors.

Also we conducted the analysis using the 10th and 90th percentiles as well as the 25th and 75th percentiles definition of low and high uncertainty. In general, the effects are lower under high uncertainty. Results are available upon request from the authors.

References

Aastveit, K.A., Natvik, G.J., Sola, S.: Economic uncertainty and the influence of monetary policy. J. Int. Money Finance 76, 50–67 (2017)

Afonso, A., Schuknecht, L., Tanzi, V.: Income distribution and public spending: an efficiency assessment. J. Econ. Inequal. 8, 367–389 (2010)

Albanesi, S.: Inflation and inequality. J. Monetary Econ. 54(4), 1088–1114 (2007)

Azzimonti, M.: Partisan conflict and private investment. J. Monetary Econ. 93(1), 114–131 (2018)

Bachmann, R., Elstner, S., Sims, E.R.: Uncertainty and economic activity: evidence from business survey data. Am. Econ. J. Macroecon. 5(2), 217–249 (2013)

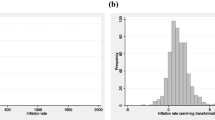

Baker, S.R., Bloom, N., Davis, S.J.: Measuring economic policy uncertainty. Q. J. Econ. 131(4), 1593–1636 (2016)

Balcilar, M., Demirer, R., Gupta, R., van Eyden, R.: The impact of US policy uncertainty on the monetary effectiveness in the Euro area. J. Policy Model. 39(6), 1052–1064 (2017)

Basu, S., Bundick, B.: Uncertainty shocks in a model of effective demand. Econometrica 85(3), 937–958 (2017)

Bernanke, B.S.: Irreversibility, uncertainty, and cyclical investment. Q. J. Econ. 98(1), 85–106 (1983)

Bernanke, B.S.: Monetary policy and inequality. Ben Bernanke’s Blog, 1 June 2015 (2015)

Bloom, N.: The impact of uncertainty shocks. Econometrica 77(3), 623–685 (2009)

Bloom, N.: Fluctuations in uncertainty. J. Econ. Perspect. 28(2), 153–176 (2014)

Bloom, N., Bond, S., Reenen, J.V.: Uncertainty and investment dynamics. Rev. Econ. Stud. 74(2), 391–415 (2007)

Bullard, J.: Income inequality and monetary policy: a framework with answers to three questions. In: Speech at C. Peter McColough Series on International Economics, Council on Foreign Relations, 26 June 2014 (2014)

Carpenter, S.B., Rodgers, W.M.: The disparate labor market impacts of monetary policy. J. Policy Anal. Manag. 23(4), 813–830 (2004)

Castelnuovo, E., Pellegrino, G.: Uncertainty-dependent effects of monetary policy shocks: a new Keynesian interpretation. https://editorialexpress.com (2017)

Coibion, O., Gorodnichenko, Y., Kueng, L., Silvia, J.: Innocent bystanders? Monetary policy and inequality in the U.S.? J. Monetary Econ. 88, 70–89 (2017)

Davtyan, K.: The distributive effect of monetary policy: the top one percent makes the difference. Econ. Model. 65, 106–118 (2017)

Dixit, A., Pindyck, R.: Investment Under Uncertainty. Princeton University Press, Princeton (1994)

Doepke, M., Schneider, M.: Inflation and the redistribution of nominal wealth. J. Polit. Econ. 114(6), 1069–1097 (2006)

Doerrenberg, P., Peichl, A.: The impact of redistributive policies on inequality in OECD countries. Appl. Econ. 46(17), 2066–2086 (2014)

Erosa, A., Ventura, G.: On inflation as a regressive consumption tax. J. Monetary Econ. 49(4), 761–795 (2002)

Fernández-Villaverde, J., GuerrónQuintana, P., Rubio-Ramirez, J.F., Uribe, M.: Risk matters: the real effects of volatility shocks. Am. Econ. Rev. 101(6), 2530–2561 (2011)

Fernández-Villaverde, J., Guerrón-Quintana, P.A., Kuester, K., Rubio-Ramírez, J.: Fiscal volatility shocks and economic activity. Am. Econ. Rev. 105(11), 352–3384 (2015)

Forbes, K. (2015): Low interest rates: King Midas’ golden touch?. In: Speech at the Institute of Economic Affairs, 24 Feb 2015

Frank, M.W.: Inequality and growth in the United States: evidence from a new state-level panel of income inequality measure. Econ. Inq. 47(1), 55–68 (2009)

Frank, M.W.: A new state-level panel of annual inequality measures over the period 1916–2005. J. Bus. Strateg. 31(1), 241–263 (2014)

Heathcote, J., Perri, F., Violante, G.L.: Unequal we stand: an empirical analysis of economic inequality in the U.S., 1967–2006. Rev. Econ. Dyn. 13(1), 15–51 (2010)

Husted, L., Rogers, J., Sun, B. (2017): Measuring monetary policy uncertainty: the federal reserve, January 1985–January 2016. International Finance Discussion Papers, Board of Governors of the Federal Reserve System, Number 1215

Istrefi, K., Mouabbi, S.: Subjective interest rate uncertainty and the macroeconomy: a cross-country analysis. J. Int. Money Finance (2017). https://doi.org/10.1016/j.jimonfin.2017.07.015

Jordà, Ò.: Estimation and inference of impulse responses by local projections. Am. Econ. Rev. 95(1), 161–182 (2005)

Jurado, K., Ludvigson, S.C., Ng, S.: Measuring uncertainty. Am. Econ. Rev. 105(3), 1177–1216 (2015)

Ledoit, O.: The redistributive effects of monetary policy. Manuscript. http://www.hec.unil.ch/documents/sem_ibf/Ledoit.pdf (2009)

Mersch, Y.: Monetary policy and economic inequality. In: Keynote Speech, Corporate Credit Conference, 17 Oct 2014 (2014)

Mumtaz, H., Theophilopoulou, A.: The impact of monetary policy on inequality in the UK. An empirical analysis. Eur. Econ. Rev. 98, 410–423 (2017)

Nakajima, M.: The redistributive consequences of monetary policy. Federal Reserve Bank of Philadelphia Research Department, Business Review, Second Quarter, pp. 9–16 (2015)

O’Farrell, R., Rawdanowicz, L.: Monetary policy and inequality: financial channels. Int. Finance 20, 174–188 (2017)

Ocakverdi, E.: Impulse responses by local projections. Econometric Analysis Insight Blog, Thursday, 23 June 2016 (2016)

Organization for Economic Cooperation and Development (OECD): In it Together: Why Less Inequality Benefits All. OECD Publishing, Paris (2015)

Ozturk, E.O., Sheng, X.S.: Measuring global and country-specific uncertainty. J. Int. Money Finance. (2017). https://doi.org/10.1016/j.jimonfin.2017.07.014

Pierdzioch, C., Gupta, R.: Uncertainty and forecasts of U.S. recessions. University of Pretoria, Department of Economics, Working Paper No. 2017-32 (2017)

Romer, C.D., Romer, D.H.: A new measure of monetary shocks: derivation and implications. Am. Econ. Rev. 94(4), 1055–1084 (2004)

Romer, C.D., Romer, D.H.: The macroeconomic effects of tax changes: estimates based on a new measure of fiscal shocks. Am. Econ. Rev. 100(3), 763–801 (2010)

Saiki, A., Frost, J.: How does unconventional monetary policy affect inequality? Evidence from Japan. DNB Working Paper 423 (2014)

Tenreyro, S., Thwaites, G.: Pushing on a string: U.S. monetary policy is less powerful in recessions. Am. Econ. J. Macroecon. 8(4), 43–74 (2016)

Teulings, C.N., Zubanov, N.: Is economic recovery a myth? Robust estimation of impulse responses. J. Appl. Econom. 29, 497–514 (2014)

Vavra, J.: Inflation dynamics and time-varying volatility: new evidence and an ss interpretation. Q. J. Econ. 129(1), 215–258 (2014)

Villarreal, F.: Monetary policy and inequality in Mexico, MPRA Paper 57074 (2014)

Williamson, S.D.: Monetary policy and distribution. J. Monetary Econ. 55(6), 1038–1053 (2009)

Wolff, E., Zacharias, A.: The distributional consequences of government spending and taxation in the U.S., 1989 and 2000. Rev. Income Wealth 53(4), 692–715 (2007)

Wu, J.C., Xia, F.D.: Measuring the macroeconomic impact of monetary policy at the zero lower bound. J. Money Credit Bank. 48(2–3), 253–291 (2016)

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank three anonymous referees for many helpful comments. However, any remaining errors are solely ours.

Rights and permissions

About this article

Cite this article

Aye, G.C., Clance, M.W. & Gupta, R. The effectiveness of monetary and fiscal policy shocks on U.S. inequality: the role of uncertainty. Qual Quant 53, 283–295 (2019). https://doi.org/10.1007/s11135-018-0752-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-018-0752-3