Abstract

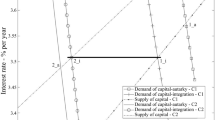

Recent literature has proposed two alternative types of financial frictions, i.e., limited commitment and incomplete markets, to explain the empirical patterns of international capital flows between developed and developing countries in the past two decades. This paper integrates these two frictions into a two-country overlapping-generations framework to facilitate a direct comparison of their respective effects. In our model, limited commitment distorts the investment made by agents with different productivity, which creates a wedge between the interest rates on equity capital vs. credit capital; while incomplete markets distort the investment among projects with different riskiness, which creates a wedge between the risk-free rate and the mean rate of return to risky capital. We show that the two approaches are observationally equivalent with respect to their implications for international capital flows, production efficiency, and aggregate output.

Similar content being viewed by others

Notes

Another line of research focuses on the risk-sharing investors can achieve by diversifying their portfolios globally (Devereux and Sutherland 2009; Tille and van Wincoop 2008, 2010). These models can explain “uphill” capital flows, but they fail to distinguish between financial capital and FDI flows.

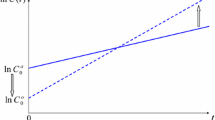

For the analytical tractability, we implicitly set the elasticity of intertemporal substitution at unity. With this preference function, we can distinguish between the coefficient of relative risk aversion and the elasticity of intertemporal substitution, which is useful in our numerical exercise in Section 4. By setting γ = 1, we revert to the conventional preference function where CRRA is equal to the inverse of EIS, \(U^{i,j}_t=(1-\beta )\ln c^{i,j}_{y,t}+\beta E_{t}\ln c^{i,j}_{o,t+1}\). Our analytical results in Sections 2 and 3 are unaffected. See Selden (1978) and Kocherlakota (1990) for further discussion on this preference function.

See Subsection 2.2 for a formal proof.

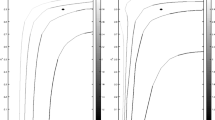

The value of γ is set around 10 in the macro-finance literature to generate plausible risk premia. Angeletos and Panousi (2011) choose σ = 0. 5 in their numerical exercise, consistent with the preferred value in Bitler et al. (2005) and Moskowitz and Vissing-Jørgensen (2002). In order to check how tight the condition in Proposition 2.3 is, we choose the upper bounds of these parameters as γ = 15 and σ = 1. Given λ i ∈ [0, 1], as long as the population share of entrepreneurs is η ≤ 0. 2, this condition holds.

Matsuyama (2004) shows in an alternative setting that financial integration may lead to multiple steady states and hence, countries with identical fundamentals except for the initial income level may end up with different incomes in the long run. Matsuyama (2004) calls it symmetry breaking. As proved explicitly in Zhang (2013a), Matsuymas symmetry breaking arises critically from his assumptions of financial frictions and minimum investment size requirement, while financial integration does not lead to symmetry breaking in the current setting, due to the absence of minimum investment size requirement. The technical proof is in the Appendix.

See von Hagen and Zhang (2014) for a detailed welfare analysis of full capital mobility.

Jermann and Quadrini (2012) show that a tightening of firm’s financing conditions contributed to the 2008–2009 recession.

Although output in country N declines more dramatically to financial crisis in percentage points under financial integration than under IFA, aggregate output in country N is always higher under financial integration than under IFA, thanks to net capital inflows.

References

Angeletos G-M (2007) Uninsured idiosyncratic investment risk and aggregate saving. Rev Econ Dyn 10(1):1–30

Angeletos G-M, Panousi V (2011) Financial integration, entrepreneurial risk and global dynamics. J Econ Theory 146(3):863–896

Antras P, Caballero R (2009) Trade and capital flows: a financial frictions perspective. J Polit Econ 117(4):701–744

Antras P, Desai M, Foley F (2009) Multinational firms, FDI flows and imperfect capital markets. Q J Econ 124(3):1171–1219

Aoki K, Benigno G, Kiyotaki N (2009) Capital flows and asset prices. In: Clarida R, Giavazzi F (eds) International seminar on macroeconomics 2007. NBER, The University of Chicago Press

Bitler MP, Moskowitz TJ, Vissing-Jørgensen A (2005) Testing agency theory with entrepreneur effort and wealth. J Financ 60(2):539–576

Buera FJ, Shin Y (2010) Productivity growth and capital flows: the dynamics of reforms. Working Paper

Caballero R, Farhi E, Gourinchas P-O (2008) An equilibrium model of ”Global Imbalances” and low interest rates. Am Econ Rev 98(1):358–93

Carroll CD, Jeanne O (2011) A tractable model of precautionary reserves, net foreign assets, or sovereign wealth funds. NBER Working Paper No. 15228

Devereux MB, Sutherland A (2009) A portfolio model of capital flows to emerging markets. J Dev Econ 89(2):181–193

Gourinchas P-O, Jeanne O (2013) Capital flows to developing countries: the allocation puzzle. In: Rev Econ Stud, forthcoming

Hausmann R, Sturzenegger F (2007) The missing dark matter in the wealth of nations and its implications for global imbalances. Econ Policy 22(51):469–518

Higgins M, Klitgaard T, Tille C (2007) Borrowing without debt? Understanding the US international investment position. Bus Econ 42(1):17

Jermann UJ, Quadrini V (2012) Macroeconomic effects of financial shocks. Am Econ Rev 102(1):238–71

Ju J, Wei S-J (2010) Domestic institutions and the bypass effect of financial globalization. Am Econ J Econ Pol 2(4):173–204.

Kocherlakota N (1990) Disentangling the coefficient of relative risk aversion from the elasticity of intertemporal substitution: an irrelevance result. J Financ 45(1):175–90

Lane P, Milesi-Ferretti GM (2001) The external wealth of nations: measures of foreign assets and liabilities for industrial and developing countries. J Int Econ 55(2):263–294

Lane PR, Milesi-Ferretti GM (2007a) A global perspective on external positions. In: Clarida R (ed) G7 Current account imbalances: sustainability and adjustment. The University of Chicago Press

Lane PR, Milesi-Ferretti GM (2007b) The external wealth of nations mark II: revised and extended estimates of foreign assets and liabilities, 1970. J Int Econ 73(2):223–250

Matsuyama K (2004) Financial market globalization, symmetry-breaking, and endogenous inequality of nations. Econometrica 72(3):853–884

Mendoza EG, Quadrini V (2010) Financial globalization, financial crises and contagion. J Monet Econ 57(1):24–39

Mendoza EG, Quadrini V, Rios-Rull J-V (2009) Financial integration, financial deepness, and global imbalances. J Polit Econ 117(3):371–416

Moskowitz TJ, Vissing-Jørgensen A (2002) The returns to entrepreneurial investment: a private equity premium puzzle? Am Econ Rev 92(4):745–778

Prasad ES, Rajan R, Subramanian A (2006) Patterns of international capital flows and their implications for economic development. In: Proceedings of the 2006 Jackson hole symposium. Federal Reserve Bank of Kansas City, pp 119–158

Prasad ES, Rajan R, Subramanian A (2007) Foreign capital and economic growth. Brook Pap Econ Act 38(1):153–230

Sandri D (2010) Growth and capital flows with risky entrepreneurship. Working Paper

Selden L (1978) A new representation of preferences over ”Certain x Uncertain” consumption pairs: the ”Ordinal Certainty Equivalent” hypothesis. Econometrica 46(5):1045–1060

Song Z, Storesletten K, Zilibotti F (2011) Growing like China. Am Econ Rev 101(1):196–233

Tille C, van Wincoop E (2008) International capital flows under dispersed information: theory and evidence. NBER Working Paper No. 14390

Tille C, van Wincoop E (2010) International capital flows. J Int Econ 80(2):157–175

von Hagen J, Zhang H (2010) Financial development and patterns of international capital flows. CEPR Discussion Paper No. 7690

von Hagen J, Zhang H (2011) International capital flows and aggregate output. CEPR Discussion Papers 8400

von Hagen J, Zhang H (2014) Financial development, international capital flows, and aggregate output. J Dev Econ 106:66–77

Zhang H (2010) International economic integration and income convergence in the presence of uninsured idiosyncratic investment risk. Working paper

Zhang H (2013a) Minimum investment requirement, financial integration and economic (in)stability: arefinement to Matsuyama (2004). SMU economics & statistics working paper no. 09-2013

Zhang H (2013b) Trade and financial integration, economic stability, and income convergences. Working paper

Acknowledgments

We would like to thank Dirk Krueger, Vasia Panousi and participants at 14th ZEI Summer School and the 2011 European Meetings of Econometric Society in Oslo for helpful comments and suggestions. Financial supports from Singapore Management University and German Research Foundation are gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Proposition 2.1

Proof

According to Eq. 7b, the relative price is rewritten as \(\chi ^{i}_{t+1}\equiv \frac {V^{i,A}_{t+1}}{V^{i,B}_{t+1}}= \frac {R^{i,h}_{t}}{V^{i,B}_{t+1}}\). Combining Eqs. 3, 7a, d, and e, we get the lending of individual household \(d^{i,h}_t=\frac {\theta ^{i}}{\theta ^i+1}\beta \omega ^{i}_{t}\). Combining it with Eqs. 7a and d, we get

Thus, the relative price is time invariant \(\chi ^{i}_{t+1}=\chi ^{i}_{IFA}\) and positively related with θ i, under IFA. According to Eq. 7b, the equity rate of entrepreneurs in sector B is rewritten as \(R^{i,e}_{t}=R^{i,h}_{t}\frac {1-\theta ^{i}}{\chi ^{i}_{t+1}-\theta ^{i}}\). Combining it with Eq. 6 and using Eq. 21 to substitute away θ i with \(\chi ^{i}_{IFA}\), we get the solution to the loan rate as specified in Eq. 8b. Plugging it back to Eq. 6, we get the solution to the equity rate as specified in Eq. 8f. The price of intermediate good B is obtained by definition. Given the Cobb-Douglas production function as specified in Eq. 2, \(\left (\omega ^{i}_{t+1}\right )^{1-\alpha }\left (V^{i,A}_{t+1}\right )^{\frac {\alpha }{2}} \left (V^{i,B}_{t+1}\right )^{\frac {\alpha }{2}}=1\) and the dynamic equation of wages is obtained as specified in Eq. 8e. □

1.2 Proof of Proposition 2.2

Proof

A second-order Taylor approximation of \(\ln \zeta ^{i}_{t}\) around σ = 0 gives,

The agent chooses \(\phi ^{i}_{t}\) to maximize the ex ante risk-adjusted rate of portfolio return, \(\ln \zeta ^{i}_{t}\), and the first order condition gives the optimal portfolio choice,

Let \(\xi ^{i}_{t}\equiv \frac {\chi ^{i}_{t+1}-1}{(1-\lambda ^i)\sigma }\) denote the Sharpe Ratio. Plugging the solution of \(\phi ^{i}_{t}\) into Eq. 22,

Using Eqs. 3, 9d, and 26, we get the relative price as a constant depending on the degree of market completeness,

Use \(\left (\chi ^{i}_{IFA}\right )^2-1=\gamma [(1-\lambda ^i)\sigma ]^{2}\) to substitute away γ(1 − λ i)σ 2 from Eq. 26, we get the portfolio choice \(\phi ^{i}_{t}\approx \frac {\chi ^{i}_{IFA}-1}{\left (\chi ^{i}_{IFA}\right )^2-1}= \frac {1}{\chi ^{i}_{IFA}+1}\).

Plugging the solution to \(\phi ^{i}_{t}\) and \(V^{i,A}_{t+1}=\chi ^{i}_{IFA}R^{i}_{t}\) into Eq. 10, we solve the risk-free interest rate as specified in Eq. 11b. Other variables can be solved as in the proof of Proposition 2.1. □

1.3 Proof of Lemma 3.1

Proof

The proof consists of three steps. First, we prove that Eq. 15a is the solution to the equity rate under full capital mobility. Define \(\Delta \chi ^{i}_{t+1}\equiv \chi ^{i}_{t+1}-\chi ^{i}_{IFA}\). If the borrowing constraint is binding, it holds under IFA and under full capital mobility,

According to Eq. 6, \((1-\eta )R^{i,h}_{IFA} +\eta R^{i,e}_{IFA}=\Psi _{IFA}\). Substituting \(R^{i,h}_{t}\) and \(R^{i,h}_{IFA}\) with \(R^{i,e}_{t}\) and \(R^{i,e}_{IFA}\) using Eq. 14 and \(R^{i,h}_{IFA}=\frac {1}{(1-\eta )}\left (\Psi _{IFA}-\eta R^{i,e}_{IFA}\right )\), we solve the equity rate from Eq. 27. Plug in the solution to the equity rate in Eq. 14 to solve the loan rate \(R^{i,h}_{t}\).

Second, we prove that \(\chi ^{i}_{t+1}\) is constant under full capital mobility. Let us assume that \(\chi ^{i}_{t+1}\) is time variant and so is the auxiliary variable \(Z^{i}_{t+1}\) defined in Eq. 15a. According to Eq. 15a, the equity rate equalization in country i and N implies that

Using Eqs. 15a, e, and 29, we rewrite the condition, \(\Omega ^{S}_{t}+\Omega ^{N}_{t}=0\), into

Given the Cobb-Douglas production function, \(\omega ^{i}_{t+1}=\left (\chi ^{i}_{t+1}\right )^{\frac {\rho }{2}}\left (R^{i}_{t}\right )^{-\rho }\). Combining it with the loan rate equalization, \(R^{i,h}_t=R^{*,h}_{t}\), we simplify Eq. 31 as

Using Eq. 29 to substitute \(\Delta \chi ^{i}_{t+1}\) with \(\Delta \chi ^{N}_{t+1}\), the left-hand side of Eq. 32 becomes a monotonically increasing function of \(\Delta \chi ^{N}_{t+1}\),

Suppose that \(\Delta \chi ^{N}_{t+1}\geq 0\). Equation 29 implies that \(\Delta \chi ^{i}_{t+1}>0\). According to the definition of \(\mathcal {K}^{i}_{t+1}\), \(\Delta \chi ^{i}_{t+1}>0\) implies that \(\mathcal {K}^{i}_{t+1}>0\). Thus, the left-hand side of Eq. 32 is larger than zero, which contradicts Eq. 32. Thus, there exits a unique solution of \(\Delta \chi ^{N}_{t+1}\) smaller than zero and time-invariant. Using Eq. 29, we can then solve \(\Delta \chi ^{S}_{t+1}\), accordingly.

Finally, we prove the existence of a unique and stable steady state under full capital mobility. \(\chi ^{i}_{t+1}\) is time-invariant and so is \(\mathcal {Z}^{i}_{t+1}\). Let \(R^{i,h}_{FCM}\equiv R^{i,h}_{IFA}+\frac {\eta } {1-\eta }\mathcal {Z}^{i}_{FCM}\) which is same across countries, \(R^{i,h}_{FCM}=R^{*,h}_{FCM}\). Thus, the loan rate depends on the dynamics of the world-average wages, according to Eq. 15b. So is the wage in country i,

The dynamics of the world-average wages are

Given α ∈ (0, 1), the phase diagram of the world-average wage is concave. Thus, there exists a unique and stable steady state. Proportional to the wage, aggregate output in country i is determined by the world output dynamics. □

1.4 Proof of Lemma 3.2

Proof

The proof consists of three steps.

First, we prove that FDI equalizes the Sharpe ratio across the border. An agent born in country i can choose between investing its single project domestically or abroad. According to the solution to the optimal portfolio choices in Angeletos (2007) and Angeletos and Panousi (2011), three factors determine the agent’s optimal portfolio share of risky investment and the risk-adjusted rate of portfolio return, i.e., the mean rate of return in the risky sector, \(\ln V^{i,A}_{t+1}\), the risk-free interest rate, \(\ln R^{i}_{t}\), and the risk-sharing factor λ i. By assumption, agents obtain risk sharing in the country where they make the risky investment. Given the world risk-free interest rate \(R^{*}_{t}\), the portfolio share of risky investment and the risk-adjusted rate of portfolio return are \(\phi ^{i,l}_{t}\approx \frac {\zeta ^{i,l}_{t}}{\gamma (1-\lambda ^l)\sigma }\) and \(\xi ^{i,l}_{t}\approx R^{*}_{t}\left [1+\frac {\left (\zeta ^{i,l}_{t}\right )^{2}}{2\gamma }\right ]\), if the agent born in country i makes the risky investment abroad in country l ≠ i, where the Sharpe ratio is \(\zeta ^{i,l}_{t}\equiv \frac {\ln V^{l,A}_{t+1}-\ln R^{*}_{t}}{(1-\lambda ^l)\sigma }\). In equilibrium, an agent is indifferent between investing the risky project domestically or abroad. Given \(R^{i}_t=R^{l}_t=R^{*}_{t}\), the no-arbitrage condition \(\xi ^{i,l}_t=\xi ^{i}_{t}\) is simplified as the equalization of the Sharpe ratio, \(\zeta ^{l}_t=\zeta ^{i}_{t}\), and the portfolio share is simplified as \(\phi ^{i,l}_t=\phi ^{l}_{t}\).

Suppose that FDI flows are from country N to country S, i.e., \(\Omega ^{N}_t>0>\Omega ^{S}_{t}\) and \(\Omega ^{N}_t+\Omega ^{S}_t=0\). The total savings of agents born in country N but making the risky investment abroad is \(\frac {\Omega ^{N}_{t}}{\phi ^{S}_{t}}\), while the total savings of agents born in country N and making the risky investment domestically is \(\frac {M^{N,A}_{t+1}}{\phi ^{N}_{t}}\). Thus, the aggregate savings of agents born in country N and in country S are specified as in Eqs. 17b, respectively.

Second, we prove by contradiction that \(\chi ^{i}_{t+1}\) is time-invariant under full capital mobility. Assume that \(\chi ^{i}_{t+1}\) is time-variant. The equalization of the Sharpe Ratio \(\zeta ^{S}_{t+1}=\zeta ^{N}_{t+1}=\zeta ^{*}_{t+1}\) implies that \(\chi ^{S}_{t+1}\) is linear and increasing in \(\chi ^{N}_{t+1}\),

Net capital flows sum up to zero at the world level,

Since \(\omega ^{i}_{t+1}=\left (\chi ^{i}_{t+1}\right )^{-\frac {\rho }{2}}\left (R^{i}_{t}\right )^{-\rho }\) and \(R^{S}_t=R^{N}_t=R^{*}_{t}\), Eq. 37 can be rewritten as

Since \(\frac {(\xi ^{i}_{t+1})^{2}}{\gamma }=\frac {(\chi ^{i}_{t+1}-1)^{2}}{(\chi ^{i}_{IFA})^2-1}\) is a function of \(\chi ^{i}_{t+1}\), given \(\chi ^{i}_{IFA}\) as a constant. Thus, according to Eq. 39, \(\chi ^{S}_{t+1}\) is an implicit function of \(\chi ^{N}_{t+1}\) and it can be proved that \(\frac {\partial \chi ^{S}_{t+1}}{\partial \chi ^{N}_{t+1}}<0\). Thus, according to Eqs. 35 and 39, there exists a unique and time-invariant solution to \(\chi ^{N}_{t+1}\) and \(\chi ^{S}_{t+1}\).

Finally, we prove the existence of a unique and stable steady state under full capital mobility. The relative price and the Sharpe ratio are time invariant which are denoted by \(\chi ^{i}_{FCM}\) and \(\xi ^{i}_{FCM}\), respectively. Define \(R^{i}_{FCM}\equiv \frac {\rho }{\beta }\frac {1}{1+\frac {(\xi ^{*}_{FCM})^{2}}{\gamma }}\), which is same across countries, \(R^{i}_{FCM}=R^{*}_{FCM}\). Thus, the loan rate depends on the dynamics of the world-average wages, \(R^{i}_{t+1}=\frac {\omega ^{w}_{t+1}}{\omega ^{w}_{t}}R^{*}_{FCM}\) and so does the wage in country i,

The dynamics of the world-average wages are

Given α ∈ (0, 1), the phase diagram of the world-average wage is concave. Thus, there exists a unique and stable steady state. Proportional to the wage, aggregate output in country i is determined by the world output dynamics. □

1.5 Proof of Proposition 2.3

Proof

The relative price of intermediate goods \(\chi ^{i}_{IFA}\) reflects the distortion of two financial frictions on aggregate allocation under IFA. Let \(\chi ^{i}_{IFA,LC}\) and \(\chi ^{i}_{IFA,IM}\) denote the respective relative price of intermediate goods under the model setting of limited commitment and that of incomplete markets. According to Eqs. 8e and 11e, the wage rate has the same functional form with respect to \(\chi ^{i}_{IFA}\) and so does aggregate output. Obviously, the steady-state aggregate output is same across the two model settings and so are the loan rate in the setting of limited commitment and the risk-free interest rate in the setting of incomplete markets, as long as \(\chi ^{i}_{IFA,LC}=\frac {1}{\chi ^{i}_{IFA,IM}}\). That is, \(1-\frac {\bar \theta -\theta ^{i}}{1-\eta }=\frac {1}{\sqrt {1+\gamma [(1-\lambda ^i)\sigma ]^{2}}} \) and the solution to θ i is a function of λ i in the form, \(\theta ^i=\bar \theta -(1-\eta )\left \{1-\frac {1}{\sqrt {1+\gamma [(1-\lambda ^i)\sigma ]^{2}}} \right \}\). A necessary condition for \(\theta ^{i}\in [0,\bar \theta )\) is \(1+\sqrt {1+\gamma [(1-\lambda ^i)\sigma ]^{2}}\leq \frac {1}{\eta }\). □

Rights and permissions

About this article

Cite this article

von Hagen, J., Zhang, H. International Capital Flows in the Model with Limited Commitment and Incomplete Markets. Open Econ Rev 25, 195–224 (2014). https://doi.org/10.1007/s11079-013-9303-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-013-9303-7

Keywords

- Financial development

- Financial frictions

- Foreign direct investment

- Incomplete markets

- Limited commitment

- International capital flows