Abstract

This paper studies the relation between endogenous and exogenous switching costs. A firm can determine the size of endogenous switching costs, but not the size of exogenous switching costs. This paper develops a game theoretical model to investigate whether these two types of switching costs complement or substitute each other in a firm’s strategy. Our analysis uncovers a substituting relationship, i.e., the equilibrium size of endogenous switching costs should be higher in markets with lower exogenous switching costs. In the equilibrium, the endogenous switching costs cause profit losses to competing firms; the amount of profit loss decreases with the size of exogenous switching costs.

Similar content being viewed by others

Notes

Committing to a loyalty reward assumes that a firm can specify the products being purchased in each period. When a firm sells multiple products, the firm may need to devise a complex incentive system that provides a unique reward for each bundle of products purchased.

This paper focuses on the situations where δ is sufficiently large that reward τ i in Eq. (11) is positive. A very small δ implies that consumers are myopic and their current decisions ignore expected payoff in the second period. In such a case, firms’ commitments to future rewards will not affect consumer decisions in the first period. Consequently, it is optimal for the firms to charge repeat customers higher prices in the second period (i.e., a negative τ i ) to exploit switching costs. Given the focus of this paper on the use of loyalty rewards as a form of endogenous switching costs, it is necessary that consumers anticipate these future rewards and incorporate the future payoffs into their current decisions; in other words, δ should be sufficiently large.

References

Blattberg, R. C., & Neslin, S. A. (1990). Sales promotion: concepts, methods, and strategies. Prentice Hall.

Bouckaert, J., & Degryse, H. (2004). Softening competition by inducing switching in credit markets. Journal of Industrial Economics, LII(1), 27–52.

Caminal, R., & Matutes, C. (1990). Endogenous switching costs in a duopoly model. International Journal of Industrial Organization, 8, 353–373.

Chen, Y. (1997). Paying customers to switch. Journal of Economics and Management Strategy, 6, 877–897.

Chiang, A. (1984). Fundamental methods of mathematical economics, 3rd Edition. McGraw-Hill Inc.

Farrell, J., & Klemperer, P. (2007). Coordination and lock-in: Competition with switching costs and network effects. In M. Armstrong & R. H. Porter (Eds.), Handbook of industrial organization, Vol. 3 (pp. 1967–2072). North Holland: Elsevier.

Farrell, J., & Shapiro, C. (1988). Dynamic competition with switching costs. The RAND Journal of Economics, 19(1), 123–137.

Fudenberg, D., & Tirole, J. (2000). Customer poaching and brand switching. The RAND Journal of Economics, 31(4), 634–657.

Kim, B., Shi, M., & Srinivasan, K. (2001). Reward programs and tacit collusion. Marketing Science, Spring.

Klemperer, P. (1987a). The competitiveness of markets with switching costs. The RAND Journal of Economics, 18, 138–150.

Klemperer, P. (1987b). Markets with consumer switching costs. Quarterly Journal of Economics, 102, 375–394.

Klemperer, P. (1995). Competition when consumers have switching costs: An overview with applications to industrial organization, macroeconomics, and international trade. Review of Economics Studies, 62, 515–539.

Lal, R., & Bell, D. E. (2003). The impact of frequent shopper programs in grocery retailing. Quantitave Marketing and Economics, 1(2), 179–202.

Marinoso, B. G. (2001). Technological incompatibility, endogenous switching costs and lock-in. The Journal of Industrial Economics, 49, 281–298.

Pazgal, A., & Soberman, D. A. (2008). Behavior-based discrimination: Is it a winning play and if so when? Marketing Science, 27(6), 977–994.

Raju, J. S., Dhar, S. K., & Morrison, D. G. (1994). The effect of package coupons on brand choice. Marketing Science, 13(2), 145–164.

Raju, J. S., Dhar, S. K., & Morrison, D. G. (1996). The effect of package coupons on brand choice: an epilogue on profits. Marketing Science, 15(2), 192–203.

Shaffer, G., & Zhang, Z. J. (2000). Pay to switch or pay to stay: preference-based price discrimination in markets with switching costs. Journal of Economics and Management Strategy, 9(3), 397–424.

Shi, M., Chiang, J., & Rhee, B. (2006). Price competition with reduced consumer switching costs: the case of wireless number portability in cellular phone industry. Management Science, 52(1), 27–38.

Shin, J., & Sudhir, K. (2010). A customer management dilemma: When is it profitable to reward one’s own customers. Marketing Science, February.

Singh, S., Jain, D., & Krishnan, T. (2008). Customer loyalty programs: Are they profitable. Management Science, 54(6), 1205–1211.

Sjostrom, W. (2002). Liner shipping: Modeling competition and collusion. In Costas Th. Grammenos (Ed.), Handbook of maritime economics and business (pp. 307–326). London: Lloyds of London Press.

Villas-Boas, M. (1999). Dynamic competition with customer recognition. The RAND Journal of Economics, 30(4), 604–631.

Villas-Boas, M. (2004). Consumer learning, brand loyalty, and competition. Marketing Science, 23(1), 134–145.

Weizsacker, V. (1984). The costs of substitution. Econometrica, 52(5), 1085–1116.

Author information

Authors and Affiliations

Corresponding author

Additional information

The author thanks the editor, two anonymous reviewers, and seminar participants at MIT, Syracuse University, Wharton, and Marketing Science Conference for helpful suggestions on this paper. Financial support from Social Sciences and Humanities Research Council of Canada is gratefully acknowledged.

Appendices

Appendix

1.1 Second-period price competition

The firms’ second-period pricing problems are defined as follows:

where market shares are given below

Substitute (A1) and (A2) into the optimization problem, we take the first order conditions and solve the second-period prices.

Substitute the prices (A3) into the market share Eqs. (A1) and (A2), we have

Substitute (A3), (A4), and (A5) into firms’ profit functions, we obtain the equilibrium second-period profit.

Proof of Proposition 1:

-

(1).

First, from (A3), we see that a firm’s second-period price \( p_2^i \) increases with its own endogenous switching cost τ i , but is independent of competing firm’s endogenous switching cost. Second, from (A4), we see that a firm’s second-period customer retention rate (\( x_2^A \) for firm A) increases with its own (τ A ) as well as competitor’s endogenous switching cost (τ B ).

-

(2).

First, from (A4), we see that a firm’s second-period customer retention rate (\( x_2^A \) for firm A) increases with exogenous switching cost (τ 0). Second, from (A3), we see that a firm’s second-period price \( p_2^i \) increases with its exogenous switching cost τ 0 if the firm’s first-period market share \( x_1^i \) is greater than 0.5. When a firm (say, firm A) sets the second-period price, the firm balances between the need to acquire new customers (in segment \( x_1^B \)) with a low price in order to overcome these consumer’s switching costs τ 0, and the need for a high price to exploit existing customers (in segment \( x_1^A \)). The equilibrium price (for firm A) increases with exogenous switching cost (τ 0) if and only if the need to exploit the existing customers has a larger weight (when \( x_1^A \) is larger than \( x_1^B \)). Q.E.D.

First-period competition

To determine the first-period market shares, we identify the marginal consumers who are indifferent between buying from A and B.

where \( x_2^A \) and \( x_2^B \) are given by (A4) and (A5) respectively, and \( p_2^A \) and \( p_2^B \) are given by (A3). (A7) can be simplified to the following equation:

Each firm sets the first-period price and rewards to maximize its total expected profits from two periods. The problem is defined as follows:

where \( x_1^i \) is determined by (A8), 2nd-period profit \( \pi_2^i\left( {x_1^A} \right) \) is given by (A6), i = A, B. Note that we assume a firm does not discount future profit. To solve the equilibrium endogenous switching cost and first-period price, we take the first order conditions:

From (A6), we have

To solve the equilibrium first-period prices and endogenous switching costs with Eqs. (A9.1), (A9.2), (A10.1), and (A10.2), we need to obtain \( \frac{{\partial x_1^i}}{{\partial p_1^i}} \) and \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \). A common and direct approach is to solve \( x_1^A \) from Eq. (A8), H = 0, and then obtain these derivatives. However, in Eq. (A8), \( x_2^A \), \( x_2^B \), \( p_2^A \), and \( p_2^B \) are all functions of \( x_1^A \) given by (A3), (A4), and (A5). Since Eq. (A8) involves nonlinear functions of \( x_1^A \), the direct approach, which solve \( x_1^i \) from (A8) before obtaining first-period equilibrium is quite cumbersome. Instead, it is easier to obtain partial derivatives \( \frac{{\partial x_1^i}}{{\partial p_1^i}} \) and \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \) from Eq. (A8). To ensure that such an approach is valid, one needs to show that the partial derivatives \( \frac{{\partial x_1^i}}{{\partial p_1^i}} \) and \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \) from (A8) are continuous. We prove this property with implicit function theory (Chiang 1984).

Proof with implicit function theory

According to implicit function theory (Chiang 1984, page 204), to ensure that (A8) defines an implicit function \( {x_\downarrow }{1^\uparrow }i = h\left( {{p_\downarrow }{1^\uparrow }A,{p_\downarrow }{1^\uparrow }B,{\tau_\downarrow }A,{\tau_\downarrow }B} \right) \) that is continuous and has continuous partial derivatives \( \frac{{\partial x_1^i}}{{\partial p_1^i}} \) and \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \), it is sufficient to show that (a) H has continuous partial derivatives \( \frac{{\partial H}}{{\partial x_1^i}} \), \( \frac{{\partial H}}{{\partial p_1^i}} \), and \( \frac{{\partial H}}{{\partial {\tau_i}}} \), and (b) derivatives \( \frac{{\partial H}}{{\partial x_1^i}} \) can be non-zero at some points. Since H is a quadratic function of first-period shares (\( x_1^i \)), first-period prices (\( p_1^i \)), and endogenous switching costs τ i , condition (a) is clearly satisfied. To demonstrate that condition (b) is also satisfied, we examine \( \frac{{\partial H}}{{\partial x_1^A}} \).

We use (A3), (A4), and (A5) to obtain partial derivatives and substitute into above equation. After further simplification, we obtain

Thus, both conditions (a) and (b) for implicit function theory are always satisfied. Q.E.D.

Take first-order derivative on Eq. (A8) with respect to\( p_1^A \),

From Eqs. (A3), (A4), and (A5), we take first-order derivative with respect to \( p_1^A \).

Substitute (A12.1) ~ (A12.4) into (A11), we simply the expression and have

From the above equation, we can solve

Similarly, we take first-order derivative on Eq. (A8) with respect to τ A ,

Again, from Eqs. (A3), (A4), and (A5), we take first-order derivative with respect to τ A ,

Substitute (A16.1) ~ (A16.4) into Eq. (A15), we simplify the expression and have

From the above equation, we can solve

Substitute (A10.1), (A10.2), (A14), and (A18) into (A9.1) ~ (A9.2), we then apply the symmetry and have

Substitute (A19) and (A20) into (A3), (A4), and (A5), we obtain 2nd period equilibrium results.

Proof for Proposition 2

-

2.1.

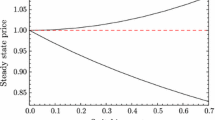

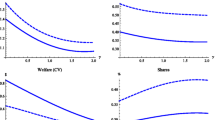

From (A19), it is clear that first-period equilibrium price \( p_1^{{i^* }} \) increases with the unit transportation cost (t) but decreases with the exogenous switching cost (τ 0).

-

2.2.

From (A20), it is clear that the equilibrium endogenous switching cost (\( \tau_i^* \)) increases with unit transportation cost (t) but decreases with the exogenous switching costs (τ 0). Q.E.D.

2.1 Validate second-order conditions

Here we validate that (A19) and (A20), which are solutions to the first-order conditions (A9.1) and (A9.2), indeed maximize respective firms’ profits. A sufficient condition is negative-definite Hessian, which requires three conditions: \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}} < 0 \), \( \frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} < 0 \), and \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}}\frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} > {\left( {\frac{{{\partial^2}{\pi^i}}}{{\partial p_1^i\partial {\tau_i}}}} \right)^2} \). Next we verify each of these three conditions. For notational convenience, we analyze firm A only. From (A9.1) and (A9.2), we have

From (A13), we can obtain following second-order derivatives,

From (A17),

Finally, from (A10.1), we take second-order derivatives, and apply symmetry,

Substitute (A14), (A26.1), and (A27.1) into (A25.1), upon simplification, we have

From (A14), we know that \( \frac{{\partial x_1^A}}{{\partial p_1^A}} < 0 \)always holds. To see if the first part of expression is always positive, we substitute equilibrium solutions and derive following condition:

which is equivalent to \( 36{t^2} + 16{\delta^3}{t^2} + 8{\delta^2}t{\tau_0} > 3{\tau_0}^2 + 2{\delta^2}{t^2} - \delta {\tau_0}t \). This condition always holds because t >τ0 and δ ≤1. Thus, \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}} < 0. \)

Substitute (A26.3) and (A27.3) into (A25.2), upon simplification, we have

Upon further simplification, we have

Since t >τ0 and t >τ *i , it is clear that \( \frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} < 0. \)

Finally, substitute (A18), (A26.2), and (A27.2) into (A25.3), upon simplification, we have

Upon further simplification, we have

To verify the third second-order condition \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}}\frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} > {\left( {\frac{{{\partial^2}{\pi^i}}}{{\partial p_1^i\partial {\tau_i}}}} \right)^2} \), we substitute simplified expressions given above. After further simplification, we reduce the condition to

To prove that the above expression is positive, we show that, first, after substituting equilibrium outcomes, the first line of expression is always positive.

Second, after substituting equilibrium outcomes, the second line of expression is also positive as

Thus, the second-order conditions are satisfied: \( \frac{{{\partial^2}{\pi^i}}}{{\partial p_1^{{i^2}}}} < 0,\;\frac{{{\partial^2}{\pi^i}}}{{\partial \tau_i^2}} < 0 \), and

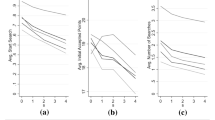

Net effect of reward on second-period equilibrium profit

A firm’s second-period equilibrium profit given by (A6) depends on the firm’s endogenous switching cost in two ways. First, the second-period profit (\( {\pi_\downarrow }{2^\uparrow }i \)) can decrease with τi because, given all others the same, the profit is lower when the cost of reward is higher. Second, the second-period profit (\( {\pi_2^i }\)) can increase with τi because, given all others the same, profit increase with the first-period market share (\( x_1^i \)), which is higher when the firm offers more reward. To examine the net effects, we take first-order derivative on \( \pi_2^i \) given by (A6) and evaluate it at symmetric outcome (\( x_1^{{i^* }} = {{1} \left/ {2} \right.} \)).

Substitute \( \frac{{\partial x_1^i}}{{\partial {\tau_i}}} \) with Eq. (A18), and further simplify the results with equilibrium reward (A20), we have

Since M <1/(2t) and t >τ 0 , clearly the net effect \( \frac{{\partial \pi_2^i\left( {{\tau_i},x_1^i} \right)}}{{\partial {\tau_i}}} < 0 \). Thus, the negative effect of reward cost overweighs the positive effect from a higher market share.

Case 1 for comparison: no endogenous switching costs

As the benchmark case, we derive equilibrium outcomes without endogenous switching costs by imposing τ A = τ B = 0 in the first order conditions. We denote this case by “o”.

4.1 Equilibrium properties

Since δτ 0 <t, from (A28) it is clear that \( p_1^{io} < t = p_2^{io} \). Since the equilibrium price with any switching costs is equal to t, exogenous switching costs decrease first-period price.

Now compare (A28) with (A19), we have

if and only if \( \left( {{2}\delta {\mathrm{t}} + {3}{\tau_{\mathrm{o}}}} \right)\left( {\delta {\mathrm{t}} - {\tau_{\mathrm{o}}}} \right) > 0 \), which is always satisfied because δt - τo >0 as assumed. Thus, endogenous switching costs increase first-period price.

Now compare the equilibrium prices in two periods, (A19) and (A21)

if and only if \( {\delta^{2}}\left( {\delta {\mathrm{t}} - {\tau_{\mathrm{o}}}} \right) > {3}\left( {\delta {\mathrm{t}} + {\tau_{\mathrm{o}}}} \right)\left( {{1} - {\delta^{2}}} \right) \), which will be satisfied with δ is sufficiently close to 1.

We now compute and compare the equilibrium profits,

which can be simplified to \( \delta \left( {{2}\delta t + {3}{\tau_{\mathrm{o}}}} \right)\left( {\delta {\mathrm{t}} - {\tau_{\mathrm{o}}}} \right) < {3}\left( {{2}\delta {\mathrm{t}} + {\tau_{\mathrm{o}}}} \right)\left( {\delta {\mathrm{t}} - {\tau_{\mathrm{o}}}} \right) \). Clearly, this condition is always satisfied. Thus, equilibrium profit decreases with endogenous switching costs; the larger the loyalty rewards, the greater the loss.

Case 2 for comparison: traditional BBPD

Consider a traditional BBPD model like Chen (1997). In the second period, each firm sets two prices, one for new customers (denoted by \( p_{2,n}^i \) for firm i), another for returning customers (denoted by \( p_{2,r}^i \) for firm A).

5.1 Second-period price competition

The firms’ second-period pricing problems are defined as follows:

where market shares are given below

Substitute (A33) and (A34) into the optimization problem, we take the first order conditions and solve the second-period prices.

Equation (35) shows that, first, endogenous switching cost is perfectly covered in second-period price for returning customers. Thus, under traditional BBPD, endogenous switching cost becomes a meaningless device. Second, the net price for returning customers (\( p_{2,r}^i - {\tau_i} = t + {\tau_0}/3 \)) is always higher than the price for new customers (\( p_{2,n}^i = t - {\tau_0}/3 \)). The difference between two prices (2τ 0 /3) increases with the size of exogenous switching cost. Substitute the prices (A35) and (A36) into the market share Eqs. (A33) and (A34), we have

We can then obtain the equilibrium second-period profit.

5.2 First-period competition

To determine the first-period market shares, we identify the marginal consumers who are indifferent from buying from A and B.

where \( x_2^A \) and \( x_2^B \) are given by (A37) and (A38) respectively, and second-period prices are given by (A35) and (A36). After simplification, from (A40) we have

Equation (A41) is very different from the model without price discrimination. This simplified outcome is essentially due to two observations discussed briefly after (A39).

Each firm sets the first-period price to maximize its total expected profits from two periods. Since τi is a meaningless device, we no long include it as a decision variable.

where \( x_1^i \) is determined by (A41), 2nd-period profit \( \pi_2^i\left( {x_1^A} \right) \) is given by (A39), i = A, B. To solve the equilibrium first-period price, we take the first order conditions:

Submitting (A41) and (A39), we have

Total equilibrium profits:

Rights and permissions

About this article

Cite this article

Shi, M. A theoretical analysis of endogenous and exogenous switching costs. Quant Mark Econ 11, 205–230 (2013). https://doi.org/10.1007/s11129-012-9129-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11129-012-9129-4