Abstract

We propose a method for mutual fund performance measurement and best-practice benchmarking, which endogenously identifies a dominating benchmark portfolio for each evaluated mutual fund. Dominating benchmarks provide information about efficiency improvement potential as well as portfolio strategies for achieving them. Portfolio diversification possibilities are accounts for by using Data Envelopment Analysis (DEA). Portfolio risk is accounted for in terms of the full return distribution by utilizing Stochastic Dominance (SD) criteria. The approach is illustrated by an application to US based environmentally responsible mutual funds.

Similar content being viewed by others

Notes

A parallel interpretation of the alpha intercept of the regression as a managerial performance measure is also well known in the context of production frontier estimation with panel data; see e.g., Schmidt and Sickles (1984).

Fama and French showed empirically that these three factors (beta, market capitalization, and book-to-market ratio) explain about 95% of the variability of stock market returns.

DEA has also been applied to mutual fund performance assessment by Murthi et al. (1997), Morey and Morey (1999), and Basso and Funari (2001, 2003), among others. The present approach differs substantially from these earlier weighting approaches by presenting a systematic efficiency measurement framework with a sound theoretical foundation.

In empirical studies, states of nature are usually interpreted as certain observed time-periods such as years or months, but they could equally well represent some hypothetical condition (e.g., bull vs. bear market).

The model could be enriched by additional features such as transaction costs, minimum investment requirement, or fund manager’s experience (compare with Murthi et al. 1997; and Basso and Funari 2001, 2003). These variables could be modeled as inputs or environmental factors in the spirit of traditional DEA.

While conventional DEA models always diagnose some DMUs as efficient by default, this is not the case in the present setting.

Absolute dominance is particularly prominent in the Free Disposable Hull (FDH) model.

Briec et al. (2004) introduced the directional distance functions to the financial performance assessment in the classic Mean-Variance framework.

The discontinuity of the FSD measure can be illustrated by the following numerical example. Let N = 3, S = 2, \({\mathbf{R}=\left({\begin{array}{lll} 1& 1.5& 3 \\ 4& 1& {2.5} \end{array}} \right)},\) and \({\Lambda =\left\{ \varvec{\lambda}\in {{\mathbb{R}}}_{+}^{{\mathfrak{N}}}\vert \mathbf{1}^{\mathbf{\prime}}\lambda =1 \right\}}.\) Consider mutual fund \({\mathbf{r}_{0}=\left( \begin{array}{l} 2 \\ {3+\varepsilon }\\ \end{array} \right)}.\) Starting with the value ɛ = 0, we obtain the efficiency score \({{\hbox{PK}}^{\rm FSD}(\mathbf{r}_{0})=0.5}\) with \({\varvec{\lambda}^{\ast}=\left(\begin{array}{lll} 0& 0& 1\\ \end{array} \right)^{\prime }}.\) However, an infinitesimal increase in the value of ɛ will change the efficiency score discontinuously to \({{\hbox{PK}}^{\rm FSD}(\mathbf{r}_{0})=\frac{1}{3}-\frac{4}{3}\varepsilon }\) with \({\varvec{\lambda}^{\ast}=\left(\begin{array}{lll} {\frac{1+2\varepsilon}{3}}& 0& {\frac{2-2\varepsilon}{3}}\\ \end{array} \right)^{\prime}}\) . [The author thanks an anonymous referee for this example.]

In fact, by enumerating all possible permutation matrices, we could express the FSD efficiency measure (4) as an enormously large linear programming problem. However, the “brute-force” strategy of considering all possible permutations becomes highly expensive for almost any non-trivial number of states (e.g., if S = 100, the number of permutations is 100! = 100·99·...·2·1≈9.33· 10157). It is therefore advisable to use modern integer programming algorithms (such as branch-and-bound) for solving problem (4).

Properties of the directional distance function in the AD case have been examined in more detail by Chambers et al. (1998).

For example, let N = 2, S = 2, \({\mathbf{R}=\left( {\begin{array}{ll} 2& 7 \\ 5& 1 \end{array}} \right)},\) and \({\Lambda =\left\{{\varvec{\lambda}\in \mathfrak{R}_+^{\mathfrak{N}}\vert\mathbf{1}^{\mathbf{\prime}}\varvec{\lambda}=1} \right\}}.\) Consider mutual fund \({{\rm {\bf r}}_0 =\left({\begin{array}{ll} 2& 5 \end{array} } \right)^{\prime }}.\) Post’s dual measure (12) will identify vector \({\left({\begin{array}{ll} 7& 1 \end{array} } \right)^{\prime}}\) as the reference portfolio, i.e., \({\varvec{\lambda}^{\ast}={\hbox{arg max}} \psi (\tau)=\left({\begin{array}{ll} 0& 1 \end{array} } \right)^{\prime}};\) note that 7 > 2, and 7 + 1 > 2 + 5. However, it is easy to verify that vector \({\left({\begin{array}{ll} 7& 1 \end{array} } \right)^{\prime }}\) does not dominate the evaluated mutual fund by SSD since 2 > 1.

DJSI is one of the most standard benchmarks for the green mutual funds. The components of this index represent the top 20% of the leading sustainability companies in each industry group within the DJSI STOXX investable universe. For further details, see http://www.sustainability-index.com/.

Similarly, Kuosmanen (2004) found no difference between the FSD and SSD efficiency measures calculated for the marker portfolio.

A parallel example from the usual DEA settings: the assumption of constant returns to scale does not influence the efficiency measures when the evaluated firm operates on the most productive scale size.

References

Andersen P, Petersen NC (1993) A procedure for ranking efficient units in data envelopment analysis. Manage Sci 39:1261–1264

Ansell J, Moles P, Smart A (2003) Does benchmarking help? Int Trans Oper Res 10:339–350

Bailey JV (1992) Are manager universes acceptable performance benchmarks? J Portf Manage 8(3):9–13

Banker RD, Charnes A, Cooper WW (1984) Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manage Sci 30(9):1078–1092

Basso A, Funari S (2001) A data envelopment analysis approach to measure the mutual fund performance. Euro J Oper Res 135:477–492

Basso A, Funari S (2003) Measuring the performance of ethical mutual funds: a DEA approach. J Oper Res Soc 54(5):521–531

Bawa VS, Lindenberg E, Rafsky L (1979) An algorithm to determine stochastic dominance admissible sets. Manage Sci 25(7):609–622

Berger AN, Humphrey DB (1997) Efficiency of financial institutions: international survey and directions for future research. Euro J Oper Res 98:175–212

Berk JB (2000) Sorting out sorts. J Finance 55(1):407–427

Black F, Jensen MC, Scholes M (1972) The capital asset pricing model: some empirical tests. In: Jensen MC (ed) Studies in the theory of capital markets. Praeger Publishers, New York

Bogetoft P (1997) DEA-based Yardstick competition: the optimality of best practice regulation. Ann Oper Res 73:277–298

Briec W, Kerstens K, Lesourd J-B (2004) Nonparametric tests of portfolio investment efficiency: a shortage function generalization. J Optim Theory Appl 120(1):1–27

Brown G, Davies D, Draper P (1992) Pension fund trustees and performance measurement. Manage Acc 4:38–44

Chambers RG, Chung Y, Färe R (1998) Profit, directional distance functions, and nerlovian efficiency. J Optim Theory Appl 98(2):351–364

Charnes A, Cooper WW, Golany B, Seiford L, Stutz J (1985) Foundations of data envelopment analysis for Pareto-Koopmans efficient empirical production frontiers. J Econom 30(1–2):91–107

Charnes A, Cooper W, Rhodes E (1978) Measuring the efficiency of decision making units. Euro J Oper Res 2(6):429 – 444

Clarke BE, Ryan AW (1994) Proper overseas benchmark: a critical choice. Pensions Invest 22:28–29

Fama EF, French KR (1992) The cross-section of expected stock returns. J Finance 47:427–465

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33:3–56

Farrell MJ (1957) The measurement of productive efficiency. J Stat Soc Ser A Gen 120 (3):253–259

Fishburn PC (1964) Decision and value theory. John Wiley & Sons, New York

Heikkinen V-P, Kuosmanen T (2003) Stochastic dominance portfolio analysis of forestry assets, chapter 14. In: Wesseler J, Weikard H-P, Weaver R (eds) Risk and uncertainty in environmental and natural resource economics. Edward Elgar, Cheltenham

Jensen MC (1967) The performance of mutual funds in the period 1945–1964. J Finance 23(2):389–416

Kuosmanen T (2001) Stochastic dominance efficiency tests under diversification. Working Paper W-283, Helsinki School of Economics and Business Administration, Helsinki

Kuosmanen T (2004) Efficient diversification according to stochastic dominance criteria. Manage Sci 50(10):1390–1406

Levy H (1992) Stochastic dominance and expected utility: survey and analysis. Manage Sci 38(4):555–593

Levy H (1998) Stochastic dominance: investment decision making under uncertainty. Kluwer Academic Publishers, Boston

Morey MR, Morey RC (1999) Mutual fund performance appraisals: a multi-horizon perspective with endogenous benchmarking. Omega 27(2):241–258

Murthi BPS, Choi YK, Desai P (1997) Efficiency of mutual funds and portfolio performance measurement. Euro J Oper Res 98:408–418

Nelson RD, Pope R (1991) Bootstrapping insights into empirical applications of stochastic dominance. Manage Sci 37:1182–1194

Post GT (2003) Empirical tests for stochastic dominance efficiency. J Finance 58(5):1905–1931

Quirk J, Saposnik R (1962) Admissibility and measurable utility functions. Rev Econ Stud 29:140–146

Roll R (1978) Ambiguity when performance is measured by the security market line. J Finance 33:1051–1069

Rothschild M, Stiglitz JE (1970) Increasing Risk I: a definition. J Econ Theory 2:225–243

Scheel H, Scholtes S (2003) Continuity of DEA efficiency measures. Oper Res 51(1):149–159

Schmidt P, Sickles RC (1984) Production frontiers and panel data. J Bus Econ Stat 4:367–374

Schueth S (2003) Socially responsible investing in the United States. J Bus Ethics 43:189–194

Simar L, Wilson PW (2000) Statistical inference in nonparametric frontier models: the state of the art. J Prod Anal 13:49–78

Thor CG (1996) Let’s clear up some confusion about benchmarking. J Qual Participat 19(4):88–90

Varian H (1983) Non-parametric tests of models of investor behavior. J Financ Quant Anal 18:269–278

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper has benefited of helpful comments from Thierry Post, two anonymous reviewers, and participants in the CEMMAP workshop “Testing Stochastic Dominance Restrictions”, November 2005, London UK; 4th International DEA Symposium, September 2004, Birmingham UK; the VIII European Workshop of Efficiency and Productivity Analysis, September 2003, Oviedo, Spain; and the EURO/INFORMS joint international meeting, July 2003, Istanbul, Turkey. The usual disclaimer applies.

Appendix: Why imposing risk aversion by assumption does not influence the efficiency measure when the evaluated portfolio has relatively low risk

Appendix: Why imposing risk aversion by assumption does not influence the efficiency measure when the evaluated portfolio has relatively low risk

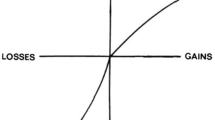

In Sect. 4 we found that all eight environmentally responsible mutual funds scored equally well in terms of FSD and SSD efficiency. The aim of this appendix is to try to rationalize this finding by means of a stylized graphical example.

Figure A presents a two-dimensional case where state 1 represents a bear market and state 2 a bull market. A risk-free asset is displayed in the bottom-right corner of the diagram; the broken diagonal line that runs through the risk free asset indicates vectors that yield equal return in both states. Volatile reference stocks are typically found in the top-left corner of the diagram, where return is negative in state 1, and highly positive in state 2. The evaluated mutual fund lies somewhere between the benchmark stock and the risk-free asset, within the return possibility set; this set is indicated by the thick solid piece-wise linear frontier with vertices in the risk-free asset and the reference stocks. The set of return vectors that dominate the evaluated fund by SSD (i.e., “the SSD dominating set”, see Kuosmanen 2004) is indicated by the thin piece-wise linear isoquant that runs through the evaluated fund. This dominating set overlaps with the return possibilities set, and thus fund 0 is SSD inefficient.

Note that the mean return of the reference stocks must typically be higher than the return of the risk-free asset, to compensate for the higher risk. Thus, the slope of the return possibilities frontier must generally be steeper than that of diagonal line-segment of the SSD dominating set, like in Fig. 1. Recall that the PK measure selects the benchmark portfolio from the intersection of the return possibility set and the SSD dominating set by maximizing the difference in mean return between the benchmark portfolio and the evaluated fund. In this example, the benchmark portfolio will be found directly above the point representing the return vector of the mutual fund 0, as indicated in Fig. A. Note that this benchmark is also included in the FSD dominating set. Thus, exactly the same benchmark is obtained by using the FSD criterion. (A similar argument holds for the DD measure.)

Although this stylized example involves only two states, it does describe some essential features of the phenomenon at hand. Also in the general setting with S states of nature, the maximum mean return over the intersection of the return possibility set and the SSD dominating set is usually found in the corner point where the boundaries of the return possibility set and the SSD dominating set intersect. The FSD and SSD measures will differ when there exists an asset that offers a high mean return with a low risk, or if the evaluated mutual fund itself is highly risky. Given the usual geometry of the return possibilities sets, the FSD and SSD measures are likely to yield the same results in the efficiency assessment of the mutual funds and other well-diversified portfolios such as the market portfolio.

Rights and permissions

About this article

Cite this article

Kuosmanen, T. Performance measurement and best-practice benchmarking of mutual funds: combining stochastic dominance criteria with data envelopment analysis. J Prod Anal 28, 71–86 (2007). https://doi.org/10.1007/s11123-007-0045-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-007-0045-7