Abstract

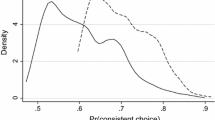

We present a survey design that generalizes static conjoint experiments to elicit inter-temporal adoption decisions for durable goods. We show that consumers’ utility and discount functions in a dynamic discrete choice model are jointly identified using data generated by this specific design. In contrast, based on revealed preference data, the utility and discount functions are generally not jointly identified even if consumers’ expectations are known. The separation of current-period preferences from discounting is necessary to forecast the diffusion of a durable good under alternative marketing strategies. We illustrate the approach using two surveys eliciting Blu-ray player adoption decisions. Both model-free evidence and the estimates based on a dynamic discrete choice model indicate that consumers make forward-looking adoption decisions. In both surveys the average discount rate is 43 percent, corresponding to a substantially higher degree of impatience than the rate implied by aggregate asset returns. The estimates also reveal a large degree of heterogeneity in the discount rates across consumers, but only little evidence for hyperbolic discounting.

Similar content being viewed by others

Notes

This is a standard normalization in the study of durable goods adoption. However, in applications where one might plausibly expect the outside good utility to depend on state variables, this normalization could bias counterfactuals. See, for instance, Aguirregabiria and Suzuki (2012) for a discussion of counterfactual biases due to the normalization of a firm’s scrap value to zero in the analysis of dynamic entry and exit games.

The notation u j (x) refers to the function \(u:\mathcal {A}\times \mathbb {R}\rightarrow \mathbb {R},\) and similarly for p(x ′|x, j).

September 5, 2013

This question regarding the data requirement is different from the question of how difficult it is for the subjects to understand and process our survey design compared to a static conjoint design.

The statement in Fang and Wang (2013) is actually somewhat more general and also allows for identification of a third parameter that indicates the extent to which a decision maker anticipates her future present-bias.

Magnac and Thesmar (2002) only discuss the finite horizon case.

The sampling was conducted to ensure that the age distribution of the respondents matched the corresponding distribution in the U.S. population.

References

Abbring, J.H. (2010). Identification of dynamic discrete choice models. Annual Review of Economics, 2, 367–394.

Aguirregabiria, V., & Suzuki, J. (2012). Identification and Counterfactuals in Dynamic Models of Market Entry and Exit. manuscript.

Arcidiacono, P., & Ellickson, P.B. (2011). Practical methods for estimation of dynamic discrete choice models. Annual Review of Economics, 3, 363–394.

Bajari, P., Chernozhukov, V., Hong, H., Nekipelov, D. (2009). Nonparametric and Semiparametric Analysis of a Dynamic Discrete Game. manuscript.

Bass, F.M. (1969). A new product growth model for consumer durables. Management Science, 15(5), 215–227.

Bass, F.M., Gordon, K. , Ferguson, T.L., Githens, M.L. (2001). DIRECTV: forecasting diffusion of a new technology prior to product launch. Interfaces, 31(3 Part 2 of 2), S82–S93.

Briesch, R.A., Chintagunta, P.K., Matzkin, R.L. (2010). Nonparametric discrete choice models with unobserved heterogeneity. Journal of Business & Economic Statistics, 28(2), 291–307.

Bronnenberg, B.J., Dubé, J.-P., Mela, C.F., Albuquerque, P., Erdem, T., Gordon, B., Hanssens, D., Hitsch, G., Hong, H., Sun, B. (2008). Measuring long-run marketing effects and their implications for long-run marketing decisions. Marketing Letters, 19, 367–382.

Chevalier, J., & Goolsbee, A. (2005). Are durable goods consumers forward looking? Evidence from college textbooks. NBER Working Paper 11421.

Chung, D., Steenburgh, T., Sudhir, K. (2014). Do bonuses enhance sales productivity? A dynamic structural analysis of bonus-based compensation plans. Marketing Science (forthcoming).

Cochrane, J.H. (2001). In Asset Pricing. Princeton: NJ.

Dubé, J.-P., Hitsch, G.J., Rossi, P.E. (2009). Do switching costs make markets less competitive?. Journal of Marketing Research, 46, 435–445.

Fang, H., & Wang, Y. (2013). Estimating Dynamic Discrete Choice Models with Hyperbolic Discounting, with an Application to Mammography Decisions . manuscript.

Fox, J.T., Kim, K.I., Ryan, S.P., Bajari, P. (2012). The random coefficients logit model is identified. Journal of Econometrics, 166, 204–212.

Frederick, S., Loewenstein, G., O’Donoghue, T. (2002). Time discounting and time preference: a critical review. Journal of Economic Literature, 40(2), 351–401.

Gowrisankaran, G., & Rysman, M. (2012). Dynamics of consumer demand for new durable goods. Journal of Political Economy, 120(6), 1173–1219.

Green, P.E., Krieger, A.M., Wind, Y. (2001). Thirty years of conjoint analysis: reflections and prospects. Interfaces, 31(3), S56—S73.

Green, P.E., & Rao, V.R. (1971). Conjoint measurement for quantifying judgmental data. Journal of Marketing Research, 8(3), 355–363.

Green, P.E., & Srinivasan, V. (1990). Conjoint analysis in marketing: new developments with implications for research and practice. Journal of Marketing, 54(4), 3–19.

Horsky, D. (1990). A diffusion model incorporating product benefits, price, income and information. Marketing Science, 9(4), 342–365.

Hotz, V.J., & Miller, R.A. (1993). Conditional choice probabilities and the estimation of dynamic models. Review of Economic Studies, 60(3), 497–529.

Huber, J. (1997). What We Have Learned from 20 Years of Conjoint Research: When to Use Self-Explicated, Graded Pairs, Full Profiles or Choice Experiments. Sawtooth Software Research Paper Series.

Magnac, T., & Thesmar, D. (2002). Identifying dynamic discrete decision processes. Econometrica, 70(2), 801–816.

Matzkin, R.L. (2007). Nonparametric Identification. In J. J. Heckman & E. E. Leamer (Eds.), Handbook of Econometrics (Vol. 6B, chap. 73, pp. 5307–5368). Elsevier B.V.

Melnikov, O. (2013). Demand for differentiated durable products: the case of the U.S. computer printer market. Economic Inquiry, 51(2), 1277–1298.

Miller, R.A. (1984). Job matching and occupational choice. Journal of Political Economy, 92(6), 1086–1120.

Nair, H.S. (2007). Intertemporal price discrimination with forward-looking consumers: application to the US market for console video-games. Quantitative Marketing and Economics, 5, 239–292.

Newton, M.A., & Raftery, A.E. (1994). Approximate bayesian inference with the weighted likelihood bootstrap. Journal of the Royal Statistical Society, Series B, 56(1), 3–48.

Norets, A., & Takahashi, S. (2013). On the surjectivity of the mapping between utilities and choice probabilities. Quantitative Economics, 4(1), 149–155.

Pakes, A. (1986). Patents as options: some estimates of the value of holding european patent stocks. Econometrica, 54(4), 755–784.

Pesendorfer, M., & Schmidt-Dengler, P. (2008). Asymptotic least squares estimators for dynamic games. Review of Economic Studies, 75, 901–928.

Phelps, E.S., & Pollak, R.A. (1968). On second-best national saving and game-equilibrium growth. Review of Economic Studies, 35(2), 185–199.

Rossi, P., Allenby, G., McCulloch, R. (2005). Bayesian statistics and marketing, Wiley.

Rust, J. (1987). Optimal replacement of GMC bus engines: an empirical model of Harold Zurcher. Econometrica, 55(5), 999–1033.

Rust, J. (1994). Structural estimation of Markov decision processes. In R. F. Engle & D. L. McFadden (Eds.), Handbook of Econometrics (Vol. IV, pp. 3081–3143). North-Holland: Elsevier.

Song, I., & Chintagunta, P.K. (2003). A micromodel of new product adoption with heterogeneous and forward-looking consumers: application to the digital camera category. Quantitative Marketing and Economics, 1, 371–407.

Viscusi, W.K., Huber, J., Bell, J. (2008). Estimating discount rates for environmental quality from utility-based choice experiments. Journal of Risk and Uncertainty, 37, 199–220.

Yao, S., Mela, C.F., Chiang, J., Chen, Y. (2012). Determining consumers’ discount rates with field studies. Journal of Marketing Research, 49(6), 822–841.

Author information

Authors and Affiliations

Corresponding authors

Additional information

An earlier version of this paper was called “Estimating Durable Goods Adoption Decisions From Stated Choice Data.” We are grateful to Alexei Alexandrov, Eric Anderson, Steve Berry, Paul Ellickson, Phil Haile, Wes Hartmann, Dan Horsky, Eric Johnson, Don Lehmann, Carl Mela, Sanjog Misra, Harikesh Nair, Andrs Musalem, K. Sudhir, Florian Zettelmeyer and two anonymous referees for helpful comments and suggestions. We also benefited from the comments of seminar participants at Carnegie Mellon University, the Columbia Marketing Camp 2013, Duke University, the London Business School, Northwestern University, the University of Rochester, the NYU Stern School of Business, Washington University in St. Louis, the 2009 Marketing Science Conference in Ann Arbor, the 2009 Marketing Dynamics Conference in New York, the 2009 Quantitative Marketing and Economics Conference in Chicago, the 2010 Triennial Choice Symposium, and the 2011 Frank Bass UTD Forms Conference. We acknowledge the Kilts Center for Marketing and the Initiative on Global Markets at the Booth School of Business, University of Chicago for providing research funds. We also acknowledge the financial support of research grant #4-1555 from the Marketing Science Institute. The first author was also supported by the Neubauer Family Faculty Fund, and the second author was also supported by the Beatrice Foods Co. Faculty Research Fund at the Booth School of Business. All correspondence may be addressed to the authors at the Booth School of Business, University of Chicago, 5807 S Woodlawn Ave, Chicago, IL 60637; or via e-mail at jdube@chicagobooth.edu or guenter.hitsch@chicagobooth.edu.

Appendices

Appendix A: Proofs and further results

Proof of Proposition 1

The proof follows Bajari et al. (2009). Define the expected value function:

Using the definition of the expected value function, the choice-specific value functions can be written in simpler form as

Furthermore, the expected value function satisfies the recursive relationship

Recall that based on the results in Hotz and Miller (1993) and Norets and Takahashi (2013) we can obtain the choice-specific value function differences

as a function of the CCPs. □

Now re-write the expected value function:

Using Eq. 8 and the choice-specific value function differences \(\bar {v}_{j}(x)\) we can express v 0(x) in the following form (remember that u 0(x) ≡ 0):

Note that the first term on the right-hand side of the equation above is known given p(𝜖),p(x ′|x, j), and the CCPs. It is straightforward to show that Eq. 9 satisfies Blackwell’s conditions and thus defines a contraction mapping with a unique solution v 0(x). Hence, we can infer v 0(x) along with all the other choice-specific value functions:

Given the choice-specific value functions, we can calculate the expected value function and then infer the utility functions from the equation defining the choice-specific value functions:

1.1 Identification for the case of geometric discounting

Consider the specific case of geometric discounting, ρ(t) = δ t,0 < δ < 1. Assume that the planing horizon is infinite, and that the continuation value from owning product j is given by

Then the value function from adopting product j in period t is

Let u j (x) and \(u_{j}^{*}(x)\) be utility functions such that Eq. 10 holds. Choose some arbitrary number \(a\in \mathbb {R}\). Define \(\tilde {u}_{j}(x)=u_{j}(x)+\delta a/(1-\delta )\) and \(\tilde {u}_{j}^{*}(x)=u_{j}^{*}(x)-a\) . Then the value function corresponding to \(\tilde {u}_{j}(x)\) and \(\tilde {u}_{j}^{*}(x)\) is

We see that the adoption value is identical regardless of whether the present value from a usage utility intercept is received at the time of adoption or spread out over all future usage occasions. This proves the following result:

Proposition 5

Under geometric discounting and an infinite planning horizon the utility functions u j (x) and \(u_{j}^{*}(x)\) are not separately identified.

Now suppose that the planning horizon of the subject is finite, T<∞. Then ω j (x) = ω 0(x) ≡ 0. Consider a sequence x where \(x_{t}=\bar {x}\) and \(x_{s}=\tilde {x}\) for s>t. We can then infer the value

Similarly, let v j τ (x ′) be the value corresponding to a sequence x ′ where \(x^{\prime }_{\tau }=\bar {x}\) and \(x^{\prime }_{s}=\tilde {x}\) for s>τ, τ ≠ t. Then

Because δ −τ−δ −t≠0 for t ≠ τ, \(u_{j}^{*}(x)\) is identified. Identification of u j (x) then follows using the same argument used in the proof of Proposition 3. We thus see that although identification of the utility functions is not generally possible under geometric discounting, identification can be achieved if there is some prior knowledge of ω j (x) and ω 0(x), here given the finite horizon assumption.

1.2 Generalization of the identification conditions

Consider a sequences x such that \(x_{s}=\bar {x}\) for all t ≤ s ≤ t + k. Then

Similarly, define a sequence x ′ such that \(x_{s}^{\prime }=\bar {x}\) for all t ≤ s ≤ t + l, l ≠ k. Define the matrix

If A t (k, l) is invertible, then \(u_{j}(\bar {x})\) and \(u_{j}^{*}(\bar {x})\) are identified from the following system of equations:

In the case of geometric discounting

and we see that A t (k, l) is not invertible. This is expected based on the non-identification result for the case of geometric discounting (Proposition 5). In general, however, A t (k, l) will be invertible. For example consider hyperbolic discounting with (β, δ)-preferences, ρ (0) = 1 and ρ(t) = β δ t for all t ≥ 1. Then

The determinant of this matrix is given by:

Hence, if 0 < β < 1 and δ > 0, then det(A 0(1, 2)) ≠0 and A t (k, l) is invertible.

Appendix B: Survey description

In several introductory screens, we provide subjects information about the Blu-ray player and the design of the study. The objective of these screens is to educate the subjects about Blu-ray players and familiarize them with the survey design and the choice tasks they will encounter. First, we show subjects differences in picture quality when using a Blu-ray player versus a traditional DVD. We then provide an in-depth description of the Blu-ray technology. Specifically, we provide the subjects information on how the Blu-ray discs and players work, the leading manufacturers of Blu-ray technology, and similarities between a Blu-ray disc and a traditional DVD. Subjects are then shown the Blu-ray player they will have the option of choosing across different choice tasks. In the first survey, the subjects are told that they have the option of choosing a mid-high quality Blu-ray player, while in the second survey, they have a choice between a medium quality player (Samsung) and a state of the art top quality Blu-ray player (Sony).

In the subsequent screens, we provide subjects details on how to respond to the choice tasks and navigate the survey. We ask the subjects about their current Blu-ray player ownership status and test their understanding of the price (and number of titles) path over time using graphs from a typical choice task. Based on their responses, subjects are provided feedback about the graphs and the choice tasks to make sure they understand the trade-offs involved across different choices. Figures 1 and 3 show typical choice tasks in the first and second survey, respectively. In each choice task, subjects are provided with the prices (and number of titles) of the Blu-ray player(s) over four (six) periods. Subjects are told that the prices and number of titles shown are expert predictions and they should expect to see these prices in the future. Additionally, they are asked to ignore changes in prices due to inflation. Further details about the variation in prices and number of titles available across different choice tasks is present in Section 4.

Rights and permissions

About this article

Cite this article

Dubé, JP., Hitsch, G.J. & Jindal, P. The Joint identification of utility and discount functions from stated choice data: An application to durable goods adoption. Quant Mark Econ 12, 331–377 (2014). https://doi.org/10.1007/s11129-014-9149-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-014-9149-3

Keywords

- Conjoint analysis

- Diffusion models

- Durable goods adoption

- Dynamic discrete choice models

- Identification of discount factors