Abstract

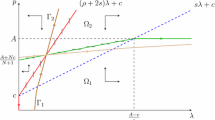

Convex demand functions, although commonly used in consumer theory and in accordance with a large amount of empirical evidence, are known to be problematic in the analysis of firms’ behavior; therefore, they are rarely used in oligopoly theory, due to the possible lack of concavity of the firms’ profit functions and the indeterminacy arising in the limit as marginal costs tend to zero. We investigate a dynamic oligopoly model with hyperbolic demand and sticky price, characterizing the open-loop optimal control and the related steady-state equilibrium, to show that the indeterminacy associated with the limit of the static model is indeed confined to the steady state of the dynamic model, while the latter allows for a well-behaved solution at any time during the game. Although the feedback solution cannot be analytically attained since the model is not built in linear-quadratic form, we show that analogous considerations also apply to the Bellman equation of the individual firm.

Similar content being viewed by others

References

Friedman, J.W.: Oligopoly and the Theory of Games. North-Holland, Amsterdam (1977)

Dixit, A.K.: Comparative statics for oligopoly. Int. Econ. Rev. 27, 107–122 (1986)

Deaton, A., Muellbauer, J.: Economics and Consumer Behavior. Cambridge University Press, Cambridge (1980)

Varian, H.R.: Microeconomic Analysis, 3rd edn. Norton, New York (1992)

Shy, O.: Industrial Organization. Theory and Applications. MIT Press, Cambridge (1995)

Hausman, J.A.: Exact consumer’s surplus and deadweight loss. Am. Econ. Rev. 71, 662–676 (1981)

Varian, H.R.: The nonparametric approach to demand analysis. Econometrica 50, 945–973 (1982)

Varian, H.R.: Goodness of fit in optimizing models. J. Econom. 46, 125–140 (1990)

Cellini, R., Lambertini, L.: Capital accumulation, mergers, and the Ramsey golden rule. In: Quincampoix, M., Vincent, T., Jørgensen, S. (eds.) Advances in Dynamic Game Theory and Applications. Annals of the International Society of Dynamic Games, vol. 8, pp. 487–505. Birkhäuser, Boston (2007)

Simaan, M., Takayama, T.: Game theory applied to dynamic duopoly problems with production constraints. Automatica 14, 161–166 (1978)

Fershtman, C., Kamien, M.I.: Dynamic duopolistic competition with sticky prices. Econometrica 55, 1151–1164 (1987)

Fershtman, C., Kamien, M.I.: Turnpike properties in a finite-horizon differential game: dynamic duopoly with sticky prices. Int. Econ. Rev. 31, 49–60 (1990)

Tsutsui, S., Mino, K.: Nonlinear strategies in dynamic duopolistic competition with sticky prices. J. Econ. Theory 52, 136–161 (1990)

Cellini, R., Lambertini, L.: Dynamic oligopoly with sticky prices: closed-loop, feedback and open-loop solutions. J. Dyn. Control Syst. 10, 303–314 (2004)

Caputo, M.R.: The envelope theorem for locally differentiable Nash equilibria of finite horizon differential games. Games Econ. Behav. 61, 198–224 (2007)

Dockner, E.J., Jørgensen, S., Long, N.V., Sorger, G.: Differential Games in Economics and Management Science. Cambridge University Press, Cambridge (2000)

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by G. Leitmann.

Rights and permissions

About this article

Cite this article

Lambertini, L. Oligopoly with Hyperbolic Demand: A Differential Game Approach. J Optim Theory Appl 145, 108–119 (2010). https://doi.org/10.1007/s10957-009-9627-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-009-9627-z