Abstract

This paper explores the macroeconomic and distributional consequences of consumption tariffs and materials tariffs. It highlights the contrasting effects of consumption and raw materials tariffs on the dynamics of key measures of aggregate economic activity and inequality. We perform empirical estimation of these effects using a panel of annual data that spans the U.S. states over the period 1980–2015. We find that consumption tariff increases lead to statistically significant reductions in income inequality, while having contractionary effects on domestic output in the short term. Materials tariff increases also have a negative impact on economic activity while increasing income inequality. Our empirical results are robust to different model specifications and measures of income inequality, consistent with the predictions of the underlying theoretical model. This work shows the importance of disaggregating tariffs when studying the distributional effects of trade policy.

Similar content being viewed by others

Notes

See Heathcote et al. (2009).

We are unable to test the impact of tariffs on wealth inequality effects because of data paucity.

A detailed discussions of related literature is provided in the working paper version of Turnovsky and Rojas-Vallejos (2018) available at https://econ.washington.edu/sites/econ/files/documents/research/turnovsky-rojas-final_version_05-18.pdf.

Since the purpose of the formal model is primarily to help interpret the empirical results, it is intentionally simple. Turnovsky and Rojas-Vallejos (2018) introduce imported capital, also subject to a tariff, and international capital flows, enabling the country to accumulate debt. Their analysis employs extensive numerical simulations, focusing on the transitional dynamics of the aggregate and distributional measures following reductions in the tariffs.

These initial endowments can be perfectly arbitrary and therefore consistent with any required non-negativity constraints. As will become clear from the solutions developed, the forms of the distribution of the initial endowments will be reflected in the evolving equilibrium distributions of wealth and income.

The expressions in (8a) and (8b) assume that τc remains constant over time. If the tariff is adjusted gradually, then we would also need to take account of its time path, as reflected by \( {\dot{\tau}}_c(t) \). Elsewhere we have shown that the transitional path over which tariffs (or other structural changes) are adjusted has implications for the long-run distributions of wealth and inequality; see e.g. Atolia et al. (2012), Turnovsky and Rojas-Vallejos (2018). Since the focus of our analysis is on the empirical evidence, we do pursue this aspect, although one should keep it in mind when interpreting our empirical findings.

While this issue is not of particular concern for our empirical study, agent i’s constant relative consumption ϕi can be obtained once his relative capital stock is determined; see Turnovsky and García-Peñalosa (2008) for an example of this.

Like all lump-sum transfer schemes, we assume that individual agents are unaware of the rule adopted by the government. An alternative procedure would be to introduce debt financing along the transitional path, but given perfect markets, Ricardian Equivalence implies that this is essentially equivalent to what we are doing. The one difference is that the relative capital stock discussed in Section 3.1 is replaced by relative wealth (capital plus government bonds). But results are essentially identical to those we obtain.

For more of the details see Turnovsky and García-Peñalosa (2008). We have also considered an alternative lump-sum transfer rule Ti = T, with very small differences in results from those we are reporting here.

Note that \( \tilde{K},\tilde{l},\tilde{L} \) are determined by equations (15) and (16). Given these aggregate quantities, the remaining two variables, \( {\tilde{k}}_i,{\tilde{l}}_i \) are determined by (19) together with (21) below, and depend upon the agent’s initial relative stock of capital.

With the return to capital being specified by r(t), this measure of relative income is net of depreciation.

It is important to point out that wealth inequality evolves only during the transition of L(t). In the event that L(t) jumps instantaneously to steady state, ω(t) ≡ 1 and wealth inequality remains unchanged, σk(t) = σk, 0.

We are assuming here that φ > 0, which holds in most plausible circumstances, although it can also be violated. This issue is discussed in a general context by Turnovsky (2020).

Details on computation of the tariff rate data are described in Jaumotte et al. (2013).

The weak principle of transfers states that any reallocation of income will be associated with a change in overall inequality, while the non-decomposable property states that each subgroup in the population may experience an increase in inequality, but overall inequality decreases.

Fixed effects are preferred to random effects in the model specification due to the nature of the problem and also because the Hausman test strongly suggests the former over the latter.

We use this standardization to refer to sensical changes in the variable of interest. For a roughly normal dataset, the values within one standard deviation of the mean account for about 68% of the data.

These estimates are computed using xtabond2 by Roodman (2009).

References

Adermon A, Lindahl M, Waldenström D (2018) Intergenerational wealth mobility and the role of inheritance: Evidence from multiple generations. Economic Journal 128:F482–F513

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies 58:277–297

Arellano, M., and Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. J Econ 68, 29–51

Atkinson AB (1970) On the measurement of inequality. J Econ Theory 2:244–263

Atkinson AB (2018) Wealth and inheritance in Britain from 1896 to the present. J Econ Inequal 16:137–169

Atolia M, Chatterjee S, Turnovsky SJ (2012) Growth and inequality: Dependence on the time path of productivity increases (anssd other structural changes). J Econ Dyn Control 36:331–348

Bahmani-Oskooee, M., and Hasanzade, M. (2020). Asymmetric link between U.S. tariff policy and income distribution: evidence from state level data. Open Economies Review. https://doi.org/10.1007/s11079-020-09584-5

Bloome D (2014) Racial inequality trends and the intergenerational persistence of income and family structure. Am Sociol Rev 79:1196–1225

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87:115–143

Braun D (1988) Multiple measurements of U.S. income inequality. Rev Econ Stat 70:398–405

Brecher RA, Findlay R (1983) Tariffs, foreign capital and national welfare with sector-specific factors. J Int Econ 14:277–288

Bureau of Economic Analysis. (2019). BEA Data Online. https://www.bea.gov/data

Caselli F, Ventura J (2000) A representative consumer theory of distribution. Am Econ Rev 90:909–926

Chase KA (2005) Trading blocs: states, firms, and regions in the world economy. University of Michigan Press, Ann Arbor

Cowell FA (2011) Measuring inequality. Oxford University Press, Oxford

Deininger K, Squire L (1996) A new data set measuring income inequality. World Bank Econ Rev 10:565–591

Durlauf SN (1996) A theory of persistent income inequality. J Econ Growth 1:75–93

Estevadeordal A, Taylor AM (2013) Is the Washington consensus dead? Growth, openness, and the great liberalization, 1970s-2000s. Rev Econ Stat 95:1669–1690

Frank MW (2009) Inequality and growth in the United States: Evidence from a new state-level panel of income inequality measures. Econ Inq 47:55–68

Frank MW (2014) A new state-level panel of annual inequality measures over the period 1916-2005. J Bus Strateg 31:241–263

Frankema E (2010) The colonial roots of land inequality: Geography, factor endowments, or institutions? Economic History Review 63:418–451

Gorman WM (1959) Separable utility and aggregation. Econometrica 27:469–481

Hansen LP, Heaton J, Yaron A (1996) Finite sample properties of some alternative GMM estimators. J Bus Econ Stat 14:262–280

Heathcote J, Storesletten K, Violante GL (2009) Quantitative macroeconomics with heterogeneous households. Annual Review of Economics 1:319–354

International Monetary Fund. (2019). World Economic Outlook (WEO) Online. https://www.imf.org/en/Data

Irwin DA (2019) Tariff incidence: Evidence from U.S. sugar duties, 1890-1914. Natl Tax J 72:599–616

Jaumotte F, Lall S, Papageorgiou C (2013) Rising income inequality: Technology, or trade and financial globalization? IMF Economic Review 61:271–309

Katsimi M, Moutos T (2010) EMU and the Greek crisis: The political economy perspective. Eur J Polit Econ 26:568–576

Kleibergen F, Paap R (2006) Generalized reduced rank tests using the singular value decomposition. J Econ 133:97–126

Mahadevan R, Nugroho A, Amir H (2017) Do inward looking trade policies affect poverty and income inequality? Evidence from Indonesia’s recent wave of rising protectionism. Econ Model 62:23–34

Nickell S (1981) Biases in dynamic models with fixed effects. Econometrica 49:1417–1426

Nishi A, Shirado H, Rand DG, Christakis NA (2015) Inequality and visibility of wealth in experimental social networks. Nature 526:426–429

Osang T, Turnovsky SJ (2000) Differential tariffs, growth, and welfare in a small open economy. J Dev Econ 62:315–342

Partridge MD (2005) Does income distribution affect U.S. state economic growth? J Reg Sci 45:363–394

Piketty T (2011) On the long-run evolution of inheritance: France 1820-2050. Q J Econ 126:1071–1131

Rojas-Vallejos J, Lastuka A (2020) The income inequality and carbon emissions trade-off revisited. Energy Policy 139:111302

Roodman D (2009) How to do xtabond2: An introduction to difference and system GMM in Stata. Stata J 9(1):86–136

Shorrocks AF (1980) The class of additively decomposable inequality measures. Econometrica 48(3):613–625

Smeeding T, Latner JP (2015) PovcalNet, WDI and ‘all the Ginis’: A critical review. J Econ Inequal 13:603–628

Theil H (1967) Economics and information theory. North-Holland, Amsterdam

Turnovsky SJ (2020) Economic growth and income inequality: insights from the representative consumer theory of distribution. In: Diamond JW, Zodrow G (eds) Prospects for economic growth in the United States. Cambridge University Press, NY

Turnovsky SJ, García-Peñalosa C (2008) Distributional dynamics in a neoclassical growth model: The role of elastic labor supply. J Econ Dyn Control 32:1399–1431

Turnovsky SJ, Rojas-Vallejos J (2018) The distributional consequences of trade liberalization: Consumption tariff versus investment tariff reduction. J Dev Econ 134:392–415

United States International Trade Commission. (2020). U.S. imports for consumption, duties collected, and ratio of duties to value, 1891-2018. Online: https://www.usitc.gov/documents/dataweb/ave_table_1891_2018.pdf

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econ 126:25–51

World Bank Group. (2019). World Development Indicators (WDI) Online. https://databank.worldbank.org/source/world-development-indicators

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1 provides some of the details supporting the results reported in the text

1.1 Properties of transitional matrix

The local transitional dynamics of the aggregate economy summarized by Eqs. (12a)-(12c) is of the form:

where \( {\displaystyle \begin{array}{l}{a}_{11}={F}_K-\delta -\lambda {F}_{LK}\left(1-L\right)-\lambda {F}_{Lm}\left(1-L\right){m}_K+\left({F}_m-1\right){m}_K;\\ {}{a}_{12}={F}_L-\lambda \left[{F}_{LL}\left(1-L\right)-{F}_L\right]-\lambda {F}_{Lm}\left(1-L\right){m}_L+\left({F}_m-1\right){m}_L\end{array}} \)

and for notational convenience, λ ≡ (1 + τcθ)/[η(1 + τc)]. Using the fact that the underlying production function is Cobb-Douglas, the relevant partial derivatives may be expressed as

Substituting these expressions and using the steady-state relationships (15b)-(15d), the expressions may be simplified as follows:

We immediately see that the determinant of the transitional matrix: Ω(a11b2 − a21b1) < 0, implying that the aggregate transitional dynamic path, summarized by the relationship between L(t) and K(t) is a saddlepoint, the stable path of which is described by

With a12 > 0, the slope of the relationship (36) depends upon sgn(μ − a11). To determine this we first solve for the stable eigenvalue, μ < 0, in terms of its trace, T, and its determinant, Δ: \( \mu =\frac{1}{2}\left(T-\sqrt{T^2-4\Delta}\right) \)

Using this expression it is straightforward to show that μ − a11 < 0 if and only if (κa11 + b1) > 0. Using the above to evaluate this expression, we see that

where ε ≡ (1 − γ)−1 is the intertemporal elasticity of substitution. Clearly (37) is a very mild restriction.

1.2 Long-run Effects of Tariff Rates

To derive the long-run effects of tariffs rates we take the differentials of (15):

In the case of the consumption tariff, the following expressions (^ denotes proportionate changes) are obtained:

Applying these changes to (16), we show further

The corresponding effects of the tariff on imported inputs are:

From these one can derive:

1.3 Derivation of condition (17)

Recalling steady-state condition (15b) and using the homogeneity of the production function, we obtain

Using the equilibrium optimality conditions (15c) and (15d) then yields

Which we may then rewrite as

from which we immediately infer the restrictions

Appendix 2

1.1 Data

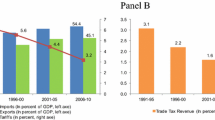

Tariffs. The tariff rate data provided by the WDI correspond to the weighted mean applied tariff of effectively applied rates weighted by the product import shares corresponding to each partner country. This estimate is computed using data classified according to the Harmonized System of trade at the six- or eight-digit level. The IMF computes data on tariff by means of the average of the effective rate (ratio of tariff revenue to import value) and of the average unweighted tariff rates. From the USITC, we obtain a tariff rate on consumption that is computed as the ratio of duties collected to total imports.

Inequality. This measure is constructed for the U.S. as well as for each state by Mark W. Frank and extended beyond his own study and is publicly available from his website at: http://www.shsu.edu/eco_mwf/inequality.html Frank constructs the Gini coefficient from tax data reported in Statistics of Income published by the Internal Revenue Service (IRS). For the construction method, see Frank (2009).

Macroeconomic variables. Other variables are retrieved from the Bureau of Economic Analysis (BEA).

Rights and permissions

About this article

Cite this article

Rojas-Vallejos, J., Turnovsky, S.J. Differential Tariffs and Income Inequality in the United States: Some Evidence from the States. Open Econ Rev 32, 1–35 (2021). https://doi.org/10.1007/s11079-020-09592-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-020-09592-5